9-15 End of Day: Grains Finish Mixed as the Market Contemplates the Fundamental Outlook

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures retrace, despite strong export inspections, as the market continues to digest the September WASDE report.

- 🌱 Soybeans: Soybean futures give back a portion of Friday’s gains as concerns of export demand weigh on the market.

- 🌾 Wheat: Wheat futures close in a mixed fashion despite export inspections running ahead of pace.

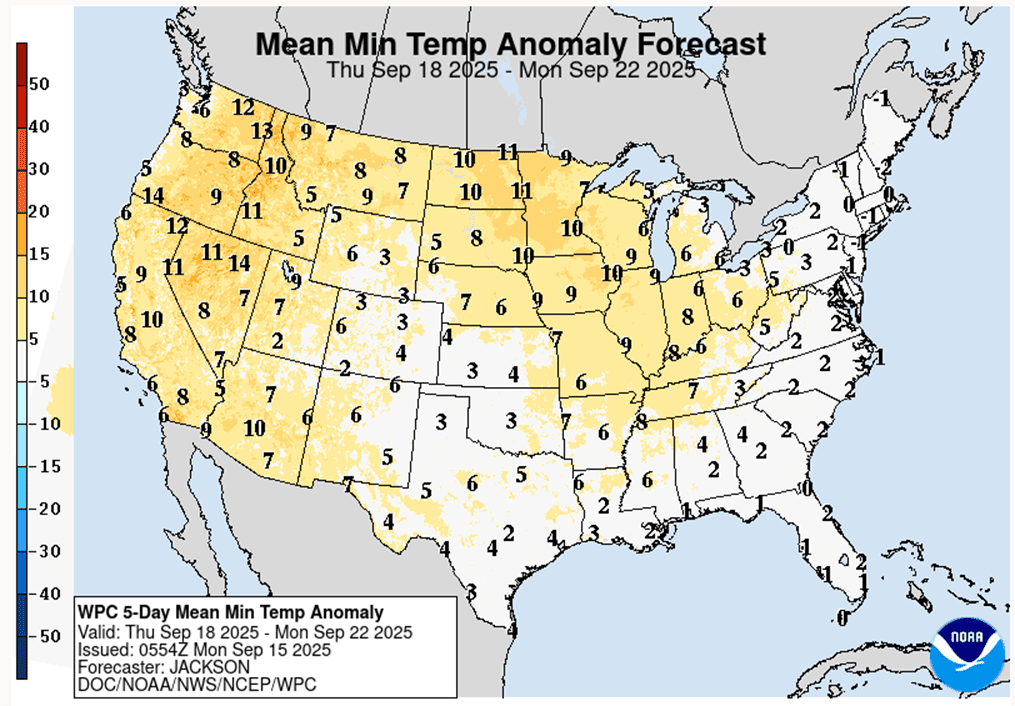

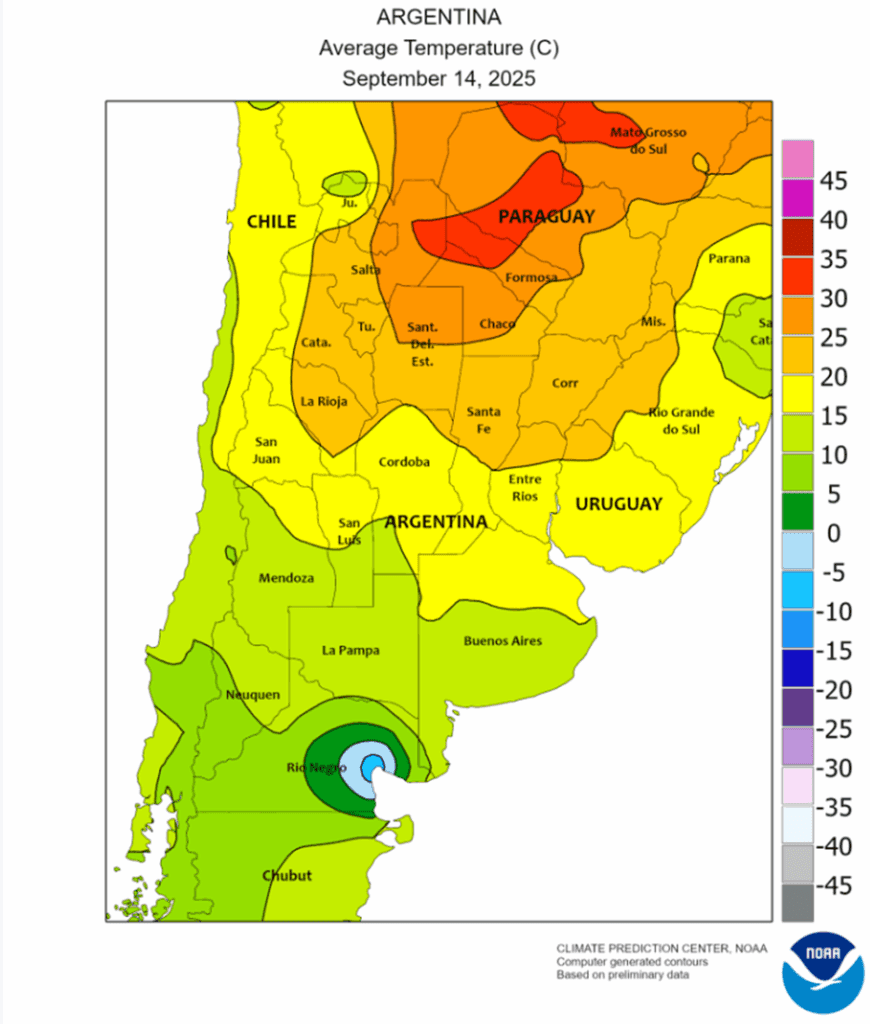

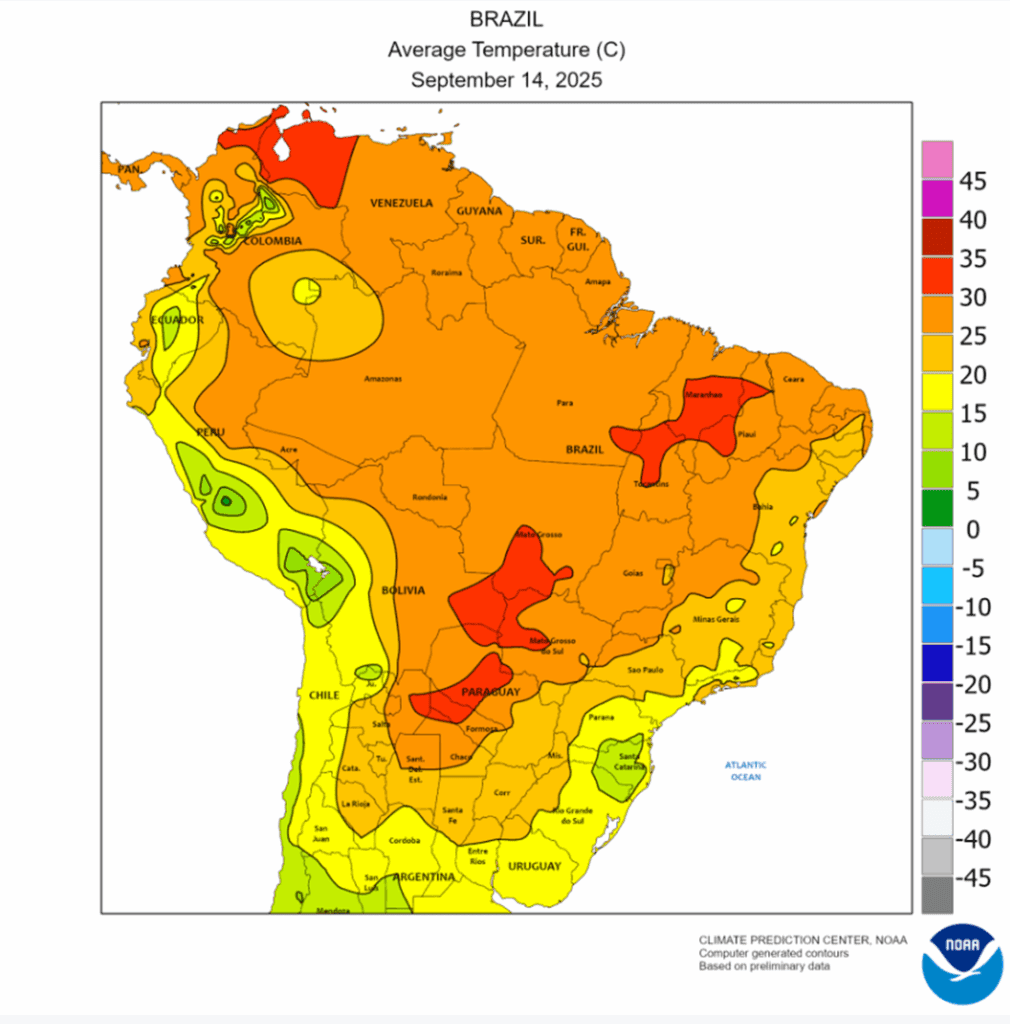

- To see the updated U.S. 5-day temperature anomaly as well as the Brazil and Argentina average temperatures, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

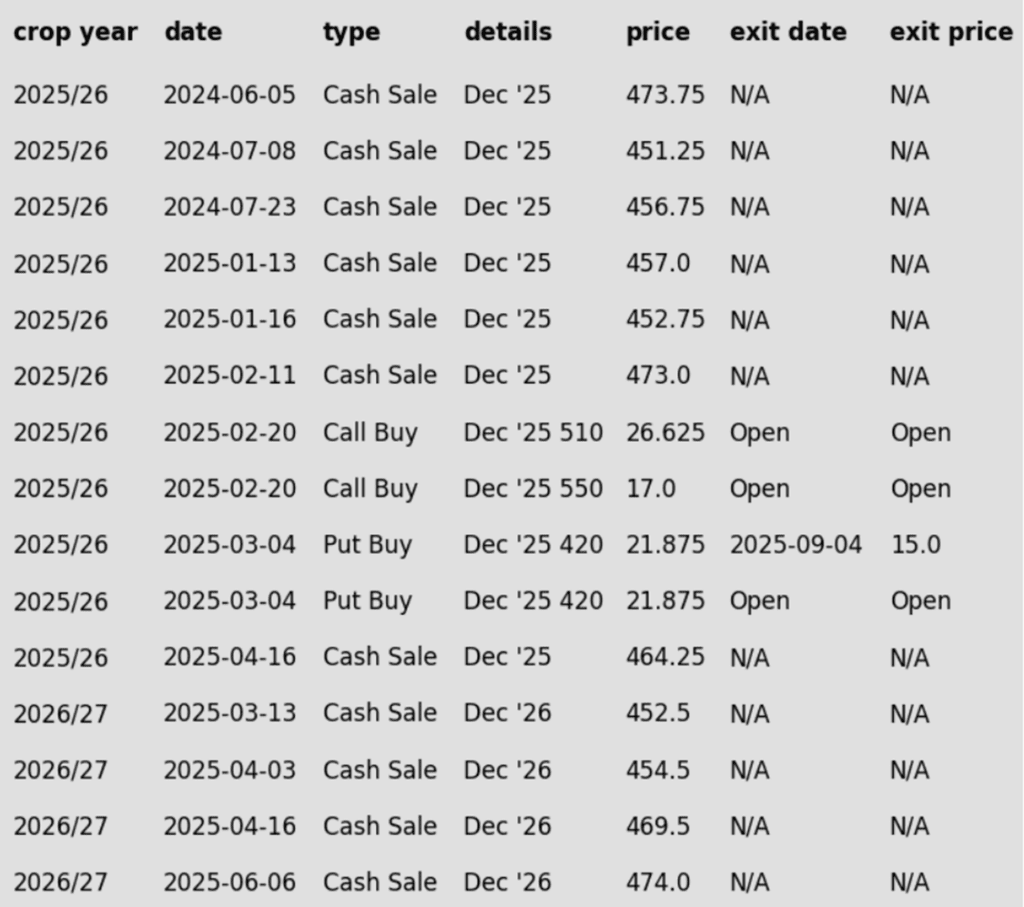

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures retreated Monday, with December down 6 ¾ to 423 ¼ and March off 6 ¼ to 441, as the market continued digesting Friday’s USDA report.

- In principle, the USDA report on Friday was still holding a bearish tone, despite the bullish reaction in prices. The addition of 1.5 million acres and yield still at a record of 186.7 bu/a will have the U.S. producing a record corn crop. Despite the strong export demand, the supply side of the balance sheet will stay heavy as harvest progresses.

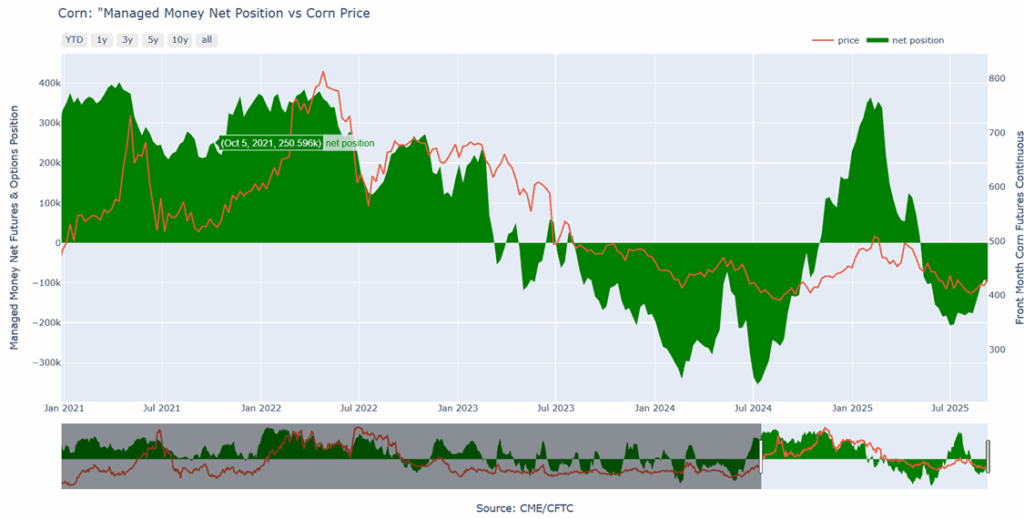

- Managed funds grew their net short position in the corn market on last week’s Commitment of Traders. Managed funds sold a net 8,400 contract and are still positioned in a net short of 99,929 contracts. Fund money flow likely reduced that position with the buying strength on Friday last week.

- USDA announced a flash export sale of corn this morning. Unknown destinations bought 148,971 MT (5.9 mb) of corn for the current marketing year (2025-26). This was the first flash sale of corn since September 4.

- Weekly export inspections were strong for the week ending September 11. For that week, the USDA reported inspections at 1.512 MMT (59.5 mb). This total was above expectations, and shipments for the start of the marketing year, September 1, are 106% over last year.

Corn Managed Money Funds net position as of Tuesday, September 9. Net position in Green versus price in Red. Money Managers net sold 8,442 contracts between September 2 – September 9, bringing their total position to a net short 99,929 contracts.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower giving back a portion of Friday’s gains. November soybeans lost 3-1/2 cents to close at $10.42-3/4 and March soybeans lost 3-3/4 cents to $10.76-1/2. October soybean meal lost $2.40 to $285.20 and October soybean oil gained 0.09 cents to close at 51.76 cents.

- Today’s Export Inspections report was supportive and above trade estimates with inspections for 25/26 totaling 29.6 million bushels. This puts total inspections at 39 mb, up 43% from the previous year. It should be noted that the USDA recently reported a sale to China two weeks ago, but this was an error as the purchase was actually made in January.

- Friday’s WASDE report was bearish with yield estimates revised slightly lower to 53.5 bpa but was above the average trade guess of 53.3 bpa. Soybean planted acreage was revised higher by 200,000 acres and export demand was revised slightly lower. Ending stocks for 25/26 were estimated at 300 mb, which was up from last month’s estimate of 290 mb.

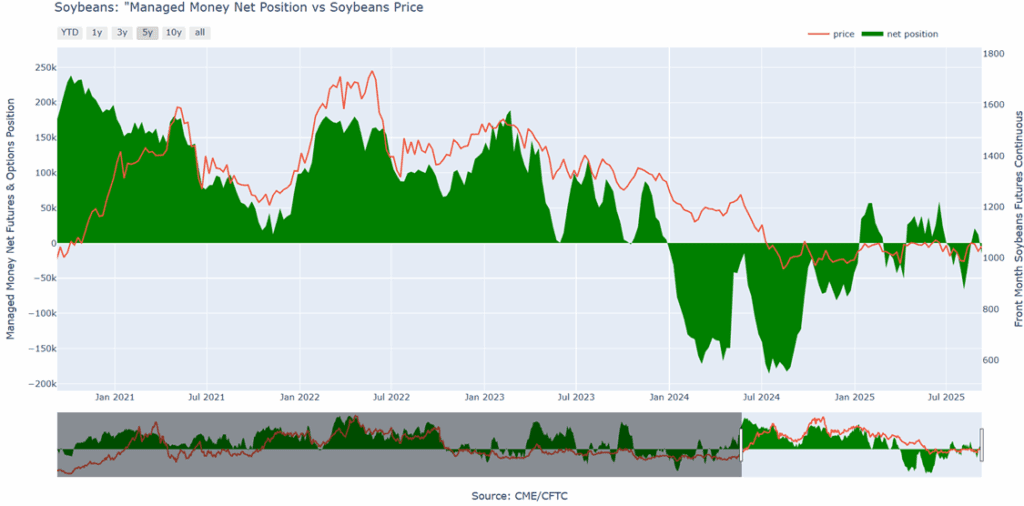

- Friday’s CFTC report saw funds as sellers of soybeans by 26,678 contracts, increasing their net short position to 14,714 contracts. They sold 12,465 contracts of bean oil, leaving them long 3,662 contracts and bought back 3,737 contracts of meal, leaving them short 85,785 contracts.

Soybean Managed Money Funds net position as of Tuesday, September 9. Net position in Green versus price in Red. Money Managers net sold 26,678 contracts between September 2 – September 9, bringing their total position to a net short 14,714 contracts.

Wheat

Market Notes: Wheat

- Wheat futures closed in mixed fashion. December Chicago was up 1-1/2 cents to 525, MIAX was unchanged at 571-3/4, and Kansas City declined 3/4 cent to 514. All things considered, wheat held its ground fairly well today, after Friday’s WASDE report indicated that major global wheat producers had harvest estimates revised their higher by 9.3 mmt (in total) compared to the August report.

- Weekly wheat inspections at 27.7 mb were above expectations, bringing the 25/26 inspections total to 289 mb, up 12% from last year. Inspections are running above the USDA’s estimated pace. Currently, they are forecasting 25/26 exports at 900 mb, up 9% from the year prior.

- According to IKAR, Russian wheat export values finished last week at $225/mt on a FOB basis, down $3 from the week before. These declining offers out of Russia have helped to keep pressure on US wheat prices.

- In a report from Reuters, Russia is attempting to avoid sanctions by bartering. Reportedly, Chinese cars were traded for Russian wheat. It is not clear how much of either product was exchanged, or what the values of the grain and cars were.

- Ukrainian grain exports have reached 5.2 mmt since the season began on July 1. This represents a 40% decline from the 8.6 mmt shipped in a similar timeframe last year. Of the total, wheat accounted for 3.55 mmt, which is down 24% year over year.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 602.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.75.

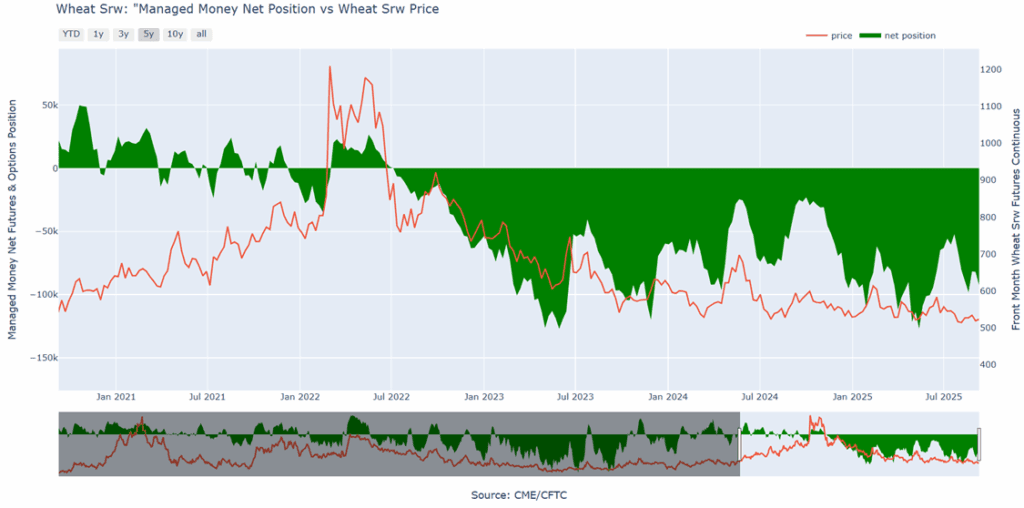

Chicago Wheat Managed Money Funds’ net position as of Tuesday, September 9. Net position in Green versus price in Red. Money Managers net sold 10,451 contracts between September 2 – September 9, bringing their total position to a net short 92,394 contracts.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None

To date, Grain Market Insider has issued the following KC recommendations:

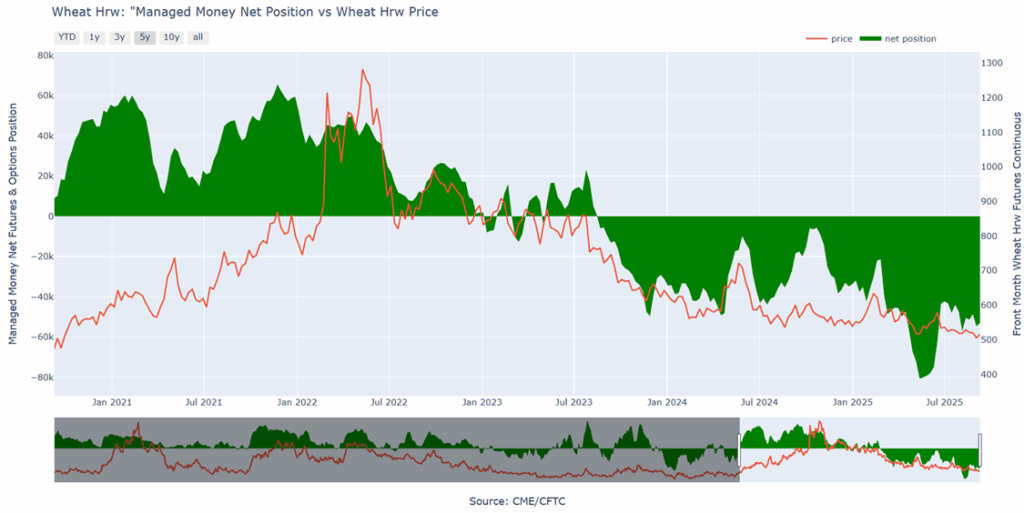

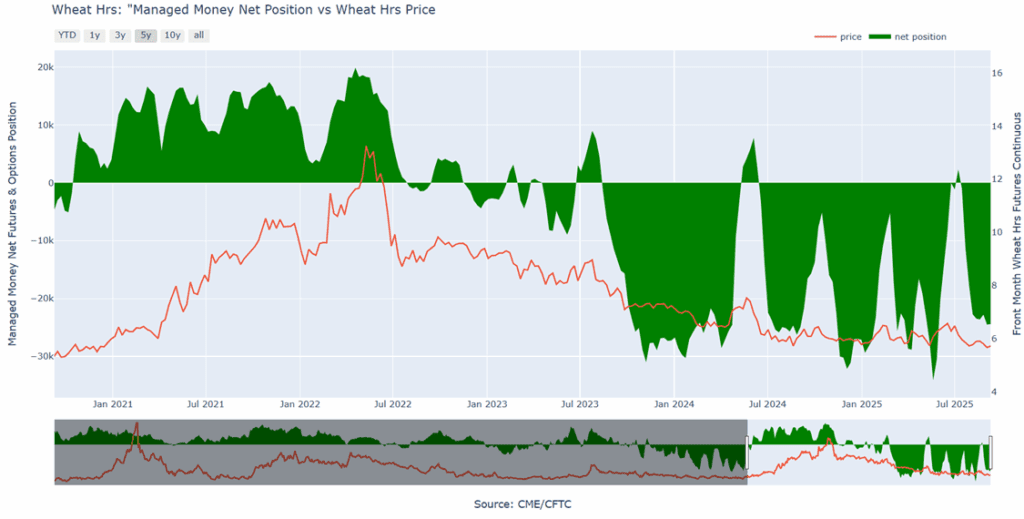

KC Wheat Managed Money Funds’ net position as of Tuesday, September 9. Net position in Green versus price in Red. Money Managers net bought 1,656 contracts between September 2 – September 9, bringing their total position to a net short 53,025 contracts.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, September 9. Net position in Green versus price in Red. Money Managers net sold 95 contracts between September 2 – September 9, bringing their total position to a net short 24,399 contracts.

Other Charts / Weather