8-26 End of Day: The Soybean Complex Settles Higher as Wheat Closes Mixed and Corn Lower

All prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’24 | 362 | -5.75 |

| DEC ’24 | 386.5 | -4.5 |

| DEC ’25 | 430 | -2.75 |

| Soybeans | ||

| NOV ’24 | 980.75 | 7.75 |

| JAN ’25 | 998.25 | 7.5 |

| NOV ’25 | 1030.25 | 3.75 |

| Chicago Wheat | ||

| SEP ’24 | 498 | -4.25 |

| DEC ’24 | 525 | -3 |

| JUL ’25 | 563.75 | -3.25 |

| K.C. Wheat | ||

| SEP ’24 | 525 | 5 |

| DEC ’24 | 537.25 | 2.25 |

| JUL ’25 | 560.5 | 0 |

| Mpls Wheat | ||

| SEP ’24 | 541.5 | -10.25 |

| DEC ’24 | 568 | -4.25 |

| SEP ’25 | 627.25 | 3.5 |

| S&P 500 | ||

| SEP ’24 | 5635.75 | -16.75 |

| Crude Oil | ||

| OCT ’24 | 77.47 | 2.64 |

| Gold | ||

| OCT ’24 | 2528 | 5.4 |

Grain Market Highlights

- December corn dropped to a new contract low during the session with a new contract low close, as selling pressure continues to weigh on the market with old crop bushels being brought to market and basis contracts being priced ahead of First Notice Day this Friday.

- Led by rallies in both soybean meal and oil, the soybean market turned and closed higher on the board after initially trading lower in the overnight session on expectations of a huge crop from Pro Farmer’s crop tour. Strength in meal and oil also added 7 ½ cents to spot Board crush margins.

- The wheat complex settled mixed, with KC contracts closing firm on profit-taking after printing new contract lows. Meanwhile, Chicago and Minneapolis contracts closed mostly lower, with spot Chicago trading below the $5 mark for the first time in four years, as Matif wheat also posted fresh contract lows.

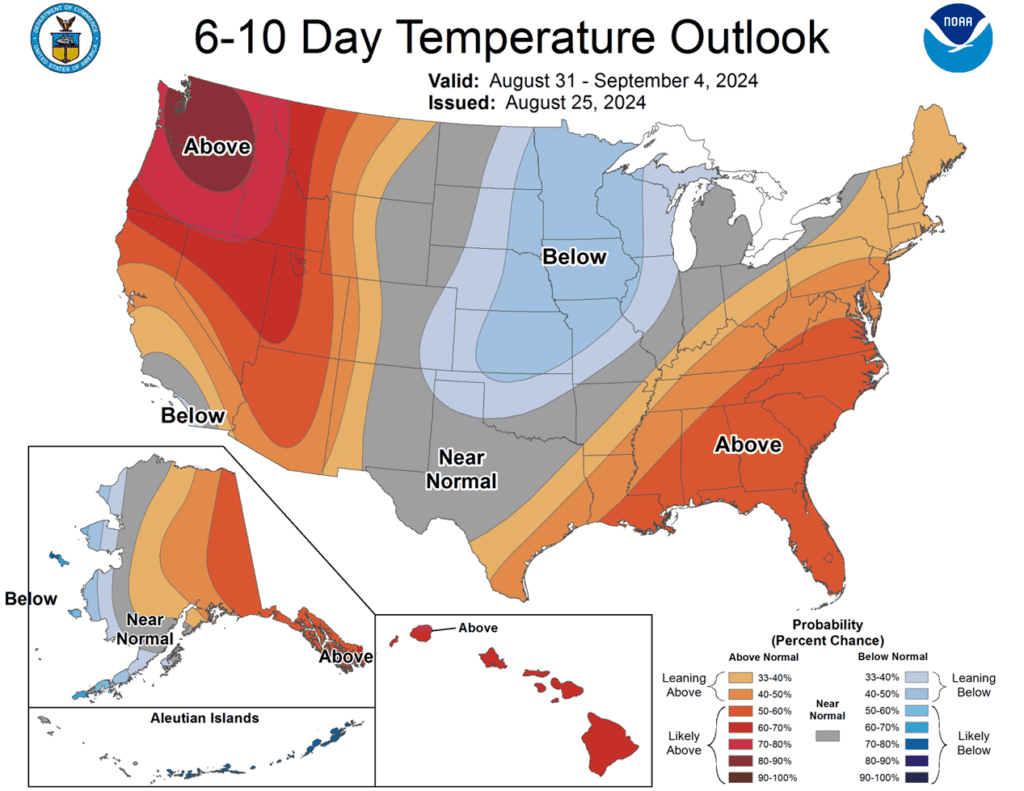

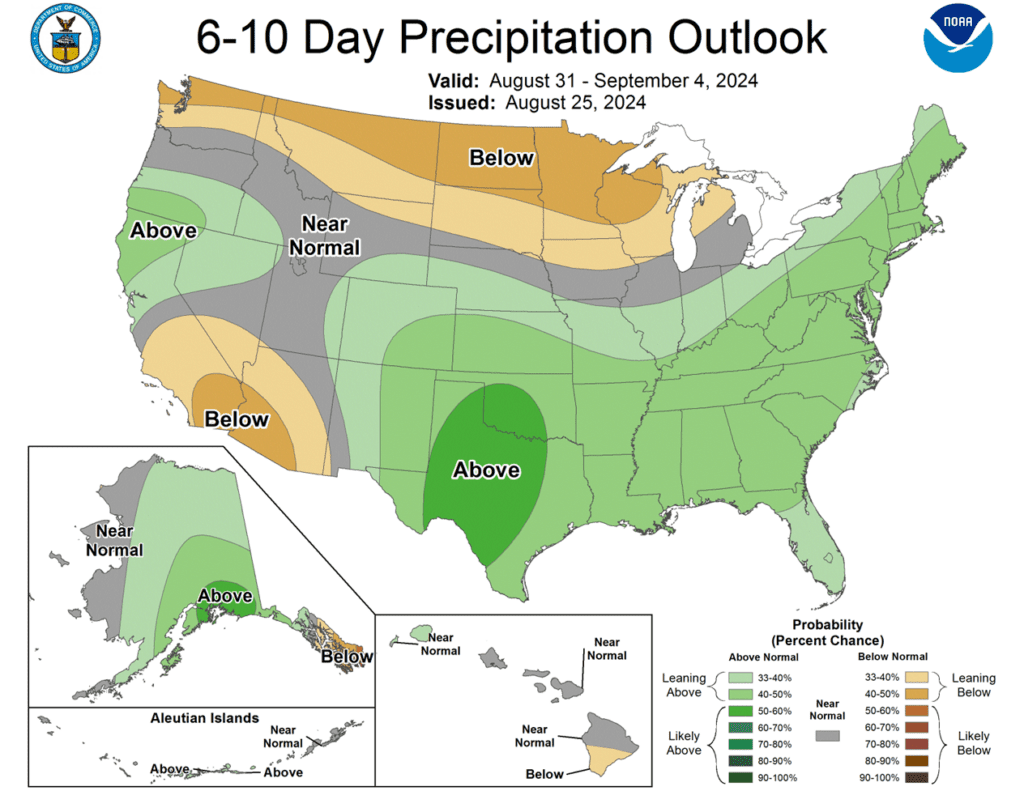

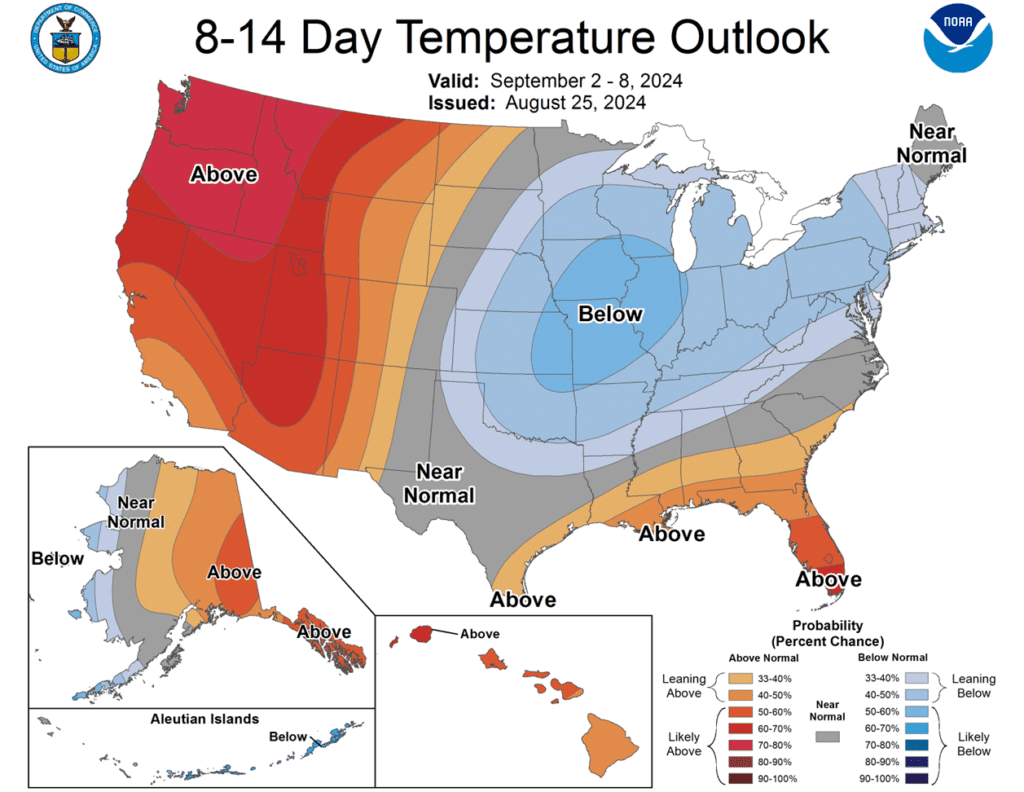

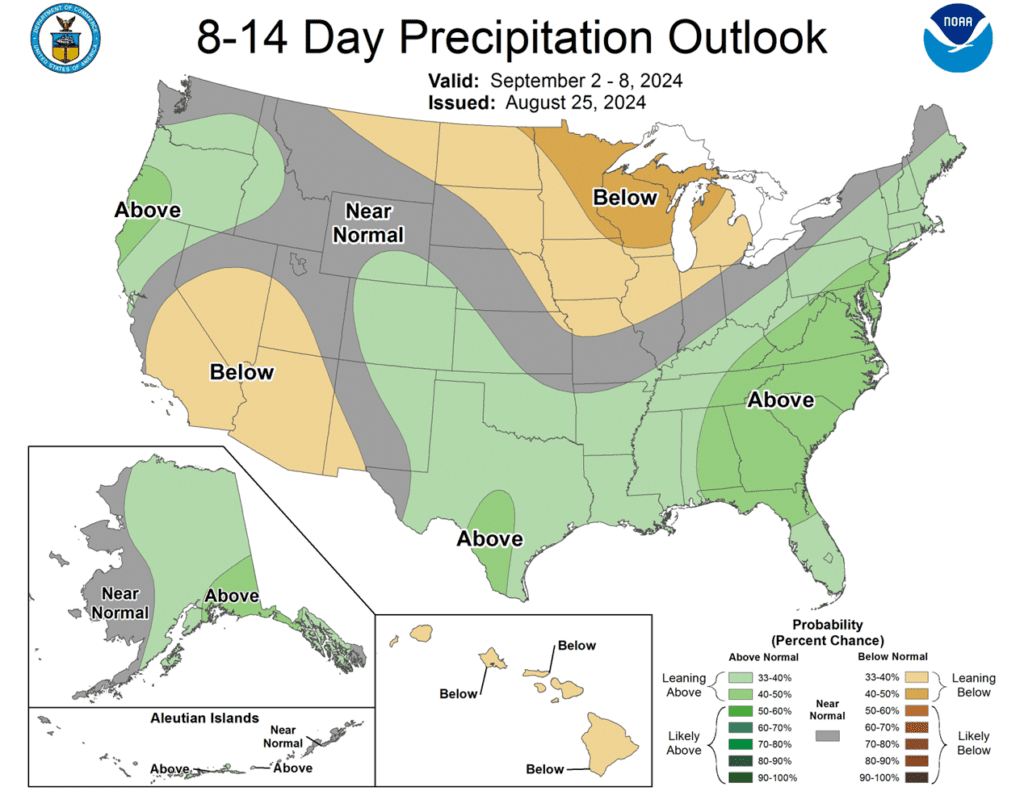

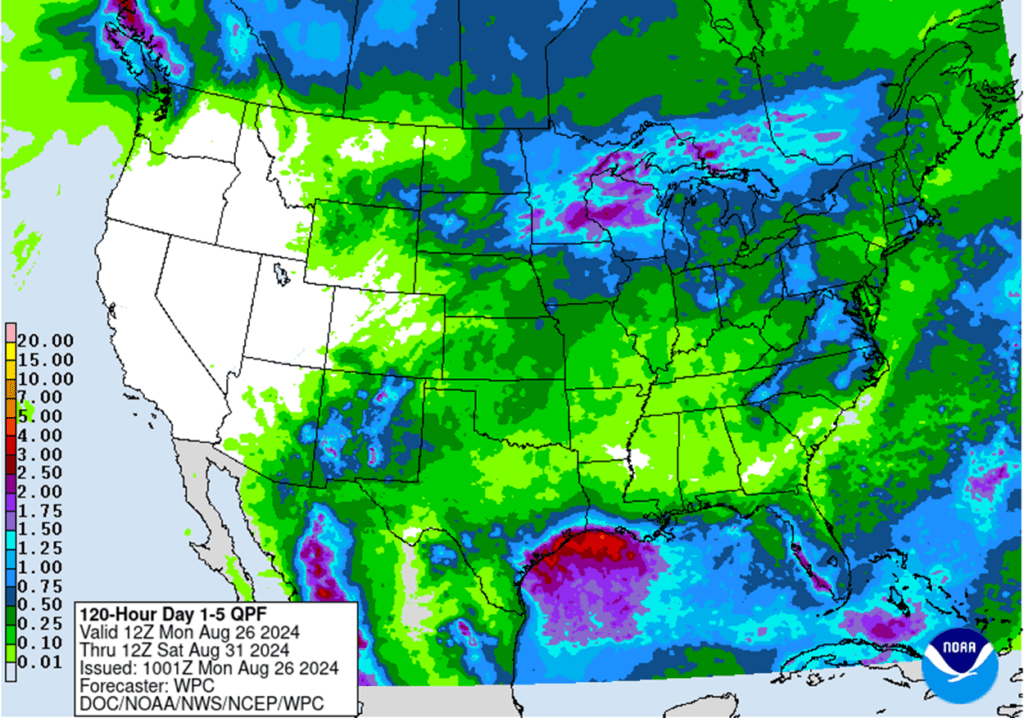

- To see the updated US 5-day precipitation forecast, and the 6 – 10 and 8 – 14 day Temperature and Precipitation Outlooks, courtesy of NOAA, and the Weather Prediction Center, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Corn Action Plan Summary

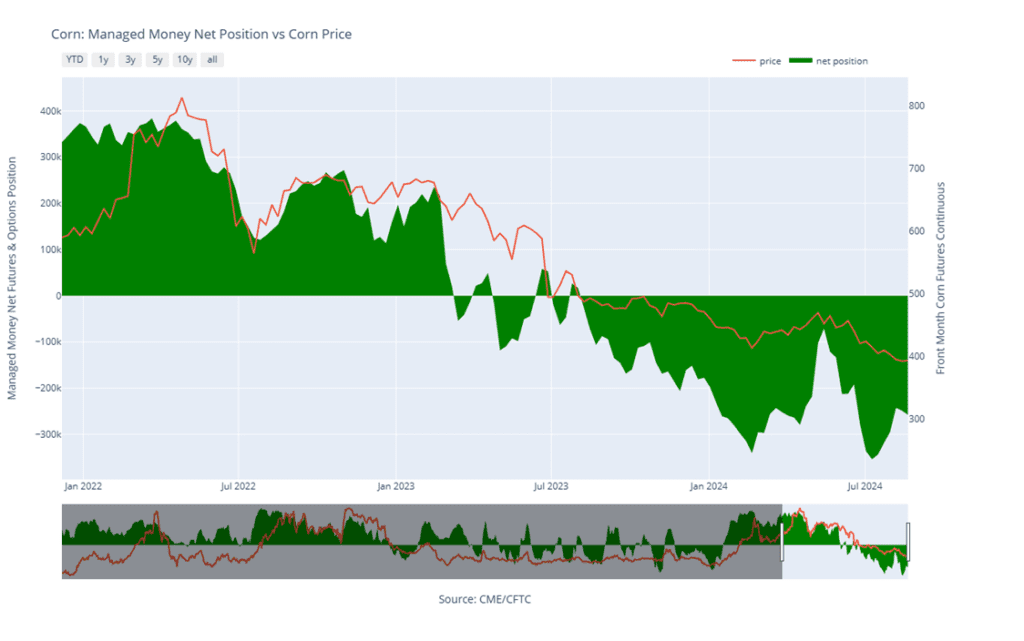

Farmer selling of old crop bushels ahead of the upcoming harvest has kept pressure on corn futures over the last month. Nearly ideal weather conditions for most during the months of July and August have only added more pressure. The corn market’s ability to close higher following a record yield estimate of 183.1 bpa by the USDA is a good sign showing corn buyers are finding value at these multi-year low levels. Any unexpected downward shift in anticipated supply or increase in demand could trigger managed funds to cover some of their extensive short positions and rally prices, however, an extended rally is unlikely before combines start rolling.

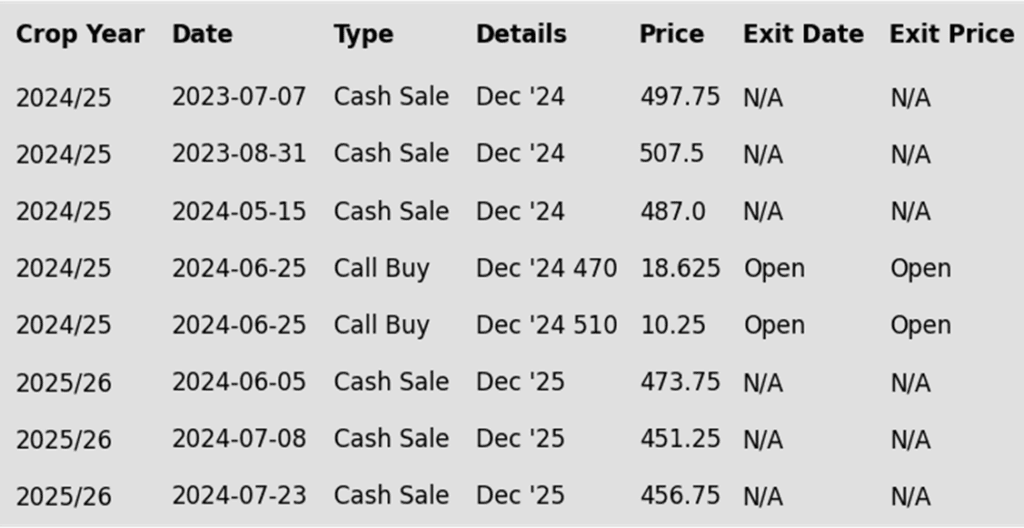

- No new action is recommended for 2024 corn. In June we recommended buying Dec ’24 470 and 510 calls after Dec ’24 closed below 451, for their relative value and because we are at that time of year of high volatility when markets can move swiftly. Moving forward, our current strategy is to target the value of 29 cents to exit the Dec ’24 470 calls. Exiting the 470 calls at 29 cents will allow you to lock in gains in case prices fall back and hold the remaining 510 calls at or near a net neutral cost, which should continue to protect existing sales and give you confidence to make further sales if the market rallies sharply. Additionally, should a contra-seasonal rally occur considering the large net short managed fund position, we continue to target the 470 – 490 area to recommend making additional sales versus Dec ’24.

- No new action is currently recommended for 2025 corn. Between early June and late July Grain Market Insider made three separate sales recommendations to get early sales made for next year’s crop. Considering the seasonal weakness of the market in late summer and early fall, we will not be looking to post any targeted areas for new sales until late fall or early winter. Although, we will look to protect current sales, in the form of buying call options, should the market begin to show signs of a potential extended rally.

- No Action is currently recommended for 2026 corn. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Despite some buying support in the soybean market, selling pressure remains in the corn market as September First Notice Day is on Friday this week, and producers are likely pricing September basis contracts. Most of those contracts will likely need to be priced or rolled out by the middle of the week.

- With the selling pressure, December corn printed a new contract low during the session, pushing through support levels established since early August. The weakened technical picture will keep the possibility of additional follow-through selling going into tomorrow’s session.

- Weekly corn export inspections were at the bottom end of trade expectations. Last week, US exporters shipped 35.2 mb (894,295mt). This brings YTD inspections to 2.009 billion bushels, up 39% from last year with the USDA targeting a 35% increase.

- The forecast for drier weather could have an impact on logistics in moving corn to the Gulf of Mexico ports. The corn market is concerned that Mississippi River levels in the Memphis area are dropping and could be at a stage where draft restrictions will be needed on barge traffic by Early September.

Above: The market’s break below 390 puts it at risk of trading lower towards the 372 support level. Should prices close below there, the next level of support could be found near 360. If a bullish catalyst triggers a market turnaround overhead resistance remains between 400 and 414 before they can move toward the 430 area.

Corn Managed Money Funds net position as of Tuesday, August 20. Net position in Green versus price in Red. Managers net sold 8,889 contracts between August 14 – 20, bringing their total position to a net short 257,896 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Soybeans Action Plan Summary

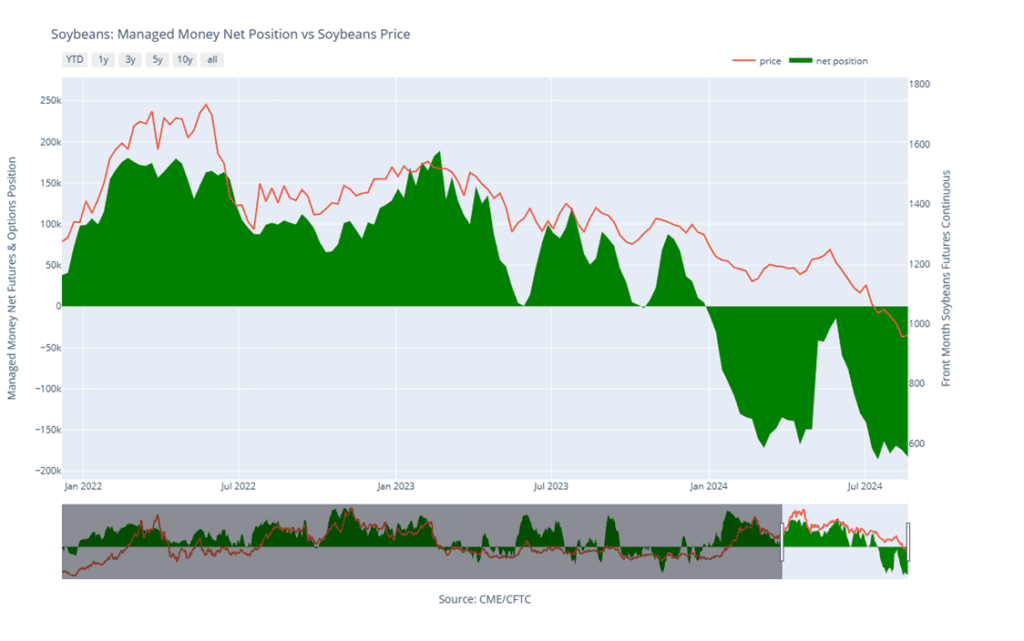

Since late May, the soybean market has stair-stepped its way lower on sluggish new crop demand, good growing weather, and the prospect of a large upcoming crop, while weather forecasts remain mostly favorable to the crop, and the trade may be factoring in higher yield estimates. The USDA pegging US soybean yield at a record with a million harvested acre jump on the August WASDE broke the market even further. The funds have yet to see a reason to cover some of their extensive short positions ahead of the quickly approaching harvest.

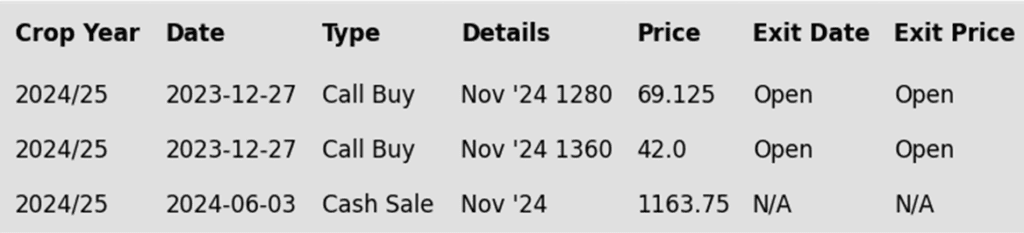

- No new action is recommended for the 2024 crop. At the end of December, we recommended buying Nov ’24 1280 and 1360 calls due to the amount of uncertainty in the 2024 soybean crop and to give you confidence to make sales and protect those sales in an extended rally. Given that the market has retreated since that time, we are targeting the 1040 – 1070 range versus Nov ’24 futures to exit 1/3 of the 1280 calls to help preserve equity. Additionally in June, the close below 1180 triggered our Plan B strategy, which recommended making additional sales due to the potential change in trend. Should a bullish catalyst enter the market to turn prices higher, we are targeting the 1090 – 1120 range from our Plan A strategy to make additional sales recommendations.

- No Action is currently recommended for 2025 Soybeans. To date, Grain Market Insider has not recommended any sales for next year’s soybean crop yet. First sales targets will probably be set in late fall or early winter at the earliest. Currently, our focus is on watching for opportunities to recommend buying call options. Should Nov ‘25 reach the upper 1100 range, the likelihood of an extended rally would increase, and we would recommend buying upside call options at that time in preparation for that possibility.

- No Action is currently recommended for 2026 Soybeans. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher to start the week but initially opened lower towards the bottom of their trading range. Soybeans have been consolidating for the past two weeks with the low end of the range in November at 955 and the high end at 985. Both soybean meal and oil ended the day higher with bean oil getting support from higher crude and palm oil.

- The Pro Farmer crop tour found solid soybean yield potential, that could put the crop in record territory. Estimates for the tour’s final soybean yield is 54.9 bpa, which if realized would be up from the USDA’s estimate of 53.2 bpa. Production was also estimated at 4.74 billion bushels, up from the USDA’s current projection of 4.589 billion.

- Today’s soybean export inspections came in at 15 million bushels, which was in line with analyst expectations and put year to date inspections at 1.624 billion, which is down 15% from last year. China picked up an estimated 3 million bushels of soybeans.

- Friday’s CFTC report showed funds as sellers of soybeans. They sold an additional 8,311 contracts which put them net short 182,758 contracts, near their record short position from mid-July of 185,750 contracts.

Above: Since the front month continuous chart rolled to the November contract on August 15, soybean futures have largely traded sideways. A breakout above 985 could push prices towards the 1005 – 1040 resistance area. To the downside, a break below 950 puts the market at risk of sliding down to the 915 – 900 support area.

Soybean Managed Money Funds net position as of Tuesday, August 20. Net position in Green versus price in Red. Money Managers net sold 8,311 contracts between August 14 – 20, bringing their total position to a net short 182,758 contracts.

Wheat

Market Notes: Wheat

- Wheat ended the session with mixed results: Chicago and Minneapolis saw losses, while Kansas City posted gains. Bull spreading was observed in Kansas City contracts, likely due to fund profit-taking after this class hit new contract lows during the session. Additionally, spot month Chicago futures fell below five dollars for the first time in four years.

- US wheat export inspections totaled 20 million bushels, hitting the upper end of expectations. Year-to-date inspections now stand at 189 mb, which is a 28% increase from last year and exceeds the USDA’s projected 15% increase for the year.

- Russia’s wheat export values ended last week at $216 per metric ton, according to IKAR, marking a two-dollar decline from the previous week. Additionally, SovEcon reported that Russia exported 1.16 mmt of grain last week, with wheat accounting for 980,000 mt of that total.

- The European Union’s Monitoring Agricultural Resources unit has lowered its estimate for EU soft wheat yields to 6.68 mt per hectare, down from 5.87 mt per hectare last month. This adjustment is largely due to concerns over both the quantity and quality of crops in France and Germany. Despite the French wheat harvest now being 100% complete and the poor crop conditions, Paris milling wheat futures hit another new contract low today.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

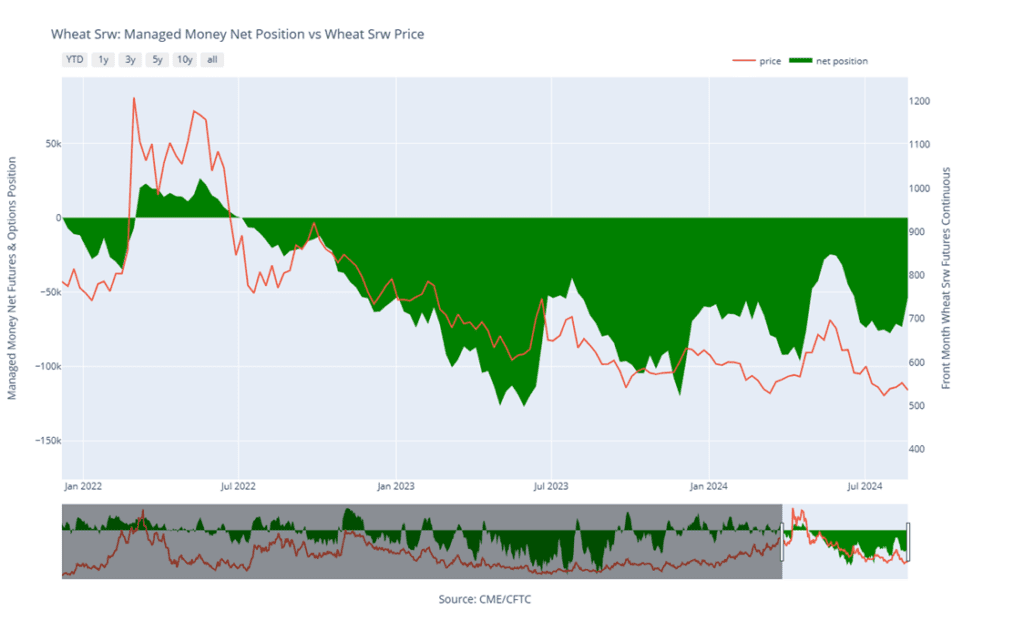

Chicago Wheat Action Plan Summary

Since mid-July, the wheat market has mostly drifted sideways as the trade tries to balance smaller US and global supplies against cheaper world export prices. During this period, a potential seasonal low was also marked on July 29th as managed funds maintained a sizable net short position in Chicago wheat. While slow global import demand and low Russian export prices continue to exert pressure on the market, any increase in US demand due to smaller crops in Europe and the Black Sea region could trigger a short-covering rally by managed funds.

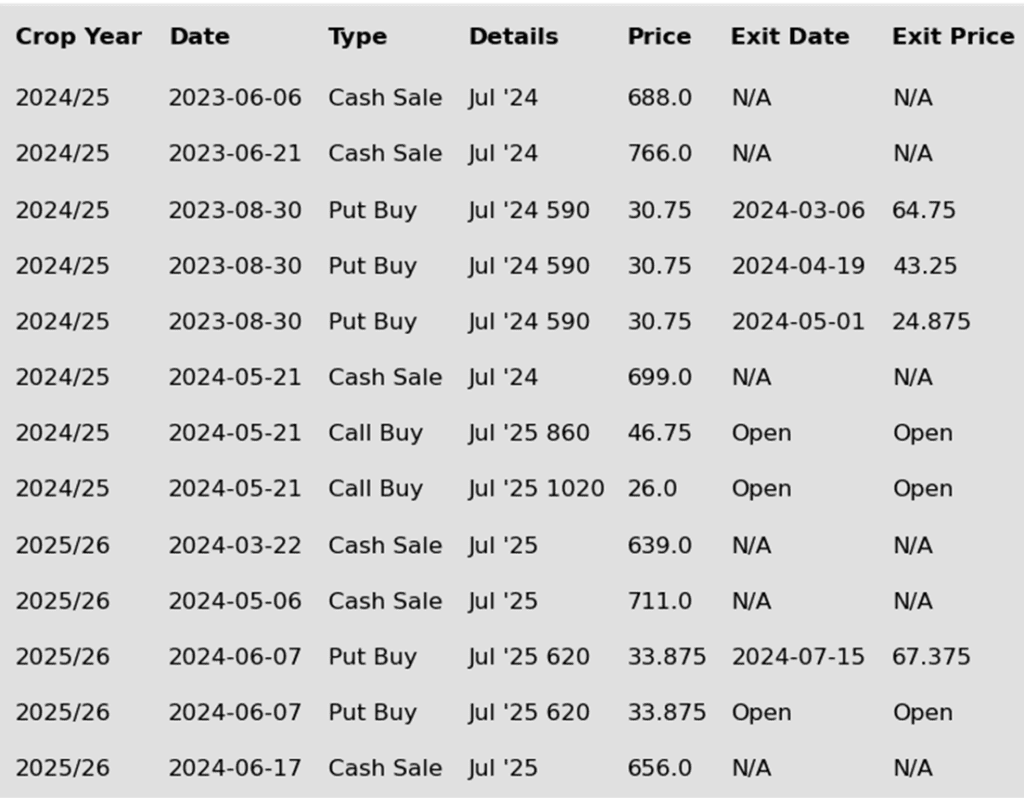

- No new action is recommended for 2024 Chicago wheat. Considering the recent rally in wheat, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 740 – 760 versus Sept ’24 to recommend further sales and to target a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 Chicago Wheat. Our most recent recommendation was to exit half of the previously recommended July ’25 Chicago 620 puts once they reached 67 cents (approximately double their original cost), to lock in gains in case the market rallies back. Moving forward, our strategy is to hold the remaining July ’25 620 puts at, or near, a net neutral cost to maintain downside coverage for any unsold bushels, while also targeting the 590 – 610 range to recommend making additional sales.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

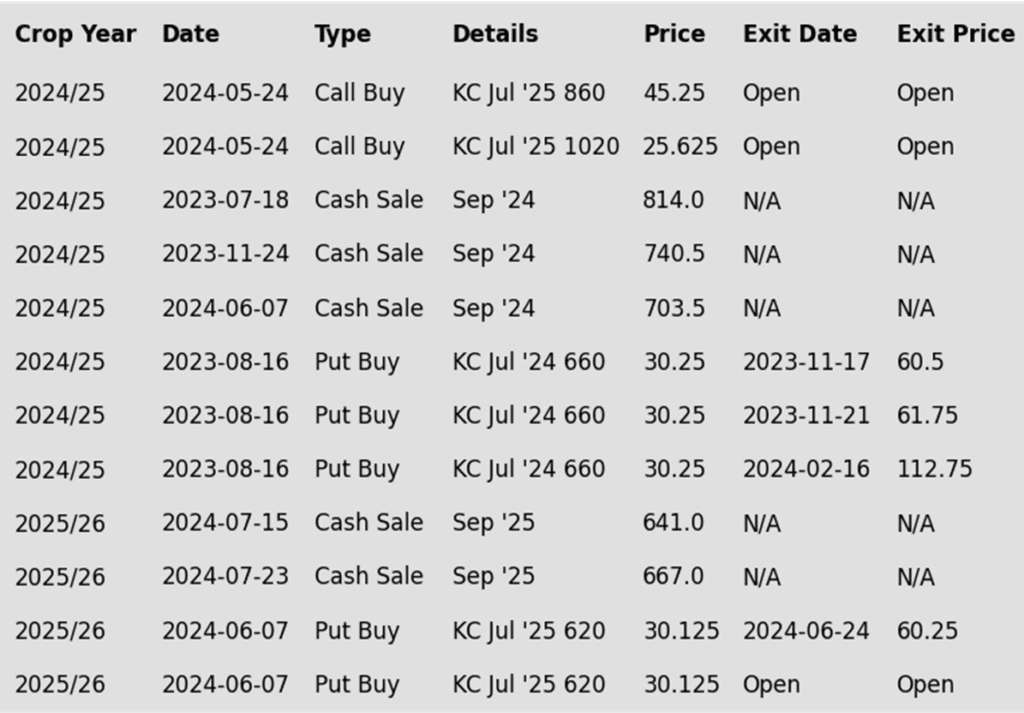

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Breaking the initial support at 537 puts December Chicago wheat at risk of dropping toward the July low of 514 ¼. However, the market may find support between 524 and 514 ¼ allowing it to stabilize. On the upside, resistance remains around the 50-day moving average; a rally above this level could push prices toward the 570–590 range.

Chicago Wheat Managed Money Funds net position as of Tuesday, August 20. Net position in Green versus price in Red. Money Managers net bought 20,303 contracts between August 14 – 20, bringing their total position to a net short 52,985 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

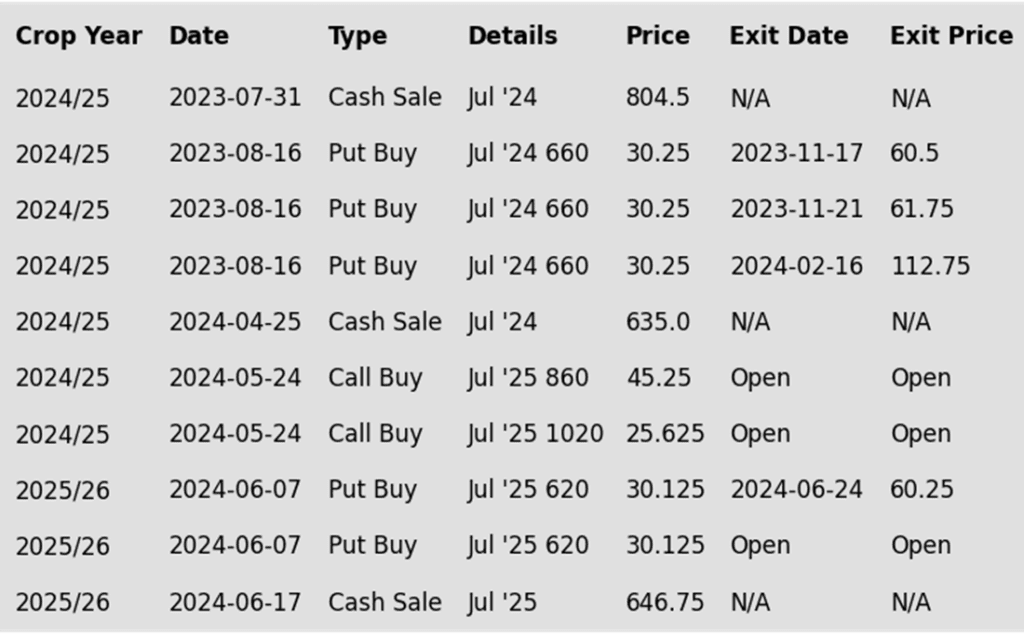

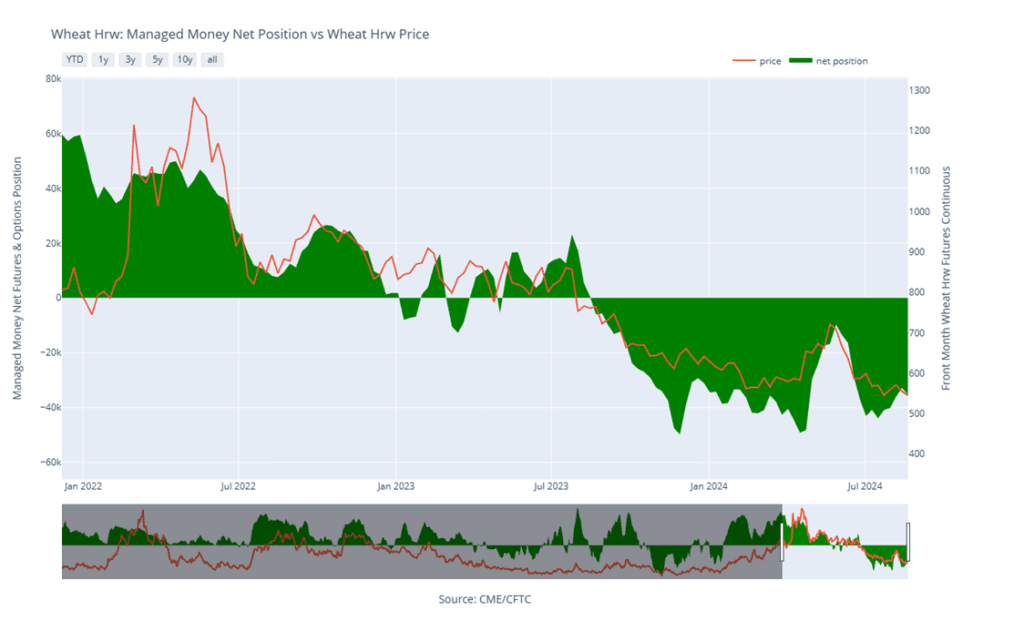

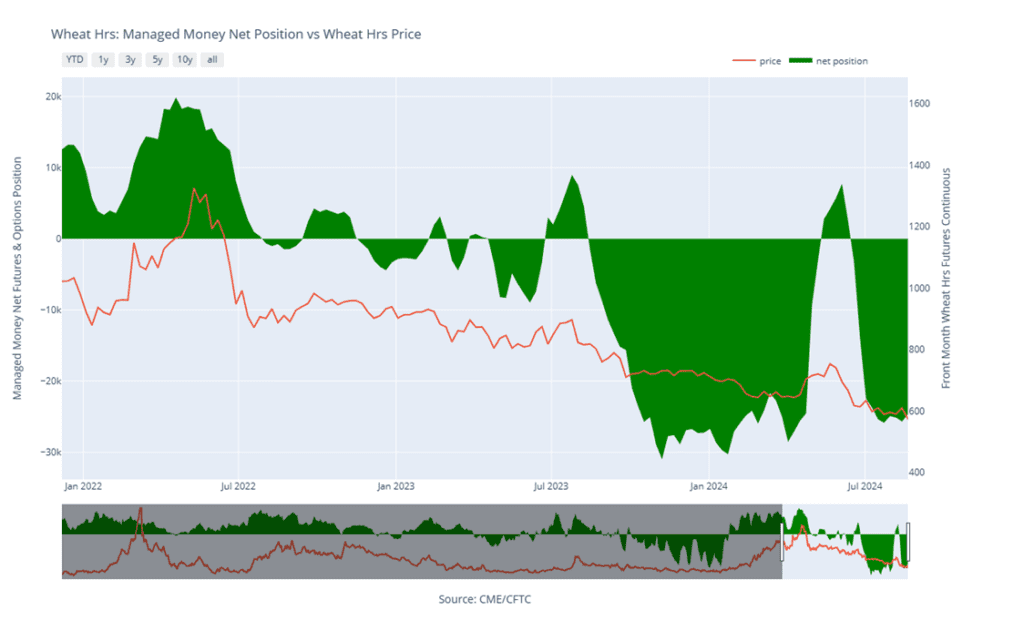

KC Wheat Action Plan Summary

Since mid-July, the wheat market has mostly drifted sideways as the trade tries to balance smaller US and global wheat supplies against cheaper world export prices. During this period, a potential seasonal low was also marked on the front month continuous charts as managed funds maintained a sizable net short position in the wheat markets. While low Black Sea export prices and slow world demand continue to weigh on US prices, the funds’ short position and oversold conditions could culminate in a short covering rally on any increase in US demand as world wheat ending stocks are expected to fall yet again this year.

- No new action is recommended for 2024 KC wheat. Considering the recent upside breakout in KC wheat, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 725 – 750 versus Sept ’24 to recommend further sales and to target a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. We recently recommended exiting half of the previously recommended July ’25 620 puts once they reached 60 cents (double the original approximate cost) to realize gains in case the market rallies back, while still holding the remaining 620 puts at, or near, a net neutral cost for continued downside coverage on any unsold bushels. Looking ahead, our strategy is to target the 640 – 670 range to recommend making additional sales.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following KC recommendations:

Above: The market appears to have found support near the 530 area in the December contract. Should this area hold and prices turn higher, overhead resistance could still be found near 565 and again between 573 and 580. A close below 527 could lead to a further slide towards 470.

KC Wheat Managed Money Funds net position as of Tuesday, August 20. Net position in Green versus price in Red. Money Managers net sold 2,495 contracts between August 14 – 20, bringing their total position to a net short 35,319 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Mpls Wheat Action Plan Summary

Since printing a near-term low in mid-July, Minneapolis wheat has trended mostly sideways as the market attempts to balance smaller US and world supplies versus lower world export prices and lower world demand. During this period, managed funds have maintained their sizable, short positions in Minneapolis wheat. Though low Russian export prices continue to keep a lid on US prices, smaller crops in Europe and the Black Sea region could increase US demand, potentially triggering a short-covering rally, especially as global wheat ending stocks are projected to decline again this year.

- No new action is recommended for 2024 Minneapolis wheat. With the recent close below the 712 support level, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we recently made two separate sales recommendations to get some early sales on the books for next year’s crop. While we will not be targeting any specific areas to make additional sales until later in the marketing year, we will continue to monitor the market for opportunities to exit the remaining July ’25 KC 620 puts that were recommended in June. To that end, should the market continue to be weak, we are currently targeting the upper 400 range to exit half of those remaining puts.

- No Action is currently recommended for the 2026 Minneapolis wheat crop. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted 2 years from now, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The breach of the 575 support area puts the market at risk of trading lower. Support below the market now could be found near 540, with further support near 520. Overhead resistance remains near the 50-day moving average and then in the 617 – 637 area.

Minneapolis Wheat Managed Money Funds net position as of Tuesday, August 20. Net position in Green versus price in Red. Money Managers net bought 1,049 contracts between August 14 – 20, bringing their total position to a net short 24,646 contracts.

Other Charts / Weather

5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.