8-21 End of Day: Positive Export Data Lifts Corn and Soybean Markets

We are excited to offer you a new way to follow the markets! While CME Group policy changes mean our daily updates will no longer show pricing data, you can now explore our interactive quote board, featuring up-to-date charts to help you track market trends.

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn markets ended the day with gains, driven by strong export demand.

- 🌱 Soybeans: Soybean markets finished today’s trade higher, supported by gains in the soybean oil market and a positive export sales report.

- 🌾 Wheat: Markets ended the day mixed, facing resistance from a stronger U.S. dollar and ongoing global harvest activity bringing new crop to market.

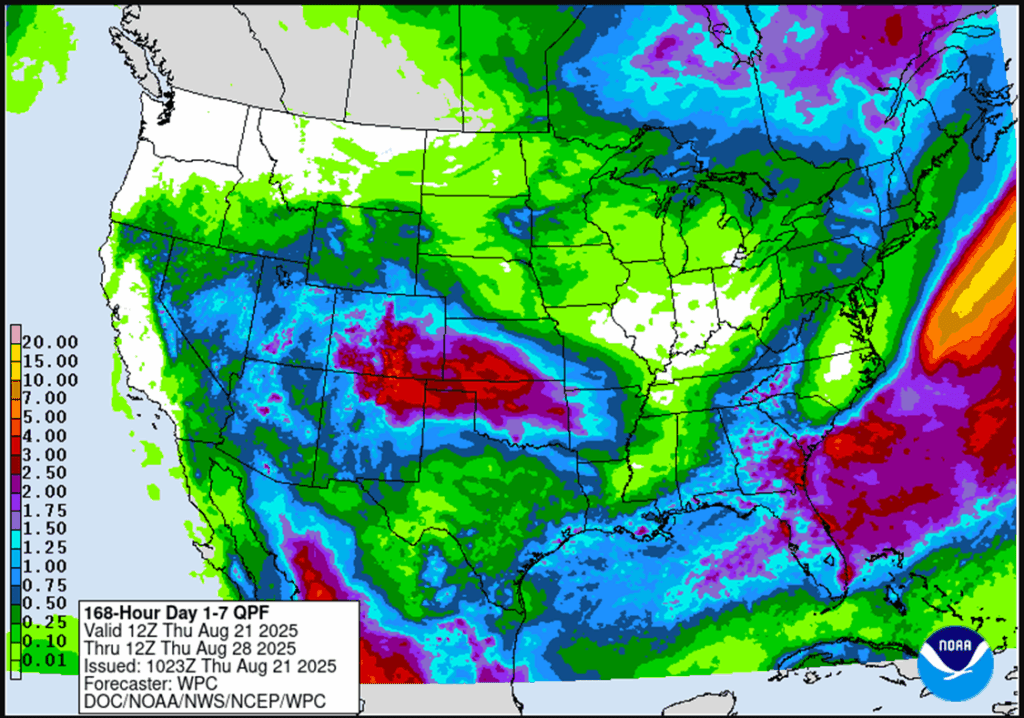

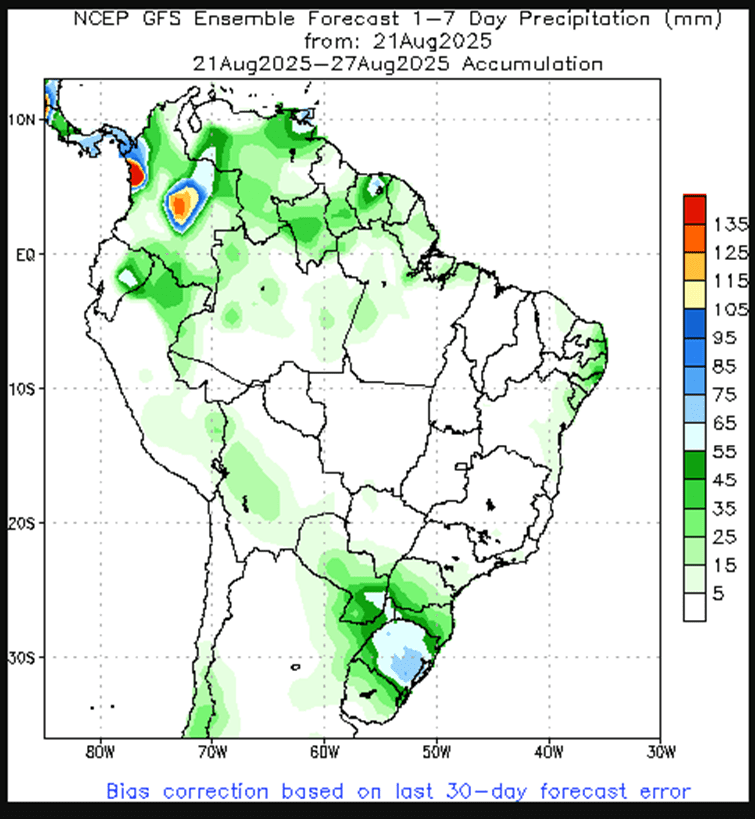

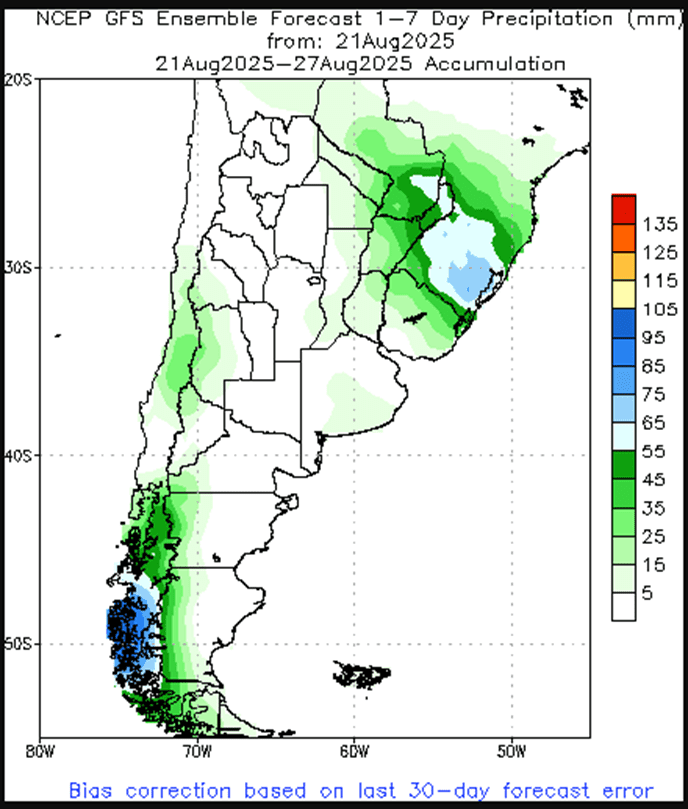

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

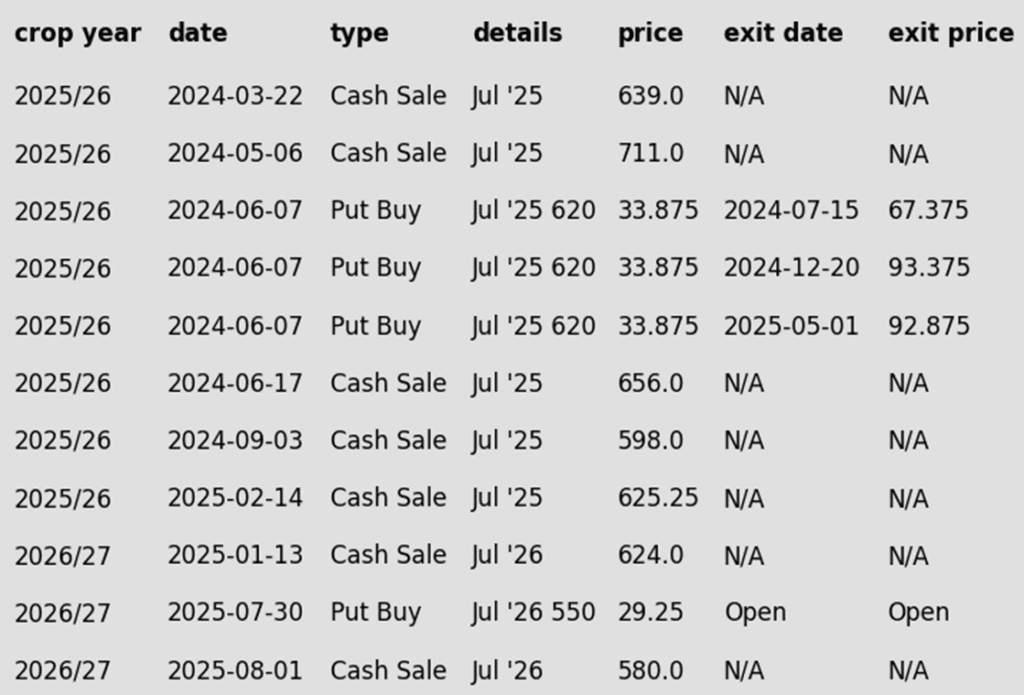

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures saw buying support, strong export demand, and technical buying supported the market today as Dec corn closed at its highest point in nearly three weeks. September closed 7 ¼ cents firmer at 387 ¼, while December gained 7 ¾ cents to 411 ¾.

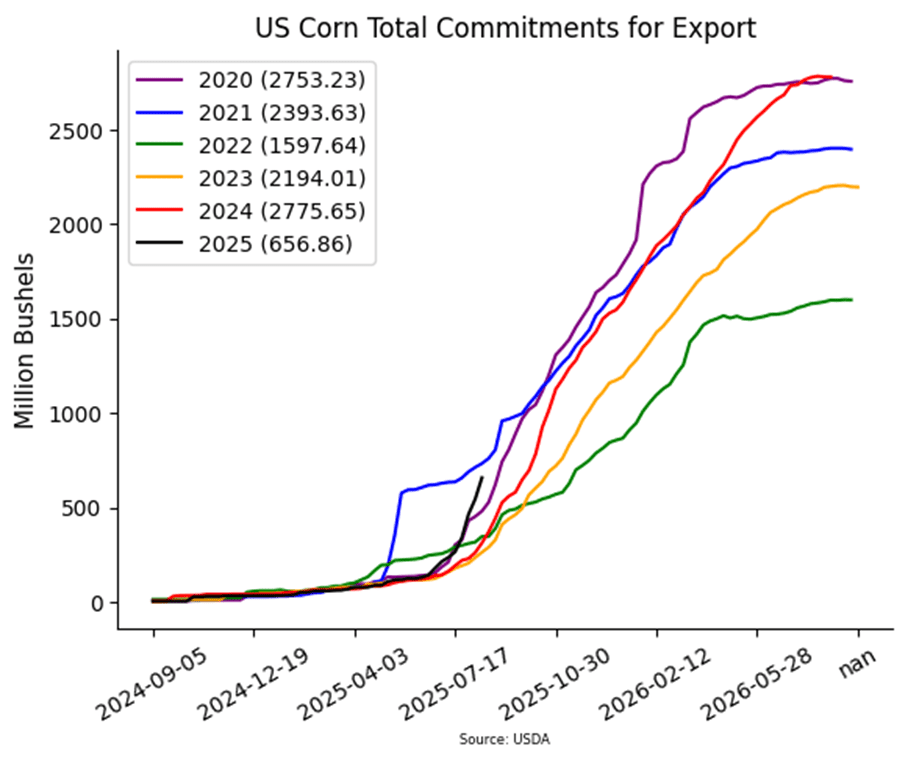

- USDA announced weekly exports sales on Thursday morning. For the week ending Aug 14, old crop corn sales saw reductions of 1.1 MMT, but new crop sales were an impressive 2.86 MMT (112.7 mb). Unknown destinations and Mexico were the largest buyers of US Corn last week.

- Total export sales for the new crop marketing year are 16.7 MMT (657 mb), which is up 111% over the pace last year and one of the strongest starts to the export program in the past 25 years. The current export total of 657 mb is 23% of the USDA target for the marketing year at 2.875 bb.

- The Trump administration/EPA are expected to rule on a backlog of Small Refinery Exceptions (SRE) on Friday. The ruling could impact the blends of biofuels in consumer diesel and gasoline. If SRE’s are approved, the corn market may be impacted by a potentially less ethanol requirement. The potential ruling likely supported the corn and soybean markets on the session with short covering.

- Pro Farmer will be completing its crop tour this afternoon and will release results for Iowa and Minnesota this evening. The Pro farmer group will release its corn and soybean yield estimates on Friday after the market closes.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- The soybean markets ended higher on Thursday as the September contract gained 19 ¼ cents to $10.34 ½ and November Futures pushed 20 cents higher to close at $10.56. The soybean oil market was a big support to soybeans on the session as the nearby Sept futures gained $2.44/lb on the session, closing at $53.64. Soymeal futures slipped on spread trading with October meal down 1.10/ton to $290/ton..

- In Illinois, the crop tour found soybean pod counts at 1,479.22 per 3’x3′ plot which compared to 1,419.11. Illinois soybeans may be weaker than initially thought. Western Iowa pod counts were better than last year between 1,279.25 in the Northwest and 1,562.54 in the Southwest.

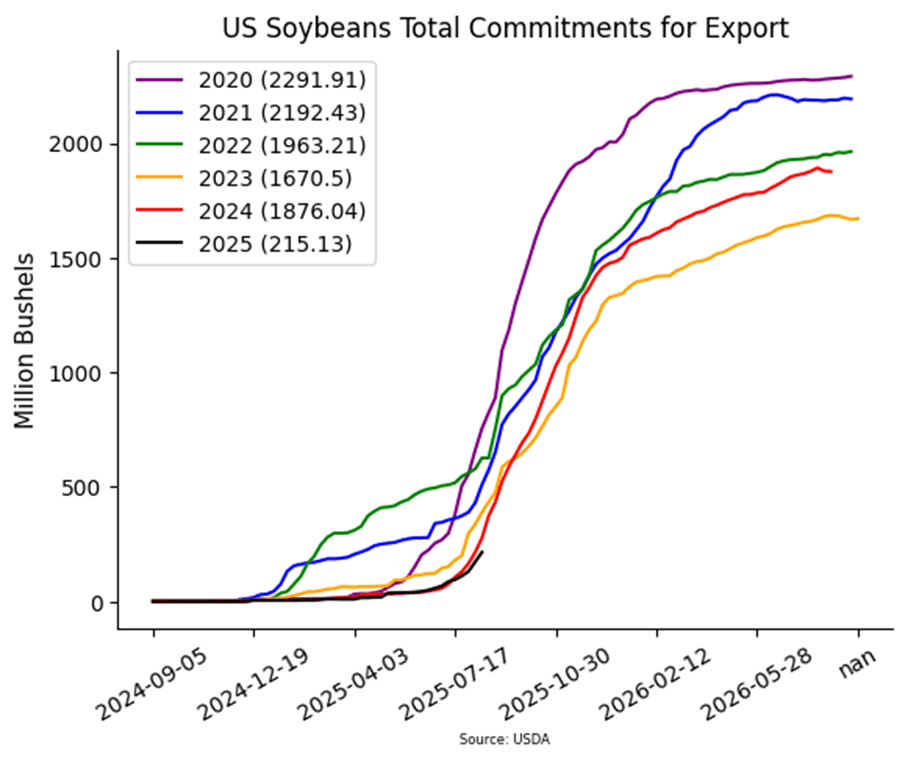

- Today’s export sales report was relatively good for soybeans with net sales reductions of 6k tons for the 24/25 marketing year and an increase of 1,143k tons for the 25/26 marketing year, which was above most trade estimates.

- The Trump administration/EPA are expected to rule on a backlog of Small Refinery Exceptions (SRE) on Friday. The ruling could impact the blends of biofuels in consumer diesel and gasoline. The potential ruling likely supported the soybean markets on the session with short covering being triggered in the soybean oil futures.

- The soybean market saw a possible technical breakout for a bullish wedge pattern as prices have consolidated around recent highs. The breakout of this pattern today likely triggered some technical buying and short covering in the market. The key will be follow-through in upcoming sessions.

Wheat

Market Notes: Wheat

- Despite leading the charge higher overnight, wheat gave back some of its early gains by the close. This also comes despite a sharp move upward for soybean and corn futures. September Chicago gained 1-1/2 cents to 507, and September Kansas City gained 2-1/2 cents to 503-1/4. The rise today in the U.S. Dollar Index and increased global harvest estimates may have limited the upside for wheat; the International Grains Council increased their 25/26 production figure by 3 mmt to 811 mmt versus the USDA at 807 mmt.

- According to the USDA, as of August 19, an estimated 31% of U.S. winter wheat acres are experiencing drought conditions, up 2% from the week prior. During the same timeframe, spring wheat areas in drought decreased by 2% to 14%. The recent rains in the U.S. northern plains are causing some concerns about quality of the portion of the spring wheat crop that has not yet been harvested.

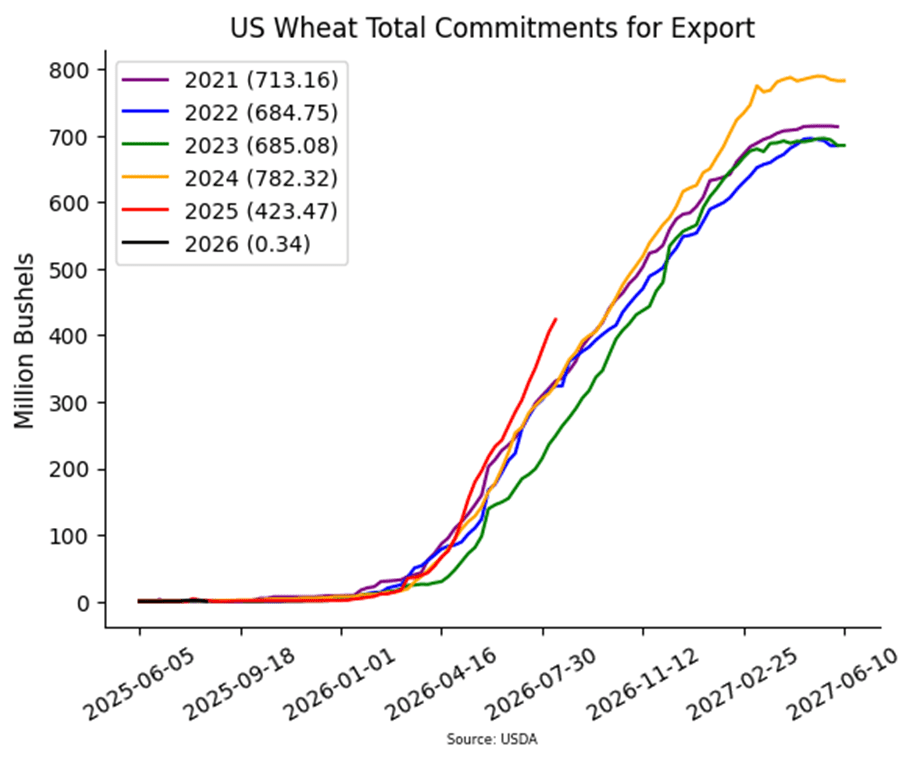

- Weekly wheat export sales totaled about 19 mb, which was at the low end of expectations. Year to date, wheat sales commitments have reached 424 mb, which is up 23% from last year and well above the USDA’s forecast of up 6%.

- LSEG commodities research has kept their estimate of Canadian 25/26 wheat production unchanged at 35.0 mmt. However, they are anticipating heat risks over the next 10 days for Alberta and Saskatchewan, which could affect late season development.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

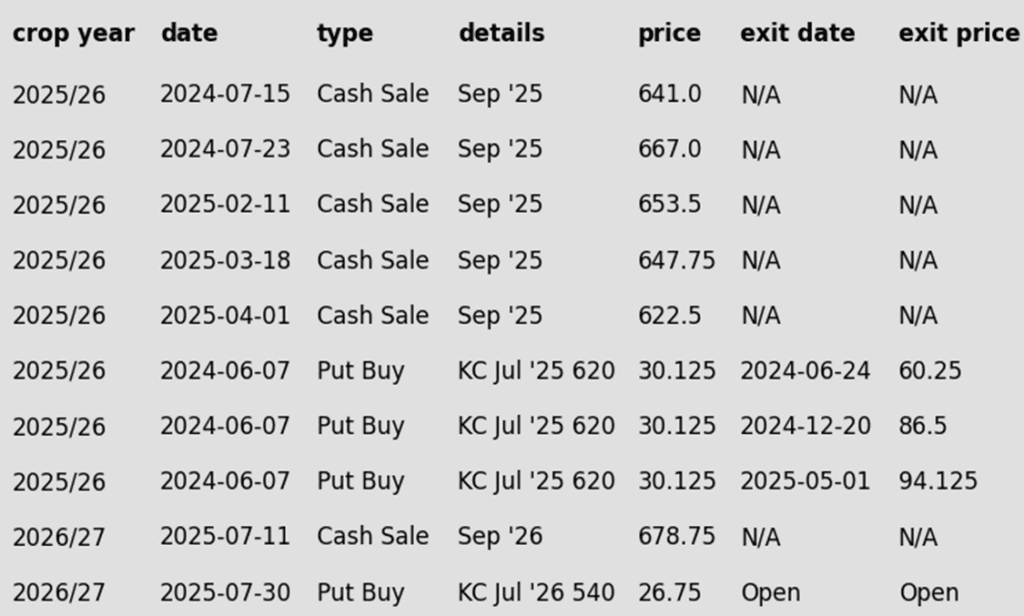

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 606.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 657 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.