9-25 End of Day: U.S. Grains Gain on Argentina Export Tax Move

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures closed higher as harvest progress continues, and strong export demand provides support.

- 🌱 Soybeans: Soybeans pushed higher today on news that Argentina reinstated its grain export tax, which is expected to make U.S. soybeans more competitively priced on the global market.

- 🌾 Wheat: Wheat ended the session on a strong note despite the spike in the U.S. dollar, finding support from news out of Argentina.

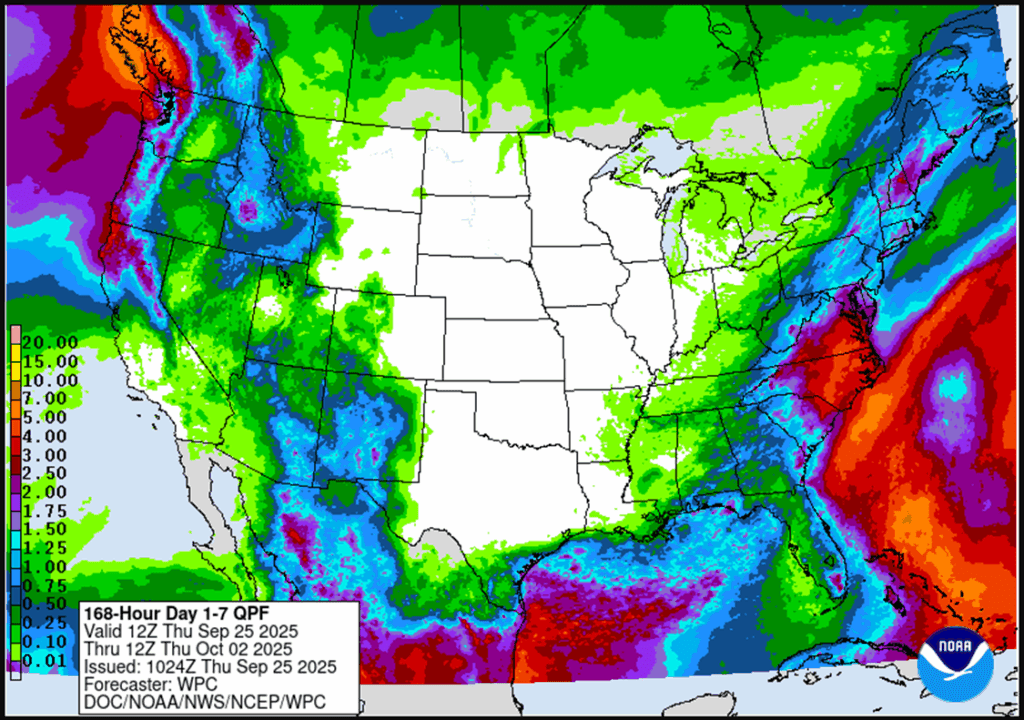

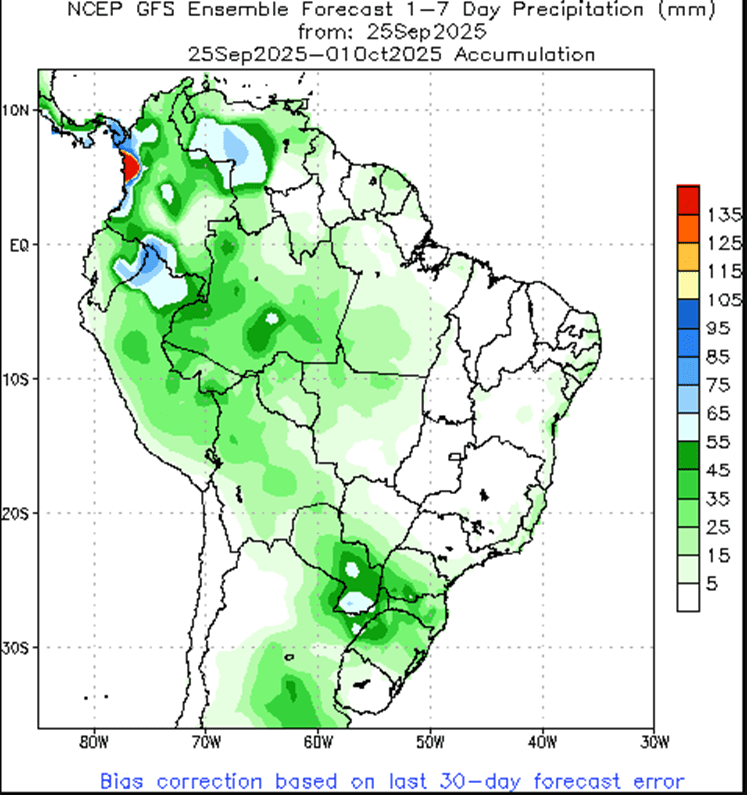

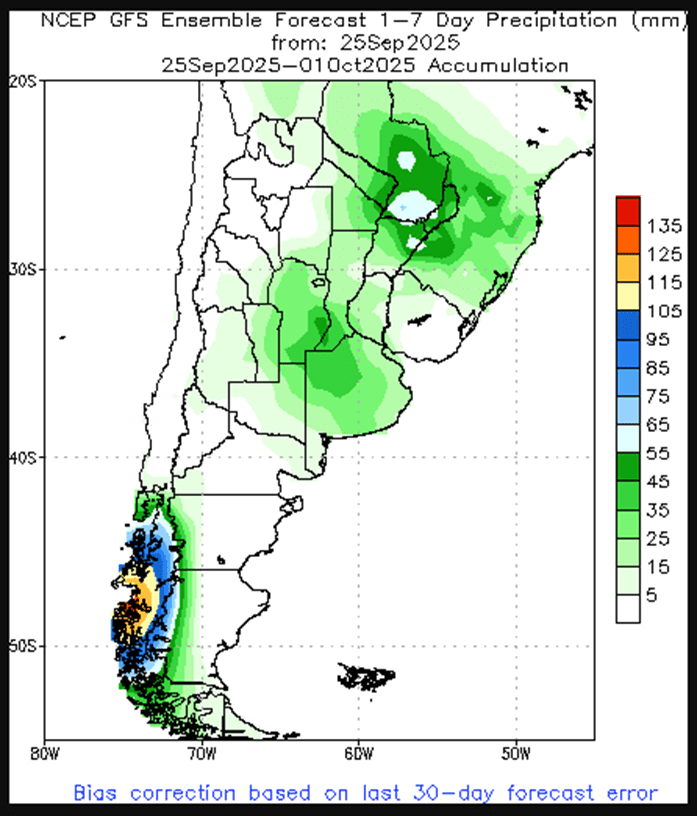

To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/3rd DEC ’25 420 Puts ~ 8c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity: Sell one-third of the remaining December ‘25 420 corn puts today.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Recommendation to sell one-third of the remaining December ‘25 corn puts has been added. This means that 33% of the remaining position should be closed out, leaving 50% of the original position to continue to provide downside protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished the day with a modest rally to close with marginal gains on the session. A strong export demand tone was balanced against a strengthening U.S. dollar to limit gains. December corn gained 1 ½ cents to 425 ¾, while March corn added 1 ¼ cents to finish at 442 ¼.

- Argentina reinstated its export taxes on agricultural commodities Thursday morning after reaching the $7 billion export sales target for all agricultural goods. The corn export tax has returned to 9.5% on Argentine corn exports.

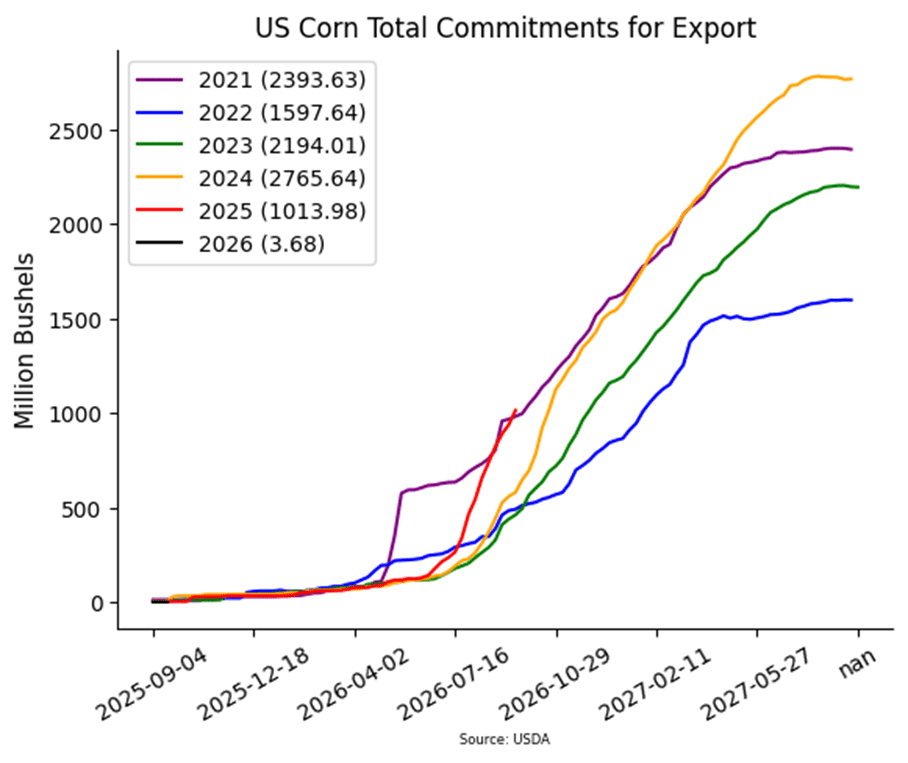

- Weekly export sales were strong again this week. For the week ending September 18, USDA recorded net sales of 1.923 MMT (75.7 mb). This total exceeded expectations, with Mexico once again the largest buyer of U.S. corn. With this pace, 2025–26 has marked the strongest start to export sales in modern recordkeeping history, surpassing the 2018–19 marketing year.

- President Trump made a statement on Thursday that his administration is working on a farmer aid package funded by tariff revenue collected by the U.S. While details remain limited, the package is expected to mirror those implemented during his first administration.

- The U.S. Dollar Index has continued to pressure grain futures prices. The dollar has traded higher in five of the last seven sessions and is currently at its highest level in a month.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher in continued rangebound trade which has seen November soybeans between $10.05 and $10.20 over the past few days. November gained 3-1/4 cents to $10.12-1/4 while March gained 2-3/4 cents to $10.47-1/2. October soybean meal lost $3.10 to $268.60 and October soybean oil gained 0.45 cents to 49.74 cents.

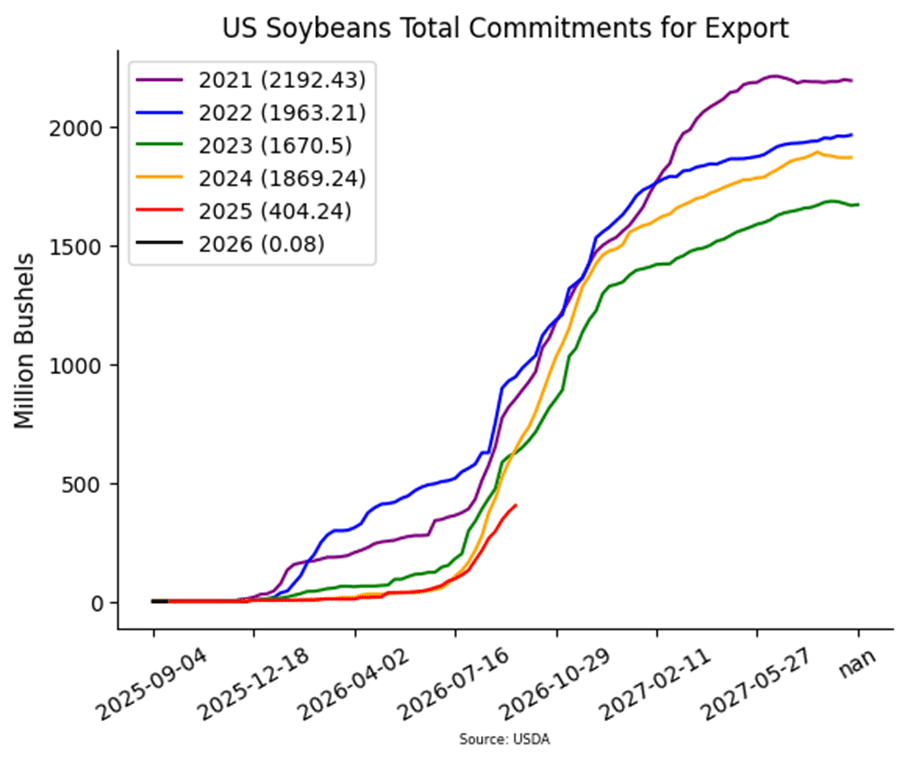

- Overnight, the Argentine government announced that the country’s $7 billion soybean export sales target had been met, and that the export tax on soybeans will return to 26% today, making U.S. soybeans more competitively priced by comparison.

- Today’s export sales report saw soybean sales within trade estimates with an increase of 26.6 million bushels for 25/26 and none for 26/27. Top buyers were Egypt, Taiwan, and Mexico. Last week’s export shipments of 18.8 mb were below the 32.1 mb needed each week to meet the USDA’s export estimates.

- Dr. Cordonnier revised his estimates for the 2025/26 soybean yields, lowering them to 52 BPA, down 0.5 BPA from his previous estimate. This compares to the USDA’s last estimate of 53.5 BPA. While declining yields could provide support, the lack of Chinese purchases may offset this impact on ending stocks.

Wheat

Market Notes: Wheat

- Wheat had a strong session today, closing with a 7-1/2 cent gain for December Chicago to 527. Meanwhile, Dec Kansas City was up 5-1/2 cents to 512-1/4 and MIAX gained 5-1/4 cents to 573. This is impressive considering that the U.S. Dollar index surged higher again today, breaking above its 100 day moving average for the first time since August 1.

- Today’s big news was that Argentina reinstated its grain export tax after just two days, having already met its $7 billion export revenue target. This development provided a boost to the U.S. grain complex, along with reports that U.S. second-quarter GDP data came in stronger than expected.

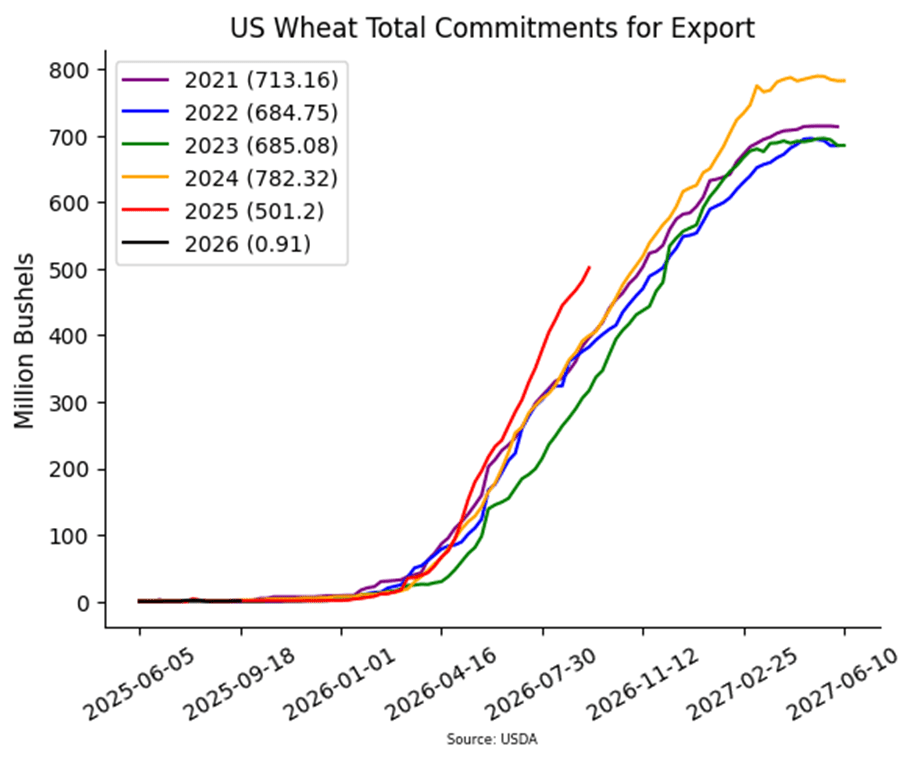

- The USDA reported an increase of 19.8 mb in wheat export sales for 25/26. Shipments last week amounted to 32.9 mb which was well above the 16.8 mb pace needed to reach the USDA export goal of 900 mb. Wheat 25/26 sales commitments now total 501 mb, which is up 24% from last year.

- Global increases to the wheat crop may limit upside for U.S. futures. The European Commission raised its estimate of EU soft wheat production by 4.5 MMT, bringing the total to 132.6 MMT, and also increased the EU wheat export forecast by 4% to 31 MMT. Additionally, IKAR again revised its forecast for Russian production upward, this time by 0.5 MMT to 87.5 MMT, while raising its export estimate by 0.1 MMT to 44.1 MMT.

- According to an analyst poll, Australia may harvest its third-largest wheat crop on record. The median forecast for the nation’s wheat crop is 35.3 MMT, which would surpass last season’s total of 34.1 MMT and exceed the five-year average of 33.8 MMT. For reference, the all-time record was 40.5 MMT during the 2022/23 season.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 623 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 623.

- Notes:

- Resistance for the macro trend sits at 623 vs December ‘25. A close above 623 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 602 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 587 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 644.75 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A target has been lowered to 587.

- The Plan B call option target has been lowered to 644.75.

- Notes:

- Resistance for the macro trend sits at 644.75 vs December ‘25. A close above 644.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

2026 Crop:

- Plan A:

- Target 641 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 641.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 644.75 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 644.75.

- Changes:

- The Plan B call option target has been lowered to 644.75.

- Notes:

- Resistance for the macro trend sits at 644.75 vs December ‘25. A close above 644.75 would signal a potential shift to a macro uptrend, triggering a call option purchase.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- Notes:

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center