9-22 End of Day: Grains Start the Week Lower as Harvest Begins

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures finished lower on Monday, pressured by heavy soybean losses.

- 🌱 Soybeans: Soybeans futures finished sharply lower following news that Argentina has suspended its grains export tax, making Argentinian soybeans more competitive in the global market.

- 🌾 Wheat: Wheat futures pressed lower, pressured by global market dynamics and spillover weakness from soybeans.

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/3rd DEC ’25 420 Puts ~ 8c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity: Sell one-third of the remaining December ‘25 420 corn puts today.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Recommendation to sell one-third of the remaining December ‘25 corn puts has been added. This means that 33% of the remaining position should be closed out, leaving 50% of the original position to continue to provide downside protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures held support but finished lower on the session. News of Argentina export tax cut was balanced by good export demand, helping corn finish with mild loses. December corn finished 2 ¼ cents lower to 421 ¾, and March corn lost 2 ½ cents to 438 ¾.

- Argentina announced that they would be lowering export taxes for corn and soybean exports to “0” until October 31 on Monday morning. The current export tax for corn was at 9.5%. The reduced export tax makes Argentina corn more competitive with US corn on the export market.

- Weekly export inspections for corn were within expectations. For the week ending September 18, USDA exporters shipped 1.328 MMT (52.3 mb) of corn. Total inspections for 2025-26 marketing year are now at 137.5 mb, up 59% from the previous year.

- USDA announced another flash sale of corn on Monday morning. The USDA reported that Mexico purchased 320,068 MT (12.6 mb) of corn for the current marketing year. This was the fourth reported sale of US corn in the past seven days.

- Corn harvest is expected to push to 13% complete, up 6% from last week on the weekly crop progress report. Recent rainfalls should limit harvest progress early in the week in some areas. The southern corn belt is concerned about heavy rainfall, which could impact crop quality.

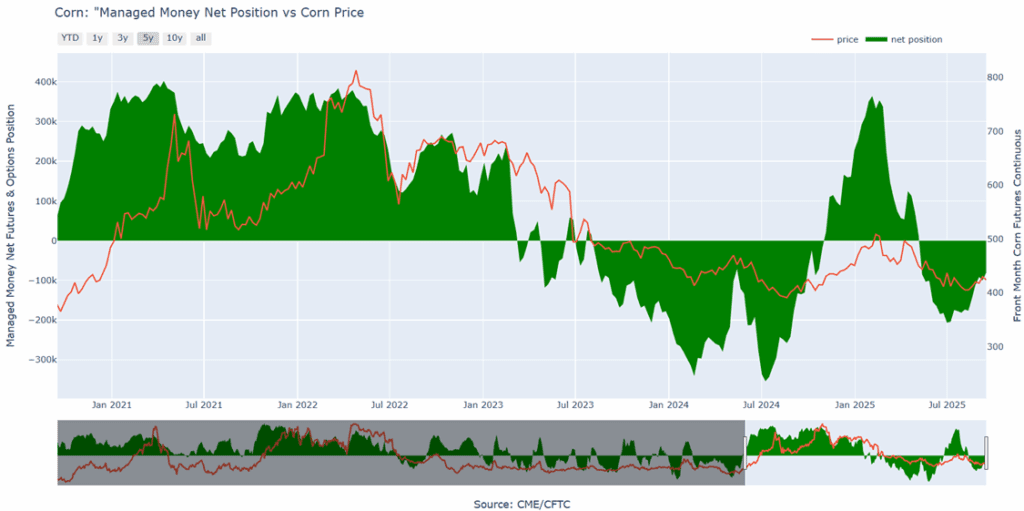

Corn Managed Money Funds net position as of Tuesday, September 16. Net position in Green versus price in Red. Money Managers purchased 19,878 contracts between September 9 – September 16, bringing their total position to a net short 80,051 contracts.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day sharply lower after Argentina announced it would cut taxes on grain exports. November soybeans lost 14-1/2 cents to $10.11 while March lost 13-3/4 cents to $10.47. Both contracts are now below all major moving averages. October soybean meal lost $4.00 to $278.90 and October bean oil lost 0.86 cents to 49.17 cents.

- Argentina announced a reduction in their soybean and corn export taxes to “0” until October 31. The current export tax for soybeans was at 26% and soybean oil and meal at 24.5%. The reduction of the export tax move Argentina soybean and product into a more competitive price level with U.S. soybeans.

- Demand concerns remain as recent trade negotiations with China were disheartening to the soybean market due to little progress on soybean exports. The reduced export taxes by Argentina may allow China to cover more needs for Nov-Dec, an area US exporter were hoping to tap into.

- Weekly soybean export inspections were withing expectations on Monday. For the week ending September 18, U.S. exporters shipped 484,00MT (17.8 mb) of soybeans. U.S. soybean export shipments typically peak in mid to late October for U.S. Soybean exports.

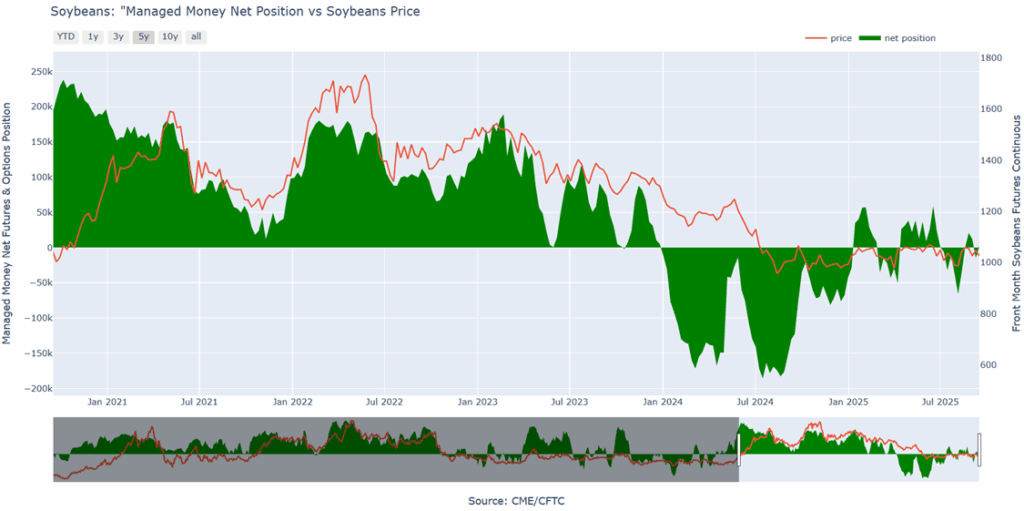

Soybean Managed Money Funds net position as of Tuesday, September 16. Net position in Green versus price in Red. Money Managers purchased 17,001 contracts between September 9 – September 16, bringing their total position to a net long 2,287 contracts.

Wheat

Market Notes: Wheat

- Wheat posted double digit losses for Chicago futures, with the December contract down 11-3/4 cents to 510-3/4. Dec Kansas City lost 5 cents to 502-1/4 and MIAX closed 3-1/2 cents lower at 564. The grain complex was largely pressured by news that Argentina has eliminated their export taxes on all grains through October 31, or until income reaches the equivalent of $7 billion. The wheat export duty was previously 9.5%.

- Weekly wheat inspections amounted to 31.4 mb, coming in above expectations. This brings the total 25/26 inspections to 320.1 mb, up 13% from last year. Inspections are running above the USDA’s estimated pace. Total 25/26 wheat exports are forecasted at 900 mb, up 9% from the year prior.

- According to IKAR, Russian wheat export values increased $3 last week to $228/mt. There are rumors that IKAR may raise their estimate of the Russian wheat crop to 88 mmt on good yields. SovEcon is forecasting Russia’s September wheat exports will reach 4.2 mmt.

- The Rosario Grains Exchange has estimated that Argentina’s 25/26 grain exports could be a record 105.1 mmt. The previous high was 104.1 mmt in the 18/19 season. Due to lower grain prices, they project that income would be steady with last season at $34.8 billion.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 602.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.75.

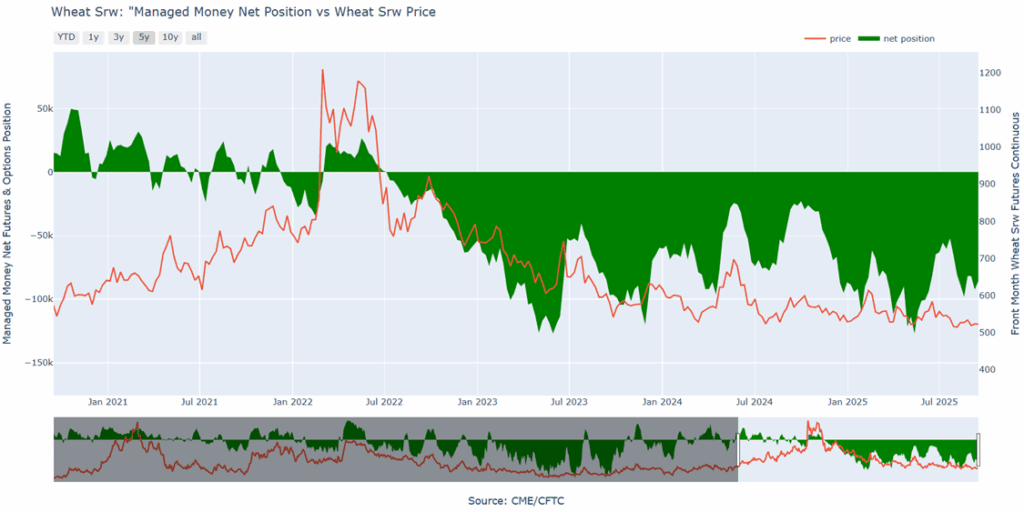

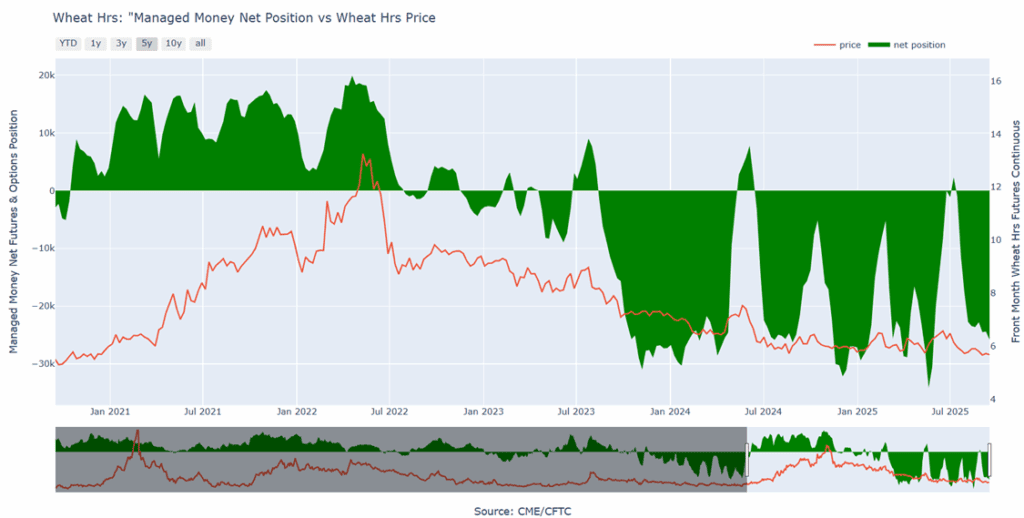

Chicago Wheat Managed Money Funds’ net position as of Tuesday, September 16. Net position in Green versus price in Red. Money Managers purchased 6,569 contracts between September 9 – September 16, bringing their total position to a net short 85,825 contracts.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None

To date, Grain Market Insider has issued the following KC recommendations:

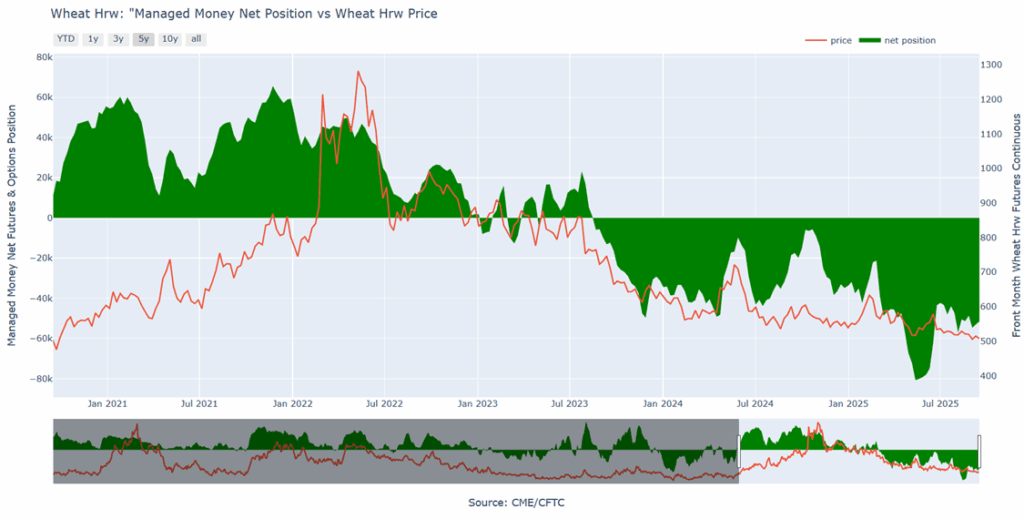

KC Wheat Managed Money Funds’ net position as of Tuesday, September 16. Net position in Green versus price in Red. Money Managers purchased 1,491 contracts between September 9 – September 16, bringing their total position to a net short 51,534 contracts.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, September 9. Net position in Green versus price in Red. Money Managers sold 1,433 contracts between September 9 – September 16, bringing their total position to a net short 25,832 contracts.

Other Charts / Weather

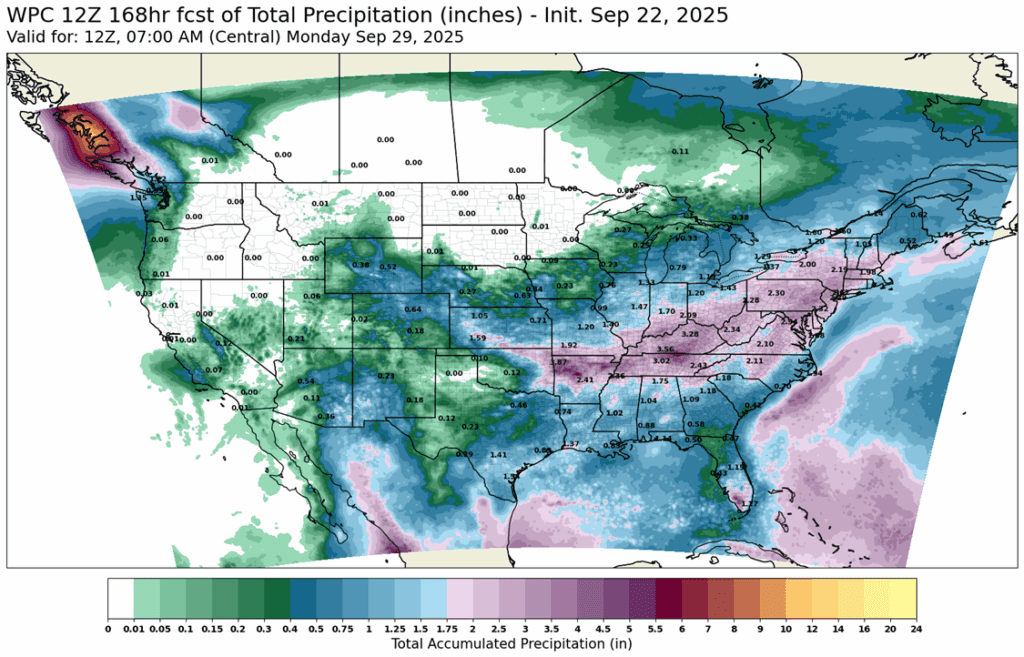

Above: U.S. 7-day total precipitation forecast, courtesy of ag-wx.com

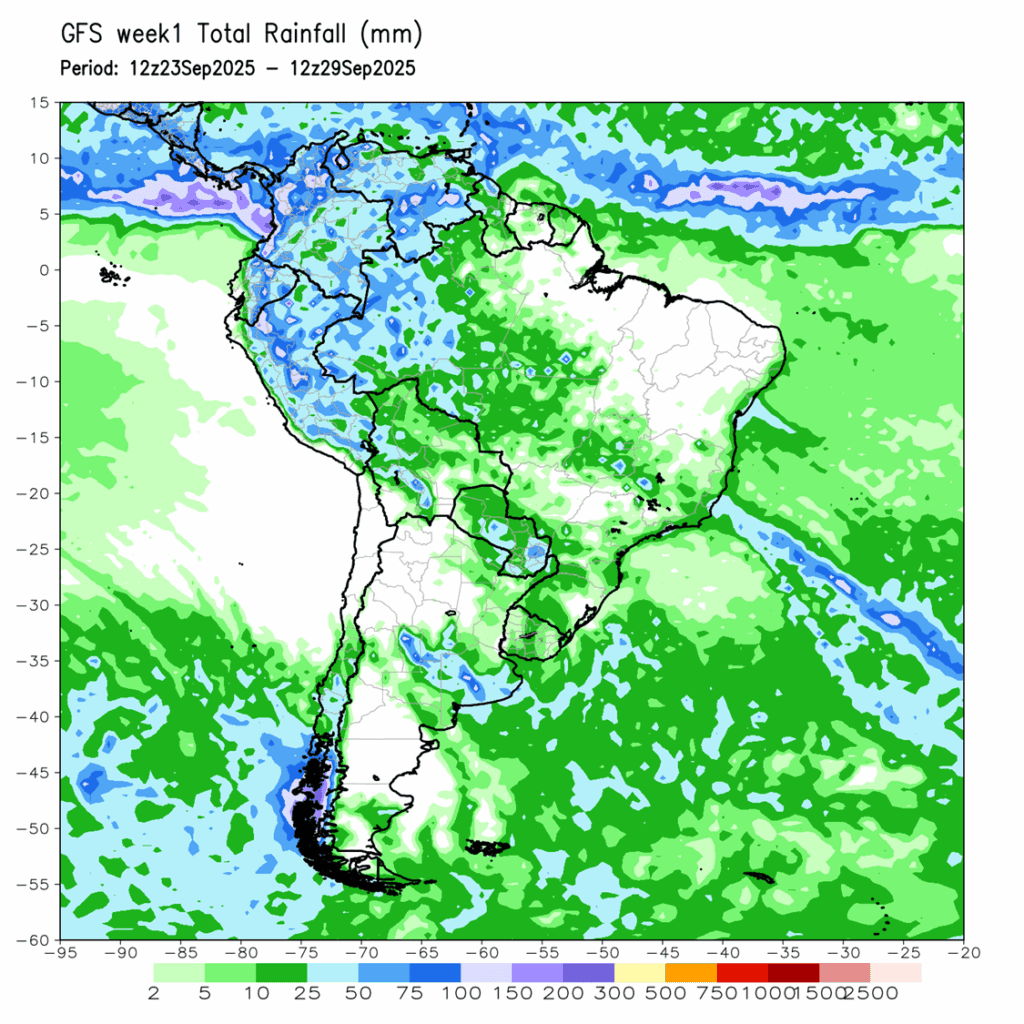

Above: South America 7-day total precipitation forecast, courtesy of National Weather Service, Climate Prediction Center