9-16 End of Day: Grains Finish Higher as U.S. Corn and Soybean Harvest Begins

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures recover Monday’s losses as the U.S. begins harvest and yield reports come in. Prices have returned to test strong technical resistance at the July 7 price gap.

- 🌱 Soybeans: Soybean futures trade higher as the market adopts an optimistic view on coming U.S. – China trade discussions.

- 🌾 Wheat: Wheat futures close with bullish undertones as flour millers in Asia have ramped up imports of U.S. wheat.

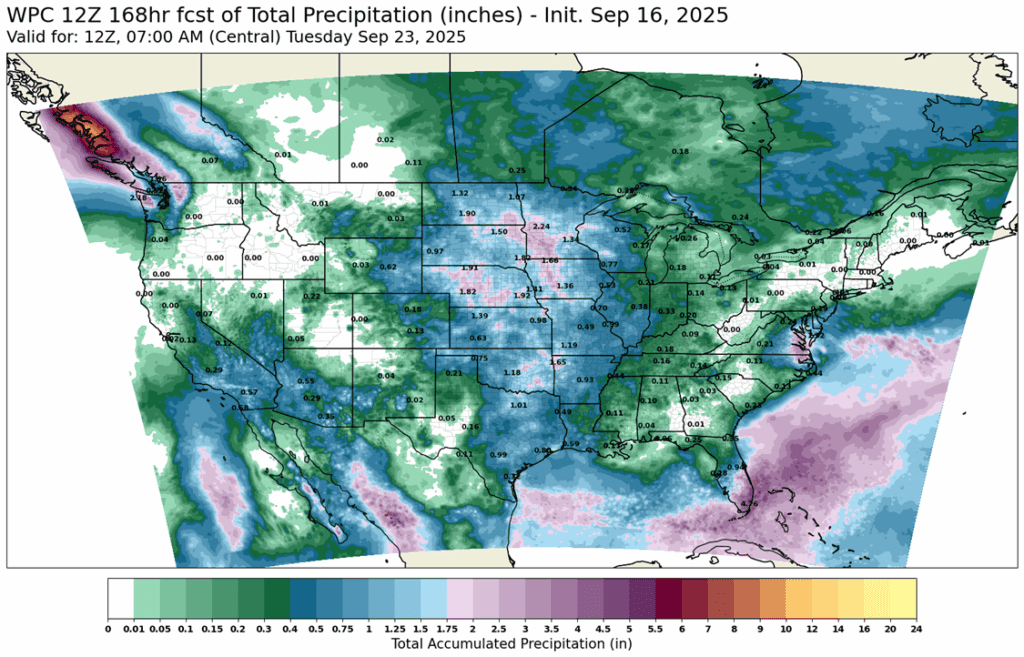

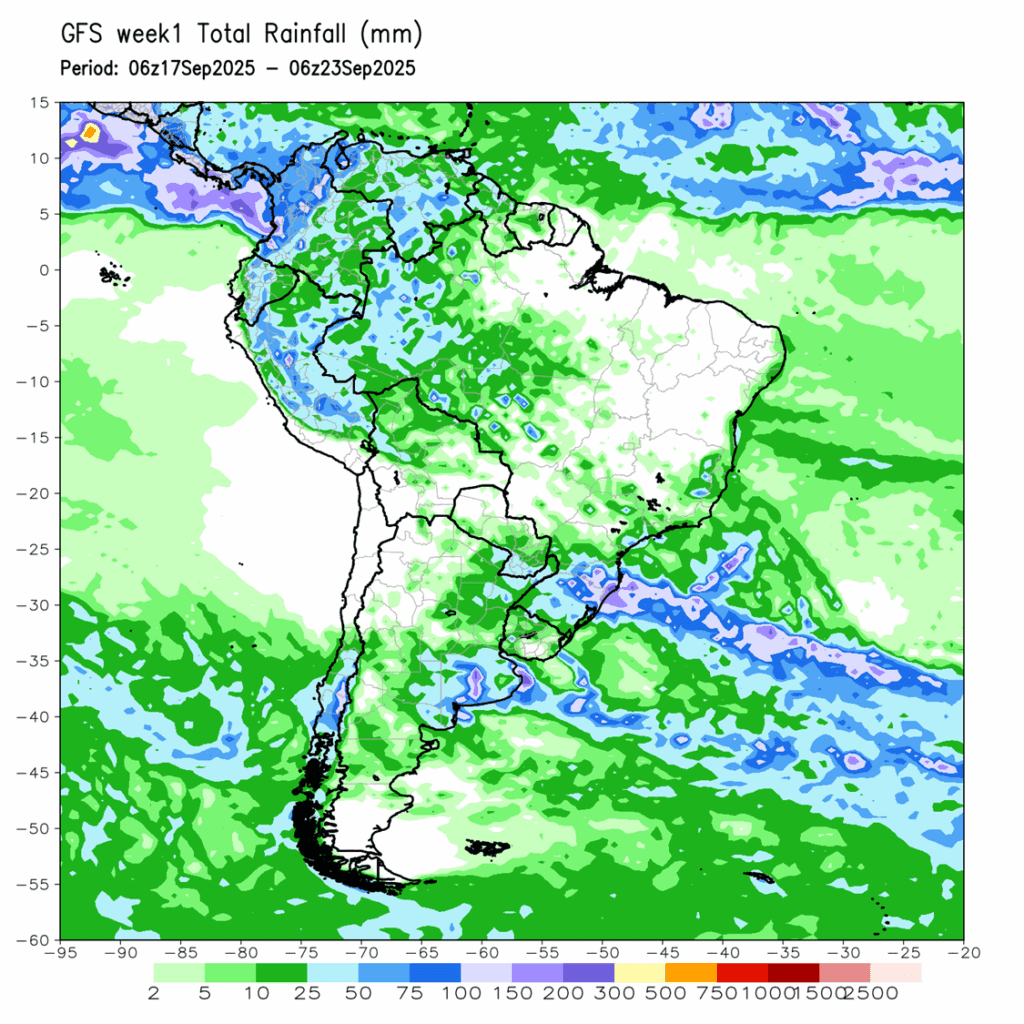

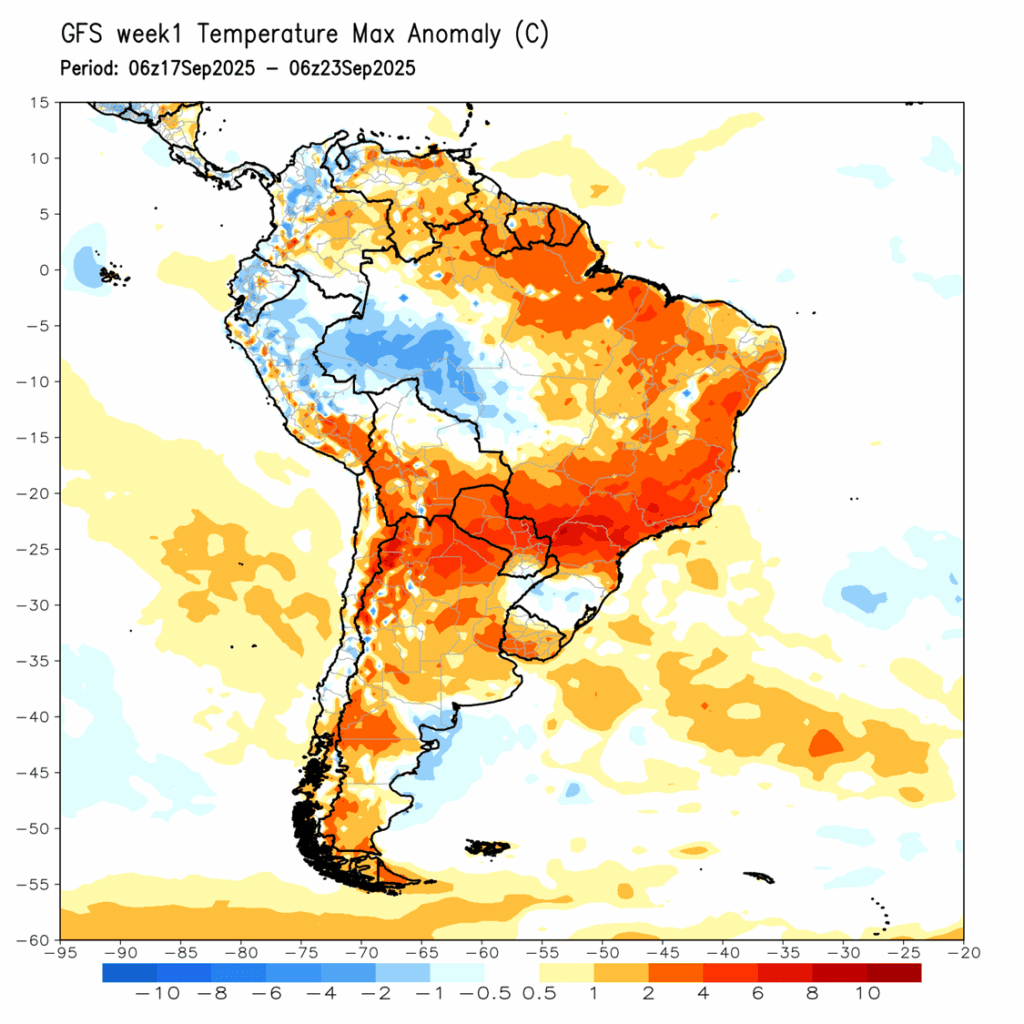

- To see the updated U.S. 7-day accumulated precipitation forecast, as well as 7-day accumulated precipitation and temperature anomalies for South America, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

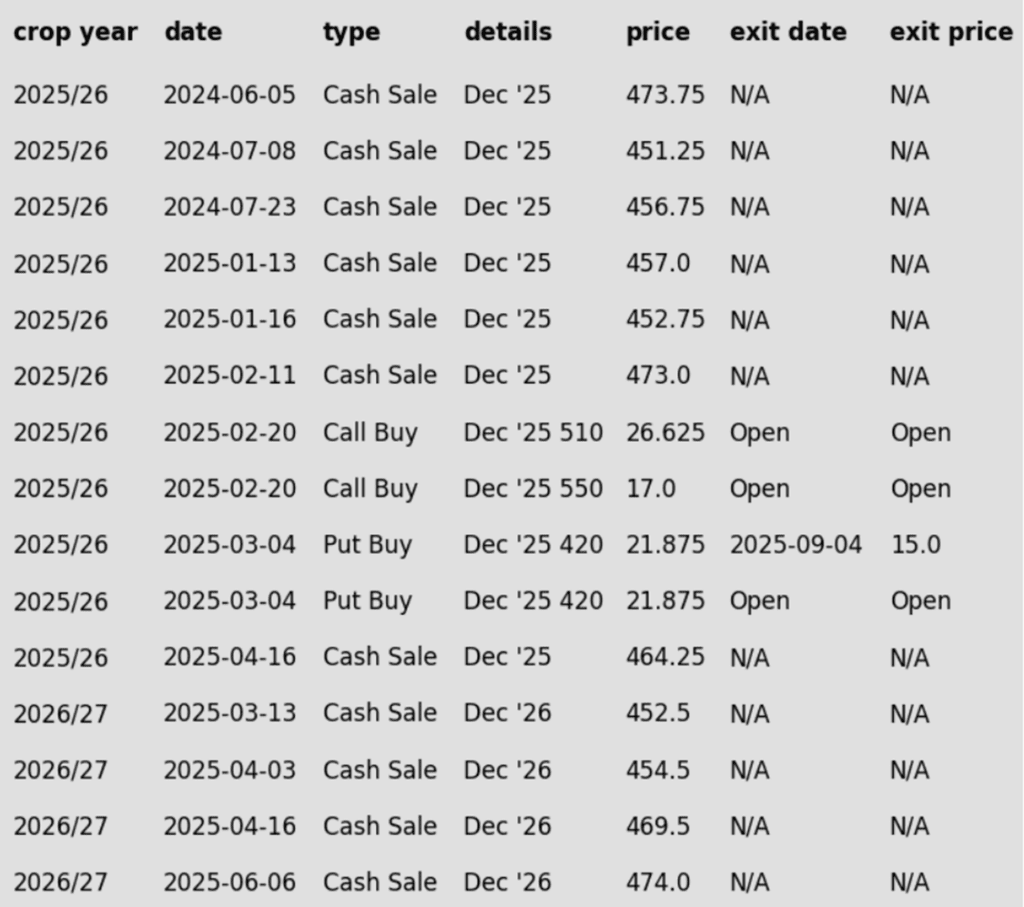

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None

- Notes:

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Buyers came back into the corn market as corn futures finished with moderately strong gains. Fund short covering and technical buying pushed the December corn market to its highest intraday levels since July 3 before settling into the close. December con gained 6 ¼ cents to 429 ½, and March added 6 cents to 447.

- The December corn contract is looking to fill the trading gap on the December chart going back to July 3. The top of the gap is 432 ¾ cents. This area is acting as a strong point of resistance. Closing this trading gap could allow prices to push higher to challenge the 440 level.

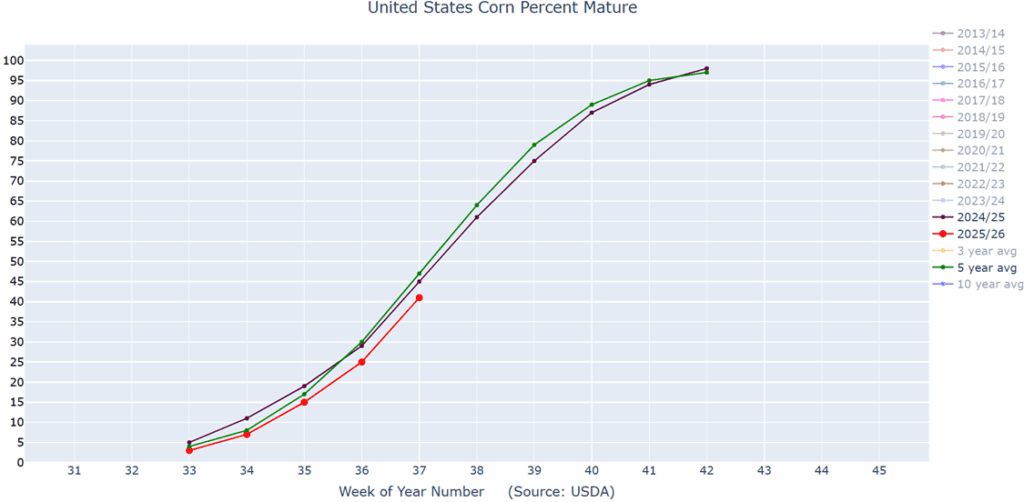

- Corn harvest has begun in the US. Weekly crop progress reports stated that corn harvest was 7% complete as of September 14. This is 2% behind the five-year average. The corn market will be monitoring yield results as the eastern and southern corn belt saw some of the driest conditions in over 100 years in August, which likely limited the final yield on the corn crop.

- Late Tuesday, the EPA released a proposal addressing the reallocation of biofuel blending obligations that were recently waived for small oil refineries. The EPA will open a comment period on two plans for reallocating 100% or 50% of the biofuel blending responsibilities waived under the small refinery exemption program.

- Extended forecast into the end of September is expected to be above normal for most areas of the corn belt, with precipitation to be normal to below normal. This forecast should help promote harvest of the corn crop.

Corn percent mature (red) versus the 5-year average (green) and last year (purple).

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day significantly higher taking back all of yesterday’s losses, posting the highest close since the end of last month. November soybeans gained 7 cents to $10.49-3/4 while March gained 7-3/4 cents to $10.84-1/4. October soybean meal gained $0.60 to $285.80 and October bean oil gained 0.93 cents to 52.69 cents.

- Support today came from hope that this Friday when President Trump meets with Chinese President Xi, agricultural exports will be included in the deal for TikTok. While China has not purchased US soybeans since January 22, 2025, they may step in thinking that this year’s crop will be small to secure a cheaper price.

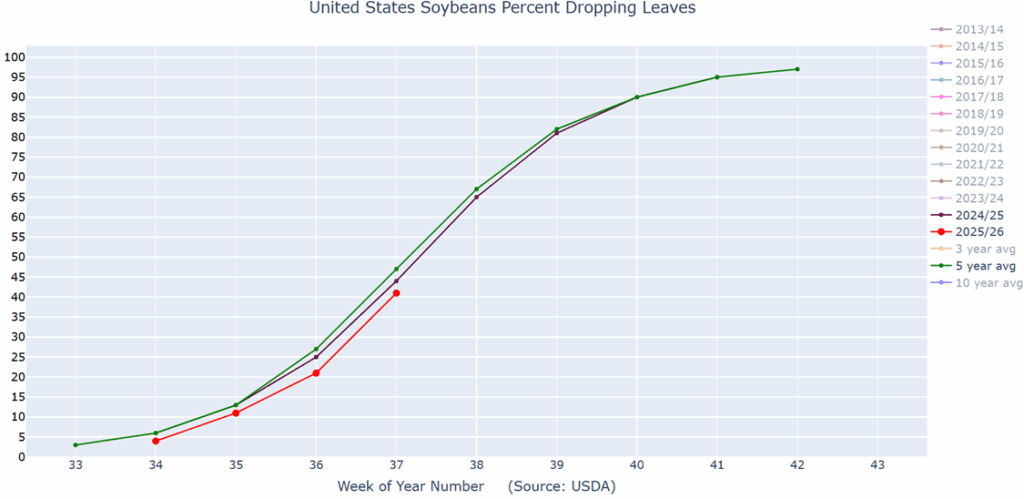

- Yesterday’s Crop Progress report saw soybean crop conditions fall by one point to 63% good to excellent which compared to 64% a year ago. 41% of the crop has dropped leaves which is above the 5-year average of 40% and 5% is harvested compared the to 5-year average of 3% at this time.

- New crop soybean sales to other countries apart from China have been the best since 2018-2019, but this has not been enough to offset the lack of Chinese business. Brazilian beans are the most expensive in the world right now, but the additional 23% tariff that China has placed on US beans has made ours the most expensive.

Soybeans percent dropping leaves (red) versus the 5-year average (green) and last year (purple).

Wheat

Market Notes: Wheat

- Wheat closed with a gain of 9 cents for December Chicago futures. Meanwhile, Dec Kansas City was up 9-1/2 at 523-1/2, and MIAX gained 4-3/4 cents to 576-1/2. Support came from a drop in the US Dollar Index to the lowest level since the start of July. Additionally, purchases in the past week by Sri Lanka, Bangladesh, and Indonesia all added some bullish sentiment.

- Wheat futures traded higher for the fourth consecutive session. This is the longest winning streak in the December Chicago wheat contract going back to November 15, 2024.

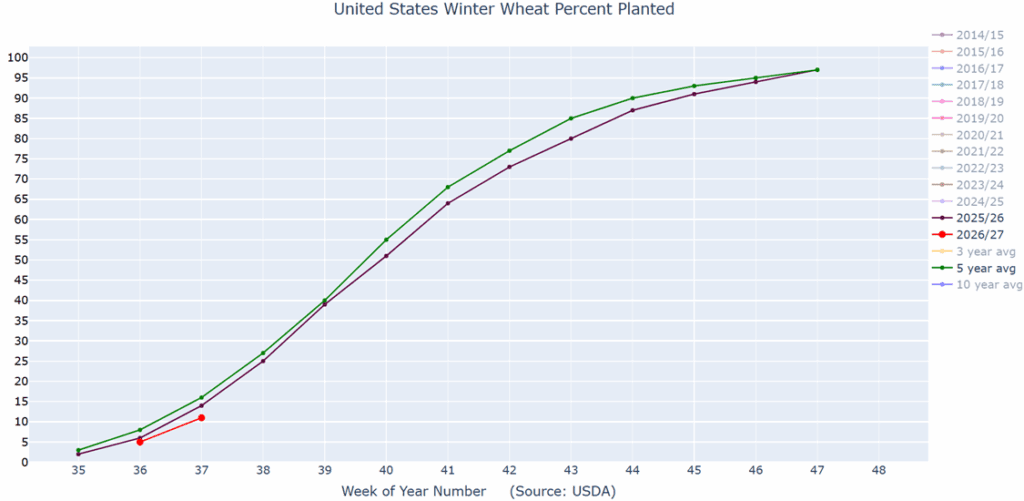

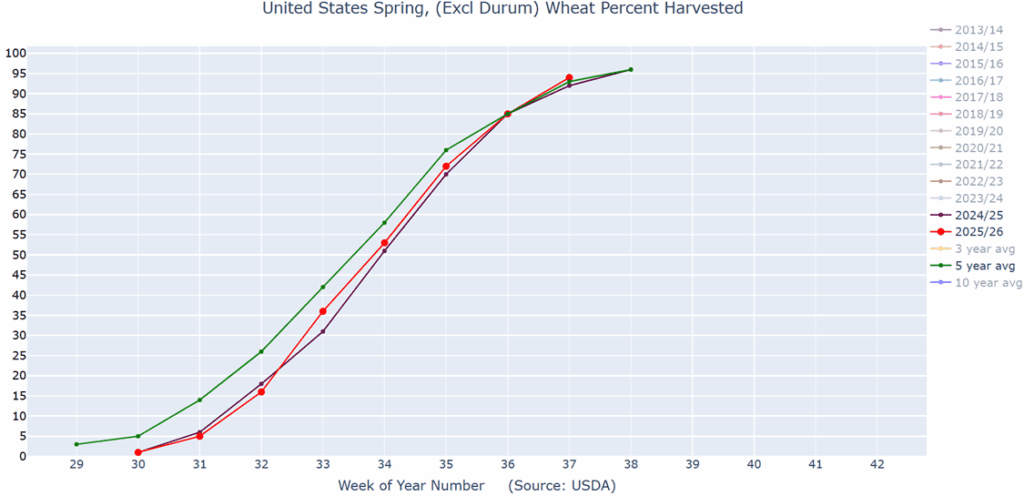

- According to yesterday’s crop progress report, the US winter wheat crop is now 11% planted, which falls just short of last year and the five-year average, both at 13%. Additionally, the spring wheat crop is 94% harvested, compared to 91% last year and 92% on average.

- The French soft wheat crop is now estimated at 33.3 mmt, an increase of 0.2 mmt from the August forecast. This represents a 30% year over year increase – last year’s production was historically low. The new estimate is also 4.7% above the five-year average.

- Asian millers have reportedly purchased more US wheat due to competitive prices and delays in Black Sea shipping. Indonesia, Bangladesh, and Sri Lanka have all secured US wheat deals with soft wheat sold at $270 per ton and hard red sold at $275 per ton. Following this, the USDA has raised its forecast for US wheat exports for the 25/26 marketing year.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 602.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.75.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None

To date, Grain Market Insider has issued the following KC recommendations:

Winter wheat percent planted (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Spring wheat percent harvested (red) versus the 5-year average (green) and last year (purple).

Other Charts / Weather

Above: U.S. 7-day forecasted total precipitation, courtesy of ag-wx.com

Above: South America 7-day forecasted total rainfall, courtesy of the National Weather Service, Climate Prediction Center.

Above: South America 7-day maximum temperature anomaly, courtesy of the National Weather Service, Climate Prediction Center.