9-27 End of Day: Meal Leads Beans and Corn Higher, While Wheat Slides

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’24 | 418 | 4.75 |

| MAR ’25 | 435 | 4 |

| DEC ’25 | 452.75 | 3.5 |

| Soybeans | ||

| NOV ’24 | 1065.75 | 24.75 |

| JAN ’25 | 1083 | 23.75 |

| NOV ’25 | 1100 | 16 |

| Chicago Wheat | ||

| DEC ’24 | 580 | -4.25 |

| MAR ’25 | 600.25 | -4 |

| JUL ’25 | 616.25 | -3.75 |

| K.C. Wheat | ||

| DEC ’24 | 576.75 | -2.25 |

| MAR ’25 | 591.75 | -2 |

| JUL ’25 | 607 | -1 |

| Mpls Wheat | ||

| DEC ’24 | 608.25 | -3.25 |

| MAR ’25 | 630.25 | -3.25 |

| SEP ’25 | 655.5 | -2.75 |

| S&P 500 | ||

| DEC ’24 | 5787 | -17.5 |

| Crude Oil | ||

| NOV ’24 | 68.24 | 0.57 |

| Gold | ||

| DEC ’24 | 2668 | -26.9 |

Grain Market Highlights

- Carryover strength from the soybean complex more than offset the influence of lower wheat, as December corn closed just off the top of the day’s range, with a 16 ¼ cent gain on the week.

- November soybeans negated yesterday’s bearish reversal, rallying back with support from sharply higher soybean meal, and closed nearly 109 cents above the August low, reaching their highest level in two months.

- Technical buying on the breakout in soybean meal, likely triggered by Hurricane Helene causing quality concerns to the soybean crop in the southern states, drove December meal to a $17.40 gain and its highest close since late June. Meanwhile, bean oil settled lower for the day, following through on yesterday’s weakness.

- Despite a strong rally in soybeans and subsequent gains in corn, the wheat complex ended the session lower across all three classes. Persistent selling pressure from yesterday’s bearish closes weighed on prices, with additional weakness likely influenced by improved rain chances in Ukraine and Russia.

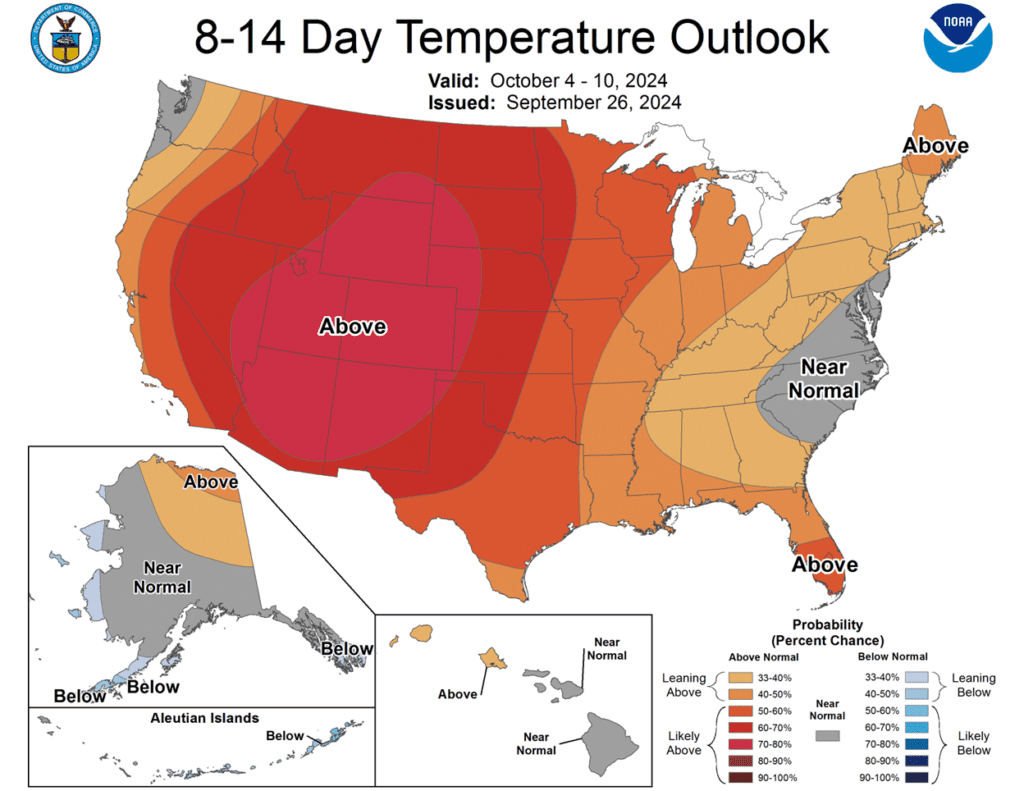

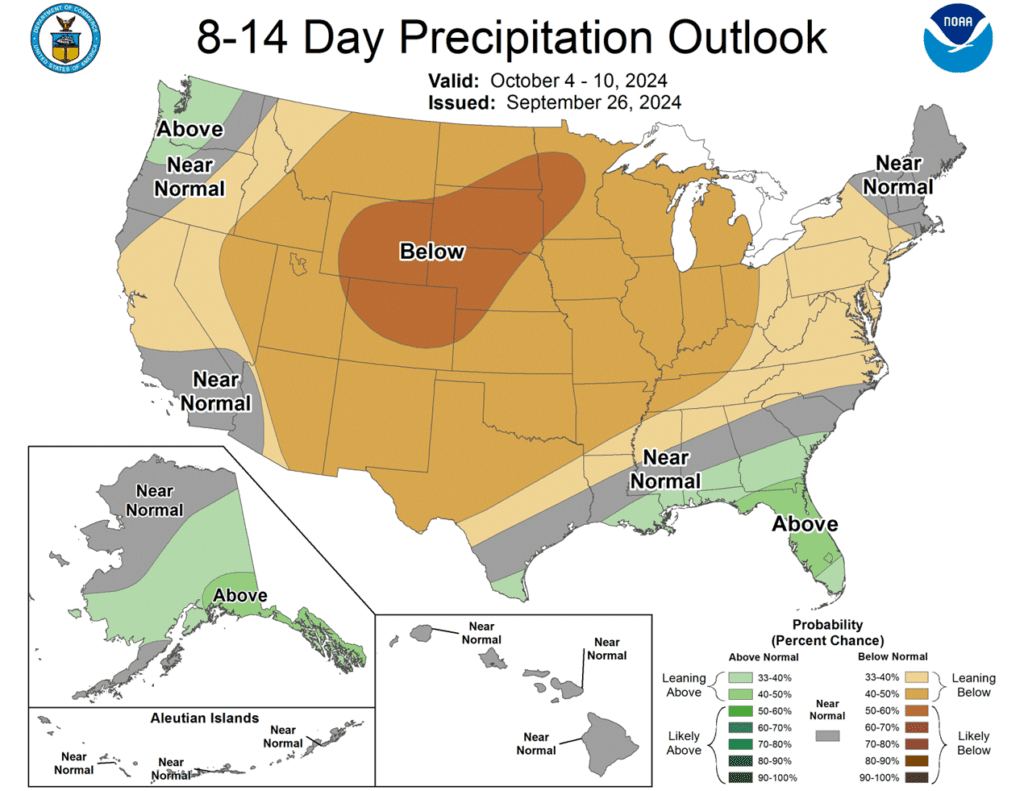

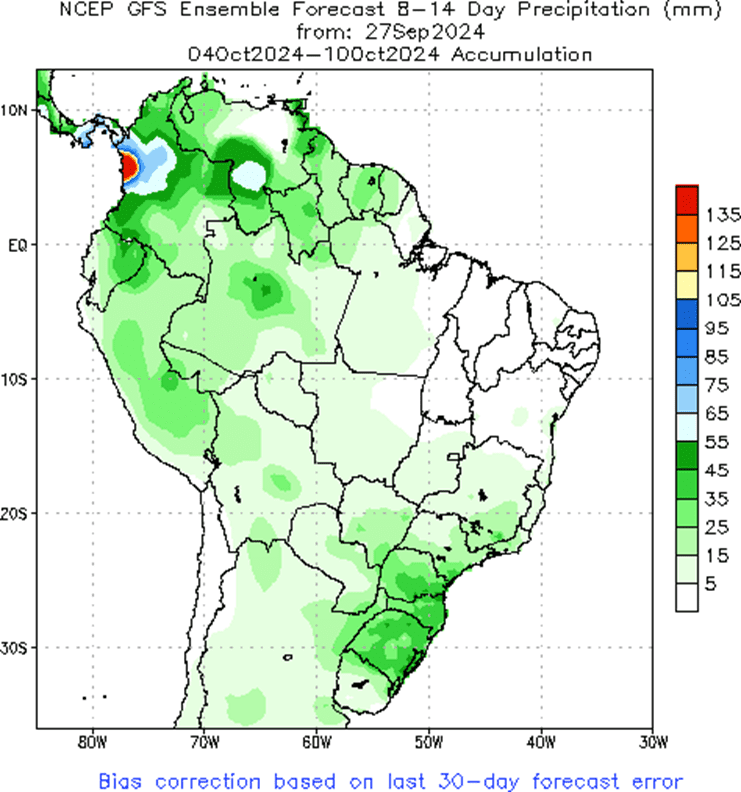

- To see the updated US 7-day precipitation forecast, 8-14 day Temperature and Precipitation Outlooks, and the 2-week precipitation forecast for Brazil and N. Argentina, courtesy of NOAA and the Climate Prediction Center, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

Since printing a market low in late August, the corn market has rallied largely on fund short covering as the rush of old crop bushels into the market has slowed and demand has picked up. While the harvest of an expectedly large crop may limit upside potential, it is a good sign that corn buyers are finding value at these multi-year low price levels. Any unexpected downward shift in anticipated supply or increase in demand could trigger managed funds to cover more of their short positions and rally prices further, however, an extended rally is unlikely until after harvest.

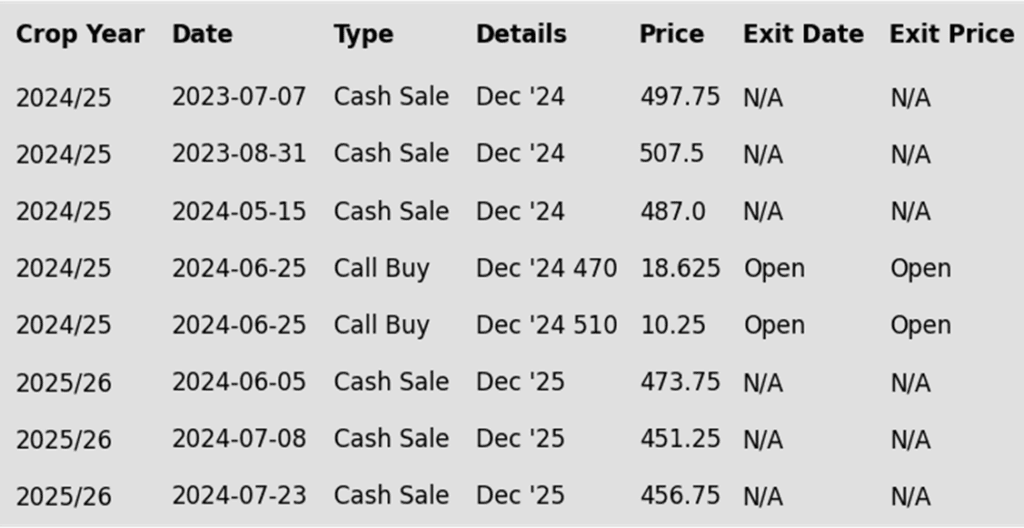

- No new action is recommended for 2024 corn. In June, we recommended purchasing Dec ’24 470 and 510 calls after Dec ’24 closed below 451, due to their relative value and the typically high market volatility during that time of year. Although we no longer have an upside objective for additional sales for now, we continue to target a value of 29 cents to exit the Dec ’24 470 calls. Exiting at this level will allow you to lock in gains that offset much of the original position’s cost, while holding the remaining 510 calls at or near a net-neutral cost. This strategy should continue to protect existing sales and provide confidence for further sales during an extended rally. Since harvest time is not an advantageous sales window, we will begin evaluating market conditions once it concludes and target areas for additional sales recommendations in late fall or early winter.

- No new action is currently recommended for 2025 corn. Between early June and late July Grain Market Insider made three separate sales recommendations to get early sales made for next year’s crop. Considering the seasonal weakness of the market in late summer and early fall, we will not be looking to post any targeted areas for new sales until late fall or early winter. Although, we will look to protect current sales, in the form of buying call options, should the market begin to show signs of a potential extended rally.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished the week with higher trade fueled by a strong rally in the soybean meal and soybean markets. Concerns regarding the quality of the southern soybean harvest impacted by Hurricane Helene helped push October soybean meal 6% higher on the session. December corn, with today’s rally, finished the week 16 ¼ cents higher and posted its highest daily close since July 26.

- Even with the strong close, corn futures still failed to push through the 420-price level, which seems to be a swing point on December corn charts.

- On Monday, The USDA will release the September Quarterly Grain Stocks Report and final planted acre estimates. The grain stocks will be closely watched. Expectations are for stocks as of Sept 1 to be at 1.846 billion bushels. This will be up 485 mb from last year. Concerns regarding the large supplies of old crop corn could be a concern, with the possibility last year’s harvest was bigger than estimated. The Grain Stocks report will set the goal post for prices through the harvest months.

- Weather in the western corn belt should stay favorable for harvest. Expectations is for corn harvest to be 24-25% complete through the weekend. Harvest pressure will likely limit corn’s upside potential.

Above: September 24, December corn pierced the 416 resistance level and posted a bearish reversal. Should the market trade lower, support may come in between 401 and 397, with further support down near 385. Otherwise, a close above the new recent high of 419 ¼, it would be poised to make a potential run towards 430, with resistance at the 200-day moving average just above there.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

After posting what appears to be a seasonal low in mid-August, the soybean market has gradually moved higher as growing conditions in the US became drier during the later stages of crop development and have remained dry in key soybean-growing areas of South America. During this time, managed funds have covered large portions of their sizable, short positions, setting the stage for potential volatility in either direction. Higher prices might occur if conditions deteriorate further, prompting more fund buying, or a downside break in prices could happen if conditions improve, leading funds to potentially reestablish short positions. Seasonally, once harvest is complete, prices tend to firm as hedge pressure subsides and a South American weather premium tends to build.

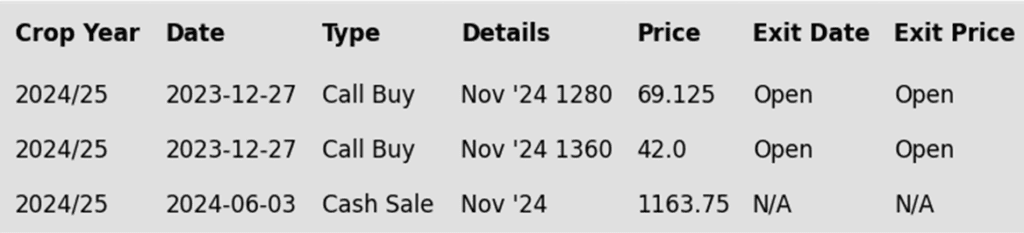

- No new action is recommended for the 2024 crop. In early June, when our Plan B strategy was triggered by the market’s close below 1180, we recommended making sales at that time due to the potential change in trend signaled by that weak close. While we don’t currently have a target range for additional sales, because harvest time typically does not present the most advantageous prices, we will begin evaluating market conditions once it concludes and will target areas for additional sales recommendations in late fall or early winter.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop yet. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day sharply higher to close out the week with huge support from soybean meal which was up $17.30 in December just today. Some of the support in meal likely came from dry conditions in both Argentina and Brazil, and Brazil is expected to receive more significant rains within the next few weeks. Soybean oil ended the day lower.

- While some support in the soybean meal may have come from dry South American weather, that is not new information. The more likely support in meal today is the impact of the hurricane and flash flooding that is impacting the quality of soybeans in the South. There are multiple large hog processing plants in North Carolina that were reportedly locking large amounts of meal today due to the quality concerns.

- While some support in the soybean meal may have come from dry South American weather, that is not new information. The more likely support in meal today is the impact of the hurricane and flash flooding that is impacting the quality of soybeans in the South. There are multiple large hog processing plants in North Carolina that were reportedly locking large amounts of meal today due to the quality concerns.Soybean oil was slightly lower to end the day which was surprising given the strength in the soybean complex and the fact that a flash sale of 20,000 metric tons of soybean oil was reported for delivery to South Korea during the 24/25 marketing period.

- For the week, November soybeans gained 53 ¾ cents to end at 1065 ¾ and March soybeans gained 51 ½ cents to end at 1095 ¼. December soybean meal gained a whopping $24.90 to end at $344.10 and December soybean oil gained 1.00 cent at 42.36 cents. Funds were estimated to have bought back over 35,000 soybean contracts this week.

Above: November soybeans’ strong close above 1031 ¼ resistance suggests that prices could run toward the late July high between 1080 – 1085. Above there, further resistance could be met near the 100-day moving average. If prices retreat, initial support may be found near 1030, with further downside support between the 50-day moving average and 995.

Wheat

Market Notes: Wheat

- Despite a sharply higher trade in soybeans, wheat received little support and closed lower across all three futures classes. This decline may be partially attributed to improved chances for rain in eastern Ukraine and southern Russia during the second week of the forecast.

- The European Commission has reportedly lowered its estimate of EU soft wheat production by 1.5 million metric tons, bringing the total to 114.6 mmt. In related news, FranceAgriMer reports that as of Monday, 1% of the French soft wheat crop has been planted, which is in line with the average pace.

- Although the Buenos Aires Grain Exchange has indicated the possibility of reducing its corn forecast, the outlook for wheat has improved. Wheat, predominantly grown in the southern regions, has benefited from recent rains, prompting the exchange to raise its wheat production estimate to 18.6 mmt on Wednesday.

- Ukraine’s wheat exports for the 24/25 season may be capped at 16.2 mmt. The country’s agricultural minister stated that limited supplies could necessitate this export cap. As of September 25, Ukraine’s wheat exports have totaled 5.6 mmt. For reference, the USDA estimates their exports at 15 mmt.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

After posting a seasonal low in late July, the wheat market staged a rally that began in late August triggered by crop concerns due to wet conditions in the EU, and smaller crops out of Russia and Ukraine. The nearly 80-cent rally from the August low to September high also saw Managed funds cover about two-thirds of their net short positions. While low Russian export prices continue to be a limiting factor for higher US prices, a new season is upon us with many uncertainties ahead that could keep volatility in the market. Additionally, US export sales remain ahead of the pace set last year and in 2022, and any increase in demand from lower World supplies could rally prices further.

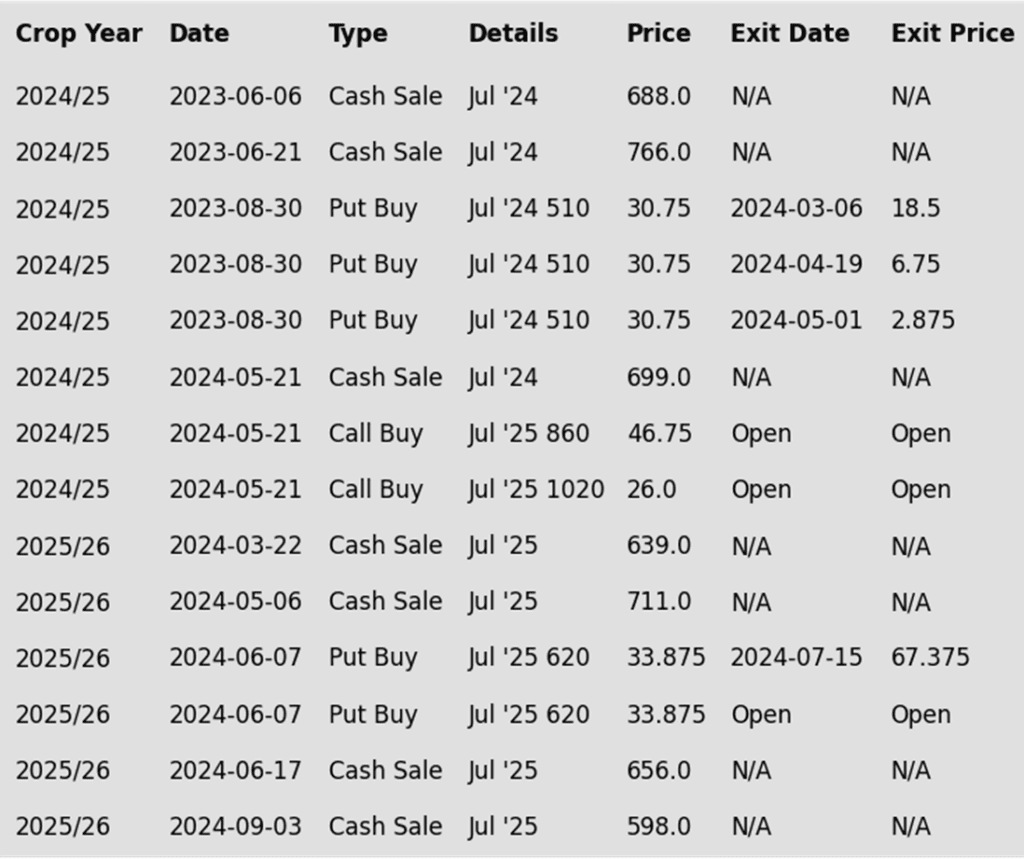

- No new action is recommended for 2024 Chicago wheat. Considering the rally in wheat back in May, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 740 – 760 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is recommended for 2025 Chicago wheat. Recently, we recommended taking advantage of the wheat rally to sell more of your anticipated 2025 SRW production. While we continue to recommend holding the remaining July ’25 620 puts — after advising to exit the first half back in July — to maintain downside coverage for any unsold bushels, we are targeting a 10-15% extension from our last sale to the 650–680 area in July ’25 to suggest making additional sales.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

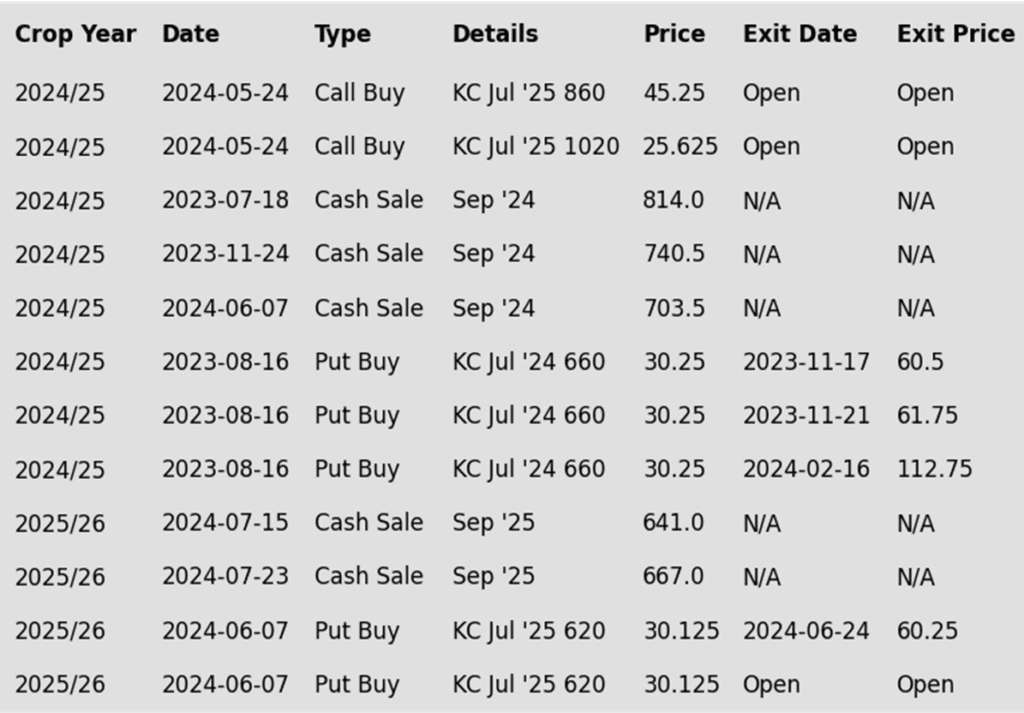

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Since early September, prices have been mostly rangebound. Overhead, a close above 600 resistance could put prices on course to test the 640 – 645 area. Whereas a close below 560 could put the market at risk of trading down to the 50-day moving average with support near 544.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

Since mid-July, the wheat market has mostly drifted sideways as the trade tries to balance smaller US and global wheat supplies against cheaper world export prices. During this period, a potential seasonal low was also marked on the front month continuous charts as managed funds maintained a sizable net short position in the wheat markets. While low Black Sea export prices and slow world demand continue to weigh on US prices, the funds’ short position could trigger an extended short covering rally on any increase in US demand as world wheat ending stocks are expected to fall yet again this year.

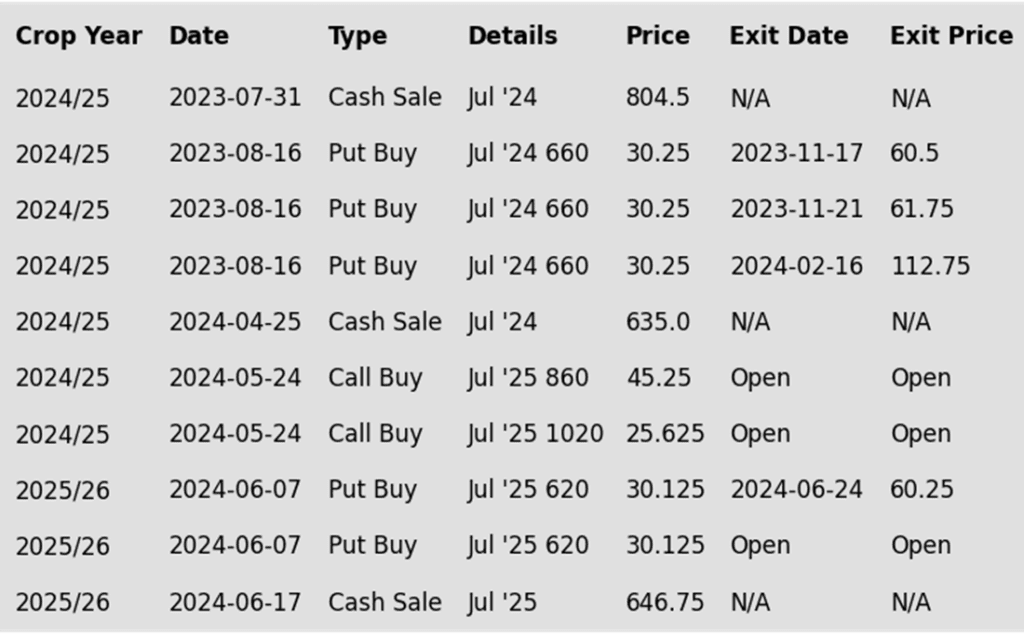

- No new action is recommended for 2024 KC wheat. Considering the upside breakout in KC wheat back in May, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 675 – 700 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. Earlier this summer we recommended exiting half of the previously recommended July ’25 620 puts once they reached 60 cents (double the original approximate cost) to realize gains in case the market rallies back, while still holding the remaining 620 puts at, or near, a net neutral cost for continued downside coverage on any unsold bushels. To that end, we are currently targeting the upper 400 range versus July ’25 to exit half of those remaining puts. Meanwhile, our current upside strategy is to target the 640 – 670 range, also in the July ’25, to recommend making additional sales.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following KC recommendations:

Above: December KC wheat appears to have found support right near the 50-day moving average and reversed back higher. Overhead, resistance remains near the 100 and 200-day moving averages near the recent 604 ¼ high. A close above there could put the market on track towards 637, whereas a close below 561 ¼ could put the market at risk of sliding towards the 527 ¼ low.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

Since posting a seasonal low in late August, Minneapolis wheat has traded at the upper end of the range that was established in early July. During this period, managed funds have covered about 40% of their short positions in Minneapolis wheat. While low export prices out of Russia continue to limit upside opportunities, concerns regarding world wheat supplies remain, which could increase opportunities for US exports and potentially drive prices higher.

- No new action is recommended for 2024 Minneapolis wheat. With the close below 712 support in June, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices. While we are at the time of year when market lows often occur, we will consider posting upside targets in late September or early October when market conditions often become more advantageous, and harvest is mostly behind us.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we made two separate sales recommendations in July to get some early sales on the books for next year’s crop. While we will not be targeting any specific areas to make additional sales until later in the marketing year, we will continue to monitor the market for opportunities to exit the remaining July ’25 KC 620 puts that were recommended in June. To that end, we are currently targeting the upper 400 range versus July ’25 KC to exit half of those remaining puts.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: Since early September, December Minneapolis wheat has been largely rangebound between support near the 50-day moving average and resistance near 637. A breakout to the upside could put the market in position to rally toward 685, with potential resistance around the 100 and 200-day moving averages. To the downside, a break below the 50-day moving average could put the market at risk of sliding towards 560.

Other Charts / Weather

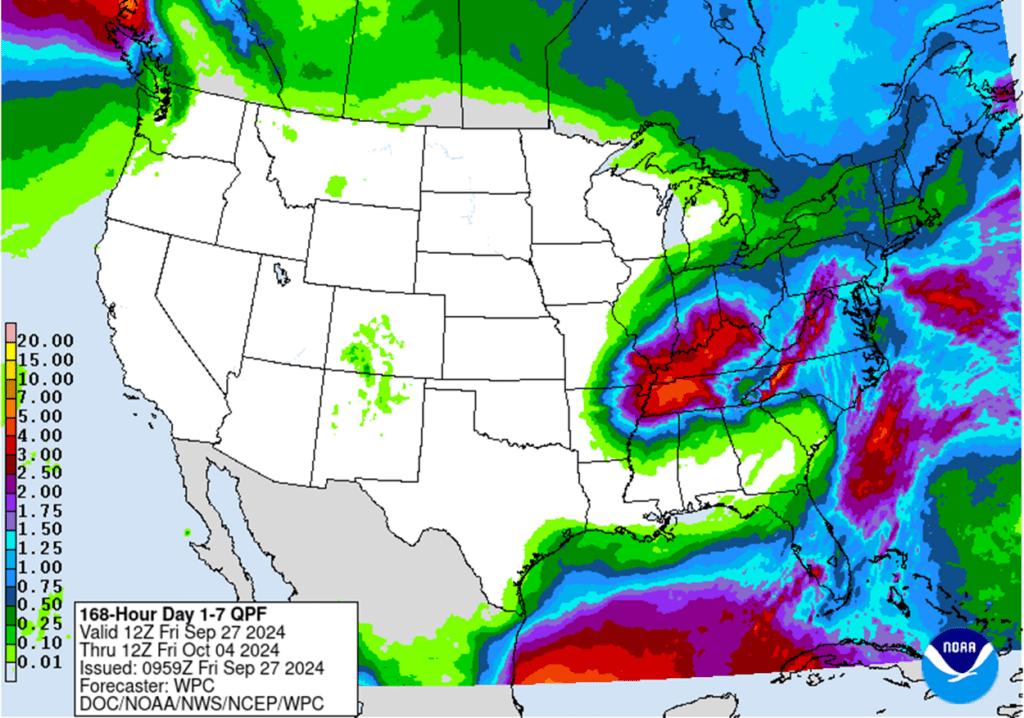

US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Brazil and N. Argentina 2-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.