8-9 End of Day: Corn and Beans Lower, Wheat Higher Ahead of WASDE

All prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’24 | 376.75 | -2.5 |

| DEC ’24 | 395 | -2 |

| DEC ’25 | 440.5 | -3.5 |

| Soybeans | ||

| NOV ’24 | 1002.5 | -5.75 |

| JAN ’25 | 1019.25 | -5.75 |

| NOV ’25 | 1046.25 | -5.25 |

| Chicago Wheat | ||

| SEP ’24 | 542.5 | 5 |

| DEC ’24 | 565.75 | 4.25 |

| JUL ’25 | 602.25 | 3.25 |

| K.C. Wheat | ||

| SEP ’24 | 554 | 2.5 |

| DEC ’24 | 570.5 | 1.75 |

| JUL ’25 | 594.5 | 0 |

| Mpls Wheat | ||

| SEP ’24 | 589.75 | 4.5 |

| DEC ’24 | 608.5 | 3.25 |

| SEP ’25 | 647.75 | -5.5 |

| S&P 500 | ||

| SEP ’24 | 5363 | 14.75 |

| Crude Oil | ||

| OCT ’24 | 75.43 | 0.39 |

| Gold | ||

| OCT ’24 | 2445.5 | 4.7 |

Grain Market Highlights

- Corn prices slipped lower to end the week on a non-threatening forecast and likely continued farmer selling of old crop bushels ahead of Monday’s WASDE report.

- Despite multiple daily export flash sales this morning, soybean futures slid lower for a fourth consecutive session.

- Wheat futures were the bright spot of the grain complex managing to close higher on the day as war tensions heightened between Russia and Ukraine.

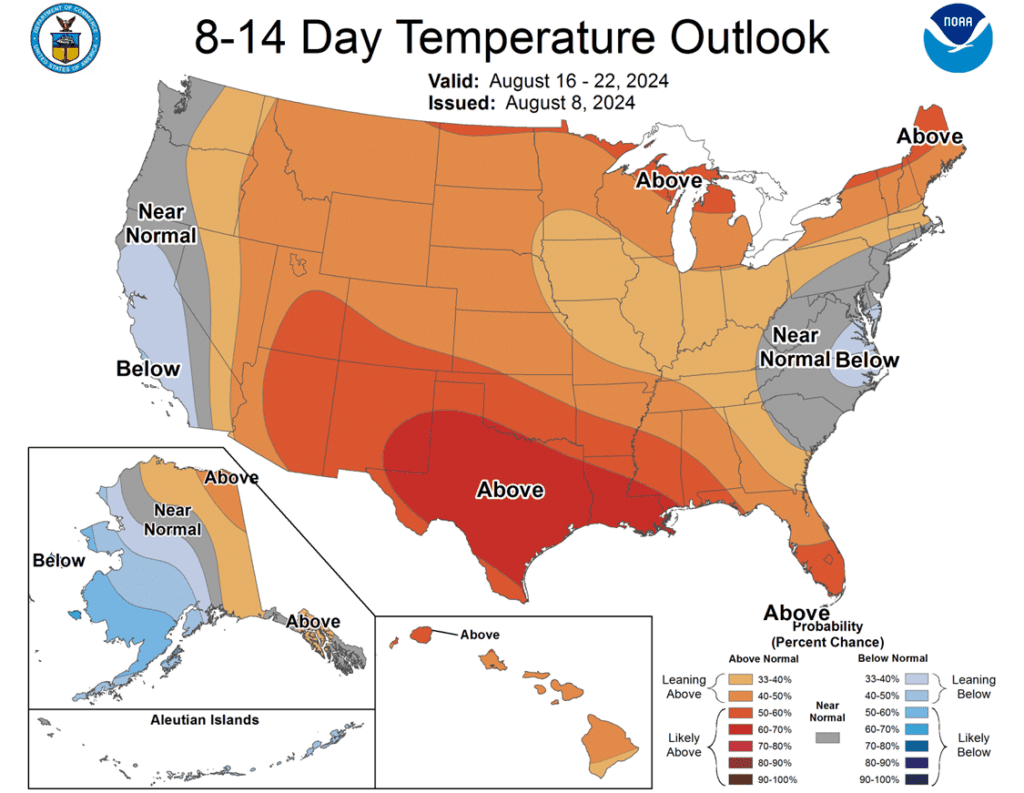

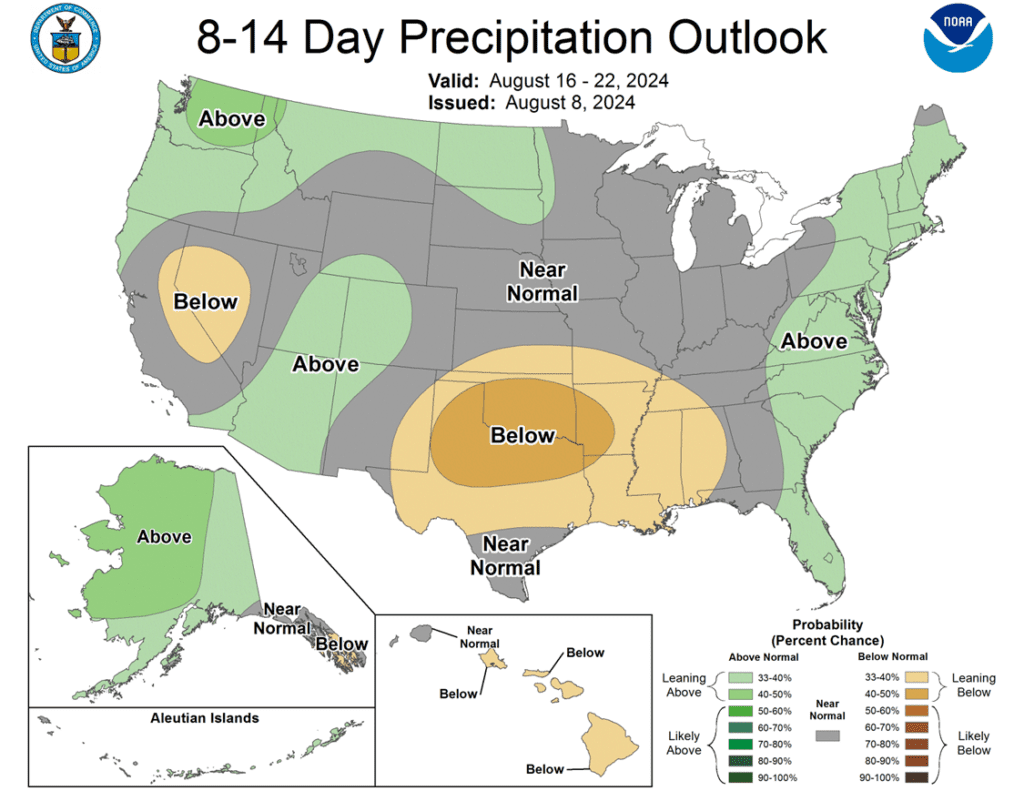

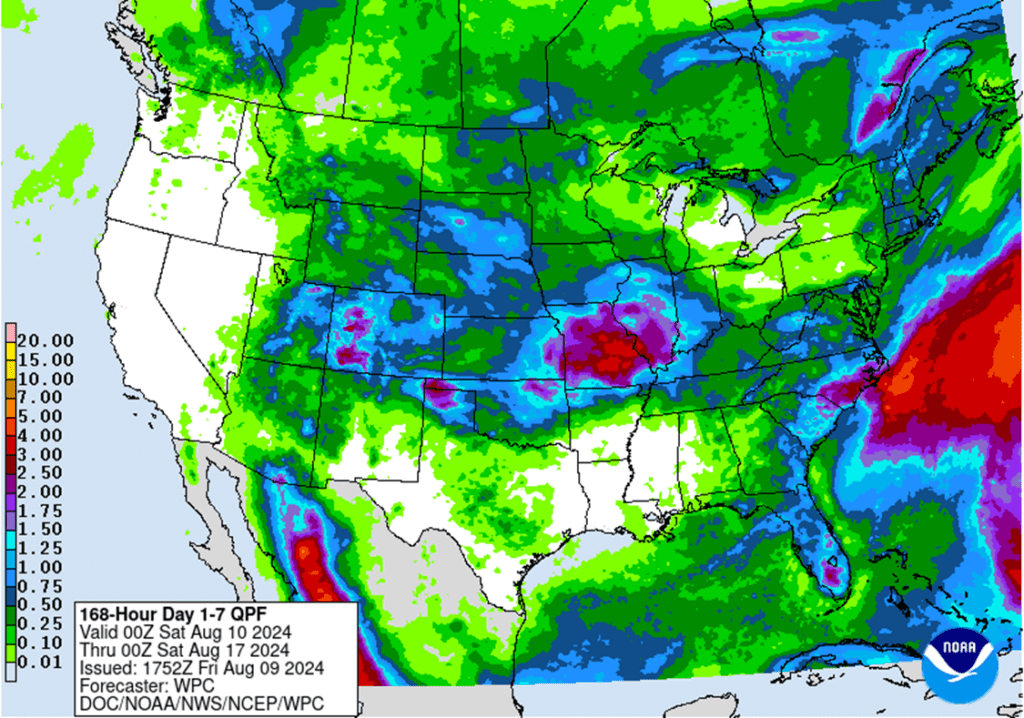

- To see the updated US 7-day precipitation forecast, the 8–14-day Temperature and Precipitation Outlooks, courtesy of NOAA, and the Weather Prediction Center, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

Since the release of the July WASDE, which surprised the market by keeping the 24/25 ending stocks figure around 2.1 billion bushels, Dec ‘25 corn has traded to a fresh contract low while managed funds re-established their record net short position. Even though the weather has been mostly favorable for the crop and the trade may be factoring in a higher potential yield, the USDA is expected to update its acreage estimates in the upcoming August WASDE report, which could shift lower due to the slow planting pace last spring. Any unexpected downward shift in anticipated supply or increase in demand could trigger managed funds to cover some of their extensive short positions and rally prices.

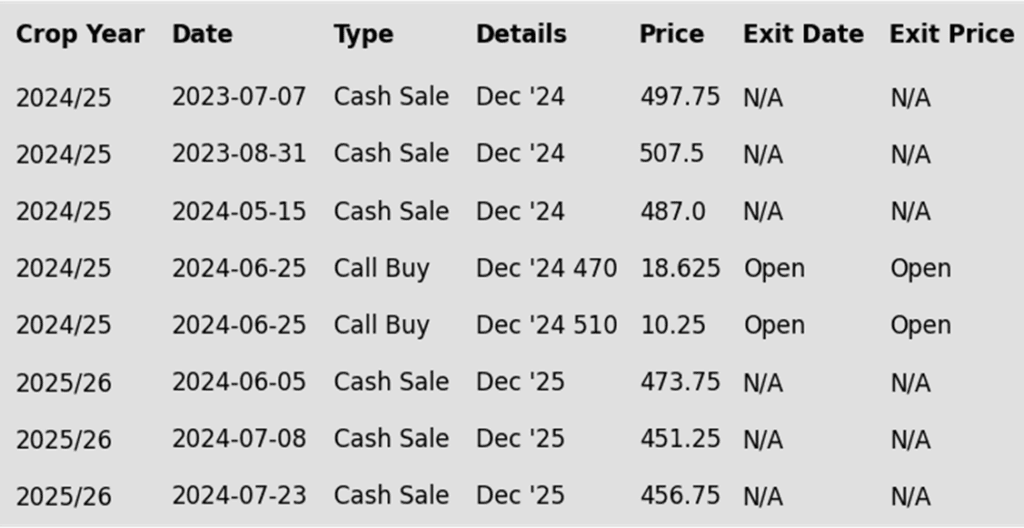

- No new action is recommended for 2024 corn. In June we recommended buying Dec ’24 470 and 510 calls after Dec ’24 closed below 451, for their relative value and because we are at that time of year of high volatility when markets can move swiftly. Moving forward, our current strategy is to target the value of 29 cents to exit the Dec ’24 470 calls. Exiting the 470 calls at 29 cents will allow you to lock in gains in case prices fall back and hold the remaining 510 calls at or near a net neutral cost, which should continue to protect existing sales and give you confidence to make further sales if the market rallies sharply. Additionally, should a contra-seasonal rally occur considering the large net short managed fund position, we continue to target the 470 – 490 area to recommend making additional sales versus Dec ’24.

- No new action is currently recommended for 2025 corn. Between early June and late July Grain Market Insider made three separate sales recommendations to get early sales made for next year’s crop. Considering the seasonal weakness of the market in late summer and early fall, we will not be looking to post any targeted areas for new sales until late fall or early winter.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- For the 4th consecutive session, corn prices bleed lower pushed by farmer selling, and weather forecasts that remain overall non-threatening. Dec corn pushed to new lows and was down 8 ¼ cents on the week.

- Producer selling is limiting the market upside as grain is moving into the system. September basis contracts and producers moving old crop supplies keep selling pressure intact. The potential for a large harvest only adds some urgency to old crop corn movement.

- Weather forecasts remain non-threatening for corn production. Long-range forecasts into mid-August are targeting cooler than normal temperatures. Rainfall looks more limited for the near term, but both warmer temperatures and rainfall chances look to increase going into the back half of August.

- On Monday, the USDA will release the August Crop Production report. With the higher-than-average crop ratings, expectations for corn yield are to be over 182 bushels/acre, up from trendline of 181 bushels/acres from previous reports. There are some possible adjustments to planted and harvested acres for this report, but the supply picture will still be a limiting factor going forward.

Above: Since August 2, September corn has been consolidating mostly between 378 and 392. Above 392 lies potentially heavy resistance between 397 and 417, a rally above which could put prices on track toward the 430 – 440 level. Otherwise, a break below 378 could put the market at risk of trading down towards 360.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

Since late May, the soybean market has stair-stepped its way lower on sluggish new crop demand, good growing weather, and the prospect of a large upcoming crop. While weather forecasts remain mostly favorable to the crop, and the trade may be factoring in higher yield estimates, the USDA is expected to update its acreage estimates in the upcoming August WASDE, which could be lower given the slow planting pace last spring. Therefore, any unexpected downward shift in anticipated supply or increase in demand could trigger managed funds to cover some of their extensive short positions and rally prices.

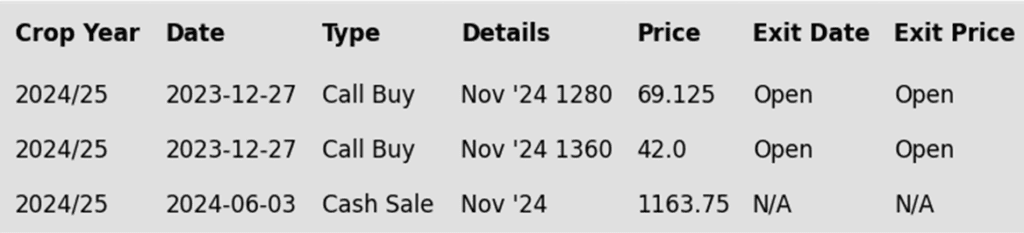

- No new action is recommended for the 2024 crop. At the end of December, we recommended buying Nov ’24 1280 and 1360 calls due to the amount of uncertainty in the 2024 soybean crop and to give you confidence to make sales and protect those sales in an extended rally. Given that the market has retreated since that time, we are targeting the low to mid-1100s versus Nov ’24 futures to exit 1/3 of the 1280 calls to help preserve equity. Most recently we employed our Plan B strategy with the close below 1180 in Nov ’24 and recommended making additional sales due to the potential change in trend. With much of the growing season still ahead of us, should the market turn back higher, we are targeting the upper 1100s to low 1200s from our Plan A strategy to make additional sales recommendations.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop yet. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower for the fourth consecutive day despite a multitude of export sales reported this morning. Trade is primarily focused on the good weather forecast and the USDA report on Monday that many analysts are expecting to be bearish. Soybean meal led the complex lower today, but soybean oil was higher along with higher crude and palm oil.

- This morning, the USDA reported multiple export sales. They reported that 132,000 mt of soybeans were sold to China for 24/25, 100,000 mt of soybean meal were sold to Colombia, and 212,000 mt of soybeans were received for delivery to unknown destinations. These sales were encouraging but will need to continue to make a significant difference in prices.

- Monday’s WASDE report is expected to show an increase in the soybean yield to 52.5 bpa with production estimates up 34 mb from July to 4.469 bb. The average trade estimate for 24/25 carryout is 472 mb, which is up 37 mb from July.

- In Argentina, workers at a soybean crush plant have extended their strike to a third day as a result of insufficient wages. Shipments have been delayed for the biggest soybean meal and oil exporter just as harvest is wrapping up.

Above: The soybean market’s break below 1000 puts it at risk of sliding further toward the 985 support level, below which psychological support may come in near 950. Should current prices hold above 985 and turn back higher, overhead resistance remains in the 1035 – 1045 area with further resistance near 1082.

Wheat

Market Notes: Wheat

- Wheat closed higher, led by Chicago futures. Support may be coming from a number of recent large global tenders, as well as escalation between Ukraine and Russia, factoring some war premium back into the market.

- The average pre-report estimate for US all wheat production comes in at 2.106 bb. This compares with 2.008 bb in the July report and to 1.812 bb last year. US ending stocks are predicted to remain unchanged for 23/24 at 702 mb, and for 24/25 are projected at 860 mb vs 856 mb in July. In addition, global 23/24 wheat carryout is expected to remain unchanged at 261.0 mmt, while 24/25 carryout is expected to slightly increase from 257.2 mmt to 257.3 mmt.

- The French agriculture ministry lowered their estimate of the nation’s wheat production by 3.35 mmt to 26.3 mmt. If accurate, that would be down 25% from last year and also the smallest crop in almost 40 years. Additionally, their harvest is said to be 88% finished.

- IKAR reportedly increased their estimate of Russian grain production by 1.5 mmt to 129.5 mmt. This compares to the Russian ag ministry’s 132 mmt estimate. For wheat in particular, IKAR increased the production forecast by 0.6 mmt to 83.8 mmt. For reference, the USDA is at 83.0 mmt.

- According to their ag ministry, Ukraine’s harvest has reaped 20.94 mmt of wheat on 97% of the planted area. This exceeds the USDA estimate of 19.5 mmt. The ministry did not offer an average yield for the wheat harvest, but they reported that 27.3 mmt of other grains and 3.3 mmt of oilseeds were harvested as of August 9.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

Since late May, the wheat market has been trending downward as concerns about Russia’s shrinking wheat crop have eased, and the US winter wheat crop has surpassed expectations. At the same time, managed funds also reestablished a sizable net short position in Chicago wheat. While slow global import demand and low Russian export prices continue to exert downward pressure on prices, any increase in US demand due to smaller crops in Europe and the Black Sea region could trigger a short-covering rally by managed funds, especially given that global wheat ending stocks are projected to decline again this year.

- No new action is recommended for 2024 Chicago wheat. Considering the recent rally in wheat, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 740 – 760 versus Sept ’24 to recommend further sales and to target a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 Chicago Wheat. Our most recent recommendation was to exit half of the previously recommended July ’25 Chicago 620 puts once they reached 67 cents (approximately double their original cost), to lock in gains in case the market rallies back. Moving forward, our strategy is to hold the remaining July ’25 620 puts at, or near, a net neutral cost to maintain downside coverage for any unsold bushels, while also targeting the 610 – 630 range to recommend making additional sales.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

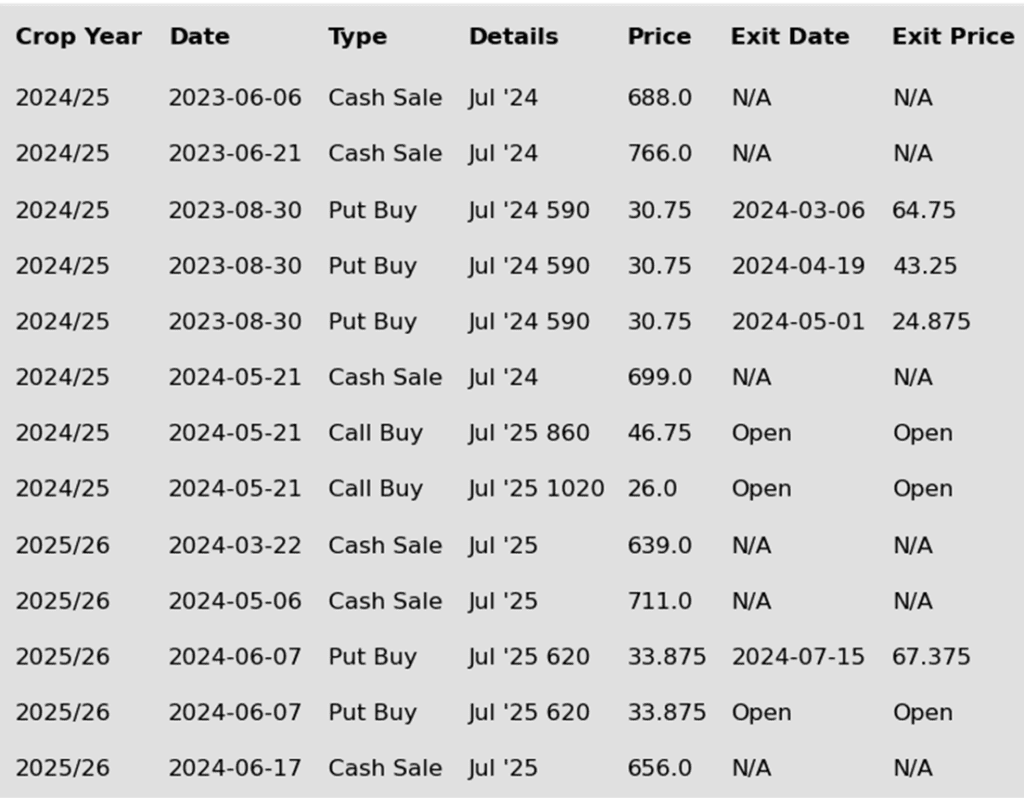

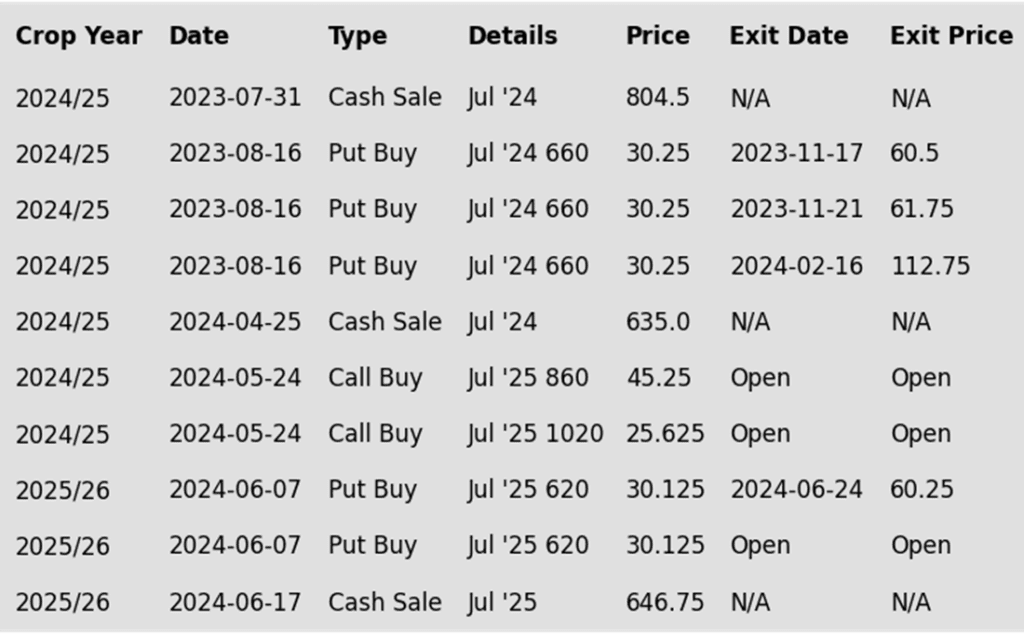

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The bullish reversal on July 29 suggests there is support below the market near 514. Should prices continue higher they may hit resistance between 555 and 580, with further resistance near 590 – 600. To the downside, a close below 514 could find support near 500 and then again in the 490 – 470 area.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

Since the end of May the wheat market has been trending lower as concerns regarding Russia’s shrinking wheat crop have waned, and US HRW harvest yields have been higher than expected. During this time managed funds started reestablishing their short positions while the market continues to show signs of being oversold. While low Black Sea export prices and slow world demand continue to weigh on US prices, the funds’ short position and oversold conditions could culminate in a short covering rally on any increase in US demand as world wheat ending stocks are expected to fall yet again this year.

- No new action is recommended for 2024 KC wheat. Considering the recent upside breakout in KC wheat, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 725 – 750 versus Sept ’24 to recommend further sales and to target a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. We recently recommended exiting half of the previously recommended July ’25 620 puts once they reached 60 cents (double the original approximate cost) to realize gains in case the market rallies back, while still holding the remaining 620 puts at, or near, a net neutral cost for continued downside coverage on any unsold bushels. Looking ahead, our strategy is to target the 660 – 690 range to recommend making additional sales.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

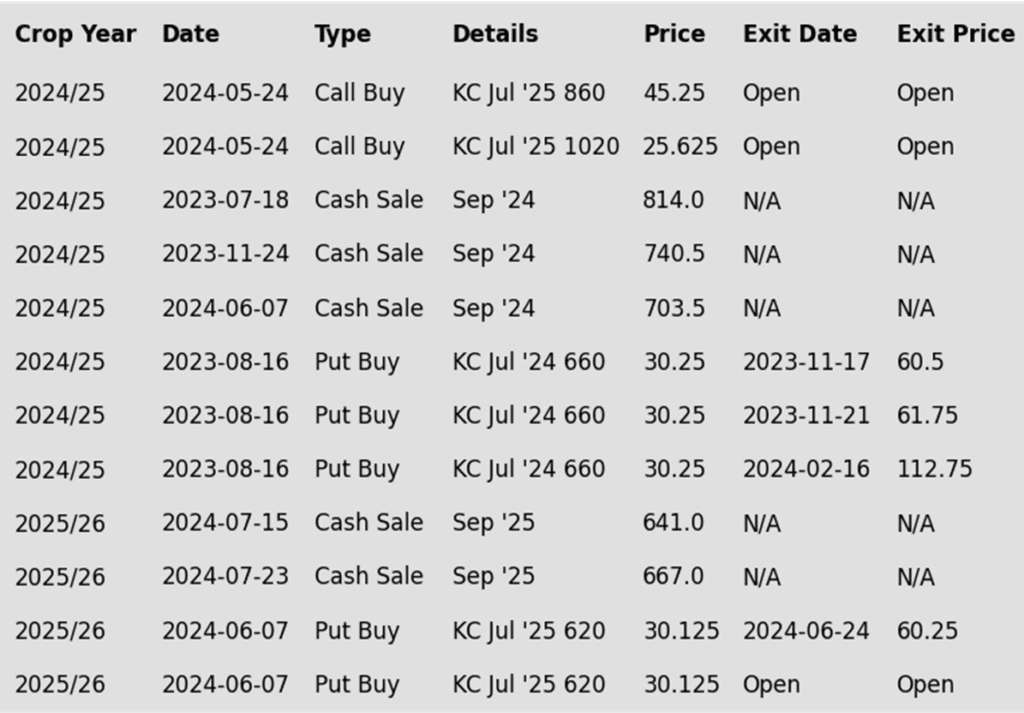

To date, Grain Market Insider has issued the following KC recommendations:

Above: The market action in the closing days of July indicates support below the market between 530 and 540. Should that area hold and close above 580, prices could then be on track toward the 600 resistance area. Otherwise, a close below 530 could find further support near 500.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

Since the end of May, the wheat market has been in a down trend as concerns about Russia’s shrinking wheat crop have eased and the US winter wheat crop exceeded expectations. During this period, managed funds reestablished their short positions in Minneapolis wheat. Though declining Russian export prices continue to keep a lid on US prices, smaller crops in Europe and the Black Sea region could increase US demand, potentially triggering a short-covering rally with the fund’s newly reestablished short position, especially as global wheat ending stocks are projected to decline again this year.

- No new action is recommended for 2024 Minneapolis wheat. With the recent close below the 712 support level, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we recently made two separate sales recommendations to get some early sales on the books for next year’s crop. While we will not be targeting any specific areas to make additional sales until later in the marketing year, we will continue to monitor the market for opportunities to exit the remaining July ’25 KC 620 puts that were recommended in June. To that end, should the market continue to be weak, we are currently targeting the upper 400 range to exit half of those remaining puts.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The market appears to have found support just below the market near 575. A close below 575 puts the market at risk of drifting lower toward the 550 – 540 support area. To the upside, a close above 630 could put prices on track to test the 650 – 660 resistance area.

Other Charts / Weather

US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.