9-5 End of Day: Corn Supported by Exports, Soybeans Retreat on China Concerns, Wheat Holds Near Support

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn ended the week slightly lower, but the market remains well-supported by strong export demand and expectations of a potential production cut in next week’s WASDE report.

- 🌱 Soybeans: Soybeans closed lower, retreating from morning highs as weakness in soybean oil and concerns over limited Chinese buying weighed on the market.

- 🌾 Wheat: Wheat futures closed mostly lower despite a weaker U.S. Dollar. Prices are holding near key support levels, with strong export demand providing underlying support.

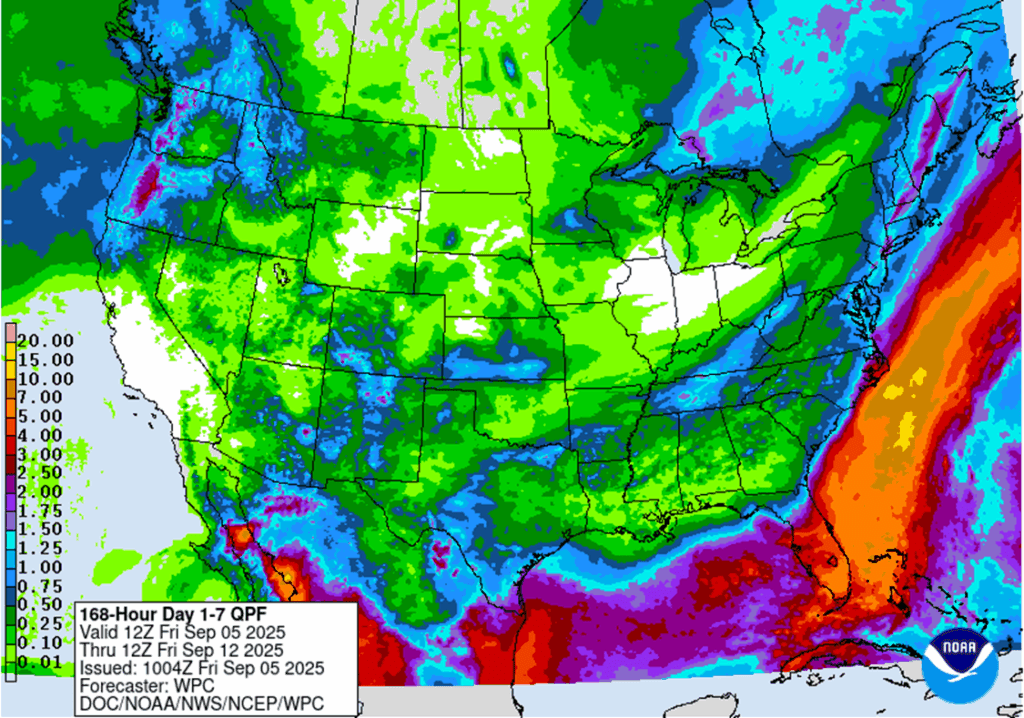

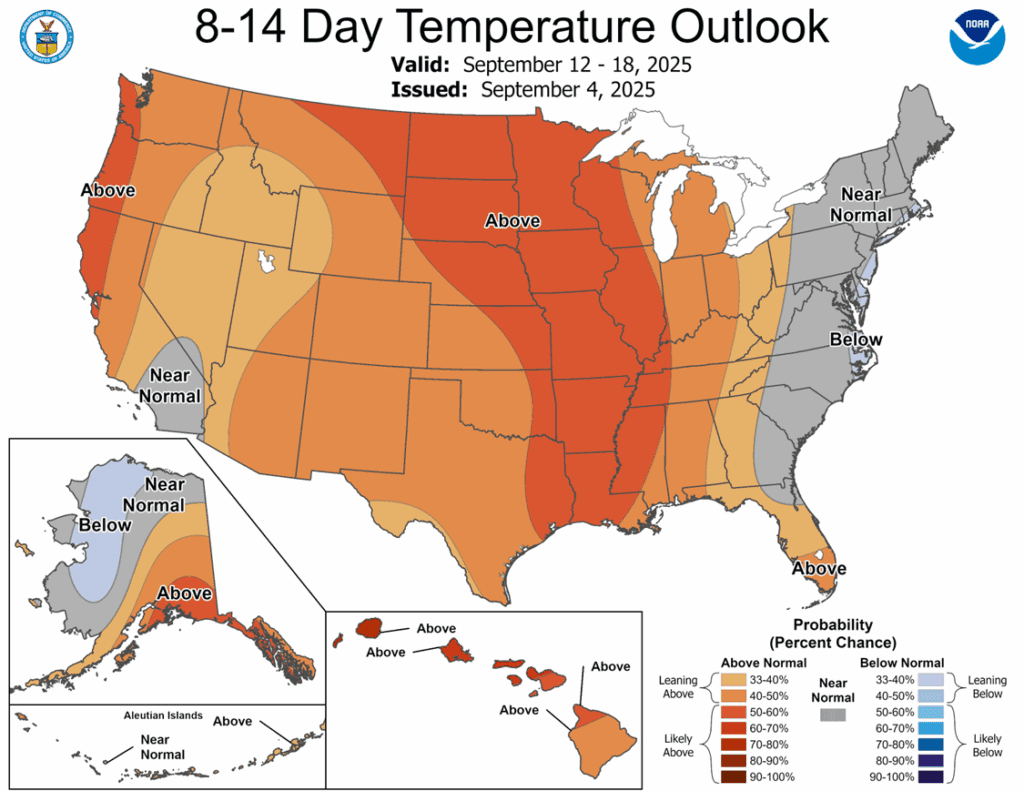

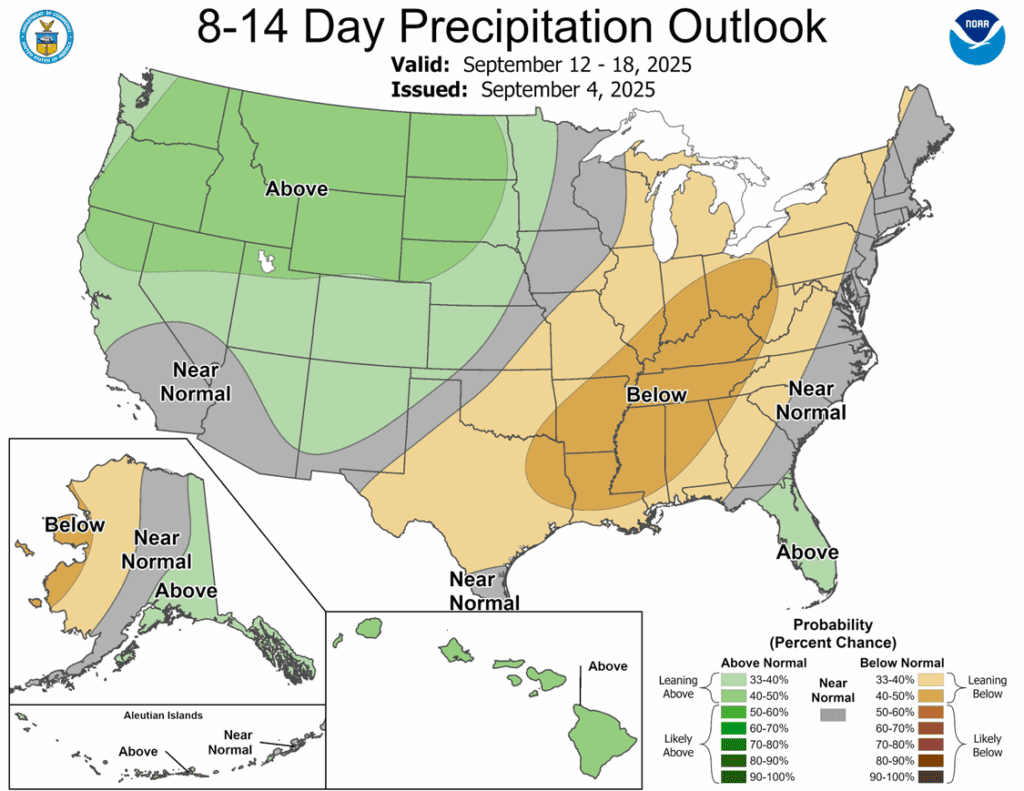

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/4th DEC ’25 420 Puts ~ 15c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell one-quarter of your December 420 puts today.

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B:

- No active targets.

- Details:

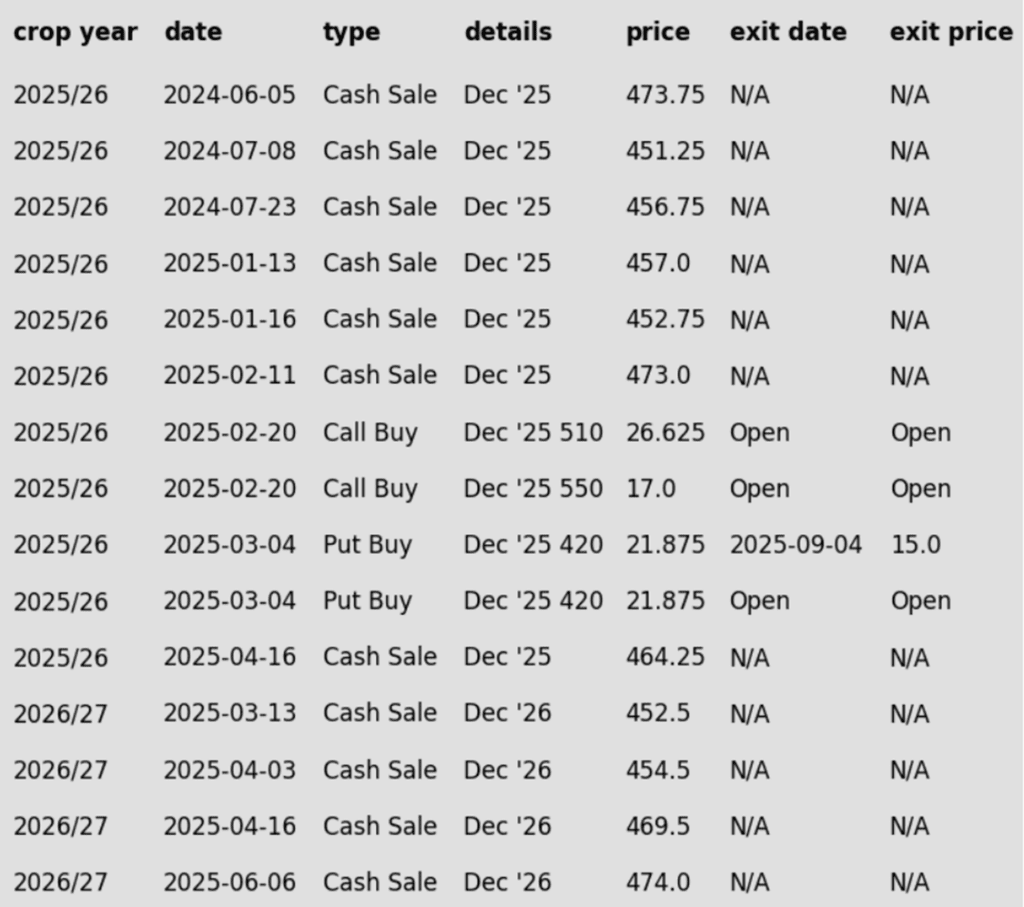

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- One-quarter of your 420 puts should be exited to lighten the position in case upside momentum continues through September. The remaining three-quarters should remain to continue providing downside protection.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- A choppy trading session ended the week as corn futures faded off session highs to finish softer on the day. End of week pressure outweighed another strong week of export sales during the day. September corn futures closed ¾ cents lower to 399, and December corn lost 1 ¾ to 418. For the week, December corn lost 2 ¼ cents.

- Weekly export sales remain very strong for the 2025-26 marketing year. For the week ending August 28, new crop corn sales totaled 2.117 MMT (83.3 mb), near the top end of expectations. Mexico remained the largest buyer of U.S. corn. Old crop sales saw cancellations of 11.1 MB as the end of the marketing year approached.

- The next USDA WASDE report will be released next Friday, September 12. The market will be seeing private analyst estimates for this corn yield and production. SP Global released a yield estimate of 189.1 bu/acre this afternoon, higher than the 188.8 forecast by the USDA in August. The corn market is still preparing for a large crop to be in the pipeline this fall.

- The White House announced this morning plans to review the biofuel waiver process. The use of refinery exemptions and the number granted can impact corn demand for ethanol. Decisions on the biofuel waiver system could impact mandates for 2026-27.

- Below normal temperatures are forecasted for the northern Corn Belt this weekend as overnight low temperatures could push toward the freezing mark. If some frost was to occur, it could limit the final development of the corn and soybean crops in those areas.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- The Plan B target to exit one-quarter of the January 1040 puts options has been removed.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower, fading from earlier morning highs as a result of lower soybean oil and further concerns over the lack of China as a buyer. November soybeans lost 6 cents to $10.27, while March soybeans lost 6-1/4 cents to $10.60-3/4. October soybean meal gained $0.40 to $280.50, and October soybean oil lost 0.70 cents to 50.81 cents as it followed crude oil lower.

- Today’s export sales report was middle of the road for soybeans with a net reduction of 0.9 million bushels of export sales for 24/25 but an increase of 30.1 mb for the 25/26 marketing year. Top buyers were unknown destinations, Mexico, and Japan. Last week’s export shipments of 16.8 million bushels were below the 20.4 mb needed each week to meet USDA expectations.

- StoneX has revised their estimates for the 25/26 soybean yield lower to 53.2 bpa. This would be slightly below the USDA’s estimate but is on par with Allendale’s last guess of 53.28 bpa. Production is estimated at 4,257 mb, and the USDA will update its estimates next Friday.

- For the week, November soybeans lost 27-1/2 cents and are trading at support levels, while March soybeans lost 26-1/4 cents. October soybean meal lost $2.90 for the week, and October soybean oil lost 0.89 cents. A bullish WASDE report could cause funds to short cover next week.

Wheat

Market Notes: Wheat

- After a two-sided trade and despite a drop in the U.S. Dollar Index, wheat closed lower. The exceptions were deferred Chicago contracts – July ’26 was neutral and December ’26 was 1/4 cent higher. As for December 2025 contracts, Chicago lost 1/4 cent at 519-1/4, Kansas City was down 1 cent to 505-1/4, and MIAX closed 4-1/4 cents lower at 566.

- Weekly export sales, which were delayed until today, showed the USDA reporting an increase of 11.5 mb of wheat export sales for 25/26, along with 0.2 mmt for 26/27. Shipments last week totaled 32.7 mmt, which far exceeded the 16.7 mb pace needed per week to reach their export goal of 875 mb. Total 25/26 wheat sales commitments have reached 456 mb, up 22% from last year.

- According to the USDA, as of September 2, spring wheat areas in drought were steady with last week’s reading of 13%. However, a recent lack of rain in winter wheat areas is becoming more apparent – drought conditions increased to 34%, up 3% from the week before. It is worth noting, however, that winter wheat acres in drought were 52% at this time last year.

- In an update from the Buenos Aires Grain Exchange, they reported that Argentina’s wheat crop is 98% good to excellent, down 1% from last week. While this is very good, some heading winter wheat may have sustained recent frost damage, and there is risk of additional cold fronts over the next two weeks.

- Ukraine has reportedly collected 28.8 mmt of grain so far in their harvest. Of that total, 22 mmt is wheat, which is up slightly from the 21.8 mmt figure at this time last year. Meanwhile, Russia is said to have collected 100 mmt of grain so far, out of an expected total of 135 mmt. In related news, Russia increased their wheat export tax by 25% to 168.6 rubles/mt through September 16.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 605.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 605.75.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- A Plan A target of 590 against December 2025 futures has been added.

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 647 target has been lowered to 642.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

Active

Sell SEP ’26 Cash

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Continued Opportunity – Sell a second portion of your 2026 Minneapolis wheat crop today.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather