8-27 Opening Update:

Grain Market Insider Interactive Quote Board

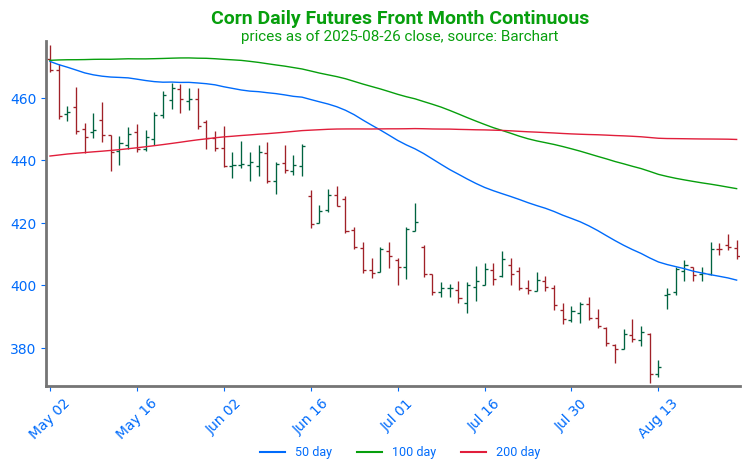

- Corn futures are slightly lower this morning with December futures down 3/4 of a cent at 408-3/4.

- Pro Farmer’s U.S. corn yield estimate of 182.7 bpa last week offered some support to the market, but the 97 million planted acres nationwide continues to give buyers pause.

- After a dry stretch this week, rain is expected to return to the Corn Belt after September 6. Cooler-than-normal temperatures should slow maturity and remain overall beneficial for the corn crop.

Corn Futures Show Signs of Life: With the front-month roll from September to December, corn has shown renewed strength. Prices rallied to close last week above the 50-day moving average, a constructive signal. Early this week, corn filled the post–July 4th gap near 413, with the next upside target seen at the gap near 430. On the downside, the 50-day average serves as initial support, while a break could expose the gap below 400.

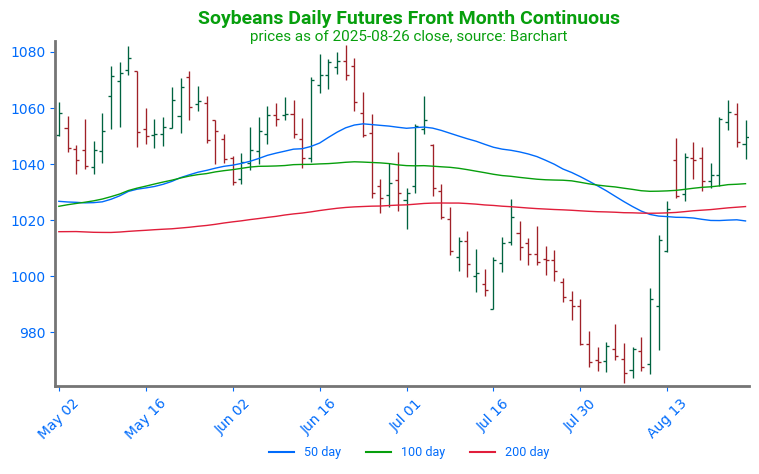

- Soybeans are trading higher to start Wednesday with November soybeans up 1-3/4 cents at 1051-1/2.

- A top Chinese trade representative is set to visit Washington this week, raising hopes among soybean traders and producers that oilseed trade will be a priority. However, recent negotiations have focused more on technology and rare earth minerals than on agriculture.

- Despite U.S. soybeans being priced below Brazilian offers, rumors suggest China is already half covered or more of their needs through October—a key month when buyers typically shift purchases from Brazil to the U.S.

Soybeans Eye Spring Highs: Soybean futures surged in early August after USDA cut 2025 harvested area by 2.5 million acres. Prices broke through heavy resistance and key moving averages around 10.30, which now act as support on pullbacks. On the upside, the next major resistance is at the spring highs near 10.80, a level that has repeatedly capped rallies over the past year.

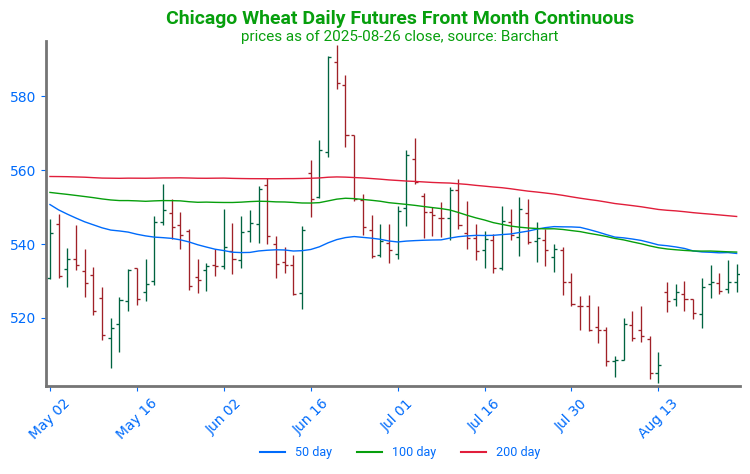

- All three wheat classes are lower to start the day Wednesday.

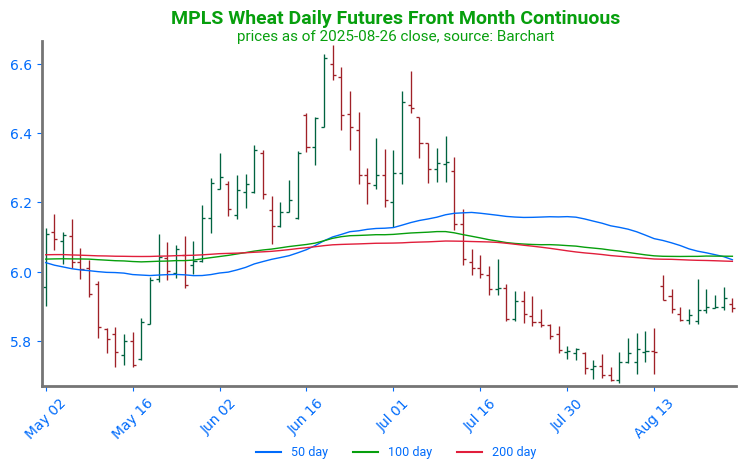

- December Chicago wheat futures are 4-1/2 cents lower at 527-1/4. December KC wheat futures are 4-1/4 cents lower at 513-1/2. December MIAX spring wheat futures are 2-1/2 cents lower at 587-1/4.

- Harvest pressure continues to weigh on the wheat market, with spring wheat harvest surpassing 50% as of Sunday, according to USDA. Ample wheat supplies from Europe and Russia are also curbing global shortage concerns.

Chicago Wheat Holds Range: Chicago wheat’s mid-June rally was short-lived, with futures retreating back toward the upper end of their 2025 trading range. Initial support lies just above 500, the early-August low. On the upside, a weekly close above 558 would signal renewed strength and open the door for a retest of the recent highs near 590.

KC Wheat Continues Sideways Trend: KC wheat futures rallied sharply in June, briefly testing the April highs near 580 before weakening into month-end. The pullback pushed prices below the 50-day moving average, which now stands as key resistance on any rebound. Support is first seen at the recent lows near 505, followed by secondary support at the May low around 500.

Spring Wheat Holds Below Moving Averages: Spring wheat futures faced pressure in July as crop conditions improved and weather turned favorable across key growing areas. While August has seen some support, gains remain limited. Technically, strong resistance sits just above 600 at a cluster of major moving averages, with a secondary target near 650 if momentum strengthens. On the downside, recent lows around 580 are expected to provide solid support against further weakness.

Grain Market Insider is provided by Stewart-Peterson Inc., a publishing company.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing by Stewart-Peterson and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Stewart-Peterson Inc. Reproduction of this information without prior written permission is prohibited. Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction and distribution of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing.

Stewart-Peterson Inc., Stewart-Peterson Group Inc., and SP Risk Services LLC are each part of the family of companies within Total Farm Marketing (TFM). Stewart-Peterson Inc. is a publishing company. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services LLC is an insurance agency. A customer may have relationships with any or all three companies.