9-2 End of Day: Corn Strengthens, Soybeans Slide, Wheat Under Global Pressure

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures fought off early weakness to close higher Tuesday. Corn’s technical breakout, strong demand, and shrinking supply outlook are fueling short covering, with traders eyeing $4.30 resistance and September’s WASDE for confirmation.

- 🌱 Soybeans: Soybeans closed sharply lower Tuesday, soybeans remain under pressure from meal weakness and China demand fears, but weather risks and fund positioning are adding volatility ahead of USDA’s September update.

- 🌾 Wheat: Wheat futures closed lower across all classes. Exports inspections remained strong last week but ample supply globally continues to weigh on prices.

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B:

- Exit 1/4 of the December 420 puts within the next two days.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- 1/4 of 420 puts will be exited within the next two days to lighten the position in case upside momentum continues through September. In four prior years with similar price action leading into August, three of the four posted their contract lows in the month of August.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures fought off early weakness to close higher Tuesday. September gained 5 cents to $4.03, and December added 2 ¾ cents to $4.23 — its third straight higher close and the strongest since July 21.

- Corn charts have improved technically, and money flow has been positive. A close above $4.20 opens the door for a test of $4.30 and the July 18 high at $4.30 ¼.

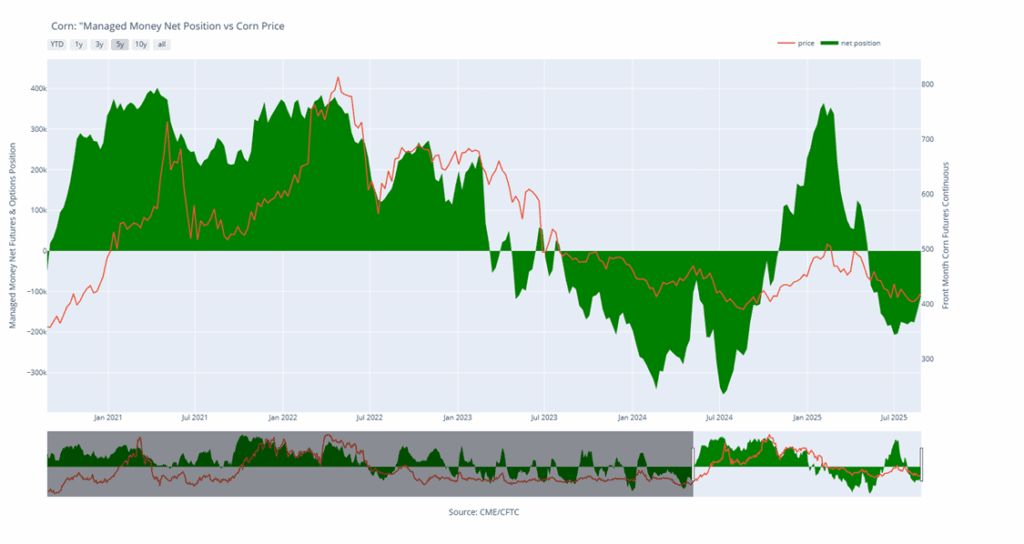

- Funds continue to cover shorts. CFTC data showed managed money trimming nearly 34,000 contracts last week, leaving a net short of 110,686 contracts as strong demand and tightening supply support prices.

- Exports remain supportive. Weekly inspections totaled 1.407 MMT (55.4 mb), pushing 2023/24 inspections to 2.636 bb — 29% above last year.

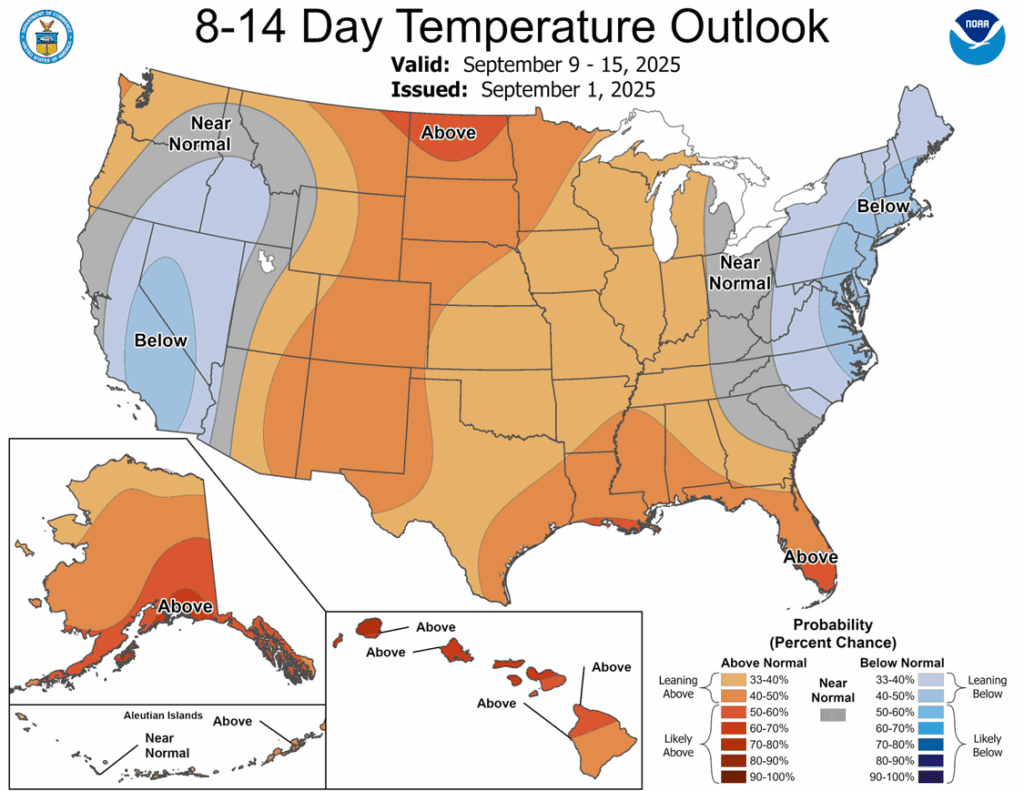

- Weather and disease concerns linger. Cool, dry finishing conditions and disease pressure may limit yields, with traders leaning below USDA’s 188.8 bpa August forecast ahead of the September 12 WASDE.

Corn Managed Money Funds net position as of Tuesday, August 26. Net position in Green versus price in Red. Money Managers net bought 33,964 contracts between August 19 – August 26, bringing their total position to a net short 110,686 contracts.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- Exit one-quarter of 1040 puts options if November futures close at or below 1022.25.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A Plan B target has been added to Exit one-quarter of the January 1040 puts options if November futures close at or below 1022.25.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed sharply lower Tuesday, pressured by weaker soybean meal. November fell 13 ½ cents to $10.41 and March dropped 12 cents to $10.75. October meal slid $5.10 to $278.30, while October oil gained 0.56 cents to 52.26. Fears of slowing Chinese demand and a meal glut from strong crush weighed on prices.

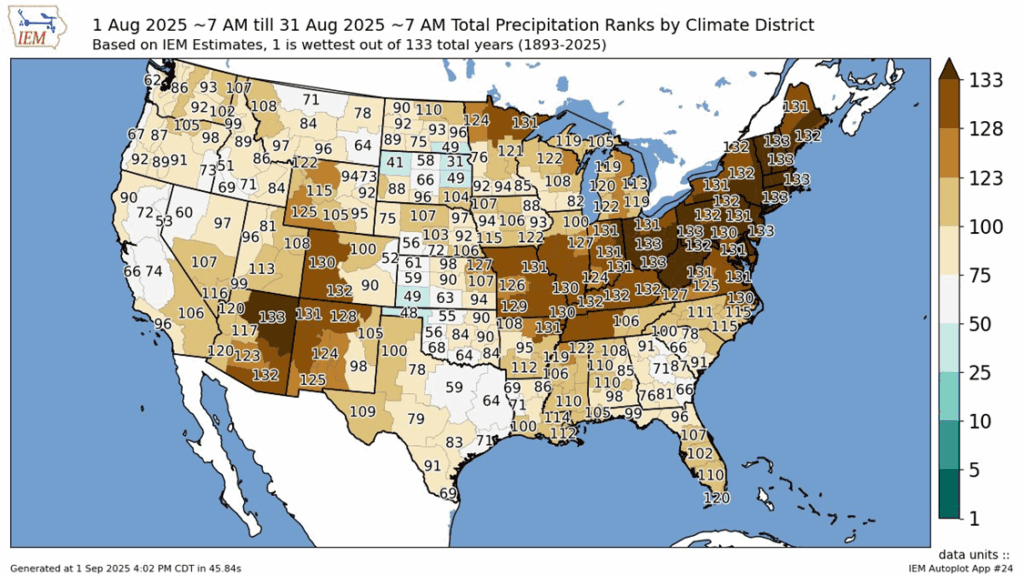

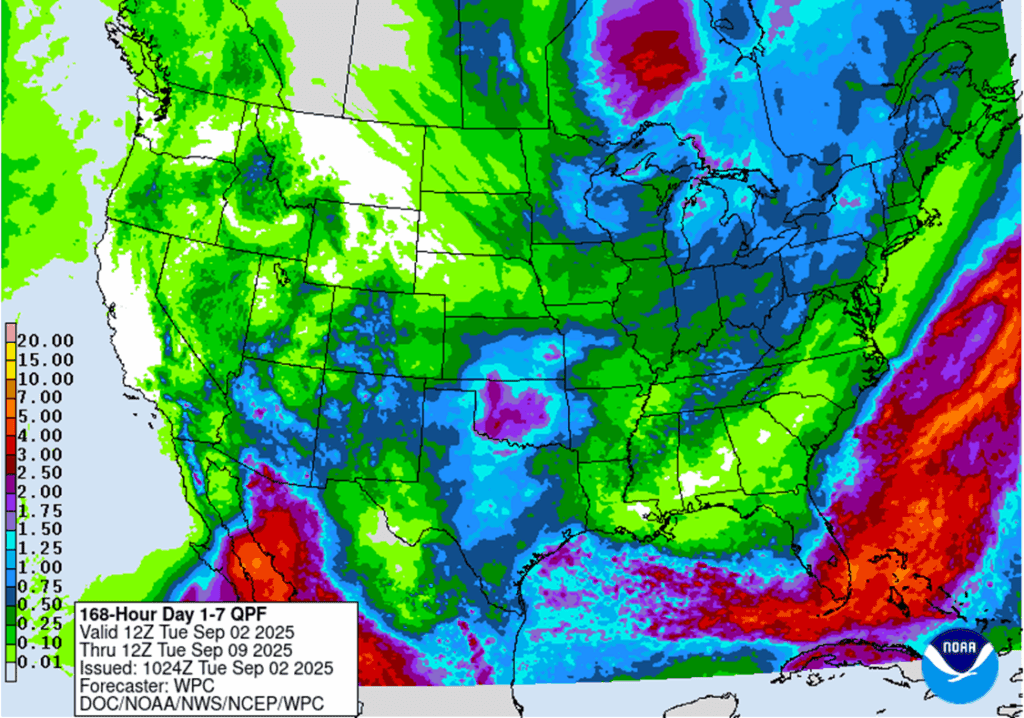

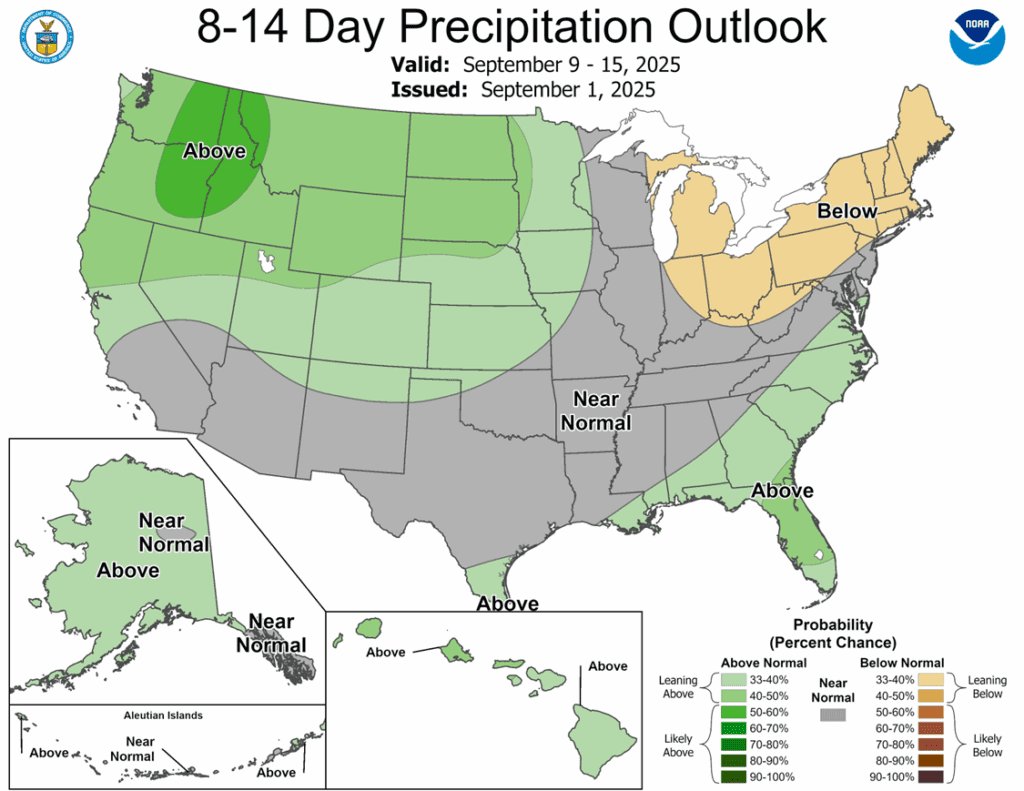

- Dry weather forecasts support the soybean market as areas in the Corn Belt have seen their driest August in over 100 years. The poor finishing weather will likely limit the potential final crop size as harvest approaches. It is likely that yields will be adjusted in this month’s USDA report.

- The European weather model is showing a more aggressive rainy season for Northern Brazil throughout September. This month is the start of the Brazilian planting season and improving soil moisture levels will likely set producers up to a good start of the season.

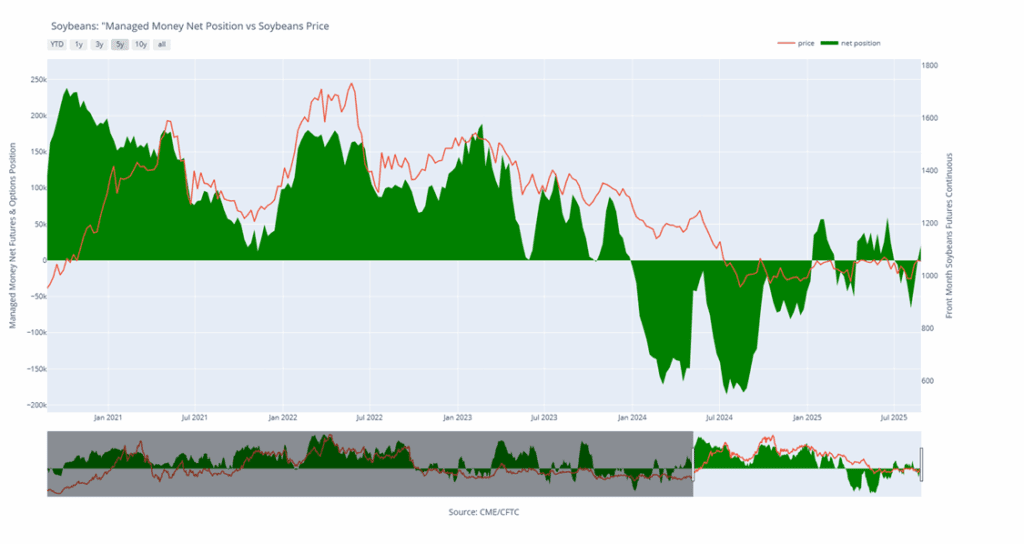

- Friday’s CFTC report saw funds as buyers of soybeans by 20,815 contracts, leaving them with a net long position of 20,818 contracts. They were sellers of soybean oil by 673 contracts, leaving them long 30,669 contracts and were buyers of meal by 23,528 contracts, reducing their net short position to 61,711 contracts.

Soybean Managed Money Funds net position as of Tuesday, August 26. Net position in Green versus price in Red. Money Managers net bought 20,815 contracts between August 19 – August 26, bringing their total position to a net long 20,818 contracts.

Wheat

Market Notes: Wheat

- Wheat futures closed lower across all classes. December Chicago fell 6 cents to 528-1/4, Kansas City dropped 8 ½ to 511-1/4, and Minneapolis lost 5 ¾ to 574-1/4. Pressure stemmed from a stronger U.S. dollar, fresh contract lows in Paris milling wheat, falling Russian values, and larger Australian production outlooks.

- Export pace remains supportive. Weekly inspections of 29.5 mb lifted 2025/26 total inspections to 244 mb, up 15% from last year and ahead of USDA’s projected pace of 875 mb for the season.

- According to SovEcon, Russian wheat export values fell to $230/mt, which is down $5 from the week prior and $15 from just a few weeks ago. This is said to be due to sluggish demand. Additionally, some are predicting the Russian wheat harvest could reach as high as 86-87 mmt, well above the USDA at 83.5 mmt.

- ABARE, Australia’s ag bureau, increased their estimate of Australian wheat production by 10% to 33.8 mmt. Although this would be down 1% from last year, it would still be 22% above the ten-year average. Better than expected rains across their wheat growing regions are cited as the reason for the increase.

- LSEG commodities research has indicated that the next 10 days will be cool across southern Argentina over the next 10 days. Temperatures could be 2-6 degrees Celsius below normal, which could lead to frost in wheat growing regions. This is causing some concern of damage for early emerging wheat.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 606.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

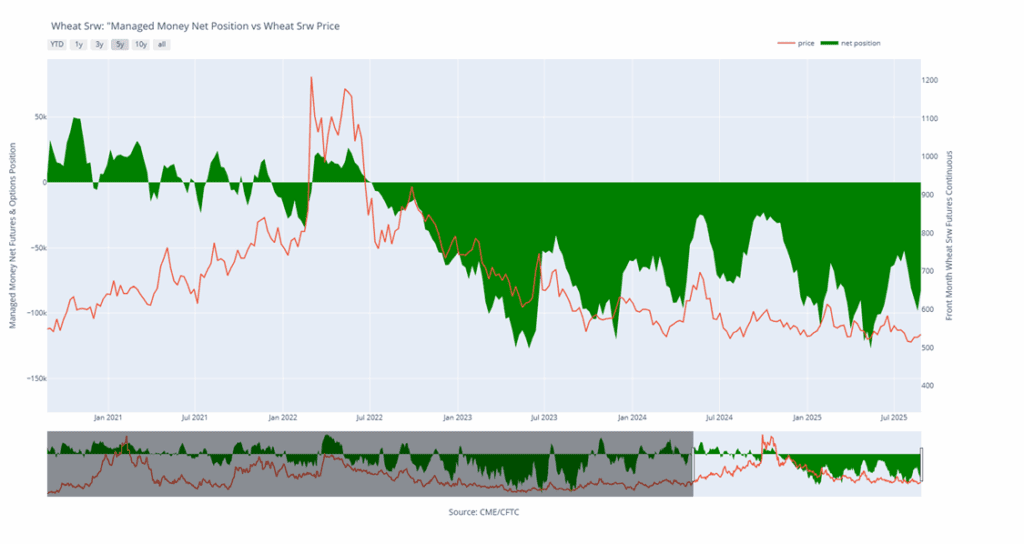

Chicago Wheat Managed Money Funds’ net position as of Tuesday, August 26. Net position in Green versus price in Red. Money Managers net bought 16, 545 contracts between August 19 – August 26, bringing their total position to a net short 81,587 contracts.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 647 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 656 target has been lowered to 647.

To date, Grain Market Insider has issued the following KC recommendations:

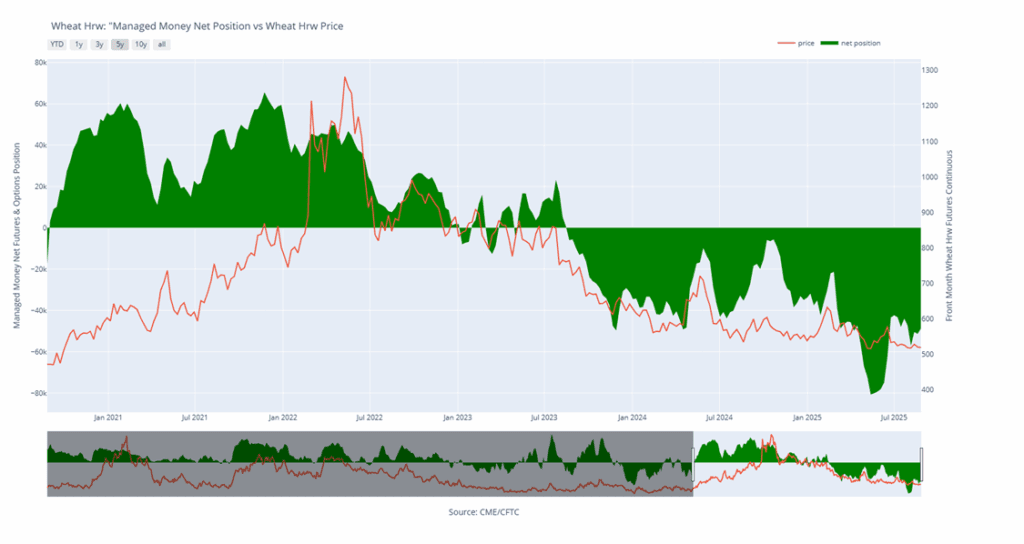

KC Wheat Managed Money Funds’ net position as of Tuesday, August 26. Net position in Green versus price in Red. Money Managers net bought 2,699 contracts between August 19 – August 26, bringing their total position to a net short 48,681 contracts.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

Active

Sell SEP ’26 Cash

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Continued Opportunity – Sell a second portion of your 2026 Minneapolis wheat crop today.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

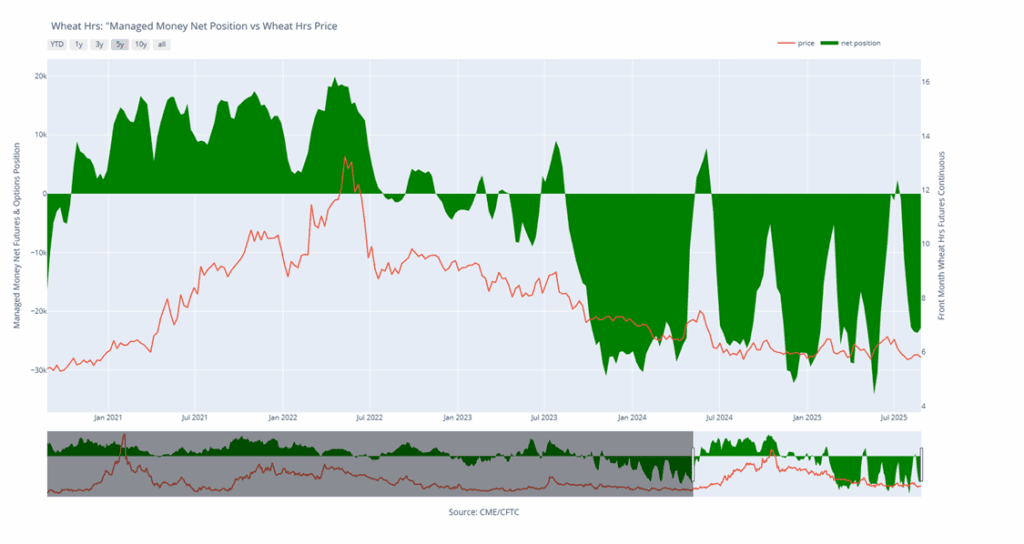

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, August 26. Net position in Green versus price in Red. Money Managers net bought 824 contracts between August 19 – August 26, bringing their total position to a net short 22,795 contracts.

Other Charts / Weather