8-29 End of Day: Corn Leads Grains Higher into Holiday Weekend

The CME and Total Farm Marketing Offices will be closed Monday, September 1, in Observance of Labor Day

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: The corn market wrapped up Thursday’s trade with gains, receiving support from strong weekly export sales that continue to show demand.

- 🌱 Soybeans: Soybean prices closed mostly higher but were ultimately mixed, as ongoing concerns over U.S.-China trade tensions kept market sentiment cautious.

- 🌾 Wheat: Wheat finished the day with gains, finding support by a weaker U.S. dollar and a positive export report.

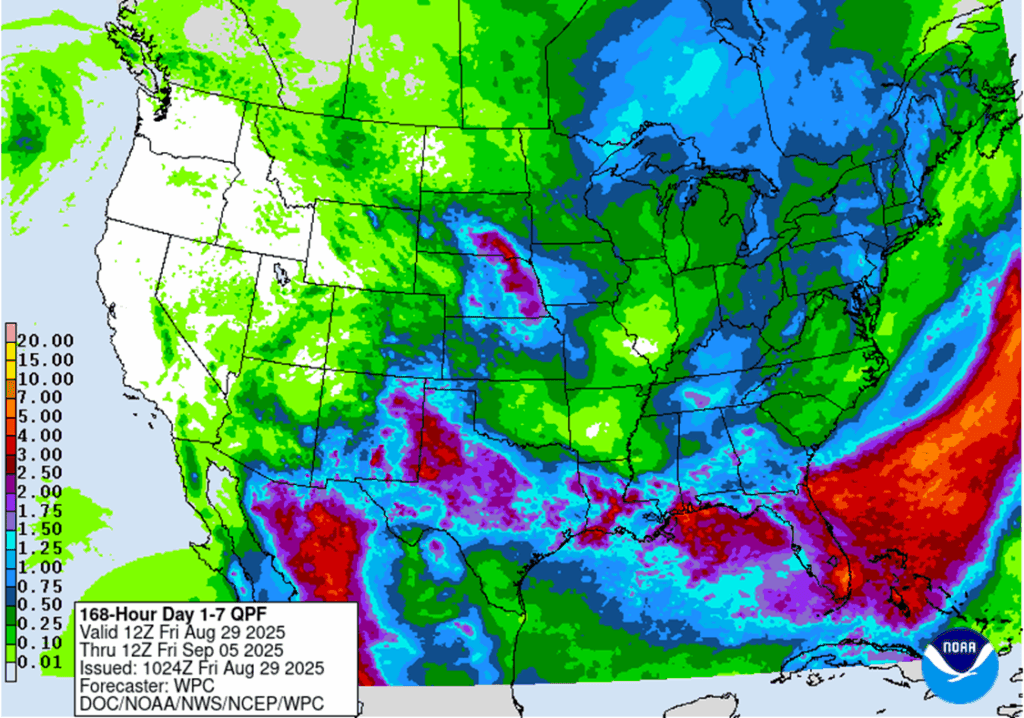

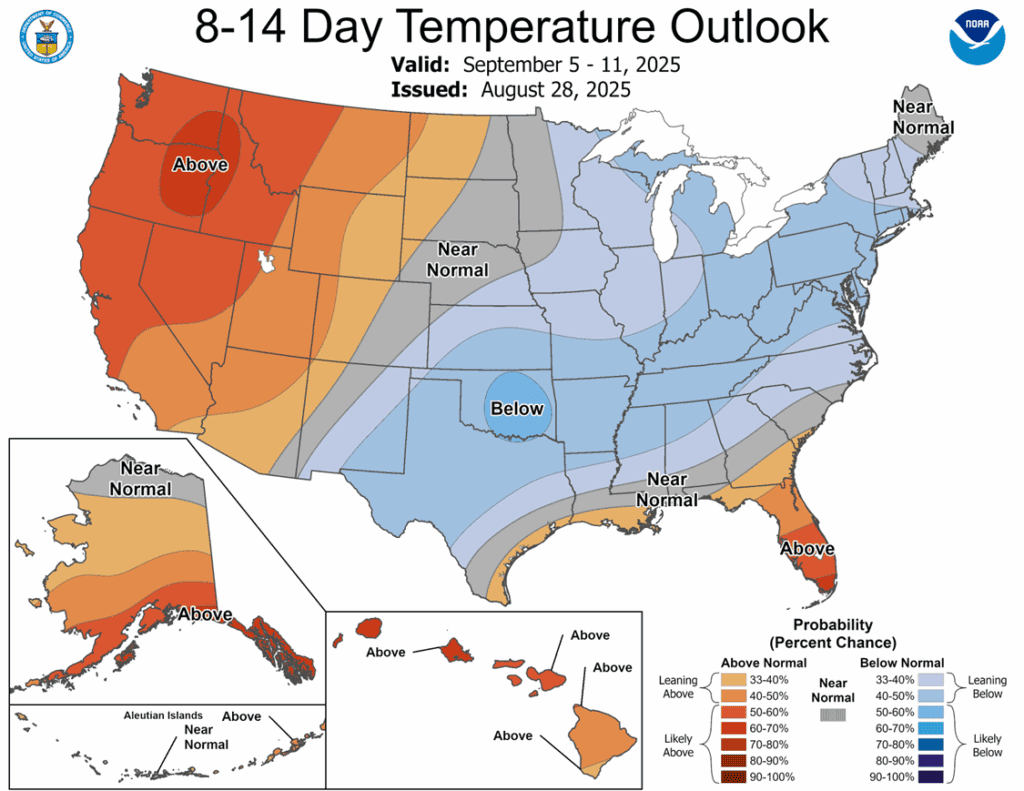

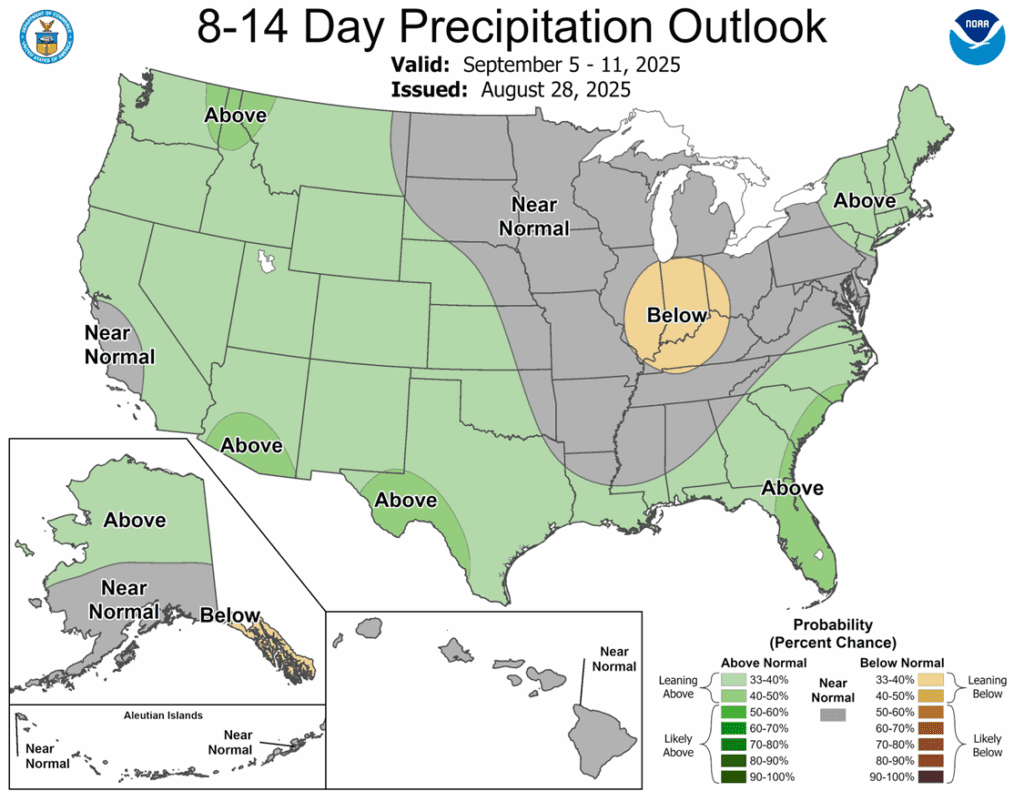

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Corn Action Plan Summary

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn markets ended the week on a strong note, pushing to new weekly highs with solid gains across the board. The rally was fueled by a bullish export report and growing sentiment that the USDA’s production and yield estimates for the 2025 season may have already peaked. The front-month September contract surged more than 12 cents on the day, closing above the 50-day moving average resistance, while all deferred contracts posted gains of over 9 cents.

- While no new flash sales were announced this morning, recent price action suggests that fresh demand may be emerging in the market.

- Brazil announced the development of 21 active corn-based ethanol projects, which could increase the country’s corn production by 50% by 2027. Of the 21 projects, 12 are currently in various stages of construction, while the remaining 9 are still in the planning phase. If all projects reach operational status, they are expected to require an additional 14 million metric tons (MMT) of corn to produce approximately 8.2 billion liters of ethanol.

- Weather conditions remain favorable across much of the U.S. as harvest approaches, with extended forecasts continuing to support crop development. Currently, only 5% of U.S. corn acreage is experiencing drought conditions, down from 8% at the same time last year. Overall, the corn crop looks promising; however, reports of tar spot and southern rush emerging in parts of the Midwest are raising some early concerns.

- LSEG has raised its 2024/25 Brazil corn production estimate to 137.4 million metric tons, a 4% increase from its previous forecast, citing expectations for a larger planted area. Meanwhile, Argentina’s corn harvest is nearing completion, with progress reported at approximately 97%.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

Soybeans Action Plan Summary

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher with September up 8-1/2 cents to $10.36-3/4 while November was up 6-1/2 cents at $10.54-1/2. October soybean meal was up by $0.50 to $283.40 and October soybean oil was down by 0.25 cents to 51.70 cents. Funds were buyers across the grain complex heading into the weekend.

- Drought conditions have expanded throughout the southern part of the Soybean Belt with a very dry August so far. The drought monitor showed an expansion of the soybean crop in drought to 11% which is up for 3% only two weeks ago.

- Analysts are estimating that the USDA soybean crush will come in around 207 million bushels for July. If this number is realized, the crush would be up 5.1% from the 197.1 mb processed in June and up 7.2% from July 2024.

- For the week, November soybeans lost 4 cents while March lost 3-1/4 cents to $10.87. October soybean meal lost $4.90 this week, and October soybean oil lost 3.24 cents. Over the past five trading days, funds are estimated to have sold over 24,000 contracts of soybeans.

Wheat

Market Notes: Wheat

- Wheat futures closed higher across all three classes, supported by end-of-month positioning, first notice day for September contracts, and spillover strength from corn. September Chicago rose 7-3/4 cents to 518, Kansas City gained 6 cents to 492-3/4, and MIAX added 4 cents to 559-1/4. Short covering and technical buying ahead of the long weekend also played a role ahead of the three-day weekend. Wheat also was likely a follower of today’s sharply higher corn market.

- Russia has increased their wheat export tax to 134.4 Rubles per mt through September 9. This is up sharply from the previous tax of 32.1 Rubles per mt.

- According to the Benos Aires Grain Exchange, Argentina’s wheat crop is off to a good start. Reportedly, 85% of the wheat crop’s soil moisture conditions are adequate to optimal.

- The European Commission updated its 25/26 grain forecast to 276.9 MMT (down from July’s 278.4 MMT), though soft wheat production was revised higher to 128.1 MMT from 127.3 MMT.

- Yesterday’s updated USDA drought monitor indicated that as of August 26, winter wheat areas experiencing drought were unchanged from the previous week at 31%. Meanwhile, spring wheat acres in drought declined 1% from last week to 13%.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 25 vs December for the next sale.

- Plan B:

- Buy call options if December closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None

2026 Crop:

- Plan A:

- Target 606.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 647 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 656 target has been lowered to 647.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

Active

Sell SEP ’26 Cash

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if December KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Continued Opportunity – Sell a second portion of your 2026 Minneapolis wheat crop today.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Two sales recommendations have been made to date, with an average price of 654.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

To date, Grain Market Insider has issued the following KC recommendations:

Other Charts / Weather