8-8 End of Day: Grains Under Pressure Ahead of Key WASDE Report

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 382.75 | -1.75 |

| DEC ’25 | 405.5 | -1.5 |

| DEC ’26 | 446.75 | -0.75 |

| Soybeans | ||

| NOV ’25 | 987.5 | -6.25 |

| JAN ’26 | 1006.5 | -6 |

| NOV ’26 | 1040.75 | -6.25 |

| Chicago Wheat | ||

| SEP ’25 | 514.5 | -3.75 |

| DEC ’25 | 535 | -4 |

| JUL ’26 | 576.75 | -4.25 |

| K.C. Wheat | ||

| SEP ’25 | 518.25 | -3.25 |

| DEC ’25 | 537.25 | -4.5 |

| JUL ’26 | 577 | -5 |

| Mpls Wheat | ||

| SEP ’25 | 5.7675 | 0.0275 |

| DEC ’25 | 5.9725 | 0.0225 |

| SEP ’26 | 6.49 | -0.015 |

| S&P 500 | ||

| SEP ’25 | 6415 | 48.5 |

| Crude Oil | ||

| OCT ’25 | 62.9 | -0.14 |

| Gold | ||

| OCT ’25 | 3429.5 | 4.3 |

Grain Market Highlights

- 🌽 Corn: Corn prices slipped into the weekend as early gains faded, marking the third straight weekly decline. Trade expects next week’s WASDE to peg U.S. corn yield at 184.3 bpa, up from 181 in July.

- 🌱 Soybeans: Soybeans ended lower Friday, erasing early gains as fund selling returned. Trade expects next week’s WASDE to peg soybean yield at 53.0 bpa and production at 4.37 bb.

- 🌾 Wheat: Wheat ended mixed Friday, with losses in Chicago and Kansas City offset by modest gains in Minneapolis. Spring wheat strength was likely supported by overnight storms in the U.S. northern Plains and southern Canadian Prairies, along with expectations that next week’s WASDE may trim yield estimates.

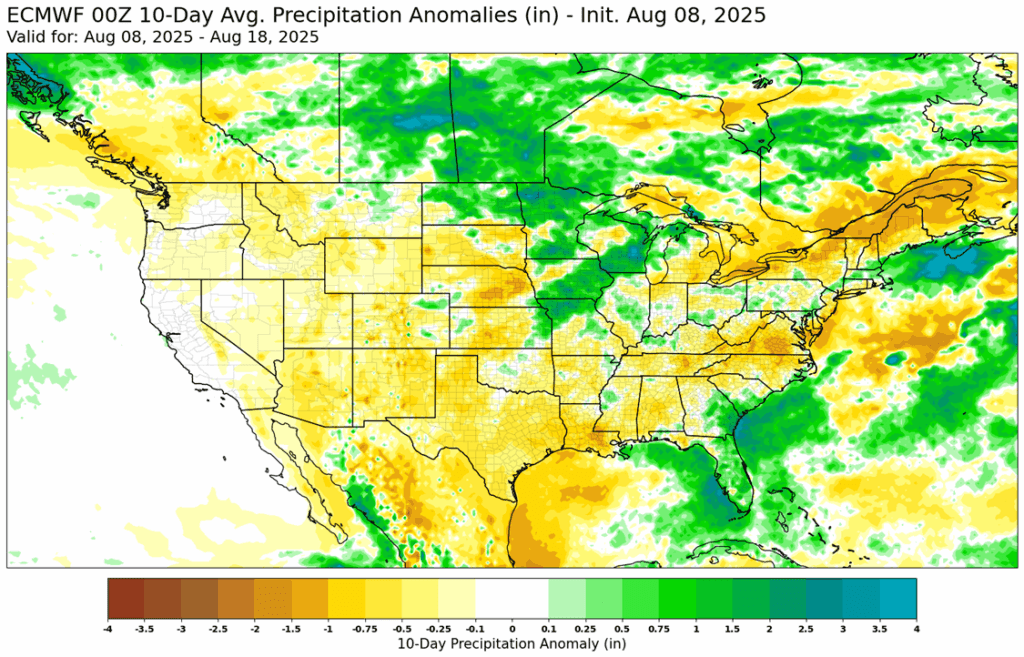

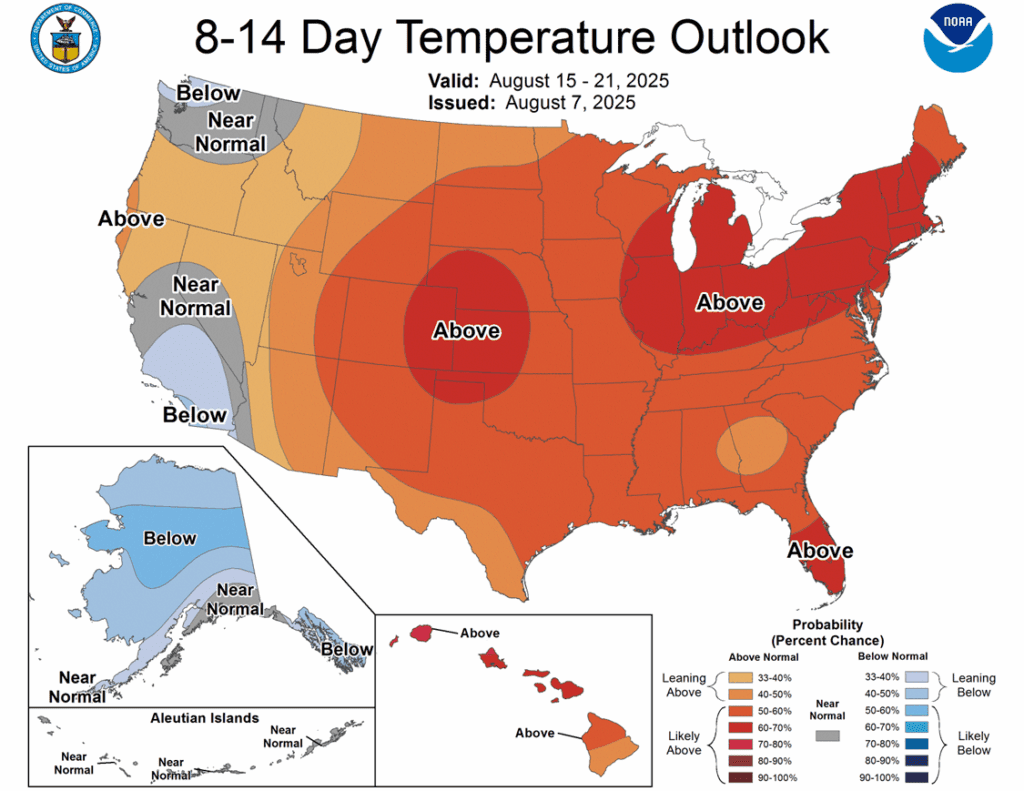

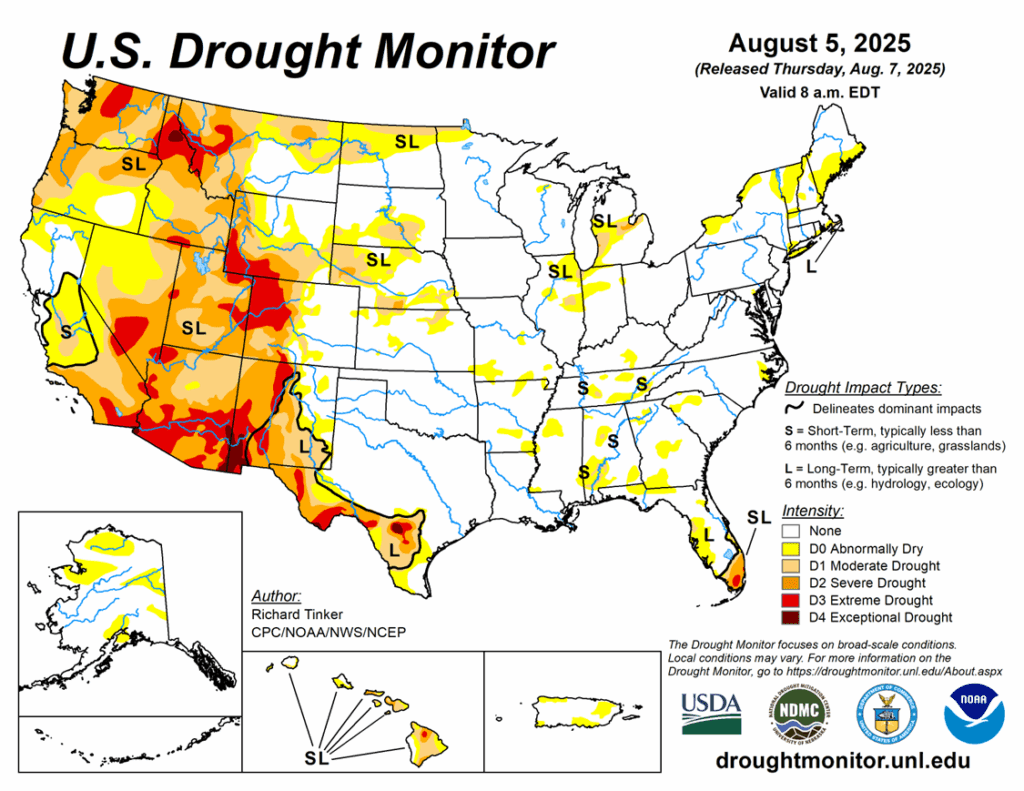

- To see the updated U.S. weather outlook maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- The exit target for the 510 call options has been cancelled, given the significant rally that would be required to reach it.

- For the 420 puts to achieve the 43 ¾ cent target, the December ’25 contract would need to fall to roughly the 380 area.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- The 483 sales target has been cancelled, and an upside Plan B call buy stop has been added at 482. Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase. Remaining below this resistance keeps the broader trend sideways-to-lower, with no immediate need for call option coverage to protect the four prior sales recommendations.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Sellers stayed in control of the corn market going into the weekend as prices failed to hold early session gains to finish with mild losses. Corn futures finished the week lower for the third consecutive week. September futures lost 6 ¾ and December futures lost 5 ¼ cents on the week.

- Even with the U.S. dollar trending lower, ag commodities faced broad pressure from tariff concerns and fund selling, leading to a generally negative tone.

- New crop corn demand remains firm, with USDA reporting a 125,000 MT sale to unknown destinations for 2025–26 delivery. Sales are running 28% ahead of last year and rank among the strongest starts in the past decade.

- The August USDA crop production report, due Tuesday, could bring yield adjustments. Analysts peg average yield at 184.3 bu/acre, 3.3 bu/acre above trend, with estimates ranging from 182.5 to 188.1—setting the stage for volatility.

- Weather outlooks call for above-normal temperatures over the next two weeks, with weekend rainfall across the Corn Belt in focus. December corn futures have closed lower in 11 of the past 12 Mondays.

Corn Futures Slump to start August

After a quiet May–July stretch, corn futures broke support near 391 to start August. A weekly close below this level could shift focus to the August 2024 low near 360, while upside targets include an unfilled gap at 413, resistance at 420, and a second gap at 430.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Still waiting on first targets for 2026 to post.

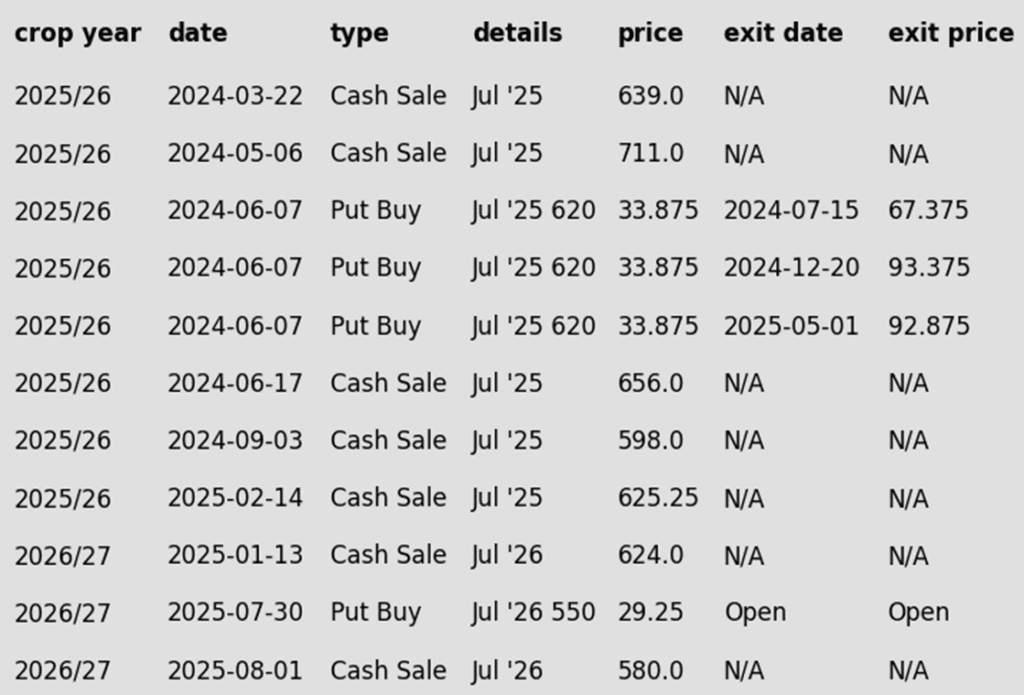

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower to finish out the week. Futures were initially higher by as much as five cents but faded throughout the day as funds reinstated selling pressure. Soybean meal closed higher, while soybean oil fell alongside crude oil.

- Trade expects next week’s WASDE to peg soybean yield at 53.0 bpa and production at 4.37 bb, though the yield could be higher. Ending stocks are projected at 358 mb, with global stocks also seen rising.

- Brazilian cash soybean prices have seen basis firming, making it difficult for importers to source soybeans out of Brazil. For the key fall months, U.S. soybeans are the better value on the export market, and there were whispers of Brazil end users looking to possibly source a few soybeans from the U.S.

- Some weakness in the soy complex can be attributed to lower energies in general following an OPEC+ statement that they would increase oil production. This has been bearish for both crude oil and soybean oil.

Soybeans Test April Lows

Soybean futures remain locked in a broader sideways trend after failing to clear key resistance at the May high of $10.82 in mid-June. With largely favorable weather throughout much of the growing season, the market has struggled to build bullish momentum, and the path of least resistance has remained lower. Technically, a breakout above the 100-day moving average could open the door to filling the gap left over the July 4th weekend near $10.50. On the downside, initial support is seen around the $10.00 mark, with stronger technical support at the April lows near $9.80.

Wheat

Market Notes: Wheat

- Wheat ended mixed Friday, with losses in Chicago and Kansas City offset by modest gains in Minneapolis. Spring wheat strength was likely supported by overnight storms in the U.S. northern Plains and southern Canadian Prairies, along with expectations that next week’s WASDE may trim yield estimates.

- Media reports suggest the U.S. and Russia have outlined a potential peace deal, possibly to be formalized at a summit next week, which would allow Russia to retain control of parts of eastern Ukraine.

- IKAR has increased their estimate of Russian wheat production by 0.5 mmt to 84.5 mmt due to good yields in central areas. For reference, this compares to the USDA forecast of 83.5 mmt. In related news, the French agriculture ministry also raised their soft wheat production estimate by 0.5 mmt to 33.1 mmt and reported that harvest is 94% complete as of August 4.

- The Buenos Aires Grain Exchange reported Argentine wheat planting is now complete at 6.7 million hectares, up 400,000 hectares from last year. Early conditions are favorable, with 99% of the crop rated normal to excellent.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

Active

Sell JUL ’26 Cash

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 599.75 vs September for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- New upside sales target.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell a second portion of your 2026 Chicago wheat crop

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Holds Range

Chicago wheat’s sharp rally in mid-June proved short-lived, with futures retreating toward the upper end of their 2025 trading range. Initial support is expected just above the 500 level, which marked the lows back in May and has since acted as a solid floor. On the upside, a weekly close above 558 would be seen as a constructive technical signal and could open the door for a retest of the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None. No new active sales targets to report yet.

2026 Crop:

- Plan A:

- Target 683 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 to make the first cash sale.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

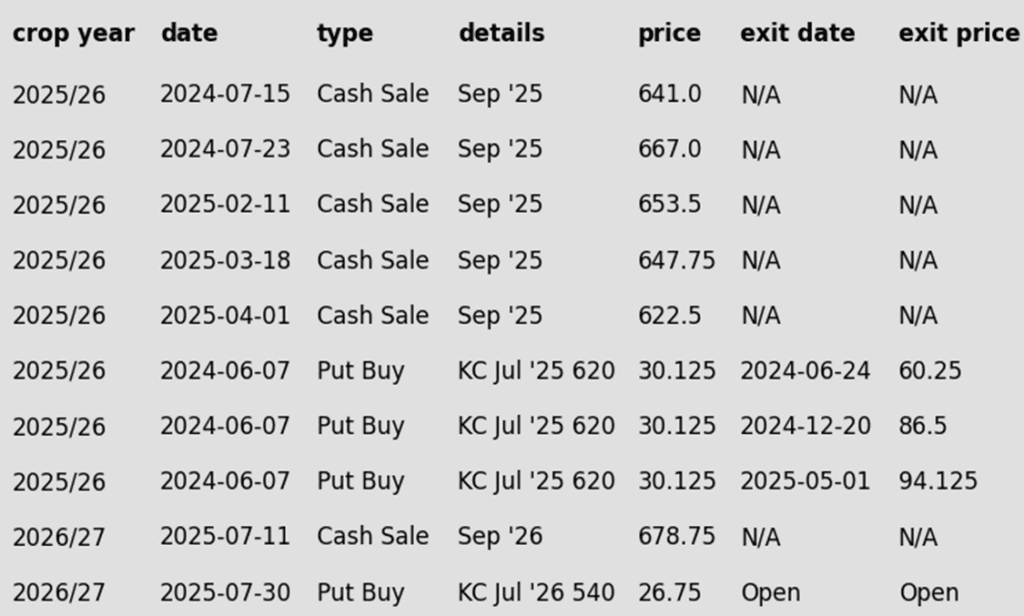

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Pulls Back Below Key Averages, Support at June Lows

KC wheat futures saw a strong rally in June, briefly testing the April highs near 580. However, late-month weakness pulled prices back below both the 100 and 200-day moving averages, which now serve as key resistance levels. On the downside, initial support is seen at the June low of 517.75, with secondary support near the May low around 500.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. Still no new active sales targets to report yet.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Futures Test Key Support After July Slide

Spring wheat futures have come under pressure in July, weighed down by improving crop conditions and generally favorable weather across key growing areas. Technically, a cluster of major moving averages just above the 600 mark presents the first layer of upside resistance, with a chart gap near 650 serving as a secondary target if momentum builds. On the downside, the May lows near 580 should provide firm support in the event of further weakness.

Other Charts / Weather