9-30 End of Day: Grains Slide on Larger-Than-Expected Stocks Report

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures fell Tuesday after USDA’s Sept. 1 stocks report showed supplies above trade expectations.

- 🌱 Soybeans: Soybeans slipped Tuesday despite a neutral Grain Stocks report, pressured by weak export inspections and spillover losses from corn and wheat.

- 🌾 Wheat: Wheat futures fell sharply Tuesday, with a bearish quarterly grain stocks report driving prices back toward recent lows.

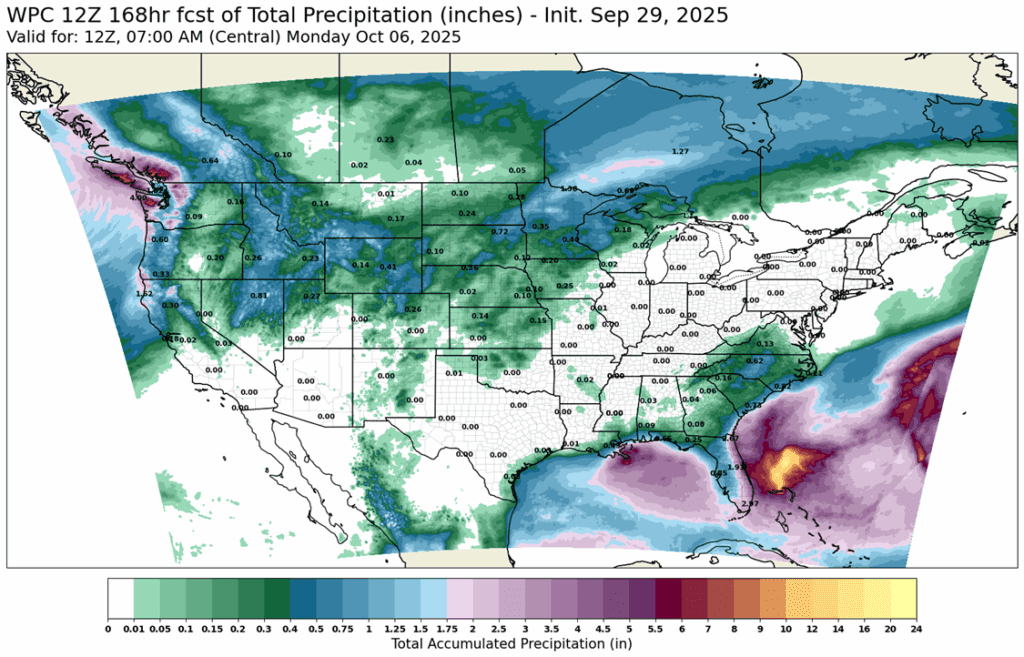

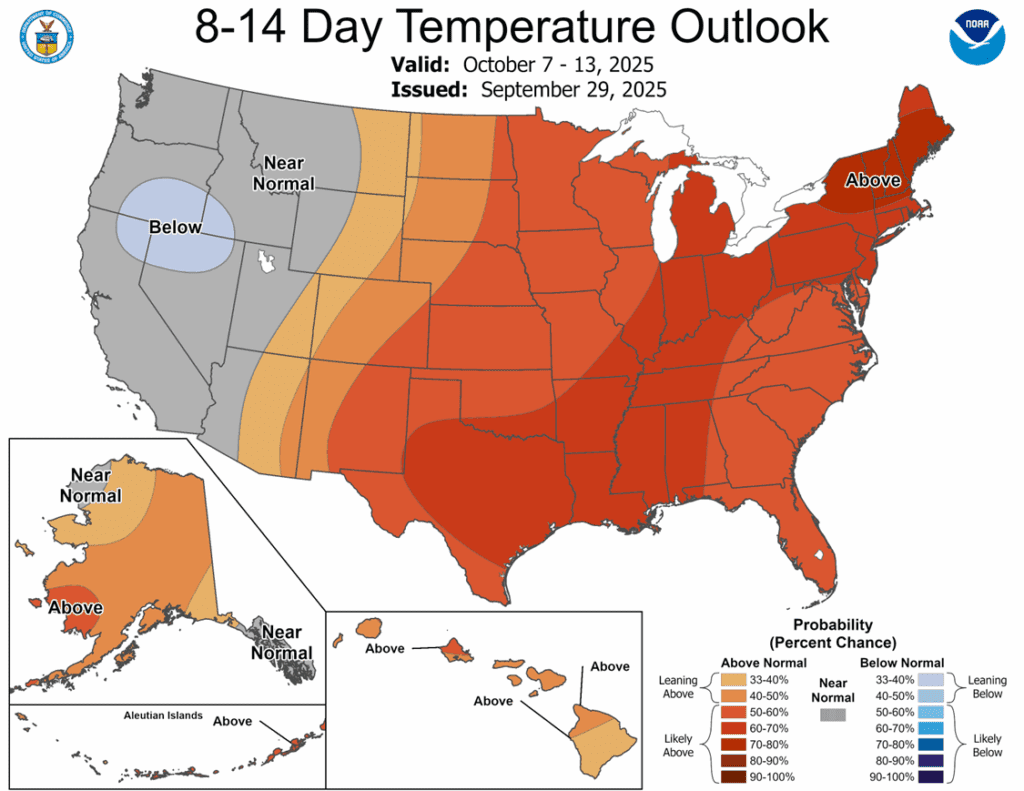

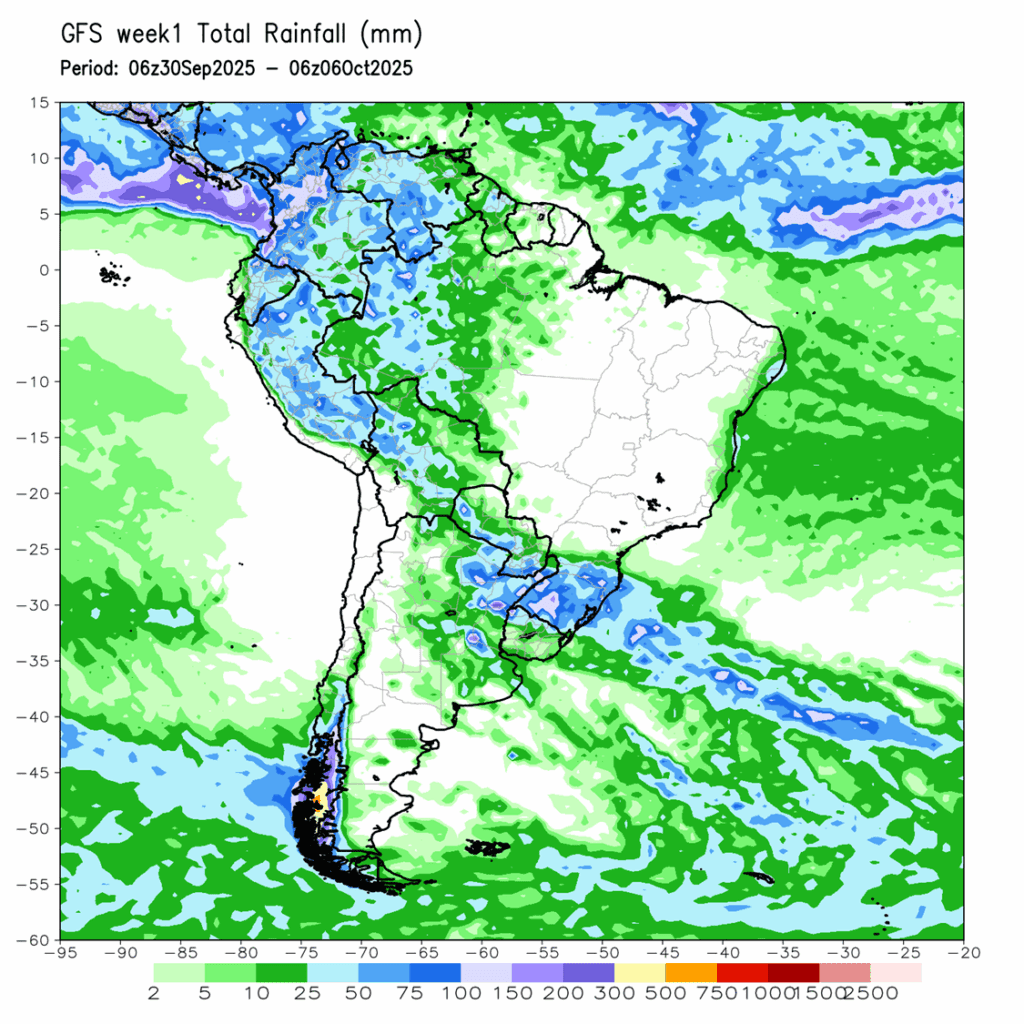

- To see updated U.S. and South America weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures saw selling pressure to end the month of September as Tuesday’s USDA Grain Stocks report was heavier than anticipated. December corn futures lost 6 cents to 415 ½, and March futures lost 6 ½ cents to 432.

- The USDA released the Quarterly Grains Stocks report on Tuesday morning. Corn stocks as of September 1 were 1.532 BB, up from 1.352 BB in the September report and well above expectations. Despite the increase, corn stocks are still 13% below last year’s levels.

- The revision of grain stocks by 207 mb was the largest revision since the 2018-19 marketing year. Corn futures held support despite the higher supply forecast. Market analysts anticipated a large possible supply given the actions of the cash market over the past handful of months.

- The USDA slightly increased harvested acres on the 2024-25 corn crop, increasing production by 25 mb for last year. Quarterly usage was weaker than expected, reflecting lighter feed demand with smaller cattle and hog numbers.

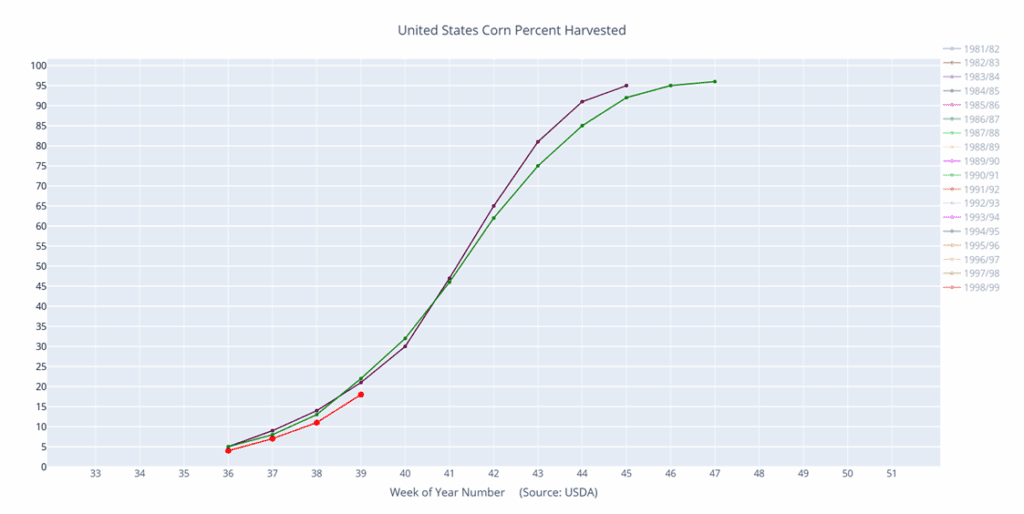

- Corn harvest was 18% complete as of Sunday, September 28. This was slightly below expectations, and down 1% from the 5-year average. Favorable weather forecasts for the Corn Belt this week should move harvest along and harvest pressure will likely limit the market.

Corn percent harvested (red) versus the 5-year average (green) and last year (purple).

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/4th JAN ’26 1040 Puts ~ 32c

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell one-quarter of the January 1040 puts.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-quarter of the January ‘26 1040 puts has been added. This recommendation has been made to begin reducing the put position in a seasonally weak time period. This means that 25% of the original position should be closed out, leaving 75% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day sharply lower following a bearish Crop Progress report and a neutral Grain Stocks report. November lost 8-3/4 cents to $10.01-3/4 and managed to stay above $10.00 throughout the day. March soybeans lost 9-3/4 cents to $10.35-3/4, October soybean meal lost $2.40 to $265.70, and October soybean oil lost 0.24 cents to 48.87 cents.

- Today’s Grain Stocks report saw quarterly stocks for soybeans at 316 million bushels, which was slightly below the average guess of 322 mb but was within the range of estimates between 295 mb and 347 mb and was seen as neutral. Early yield reports are good so trade may believe that the stock number rises.

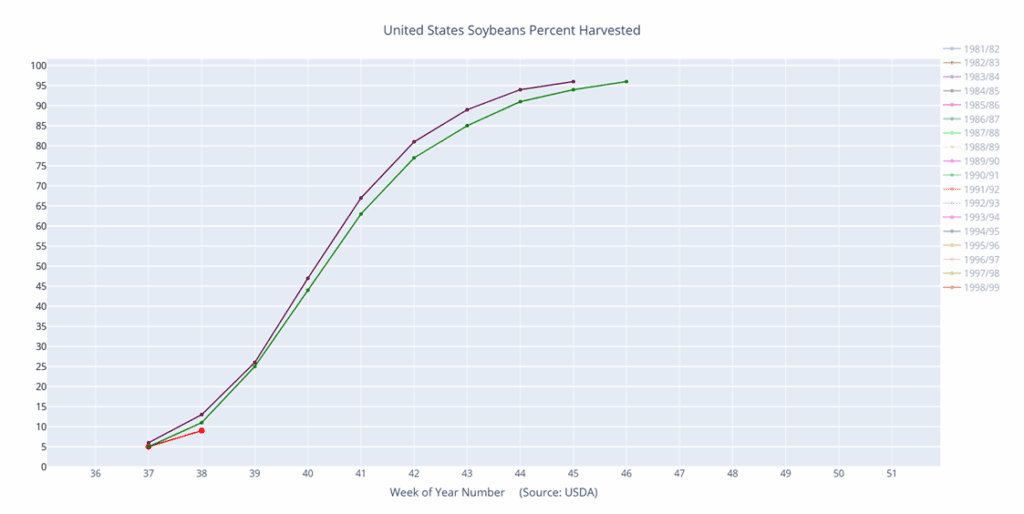

- Crop Progress saw soybean crop ratings improve one point from last week to 62% while trade estimates were expecting a decline. 79% of the crop is dropping leaves and 19% is harvested. Wet weather last week delayed harvest, but this week is expected to be dry.

- Yesterday’s Export Inspections report saw soybean inspections on the lower end of trade estimates. Soybean inspections totaled 21.8 million bushels for the week ending September 25. This put total inspections for 25/26 at 82.5 mb, which is up from 16% the previous year.

Soybeans percent harvested (red) versus the 5-year average (green) and last year (purple).

Wheat

Market Notes: Wheat

- Wheat posted double-digit losses for both Chicago and Kansas City futures, with smaller losses for MIAX contracts. Dec Chi closed 11-1/2 cents lower at 508, KC was down 10-1/2 at 497-3/4, and MIAX lost 6-1/2 cents to 562-3/4. A combination of negative report data, a lower close for Matif wheat futures, and the increasing likelihood of a government shutdown all weighed on the wheat complex today.

- USDA pegged September 1 wheat stocks at 2.120 bb, above the high end of pre-report estimates and up from 1.992 bb last year. All-wheat production for 2025/26 came in at 1.985 bb, also above expectations, versus 1.927 bb in August and 1.971 bb last year. Winter wheat output totaled 1.402 bb, up 3% from 2024.

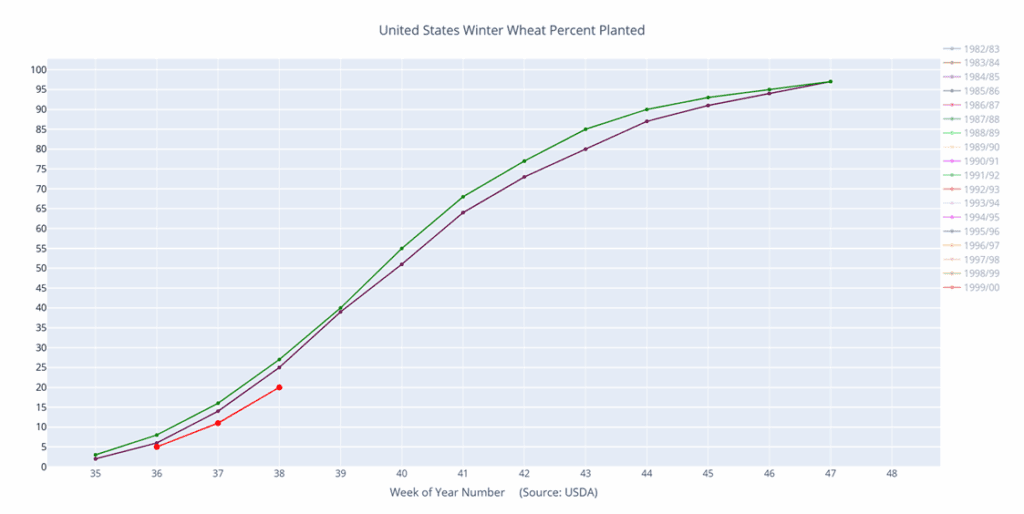

- Yesterday afternoon’s Crop Progress report indicated that the U.S. winter wheat crop is now 34% planted, which is down 3% from last year and 2% from the five-year average pace. Additionally, 13% of the crop is emerged, which is in line with last year, and 1% above the five-year average.

- Brazilian domestic wheat prices are said to be falling, largely pressured by their new crop harvest. According to CONAB, an estimated 23.2% of the planted wheat area in Brazil has been harvested as of September 20. Additionally, data from Secex indicates that Brazil’s September wheat imports through the first two weeks of September totaled about 293,450 mt, down 50% versus September of 2024.

- Poland’s statistics office has increased their estimate of their country’s wheat production from 12.8 mmt to 13.4 mmt. Furthermore, the total Polish grain crop is estimated at 37.1 mmt.

- According to Russia’s economic development minister, Russia is working with China to lift restrictions on imports of Russian winter wheat and barley, among other goods. Both countries signed an agreement in May regarding the promotion and mutual protection of investment. Trade between Russia and China exceeded $244 billion last year, and could increase if these restrictions are eliminated.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 610.25 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 610.25.

- Notes:

- Resistance for the macro trend sits at 610.25 vs December ‘25. A close above 610.25 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 602 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 587 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 628.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan B call option target has been lowered to 636.50.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 641 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 641.

To date, Grain Market Insider has issued the following KC recommendations:

Winter wheat percent planted (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 628.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 628.75.

- Notes:

- Resistance for the macro trend sits at 628.75 vs December ‘25. A close above 628.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: U.S. 7-day total precipitation forecast, courtesy of ag-wx.com

Above: South America 7-day total precipitation forecast, courtesy of National Weather Service, Climate Prediction Center.