9-19 End of Day: Grains Weaken to End the Week as U.S.-China Talks Stall

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures finished mixed to lower on Friday, pressured by sharp double-digit soybean losses. A USDA flash sale to unknown destinations provided some support and limited downside.

- 🌱 Soybeans: Soybeans ended lower Friday as trade talks between President Trump and China’s Xi failed to yield progress.

- 🌾 Wheat: Wheat futures ended the week lower on Friday as spill over weakness from soybeans and a higher U.S. dollar weighed on prices.

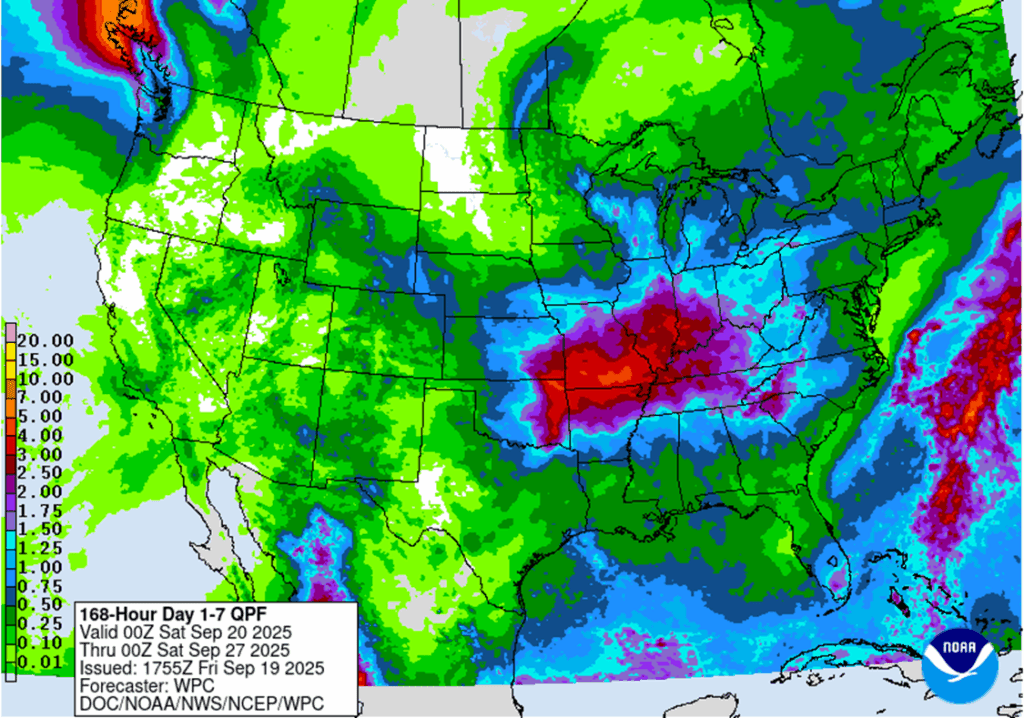

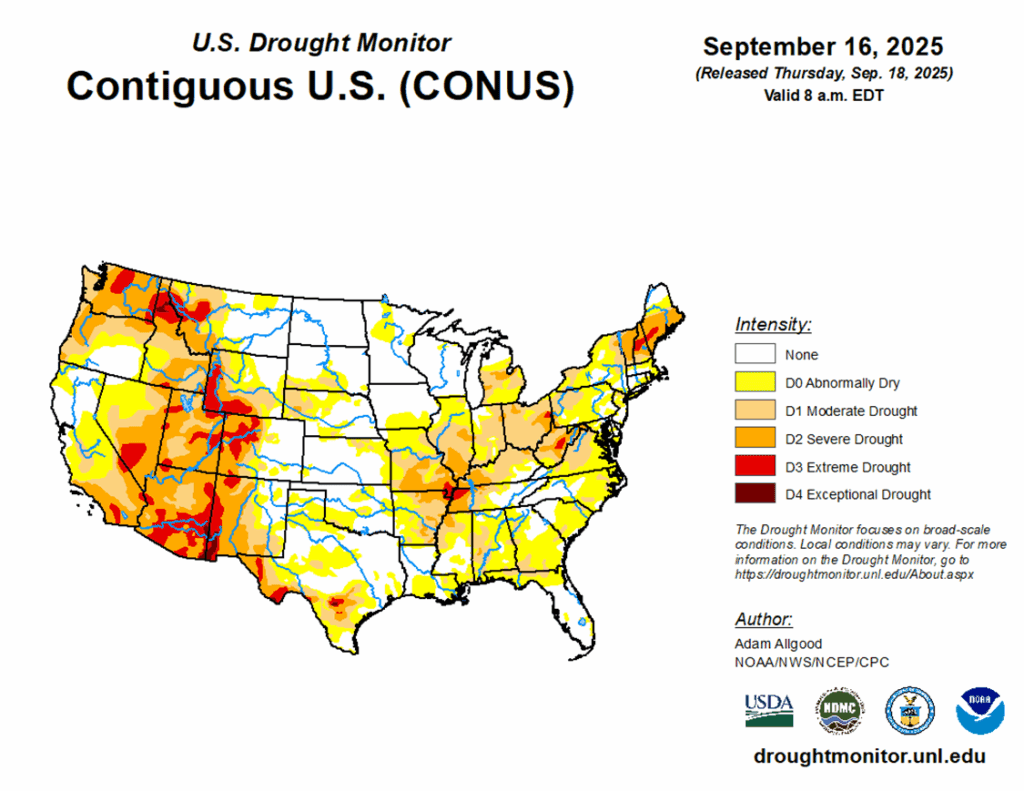

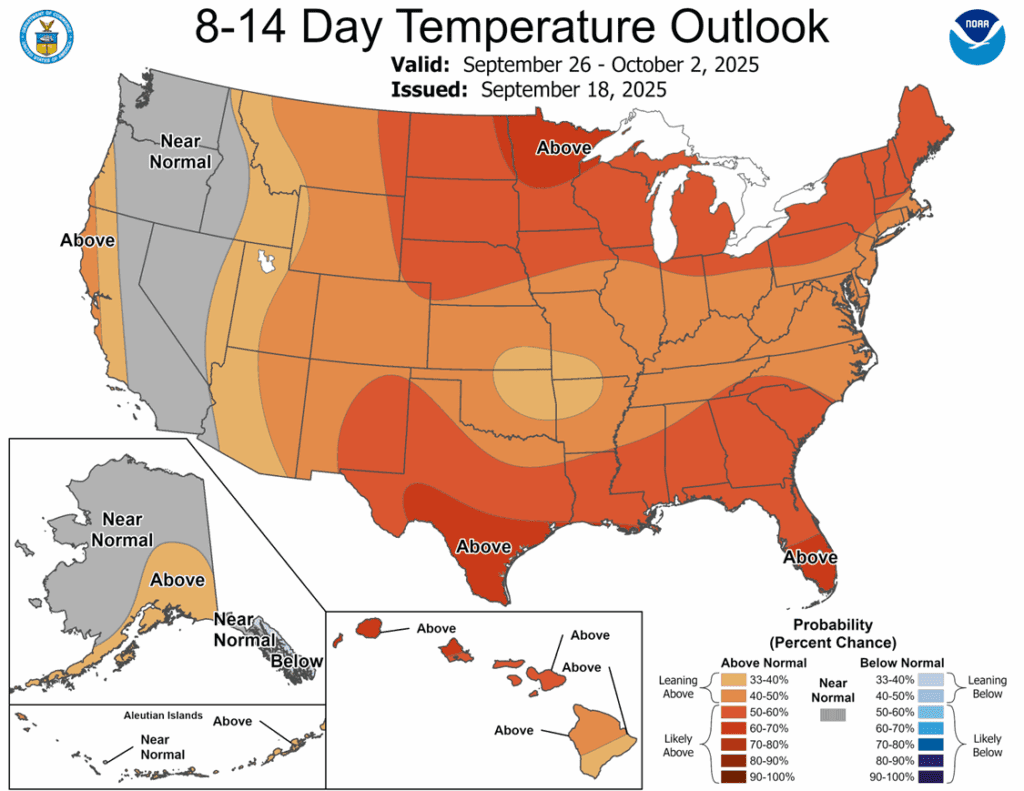

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/3rd DEC ’25 420 Puts ~ 8c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity: Sell one-third of the remaining December ‘25 420 corn puts today.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Recommendation to sell one-third of the remaining December ‘25 corn puts has been added. This means that 33% of the remaining position should be closed out, leaving 50% of the original position to continue to provide downside protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures slid off early session highs to finish mixed to mostly lower with only the December contract posting a slight gain. December corn finished ¼ cent higher to 424, but 6 cents lower for the week. March slipped ¼ cent lower to 441 ¼.

- The corn market traded higher on the session with the prospects of some trade resolution between the U.S. and China as President Trump and President Xi held a phone conversation. The market lost its strength as the realization that the current situation remained unchanged.

- Harvest is advancing, with 7% complete as of last week’s progress report. Warm, dry conditions should aid fieldwork but are also keeping early harvest pressure on the market.

- A stronger U.S. dollar, now higher for three straight sessions, added headwinds late in the week.

- USDA announced a flash sale of corn on Friday morning. Unknown destinations purchased 206,640 MT of corn for the current marketing year. This was the third posted flash sale this week as corn export demand remains supportive.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower following a meeting between President Trump and China’s Xi that did not result in progress towards a trade deal. Prices bounced off support at the 50-day moving average. November soybeans lost 12 cents to $10.25-1/2 while March lost 10-3/4 to $10.60. October soybean meal lost $0.10 to $282.90 and October bean oil lost 0.54 cents to 50.03 cents.

- Weakness stemmed largely from the lack of a U.S.-China trade deal. While Trump and Xi agreed on TikTok and discussed trade, no firm commitments were made. Trump said he will meet Xi again at a South Korea summit next month and plans to visit China early next year.

- Brazilian soybean exports are expected to reach 7.53 mmt in the month of September which would compare to 7.43 mmt the previous month. Brazilian crush estimates have been raised by 0.7% to 58.5 mmt for 2025 according to ANEC.

- For the week, November soybeans lost 20-3/4 cents while March lost 19-1/2 cents. October soybean meal lost $4.70 and October soybean oil lost 1.64 cents. While rains throughout the Corn Belt may stall harvest and be supportive, the lack of progress regarding a trade deal with China has pressured markets.

Wheat

Market Notes: Wheat

- Wheat posted losses in all three classes today, with December contracts of Chicago closing 1-3/4 cents lower to 522-1/2, Kansas City down 2-3/4 to 507-1/4, and MIAX losing 4-1/4 to 567-1/2. A lack of fresh friendly news and another move higher in the U.S. Dollar Index pressured wheat today. Wheat may have also been a follower of the sharp drop in soybean futures.

- The Grain Industry Association of Western Australia has increased their wheat production estimate by 4.4% to 11.8 mmt for the 25/26 season. However, this is below the Australian Department of Agriculture’s forecast of 12.7 mmt earlier this month.

- According to the Russian agriculture ministry, 114 mmt of grain has been harvested so far this season, with wheat accounting for 84 mmt of that total. Additionally, they have kept their total grain production forecast unchanged at 135 mmt.

- The Buenos Aires Grain Exchange has reported that 97.1% of Argentina’s 25/26 wheat crop is in normal to excellent condition. However, they also stated that certain regions are reporting disease issues due to excess moisture.

- USDA’s latest drought monitor showed winter wheat acres in drought rose 6 points to 44%, still better than 56% a year ago. Recent rains across the central Plains should help improve soil conditions for newly seeded wheat.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 602.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.75.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather