8-19 End of Day: Grains Retreat Tuesday Ahead of Pro Farmer Tour Results

We are excited to offer you a new way to follow the markets! While CME Group policy changes mean our daily updates will no longer show pricing data, you can now explore our interactive quote board, featuring up-to-date charts to help you track market trends.

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn futures weakened Tuesday, with September down 4 ½ cents to 379 ½ and December 3 ¼ lower at 403 ¼. U.S. corn holds a strong price advantage, roughly 30 cents/bu under Brazil, keeping U.S. exports competitive.

- 🌱 Soybeans: Soybean futures fell Tuesday after failing to break key resistance at $10.50 in November contracts. USDA reported a flash sale to Mexico of 228,606 MT (8.4 mb) for 2025/26. New-crop soybean sales remain at a 10-year low for this point in the season.

- 🌾 Wheat: Chicago and Kansas City wheat futures closed lower Tuesday in sympathy with weakness in corn and soybeans during a broad risk-off trade. Spring wheat conditions improved 1% to 50% good/excellent, while harvest jumped 20 points to 36% complete.

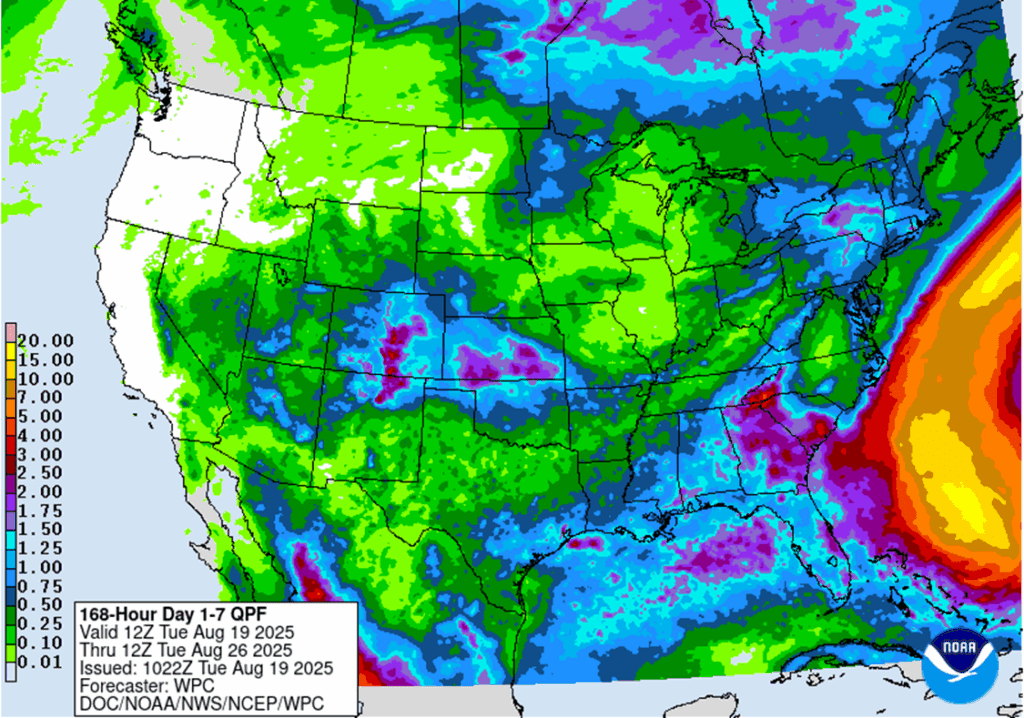

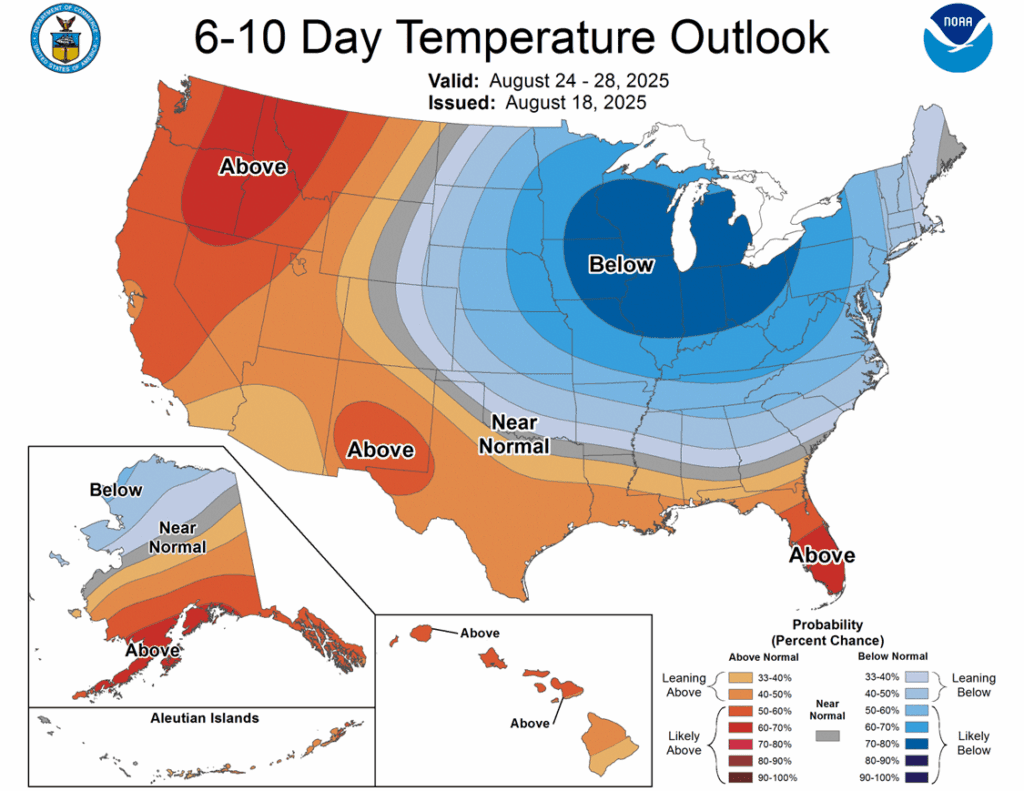

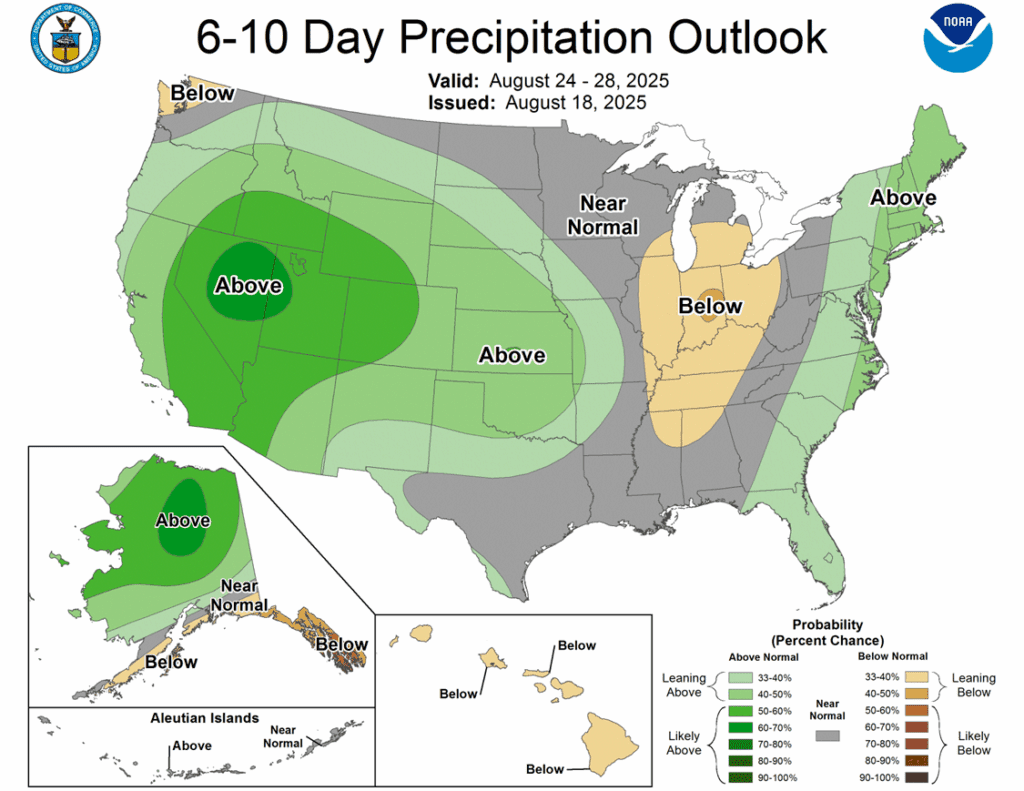

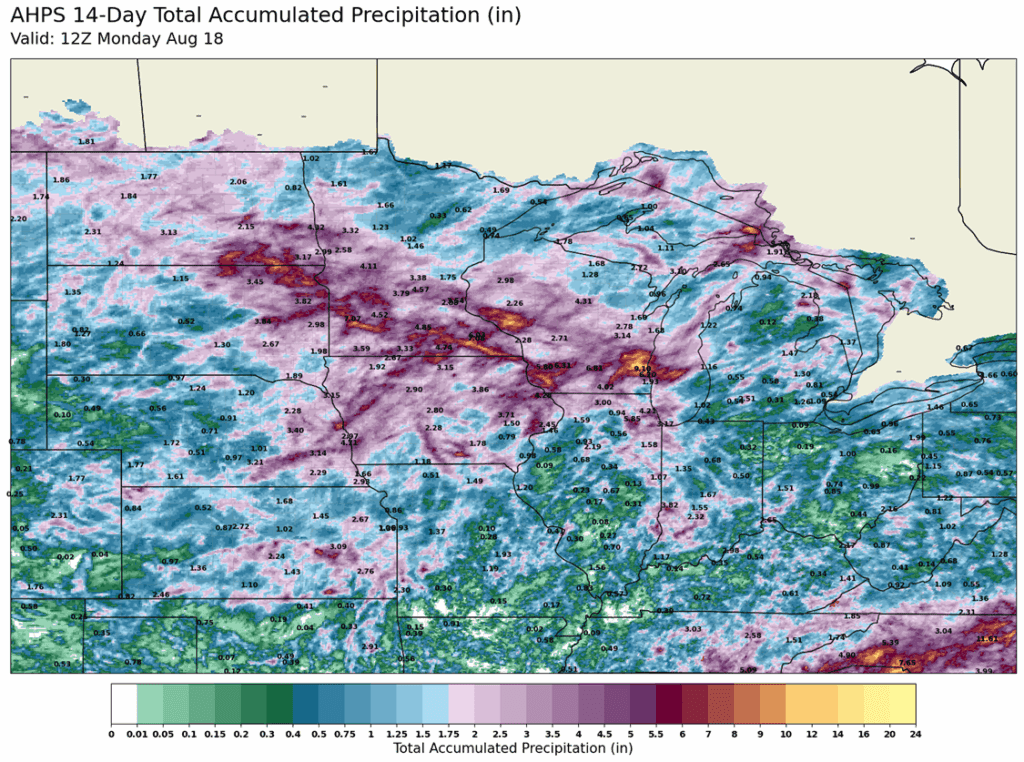

- To see updated U.S. weather forecast maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures saw selling pressure on Tuesday as the front month September futures lost 4 ½ cents to 379 ½, and December futures traded 3 ¼ lower to 403 ¼.

- The Pro Farmer Crop Tour reported South Dakota corn yields at 174.2 bpa (vs. 156.5 last year, 144.1 three-year avg) and Ohio yields at 185.7 bpa (vs. 183.3 last year, 180.5 thirty-year avg). Nebraska and Indiana results are due this evening.

- Brazil’s second-crop corn harvest is 89.3% complete, up from 83% last week. Despite a record crop, farmer selling remains light due to low prices.

- U.S. corn holds a strong price advantage, roughly 30 cents/bu under Brazil, keeping U.S. exports competitive as Brazilian farmers withhold sales.

- The September corn options expire on Friday. The corn market may trade choppy going into options expiration as price flow to large areas of open interest for both September puts and calls.

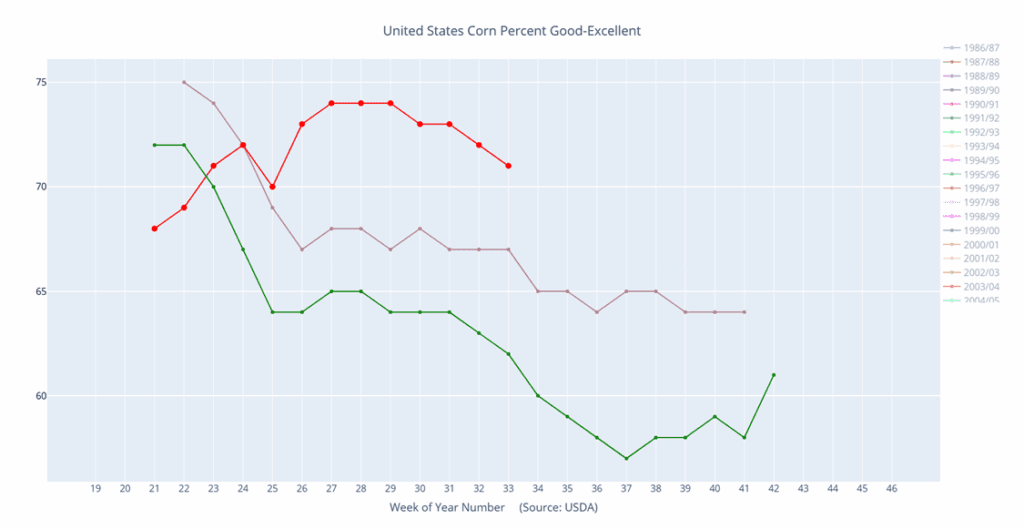

Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase. Remaining below this resistance keeps the broader trend sideways-to-lower, with no immediate need for call option coverage.

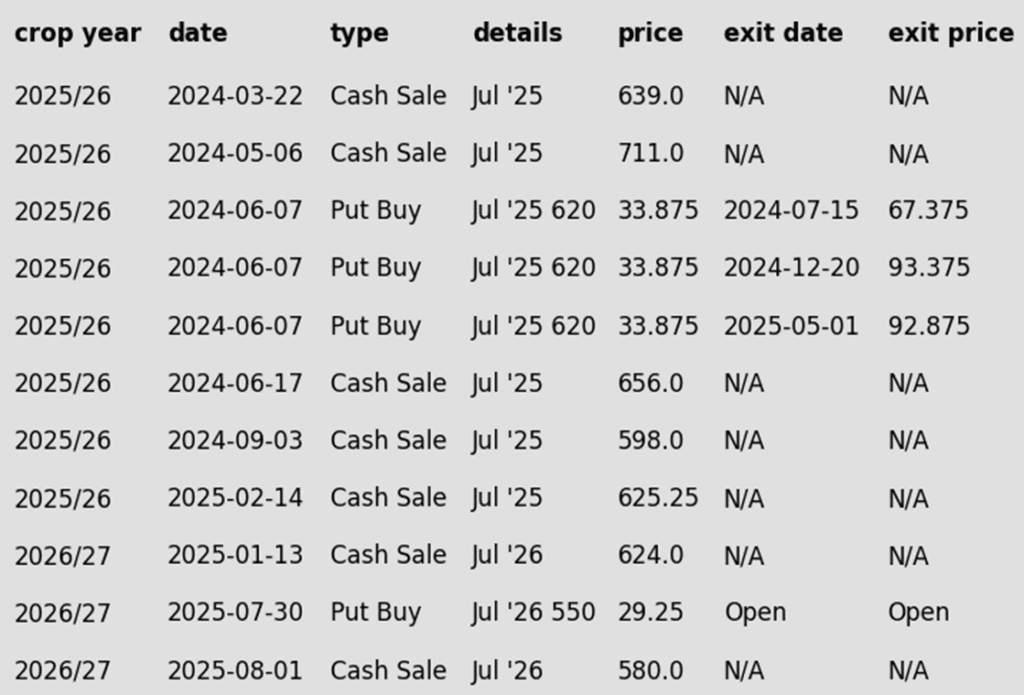

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybean futures fell Tuesday after failing to break key resistance at $10.50 in November contracts. September closed 7 ¾ cents lower at $10.13, while November lost 7 ½ cents to $10.33 ¾.

- USDA reported a flash sale to Mexico of 228,606 MT (8.4 mb) for 2025/26. Despite the sale, new-crop soybean sales remain at a 10-year low for this point in the season.

- Pro Farmer found soybean pod counts above last year in both Ohio and South Dakota. Ohio averaged 1,287.28 pods per 3’x3′ plot (vs. 1,229.93 in 2024), while South Dakota came in at 1,188.45 (vs. 1,025.89 in 2024).

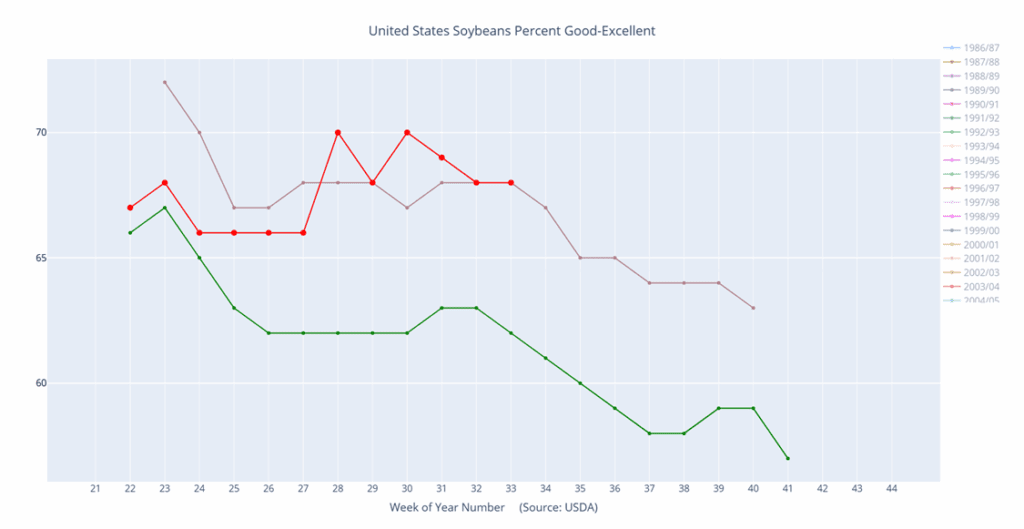

- Yesterday’s Crop Progress report saw soybean conditions unchanged from last week at 68% good to excellent with 95% of the crop blooming and 82% setting pods, both on par with the 5-year average. Forecasts remain wet through the end of the month.

Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

Market Notes: Wheat

- Chicago and Kansas City wheat futures closed lower in sympathy with lower corn and soybeans, in a broad risk off trade today. September Chi lost 4-1/4 cents to 498-1/2, while September KC lost 6-3/4 to 499-1/2. MIAX contracts did post small gains, despite an increase for the spring wheat crop conditions; the September contract gained 3/4 cent to 568-1/2.

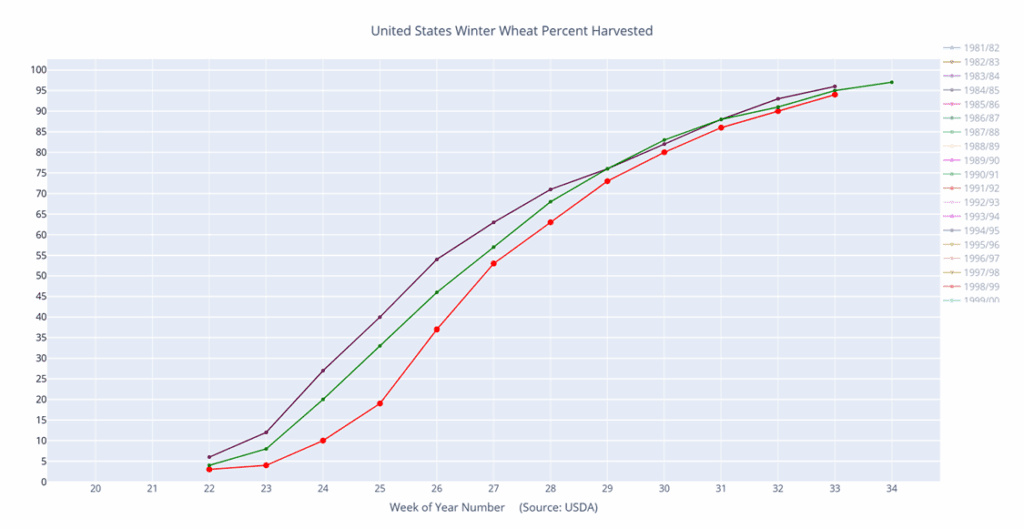

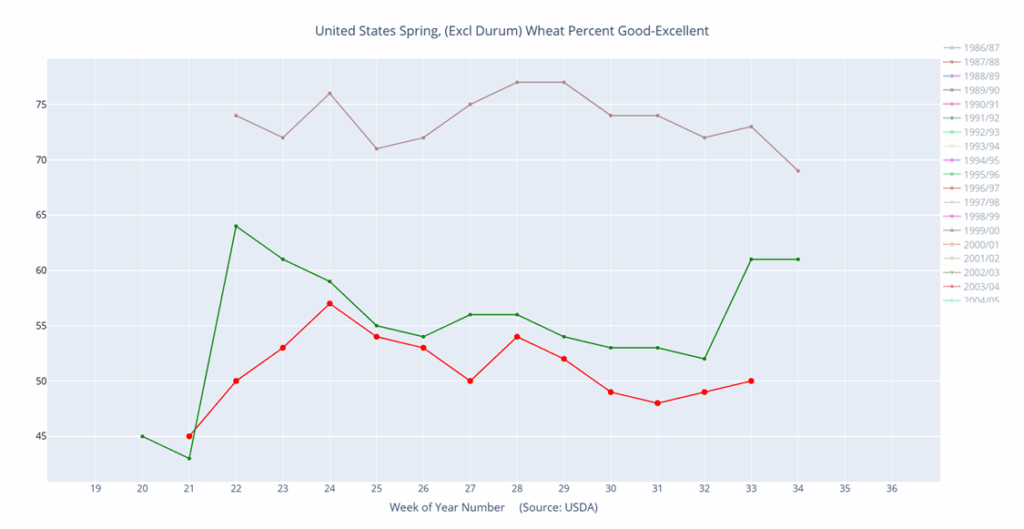

- USDA reported winter wheat harvest at 94% complete, up 4 points from last week. Spring wheat conditions improved 1% to 50% good/excellent, while harvest jumped 20 points to 36% complete.

- Heavy rainfall in Argentina over the past 24 hours has boosted soil moisture for winter wheat, though excessive wetness is raising root rot concerns in some regions. In Brazil, CONAB pegs planted wheat area at 2.55 million hectares, down 16.7% from last year, but projects 2025 output at 7.81 mmt—just 1% lower—on expectations of a 19% yield increase.

- LSEG commodities research has estimated global 25/26 wheat production at 801.38 mmt. This represents a slight bump of 0.3% from their last estimate; higher production forecasts for Russia and the EU were largely offset by declines for the U.S.

- The state grain buyer of Egypt has made a deal to purchase at least 200,000 mt of French wheat in private deals. They also agreed to purchase smaller amounts from Ukraine and Romania. Last December, their state purchases were taken over by a military organization, who import primarily by private deals. In contrast, the previous state buyer, GASC, imported via international tenders.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 608.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The 612.25 upside target was lowered to 608.50.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 658 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 549 downside Plan B sale stop has been cancelled.

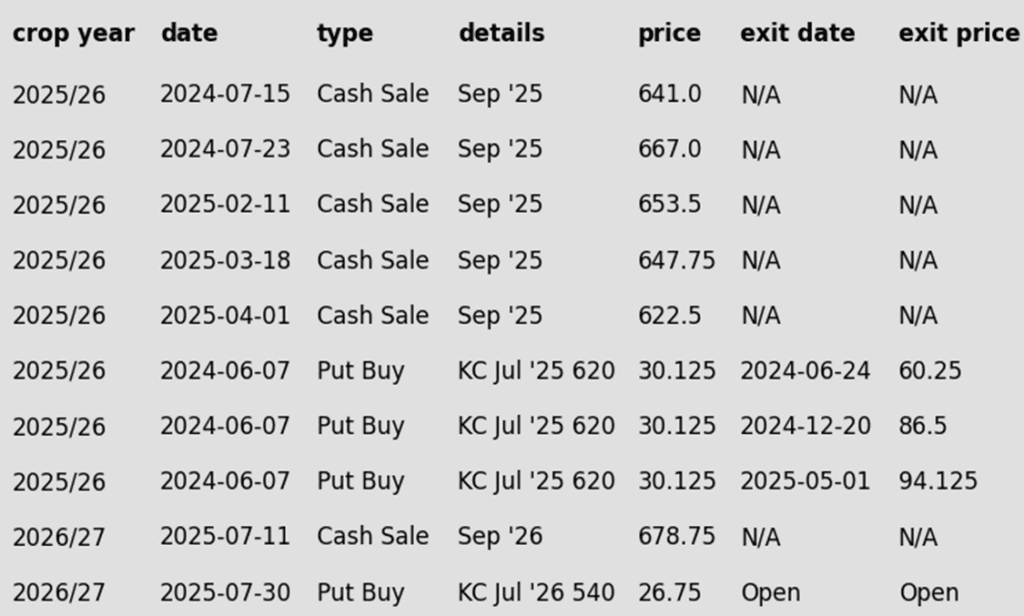

To date, Grain Market Insider has issued the following KC recommendations:

Winter wheat percent harvested (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Other Charts / Weather