9-4 End of Day: Corn and Soybeans Rebound, Wheat Ends Lower

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures ended the day higher, supported by emerging weather concerns from expanding drought conditions and a favorable ethanol report.

- 🌱 Soybeans: Soybean futures closed higher, supported by strong U.S. soybean crush data and firm domestic demand.

- 🌾 Wheat: Wheat markets closed lower today, pressured by a lack of fresh news and strength in the U.S. dollar.

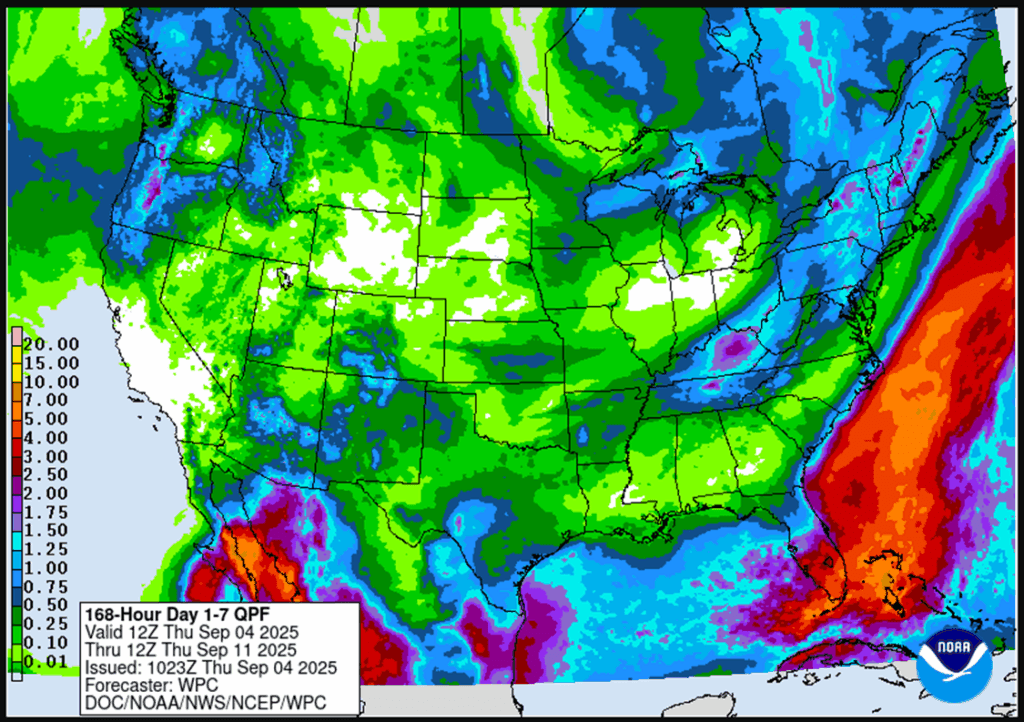

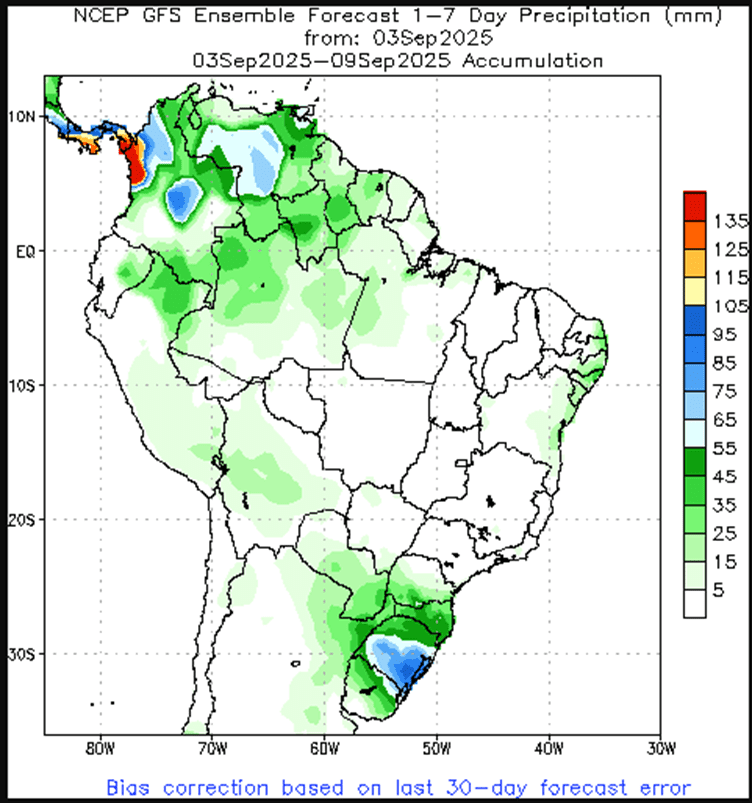

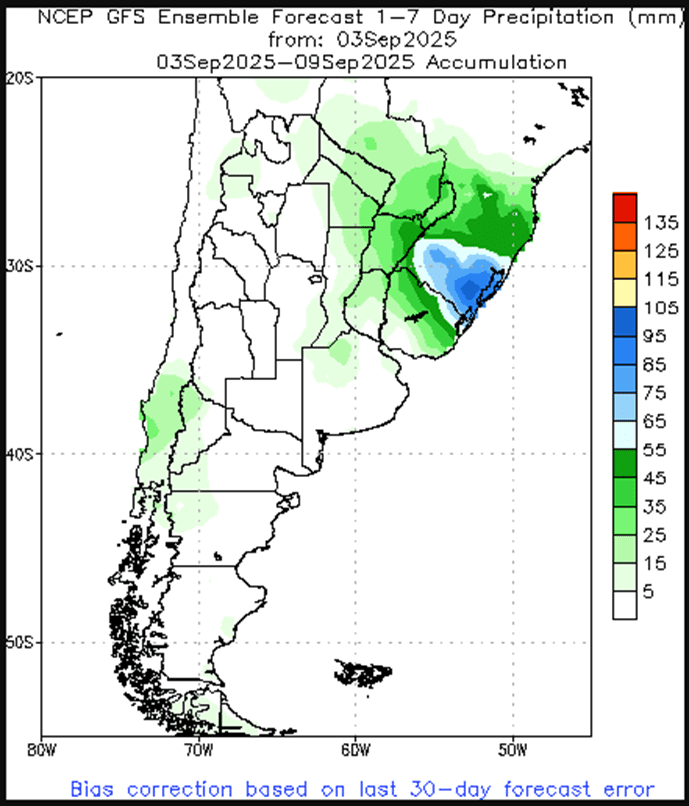

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

New Alert

Exit 1/4th DEC ’25 420 Puts ~ 15c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- New Alert – Sell one-quarter of your December 420 puts today.

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- One-quarter of your 420 puts should be exited to lighten the position in case upside momentum continues through September. The remaining three-quarters should remain to continue providing downside protection.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

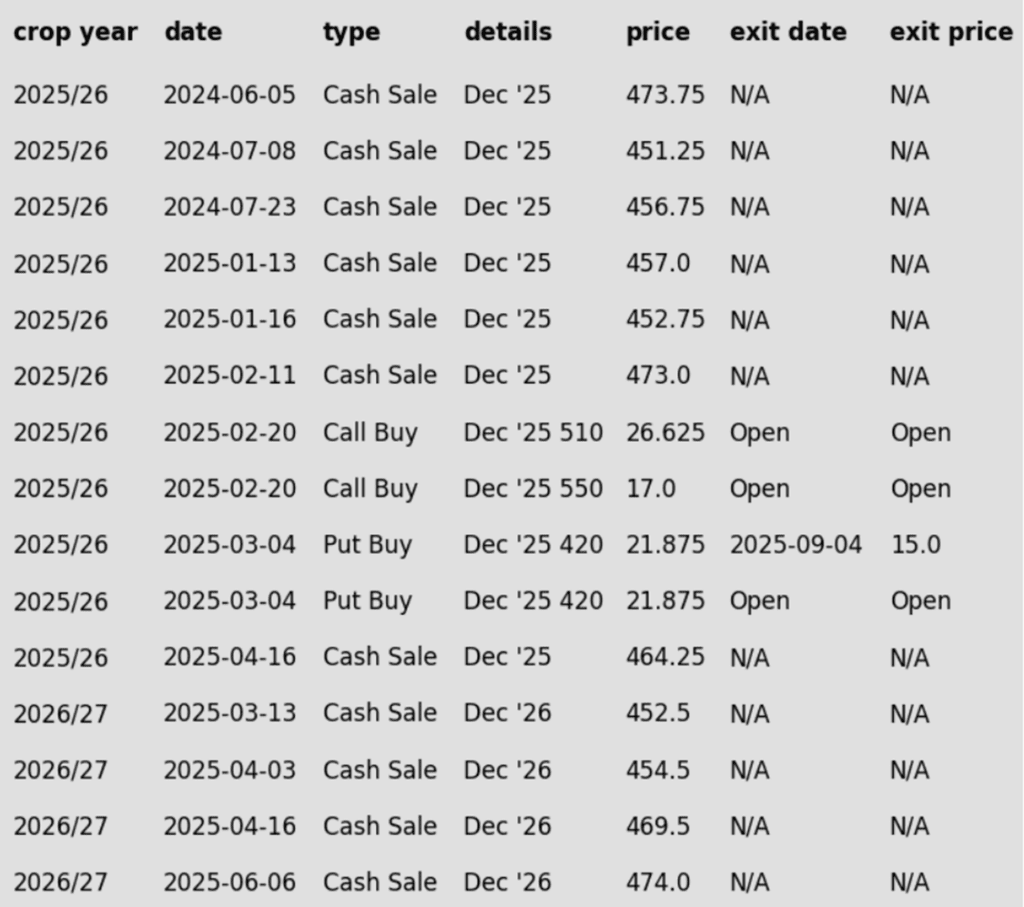

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures rallied off session lows to finish higher, supported by technical buying after prices tested and held key support levels. September corn gained 2 cents to 399 ¾, and December futures added 1 ¾ cent to 419 ¾.

- The U.S. drought monitor maps released on Thursday morning show an increase of dry conditions in the eastern Corn Belt. As of August 2, 9% of corn acres were in some form of drought, up 4% from last week. The dry conditions will likely limit the top side in corn production for the second straight year.

- Weekly ethanol production increased last week to 316 million gallons/day for the week ending August 29. A total of 107 mb of corn was used last week for ethanol production. This is very close to the pace needed to reach the USDA target for the marketing year, which ended on August 31.

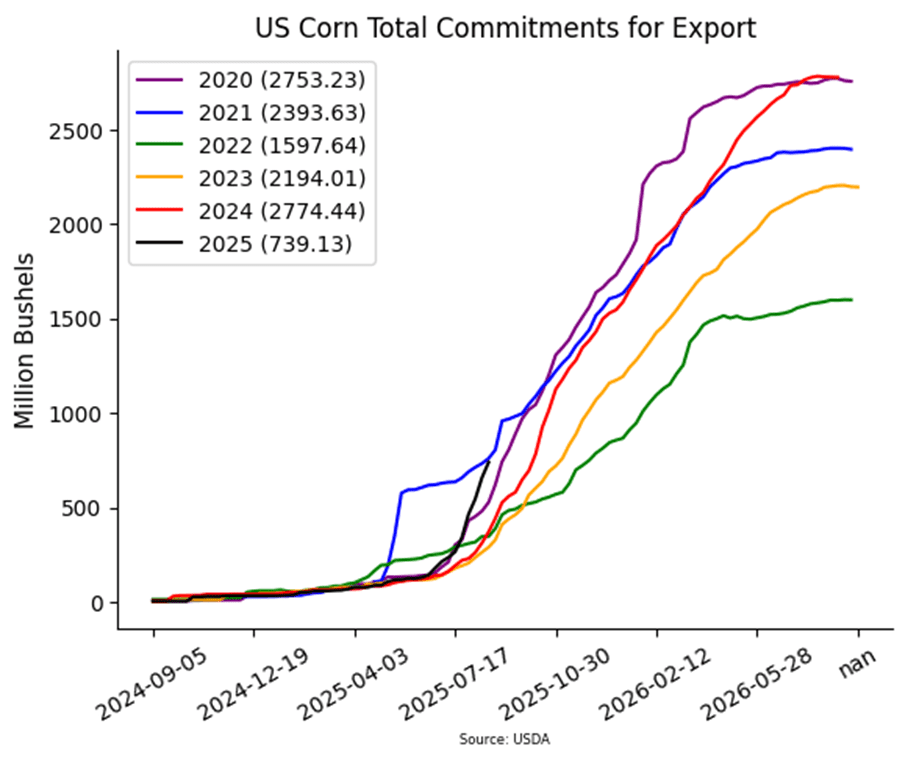

- USDA will release weekly export sales on Friday morning. Expectations are for 2025-26 sales to range from 900,000-2.2 MMT. Current exports sales are nearly double last year and the second-best start in sales in the last 25 years for this time frame.

- Below normal temperatures are forecasted for the northern Corn Belt this weekend as overnight low temperature could push toward the freezing mark. If some frost was to occur, it could limit the final development of the corn and soybean crops in those areas.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A Plan B target has been added to exit one-quarter of the January 1040 puts options has been removed.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher, surging back from earlier morning lows along with the rest of the grain complex. November soybeans gained 1-1/2 cents to $10.33 while March gained 1-1/4 to $10.67. October soybean meal gained $2.50 to $280.10 and October soybean oil gained 0.07 cents to 51.51 cents.

- Yesterday, Allendale projected that the national soybean yield would come in near 53.28 bpa with production at 4.27 bb. This would be slightly below the USDA estimate which will likely be updated in next week’s WASDE report. The USDA’s last yield projection was 53.58 bpa.

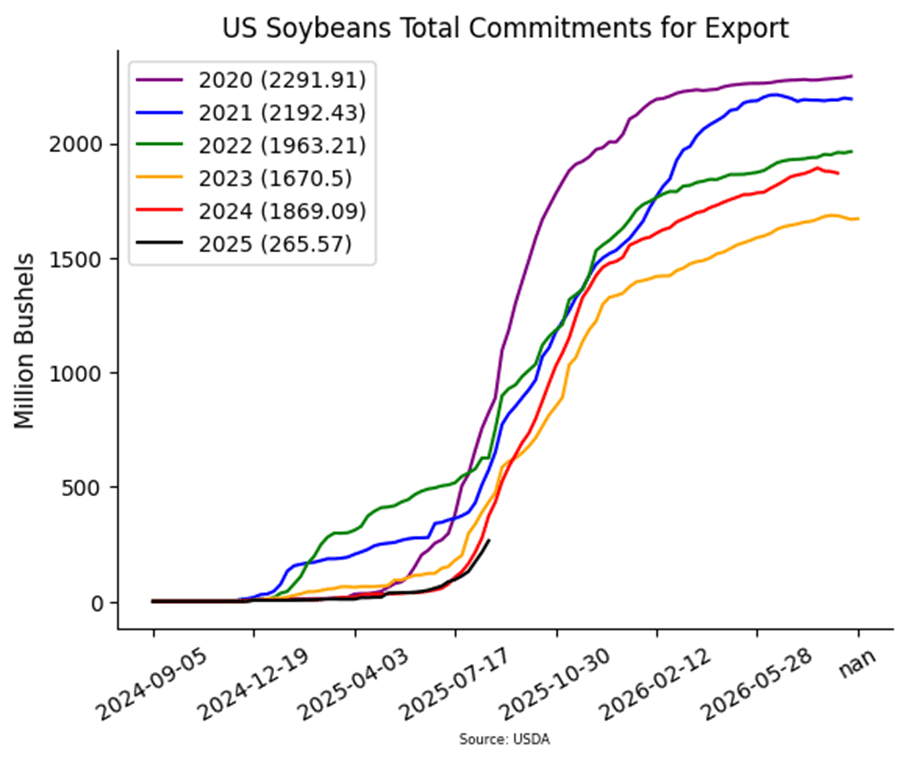

- Chinese soybean demand stays absent from the U.S. market, limiting prices. China has been an active buyer of both old and new crop soybeans out of South America this week. It was reported that China logged purchases on soybeans from Argentina yesterday.

- U.S. soybean crushings were seen at 204.8 million bushels in July which was up 5.9% from the same period last year and above June crushings of 196.9 mb. This strong domestic demand should be supportive relative to slow export demand.

Wheat

Market Notes: Wheat

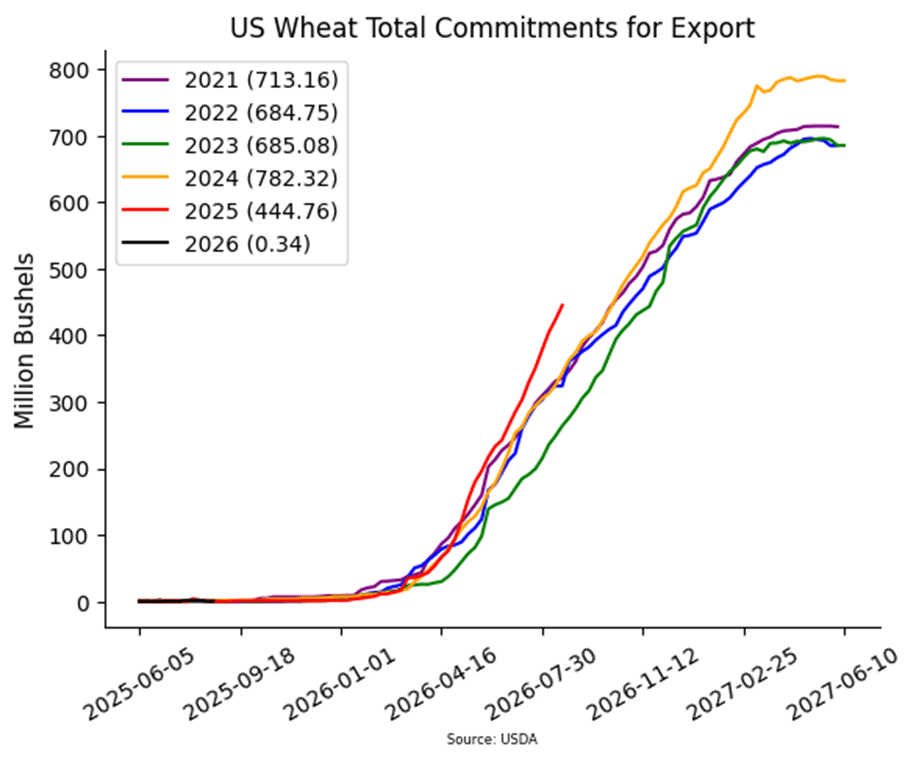

- Wheat futures ended lower across all three classes, unable to join the recovery seen in corn and soybeans. The absence of fresh news and a firmer U.S. dollar pressured prices. December Chicago closed 2-1/2 cents lower at 519-1/2, while December Kansas City lost 4 cents and December MIAX lost 2-3/4 cents to 506-1/4 and 570-1/4, respectively.

- Ukraine, which is getting ready to plant winter wheat, has seen good rainfall through late August in the central, southern, and eastern growing regions. This has helped to create adequate soil moisture and agreeable conditions to get the crop off to a good start.

- Alongside a recent increase to the Australian wheat crop production estimate from ABARE, LSEG commodities research has also upped their projection. Their forecast for the 25/26 crop was raised 7.3% to 32.3 mmt. Widespread rains in July and August were cited as the reason for the increase.

- A memorandum of understanding was signed between Israel and Moldova in regard to joint wheat cultivation. Reportedly, Israel will provide seed and knowledge, while Moldova will provide land, water, and labor. This is said to be part of Israel’s strategy to increase food security.

- According to their ministry of agriculture, in Saskatchewan (Canada), the spring wheat harvest is 14% done as of the beginning of this month. Total production is anticipated to be above the five-year average, despite expectations for slightly lower yields.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 601.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 601.75.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 647 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 656 target has been lowered to 647.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

Active

Sell SEP ’26 Cash

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Continued Opportunity – Sell a second portion of your 2026 Minneapolis wheat crop today.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.