9-11 End of Day: Short Covering Leads Grains Higher Ahead of WASDE Report Friday

Grain Market Insider Interactive Quote Board

Grain Market Highlights

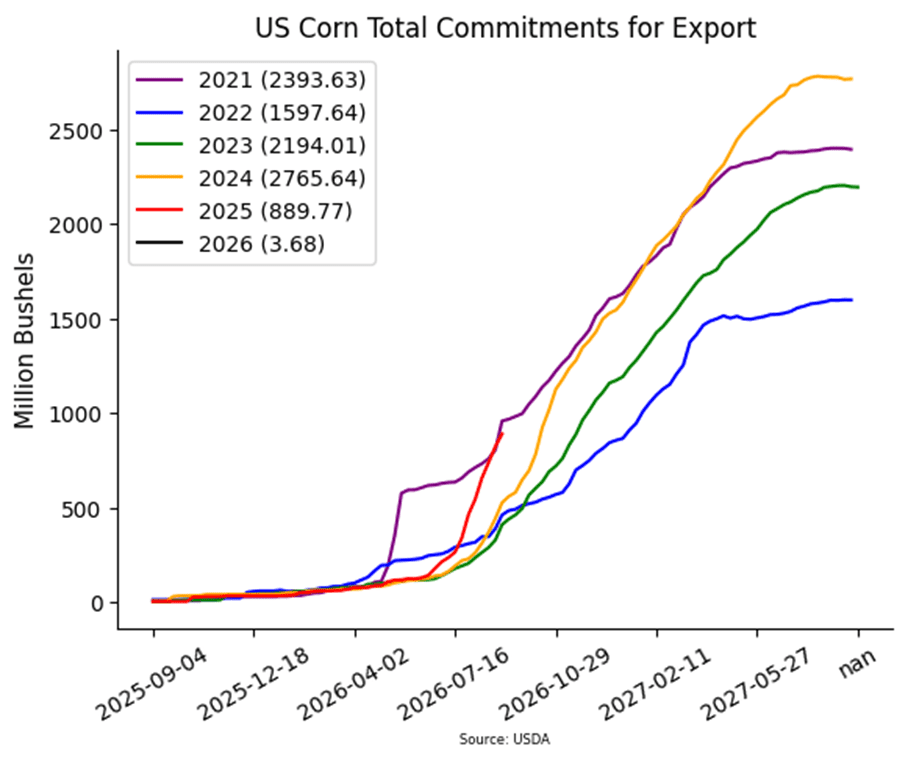

- 🌽 Corn: Corn futures finished higher Thursday, supported by firm export demand ahead of Friday’s WASDE.

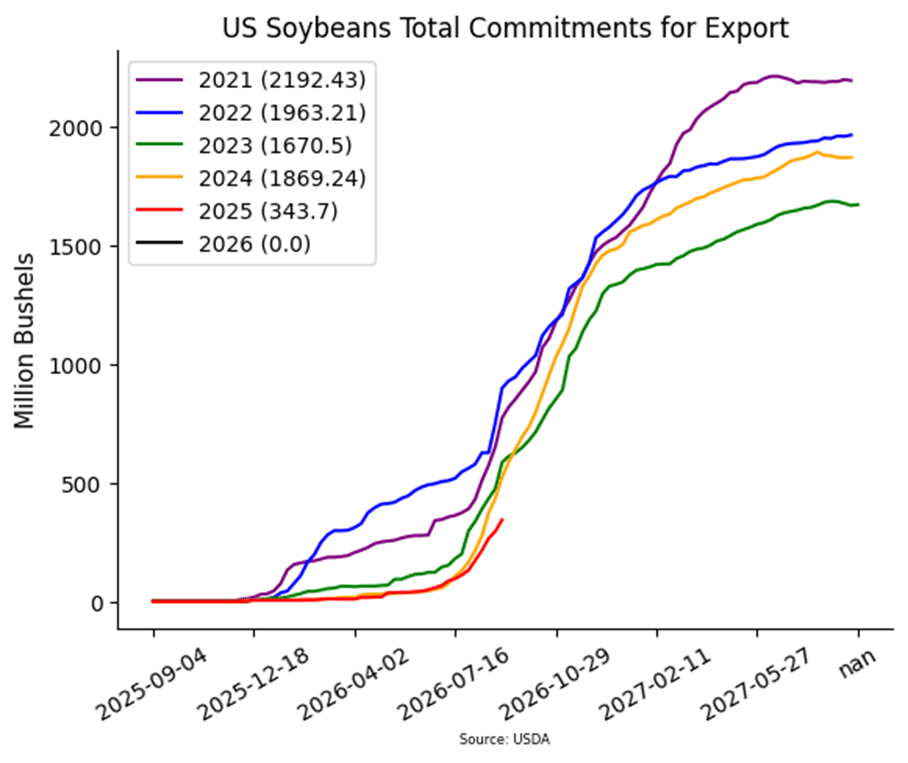

- 🌱 Soybeans: Soybeans rallied off support Thursday, closing higher ahead of Friday’s WASDE.

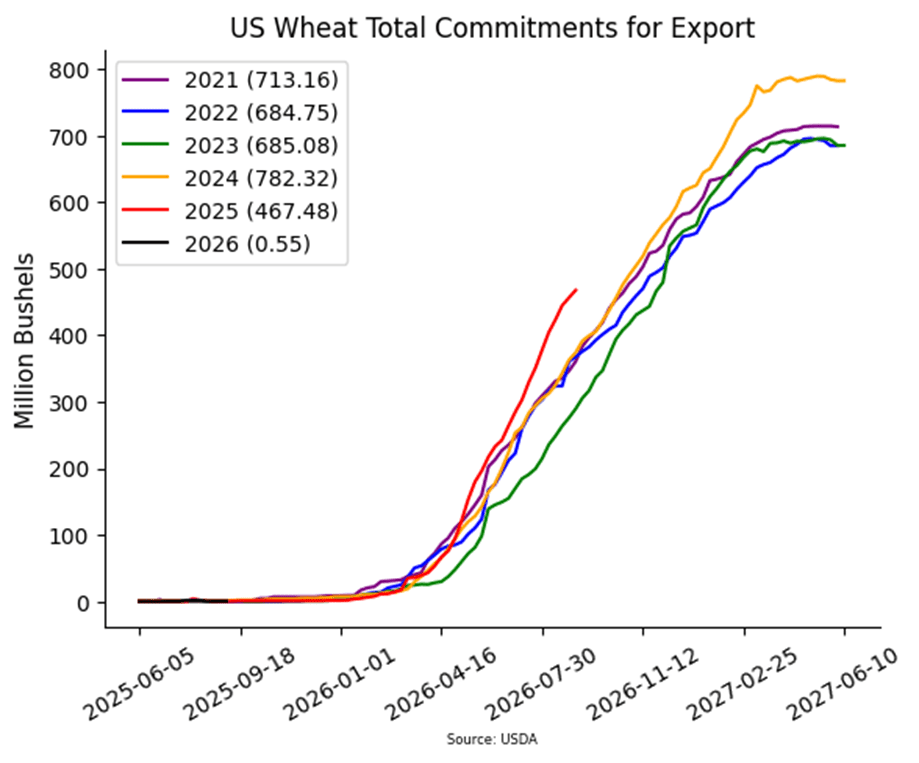

- 🌾 Wheat: Wheat futures closed higher Thursday, supported by export commitments running ahead of last year’s pace.

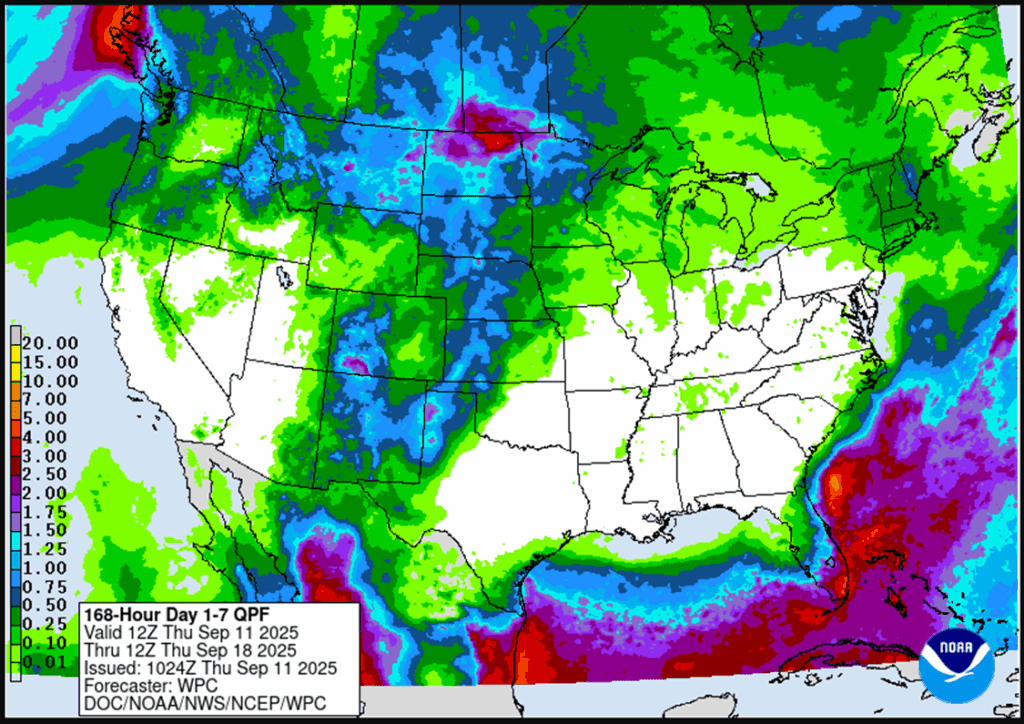

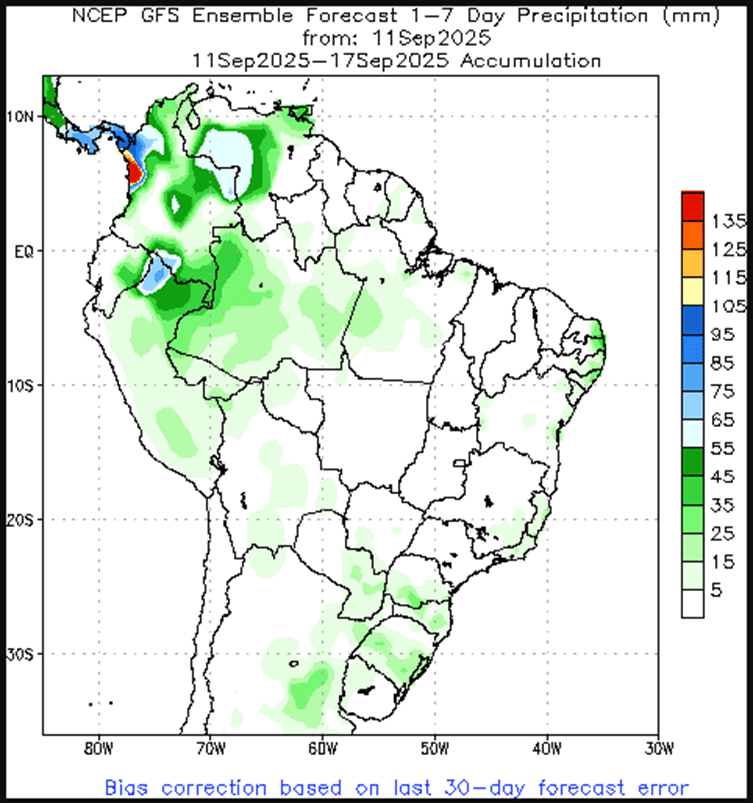

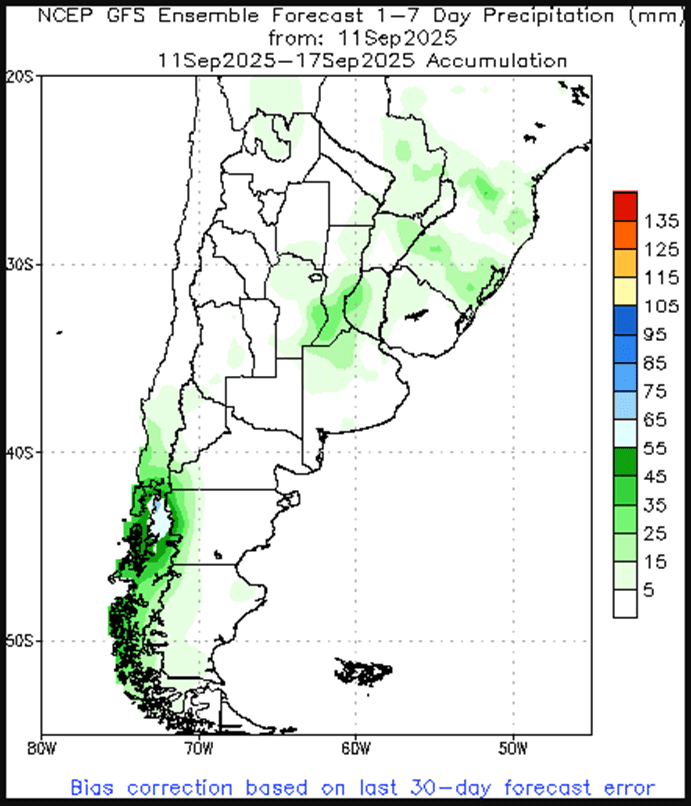

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/4th DEC ’25 420 Puts ~ 15c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell one-quarter of your December 420 puts today.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

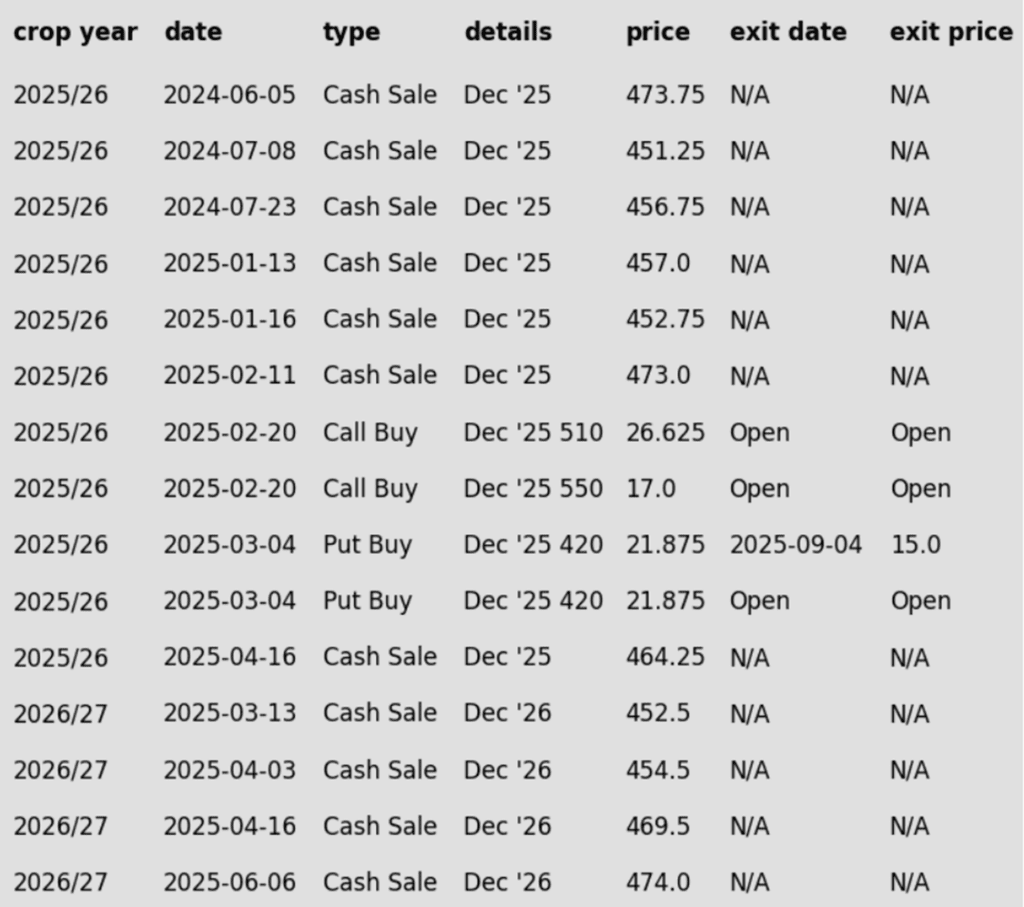

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- One-quarter of your 420 puts should be exited to lighten the position in case upside momentum continues through September. The remaining three-quarters should remain to continue providing downside protection.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures ended Thursday with moderate gains, supported by firm demand tone and short covering ahead of Friday’s WASDE. December corn gained 2 ¾ to 419 ¾ and March added 2 ¾ to 437 ¼.

- The USDA released weekly export sales on Thursday morning. For the week ending September 4, the USDA reported new sales of 21.3 mb for the 2025-26 crop year. In addition, a total of 41.2 mb was rolled from the 2024-25 marketing year into the new marketing year. Total corn commitments for the 2025-26 marketing year are at 890 mb, up 69% from last year.

- The Brazil ag agency, CONAB, released their September crop production forecast on Thursday morning. The agency raised their corn production estimate for the 2024-25 marketing year to a record 139.7 MMT, up 2.7 MMT from last month and over 24 MMT above last year.

- USDA’s drought monitor reported expanding dryness across the eastern and southern Corn Belt, with 13% of corn acres now in drought versus 9% last week—likely capping production potential this fall.

- USDA will release the September WASDE on Friday, February 12. Expectations are for corn yield to be reduced to 186.0 bu/a according to analyst survey. The 2025-26 corn ending stocks should also be reduced slightly with demand adjustments to near 2.000 bb.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Notes:

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybean futures bounced off of support on Thursday ahead of Friday’s USDA WASDE report. November soybeans added 8-3/4 cents to close at 1034. October soybean meal added 2.60 to close at 286.10 and October soybean oil gained 0.61 cents to close at 51.08 cents.

- Soybean oil futures extended gains Thursday, following Wednesday’s rumors that the Trump administration may require large crude oil refineries to cover 50% of waived small-blender obligations. A decision isn’t expected until late October.

- China has booked nearly all of its October soybean needs and about 15% of November with higher-priced Brazilian supplies. If a U.S.-China trade deal emerges soon, their purchases of U.S. soybeans could be delayed, creating potential logistical bottlenecks domestically.

- WASDE estimates project 2025/26 ending stocks steady to slightly lower at 287 mb, with 2024/25 stocks seen unchanged. Yield is pegged 0.4 bpa lower at 53.2, while USDA may trim export demand to reflect weak Chinese buying.

Wheat

Market Notes: Wheat

- Wheat finished the session higher across all three classes, led by Chicago contracts. December Chi gained 6-1/2 cents to 521-1/2, while KC was up 3 at 510, and MIAX was up 2 at 571-1/2. Higher equity markets today may have spilled over some positive influence to commodities, with most of the grain complex positing higher closes.

- USDA reported 11.2 mb in 2025/26 wheat export sales, with no new 2026/27 sales. Weekly shipments totaled 13.1 mb, below the 16.7 mb pace needed to reach the 875 mb export goal. Total 2025/26 commitments stand at 467 mb, up 19% from last year.

- The average pre-report estimate for U.S. 25/26 wheat carryout comes in at 862 mb, down from 869 mb in August. However, world ending stocks are expected to increase slightly. For 24/25 the trade is looking for 263.1 mmt vs 262.7 mmt last month, and for 25/26 is looking for 260.8 mmt vs 260.1 mmt. U.S. production numbers will be updated at the end of the month on the Small Grains Summary report.

- In an update from CONAB, the Brazilian wheat production forecast was decreased from 7.8 mmt to 7.54 mmt. This is largely due to a smaller planted area, and is despite expectations for improved yields.

- As of September 9, USDA reported spring wheat acres in drought unchanged at 13%. Winter wheat drought coverage rose to 38%, up 4% on the week but still well below 57% at this time last year.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 602.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 602.75.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.