8-22 End of Day: Pro Farmer Estimates Corn Yield at 182.7 bpa, Soybean Yield at 53.0 bpa

We are excited to offer you a new way to follow the markets! While CME Group policy changes mean our daily updates will no longer show pricing data, you can now explore our interactive quote board, featuring up-to-date charts to help you track market trends.

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn trade ended the week quiet and mixed. Pro Farmer pegged national corn yield at 182.7 bpa, well below USDA’s 188.8 bpa forecast, in projections released Friday after the close.

- 🌱 Soybeans: Soybeans ended higher Friday but retreated from session highs. Pro Farmer projected the national soybean yield at 53.0 bpa, slightly below USDA’s latest estimate of 53.6 bpa.

- 🌾 Wheat: Wheat futures ended the week mixed, with winter wheat contracts lower while spring wheat finished fractionally higher. A sharp decline in the U.S. dollar provided little support to the complex.

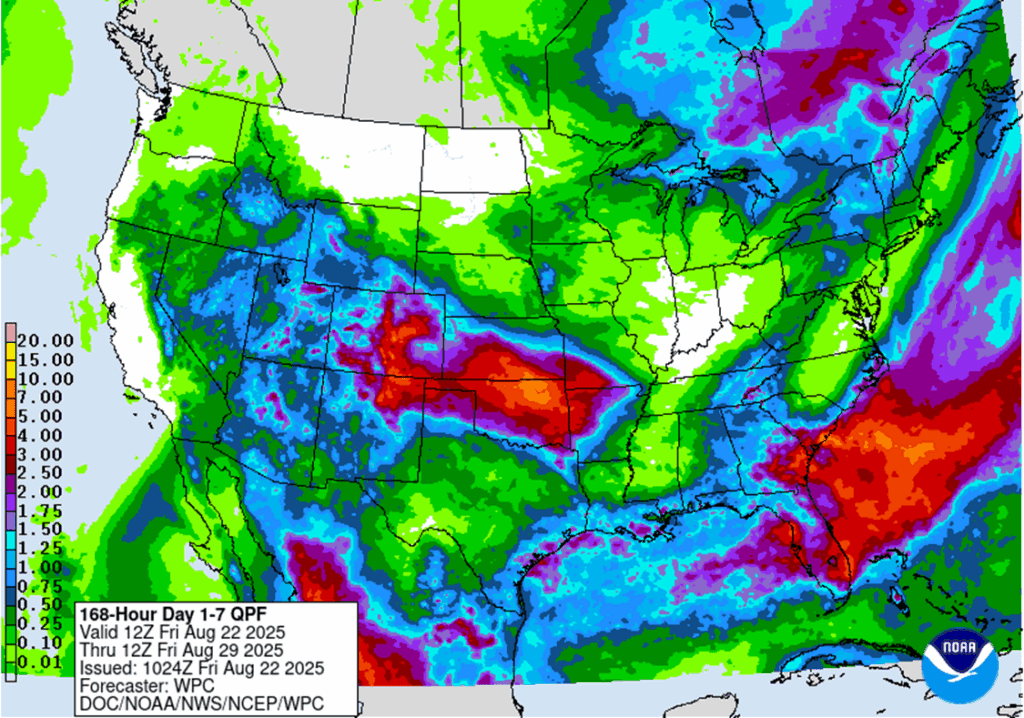

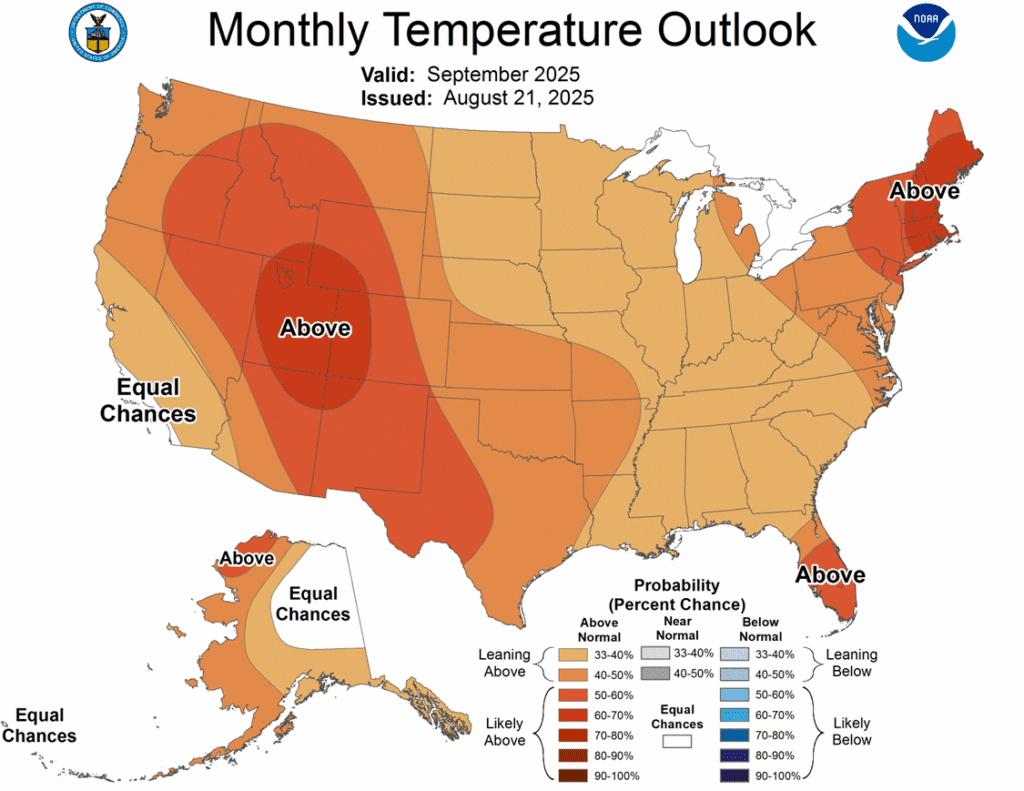

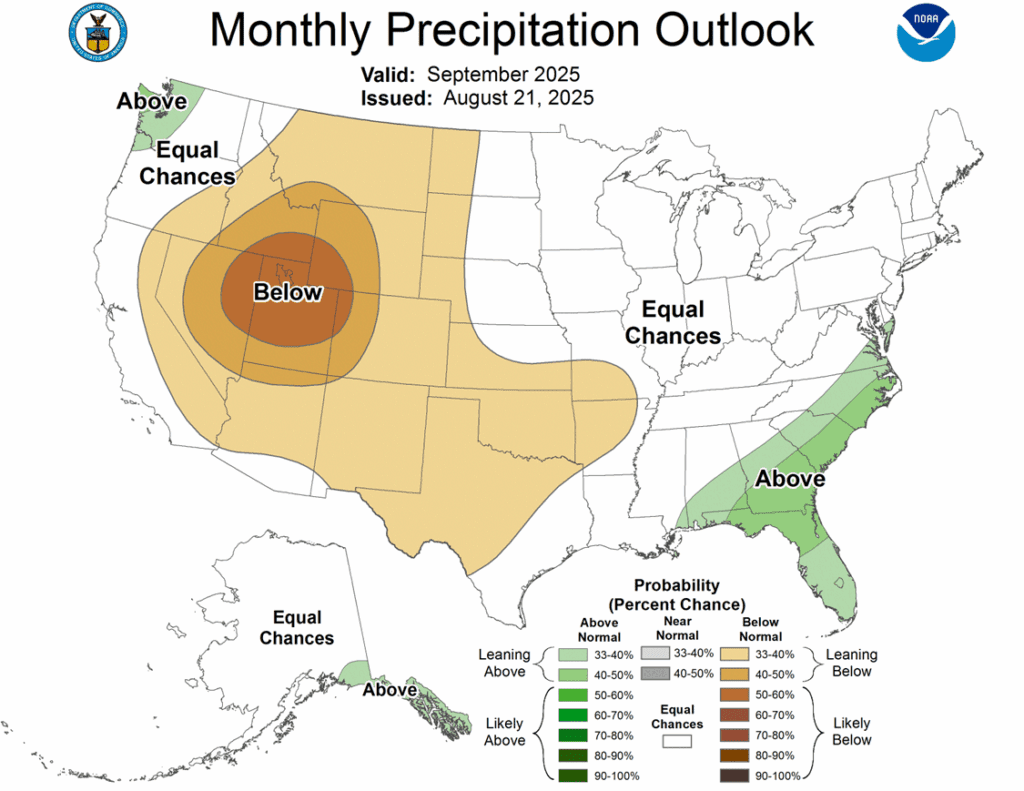

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn trade ended the week quiet and mixed. September gained 1 cent to 388 ¼, while December slipped ¼ cent to 411 ½. For the week, September added 4 ½ cents and December gained 6 ¼.

- USDA announced new flash sales Friday — Costa Rica purchased 119,796 MT (4.7 mb) and Spain 140,452 MT (5.5 mb) for 2025/26 — underscoring strong new-crop demand.

- Hot, dry weather across Europe is stressing crops as they approach maturity, raising yield concerns and potentially increasing EU import needs. France’s Ag Ministry projects national corn output 5.6% below last year on dryness and heat.

- Pro Farmer pegged national corn yield at 182.7 bpa (range 180.9–184.5), well below USDA’s 188.8 bpa forecast, in projections released Friday after the close.

- September futures saw options expiration today and will be moving towards first notice day next Friday. This could bring volatility and pressure to the September contract as producers may need to make pricing decisions regarding old crop bushels.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher but slid off their daily highs into the close. September futures gained 2 cents to close at $10.36-1/2, 4 cents off their high, while November futures gained 2-1/2 cents to $10.58-1/2, also 4 cents off their high. Soybean oil led the complex higher with a gain of 1.20 cents to 54.84 in September while meal lost $0.10 to $296.70. Rumors of unconfirmed Chinese purchases supported the market.

- The EPA issued decisions on 175 small refinery exemption petitions, granting 63 full waivers, 77 partial, and denying 28. The Renewable Fuels Association called the approach reasonable, and the outcome was viewed as supportive for soybean oil.

- Pro Farmer’s survey reported strong soybean pod counts across most states. All but Indiana were above last year, and all exceeded the three-year average. Iowa, Minnesota, Nebraska, and South Dakota were sharply above average, with Illinois leading at 1,479 pods per 3’x3’ plot.

- For the week, September soybeans gained 14-1/4 cents and between this and last week wiped out 5 prior consecutive weeks of losses. November soybeans gained 16 cents on the week, and September meal gained $13.30 while September bean oil gained 1.66 cents. Going forward, trade will look to a potential trade deal with China to establish whether this higher trend will continue.

Wheat

Market Notes: Wheat

- Wheat sustained small to modest losses today – September Chicago was down 2-1/4 cents to 504-3/4 while September Kansas City lost 5-1/4 cents to 498. Minneapolis MIAX futures fared slightly better with September up 1/4 cent at 569-1/2, though deferred contracts closed neutral to fractionally lower.

- A sharp U.S. Dollar drop following Fed Chair Powell’s speech offered little support, while lower Matif wheat added pressure. Traders remain focused on heavy rains forecast for the U.S. Southern Plains, expected to benefit winter wheat planting.

- The Russian agriculture ministry is reported to have re-established an export tax on wheat, at 32.1 Rubles/mt through September 2. Nevertheless, the recent price declines for U.S. wheat have made it much more competitive globally. U.S. HRW wheat is said to be at parity with offers from Russia and Argentina too.

- Ukraine has collected 27.25 mmt of grain so far this season, down 5% from the 28.6 mmt harvested during the same time last year. Wheat accounted for 21 mmt of that total versus 21.7 mmt last year. About half of the wheat is said to be milling quality, and 1.7 mmt of it is being earmarked for making bread.

- The Buenos Aires Grain Exchange has stated that recent rains across Argentina’s growing region has helped to boost soil moisture levels and benefit the wheat crop. This moisture should aid in the uptake of nutrients when farmers add fertilizer. Total 25/26 planted area reached 6.7 million hectares, up from 6.3 million last season.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

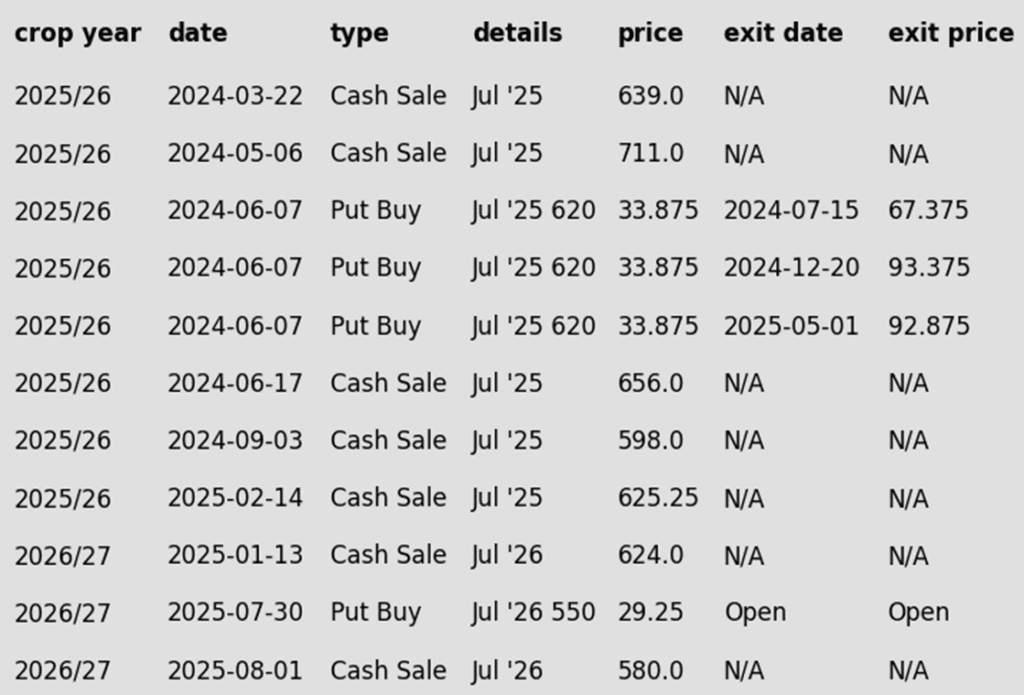

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 606.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 657 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

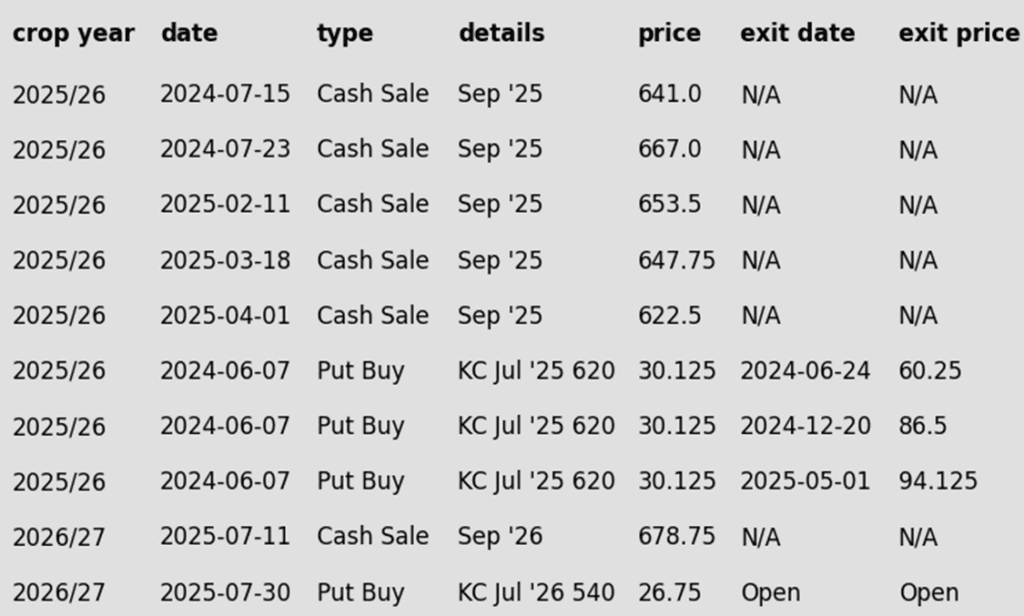

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Other Charts / Weather