8-25 End of Day: Soybeans Slip on Stalled China Trade Deal, Corn Ends Higher Monday

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures closed slightly higher Monday, supported by strength in wheat, expectations for tighter supplies, and a firm demand tone.

- 🌱 Soybeans: Soybeans closed lower Monday. Prices retreated from morning highs amid trade concerns over a stalled China deal.

- 🌾 Wheat: Wheat began the week mixed, with Chicago posting modest gains while Kansas City edged slightly lower

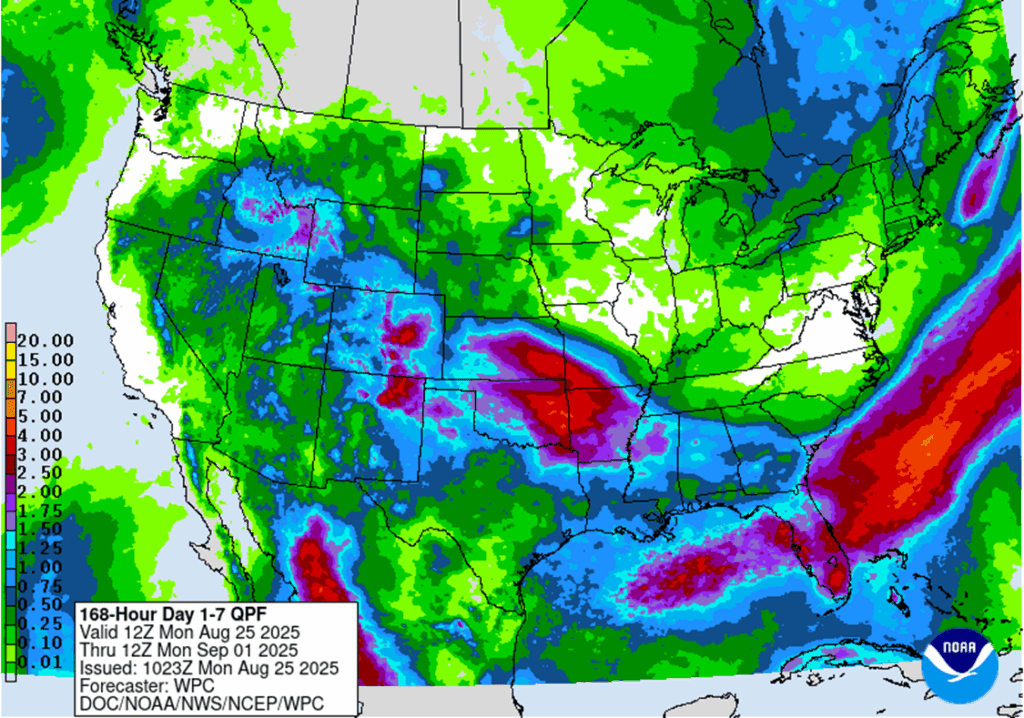

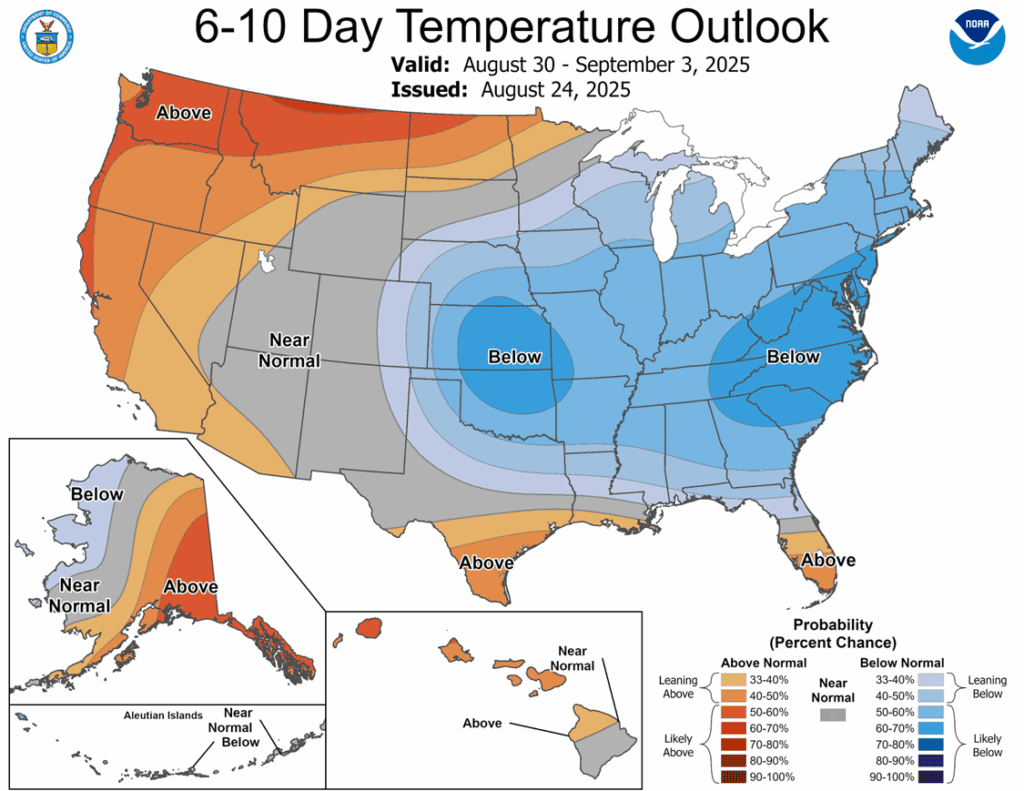

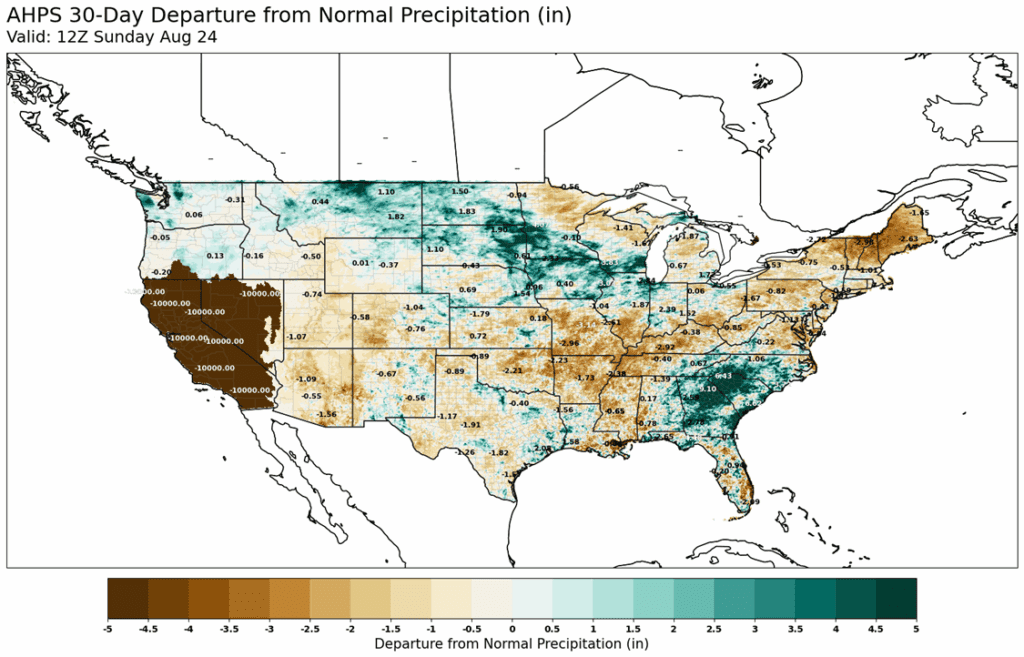

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished slightly higher on the session, supported by the wheat market, the prospects of a tighter supply and favorable demand tone. September corn finished 1 cent higher to 389 ½ and the December contract gained ¾ cent to 412 ¼.

- Pro Farmer pegged national corn yield at 182.7 bpa (range 180.9–184.5) on Friday afternoon, well below USDA’s 188.8 bpa forecast. The market is weighing a final outcome between the two, with shrinking crop potential and solid demand underpinning prices.

- Export inspections stayed strong, with 1.302 MMT shipped in the week ending Aug. 21 — near the high end of expectations and up 29% from last year. The marketing year closes Aug. 31.

- Concerns regarding fungus issues in the corn crop may push the crop toward the finish line faster than producers want, that could limit potential yield. Crop ratings and Maturity ratings on Monday’s crop progress report could reflect the impact.

- September futures will be moving towards first notice day on Friday this week. This could bring volatility and pressure to the September contract as producers may need to make pricing decisions regarding old crop bushels.

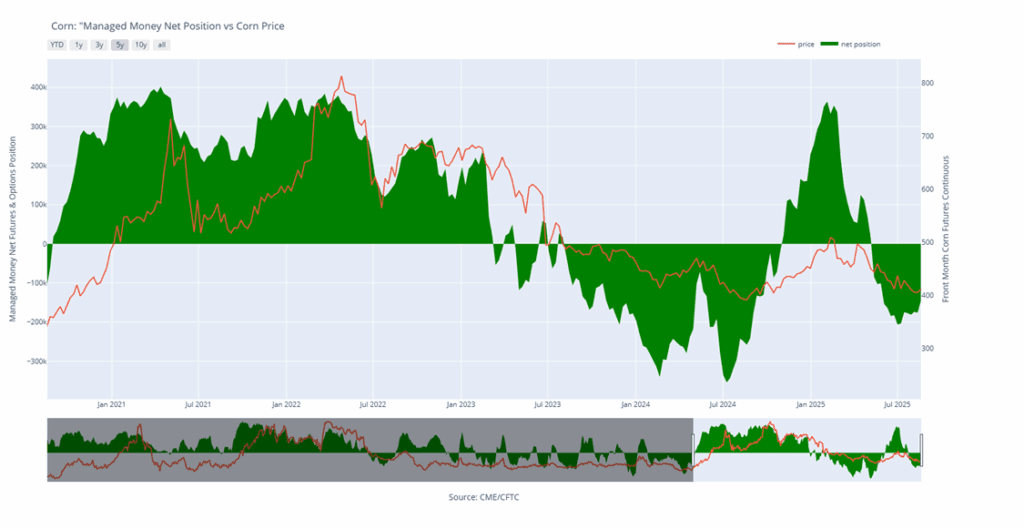

Corn Managed Money Funds net position as of Tuesday, August 19. Net position in Green versus price in Red. Money Managers net bought 31,464 contracts between August 12 – August 19, bringing their total position to a net short 144,650 contracts.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

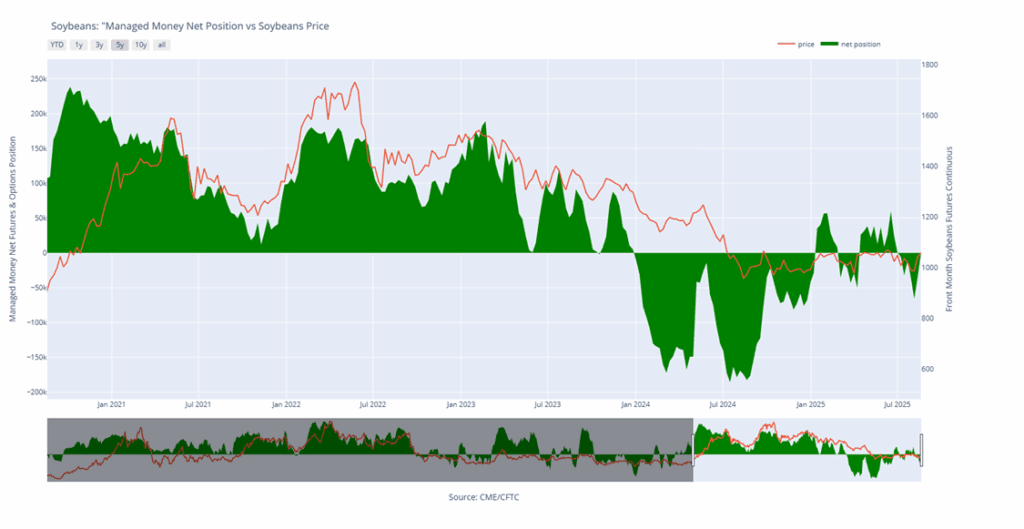

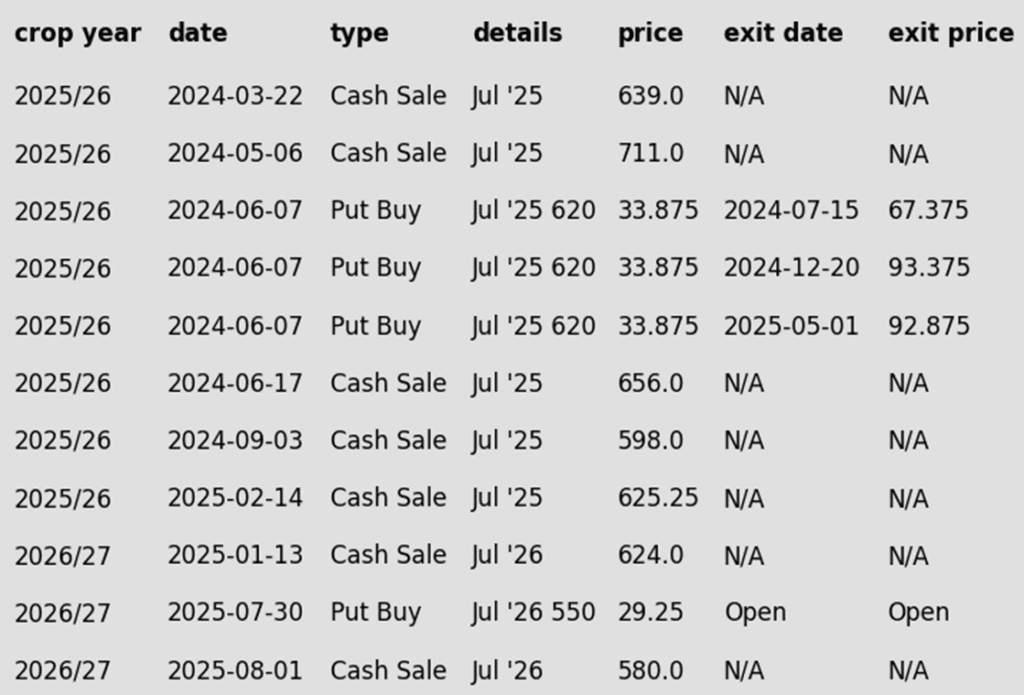

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower with the September contract down 11 cents at $10.25-1/2 and November down 10-3/4 cents at $10.47-3/4. October soybean meal was up $0.70 at $289 while October soybean oil was down 0.44 cents to 54.50 cents. Prices faded from earlier morning highs as trade worries about a lack of a Chinese trade deal.

- Comments from China over the weekend highlighted “rampant” U.S. protectionism threatening agricultural ties, fueling concern that a trade agreement may not materialize.

- Pro Farmer pegged the national soybean yield at 53.0 bpa, slightly below USDA’s 53.6 bpa estimate. Disease issues similar to those seen in corn were noted, which could support prices later if conditions worsen.

- Friday’s CFTC report saw funds as buyers of soybeans by 35,273 contracts which flipped their net short position to a net long position of just 3 contracts. They sold 13,070 contracts of bean oil leaving them long 31,342 contracts and bought back 24,070 contracts of meal leaving them short 85,239 contracts.

Soybean Managed Money Funds net position as of Tuesday, August 19. Net position in Green versus price in Red. Money Managers net bought 35,273 contracts between August 12 – August 19, bringing their total position to a net long 3 contracts.

Wheat

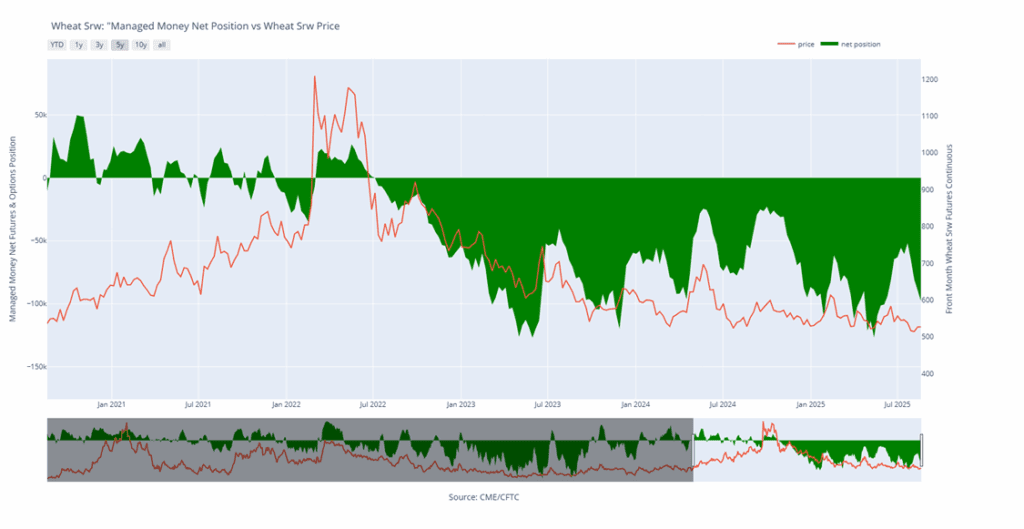

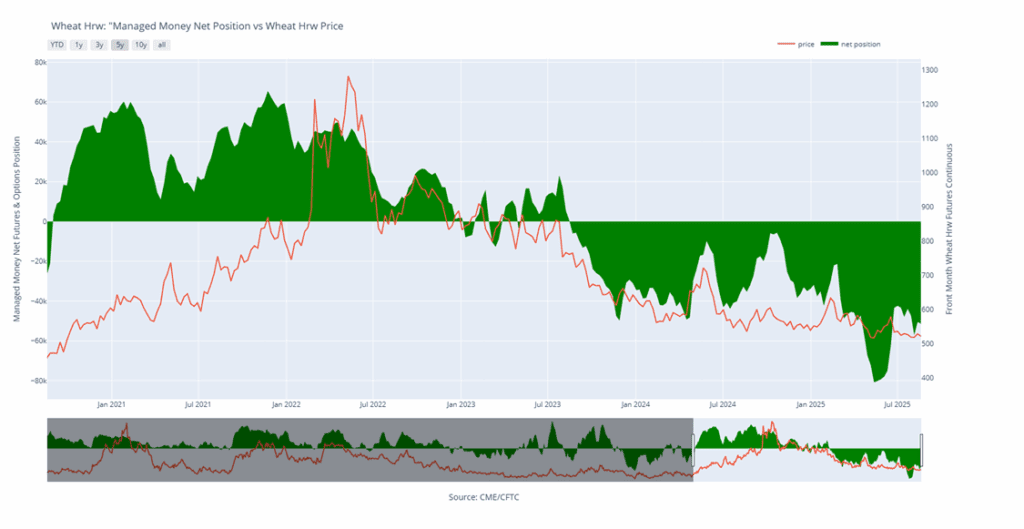

Market Notes: Wheat

- Wheat began the week with mixed performance. Chicago wheat posted modest gains, while Kansas City wheat ended the day slightly lower. The market found some support from last week’s decline in the U.S. dollar, as well as a somewhat encouraging weekly export inspections report.

- Weekly wheat inspections amounted to 34.8 mb, bringing total 25/26 inspections to 212 mb, which is up 11% from last year. Inspections are running a little bit above the USDA’s estimated pace; total exports for 25/26 are projected at 875 mb, up 10% from last year.

- In the southern hemisphere, Argentina saw some frost over the weekend in some wheat growing regions. This may have caused some wheat damage, and northern areas may see more frost in the coming days. Meanwhile, Australia saw heavy rains in western regions this weekend which should benefit their wheat. However, southeastern areas have been drier and need rain to help wheat that is in the reproductive stage.

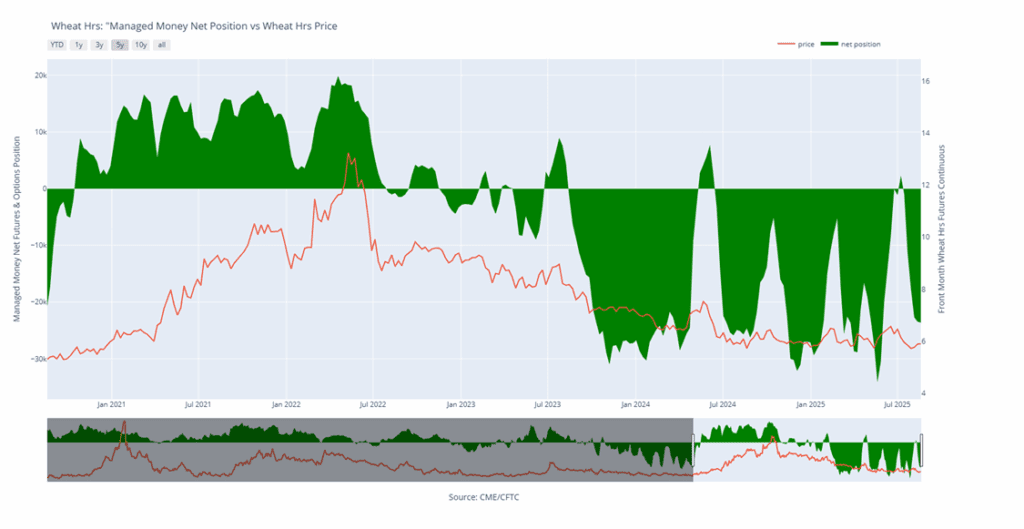

- According to Friday’s CFTC Commitments of Traders report, managed funds added about 8,800 contracts to their net short position in Chicago wheat. This was about a 10% increase, bringing the total number of shorts to just over 98,000. However, in Kansas City futures, they added only 825 short contracts, a change of just under 2% for the week.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 606.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Managed Money Funds’ net position as of Tuesday, August 19. Net position in Green versus price in Red. Money Managers net sold 8,837 contracts between August 12 – August 19, bringing their total position to a net short 98,132 contracts.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 657 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

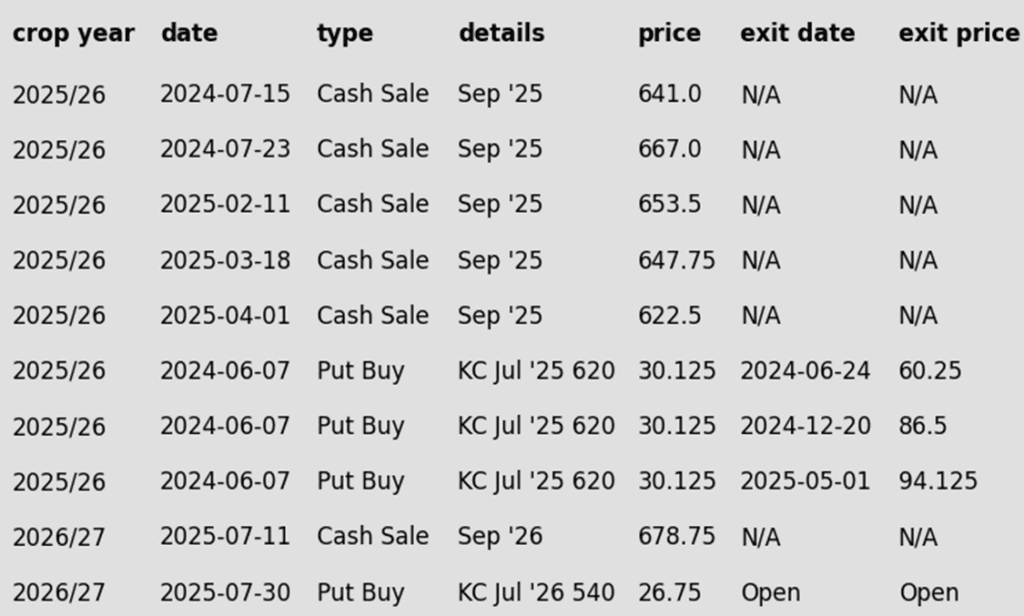

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Managed Money Funds’ net position as of Tuesday, August 19. Net position in Green versus price in Red. Money Managers net sold 825 contracts between August 12 – August 19, bringing their total position to a net short 51,380 contracts.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, August 19. Net position in Green versus price in Red. Money Managers net sold 161 contracts between August 12 – August 19, bringing their total position to a net short 23,619 contracts.

Other Charts / Weather