8-18 End of Day: Grains Trade Mixed Monday

We are excited to offer you a new way to follow the markets! While CME Group policy changes mean our daily updates will no longer show pricing data, you can now explore our interactive quote board, featuring up-to-date charts to help you track market trends.

Grain Market Insider Interactive Quote Board

Grain Market Highlights

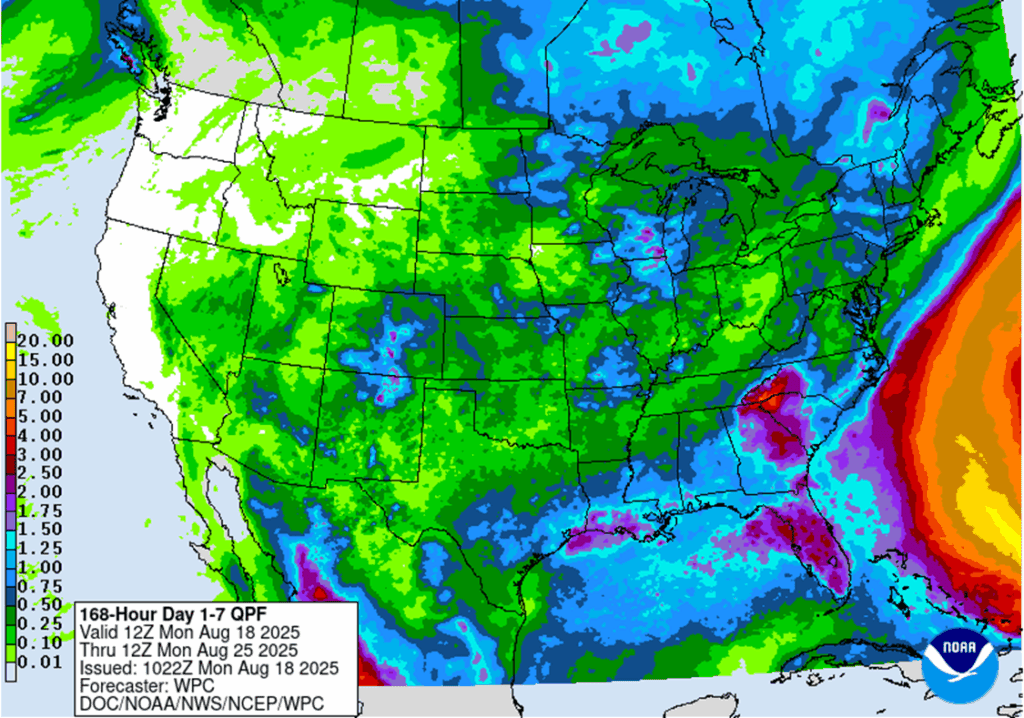

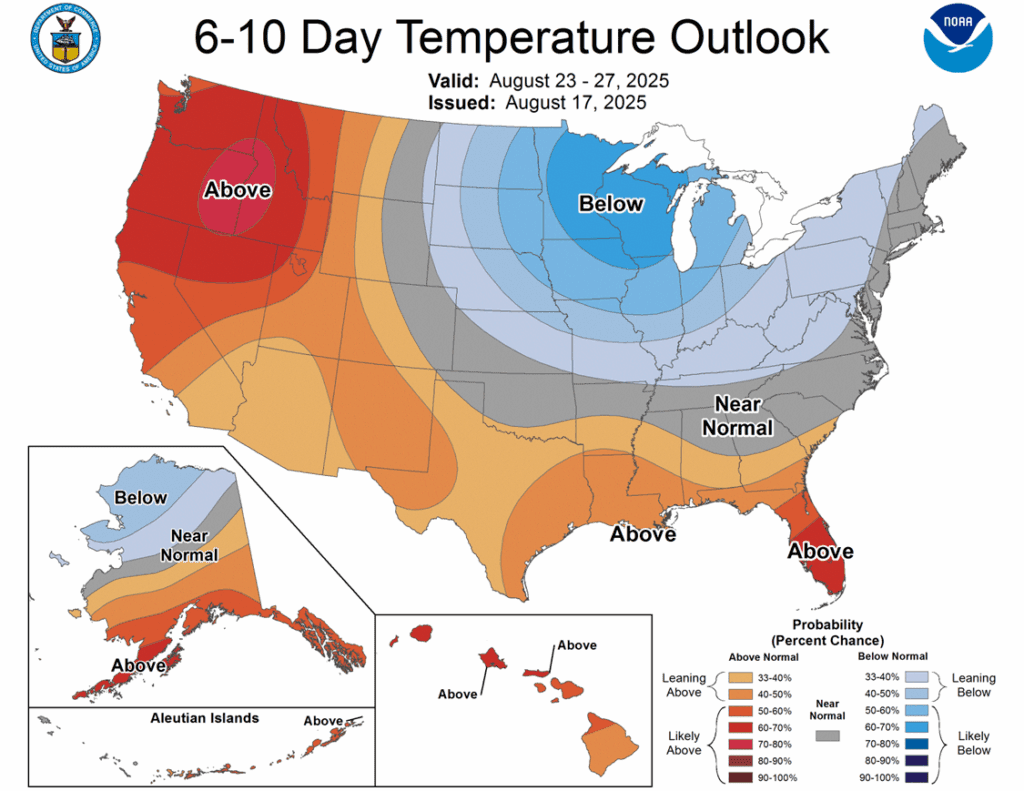

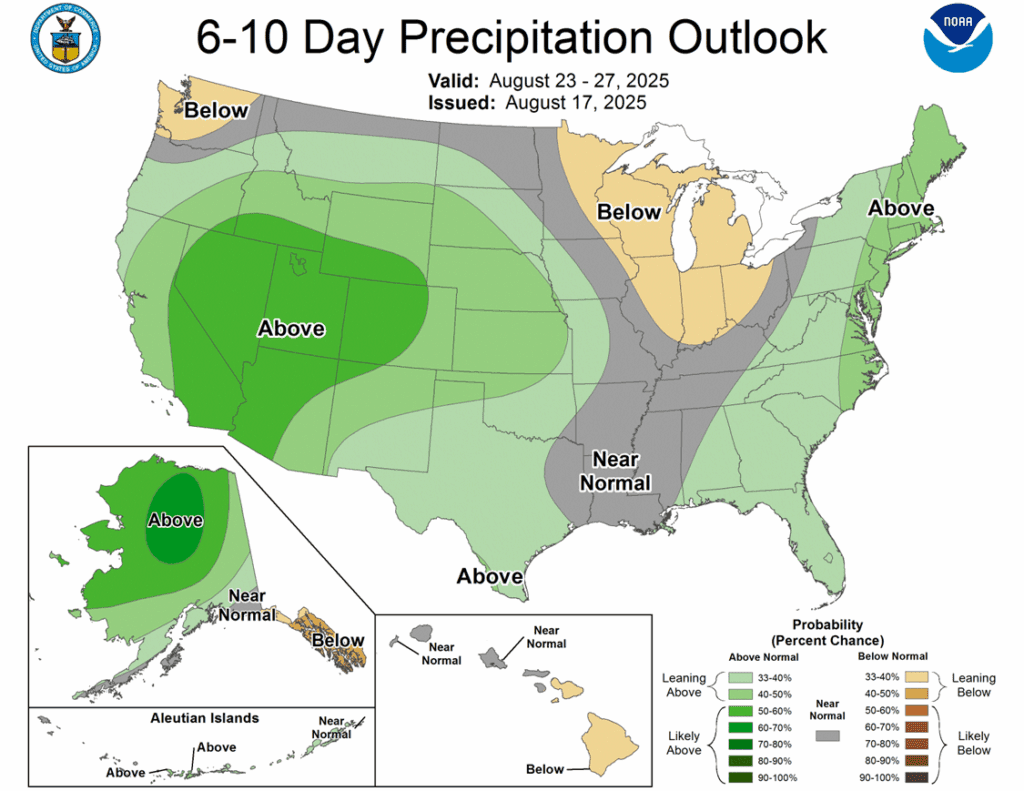

- 🌽 Corn: Corn futures closed mostly higher with modest gains, except for the September contract. Strong export demand and worries about dry conditions in the eastern Corn Belt bolstered prices.

- 🌱 Soybeans: Soybean futures ended lower after overnight losses and intraday gains faded into the close. November futures remain above all major moving averages but face resistance at $10.60.

- 🌾 Wheat: Wheat futures closed slightly lower after a subdued session, with ample global supplies keeping prices under pressure. Recent rains in the northern Plains likely delayed the U.S. spring wheat harvest.

- To see updated U.S. weather forecast maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures closed mostly higher with modest gains, except for the September contract. Strong export demand and worries about dry conditions in the eastern Corn Belt bolstered prices.

- The USDA announced a flash sale of 124,000 metric tons (4.9 million bushels) of 2025/26 corn to an unknown destination, reinforcing strong new-crop export sales despite China’s absence.

- Weekly corn export inspections were toward the bottom end of expectations as U.S. exporters shipped 1.05 MMT (41 mb) for the week ending August 14. This total was below the 53 mb needed to reach the revised USDA forecast of 2.820 bb. The marketing year ends at the end of August.

- The Pro Farmer Crop Tour, currently underway, is closely watched by corn and soybean markets. Yield estimates for Ohio and South Dakota will be released tonight, with final national yield projections expected later this week.

- Drier and warmer-than-normal conditions in the eastern Corn Belt are accelerating corn crop maturation, supporting futures prices but raising concerns about potential yield reductions due to a rushed finish.

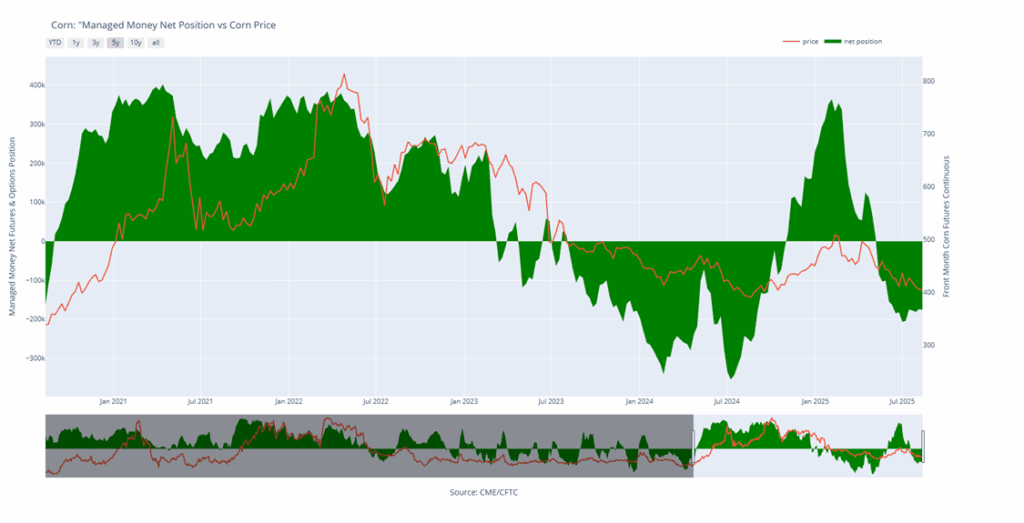

Corn Managed Money Funds net position as of Tuesday, August 12th. Net position in Green versus price in Red. Money Managers net sold 2,364 contracts between August 5 – August 12, bringing their total position to a net short 176,114 contracts.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase. Remaining below this resistance keeps the broader trend sideways-to-lower, with no immediate need for call option coverage.

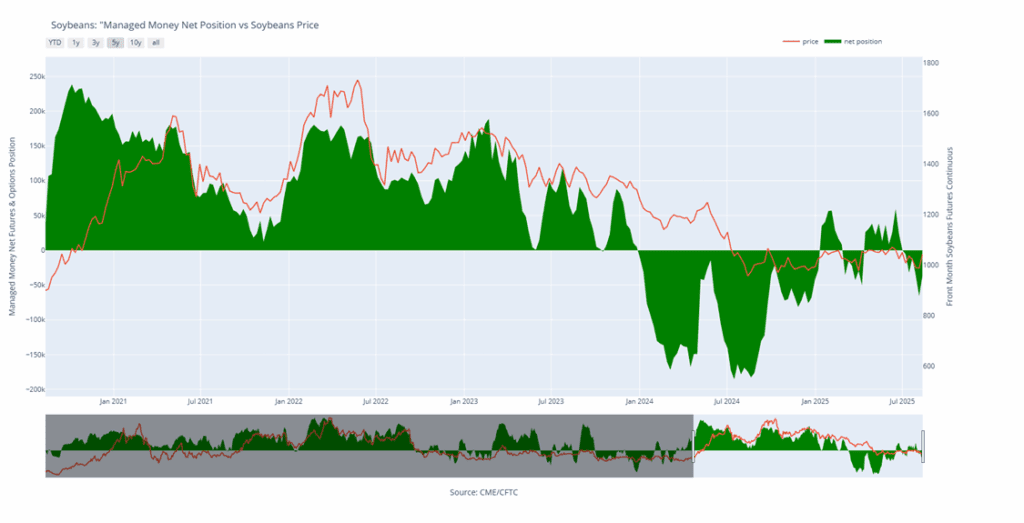

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybean futures ended lower after overnight losses and intraday gains faded into the close. November futures remain above all major moving averages but face resistance at $10.60. Soybean meal closed lower, while soybean oil tracked crude oil higher.

- On Friday, NOPA crush numbers were released, and July crush jumped to 195.699 million bushels which was well above the average trade guess of 190.8 mb and was a six-month high for the month of July. It was up 5.6% from the June’s 185.27 mb.

- Forecasts predict warm summer temperatures and sufficient moisture through the rest of the month, aiding soybean pod fill. The USDA may raise yield estimates in the next report, but lower export demand could increase ending stocks.

- Friday’s CFTC report saw funds as buyers of soybeans by 30,660 contracts which reduced their net short position to 35,270 contracts. They sold 10,527 contracts of bean oil leaving them long 44,412 contracts and bought back 24,238 contracts of meal leaving them short 109,309 contracts.

Soybean Managed Money Funds net position as of Tuesday, August 12th. Net position in Green versus price in Red. Money Managers net bought 30,660 contracts between August 5th – August 12th, bringing their total position to a net short 35,270 contracts.

Wheat

Market Notes: Wheat

- Wheat futures closed slightly lower after a subdued session, with ample global supplies keeping prices under pressure. Recent rains in the northern Plains likely delayed the U.S. spring wheat harvest.

- Weekly wheat inspections amounted to 14.5 mb, which brings total 25/26 inspections to 177 mb, up 4% from last year. Inspections are running below the USDA’s estimated pace; total 25/26 exports are projected at 875 mb, up 10% from last year.

- IKAR raised its Russian wheat production estimate by 1 million metric tons to 85.5 million metric tons, compared to the USDA’s 83.5 million metric tons. IKAR also projects Russian wheat exports at 42.5 million metric tons, above the USDA’s 39 million metric tons, adding to global supply pressure.

- Widespread rain is expected across Argentina’s wheat regions, with southern areas potentially seeing frost but minimal crop damage. Northern areas, where wheat is starting to head, could face damage if frost occurs.

- According to Chinese customs data, their July wheat and wheat flour imports totaled 410,000 mt, which is down 48.3% year over year. Year to date total wheat and wheat flour imports are down a whopping 76.4% at 2.37 mmt.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The 596 target was lowered to 594.25.

- All targets are now vs the December contract.

2026 Crop:

- Plan A:

- Target 608.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The 612.25 upside target was lowered to 608.50.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

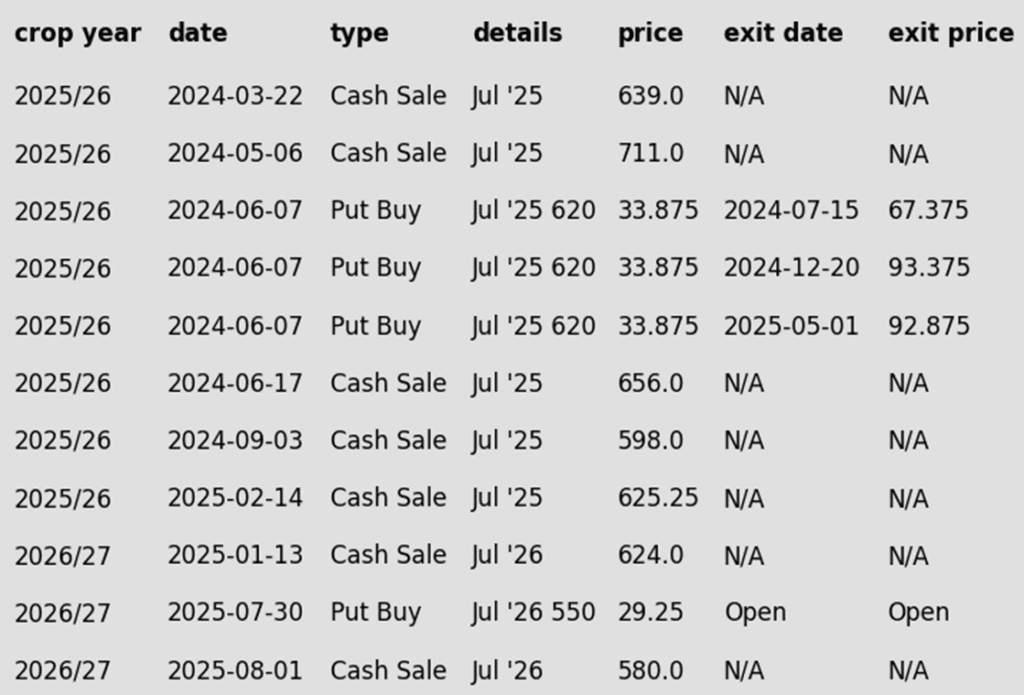

Chicago Wheat Managed Money Funds’ net position as of Tuesday, August 12th. Net position in Green versus price in Red. Money Managers net sold 8,526 contracts between August 5th – August 12th, bringing their total position to a net short 89,295 contracts.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 658 vs July ‘26 to make the first cash sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 549 downside Plan B sale stop has been cancelled.

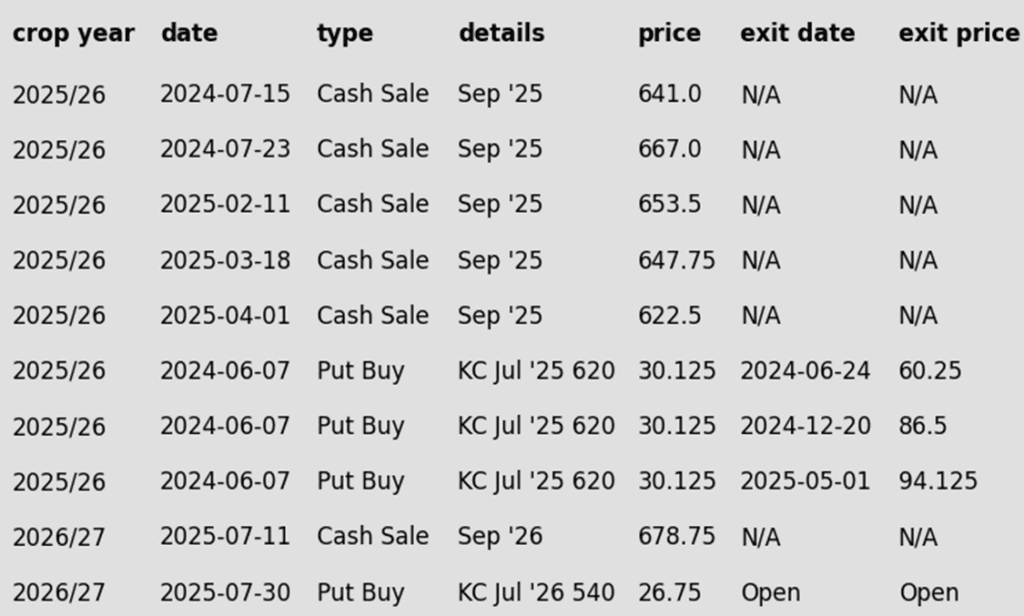

To date, Grain Market Insider has issued the following KC recommendations:

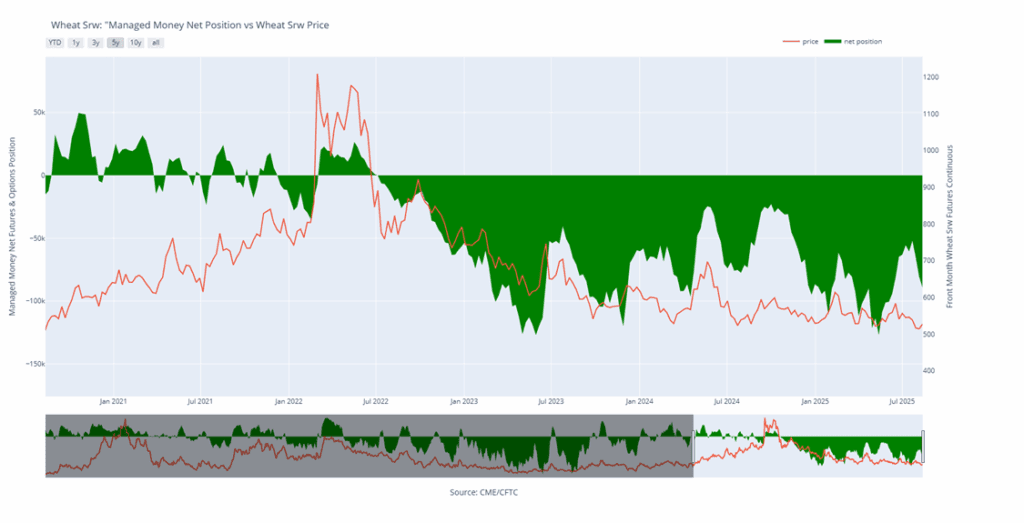

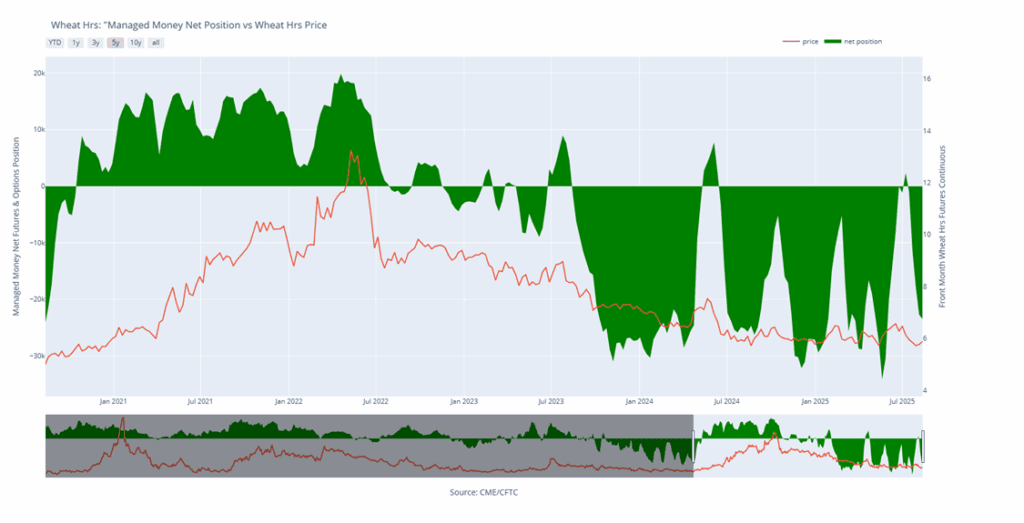

KC Wheat Managed Money Funds’ net position as of Tuesday, August 12th. Net position in Green versus price in Red. Money Managers net bought 6,508 contracts between August 5th – August 12th, bringing their total position to a net short 50,555 contracts.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, August 12th. Net position in Green versus price in Red. Money Managers net sold 755 contracts between August 5th – August 12th, bringing their total position to a net short 23,458 contracts.

Other Charts / Weather