9-17 End of Day: Grains End Lower Wednesday

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures retreated from yesterday’s highs on Wednesday as weekly ethanol production slipped to a 17-week low.

- 🌱 Soybeans: Soybeans closed lower, giving back most of Tuesday’s gains but managed to hold above recent lows.

- 🌾 Wheat: Wheat futures closed lower in sympathy with corn and soybeans, despite strength in Paris milling wheat and another drop in the U.S. Dollar Index to its lowest since early 2022.

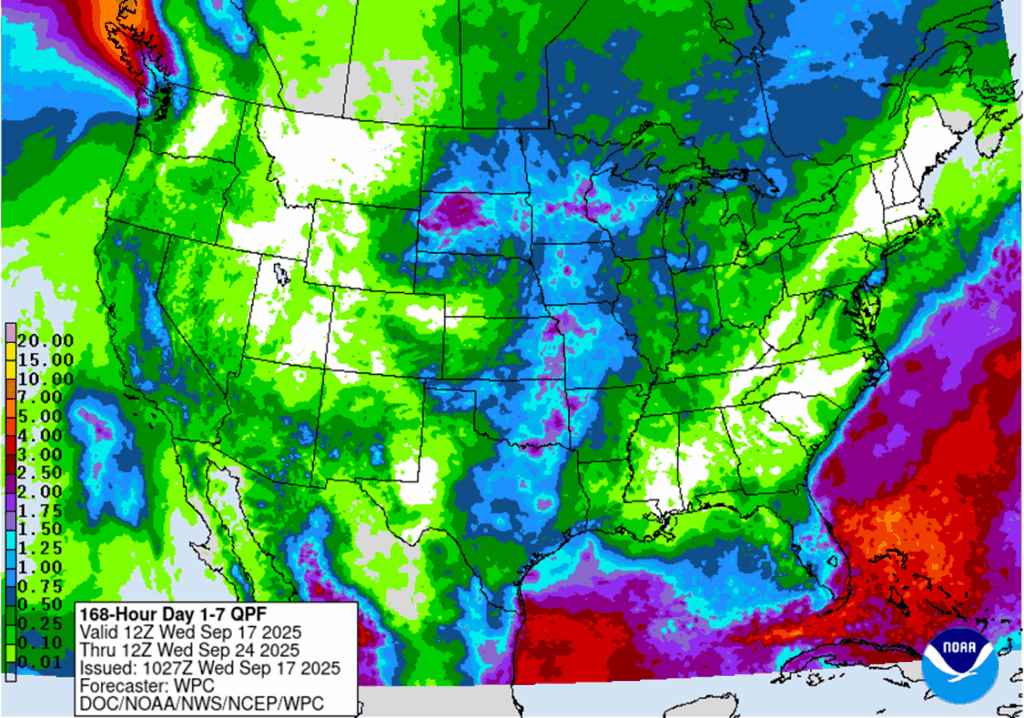

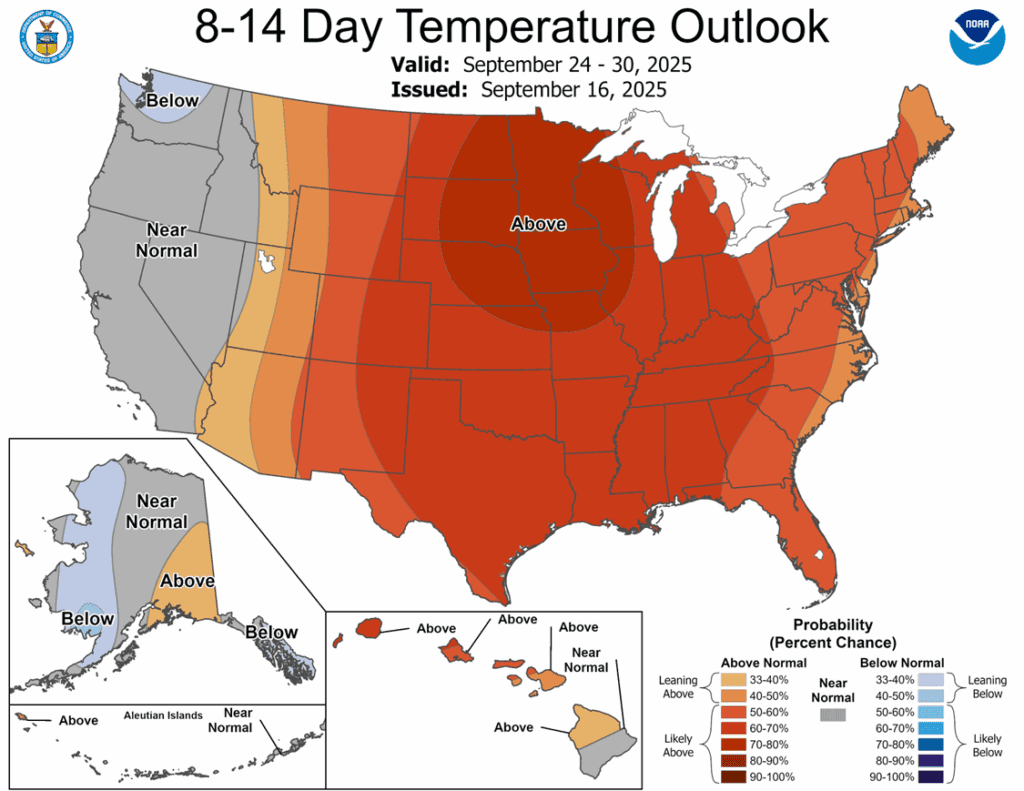

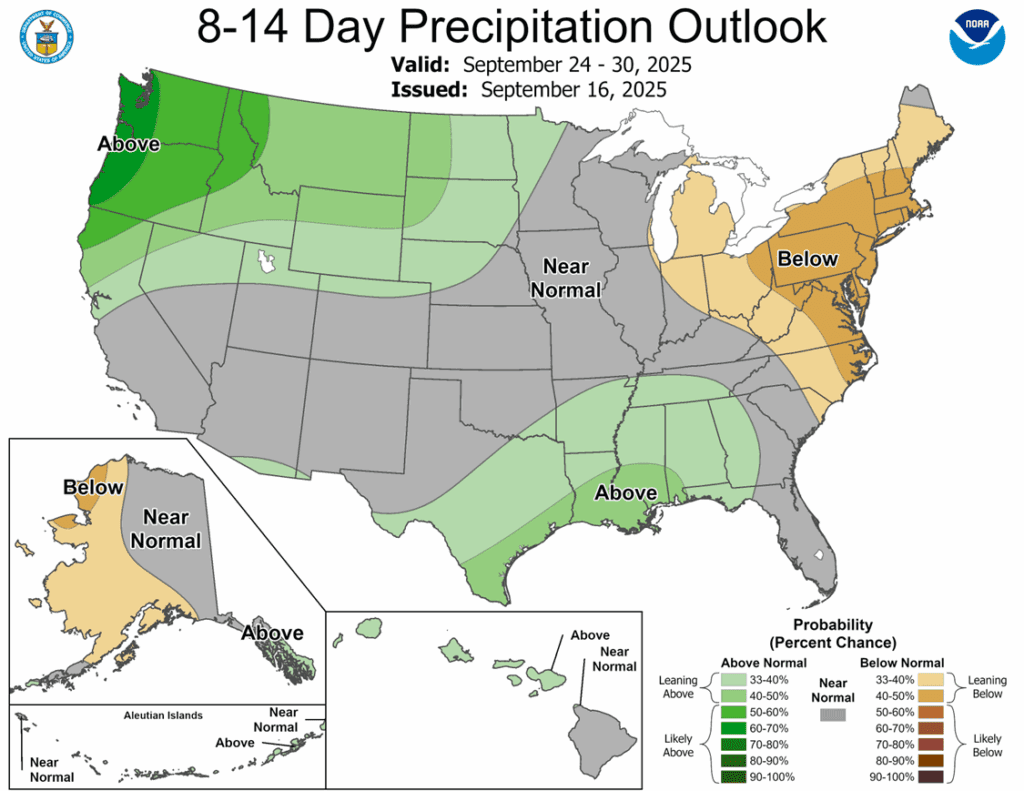

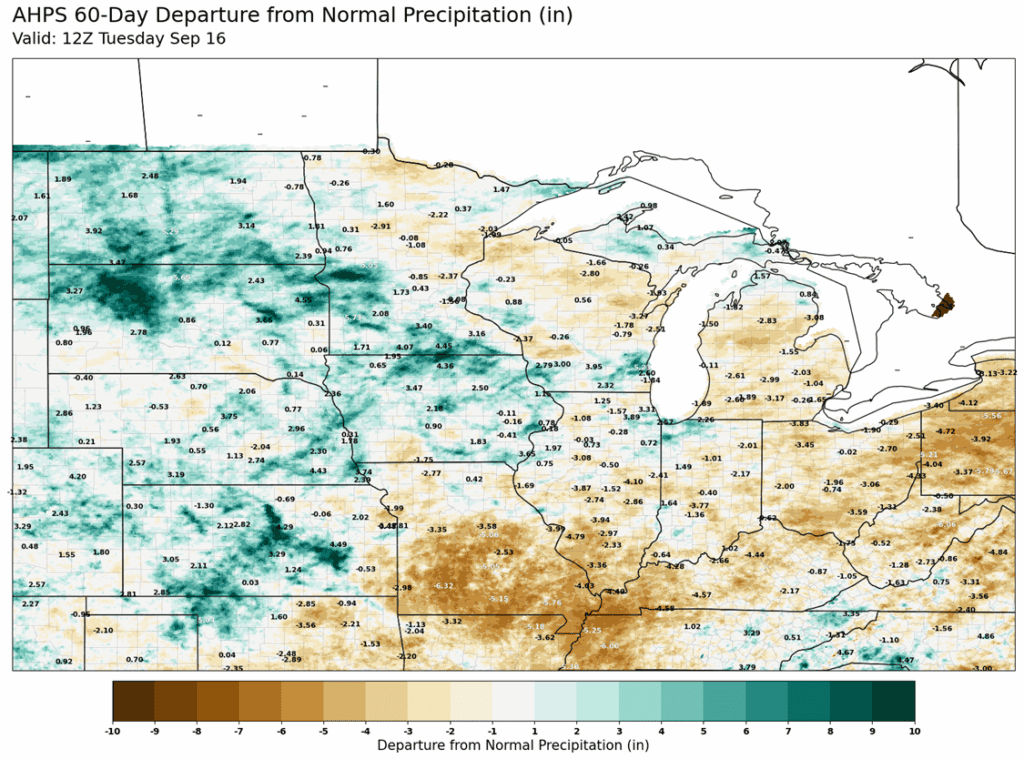

- To see the updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

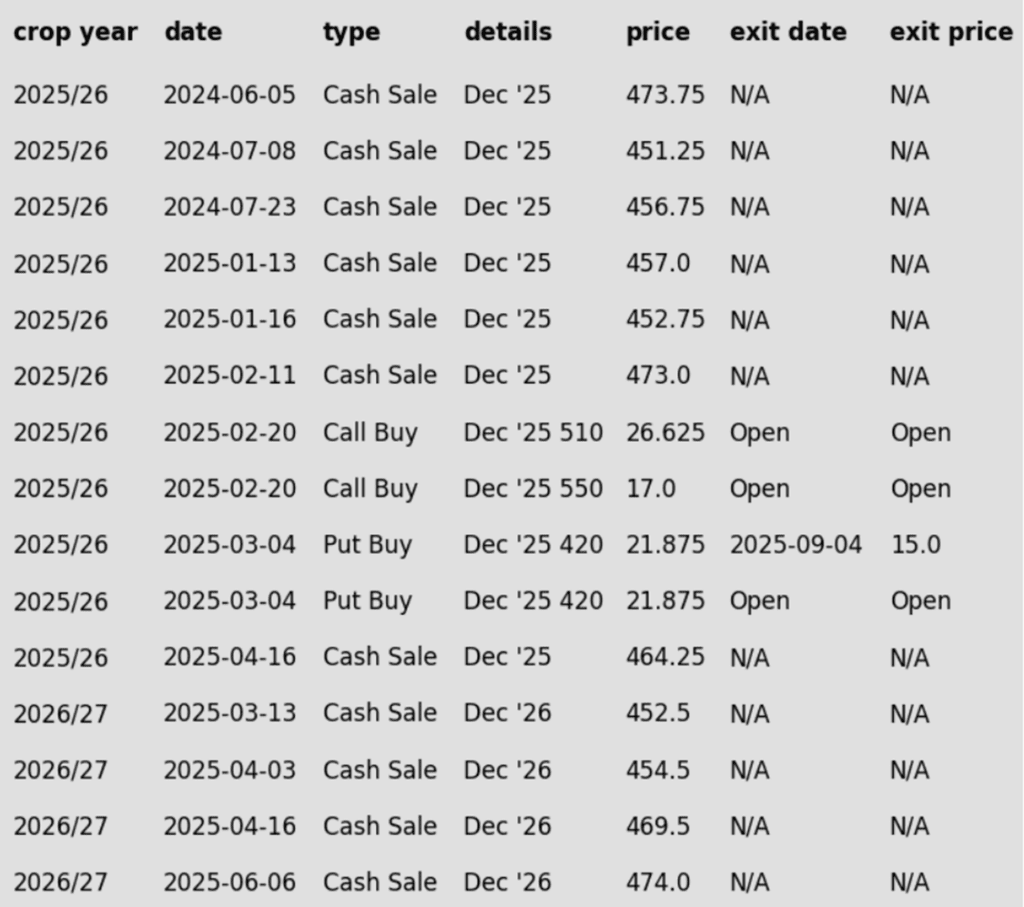

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures traded lower Wednesday as biofuel concerns and caution ahead of the FOMC rate decision kept buyers sidelined.

- The EPA has opened a discussion window regarding the latest allocation of blending exemptions. This built uncertainty in possible usage of biofuel to meet blending requirements. The lack of clarity pressured both the corn and soybean oil market on the session.

- The Fed cut rates by 0.25%, with two more possible by year-end. The softer stance pressured the U.S. dollar, supportive for corn and commodities; the dollar has fallen a full point over the past three sessions.

- Weekly ethanol production was softer than last week at 310 million gallons/day. The total was still 0.6% higher than last year. Production was the lowest in 17 weeks and below expectations. A total of 510 mb of corn was used last week in the production of ethanol. Overall ethanol stocks remain low at 22.6 million barrels.

- The late-September forecast calls for above-normal temps across most of the Corn Belt, with normal to below-normal precipitation—favorable for harvest progress.

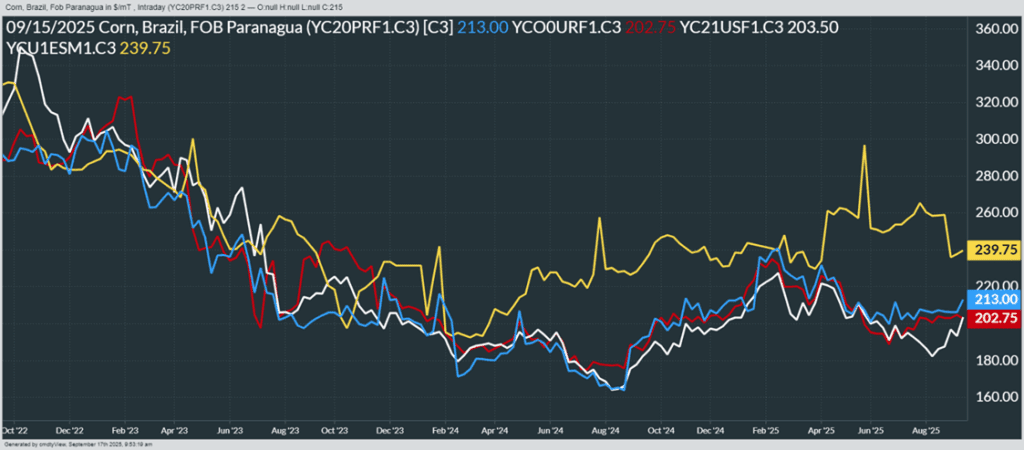

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower, taking out most of yesterday’s gains but did not take out its low and also found support once again at the 20-day moving average. November soybeans lost 6 cents to $10.43-3/4 and March lost 6-1/4 cents to $10.78. October soybean meal lost $1.90 to $283.90 and October soybean oil led the complex lower losing 1.45 cents to 51.24 cents.

- Brazilian soybean exports are expected to reach 7.53 mmt in the month of September, which would compare to 7.43 mmt the previous month. Brazilian crush estimates have been raised by 0.7% to 58.5 mmt for 2025 according to ANEC.

- President Trump is set to meet Chinese President Xi on Friday regarding TikTok and broader trade issues. While China hasn’t bought U.S. soybeans since January 22, 2025, traders speculate they may step in if a deal materializes and ahead of a potentially smaller U.S. crop.

- New crop soybean sales to other countries apart from China have been the best since 2018-2019, but this has not been enough to offset the lack of Chinese business. Brazilian beans are the most expensive in the world right now, but the additional 23% tariff that China has placed on U.S. beans has made ours the most expensive.

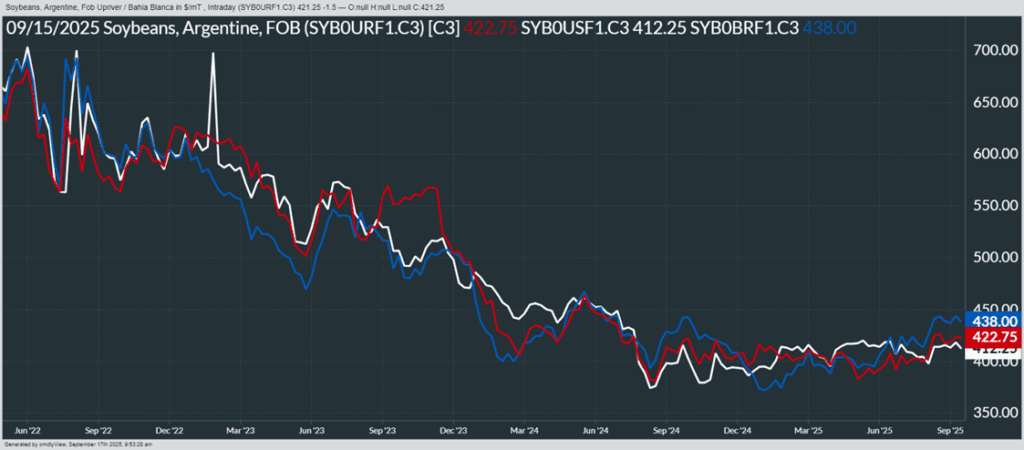

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- The wheat market closed lower in sympathy with corn and soybeans. The losses come despite a higher close for Paris milling wheat futures and another move lower for the U.S. Dollar Index, which hit the lowest level today since early 2022. The December wheat contracts lost 5-3/4 cents in Chicago to 528-1/4, 7-1/4 cents in Kansas City to 516-1/4, and 2-1/2 cents in MIAX to 574.

- Good rains fell over parts of the U.S. Southern Plains over the past 24 hours, which should help to recharge soil moisture for winter wheat that is currently being planted.

- Statistics Canada raised its 2025 all-wheat production estimate by 700,000 mt to 36.6 mmt (+1.9% vs 2024), in line with USDA’s recent increase to 36.0 mmt.

- Russia’s ag ministry sharply raised its wheat export tax nearly 300% to 495.9 Rubles/mt for September 17–23, part of the grain damper mechanism introduced in 2021 to subsidize producers.

- According to the European Commission, EU soft wheat exports are down 34% year over year, totaling 3.78 mmt as of September 14. This compares with 5.73 mmt shipped during a similar timeframe last year. Saudi Arabia was the largest importer at 569,000 mt, followed by smaller amounts from Jordan and Morocco.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 602.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.75.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

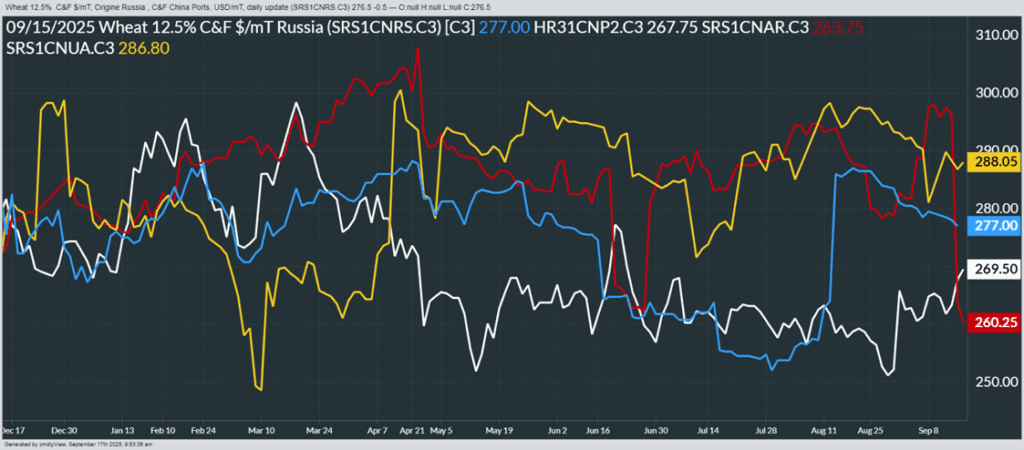

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather

From ag-wx.com