9-24 End of Day: Stronger U.S. Dollar Weighs on Grains Wednesday

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures finished softer Wednesday as harvest pressure and a firmer U.S. dollar limited buying interest.

- 🌱 Soybeans: Soybeans ended lower Wednesday after fading from early gains of up to 8 cents, Reuters reported China has purchased 20 soybean cargoes from Argentina following its temporary export tax cut.

- 🌾 Wheat: Wheat futures closed lower Wednesday in Chicago and Kansas City, pressured by a stronger U.S. dollar at a two-week high.

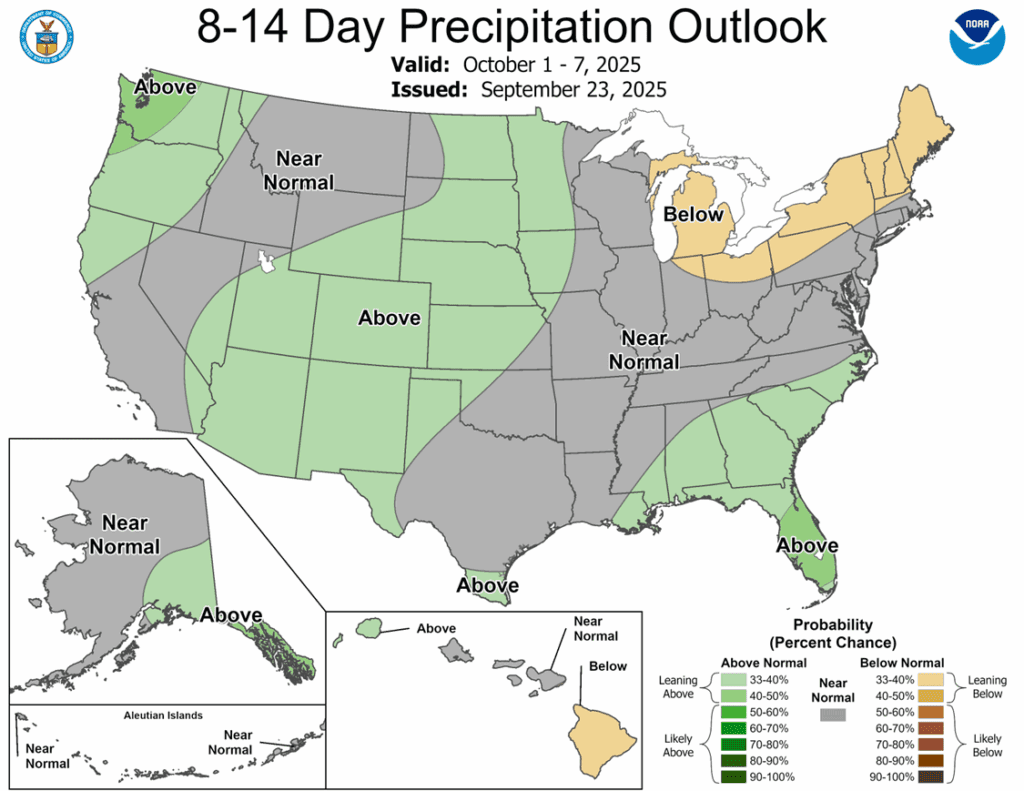

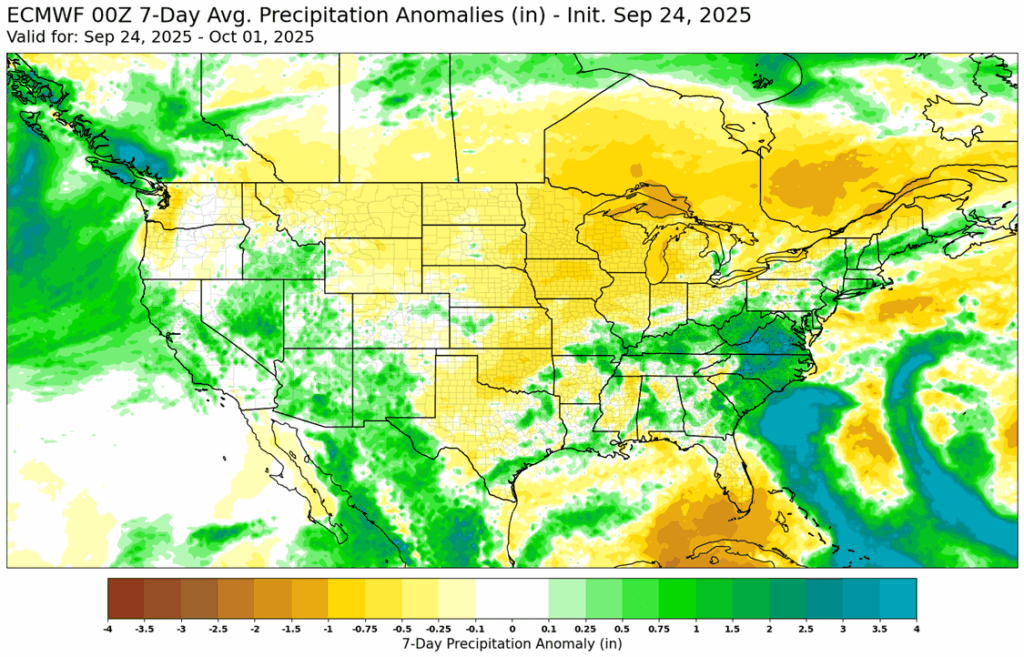

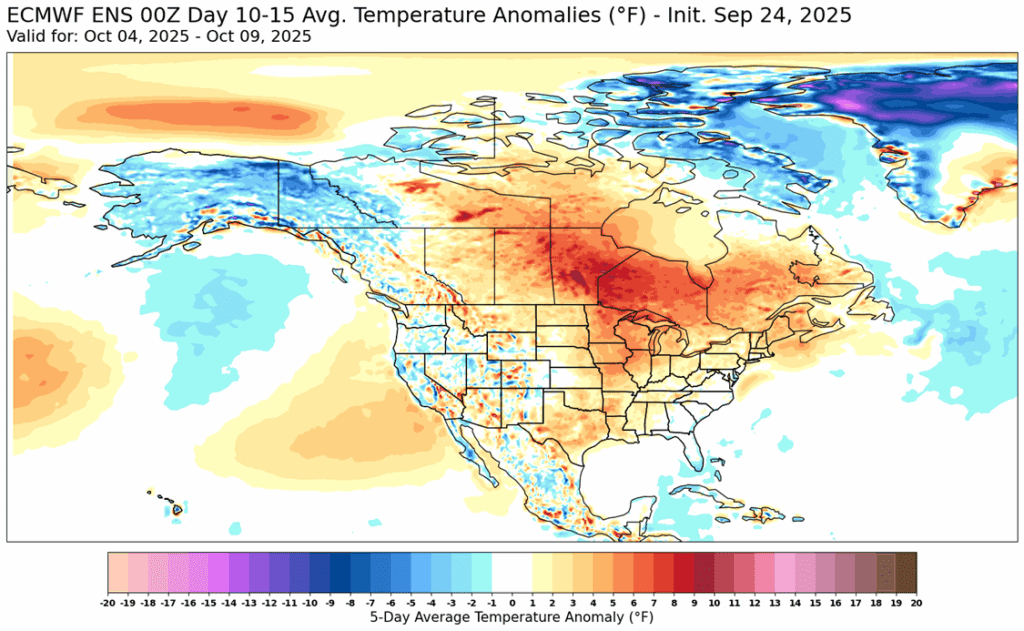

To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/3rd DEC ’25 420 Puts ~ 8c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity: Sell one-third of the remaining December ‘25 420 corn puts today.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Recommendation to sell one-third of the remaining December ‘25 corn puts has been added. This means that 33% of the remaining position should be closed out, leaving 50% of the original position to continue to provide downside protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

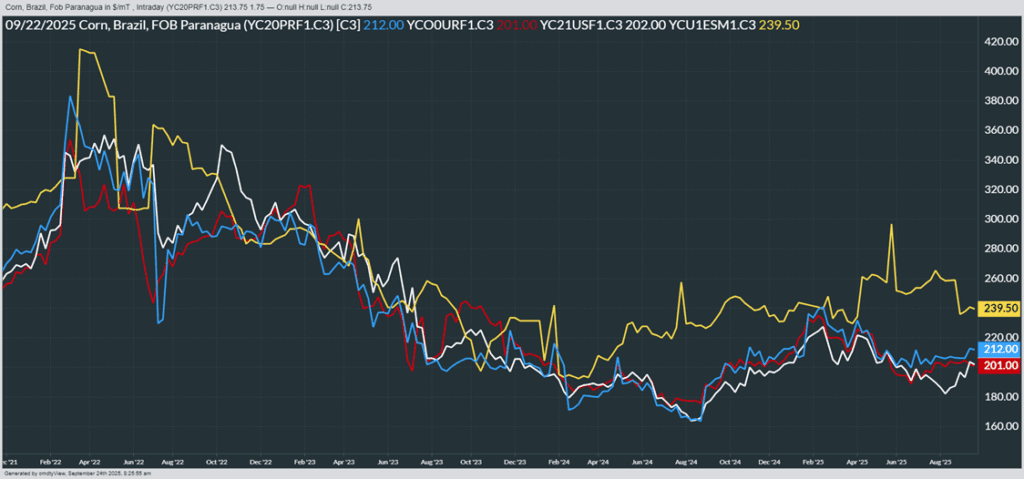

- Corn futures finished softer Wednesday as harvest pressure and a firmer U.S. dollar limited buying interest despite solid export demand. December corn slipped 2 cents to 424-1/4, while March fell 2 cents to 441.

- Weekly ethanol production averaged 1.024 million barrels/day, down 2.9% from last week and 3% from last year — below expectations. About 102 mb of corn was used, trailing the pace needed to meet USDA’s annual target.

- USDA announced a flash export sale of corn on Wednesday morning. Mexico purchased 312,956 MT (12.3 mb) of corn for the current marketing year. Since last Friday (9/19), Mexico has purchased nearly 40 mb of U.S. corn. The USDA will release weekly export sales total on Thursday morning.

- The U.S. dollar climbed to near a two-week high, limiting gains across ag commodities.

- Longer-range forecasts show above-normal temperatures and normal to below-normal precipitation into October — favorable for harvest, though harvest pressure is expected to cap rallies.

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

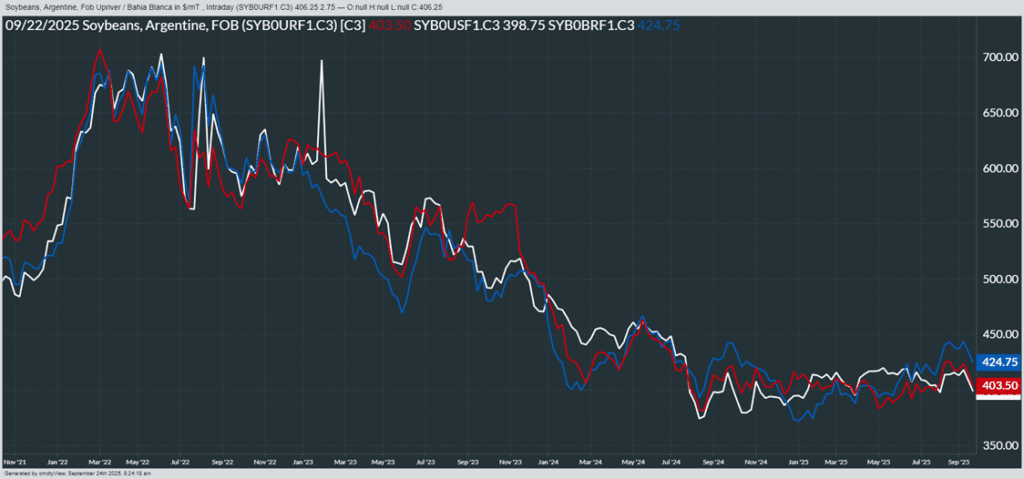

- Soybeans ended the day lower after having faded significantly from earlier morning highs, which saw prices up as much as 8 cents, and futures remain below all major moving averages. November soybeans lost 3 cents on the day to $10.09, while March lost 3 cents to $10.44-3/4. October soybean meal lost $3.40 to $271.70 and October soybean oil lost 0.06 cents to 49.29 cents.

- Dr. Cordonnier revised his estimates for the 25/26 soybean yields to be lowered to 52 bpa, down 0.5 bpa from his last estimate. This compares to the USDA’s last estimate of 53.5 bpa. While declining yields could be supportive, the lack of Chinese purchases could offset this in the ending stocks.

- This morning, private exporters reported to the U.S. Department of Agriculture export sales of 101,400 metric tons of soybean cake and meal for delivery to Guatemala during the 2025/2026 marketing year. While China has purchased nearly all of their soy products from South America, other countries are pressured to get their needs from the U.S.

- Reuters reported China has purchased 20 soybean cargoes from Argentina following its temporary export tax cut. While this made Argentine soybeans cheaper, reports also suggest the U.S. will buy Argentine bonds—strengthening the peso and negating some of the competitiveness.

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

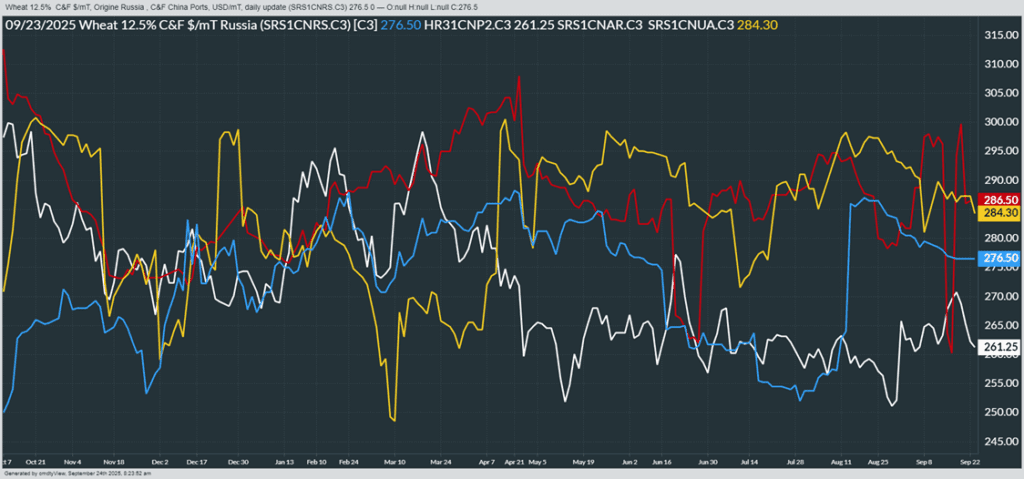

- Wheat futures closed lower Wednesday in Chicago and Kansas City, pressured by a stronger U.S. dollar at a two-week high. December Chicago lost 1 cent to 519-1/2, Kansas City fell 4-3/4 to 506-3/4, while Minneapolis was steady at 567-3/4. Paris milling wheat posted a second straight higher close, offering some spillover support.

- U.S. HRW wheat is now priced below comparable Russian and German hard wheats, keeping U.S. export sales ahead of expectations.

- Over the weekend a storm front brought widespread rainfall to Argentina. However, it was followed by cold air which caused some frost in southeastern areas. This may have caused some wheat damage; however, the rains are timely and are beneficial for wheat development.

- According to the International Grains Council, Russian wheat export prices increased last week, despite falling for other global exporters. U.S. wheat offers at the Gulf are said to be 12% below where they were last year at this time.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The Plan B call option target has been lowered to 633.25.

2026 Crop:

- Plan A:

- Target 602.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A target has been lowered to 587.

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 641.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather

US 7-day ECMWF precipitation anomaly courtesy of ag-wx.com

US 10-15 day ECMWF temperature anomaly courtesy of ag-wx.com