8-26 End of Day: Soybeans Edge Higher on China Trade Hopes; Corn Slips on FND Pressure

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures slipped lower on Tuesday. Crop ratings remained strong as of Sunday coming in at 71% good-to-excellent.

- 🌱 Soybeans: Soybeans ended higher Tuesday. Support came from reports that China may send a top trade negotiator to the U.S.

- 🌾 Wheat: Wheat futures ended mixed. Support came from strong U.S. export inspections, but gains were capped by larger Russian crop estimates and favorable U.S. weather.

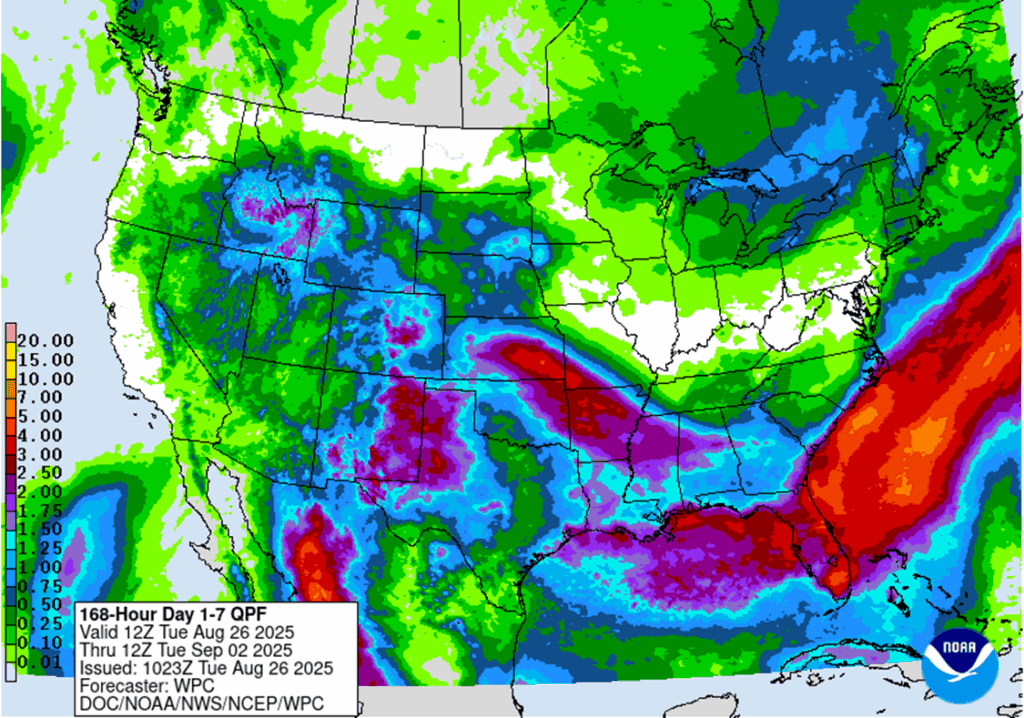

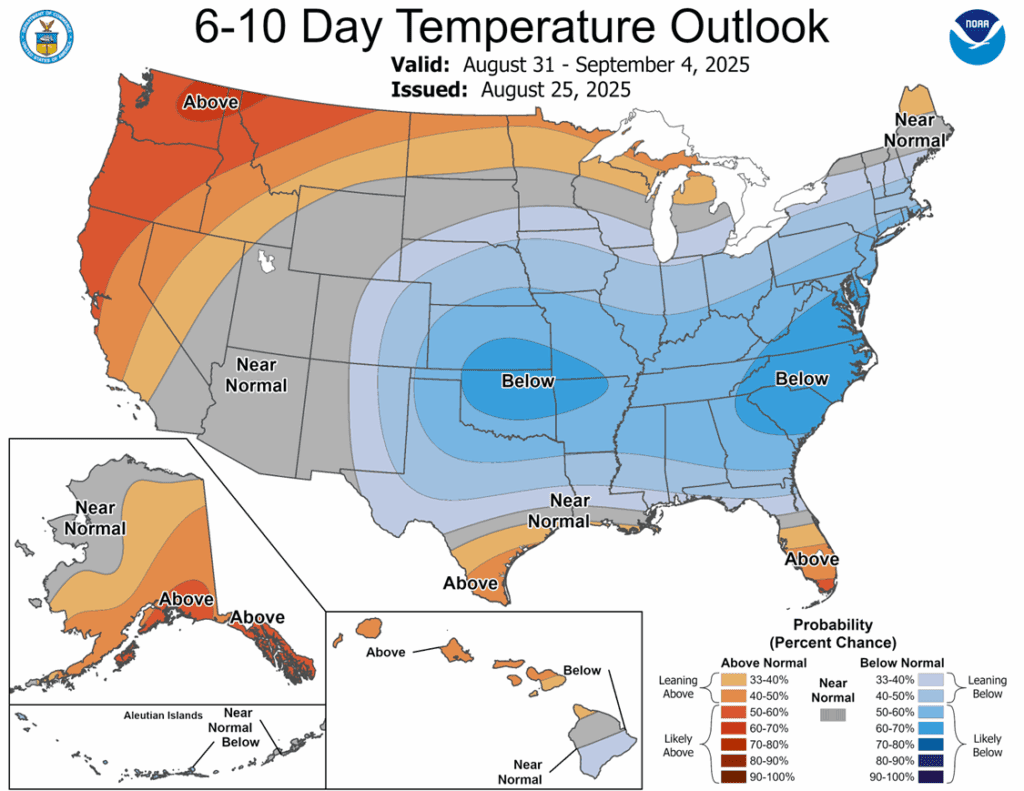

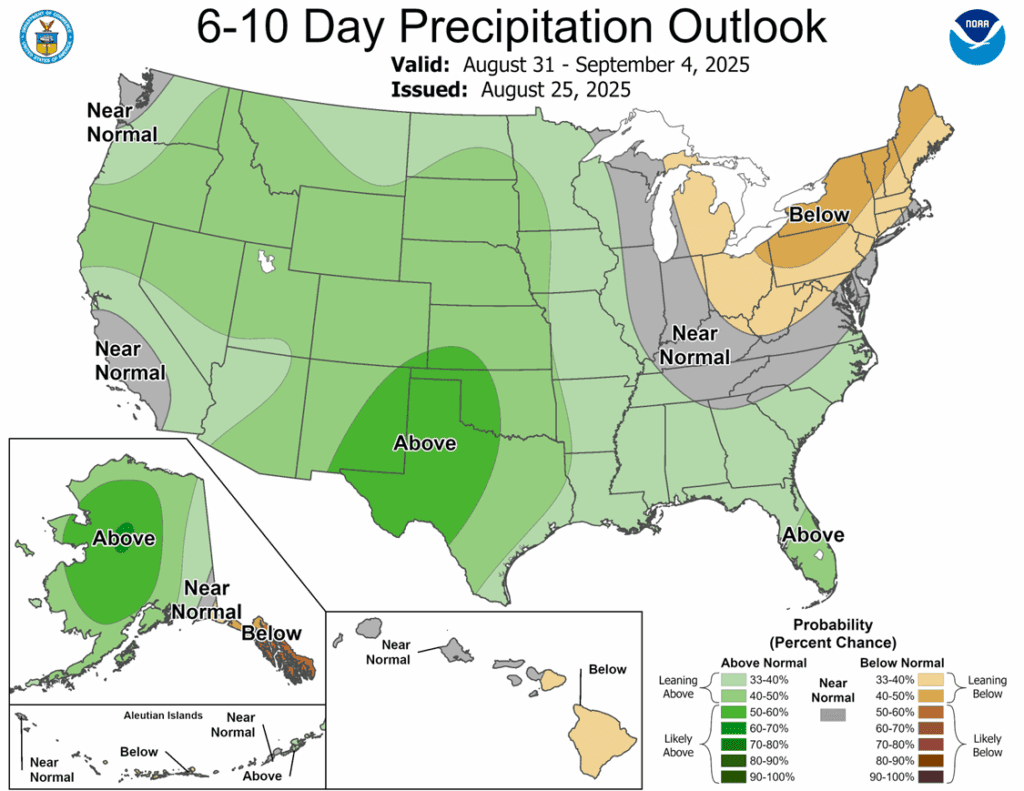

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

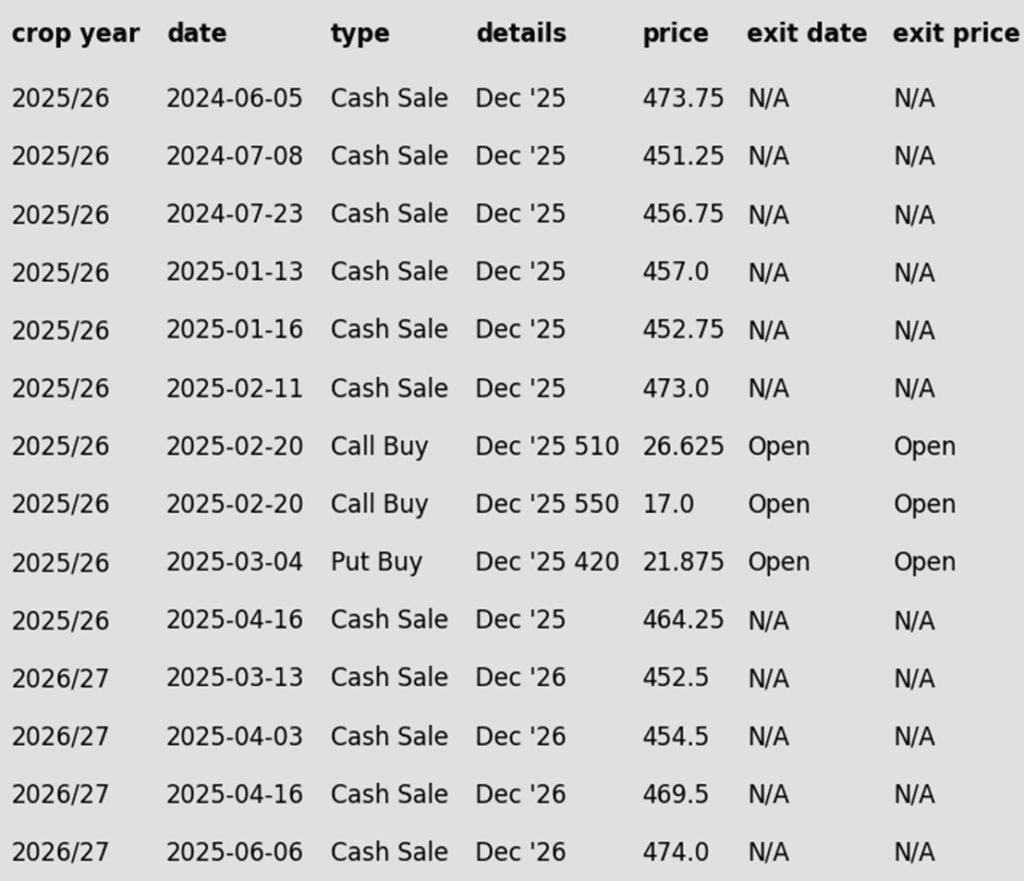

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

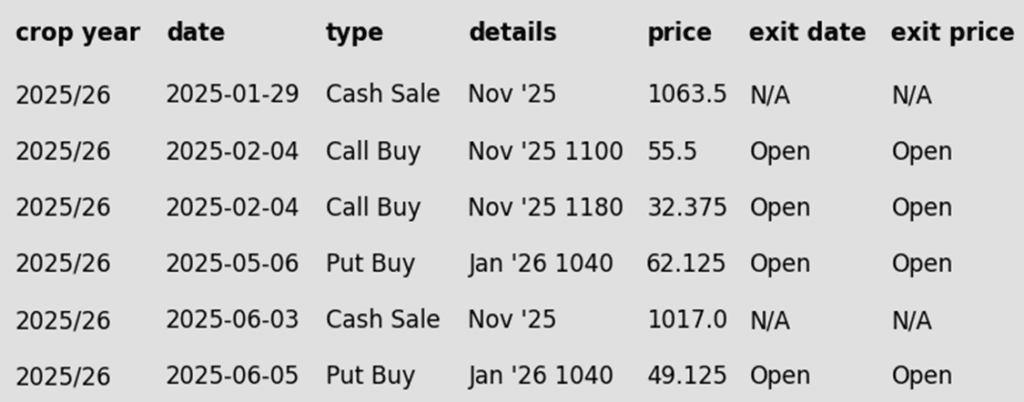

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures saw selling pressure as the influence of First Notice Day, and technical selling pressured the market. September corn futures finished 1 ¾ cent lower to 387 ¼, and December futures lost 2 ¾ cents.

- December failed to break resistance at 417 on Monday, sparking follow-through selling. Next support lies near 405, with the psychological 400 level below that.

- September contracts face added pressure ahead of Friday’s First Notice Day, as producers weigh pricing decisions on old-crop bushels.

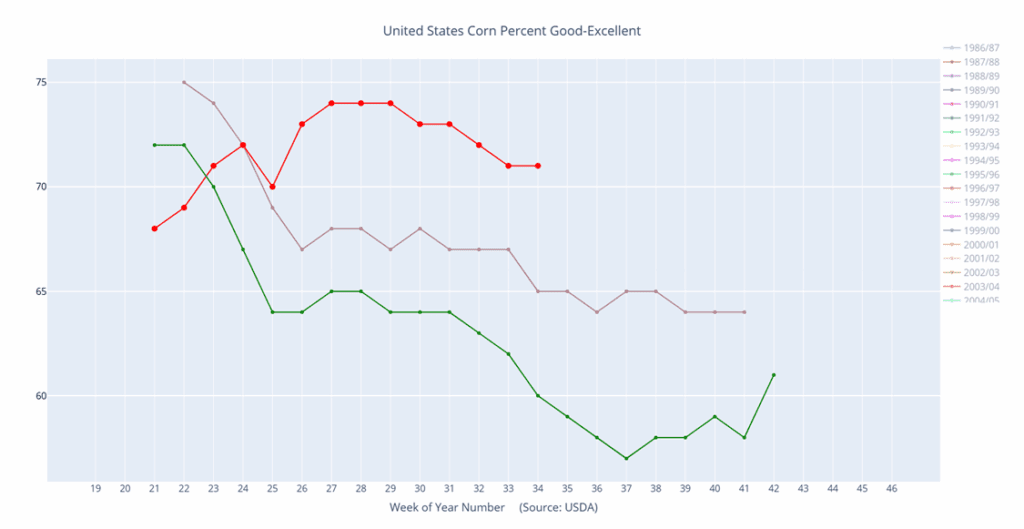

- Crop ratings remain strong at 71% good-to-excellent, a point above expectations. Progress is in line with averages at 44% dented and 7% mature.

- Brazil’s second corn harvest is 94.8% complete, up 5.5 points from last week. Farmer selling remains slow, with just over 50% of the record crop sold.

Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

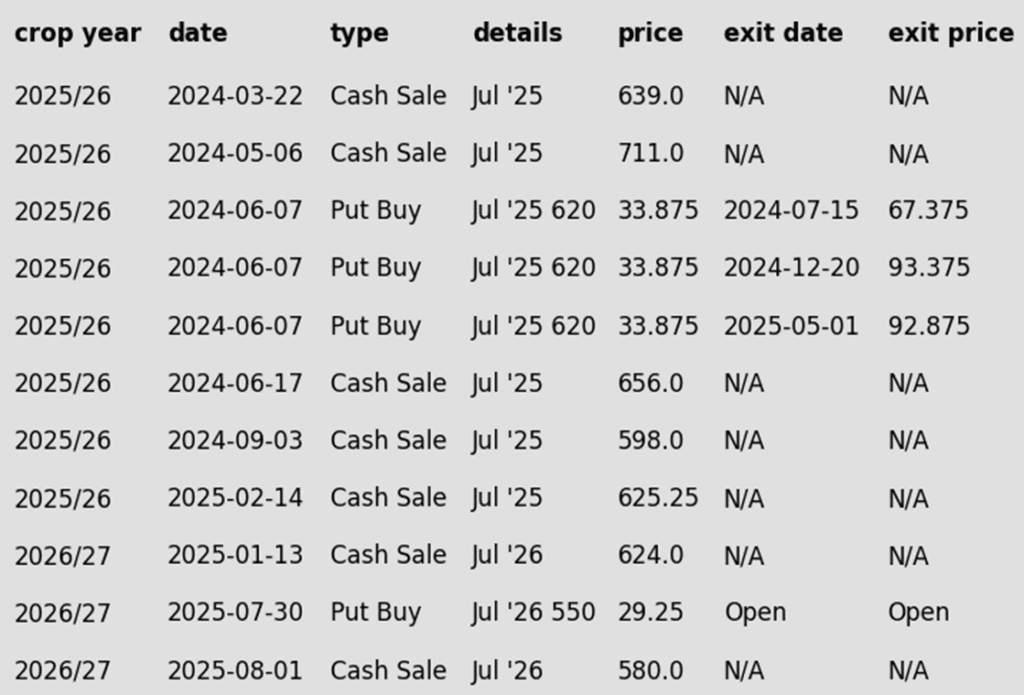

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher with the September contract up 3-1/4 cents at $10.28-3/4 while November was up 1-3/4 cents at $10.49-1/2. October meal gained $1.50 to $290.50, while October oil slipped 1.47 cents to 53.03. Support came from reports that China may send a top trade negotiator to the U.S.

- In what may be a sign of progressing trade talks between China and the U.S., China has said it would send a key trade negotiator to meet with U.S. officials and business leaders. This is not included in a formal negotiating session. Before making any commitments to purchase soybeans or Boeing planes, Beijing is demanding the removal of the 20% tariffs.

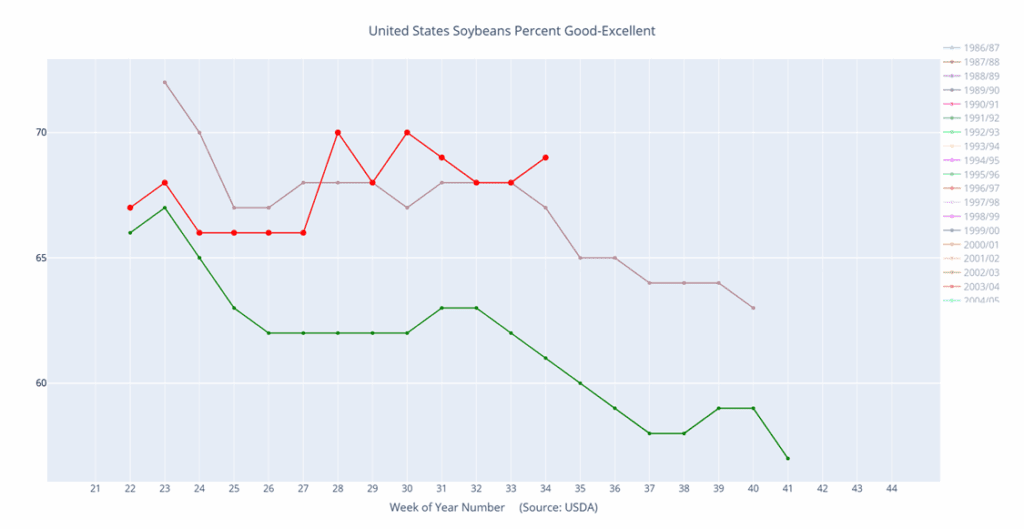

- Yesterday’s Crop Progress saw soybean ratings improve one point from last week to 69% good to excellent. 89% of the crop is setting pods which is on par with the 5-year average while 4% is dropping leaves. This is compared to 6% at this time last year and the 5-year average of 4%.

- Yesterday’s export inspections were sluggish at 383k tons, which compared to 503k a week ago and 420k a year ago. Top destinations were to Indonesia, Mexico, and Italy.

Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

Market Notes: Wheat

- Wheat futures ended mixed Tuesday. September Chicago gained 2-3/4 cents to 509-1/2, while Kansas City lost 3-3/4 cents to 493 and Minneapolis fell 5-3/4 cents to 565-3/4. Support came from strong U.S. export inspections at 34.8 mb — well above expectations and more than double the prior week — but gains were capped by larger Russian crop estimates and favorable U.S. weather.

- Storms rolling through the Southern Plains are bringing widespread rainfall ahead of winter wheat planting, pressuring Kansas City futures as the added moisture should give the crop a strong start.

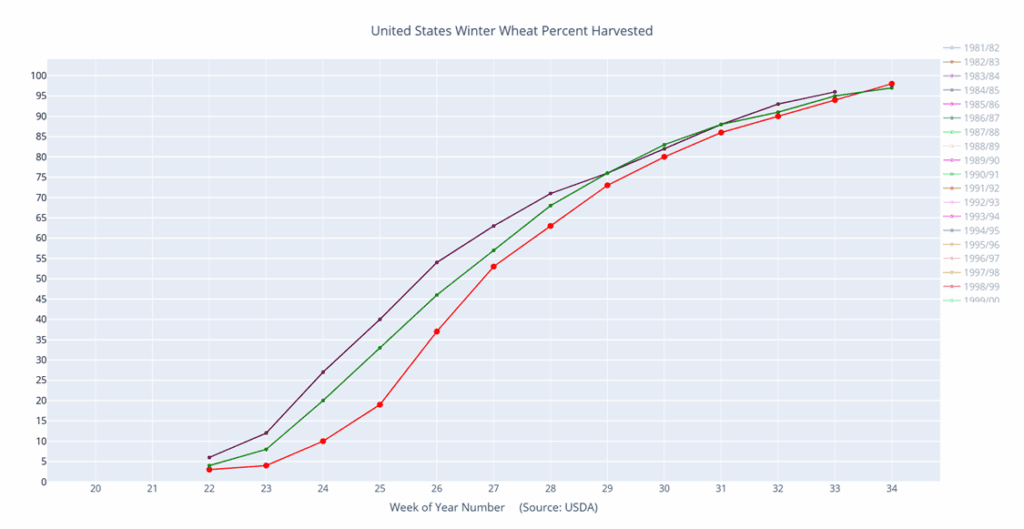

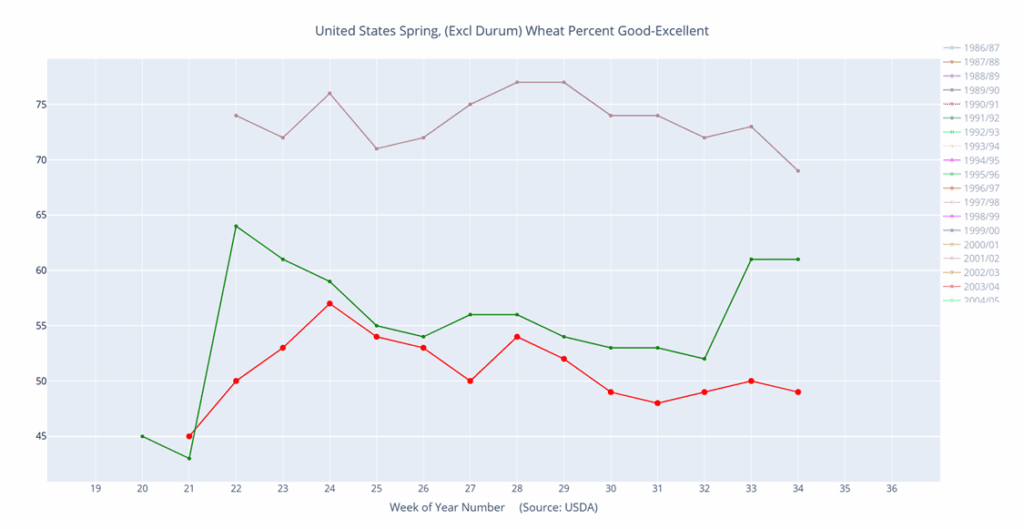

- According to yesterday afternoon’s crop progress report, the U.S. winter wheat crop is 98% harvested. As for the spring wheat crop, conditions dropped 1% from last week to 49% good to excellent. Additionally, that crop harvest jumped from 36% to 53% complete, which is now just 1% behind the average pace.

- IKAR has reportedly increased their estimate of Russian wheat production by 0.5 mmt to 86 mmt. For reference, the USDA figure is sitting at only 83.5 mmt. IKAR also raised their Russian wheat export projection by 0.5 mmt to 43 mmt.

- LSEG commodities research is predicting that more heavy rains for Argentine wheat regions will arrive by the end of the week. Totals could be 20-45 mm (about 3/4 to 1-3/4 inch) above normal, with a likelihood for higher amounts in the south. With soil moisture levels already adequate, this is raising some concern about root rot and other disease issues for their wheat crop.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 606.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

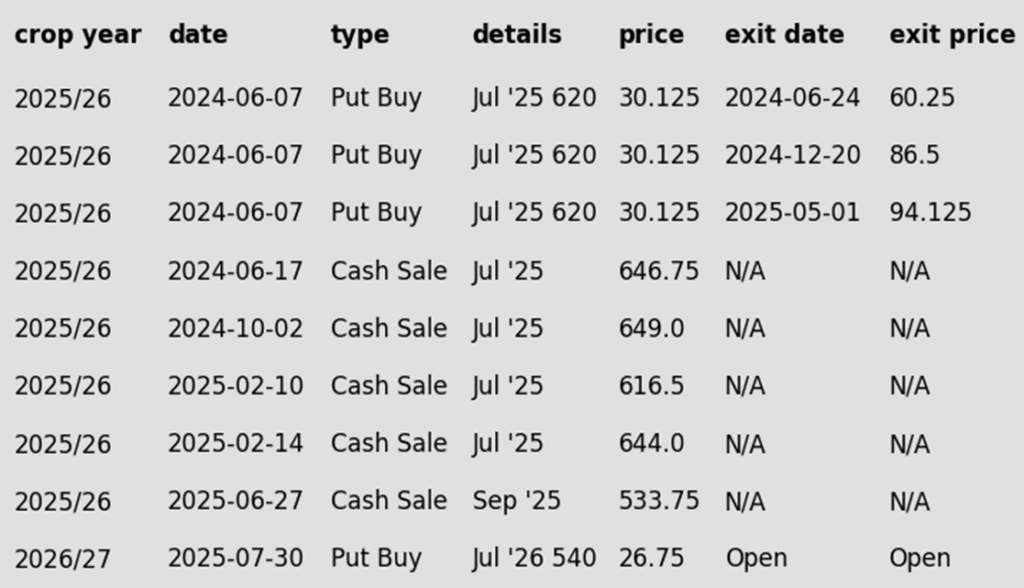

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 657 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 657 target has been lowered to 656.

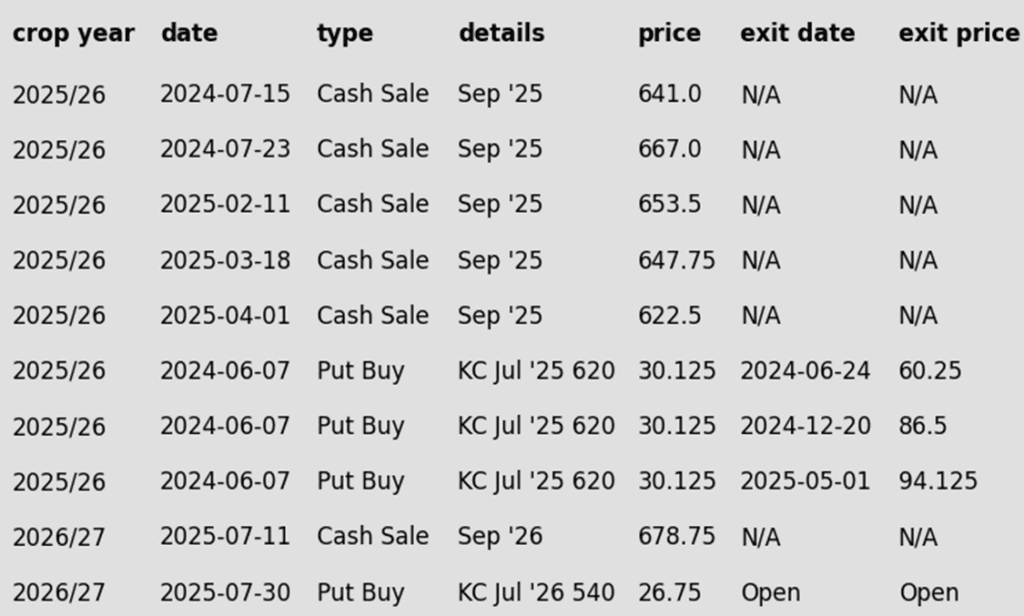

To date, Grain Market Insider has issued the following KC recommendations:

Winter wheat percent harvested (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Other Charts / Weather