8-5 End of Day: Markets Lean Bearish as Harvest Nears and Ratings Hold Strong

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 381.5 | -5.5 |

| DEC ’25 | 402 | -5 |

| DEC ’26 | 445 | -3 |

| Soybeans | ||

| NOV ’25 | 990.75 | -3.75 |

| JAN ’26 | 1009.25 | -3.75 |

| NOV ’26 | 1047.25 | -4 |

| Chicago Wheat | ||

| SEP ’25 | 508.25 | -8.5 |

| DEC ’25 | 528.5 | -8.5 |

| JUL ’26 | 568.75 | -7 |

| K.C. Wheat | ||

| SEP ’25 | 504.5 | -12.5 |

| DEC ’25 | 525.25 | -12.25 |

| JUL ’26 | 567.25 | -11.75 |

| Mpls Wheat | ||

| SEP ’25 | 5.7025 | -0.0275 |

| DEC ’25 | 5.925 | -0.035 |

| SEP ’26 | 6.46 | -0.0225 |

| S&P 500 | ||

| SEP ’25 | 6332 | -24 |

| Crude Oil | ||

| OCT ’25 | 64.19 | -1.11 |

| Gold | ||

| OCT ’25 | 3406.8 | 7.3 |

Grain Market Highlights

- 🌽 Corn: Corn futures hit new lows as strong crop ratings and expectations for a large harvest outweighed supportive demand; technicals remain weak, encouraging sellers.

- 🌱 Soybeans: Soybeans ended lower after early gains faded; November briefly broke above $10.00 before slipping. Crop Progress showed soybean ratings at 69% good-to-excellent, down one point from last week.

- 🌾 Wheat: Wheat futures closed lower across the board as harvest pressure and steady farmer selling continued to weigh on prices.

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

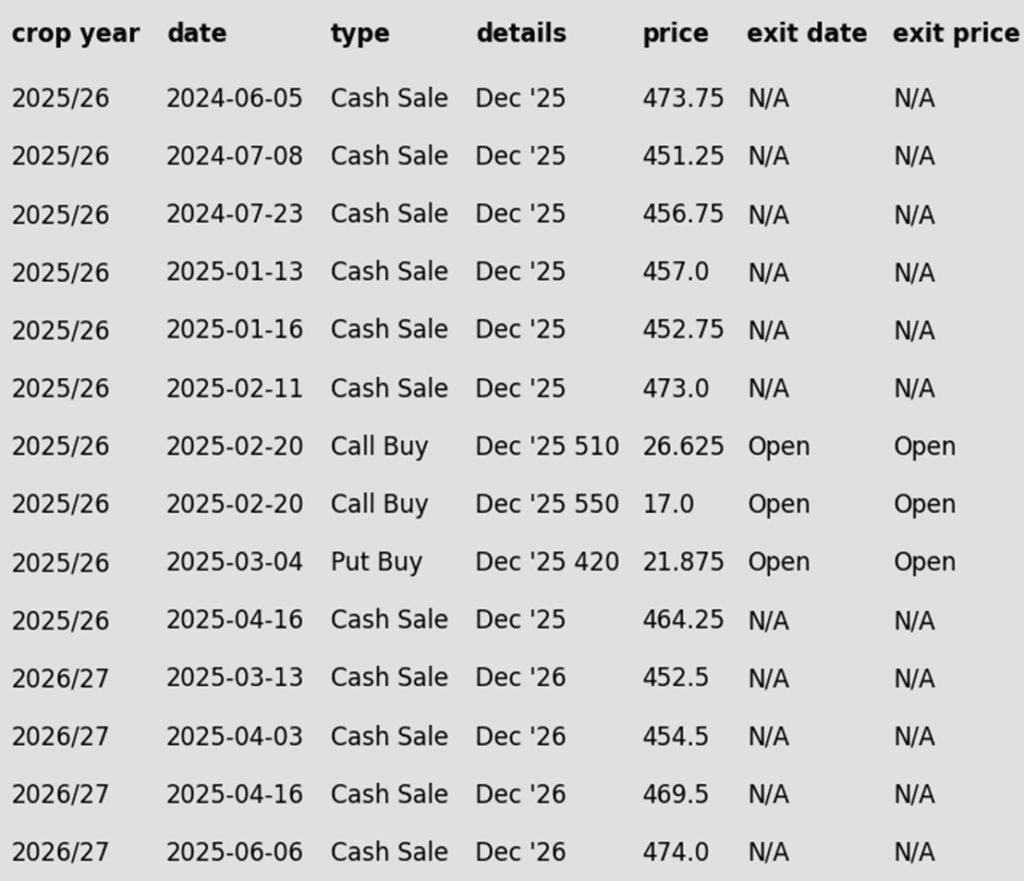

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- The exit target for the 510 call options has been cancelled, given the significant rally that would be required to reach it.

- For the 420 puts to achieve the 43 ¾ cent target, the December ’25 contract would need to fall to roughly the 380 area.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- The 483 sales target has been cancelled, and an upside Plan B call buy stop has been added at 482. Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase. Remaining below this resistance keeps the broader trend sideways-to-lower, with no immediate need for call option coverage to protect the four prior sales recommendations.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures hit new lows as strong crop ratings and expectations for a large harvest outweighed supportive demand; technicals remain weak, encouraging sellers.

- USDA reported a flash sale of 128,000 MT (5.03 mb) of corn to unknown destinations for 2025/26. U.S. corn remains highly competitive, with new crop sales ranking third-best in a decade for this time of year.

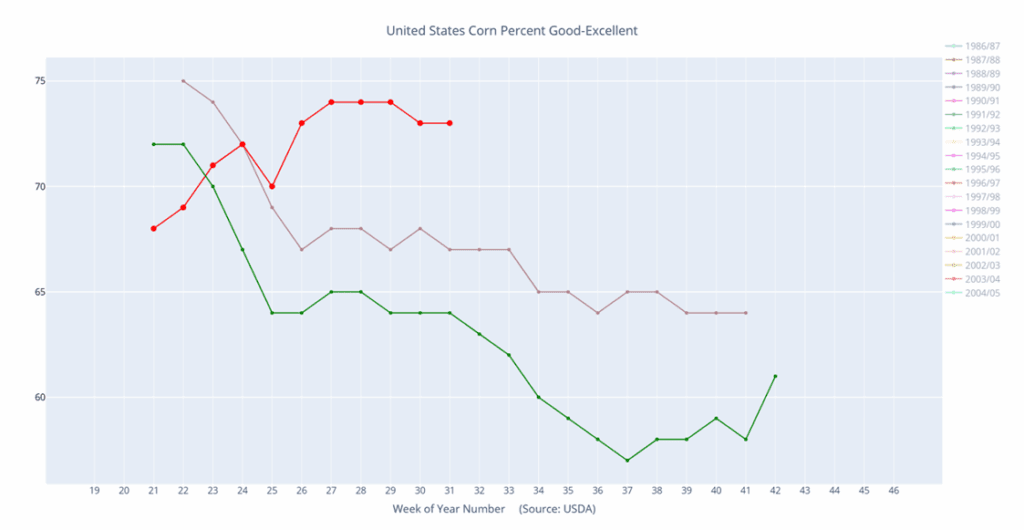

- Corn crop rating remains strong at 73% G/E. Only 2016 was rated higher in the past decade for this time frame. The strong ratings have corn market traders comfortable with the short side of the market given the possible potential yield.

- The corn market will be looking toward the August WASDE report on August 12 and the potential adjustments in corn yield given the condition of the crop. One private analyst group forecasted the August yield at 188.1 bushels/acre, up 7 bu/acre of trendline yield. More individual private analysts’ estimates will start hitting the news as the report moves closer.

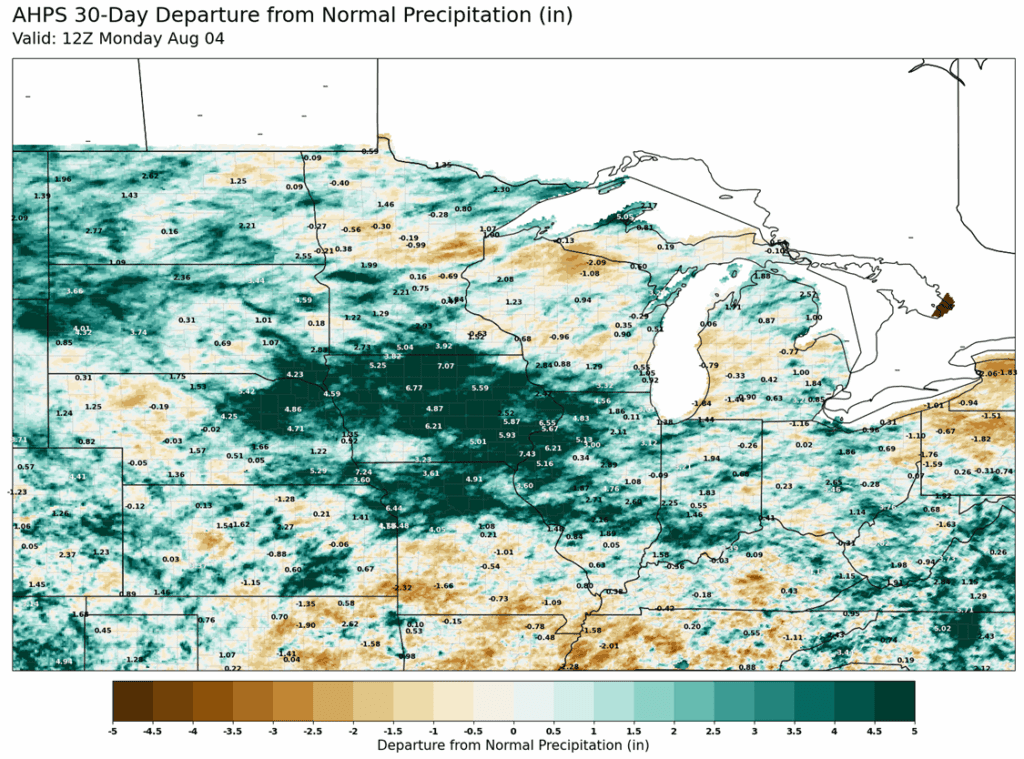

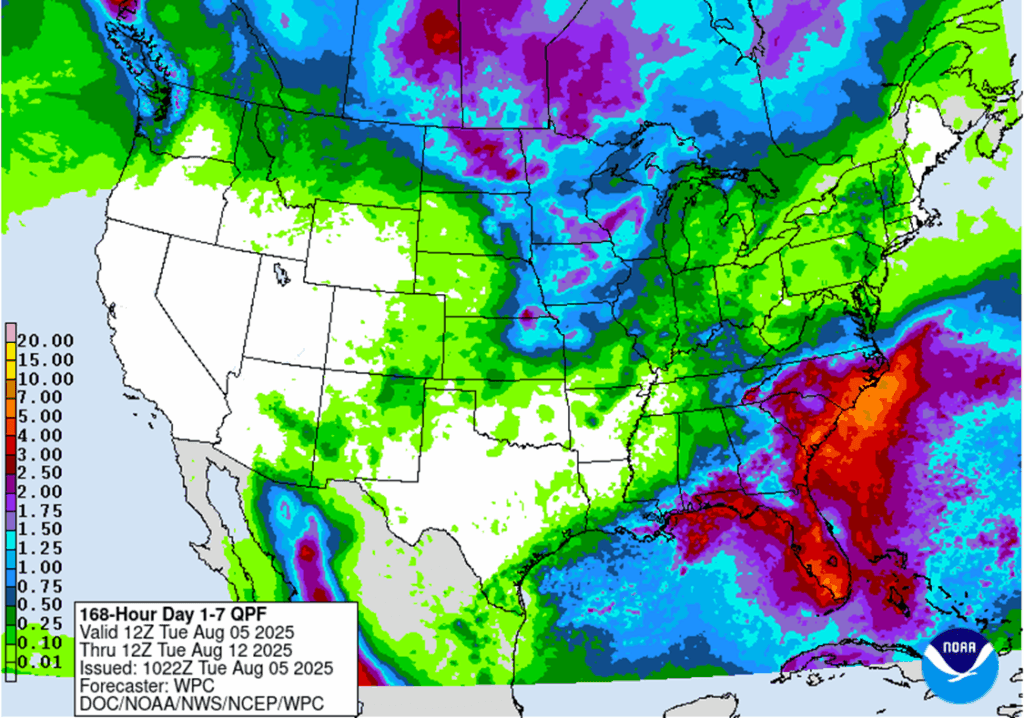

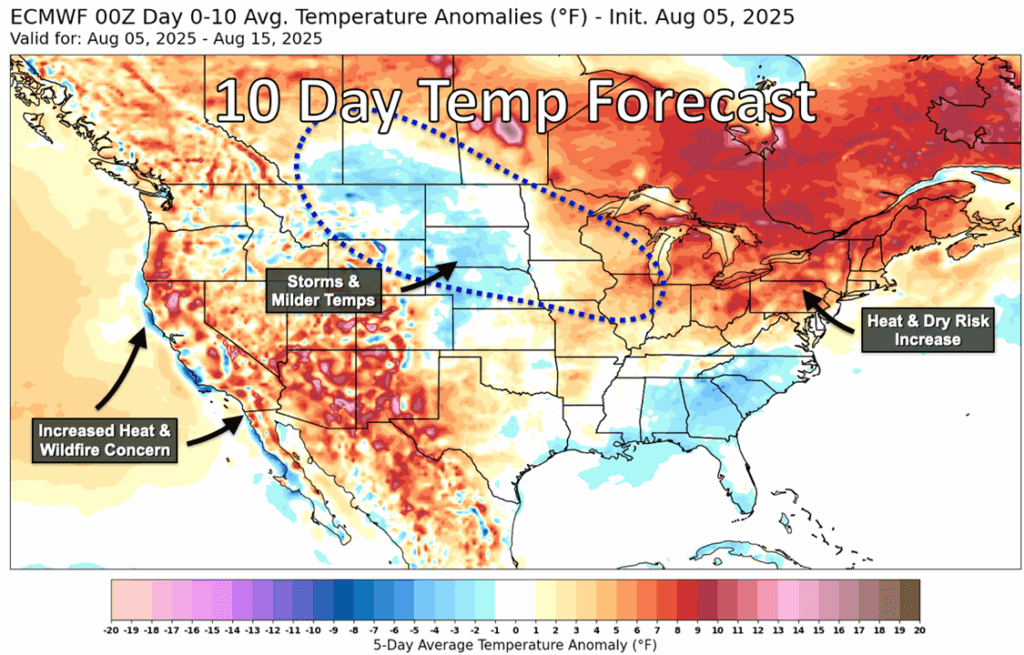

- Weather forecasts remain most favorable in the near term. Temperatures are expected to trend above normal, but rainfall is expected to also be normal to above normal for the same time period.

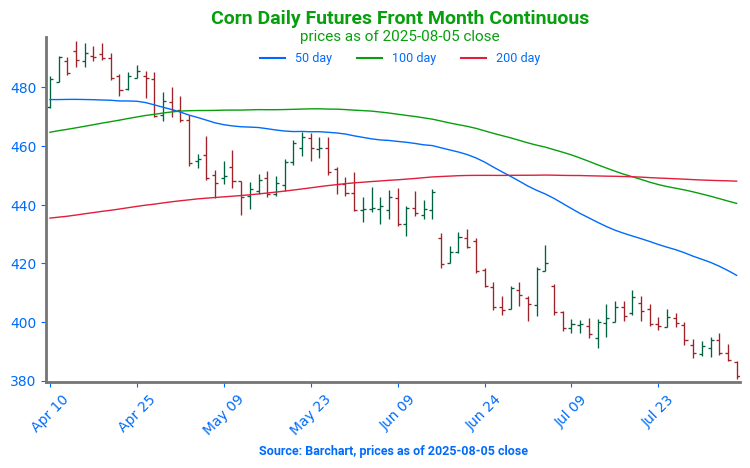

Corn Futures Slump to start August

After a quiet May–July stretch, corn futures broke support near 391 to start August. A weekly close below this level could shift focus to the August 2024 low near 360, while upside targets include an unfilled gap at 413, resistance at 420, and a second gap at 430.

Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- With the move into August and additional price weakness, the 1114 upside sales target has been cancelled.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Still waiting on first targets for 2026 to post.

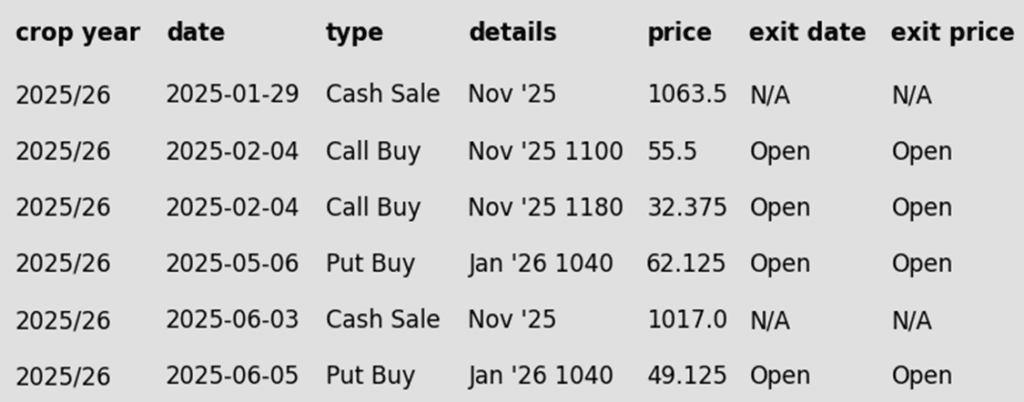

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended lower after early gains faded; November briefly broke above $10.00 before slipping. Soybean meal rose, but bean oil followed crude lower.

- Brazilian soybean farmers are expected to plant 120 million acres in the 25/26 season according to consulting firm Celeres. StoneX anticipates that this will cause production to rise by 5.6% from the previous season to 178.2 mmt. For the 24/25 season, StoneX raised its production forecast to 111.7 mmt.

- Yesterday’s Crop Progress report saw soybean ratings fall one point from last week to 69% good to excellent, but trade expected this. 58% of the soybean crop is setting pods and 85% is blooming

- Yesterday’s Export Inspection report saw soybean sales still sluggish but ahead of last week at 613k tons. This compared to 428k last week and 267k a year ago. Poor export demand combined with likely large yields have pressured the market- StoneX has forecast US yields at 53.6 bpa.

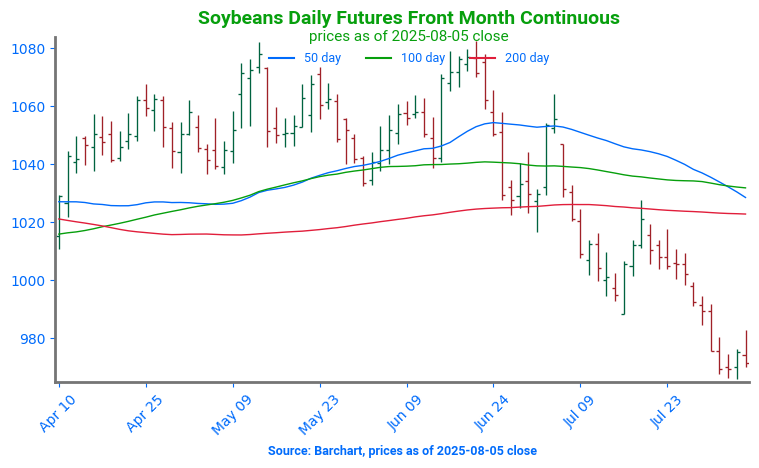

Soybeans Test April Lows

Soybean futures remain locked in a broader sideways trend after failing to clear key resistance at the May high of $10.82 in mid-June. With largely favorable weather throughout much of the growing season, the market has struggled to build bullish momentum, and the path of least resistance has remained lower. Technically, a breakout above the 100-day moving average could open the door to filling the gap left over the July 4th weekend near $10.50. On the downside, initial support is seen around the $10.00 mark, with stronger technical support at the April lows near $9.80.

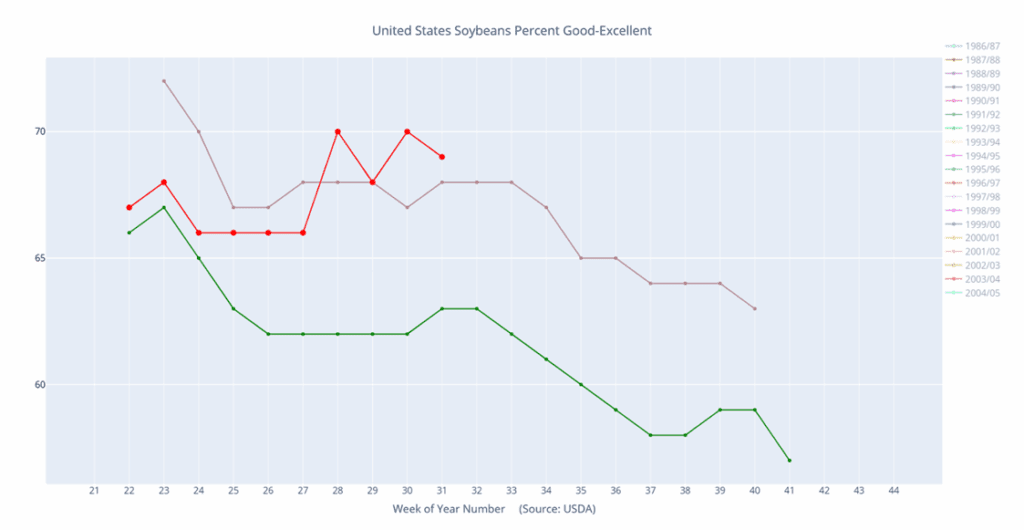

Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

Market Notes: Wheat

- Wheat markets closed lower across the entire complex today as new crop supplies continue to enter the pipeline. Active global harvest pressure and steady farmer selling have weighed on prices. With favorable weather expected to persist through the remainder of the harvest season, fresh supplies are likely to keep flowing into the market in the near term.

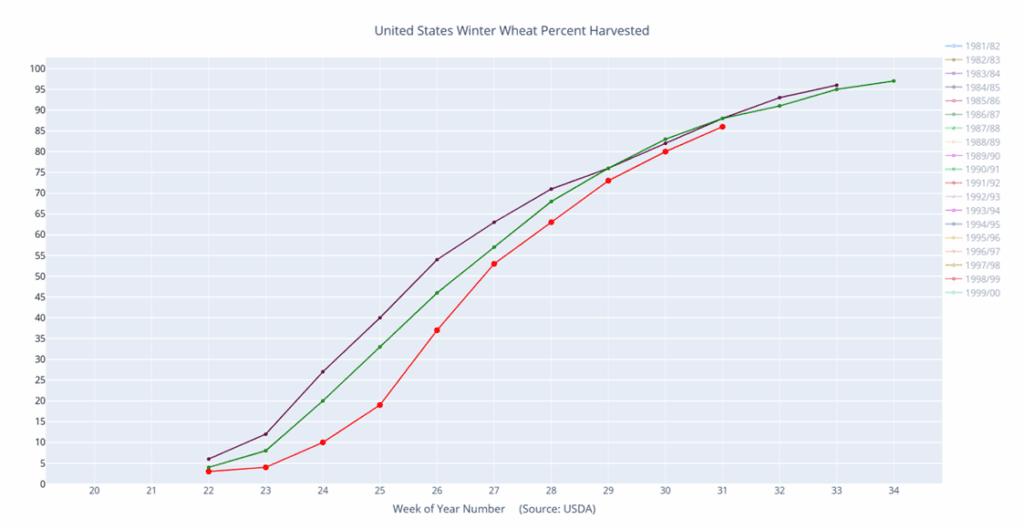

- The U.S. winter wheat harvest is now 86% complete, in line with the five-year average. Progress remains slowest in Montana and South Dakota, where harvest operations are trailing behind other key producing states.

- Open interest in Chicago wheat jumped over 18,000 contracts Monday despite flat prices, signaling fresh positioning ahead of key supply updates.

- Wheat export inspections for the week ending July 31 totaled 599,595 metric tons. Cumulative inspections for the marketing year to date have reached 3,911,270 metric tons, up 8.7% from the same period last year. This represents 16.9% of USDA’s 2025/26 export forecast, compared to the five-year average of 15.6% at this point in the season.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

Active

Sell JUL ’26 Cash

2027

No New Action

Puts

2025

No New Action

2026

Active

Enter(Buy) JUL ’26 Puts:

550 @ ~ 29c

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. No new active sales targets to report yet.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell a second portion of your 2026 Chicago wheat crop

- CONTINUED OPPORTUNITY – Buy July ‘26 550 Chicago wheat puts on a portion of your 2026 SRW crop for approximately 29 cents in premium, plus commission and fees.

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD). – Hit 7/29.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

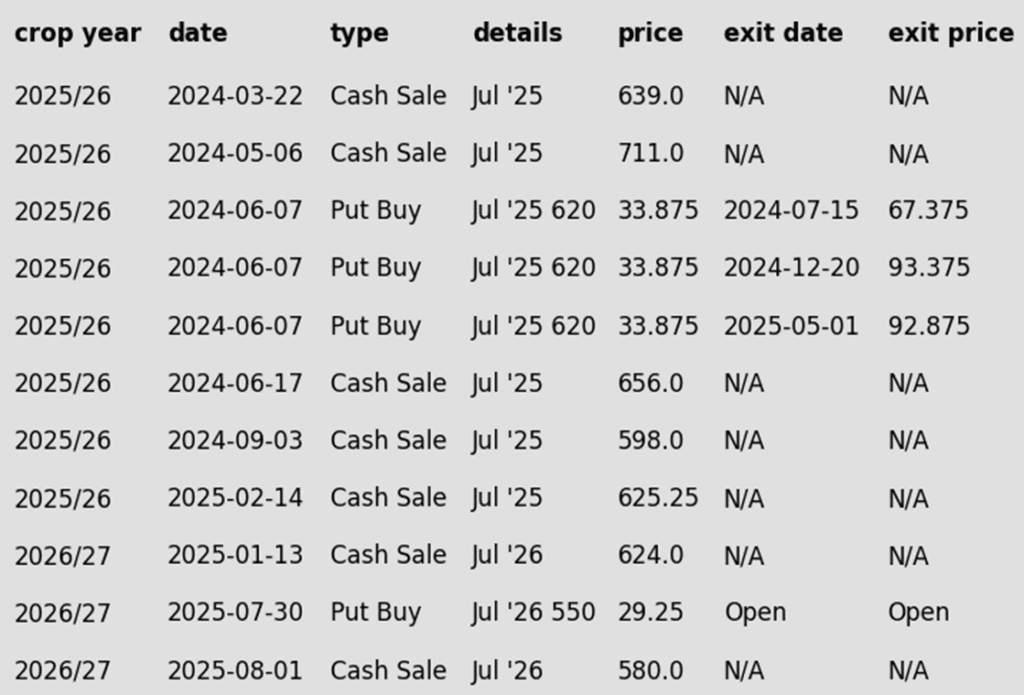

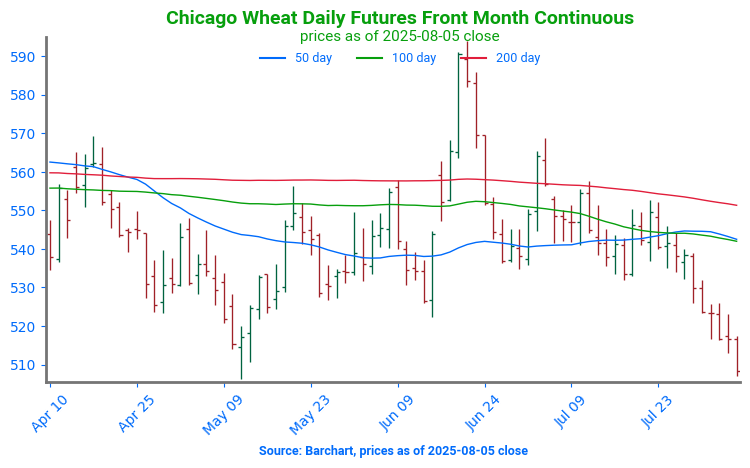

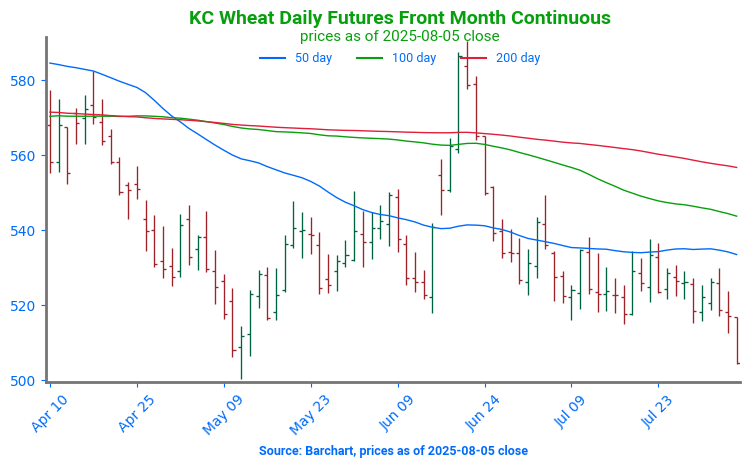

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Holds Range

Chicago wheat’s sharp rally in mid-June proved short-lived, with futures retreating toward the upper end of their 2025 trading range. Initial support is expected just above the 500 level, which marked the lows back in May and has since acted as a solid floor. On the upside, a weekly close above 558 would be seen as a constructive technical signal and could open the door for a retest of the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

Active

Enter(Buy) JUL ’26 KC Puts:

540 @ ~ 26c

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None. No new active sales targets to report yet.

2026 Crop:

- CONTINUED OPPORTUNITY – Buy July ‘26 540 KC wheat puts on a portion of your 2026 HRW crop for approximately 26 cents in premium, plus commission and fees.

- Plan A:

- Target 683 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 to make the first cash sale.

- Close below 584 support and buy July ‘26 put options (strikes TBD). – Hit 7/29.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Heads up that the July ‘26 contract is nearing the 584 Plan B stop, which if hit, would prompt buying July ‘26 put options.

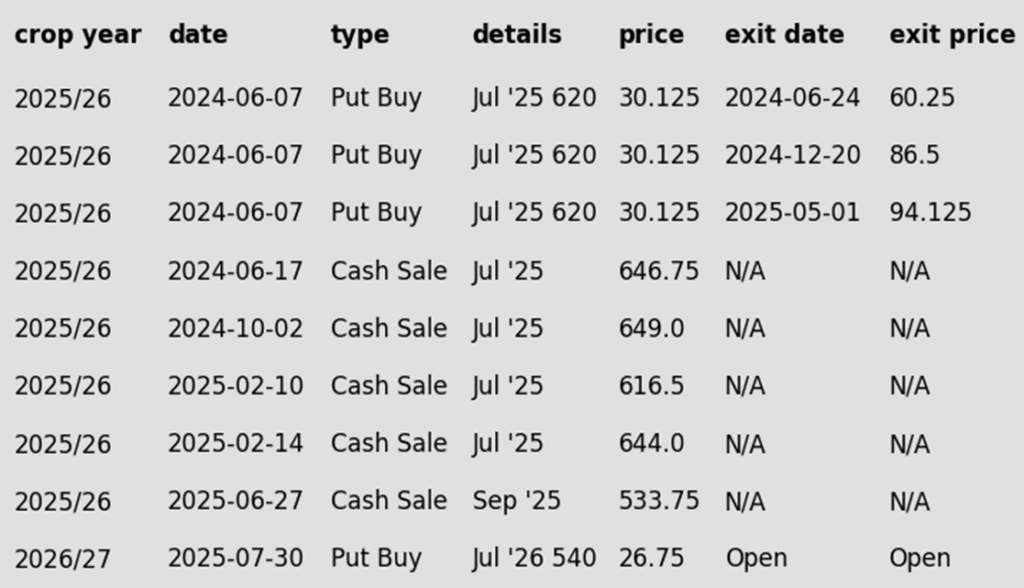

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Pulls Back Below Key Averages, Support at June Lows

KC wheat futures saw a strong rally in June, briefly testing the April highs near 580. However, late-month weakness pulled prices back below both the 100 and 200-day moving averages, which now serve as key resistance levels. On the downside, initial support is seen at the June low of 517.75, with secondary support near the May low around 500.

Winter wheat percent harvested (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

Active

Enter(Buy) JUL ’26 KC Puts:

540 @ ~ 26c

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. Still no new active sales targets to report yet.

- FYI – KC options are used for better liquidity.

2026 Crop:

- CONTINUED OPPORTUNITY – Buy July ‘26 540 KC wheat puts on a portion of your 2026 HRS crop for approximately 26 cents in premium, plus commission and fees.

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).– Hit 7/29.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

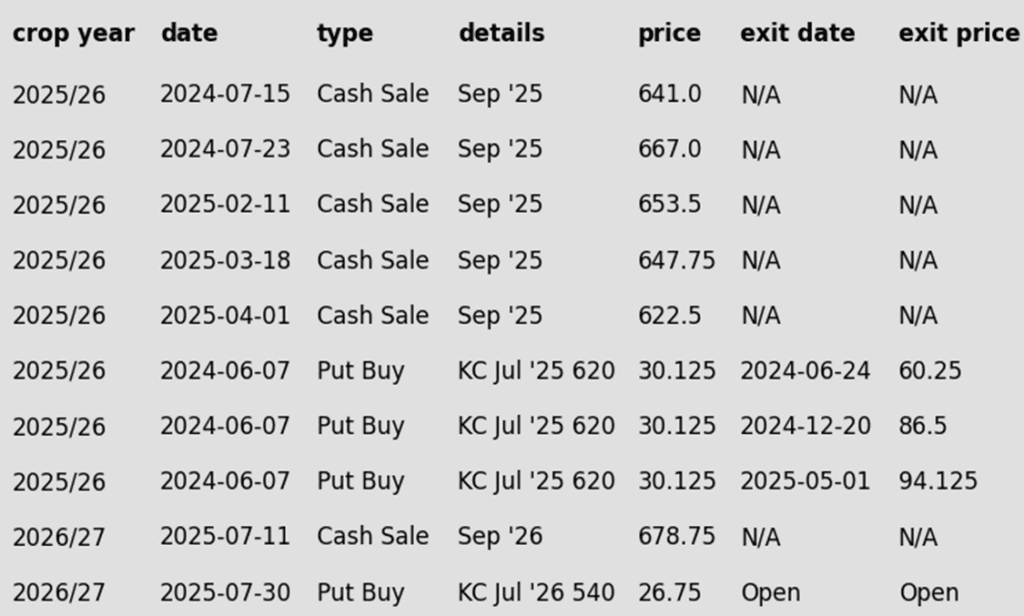

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

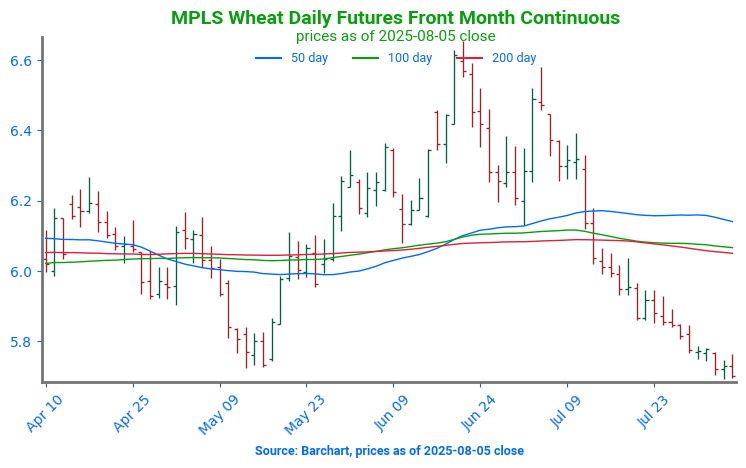

Spring Wheat Futures Test Key Support After July Slide

Spring wheat futures have come under pressure in July, weighed down by improving crop conditions and generally favorable weather across key growing areas. Technically, a cluster of major moving averages just above the 600 mark presents the first layer of upside resistance, with a chart gap near 650 serving as a secondary target if momentum builds. On the downside, the May lows near 580 should provide firm support in the event of further weakness.

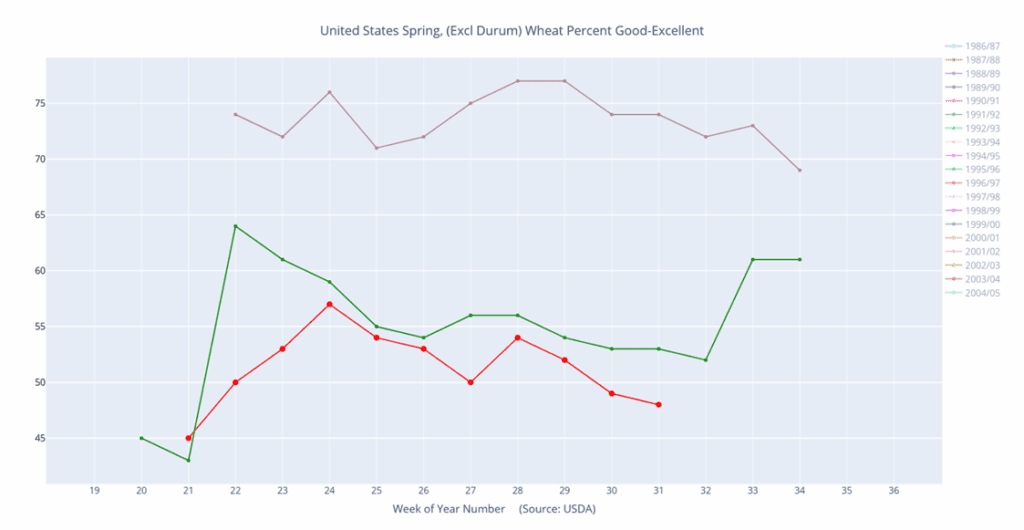

Spring wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Other Charts / Weather

From ag-wx.com