9-29 End of Day: Grains Finish Mixed Ahead Of Grain Stocks Report

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures finish mixed as traders finalize positioning ahead of the September 30 Grain Stocks report.

- 🌱 Soybeans: Soybeans begin the week lower as traders await grain stocks data from USDA, as well as renewable diesel and biodiesel data from EIA.

- 🌾 Wheat: Wheat futures finished mixed despite strong export data. Traders await information from the Grain Stocks report due tomorrow.

- To see updated U.S. and South America weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished mixed on the session with light selling pressure at the front end of the market. Despite additional export demand, harvest pressure and positioning for tomorrow’s USDA Grain Stock report limited the upside. December futures slipped ½ cent to 421 ½, and March lost ¼ cent to 438 ½.

- Weekly corn inspections total 1.527 MMT (60.1 mb) for the week ending September 25. For this early part of the marketing year, we have shipped just over 5.0 MMT, which is up 52% over last year in this time window.

- USDA announced 2 flash sales of export corn on Monday morning. USDA reported sales of 135,660 MT (5.3 mb) to Mexico and 110,668 MT (4.4 mb) to Unknown Destinations, both sales for the current marketing year.

- USDA will release the September 1 Quarterly Grain Stocks report on Tuesday. Expectations for corn supply stocks to be near 1.336 billion bushels, which is down over 400 mb from last year, reflecting the strong corn demand. Market analysts are cautious that the USDA could raise the 2024 corn crop, potentially adding bushels to the U.S. supply.

- Above normal temperatures and dry conditions should allow corn harvest to progress rapidly this week. The infusion of freshly harvested bushels into the pipeline will likely limit corn prices due to ongoing harvest pressure.

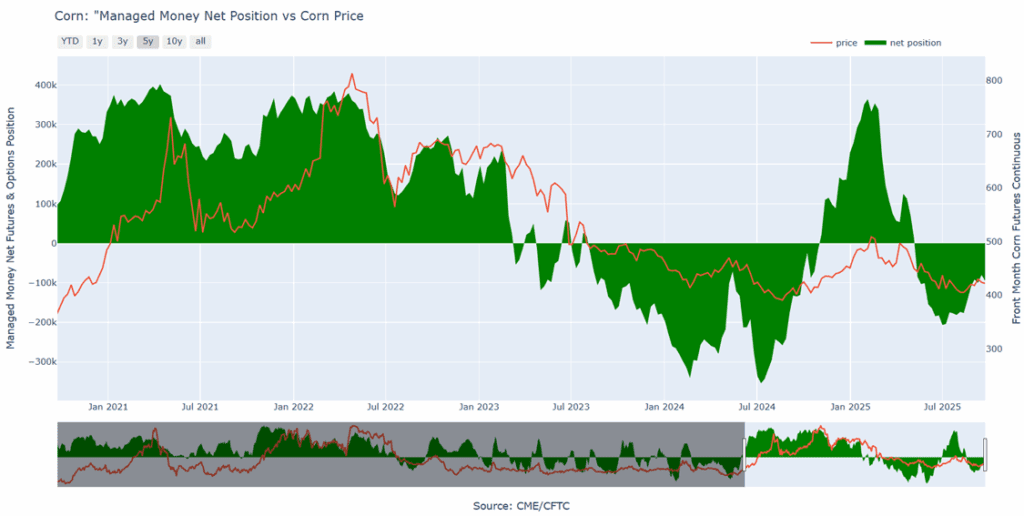

Corn Managed Money Funds net position as of Tuesday, September 23. Net position in Green versus price in Red. Money Managers sold 14,624 contracts between September 16 – September 23, bringing their total position to a net short 94,675 contracts.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

New Alert

Exit 1/4th JAN ’26 1040 Puts ~ 32c

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- NEW ALERT – Sell one-quarter of the January 1040 puts.

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A recommendation to sell one-quarter of the January ‘26 1040 puts has been added. This recommendation has been made to begin reducing the put position in a seasonally weak time period. This means that 25% of the original position should be closed out, leaving 75% of the original position to continue providing downside protection.

- Notes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower, falling from overnight highs, but climbed back from lows around noon today. Soybeans have been rangebound for over a week. November lost 3-1/4 cents to $10.10-1/2 and March lost 3-1/2 cents to $10.45-1/2. October meal lost $0.70 to $268.10 and October soybean oil lost 0.49 cents to 49.11 cents.

- Today’s Export Inspections report saw soybean inspections on the lower end of trade estimates. Soybean inspections totaled 21.8 million bushels for the week ending September 25. This put total inspections for 25/26 at 82.5 mb, which is up from 16% the previous year.

- The Crop Progress report later today is expected to show harvest progress lagging behind the 5-year average as a result of rains throughout the Midwest last week. Temperatures are forecast to be above average this week, which should boost progress.

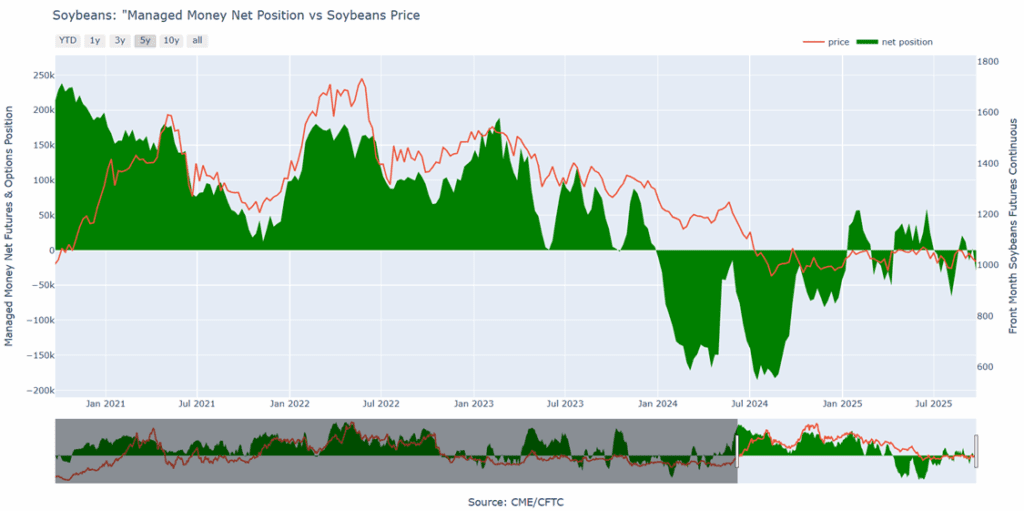

- Friday’s CFTC report saw funds as sellers of 31,589 contracts of soybeans as of September 23 leaving them short 29,302 contracts. They sold 22,286 contracts of bean oil leaving them short just 898 contracts and 20,497 contracts of meal which increased their net short position to 103,269 contracts.

Soybean Managed Money Funds net position as of Tuesday, September 23. Net position in Green versus price in Red. Money Managers sold 31,589 contracts between September 16 – September 23, bringing their total position to a net short 29,302 contracts.

Wheat

Market Notes: Wheat

- After a relatively quiet session, and despite a drop for the U.S. dollar, wheat closed in mixed fashion. December Chicago lost 1/4 cent to 519-1/2 but Kansas City was up 2-3/4 at 508-1/4, and MIAX was up 1-1/2 cents to 569-1/4. Growing world crop estimates appear to be keeping pressure on the U.S. wheat market.

- Tomorrow will feature the Quarterly Stocks report, as well as the Small Grains Summary. The average pre-report estimate of September 1 wheat stocks comes in at 2.041 bb vs 1.992 bb last year. Additionally, all wheat production for 25/26 is estimated at 1.925 bb, which would be down 2 mb from August, and compares with 1.971 bb during the 24/25 season.

- Weekly wheat inspections amounted to 27.1 mb, bringing the total 25/26 inspections to 350.4 mb, which is up 15% from last year. Wheat inspections are running above the USDA’s estimated pace; total 25/26 exports are estimated at 900 mb, up 9% from the year prior.

- According to IKAR, Russian wheat export values finished last week at $230/mt, which is up $2 from the week prior. In related news, the Russian agriculture ministry decreased their export tax on wheat by 5.8% to 617.7 Rubles/mt through October 7.

- Ukraine has completed their wheat harvest, according to their Economy Ministry. The grain harvest reportedly totaled 30.4 mmt as of September 26, which is down 40% year on year. Of that total, wheat accounted for 22.5 mmt, which is up 0.9% year over year.

- The European Commission increased their EU soft wheat production estimate from 128.1 mmt to 132.6 mmt last Thursday. This has put pressure on the U.S. market, as well as Paris milling wheat futures.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 617 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 617.

- Notes:

- Resistance for the macro trend sits at 617 vs December ‘25. A close above 621.25 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 602 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.

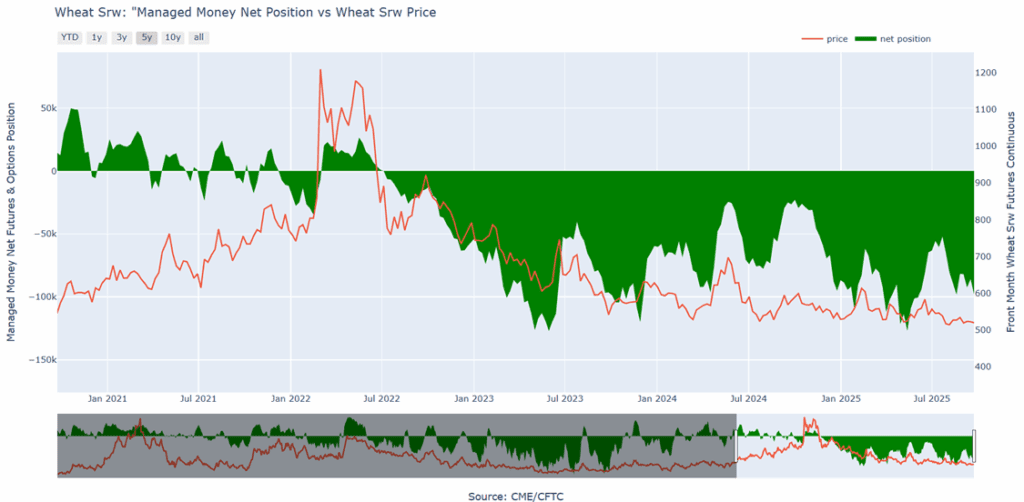

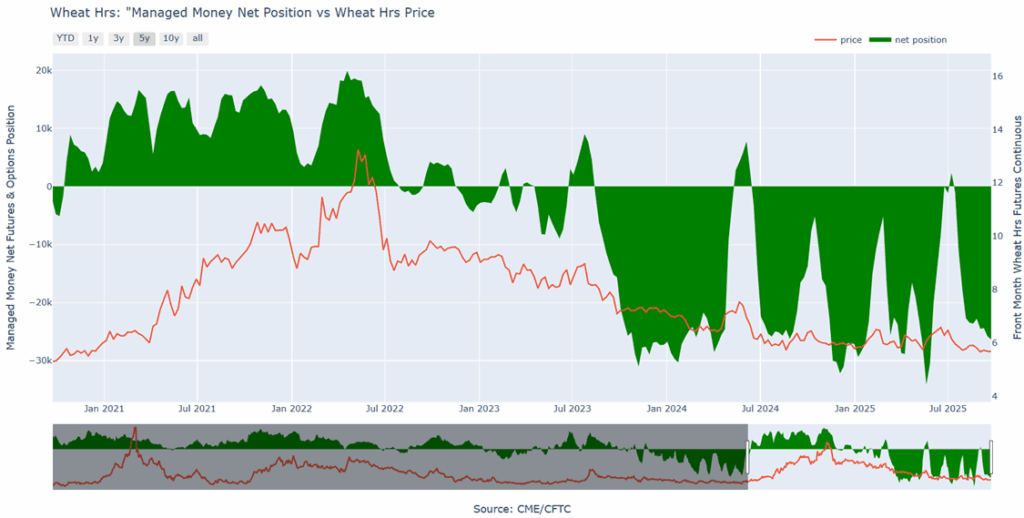

Chicago Wheat Managed Money Funds’ net position as of Tuesday, September 23. Net position in Green versus price in Red. Money Managers sold 12,110 contracts between September 16 – September 23, bringing their total position to a net short 97,935 contracts.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 587 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 636.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan B call option target has been lowered to 636.50.

- Notes:

- Resistance for the macro trend sits at 636.50 vs December ‘25. A close above 636.50 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 641 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 641.

To date, Grain Market Insider has issued the following KC recommendations:

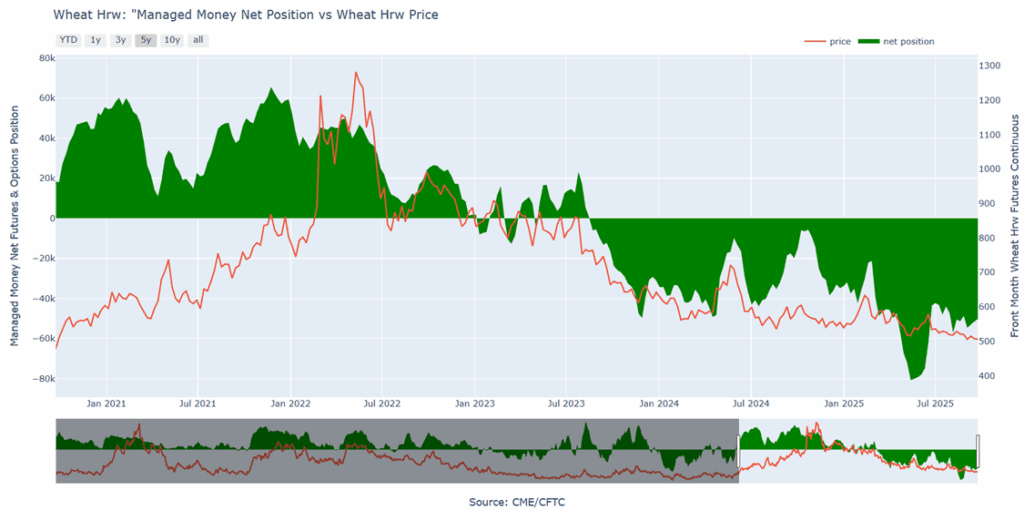

KC Wheat Managed Money Funds’ net position as of Tuesday, September 23. Net position in Green versus price in Red. Money Managers purchased 1,230 contracts between September 16 – September 23, bringing their total position to a net short 50,304 contracts.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 639.25 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 639.25.

- Notes:

- Resistance for the macro trend sits at 639.25 vs December ‘25. A close above 639.25 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, September 16. Net position in Green versus price in Red. Money Managers sold 521 contracts between September 16 – September 23, bringing their total position to a net short 26,353 contracts.

Other Charts / Weather

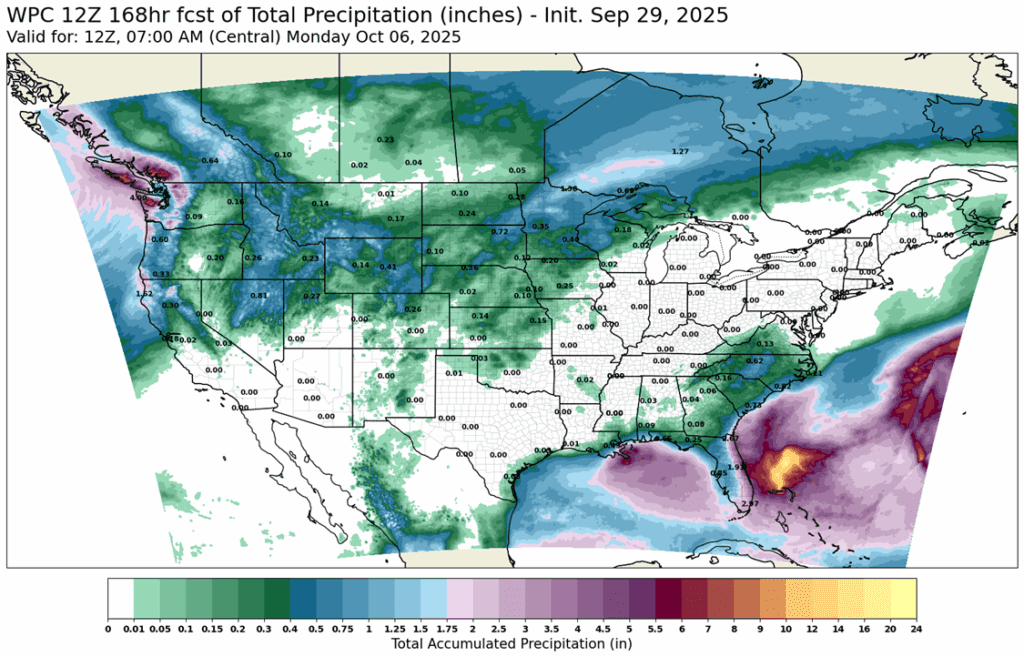

Above: U.S. 7-day total precipitation forecast, courtesy of ag-wx.com

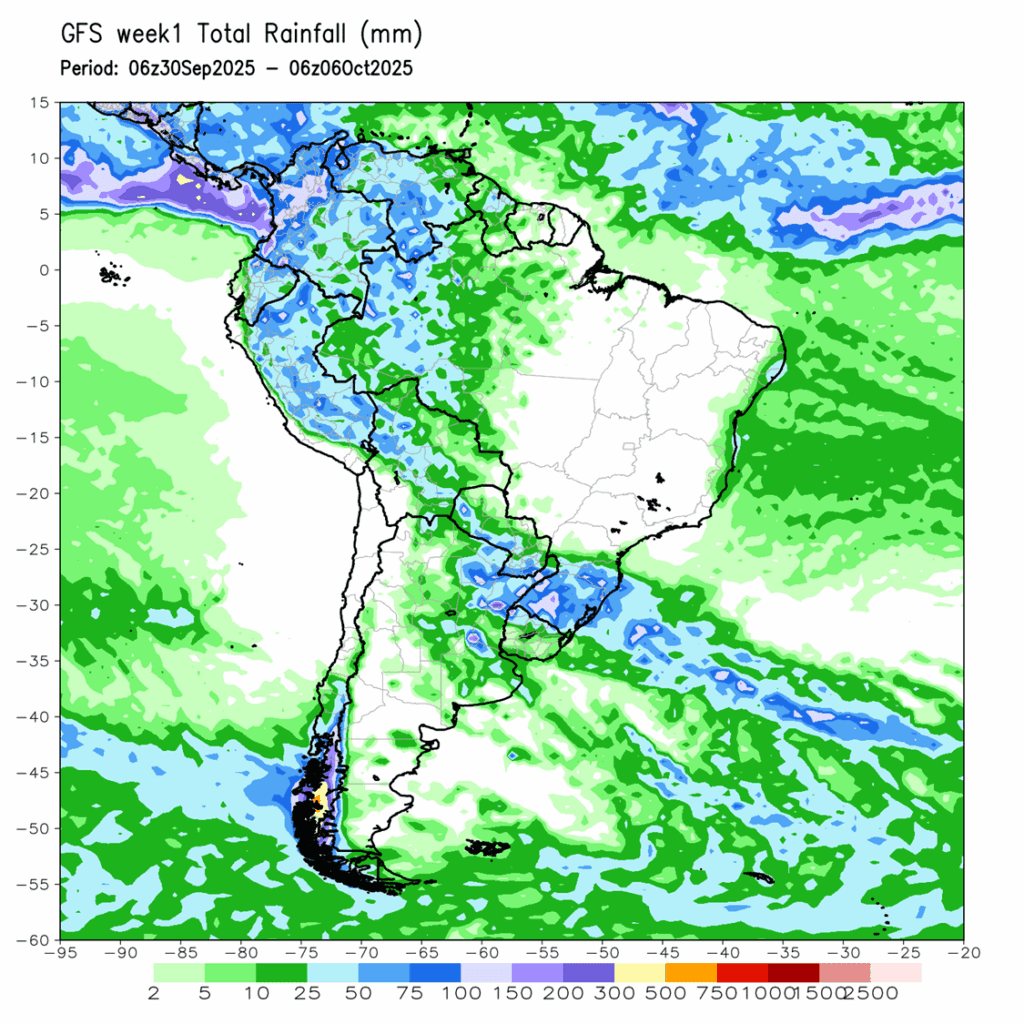

Above: South America 7-day total precipitation forecast, courtesy of National Weather Service, Climate Prediction Center.