8-15 End of Day: Grains End Week with Gains Ahead of the Weekend

We are excited to offer you a new way to follow the markets! While CME Group policy changes mean our daily updates will no longer show pricing data, you can now explore our interactive quote board, featuring up-to-date charts to help you track market trends.

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn ended Friday’s session with broad-based gains, supported by strong demand and strength in the soybean market.

- 🌱 Soybeans: Soybean futures posted gains to close the day, supported by forecasts for drier conditions that raised concerns about late-season crop stress, giving the market a boost.

- 🌾 Wheat: Wheat futures ended the week slightly higher, supported by a weaker U.S. dollar and spillover strength from the corn market, though they lacked the momentum seen in corn and soybeans to close out the week.

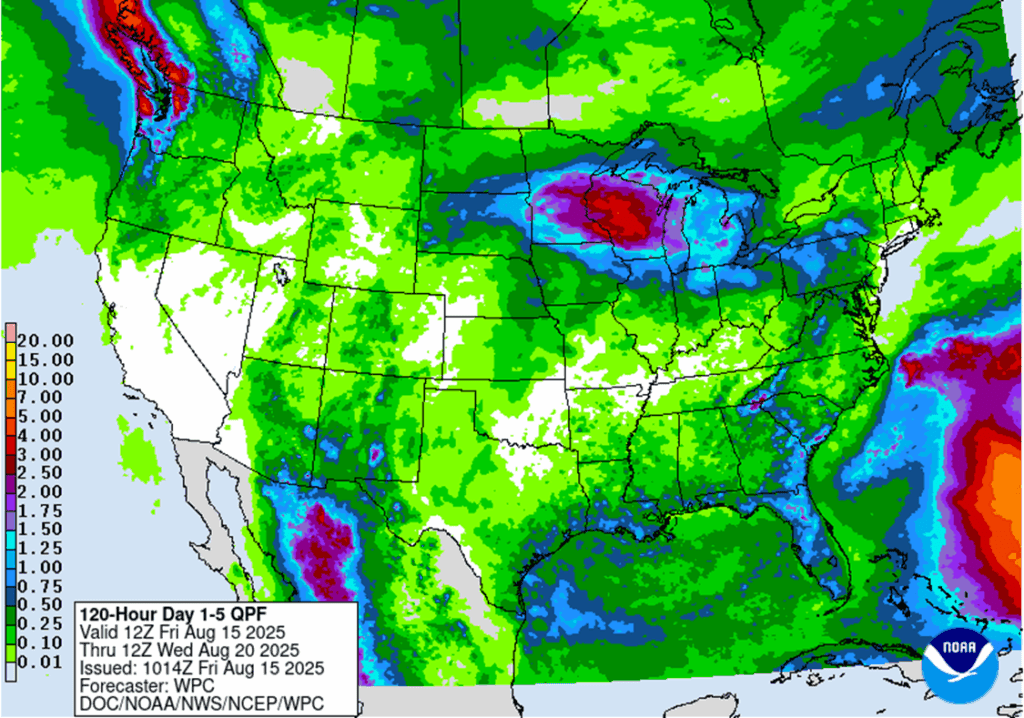

- To see updated U.S. and Global weather outlook maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- FYI – yesterday the 420 puts closed at 28-1/4 cents.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures ended the week with buying strength, supported by a short-covering rally and technical buying. A firm demand tone, dry conditions in the eastern Corn Belt, and strength in the soybean market also lent support. Despite shaking off pressure from a bearish USDA report, December corn futures ended the week down ¼ cent—marking the fourth consecutive week of lower trade.

- Export demand has remained strong for new crop corn. Current corn sales on the books for the 2025-26 marketing year are the strongest in a decade and trending 208% above this time last year. U.S. corn should stay competitively priced in the near term and export sales should reflect the advantage.

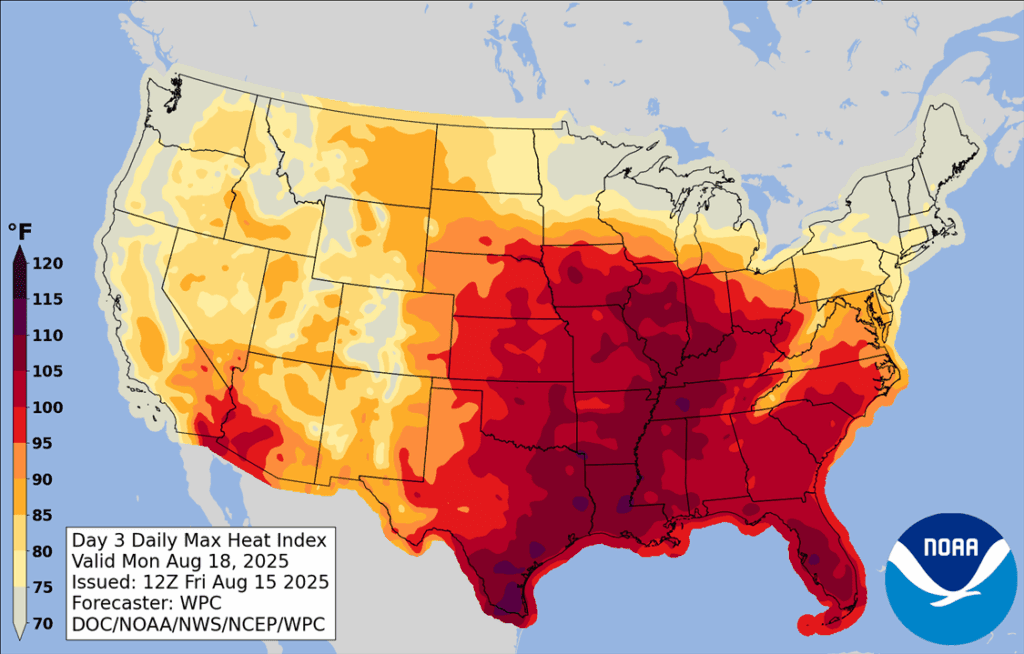

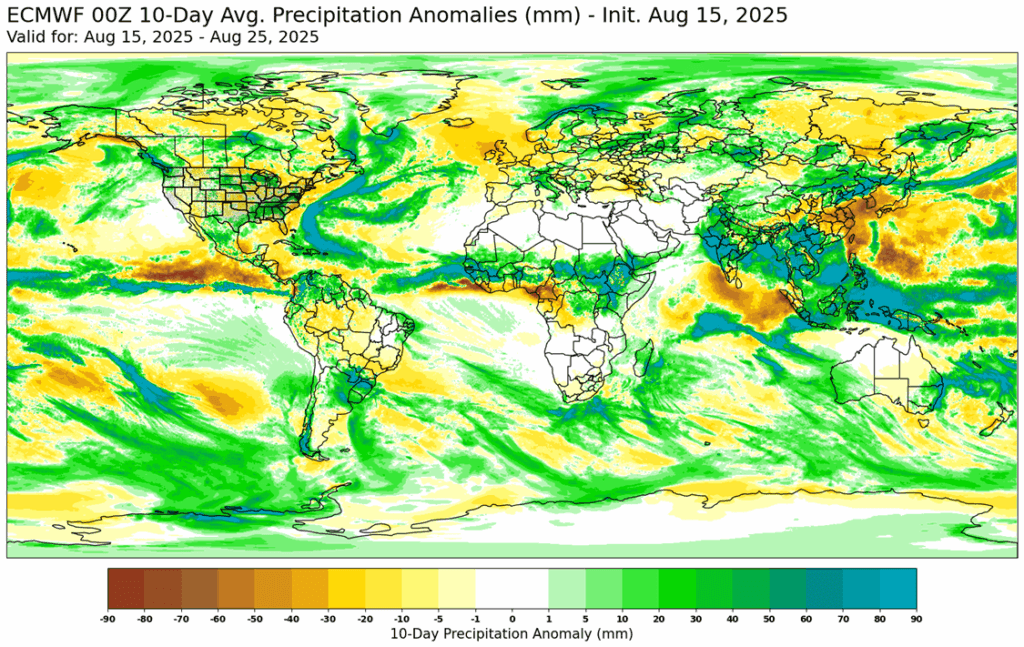

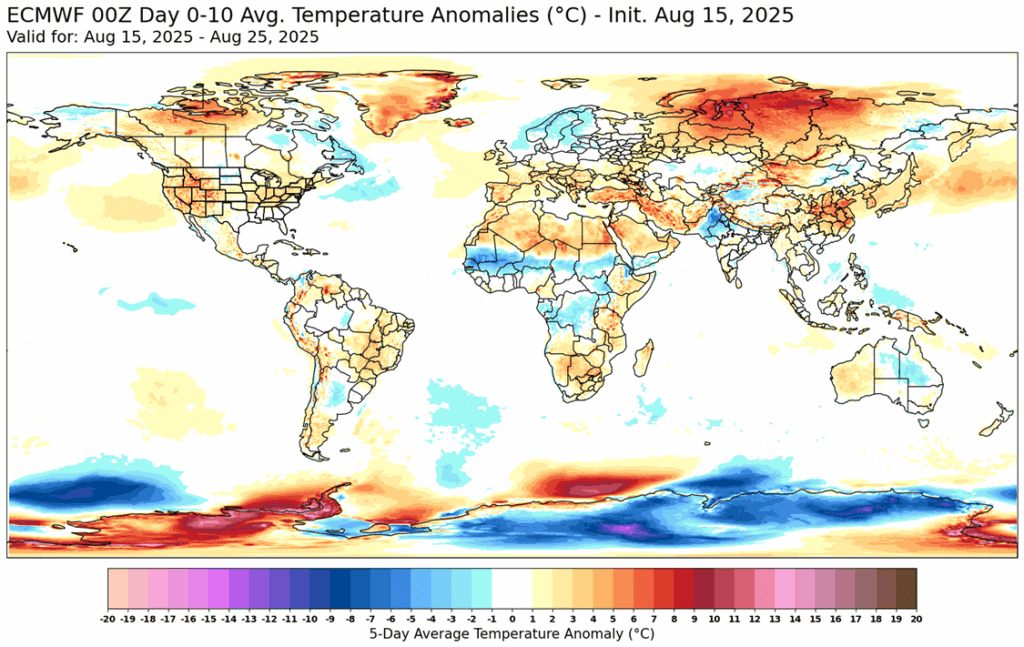

- With a record corn crop still in the forecast, market attention is turning to late August weather. Currently, the eastern Corn Belt is trending dry, raising concerns that continued dryness could trim top-end yield potential and push the crop to maturity too quickly.

- The corn market has built an improved technical signal this week after the USDA report. December corn charts established a potential double bottom on Tuesday and Thursday lows. Today, Dec corn closed above the 10-day moving average. Technical strength likely triggered some technical short covering.

- Next week could bring volatility into the corn market. Pro Farmer will run its annual crop tour from August 18-20, and the corn market will be watching the yield results. The September options expire on Friday, August 22, and markets may show some extra volatility into this event.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase. Remaining below this resistance keeps the broader trend sideways-lower, with no immediate need for call option coverage.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day sharply higher, taking back nearly all of yesterday’s losses ahead of the weekend. A drier forecast for part of the Corn Belt next week may have added support while significantly higher soybean oil prices also helped the soy complex, but soybean meal was lower.

- NOPA soybean crush was released today and showed 195.699 million bushels crushed in the month of July which was a six-month high and was above trade expectations of 191 million bushels. Domestic demand remains firm for soybean oil, but large crush numbers are causing a glut of soybean meal.

- Weather forecasts throughout the rest of the month call for warm summer temperatures and enough moisture to get through pod fill. It is possible that the USDA increases yield again in the September report, but it is also possible that export demand is lowered which could see the ending stocks number increase.

- For the week, September soybeans gained a whopping 54-1/2 cents to $10.22-1/4 and took back all losses over the past three weeks. November soybeans gained 55 cents to close at $10.42-1/2. September soybean meal gained $6.80 to $283.40 while September soybean oil gained 0.47 cents to 53.18 cents.

Wheat

Market Notes: Wheat

- Winter wheat futures closed slightly higher today, though spring wheat could not do the same. Despite a drop in the U.S. Dollar Index, wheat just did not seem to find the same footing today as corn and soybeans. A lower close for Matif wheat did not offer any support, and neither did the lack of fresh bullish news today.

- Western Australia’s grain association, GIWA, increased their wheat harvest estimate by 2.1 mmt to 11.5 mmt due to favorable growing conditions. Despite the increase, this would still be down about 1 mmt from last year’s crop. Nationally, the wheat crop is anticipated to be near last year’s production of 34 mmt.

- The Ukrainian agriculture ministry reports that their grain harvest has reached 24.8 mmt so far this season. This represents a roughly 13% decline from the 28.5 mmt harvested in a similar timeframe last year. Wheat accounts for 19 mmt of that total, compared to 21.7 mmt a year ago.

- India has seen plentiful rains due to monsoons, which have helped to replenish water reservoirs. This should be beneficial for winter wheat, much of which relies on irrigation. India’s wheat crop is typically planted in October and November, and the nation’s farm secretary is expecting a higher planted area for winter crops this season.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 594.25 vs December for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

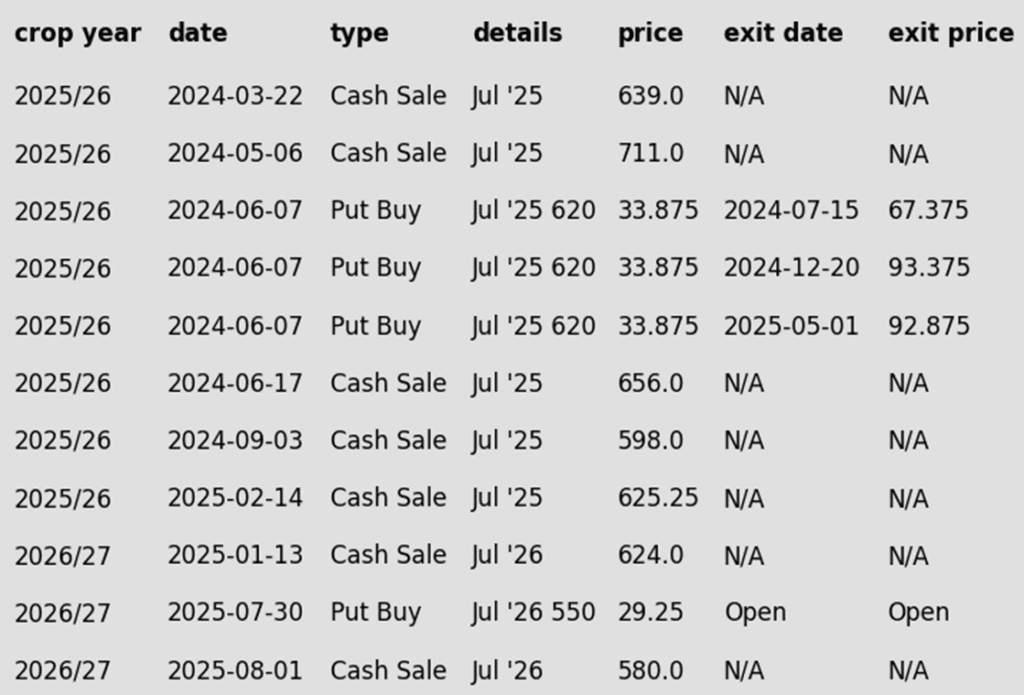

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The 596 target was lowered to 594.25.

- All targets are now vs the December contract.

2026 Crop:

- Plan A:

- Target 612.25 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The 608.50 upside target was raised to 612.25.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if December closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- Call buy target is now vs the December contract.

2026 Crop:

- Plan A:

- Target 658 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 to make the first cash sale.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 661 upside sale target was lowered to 658.

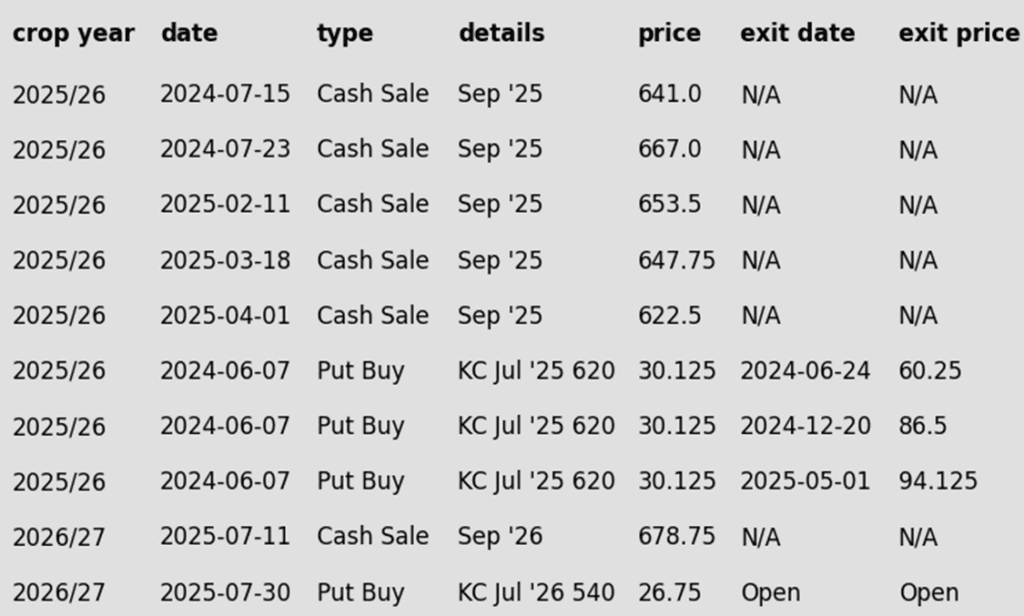

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The upside call buy stop target is now vs the December KC contract.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Other Charts / Weather

Above: US 5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.