9-17 Opening Update: Grains Trade Near Unchanged This Morning

Grain Market Insider Interactive Quote Board

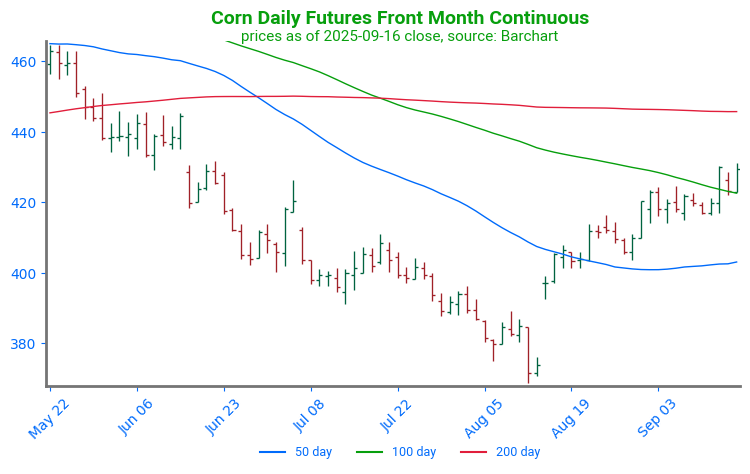

- Corn futures are trading near unchanged this morning with December futures near 429 and May futures trading near 456.

- Rains are forecast west of the Mississippi this week—likely slowing harvest but providing relief to falling river levels after recent dryness.

- Corn futures have pushed above the 100-day moving average, with strong demand fueling the rally. Prices are nearing overbought territory just as harvest pressure looms.

Corn Futures Extend Higher: December corn futures extended gains following the release of the September WASDE report. Prices broke through the 100-day moving average, but face further technical resistance at the July 7 price gap.

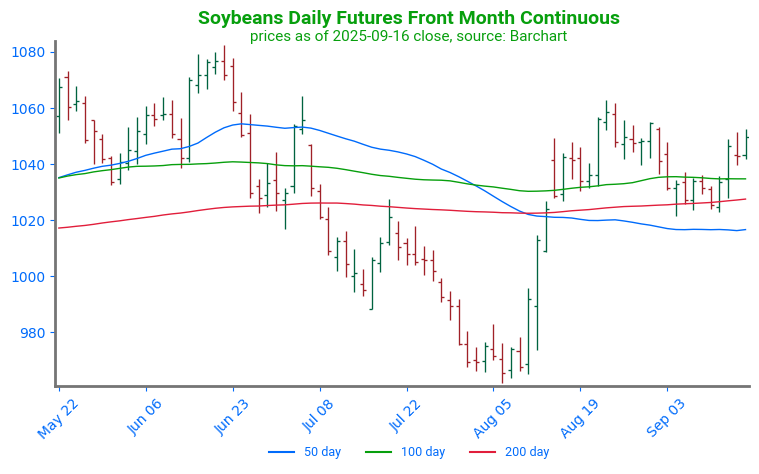

- Soybeans are lower to start the day following yesterday’s close higher. November soybeans are down 3-1/2 cents to $10.46-1/4 and March is down 3-1/2 cents to $10.80-1/2. October meal is up $0.30 to $286.40 and October bean oil is down 0.62 cents to 52.52 cents.

- President Trump is set to speak with China’s President Xi on Friday regarding trade, with traders hopeful soybeans will be part of the talks.

- The EPA on Tuesday issued a co-proposal to reallocate either 50% or 100% of small refinery exemptions for 2023–25, while also revising RVOs for 2026–27. A higher reallocation means more soybean oil demand for biofuels.

Soybean Futures Press Higher: Soybean futures closed sharply higher following the release of the September WASDE report, breaking through the 100-day moving average. The next point of technical resistance can be found near $10.60, an area that has capped rallies since late June.

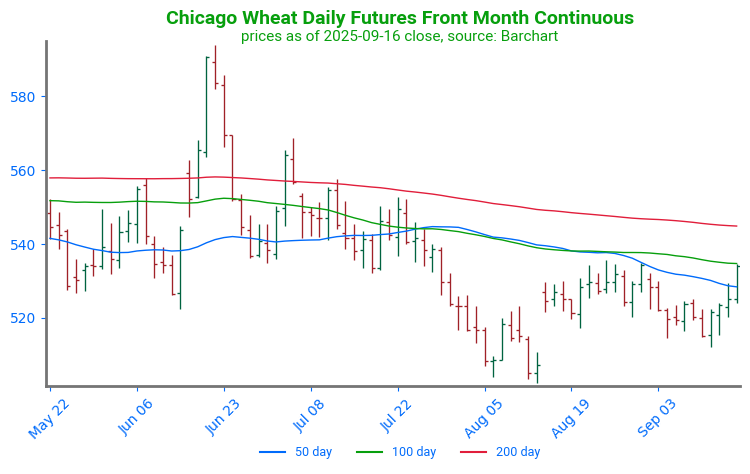

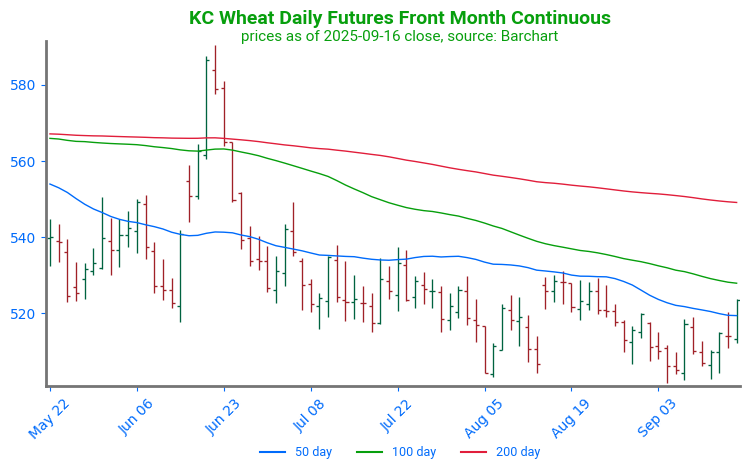

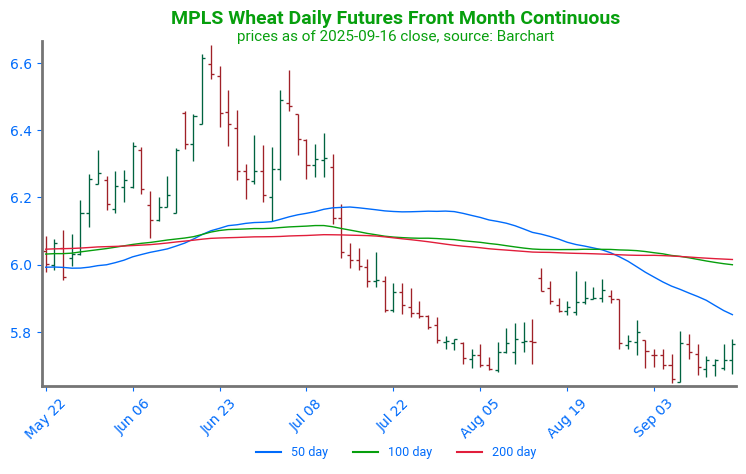

- Wheat is trading near unchanged to start the day with December Chicago wheat near 534, December KC wheat near 523 and December spring wheat near 575.

- Both winter wheat futures pushed above upside resistance with yesterday’s close after word that three importers has bought large quantities of U.S. wheat.

- A Federal Reserve rate cut is expected in today’s meeting. If realized a cut could provide pressure to the U.S. dollar which has already been trending downward.

Chicago Wheat Tests Resistance: Wheat futures broke through resistance at the 50-day moving average. Prices currently face strong technical resistance near 534 through the 100-day moving average.

KC Wheat Trends Sideways, Tests Lows: December KC wheat broke through its 50-day moving average in a strong fashion. The next area of technical resistance lies near 527, at the 100-day moving average.

Spring Wheat Tests Support: Futures remain rangebound as harvest advances, holding early August lows near 570 support. On the upside, the first point of strong resistance sits near 585 at the 50-day moving average. A second point can be found through a cluster of moving averages near 600.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.