9-26 End of Day: Corn and Wheat Slump, Soybeans Inch Higher Friday

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures ended the week with moderate losses, pressured by harvest progress, a weak wheat market, and a lack of fresh news.

- 🌱 Soybeans: Soybeans closed modestly higher Friday, supported by soybean meal, though futures remained rangebound all week.

- 🌾 Wheat: Wheat futures ended the week lower across all three classes, pressured by ample global supplies and sluggish export demand.

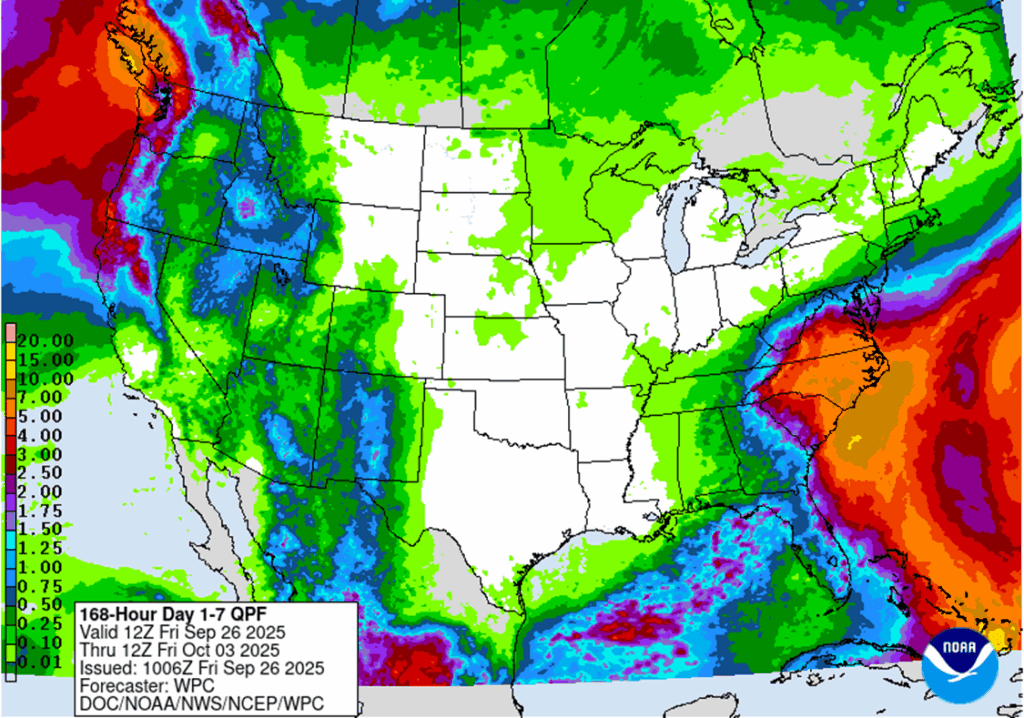

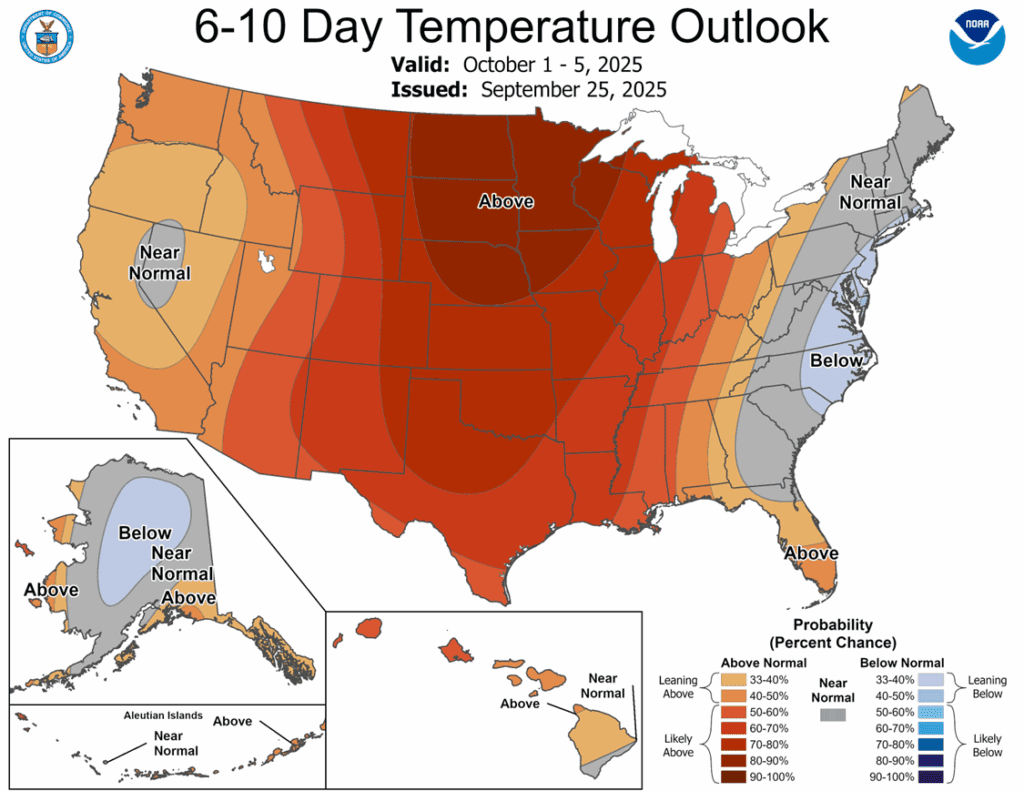

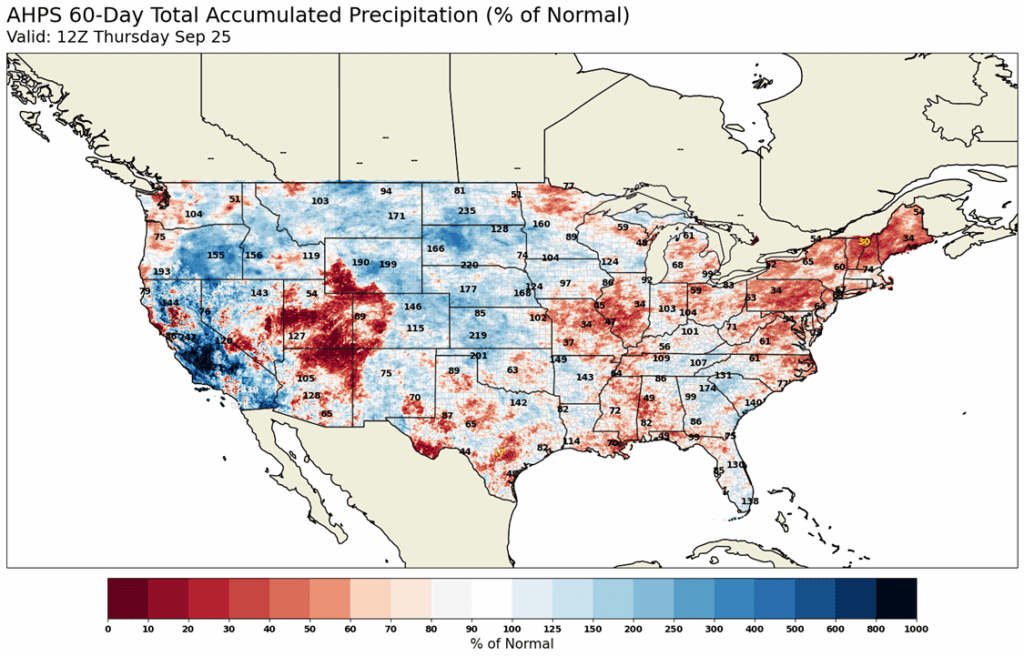

To see updated U.S. weather maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/3rd DEC ’25 420 Puts ~ 8c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity: Sell one-third of the remaining December ‘25 420 corn puts today.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Recommendation to sell one-third of the remaining December ‘25 corn puts has been added. This means that 33% of the remaining position should be closed out, leaving 50% of the original position to continue to provide downside protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures ended the week with moderate losses, pressured by harvest progress, weak wheat markets, and a lack of fresh news. December corn lost 3 ¾ cents to 422, and March lost 3 ½ cents to 438 ¾. For the week, December corn traded 2 cents lower.

- Harvest reached 11% complete as of Sept. 21. Progress is expected to accelerate with above-normal temperatures forecast into mid-October across much of the Corn Belt.

- Export demand remains strong with 2025/26 sales at 1.014 bb — up 75% from last year and already 34% of USDA’s 2.975 bb annual forecast

- Demand for U.S. corn on the export market should remain strong as global ending stocks are at their lowest since 2014, and U.S. supplies are forecasted to be well above the 5-year average, leaving the U.S. as the main source of global corn exports.

- Total acres of U.S. corn acreage in drought reached 26% percent on Thursday’s drought monitor map. This is nearly triple the acres in drought from 2 weeks ago as areas of the corn belt remain dry, which could impact final yield totals.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher going into the weekend thanks to support from soybean meal, but prices have been rangebound all week. November soybeans gained 1-1/2 cents to $10.13-3/4 and March soybeans gained 1-1/2 cents to $10.49. October soybean meal gained $0.20 to $268.80 and October soybean oil lost 0.14 cents to 49.60 cents.

- China booked roughly 40 cargoes of Argentine soybeans during the temporary export tax suspension, but with the tax now reinstated, Argentina has met sales goals. Despite the absence of Chinese buying, U.S. soybean export sales have held steady.

- Dr. Cordonnier revised his estimates for the 2025/26 soybean yields, lowering them to 52 BPA, down 0.5 BPA from his previous estimate. This compares to the USDA’s last estimate of 53.5 BPA. While declining yields could provide support, the lack of Chinese purchases may offset this impact on ending stocks.

- For the week, November soybeans lost 11-3/4 cents with the bulk of those losses on Monday. March soybeans lost 11-3/4 cents as well. October soybean meal lost $14.10 and came close to the contract low from August. October soybean oil lost 0.43 cents and found support at the 200-day moving average earlier in the week.

Wheat

Market Notes: Wheat

- Wheat ended the week lower across all three classes, continuing a week of pressure from ample global supplies and sluggish export demand. Prices briefly rallied during Thursday’s trading session, but were unable to sustain gains. Overall, the market remains weighed down by ongoing uncertainty in trade and expectations of steady production levels. The December contract for Chicago is down 7-2 cents at $5.19.

- SovEcon has lowered its forecast for Russian grain exports in 2025/26 by 0.7%, bringing the total to 43.4 mmt. The revision reflects a slower-than-expected start to the export season, with shipments down 29% from July through September. In comparison, the USDA continues to project Russian exports at 45 mmt.

- President Trump has announced that revenue from tariffs will be used to fund a farmer aid package aimed at supporting producers affected by trade disputes. The package is expected to roll out in early 2026, pending approval.

- Rains in central and northern Argentina are supporting wheat development, while the EU has raised its total grain output for the upcoming season to 284.2 million tons, up from 276.9 million tons last month. The strength of global wheat production and overall supply continues to put pressure on markets.

- The USDA is set to release its Small Grains Summary this coming Tuesday. Wheat is expected to see only minor adjustments from previous estimates for the 2025/26 U.S. crop.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 621.25 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 621.25.

- Notes:

- Resistance for the macro trend sits at 621.25 vs December ‘25. A close above 621.25 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 602 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 587 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 639.25 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan B call option target has been lowered to 639.25.

- Notes:

- Resistance for the macro trend sits at 639.25 vs December ‘25. A close above 639.25 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 641 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 641.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 639.25 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 639.25.

- Notes:

- Resistance for the macro trend sits at 639.25 vs December ‘25. A close above 639.25 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather