9-20 End of Day: Grain Markets Settle Mostly Lower to End the Week

All prices as of 2:00 pm Central Time

| Corn | ||

| DEC ’24 | 401.75 | -4 |

| MAR ’25 | 420 | -4.25 |

| DEC ’25 | 442.75 | -3 |

| Soybeans | ||

| NOV ’24 | 1012 | -1.25 |

| JAN ’25 | 1029.5 | -1.75 |

| NOV ’25 | 1060.25 | -2.75 |

| Chicago Wheat | ||

| DEC ’24 | 568.5 | 3 |

| MAR ’25 | 587.5 | 2.5 |

| JUL ’25 | 603.75 | 1.75 |

| K.C. Wheat | ||

| DEC ’24 | 564 | -0.5 |

| MAR ’25 | 577.5 | -0.75 |

| JUL ’25 | 590.25 | -0.75 |

| Mpls Wheat | ||

| DEC ’24 | 608 | 0.25 |

| MAR ’25 | 629.75 | 0 |

| SEP ’25 | 654.25 | -1.75 |

| S&P 500 | ||

| DEC ’24 | 5746 | -32 |

| Crude Oil | ||

| NOV ’24 | 71.06 | -0.1 |

| Gold | ||

| DEC ’24 | 2644.3 | 29.7 |

Grain Market Highlights

- For the second consecutive day the corn market closed lower on the day, with harvest pressure and October options expiration contributing to the negativity.

- The soybean market remained in a sideways trend, closing with minor losses as October options expired after a day of choppy trade. Soybean meal followed a similar pattern, closing lower, while bean oil settled higher for the fifth consecutive day, supported by stronger palm oil prices, which in turn helped support soybeans.

- The wheat complex ended the day mixed after trading higher across the board on shrinking Australian and EU production estimates. Forecasts for rain in the parched HRW areas enticed sellers in the KC contracts, which led the trade lower.

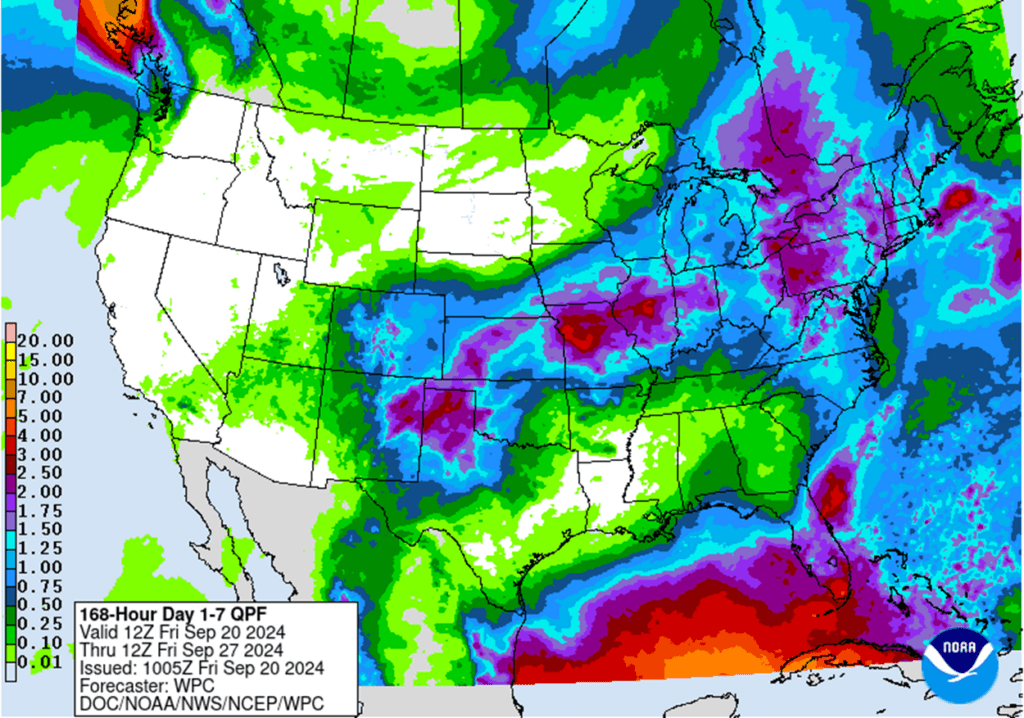

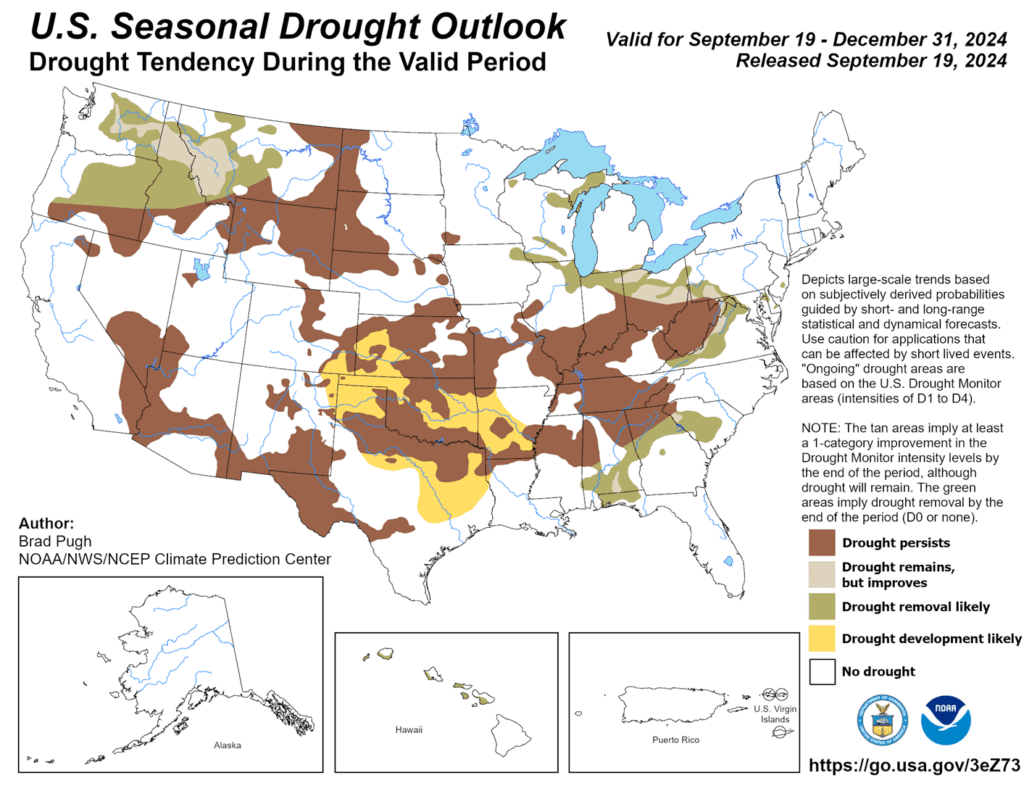

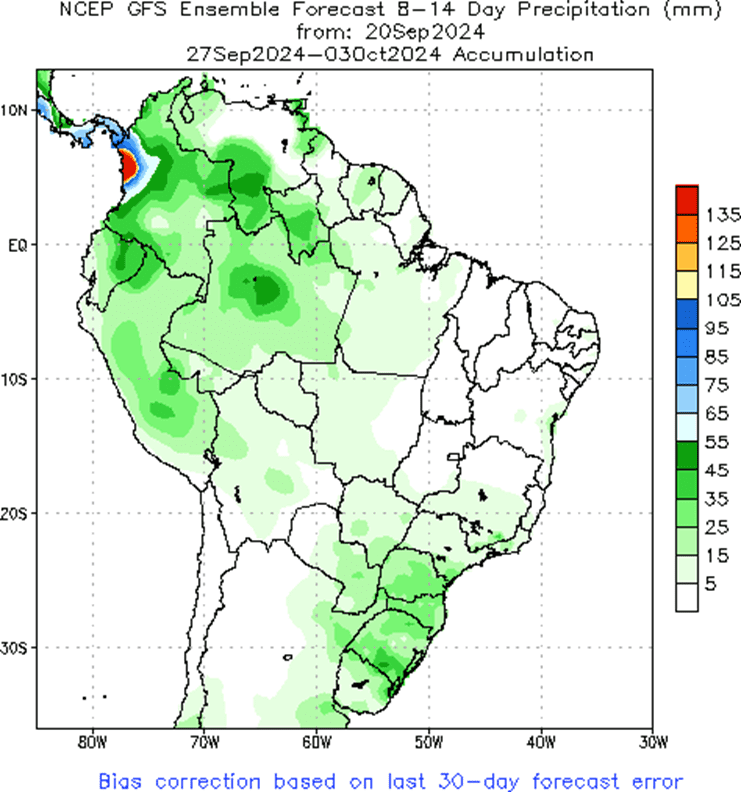

- To see the updated US 7-day precipitation forecast, US Seasonal Drought Outlook, and 2-week Forecast Precipitation for South America, courtesy of NOAA, the Weather Prediction Center, and NDMC scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

Since printing a market low in late August the corn market has rallied largely on fund short covering as the rush of old crop bushels into the market has slowed and demand has picked up. While the upcoming harvest of an expectedly large crop may continue to limit upside potential, it is a good sign that corn buyers are finding value at these multi-year low price levels. Any unexpected downward shift in anticipated supply or increase in demand could trigger managed funds to cover more of their extensive short positions and rally prices further, however, an extended rally is unlikely until after harvest.

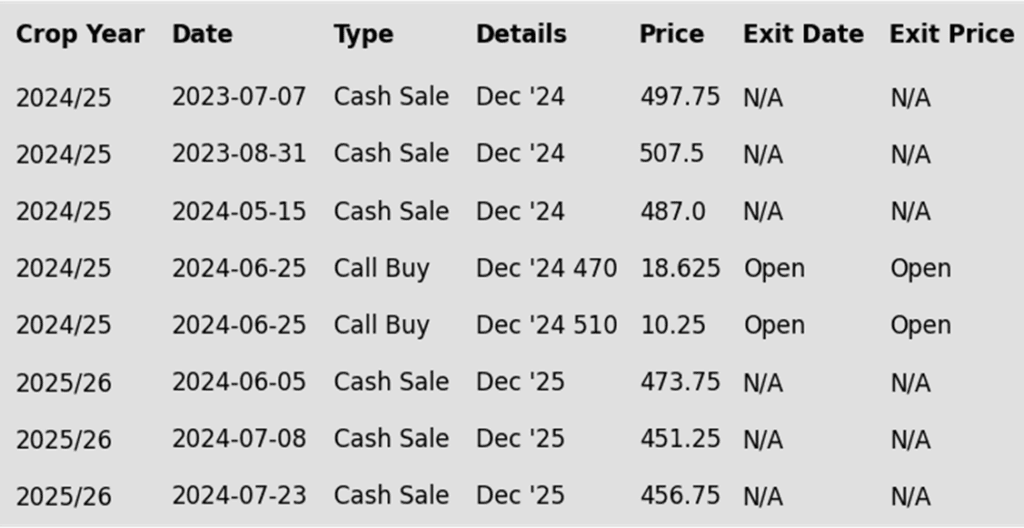

- No new action is recommended for 2024 corn. In June, we recommended purchasing Dec ’24 470 and 510 calls after Dec ’24 closed below 451, due to their relative value and the typically high market volatility during that time of year. Although we no longer have an upside objective for additional sales for now, we continue to target a value of 29 cents to exit the Dec ’24 470 calls. Exiting at this level will allow you to lock in gains that offset much of the original position’s cost, while holding the remaining 510 calls at or near a net-neutral cost. This strategy should continue to protect existing sales and provide confidence for further sales during an extended rally. Since harvest time is not an advantageous sales window, we will begin evaluating market conditions once it concludes and target areas for additional sales recommendations in late fall or early winter.

- No new action is currently recommended for 2025 corn. Between early June and late July Grain Market Insider made three separate sales recommendations to get early sales made for next year’s crop. Considering the seasonal weakness of the market in late summer and early fall, we will not be looking to post any targeted areas for new sales until late fall or early winter. Although, we will look to protect current sales, in the form of buying call options, should the market begin to show signs of a potential extended rally.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market finished lower on the session for the second straight day. Hedge pressure and October grain options expiration likely pressured the market lower to end the week. December corn closed the week 11 ½ cents lower.

- Corn harvest continues to ramp up across the Midwest as favorable weather supports progress. Early results show strong yields in most regions, which could offset losses in other areas caused by spring weather. As fresh supplies enter the pipeline, upside potential may be limited as harvest advances.

- Low Mississippi River levels in the Memphis area is a concern for the transportation of bushels to export markets. Restrictive flow has increased freight costs, which impacts the price of corn to the export market, and the backlog of corn will likely pressure basis levels in the cash market.

- Managed Funds have eliminated over 200,000 net short contracts since reaching their maximum short positions in early July. This has happened despite a muted rally in the corn market. On Friday’s Commitment of Traders report, expectations are for funds to be under 100,000 net short contracts, pushing their lowest net short for the year with harvest starting to build.

Above: Since posting a bearish reversal on September 6, November soybeans have been rangebound. If prices break initial support around 995, they could trade back towards 940. Otherwise, a close above 1031 ¼ could suggest a continuation towards 1080 – 1085.(pink).

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

Since early September, the soybean market has traded mostly sideways after a late August rally, as weather conditions turned dry during the later development stages of the crop. While the USDA projects record soybean yields for this season, the warm and dry finish to the growing season may have reduced final yields from earlier projections. Although export sales have increased in recent weeks, the current sales pace remains the slowest since 2019, which may still weigh on prices. Any pickup in demand or a decrease in this year’s projected supply could rally prices, especially post-harvest.

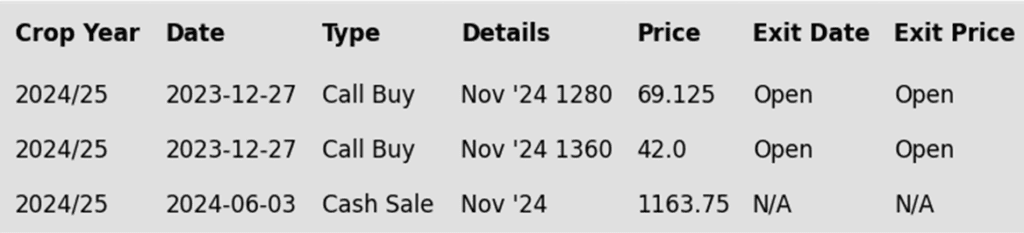

- No new action is recommended for the 2024 crop. At the end of December, we recommended buying Nov ’24 1280 and 1360 calls due to the uncertainty surrounding the 2024 soybean crop, aiming to give you the confidence to make sales and protect those sales during an extended rally. Since the market has retreated since that time, we continue to target the 1040–1070 range versus Nov ’24 futures to exit one-third of the 1280 calls in order to help preserve equity. Additionally, in June, the close below 1180 triggered our Plan B strategy, which recommended making additional sales due to the potential change in trend. While we typically avoid recommending sales at this time of year, our Plan A strategy is to make additional sales recommendations should the market rally significantly toward the 1090 – 1120 area in the Nov ’24 contract.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop yet. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybean markets finished slightly lower with choppy trade during the session. The loss of upward momentum and October options expiration likely pressured soybeans as harvest continues to push forward.

- Despite being a serial option, October grain options expired today, and prices typically gravitate toward areas with significant open interest on expiration day. At the start of the session, there was a combined open interest of nearly 16,000 put options at the 1000 and 1010 levels. With the market closing at 1012, those puts expired worthless at the close.

- The USDA announced a flash sale of soybeans this morning. China purchased 121,000mt (4.4 mb) of US soybeans for the 24/25 marketing year. Soybean demand has improved in recent weeks, but total sales for the 24/25 marketing year are still at their lowest totals since the 18/19 marketing year.

- In South America, conditions have been very dry especially in Brazil, which has slowed soybean planting in the early part of the season. Weather models are seeing improved rainfall chances late next week into October, in line with the start of the Brazil rainy season. If forecasts materialize, the improved moisture chances in Brazil will limit the soybean futures market.

Above: After entering the 1005 – 1040 resistance area, November soybeans posted a bearish key reversal which remains intact, suggesting prices could erode further. Below the market, support remains between 960 and 955, with key support near the August low of 940.

Wheat

Market Notes: Wheat

- With little fresh news for buyers to sink their teeth into, the wheat complex gave up its earlier gains from reports of lower production in Europe and Australia and ended the day mixed, on the prospect of rain over the weekend.

- The Belgian trade association, Coceral, lowered its EU grain production forecast to 280.3 million metric tons, down from its June estimate of 296 mmt. Of this total, 126 mmt is soft wheat, reduced from 134.5 mmt in June.

- Argentina’s prolonged drought is causing some farmers to abandon wheat fields in the northern and western regions. In contrast, around 80% of the wheat crop in the eastern areas is reportedly in normal to excellent condition.

- In Western Australia, the Grain Industry Association reduced the region’s wheat production estimate by 7% from last month, lowering it to 9.3 mmt due to dry weather. Nationally, Australia is projected to produce 31.8 mmt, according to ABARES.

- In the US, a system is expected to bring some widespread rain with some heavier precipitation across the central and southern Plains over the weekend, which should improve conditions and help newly planted wheat get established.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

Since mid-July, the wheat market has mostly drifted sideways as the trade tries to balance smaller US and global supplies against cheaper world export prices. During this period, a potential seasonal low was also marked on July 29th as managed funds maintained a sizable net short position in Chicago wheat. While slow global import demand and low Russian export prices continue to be a limiting factor in the market, any increase in US demand due to smaller crops in Europe and the Black Sea region could trigger an extended short-covering rally by managed funds.

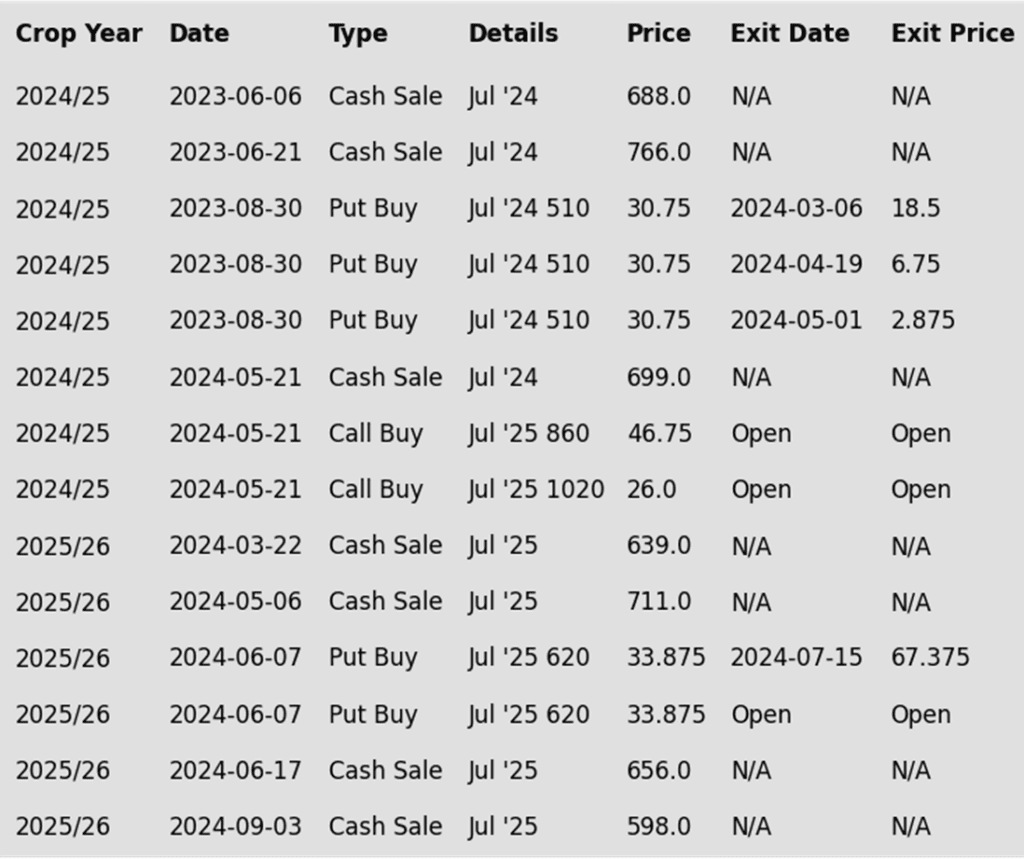

- No new action is recommended for 2024 Chicago wheat. Considering the rally in wheat back in May, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 740 – 760 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is recommended for 2025 Chicago wheat. Recently, we recommended taking advantage of the wheat rally to sell more of your anticipated 2025 SRW production. While we continue to recommend holding the remaining July ’25 620 puts — after advising to exit the first half back in July — to maintain downside coverage for any unsold bushels, we are targeting a 10-15% extension from our last sale to the 650–680 area in July ’25 to suggest making additional sales.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The apparent rejection of the 600 area in December wheat, suggests prices could drift toward the 560 support area. If this support holds and prices rebound, resistance overhead remains in the 600–605 area. Below 560, additional support may be found near the 50-day moving average.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

Since mid-July, the wheat market has mostly drifted sideways as the trade tries to balance smaller US and global wheat supplies against cheaper world export prices. During this period, a potential seasonal low was also marked on the front month continuous charts as managed funds maintained a sizable net short position in the wheat markets. While low Black Sea export prices and slow world demand continue to weigh on US prices, the funds’ short position could trigger an extended short covering rally on any increase in US demand as world wheat ending stocks are expected to fall yet again this year.

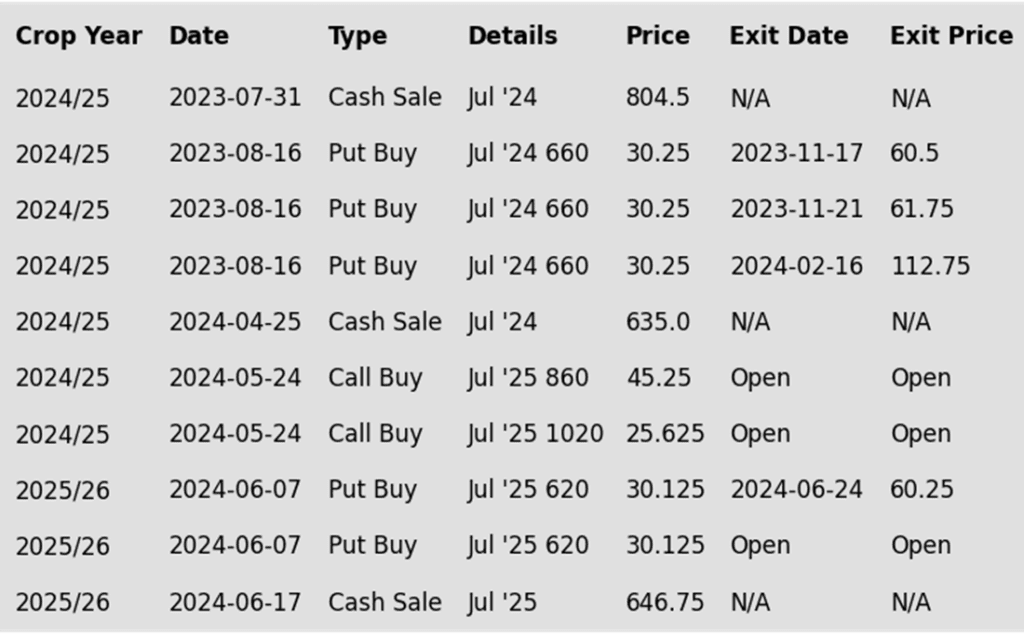

- No new action is recommended for 2024 KC wheat. Considering the upside breakout in KC wheat back in May, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 725 – 750 versus Dec ’24 to recommend further sales, while also targeting a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. Earlier this summer we recommended exiting half of the previously recommended July ’25 620 puts once they reached 60 cents (double the original approximate cost) to realize gains in case the market rallies back, while still holding the remaining 620 puts at, or near, a net neutral cost for continued downside coverage on any unsold bushels. To that end, we are currently targeting the upper 400 range versus July ’25 to exit half of those remaining puts. Meanwhile, our current upside strategy is to target the 640 – 670 range, also in the July ’25, to recommend making additional sales.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

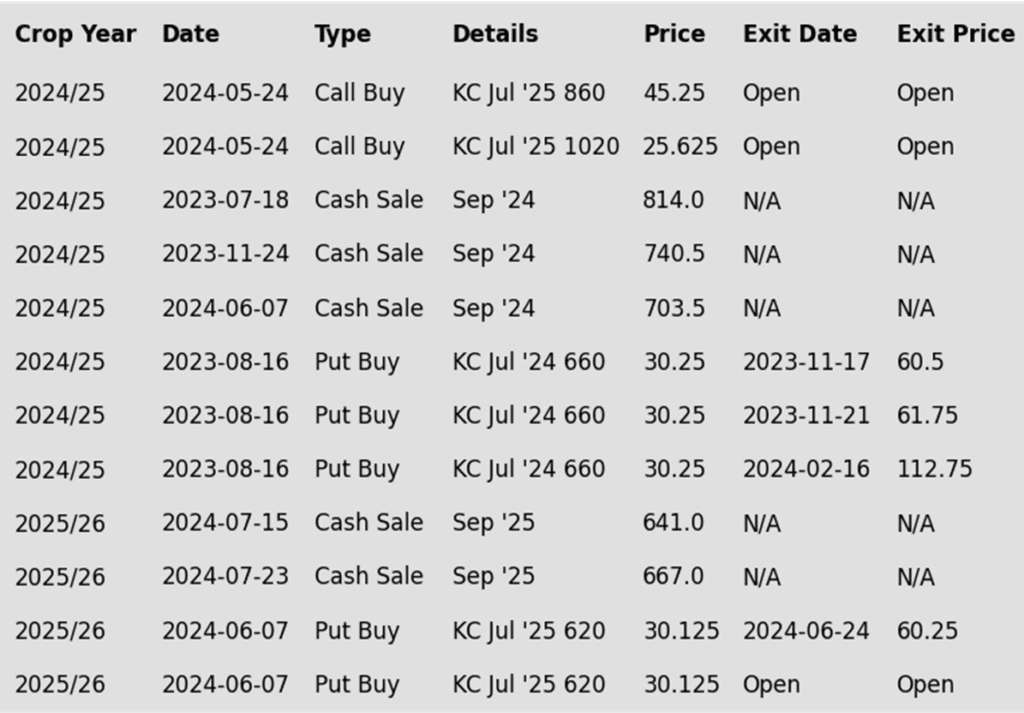

To date, Grain Market Insider has issued the following KC recommendations:

Above: December KC wheat appears to have encountered resistance near the 100 and 200-day moving averages, a close above which could put the market on track towards 637, a 50% retracement to the May 28 high. If the market turns lower, initial support remains near the 50-day moving average, with further support near the recent 527 ¼ low.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

Since printing a near-term low in mid-July, Minneapolis wheat has trended mostly sideways as the market attempts to balance smaller US and world supplies versus lower world export prices and lower world demand. During this period, managed funds have maintained their sizable, short positions in Minneapolis wheat. Though low Russian export prices continue to keep a lid on US prices, smaller crops in Europe and the Black Sea region could increase US demand, potentially triggering an extended short-covering rally, especially as global wheat ending stocks are projected to decline again this year.

- No new action is recommended for 2024 Minneapolis wheat. With the close below 712 support in June, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices. While we are at the time of year when market lows often occur, we will consider posting upside targets in late September or early October when market conditions often become more advantageous, and harvest is mostly behind us.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we made two separate sales recommendations in July to get some early sales on the books for next year’s crop. While we will not be targeting any specific areas to make additional sales until later in the marketing year, we will continue to monitor the market for opportunities to exit the remaining July ’25 KC 620 puts that were recommended in June. To that end, we are currently targeting the upper 400 range versus July ’25 KC to exit half of those remaining puts.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The 617 – 637 resistance area appears to remain intact. A close above this area could put the market in position for a run toward 685, with potential resistance near the 100 and 200-day moving averages before that. To the downside, a break below the 50-day moving average could put the market at risk of sliding towards 560.

Other Charts / Weather

US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil 2-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.