8-27 End of Day: Soybeans Trend Sideways While Corn and Wheat Slip Lower Wednesday

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures slipped Wednesday. Corn lacks a bullish spark, with delivery pressure and muted export sales outweighing supportive ethanol data.

- 🌱 Soybeans: Soybeans traded mixed before finishing lower today. Soybean futures are treading water as traders balance good yield potential against uncertainty over China demand and U.S. export prospects.

- 🌾 Wheat: Wheat futures led the grain market lower Wednesday. Global wheat supplies remain ample and rising production estimates continue to weigh on futures.

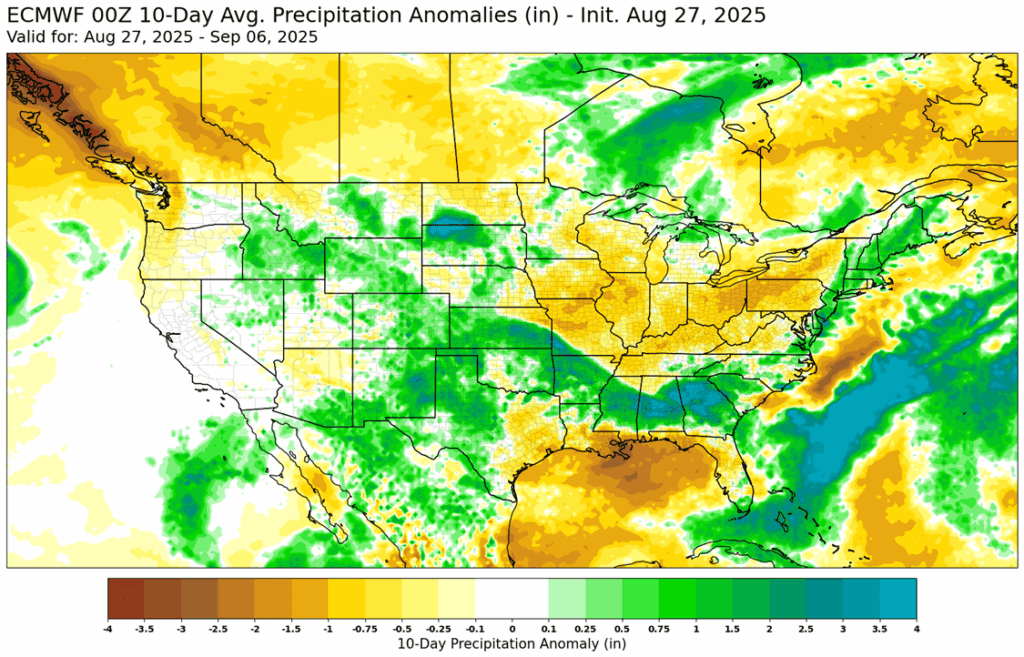

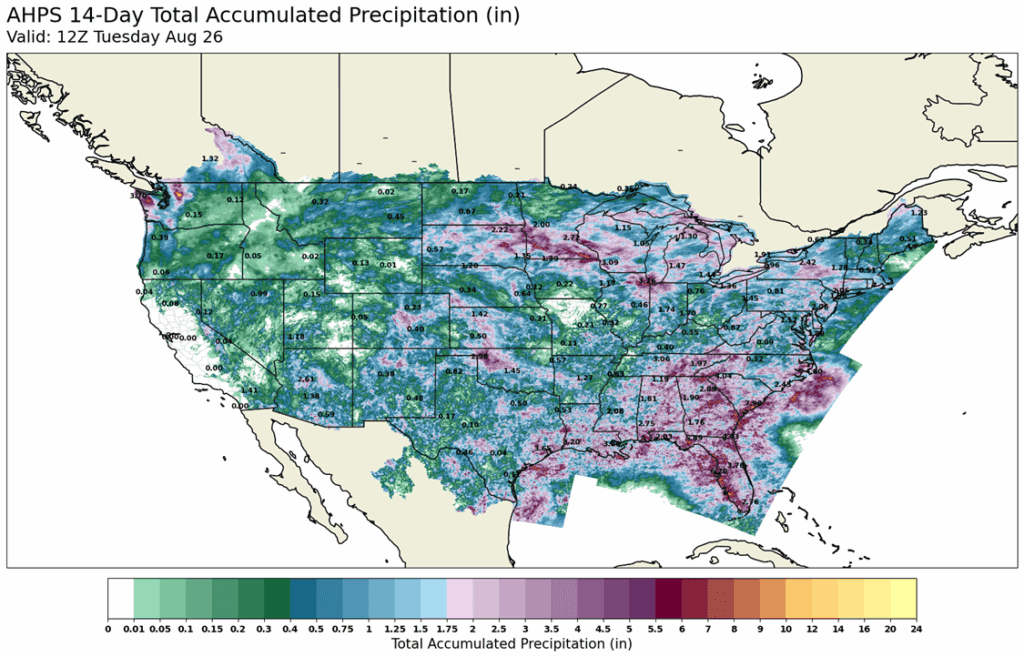

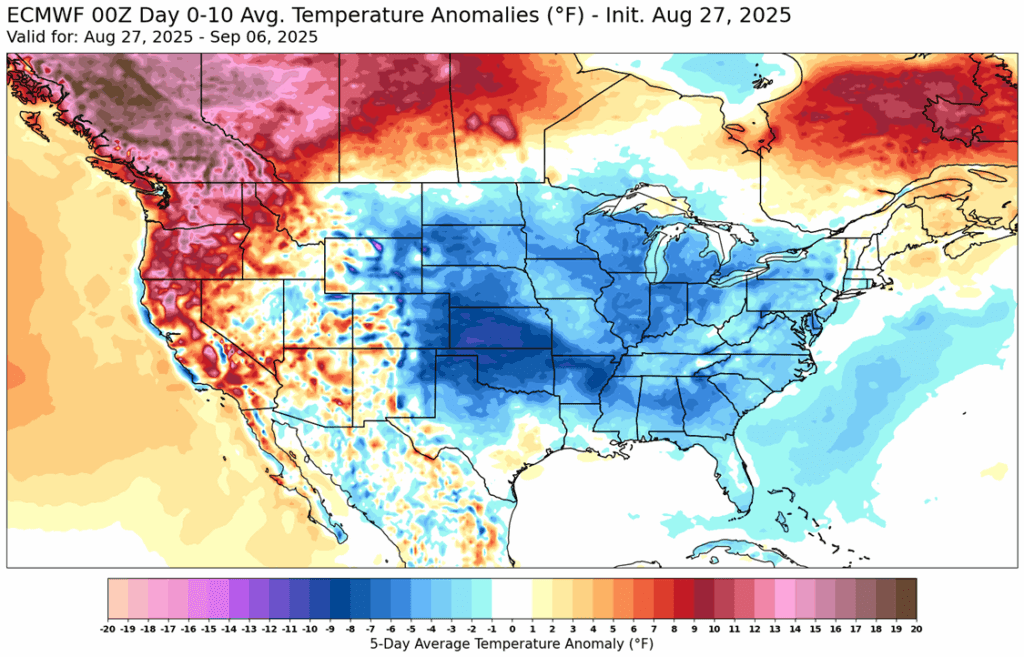

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures closed lower on Wednesday as September lost 5 cents to $3.82-1/2 and December fell 3-1/2 cents to $4.06. With First Notice Day looming Friday, old-crop pricing and long liquidation continue to weigh on the market. Charts look weak, leaving room for additional downside.

- September pressure persists. Open interest remains above 80,000 contracts, and producers holding basis contracts will need to make pricing decisions this week, adding volatility to the nearby contract.

- The weekly ethanol report saw production at 2,000 barrels per day, which compares to the average trade guess of 1,073 bpd and last week’s figure at 1,072 bpd. Stocks were 100,000 barrels lower and were down from 22.688 million bbl.

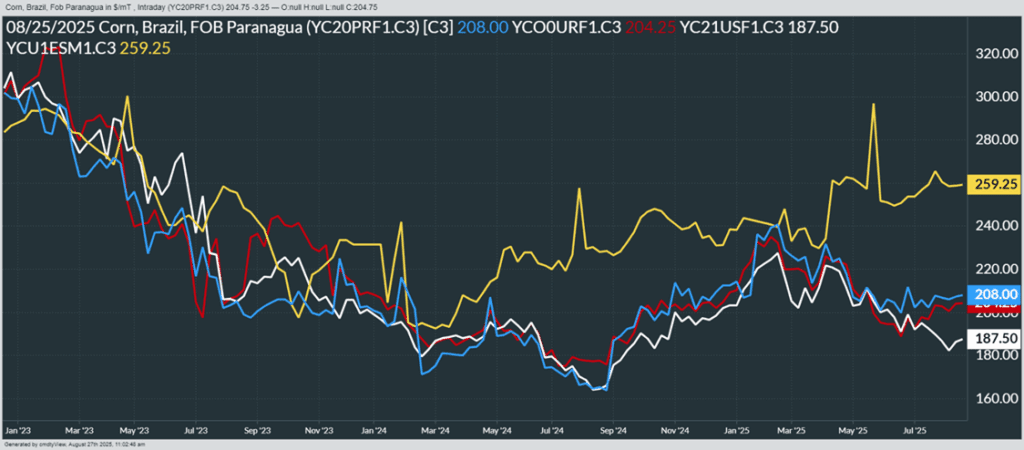

- Export demand has been quiet over the last week. USDA has not reported a flash sale since Aug. 22 as U.S. and Brazilian prices converge. Trade chatter suggests Taiwan may have booked corn out of the PNW, though only sales over 100,000 MT would trigger USDA reporting.

- Dry and cool weather seems to be the dominant theme in the near-term for U.S. weather. Parts of the Eastern Corn Belt are observing their driest August in over 100 years. Talk of “Flash Drought” may start hitting the market as the dryness may push the maturity speed on the corn crop.

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

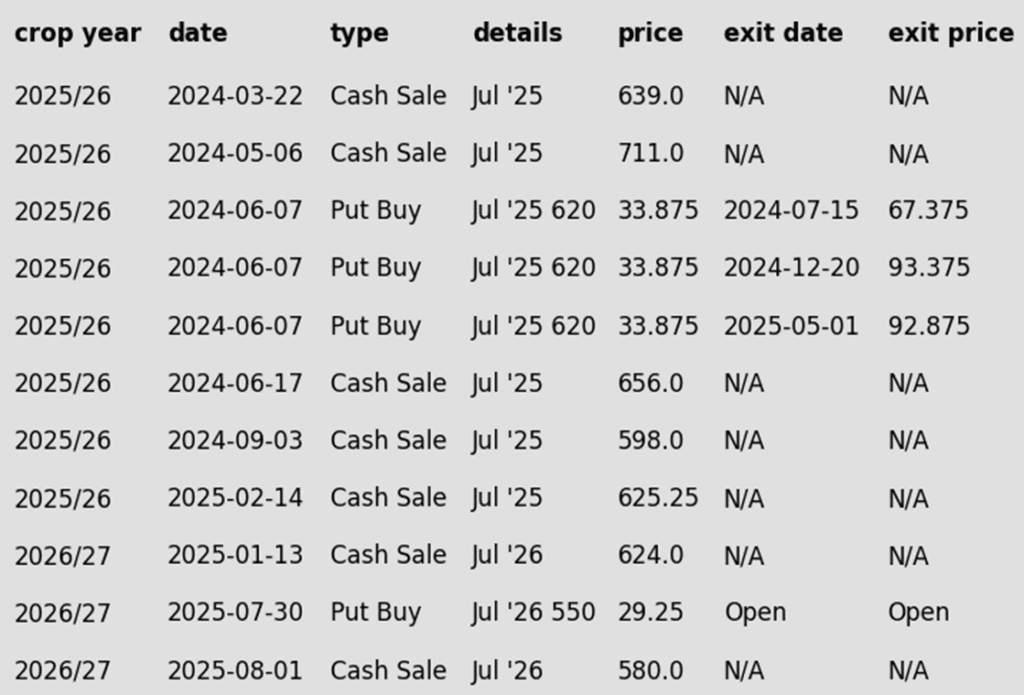

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower and traded on either side of unchanged throughout the day. September closed down 1-1/2 cents at $10.27-1/4 and November fell 2 cents to $10.47-1/2. October soybean meal slid $6.20 to $284.30, while October soybean oil eased 0.31 cents to 52.72 cents. With first notice day Friday, many traders are exiting September longs and rolling into deferred contracts.

- Trade optimism remains in focus. China confirmed it will send a top negotiator to Washington to meet U.S. officials and business leaders this week, though not in a formal negotiating session. Beijing continues to link major purchases — including soybeans and Boeing planes — to the removal of tariffs.

- The USDA projected the national soybean yield at 53.5 bpa while Pro Farmer estimated it at 53.0 bpa, and many traders think the actual number will be closer to 53.0. Weather has been drier than usual for August, but soil moisture levels were good enough coming into the month to maintain crop conditions.

- The bearish story for soybeans is the possibility that a trade deal with China does not get achieved, and in this case, the USDA would need to revise export estimates lower which would in turn raise the carryout number past the last estimate of 350 mb for 25/26.

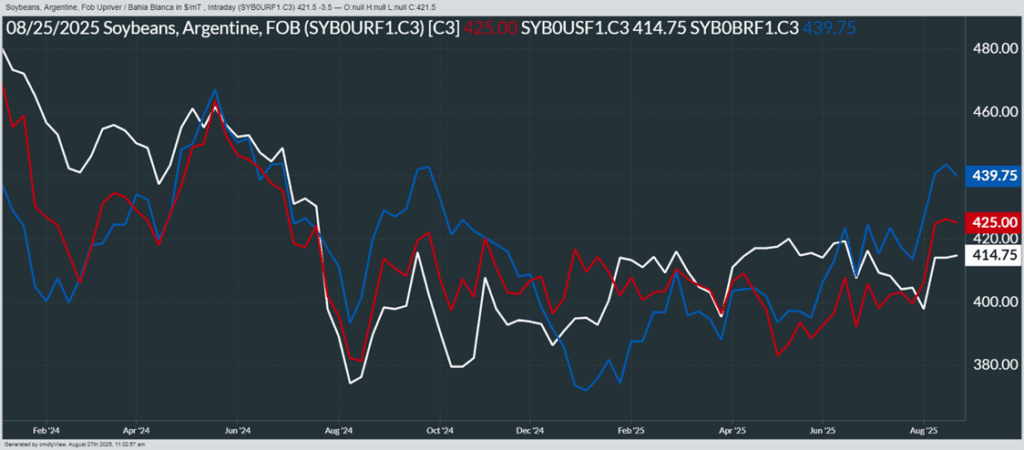

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- Wheat led the way to the downside today with September Chicago posting a 7-1/4 cent loss to 502-1/4, while September Kansas City was down 7-1/2 to 485-1/2. September MIAX took the biggest hit, closing down 15-1/4 cents to 551. Pressure likely stemmed from anticipation that tomorrow, Statistics Canada’s updated estimates will show increased wheat production; the average pre-report estimate for all wheat production comes in at 35.9 mmt versus 34.4 mmt August last year.

- The Australian Bureau of Agricultural Resource Economics (ABARE) is anticipated to release an updated wheat production forecast for their nation next week. It is expected to be well above the June estimate of 30.6 mmt, with many private analysts thinking the harvest could be closer to last year’s 34.1 mmt crop.

- The Indian government has reportedly reduced the limit of wheat stockpiles for traders and wholesalers from 3,000 mt to 2,000 mt. Retailers also saw a reduced requirement from 10 mt to 8 mt, and these restrictions will be in place until the end of March 2026.

- European Union soft wheat exports for the 25/26 season are down 48% year on year. Since the season began on July 1, only 2.18 mmt of wheat has been exported, compared with 4.15 mmt a year ago. The top importer was Saudi Arabia, followed by Morocco and Nigeria.

- Ukraine’s largest farming union, UAC, has stated that their country’s 2025 wheat production estimate has a maximum of 21.8 mmt. This would be a decrease from the 2024 crop that totaled 22.7 mmt. Currently, Ukraine’s economy ministry is estimating the output at 21 mmt, but the UAC said this does not account for production from small farmers.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 606.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

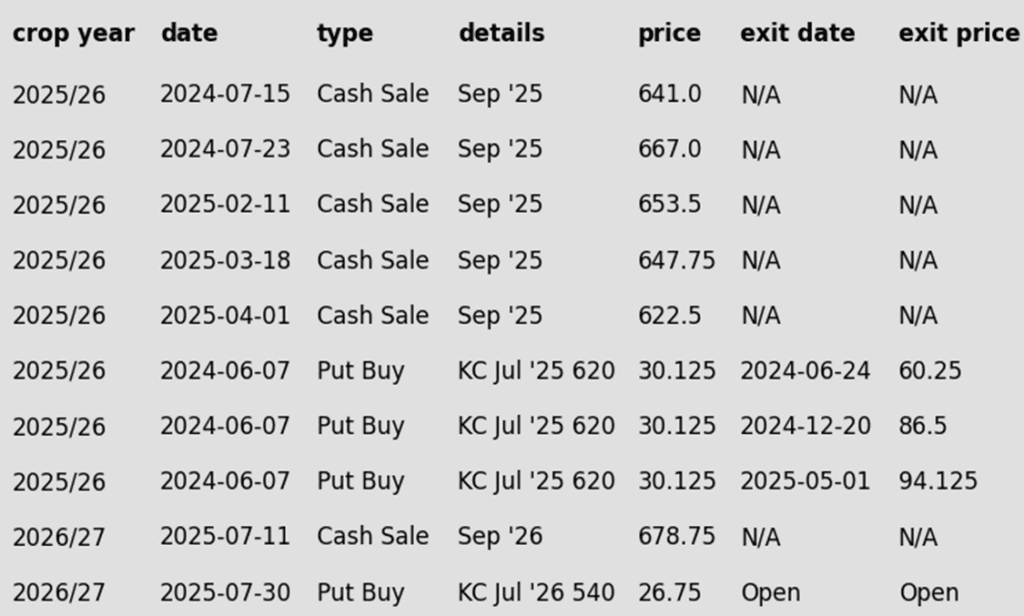

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 657 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 657 target has been lowered to 656.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

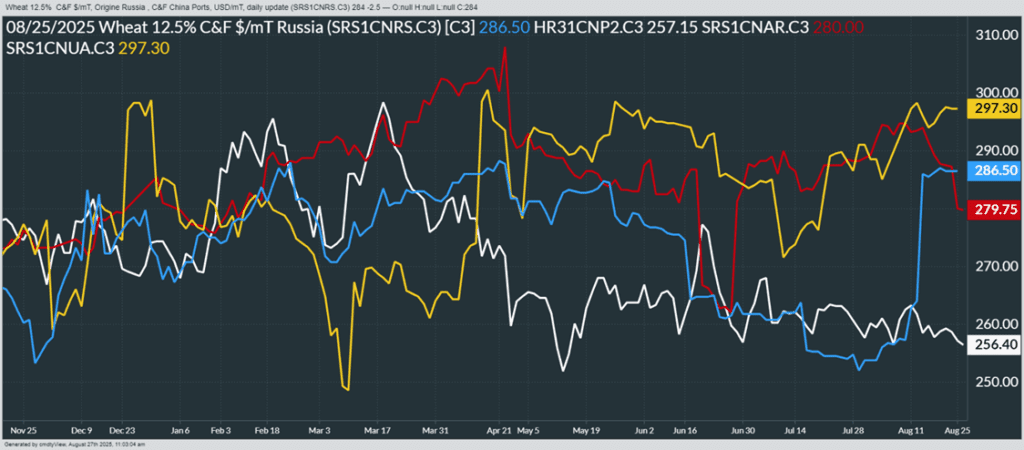

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather