9-23 End of Day: Grains Stabilize and Recover from Monday Losses

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures finished slightly higher with continued export demand strength supporting market prices.

- 🌱 Soybeans: Soybeans futures ended the day with minimal gains, stabilizing following their four-day losing streak.

- 🌾 Wheat: Wheat futures recovered from Monday’s losses following reports that Russian export values continue to rise.

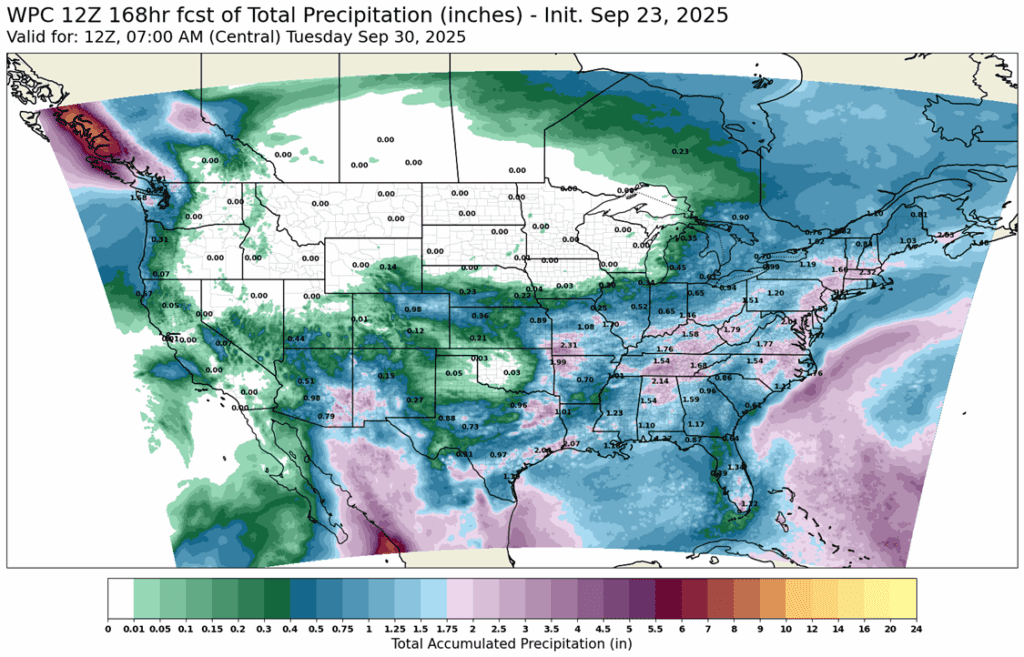

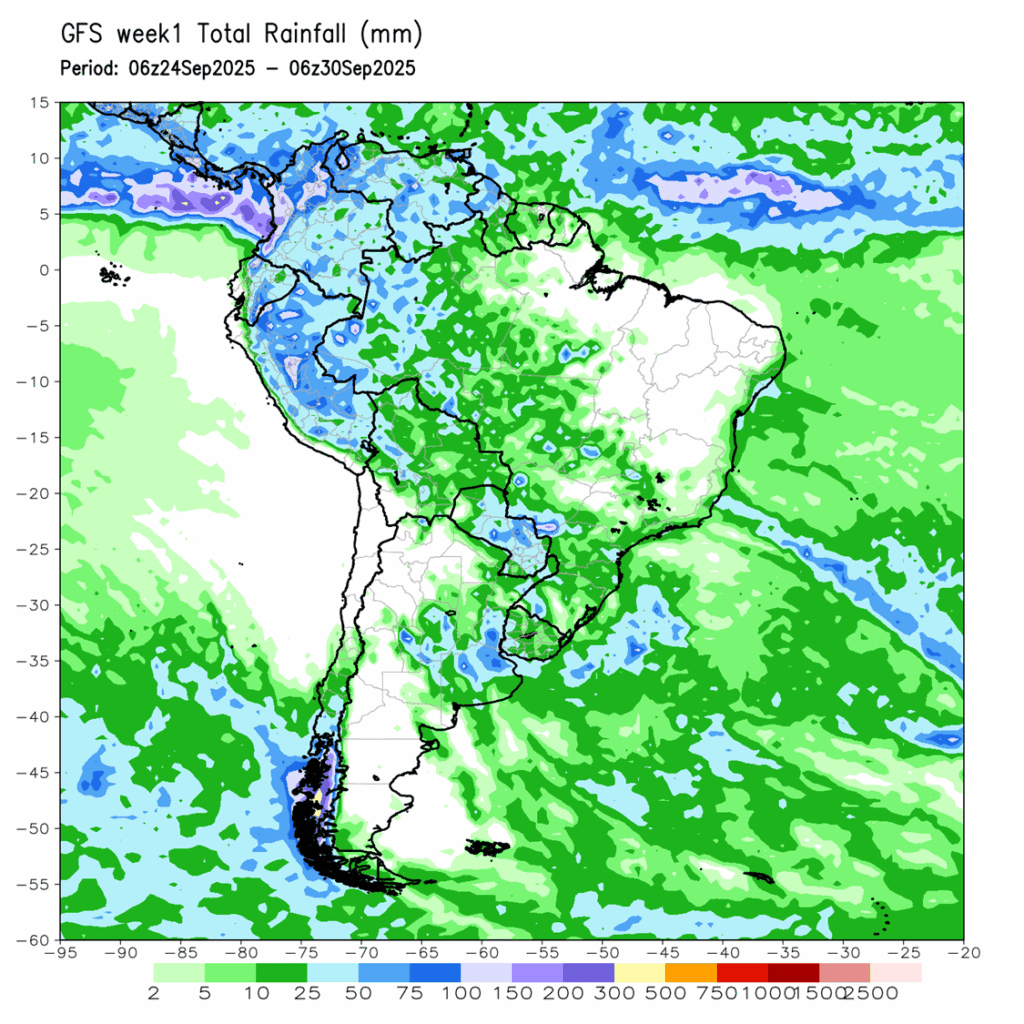

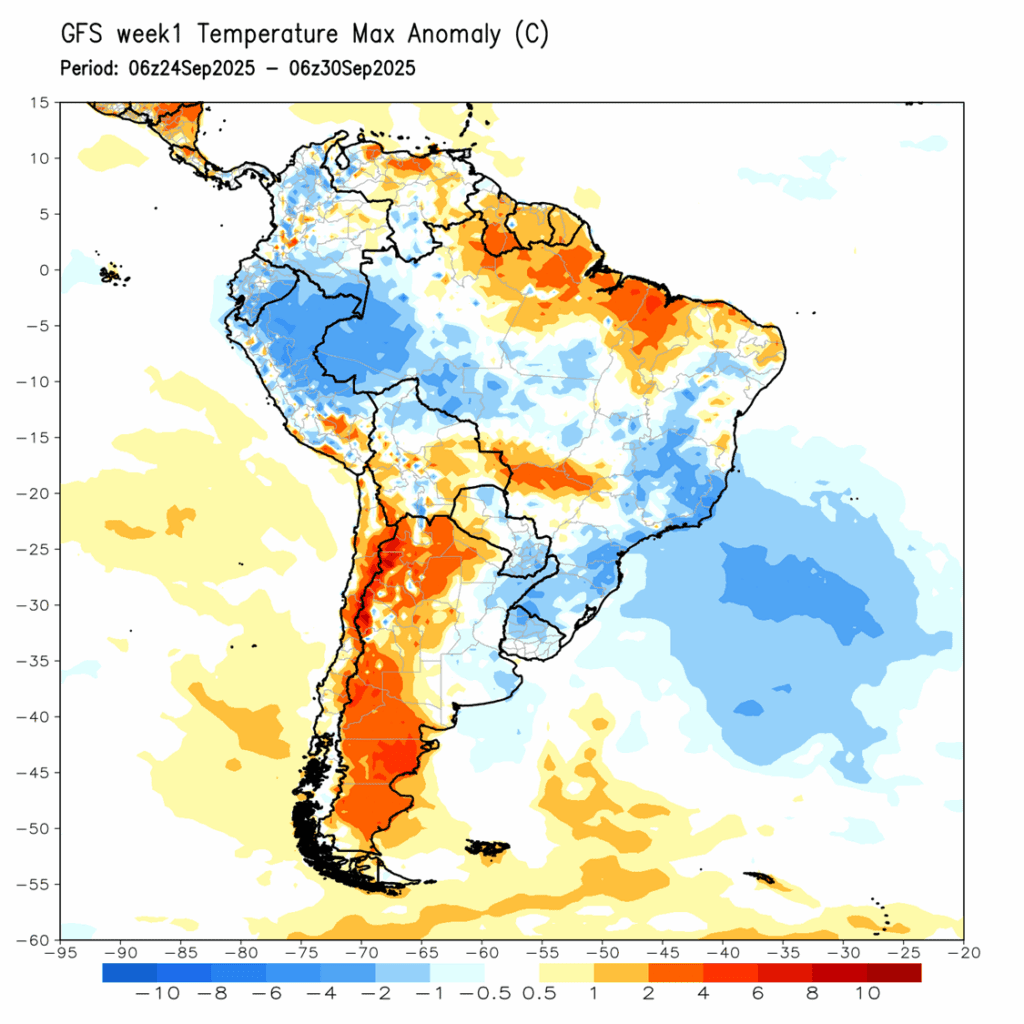

To see updated U.S. and South America weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/3rd DEC ’25 420 Puts ~ 8c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity: Sell one-third of the remaining December ‘25 420 corn puts today.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Recommendation to sell one-third of the remaining December ‘25 corn puts has been added. This means that 33% of the remaining position should be closed out, leaving 50% of the original position to continue to provide downside protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures fought off early session lows and closed higher in Tuesday’s session as good export demand helped support prices. December corn gained 4 ½ cents to 426 ¼, and March added 4 ¼ cents to 443.

- The technical picture for corn improved with today’s price action. December futures held support near 420 and closed at the top of the range above the 100-day moving average, and above yesterday’s high. The strong close could lead to additional short covering and buying strength on Wednesday.

- The USDA announced a flash sale of export corn again on Tuesday morning. Mexico bought 122,947 MT (4.84 mb) of corn, with 100,593 MT (3.96 mb) for this marketing year and 22,354 (880,000 bu) for 2026-27. This was the fourth consecutive morning with an export sale.

- As export demand remains strong, projections for the corn crop stay on the decline. The dry weather and disease pressure has analyst and satellite data pushing the size of the corn crop closer to the trendline average. This would still be a record corn crop with the additional acres added over the past two WASDE reports.

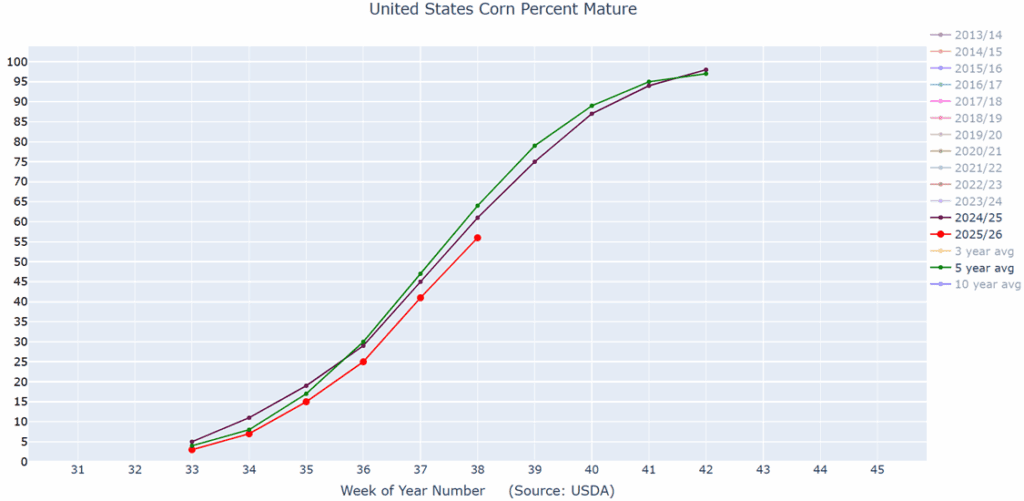

- The corn harvest in the US is progressing in line with the 5-year average. As of September 21, 11% of this year’s crop was harvested, up 4% over last week. Wet weather in some regions will slow harvest to start this week, but long-term forecast look support of a good harvest pace.

Corn percent mature (red) versus the 5-year average (green) and last year (purple).

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day quietly higher breaking a 4-day losing streak and coming back from earlier morning lows that took out yesterday’s low. November soybeans gained 1 cent to $10.12 while March soybeans gained ¾ cent to $10.47-3/4. October soybean meal lost $3.80 to $275.10 and October soybean oil gained 0.18 cent to 49.35 cents.

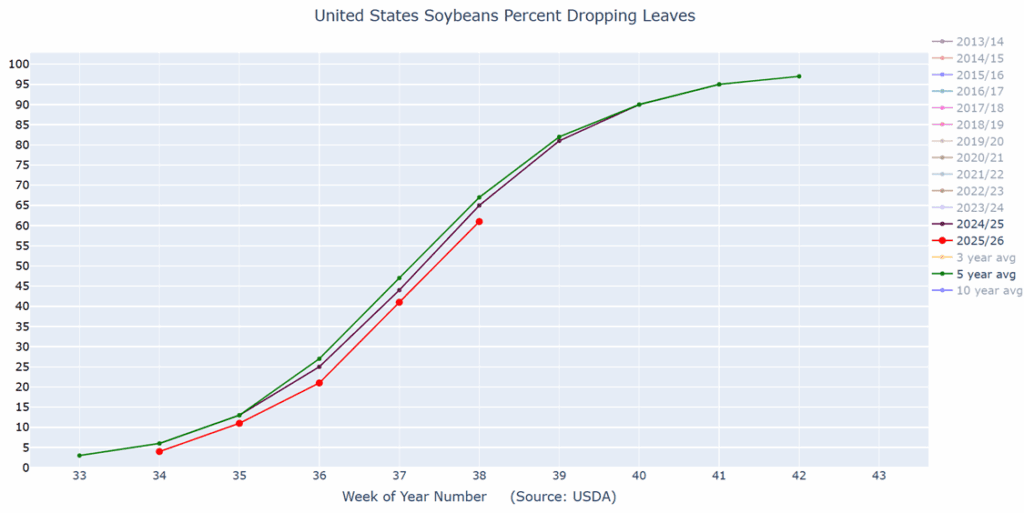

- Yesterday’s Crop Progress Report saw crop ratings fall by 2 points from last week to 61% good to excellent compared to 64% a year ago. 61% of the crop is dropping leaves compared to the 5-year average of 60%. Harvest is now 9% complete compared to 5% a week ago.

- Yesterday’s export inspections were sluggish for soybeans at 484k tons which compared to 822k last week and 499k a year ago. Top destinations were to Egypt, Indonesia, and United Kingdom. Total inspections for 25/26 are now at 57.7 million bushels, which is up 26% from the previous year.

- Demand concerns remain as recent trade negotiations with China were disheartening to the soybean market due to little progress on soybean exports. The reduced export taxes by Argentina may allow China to cover more needs for Nov-Dec, an area US exporter were hoping to tap into.

Soybeans percent dropping leaves (red) versus the 5-year average (green) and last year (purple).

Wheat

Market Notes: Wheat

- Wheat futures rebounded today December contracts of Chicago gaining 9-3/4 cents to 520-1/2, Kansas City up 9-1/4 to 511-1/2, and MIAX gaining 3-3/4 to 567-3/4. With little fresh news, this may be a purely technical bounce. However, there are some reports that firming Russian values may be benefiting global wheat prices – SovEcon has said that Russian wheat export values rose another dollar (versus last week) to $229/mt.

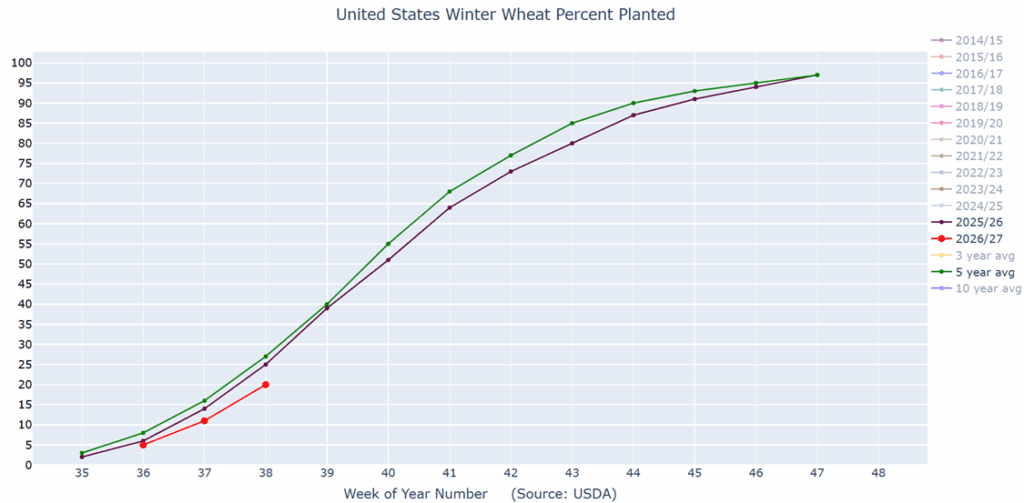

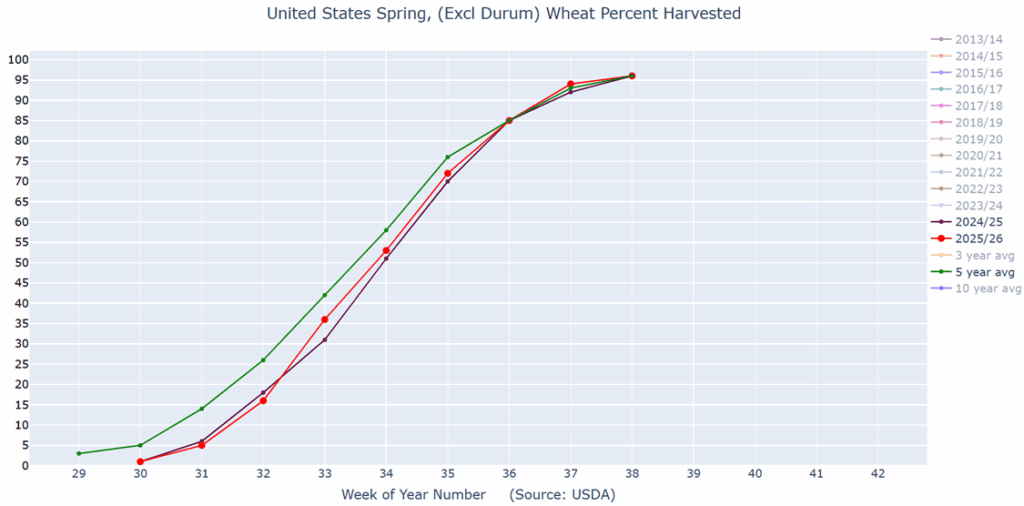

- According to the USDA, the spring wheat harvest is 96% complete, in line with average and 1% ahead of last year’s pace. Additionally, the winter wheat crop is 20% planted, which is behind both the average and last year’s pace by 3%. Winter wheat is 4% emerged, in line with last year and the average pace.

- Wheat harvest in Brazil is increasing their domestic supply, leading to suppressed prices. According to CONAB, as of September 13, and estimated 13.8% of the wheat area has been harvested.

- Ukraine’s economy ministry has reported that winter grain planting has reached 1.6 million hectares as of September 23. This is down slightly from the 1.8 million sown at the same time last year. This year, winter wheat planting has reached 672,000 hectares, compared with 878,800 last year.

- The Canadian Grain Commission has said that samples of the Canadian durum wheat crop show sprouting damage and mildew, caused by damp weather conditions. Earlier this month, Stats Canada estimated the durum crop at 6.53 mmt – if realized this would be the largest harvest since 2020.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 602.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- The Plan A target has been lowered to 587.

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The Plan A target has been lowered to 641.

To date, Grain Market Insider has issued the following KC recommendations:

Winter wheat percent planted (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Spring wheat percent harvested (red) versus the 5-year average (green) and last year (purple).

Other Charts / Weather

Above: U.S. 7-day total precipitation forecast, courtesy of ag-wx.com

Above: South America 7-day total precipitation forecast, courtesy of National Weather Service, Climate Prediction Center

Above: South America 7-day maximum temperature anomaly, courtesy of National Weather Service, Climate Prediction Center