9-20 Opening Update:

Grain Market Insider Interactive Quote Board

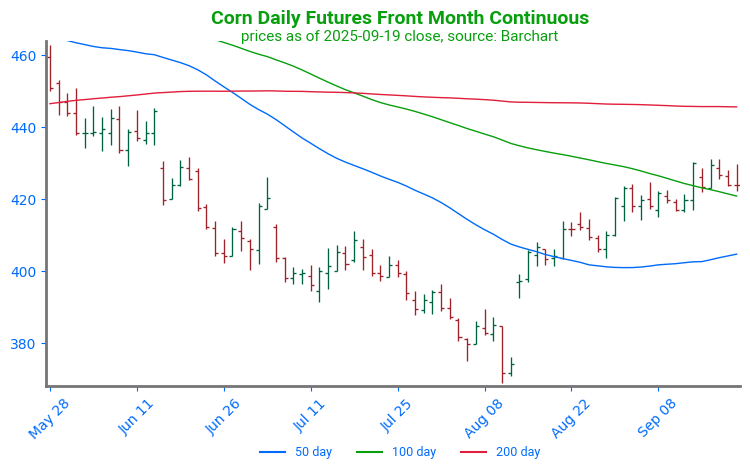

- Corn futures are trading lower to start the week with December corn down 3 cents to $4.21 while March is down 3 cents to $4.38-1/4. Rains throughout the Midwest may delay harvest progress.

- New estimates for the Argentinian corn crop have been released with the Buenos Aires Grain Exchange seeing the 25/26 planting estimate at 7.8 million hectares, up from 7.1m ha last year. The crop is 6.2% planted.

- Friday’s CFTC report saw funds as buyers of corn as of September 16 by 19,878 contracts. This reduced their net short position to 80,051 contracts.

Corn Futures Consolidate Below Resistance: Following the release of the September WASDE report, corn futures pressed higher. Prices managed to break through the 100-day moving average, but have since begun to consolidate below strong resistance at the July 7 price gap.

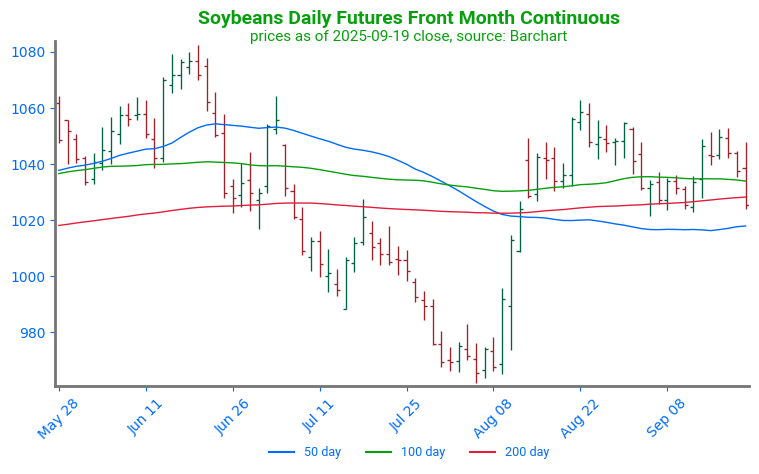

- Soybeans are trading sharply lower to start the day with pressure coming from lower soybean oil. November soybeans are down 12 cents to $10.13-1/4 while March is down 11-3/4 to $10.49. October bean meal is down $3.30 to $279.60 and October soybean oil is down 0.63 cents to 49.40 cents.

- The biggest bearish factors in the soy complex right now are the lack of a trade deal between the US and China and the oil refineries generating fewer renewable blending credits last month.

- Friday’s CFTC report saw funds as buyers of soybeans by 17,001 contracts which flipped them to a net long position of 2,287 contracts. They bought back 17,726 contracts of bean oil and bought back 3,013 contracts of meal.

Soybean Futures Range Bound: Soybean futures offered a strong reaction following the release of the September WASDE report, but have since failed to break out of the 1020 to 1060 price range they have traded in following contract rollover on August 14.

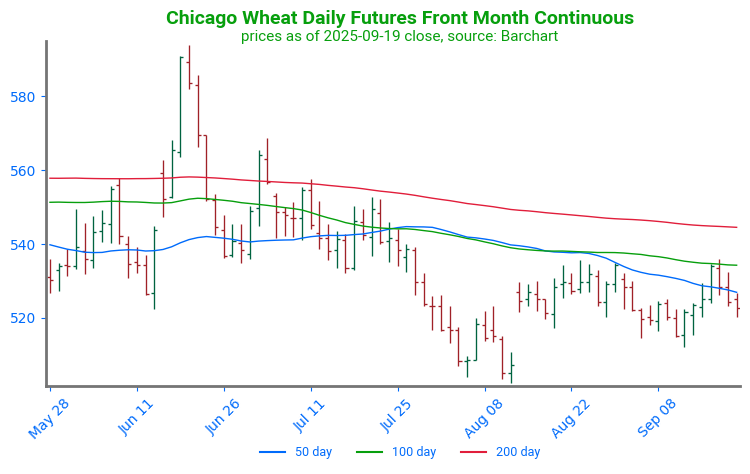

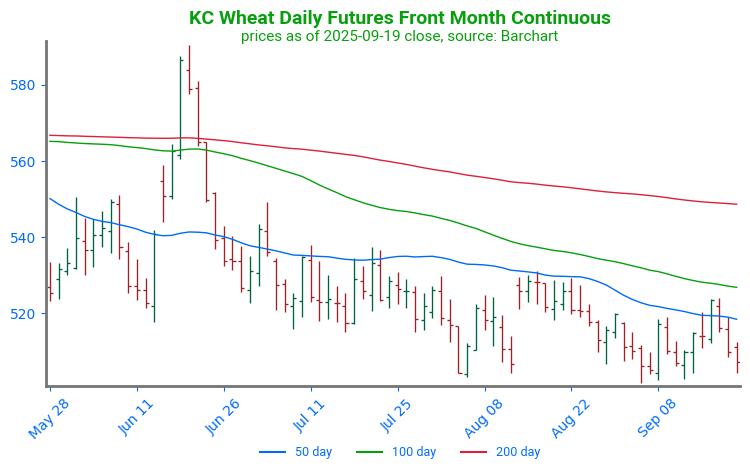

- Wheat is trading lower along with the rest of the grain complex. December Chicago wheat is down 4-3/4 cents to $5.17-3/4 while December KC wheat is down 3 cents to $5.04-1/4.

- The Grain Association of Western Australia has raised its forecast for the region’s wheat harvest to 11.8 mmt for the 25/26 season. This would be up from August’s estimate of 11.5 mmt. Australia is one of the world’s largest exporters of wheat.

- Friday’s CFTC report saw funds as buyers of 6,569 contracts of Chicago wheat which reduced their net short position to 85,825 contracts. They bought back 1,491 contracts of KC wheat which reduced their net short position to 51,534 contracts.

Chicago Wheat Rejected by Resistance: Wheat futures failed to break through its 100-day moving average. Instead, prices reverted lower, breaking below support at the 50-day moving average.

KC Wheat Trends Sideways, Tests Lows: December KC wheat broke through its 50-day moving average in a strong fashion following the September WASDE report. The market has since turned lower, breaking back below the 50-day moving average.

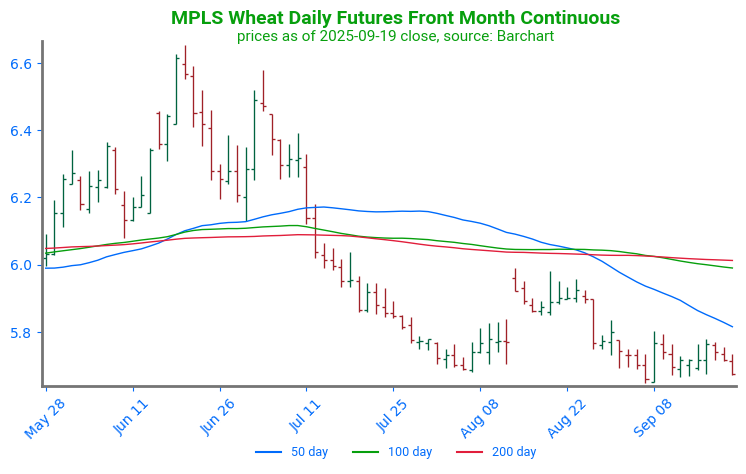

Spring Wheat Tests Support: Futures remain rangebound as harvest advances, holding early August lows near 570 support. On the upside, the first point of strong resistance sits near 585 at the 50-day moving average. A second point can be found through a cluster of moving averages near 600.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.