8-20 End of Day: Competitive U.S. Export Values Support Grains Wednesday

We are excited to offer you a new way to follow the markets! While CME Group policy changes mean our daily updates will no longer show pricing data, you can now explore our interactive quote board, featuring up-to-date charts to help you track market trends.

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures edged higher Wednesday on light buying and continued demand support. USDA reported two flash sales Thursday morning as U.S. prices remain competitive globally.

- 🌱 Soybeans: Soybeans moved higher Wednesday as prices continue to consolidate above major moving averages.

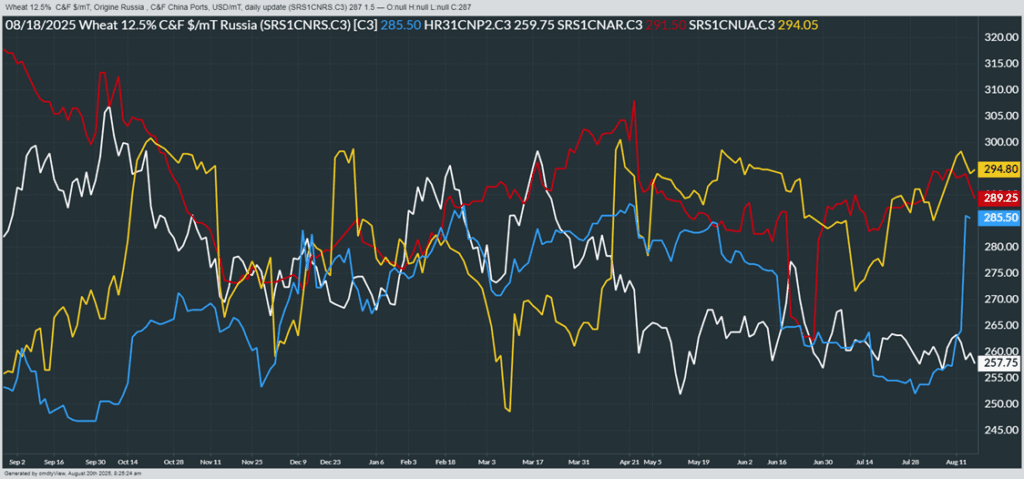

- 🌾 Wheat: Chicago wheat futures rebounded from fresh contract lows Wednesday, with KC and Minneapolis contracts also finishing higher. The recovery was driven by oversold conditions and competitive U.S. FOB Gulf values, which are trading roughly $10 below Russian offers.

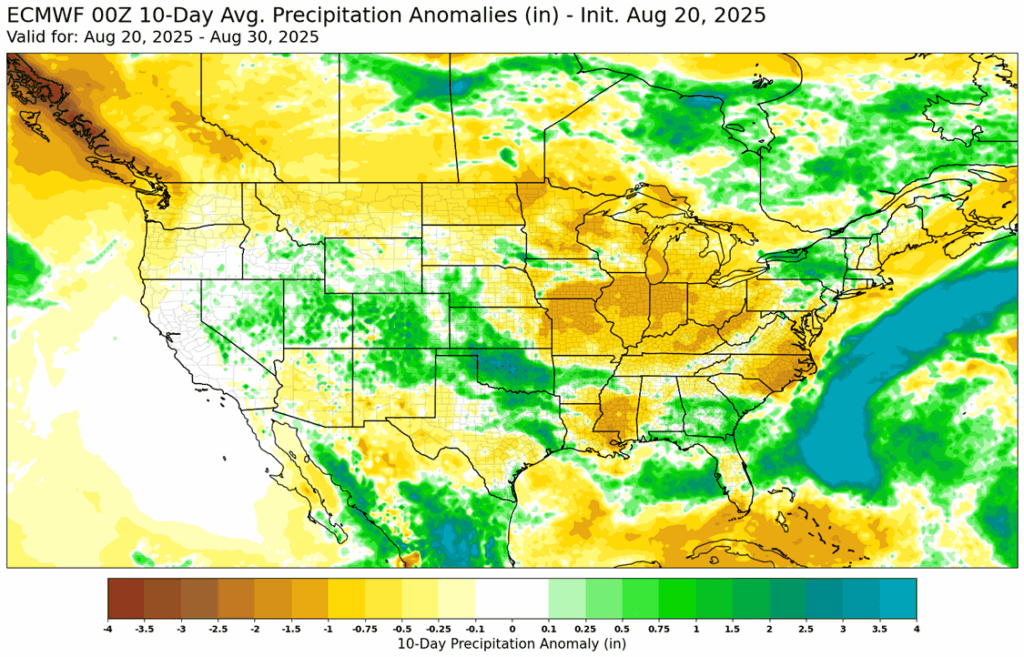

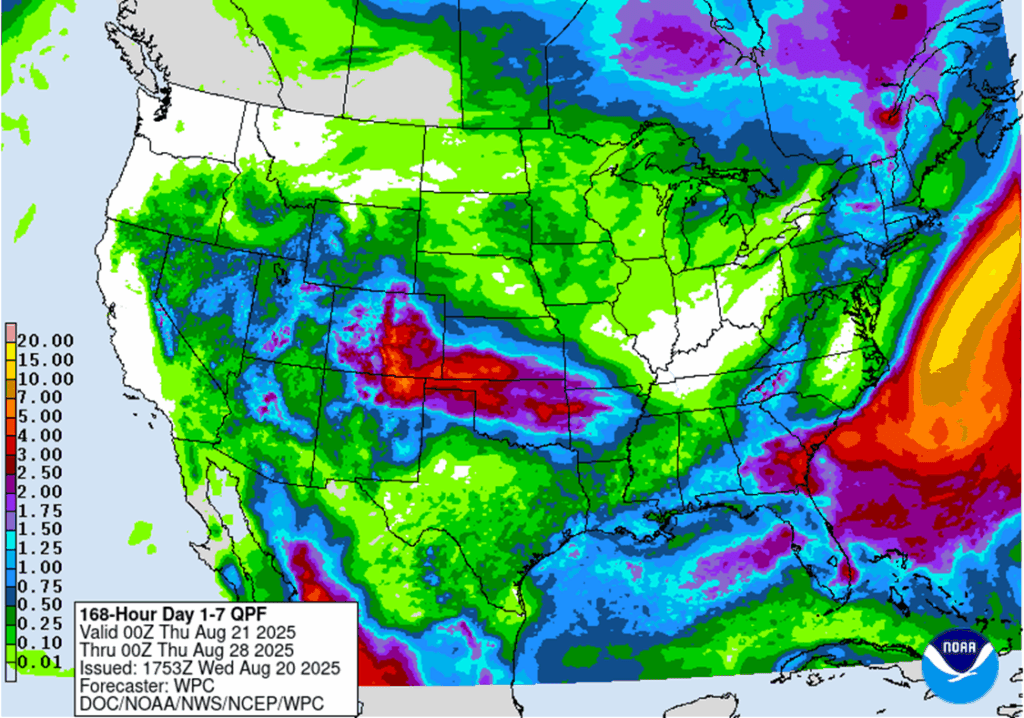

- To see updated U.S. weather forecast maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

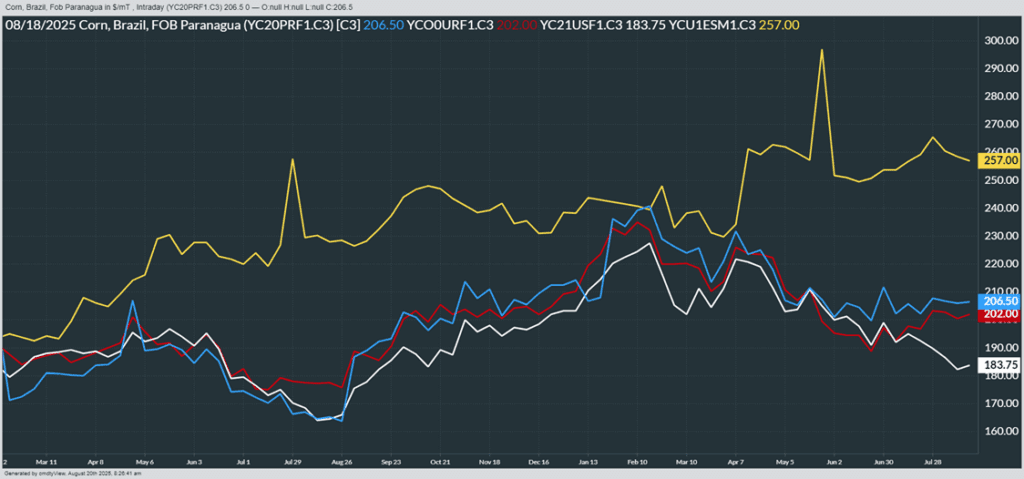

- Corn futures edged higher Wednesday on light buying and continued demand support. September closed ½ cent firmer at 380, while December added ¾ cent to 404.

- USDA reported two flash sales Thursday morning—Mexico purchased 125,741 MT (5 mb) and Colombia 100,000 MT (3.9 mb) for 2025/26—as U.S. prices remain competitive globally.

- Pro Farmer pegged Nebraska corn yields at 179.5 bpa (vs. 173.25 in 2024, 166.3 three-year avg) and Indiana at 193.82 bpa (vs. 187.54 in 2024, 182.09 thirty-year avg). The tour is moving into western Iowa and Illinois today.

- The September corn options expire on Friday. The corn market may trade choppy going into options expiration as price flow to large areas of open interest for both September puts and calls.

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase. Remaining below this resistance keeps the broader trend sideways-to-lower, with no immediate need for call option coverage.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

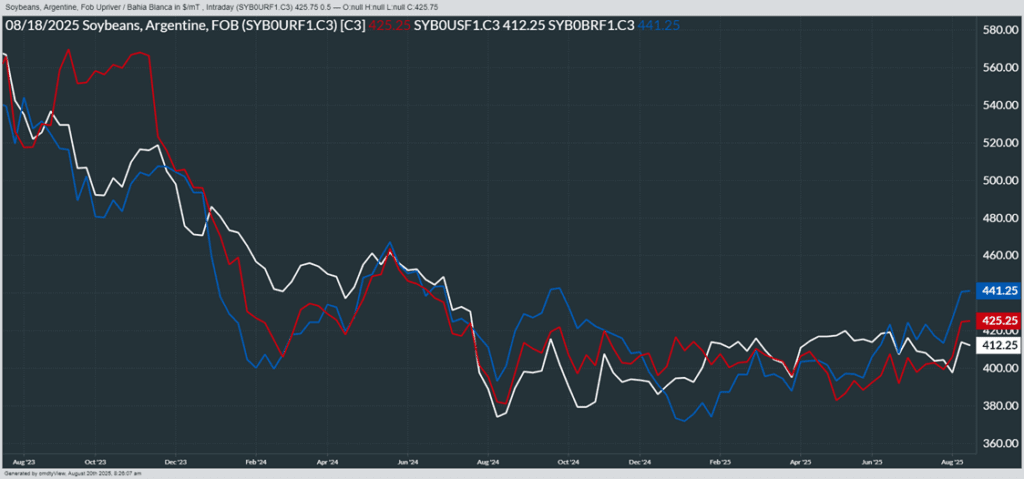

- Soybeans ended higher Wednesday, with September up 2 cents at $10.15 and November gaining 2 ¼ to $10.36. In products, September meal rose $4.60 to $292 while September oil slipped 0.48 cents to 51.20. November soybeans remain above all major moving averages and continue to consolidate.

- Pro Farmer reported Nebraska pod counts at 1,348.3 per 3’x3’ square, above last year. Indiana pod counts came in at 1,376.6, below last year’s 1,409.

- Brazil’s antitrust regulator (CADE) suspended the 20-year “Soy Moratorium,” ordering traders to end compliance within 10 days or face fines. The pact had barred purchases of soy grown on land cleared after July 2008. July exports totaled 12.3 mmt (+9% y/y), with 78% shipped to China. The move could boost Brazilian soybean and corn supply, heightening competition with the U.S.

- The American Soybean Association urged President Trump to prioritize soybeans in U.S.–China trade talks, warning that retaliatory tariffs could shut U.S. farmers out of their largest export market heading into harvest.

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

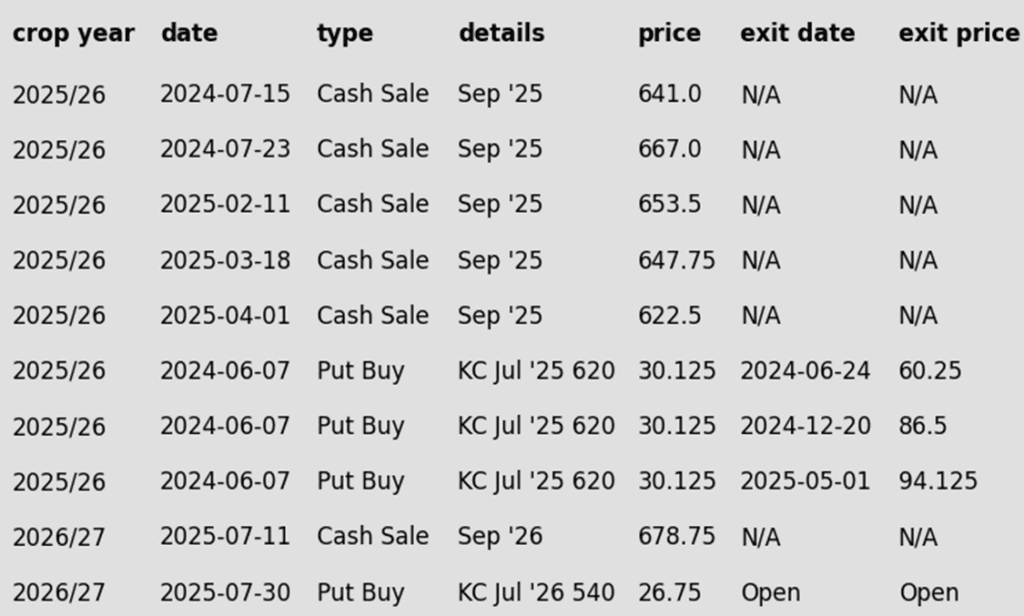

- After setting a new contract low Tuesday, Chicago wheat rebounded with September up 7 cents to 505 ½. Kansas City and Minneapolis posted smaller September gains, up 1 ¼ to 500 ¾ and up 1 ½ to 570, respectively. The bounce reflected oversold conditions and U.S. FOB Gulf values trading about $10 below Russian offers.

- SovEcon raised its Russian wheat crop estimate by 0.2 mmt to 85.4 mmt, above USDA’s 83.5 mmt. Ongoing upward revisions to Russian output have weighed on global values in recent weeks.

- Ukrainian grain exports have reached 3.1 mmt since their export season began on July 1. This represents a 52% decline from the 6.4 mmt shipped during the same time last year. Of the total, wheat accounts for 1.73 mmt, which is down 44% year over year.

- Widespread rains across key winter wheat areas in the past month have left soil moisture above normal, improving crop prospects. Additional favorable rains are forecast in the coming weeks.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 606.75 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The 608.50 target has been lowered to 606.75.

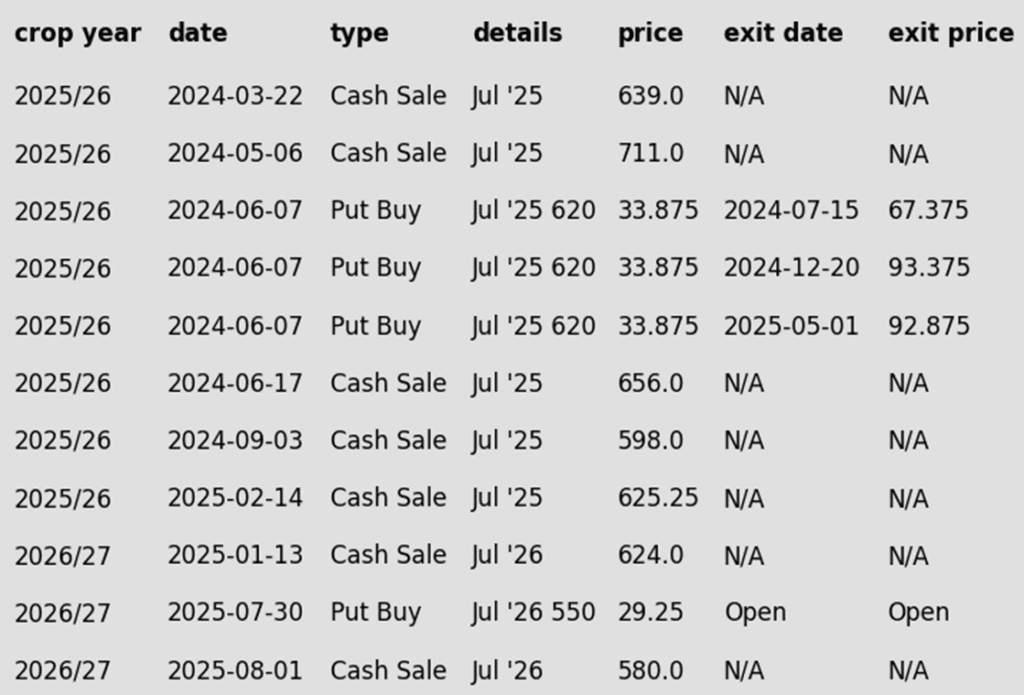

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 657 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 658 target has been lowered to 657.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

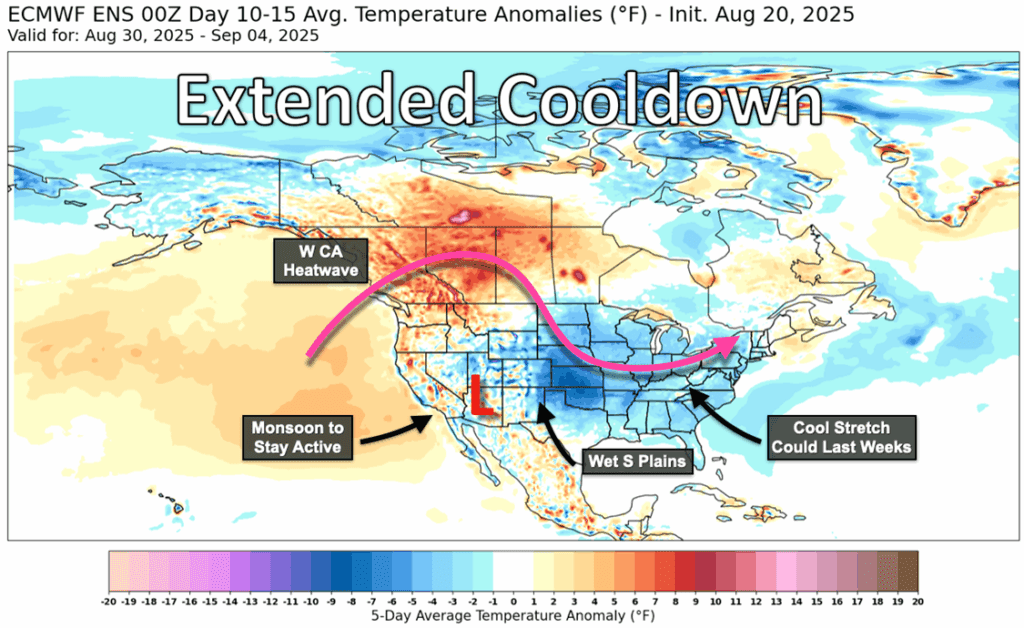

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather

From ag-wx.com