9-18 End of Day: Grain Futures Lower on Harvest Pressure and U.S. Dollar Strength

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: As corn harvest begins to ramp up, early harvest pressure is starting to weigh on the market, with corn ending the day lower.

- 🌱 Soybeans: Soybeans ended the day lower again, as the ongoing absence of a trade deal with China continues to weigh on the market and fuel concerns among traders.

- 🌾 Wheat: The wheat market closed lower across all three classes today, pressured by a sharp rebound in the U.S. dollar and rising global production estimates.

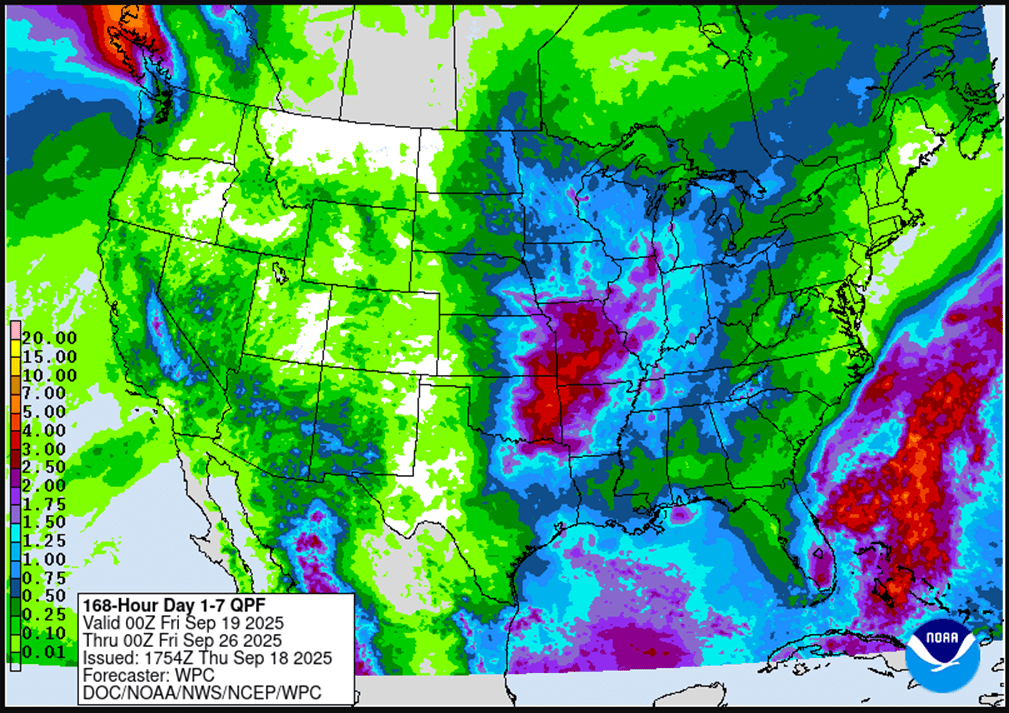

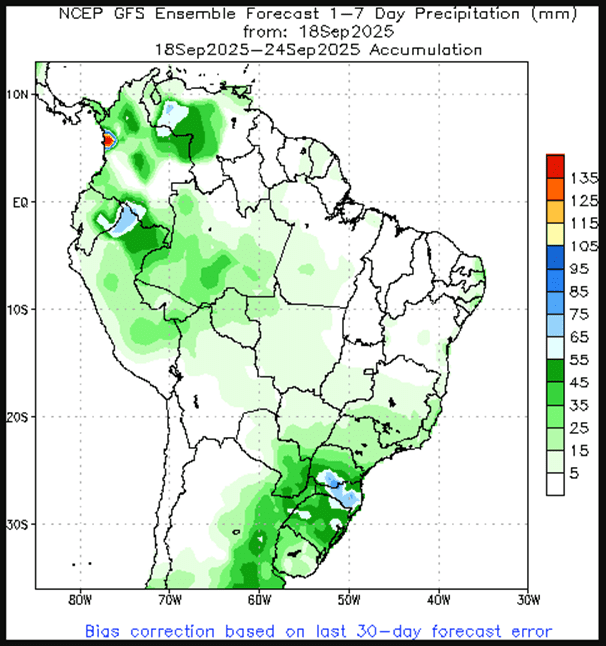

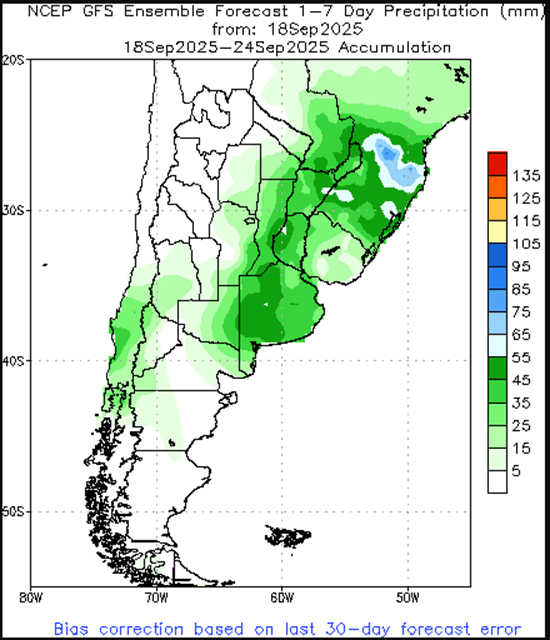

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

New Alert

Exit 1/3rd DEC ’25 420 Puts ~ 8c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- New Alert: Sell one-third of the remaining December ‘25 420 corn puts today.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Recommendation to sell one-third of the remaining December ‘25 corn puts has been added. This means that 33% of the remaining position should be closed out, leaving 50% of the original position to continue to provide downside protection.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures trended lower on the session as the U.S. dollar recovered of recent lows, and early harvest pressure is weighing on basis and the cash market. December corn lost 3 cents to 423 ¾, and the March contract slipped 3 cents to 441 ½.

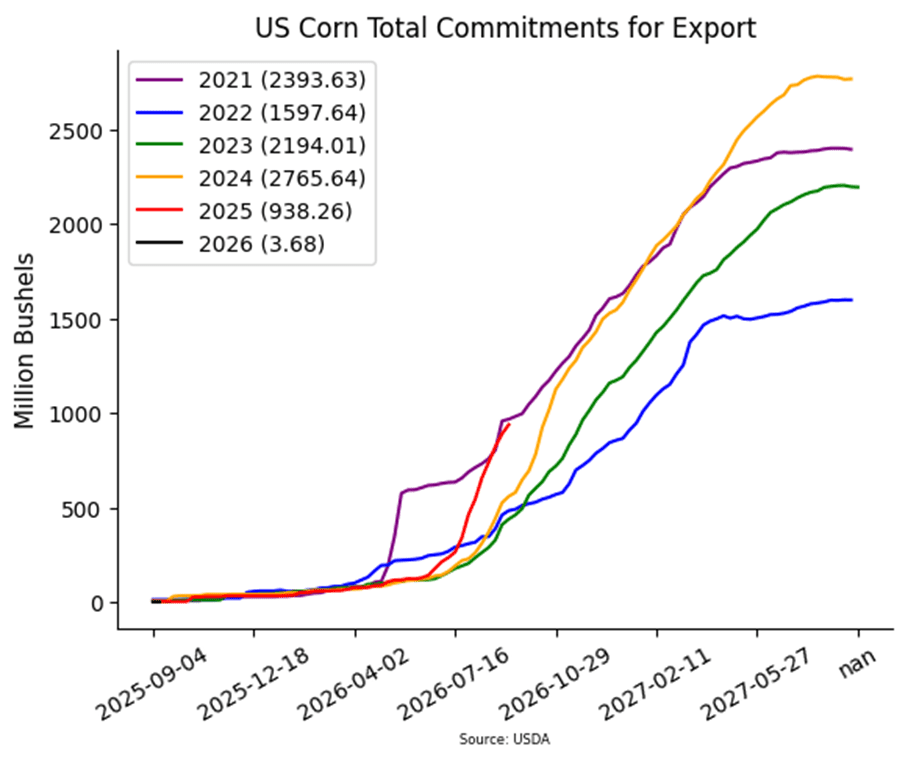

- USDA released weekly export sales data on Thursday morning. For the week ending September 11, USDA reported new sales of 48.5 mb of corn for the marketing year. Mexico and South Korea were the top buyers of U.S. corn last week. Total export sales are up 98% over last year, and one of the best starts to the marketing year over the past 25 years.

- The weekly drought monitor map continues to show the growth of drought across the Corn Belt. Acres of corn ground in drought rose to 25% this week, up from 13% last week. The dry conditions are expected to impact final yields as the crop was rushed to maturity.

- Early harvest activity is putting pressure on the cash market and basis levels. As producers deliver early bushels, storage availability remains tight in some areas, and the cash market is beginning to reflect the impact of fresh supplies.

- The U.S. dollar has rallied off recent lows in reaction to the Fed interest rate cut on Wednesday. The dollar sold off aggressively in preparation of the rate cut, but has since corrected, pressuring grain prices.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower for a second consecutive day over concerns for a lack of a Chinese trade deal. November soybeans lost 6-1/4 cents to $10.37-1/2, while March lost 6-1/2 cents to $10.71-1/2. October soybean meal lost $0.90 to $283 and October soybean oil led the complex lower with a loss of 0.67 cents at 50.57 cents.

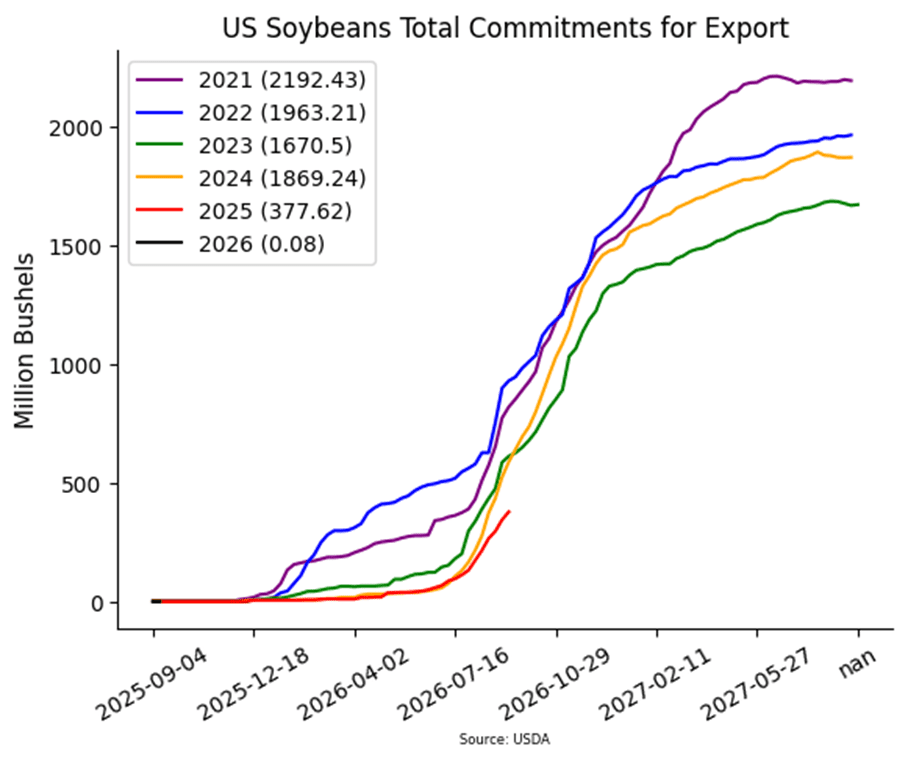

- Today’s Export Sales report was middle of the road for soybeans with an increase of 33.9 million bushels for 25/26 and 0.1 mb for 26/27. Top buyers were to Egypt, Mexico, and Spain. China has not purchased U.S. soybeans since January 22. Last week’s export shipments of 30.8 mb were below the 32.1 mb needed each week to meet USDA expectations.

- Brazilian soybean exports are expected to reach 7.53 mmt in the month of September, which would compare to 7.43 mmt the previous month. Brazilian crush estimates have been raised by 0.7% to 58.5 mmt for 2025 according to ANEC.

- The EPA on Tuesday issued a co-proposal to reallocate either 50% or 100% of small refinery exemptions for 2023–25, while also revising RVOs for 2026–27. A higher reallocation means more soybean oil demand for biofuels.

Wheat

Market Notes: Wheat

- Wheat futures closed lower across the board today, pressured by a sharp rebound in the U.S. Dollar Index and weaker closes in both corn and soybean markets. Additionally, rising global production forecasts weighed on the wheat complex. The December contracts of Chicago and Kansas City lost 4 and 6-1/4 cents respectively, to 524-1/4 and 510.

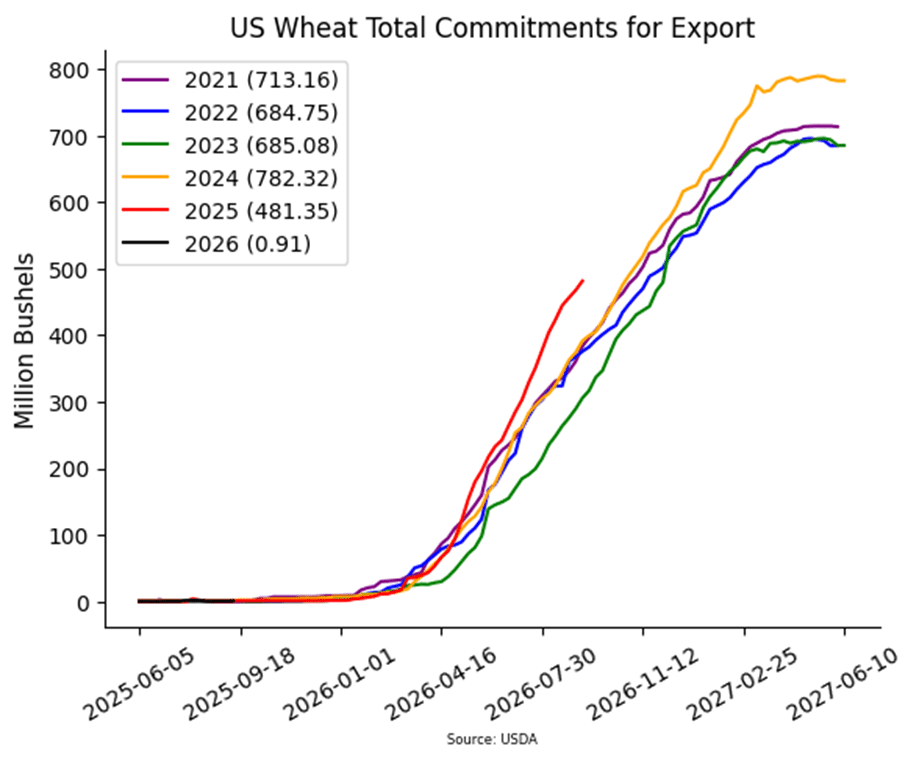

- The USDA reported an increase of 13.9 mb of wheat export sales for 25/26, along with an increase of 0.4 mb for 26/27. Shipments last week amounted to 28.5 mb, which was well above the 17.1 mb pace needed per week to reach their 900 mb export goal. Wheat sales commitments for 25/26 now total 481 mb, up 21% from last year.

- The International Grains Council raised its forecast for 2025/26 global wheat production by 8 mmt, bringing the total to 819 mmt. The upward revision is attributed to larger production estimates for Canada, Australia, and Russia. For reference, the USDA is using a figure of 816.2 mmt. Additionally, global consumption is expected to total 819 mmt, which would keep stocks unchanged at 270 mmt.

- Coceral, a European trade association, is estimating UK and EU combined soft wheat production at 147.4 mmt, an increase of 4.3 mmt from their July forecast.

- According to Chinese customs data, their August imports of wheat and wheat flour totaled 230,000 mt. This is down 44.8% year over year. Meanwhile, year to date imports reached only 2.6 mmt, which is down 75.2% year over year.

- A letter of intent, signed by U.S. Wheat Associates and the Taiwan Flour Miller’s Association, indicates that Taiwan has agreed to buy 3.6 mmt of U.S. wheat over the next three years. This would amount to about $1.3 billion in purchases between 2026 and 2029.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 602.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.75.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center