9-10 End of Day: Grains Drift Lower Again on Wednesday

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn traded lower on Wednesday. Trading was quiet as the market drifted lower ahead of Friday’s USDA WASDE report.

- 🌱 Soybeans: Soybeans fell for a second session. Concerns over the lack of Chinese purchases continue to pressure prices, offsetting support from dry forecasts and yield risks heading into Friday’s USDA report.

- 🌾 Wheat: Wheat futures slid lower again on Wednesday. A lack of supportive news and rising global crop estimates continue to cap rallies.

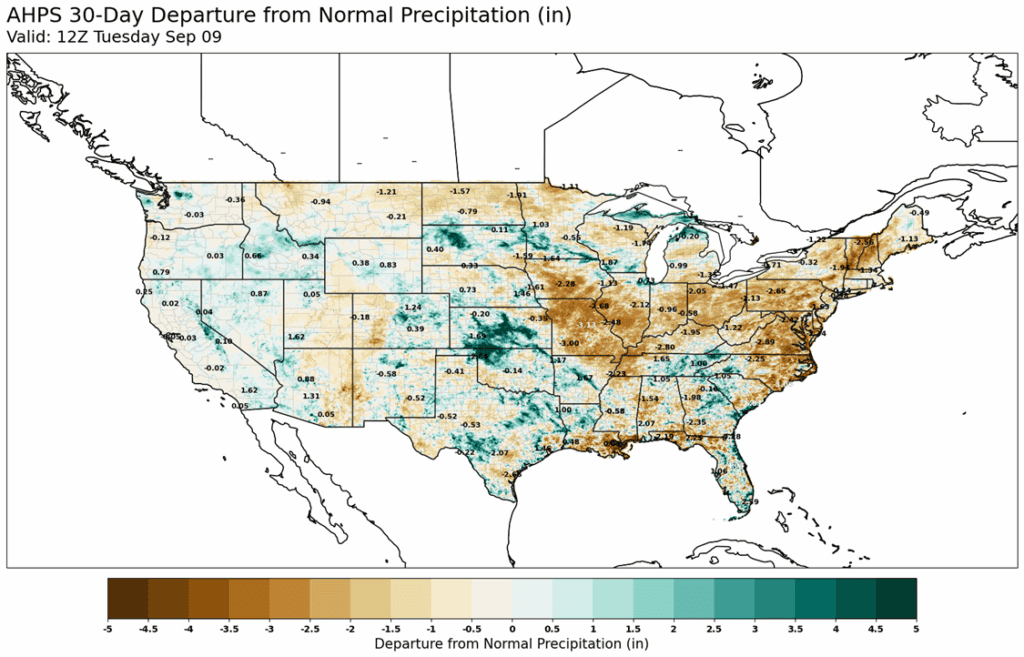

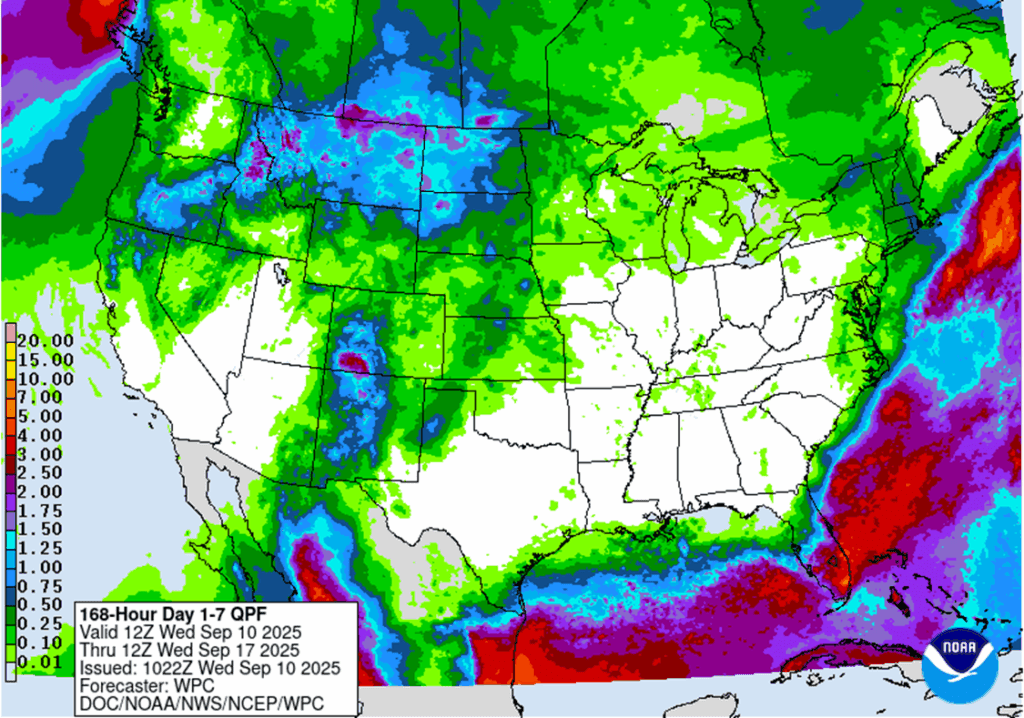

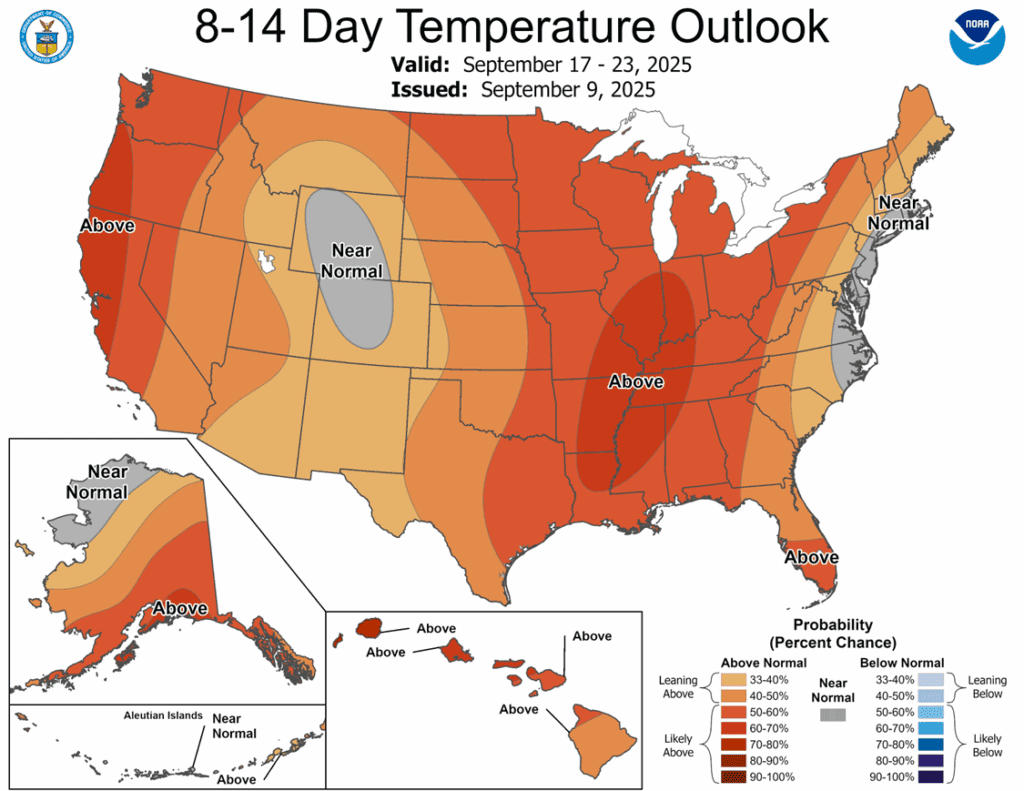

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

Active

Exit 1/4th DEC ’25 420 Puts ~ 15c

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Continued Opportunity – Sell one-quarter of your December 420 puts today.

- Plan A:

- No active targets.

- Plan B:

- No active targets.

- Details:

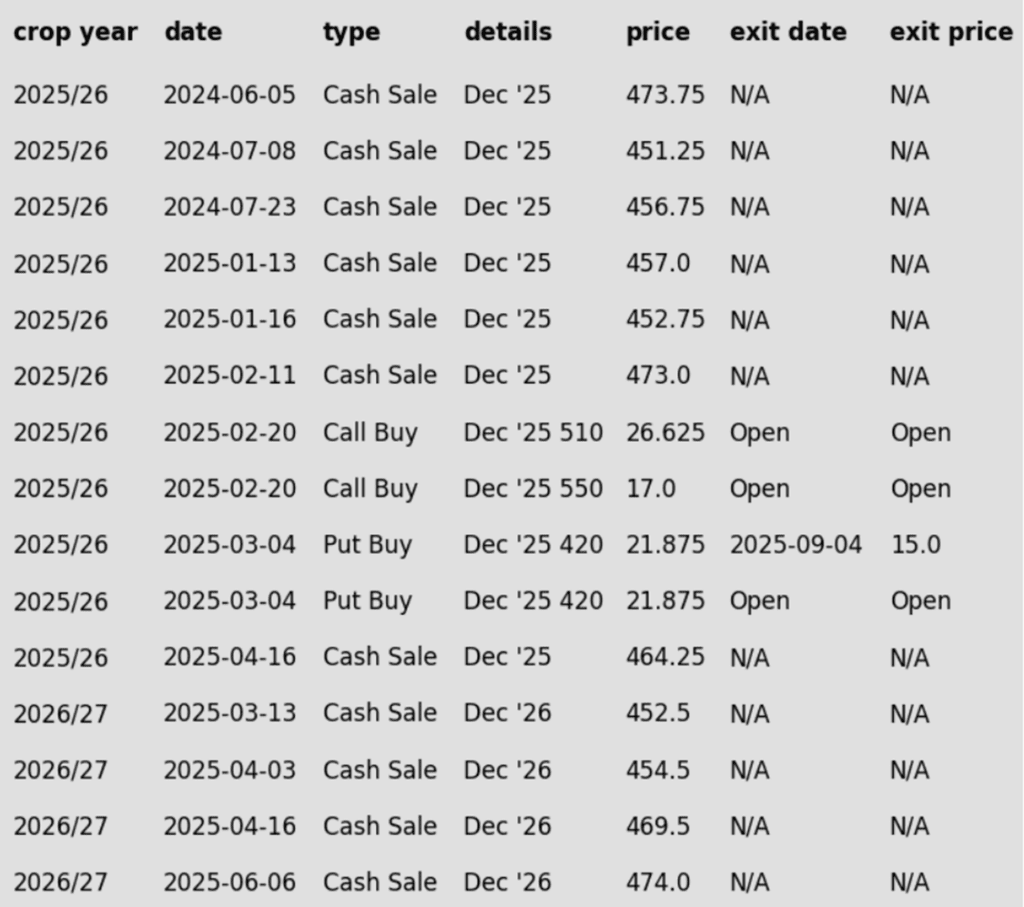

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- The target to exit half of the December 420 put position has been removed.

- One-quarter of your 420 puts should be exited to lighten the position in case upside momentum continues through September. The remaining three-quarters should remain to continue providing downside protection.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished with mild losses for the second straight session on Wednesday. Very quiet news and anticipation of Friday’s USDA report have helped the corn market to drift lower with narrow trading ranges in the past couple of sessions. December corn lost 2 ¾ cents to 417 and March corn slipped 3 cents to 434 ½.

- Ethanol output hit a 12-week high. For the week ending Sept. 5, average daily production was 1.105 million barrels — the highest ever for this week of the year. Roughly 110 mb of corn was used in production.

- Biofuels concerns have trickled into the market again on Wednesday as the White House is looking at limiting the amount of blending mandates that large oil companies will need to cover small refineries regarding blending credits. A small than anticipated plan could impact corn demand for biofuels. The lack of clarity regarding policy and recent negative tone may help limit gains in the corn market.

- USDA will release the September WASDE on Friday, February 12. Expectations are for corn yield to be reduced to 186.0 bu/a according to analyst survey. The 2025-26 corn ending stocks should also be reduced slightly with demand adjustments to near 2.000 bb.

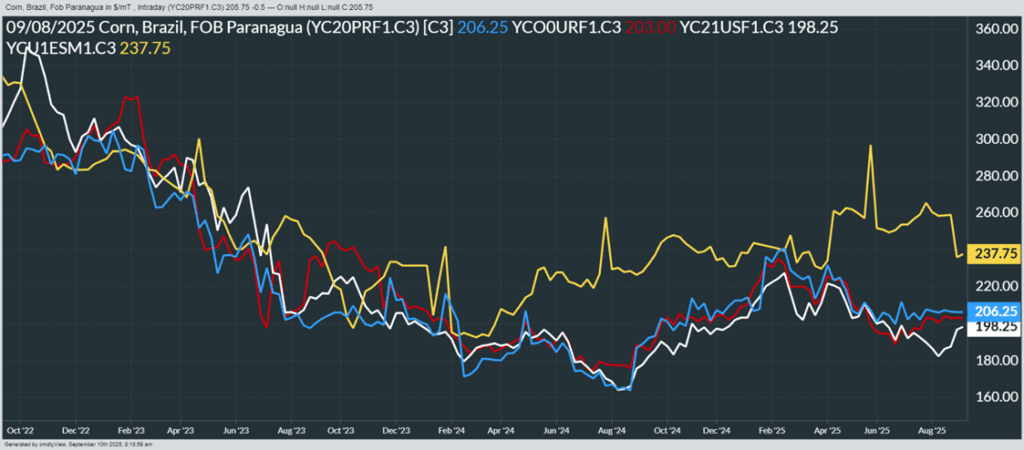

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- The Plan B target to exit one-quarter of the January 1040 puts options has been removed.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower for the second consecutive day with the November soybeans down 6 cents to $10.25-1/4 while March lost 5 cents to $10.61. October soybean meal was down $4.20 to $283.50 and October soybean oil gained 0.54 cents to 50.47 cents.

- The soybean market is trying to balance the demand and the potentially tightening supply narrative in the market. Increased news media regarding the lack of Chinese purchases of U.S. soybeans is trying to outweigh the dry weather forecast and a shrinking potential crop going into Friday’s USDA Report

- Policy uncertainty is adding headwinds. The White House is reviewing a plan that would shift some waived blending obligations onto major oil companies, a move that could limit soybean oil’s role in biodiesel.

- Estimates for the WASDE report see 25/26 ending stocks slightly lower to unchanged at 287 mb while 24/25 ending stocks are expected to be unchanged. Yield is projected 0.4 bpa lower at 53.2 bpa. There is a possibility that the USDA lowers export demand to account for the lack of Chinese purchases.

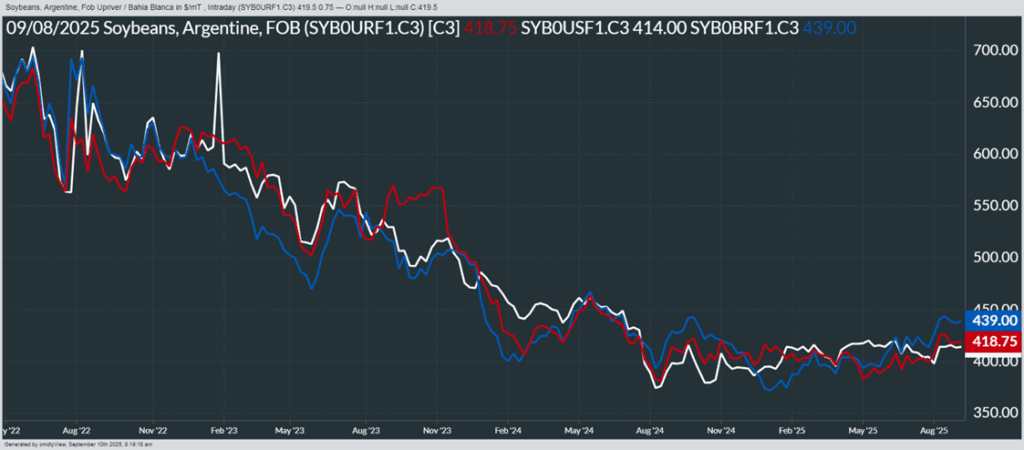

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- Wheat futures were down again today, closing 5-1/4 cents lower in December Chicago to 515, while Kansas City lost 3-1/4 cents to 507, and MIAX was down 4-1/2 cents at 569-1/2. A general lack of fresh friendly news, as well as rising Russian and southern hemisphere crop production estimates have been limiting upside for wheat.

- IKAR increased their estimate of Russian wheat production from 86 mmt to 87 mmt, which is now closer in line with SovEcon’s 87.2 mmt forecast. In addition, IKAR raised their Russian wheat export estimate by 1 mmt to 44 mmt.

- This morning, news outlets reported that Poland shot down Russian drones that entered their airspace. This has raised concern about broader conflict developing in the region, as Poland is a NATO member. However, Poland’s prime minister indicated that while this was a provocation, they are not likely on the brink of war.

- LSEG commodities research has kept their estimate of Canadian 25/26 wheat production unchanged from their last estimate at 35.0 mmt. And while they also reported that although harvest is going well, rains coming in about 5-10 days could slow the current pace.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 605.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The Plan A target has been lowered to 605.75.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: Target 590 against December 2025 for the sixth sale.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- A Plan A target of 590 against December 2025 futures has been added.

2026 Crop:

- Plan A:

- Target 642 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 647 target has been lowered to 642.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

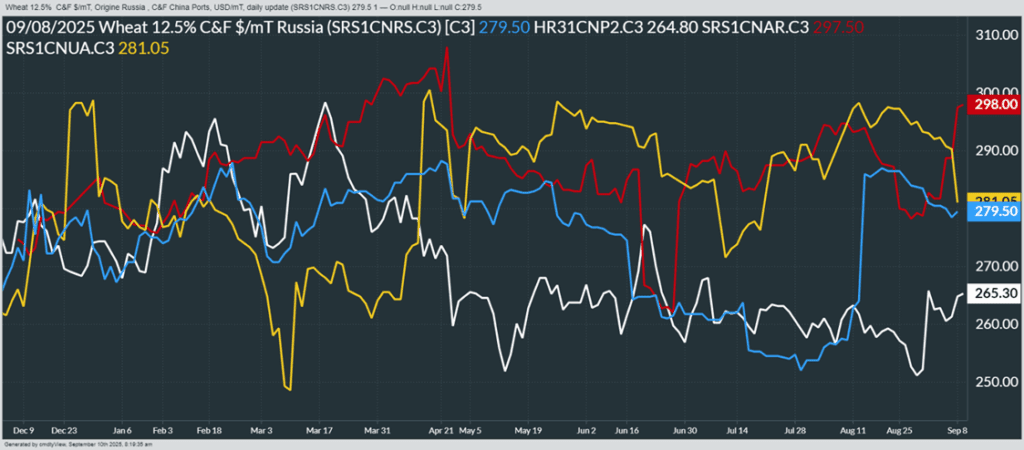

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather