8-14 End of Day: Grains Close Lower Across the Board Following Export Sales Report

We are excited to offer you a new way to follow the markets! While CME Group policy changes mean our daily updates will no longer show pricing data, you can now explore our interactive quote board, featuring up-to-date charts to help you track market trends.

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: Corn markets saw weakness today, closing lower due to a disappointing export report and expectations of a larger-than-anticipated upcoming crop, both of which weighed on prices.

- 🌱 Soybeans: Soybeans closed lower as growing concerns over China’s reliability as a trade partner weighed on the market.

- 🌾 Wheat: Wheat futures ended the trading day lower across all classes, pressured by a stronger U.S. dollar and a lack of fresh catalysts to spark any upward momentum in the market.

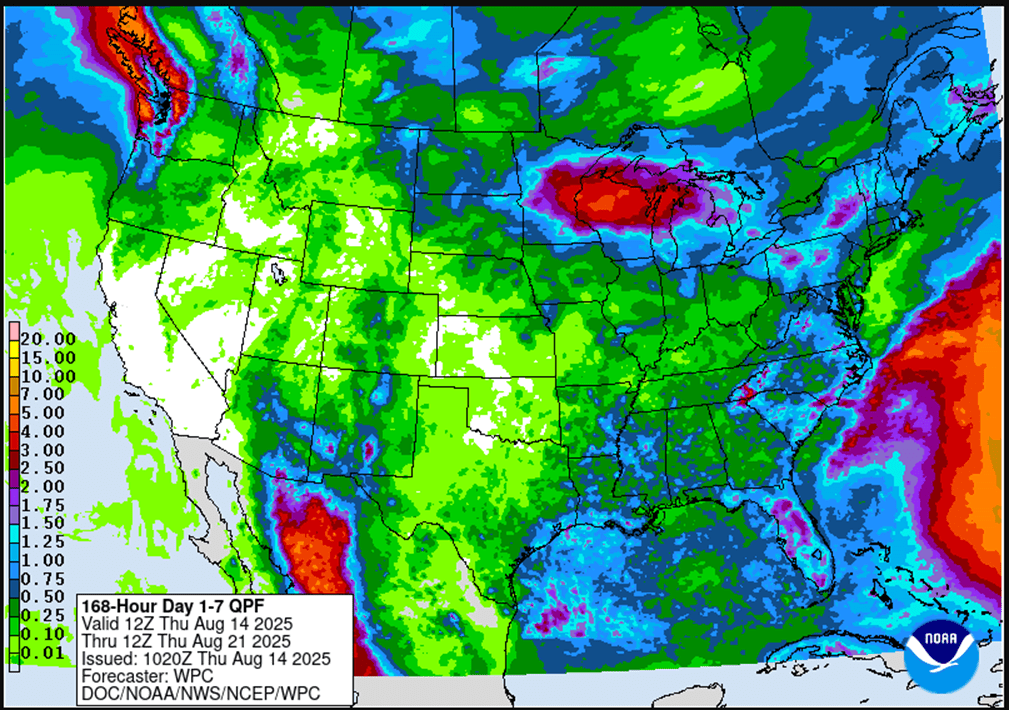

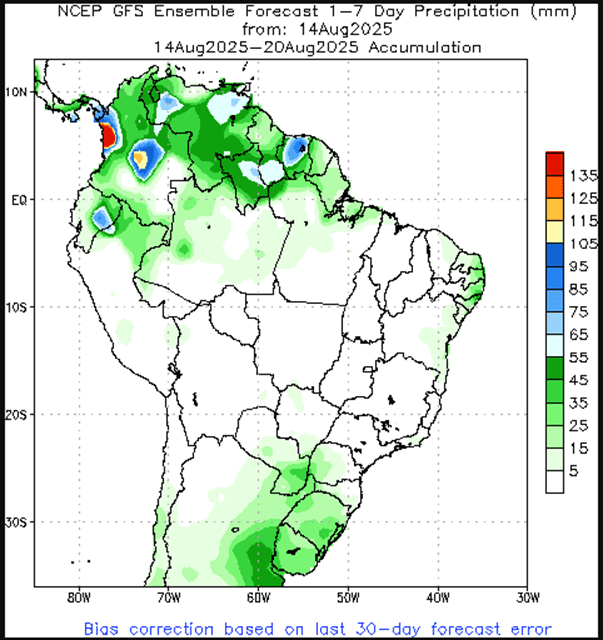

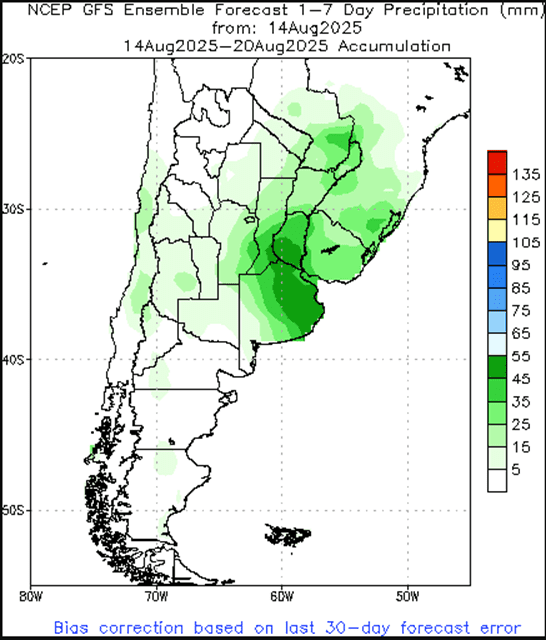

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

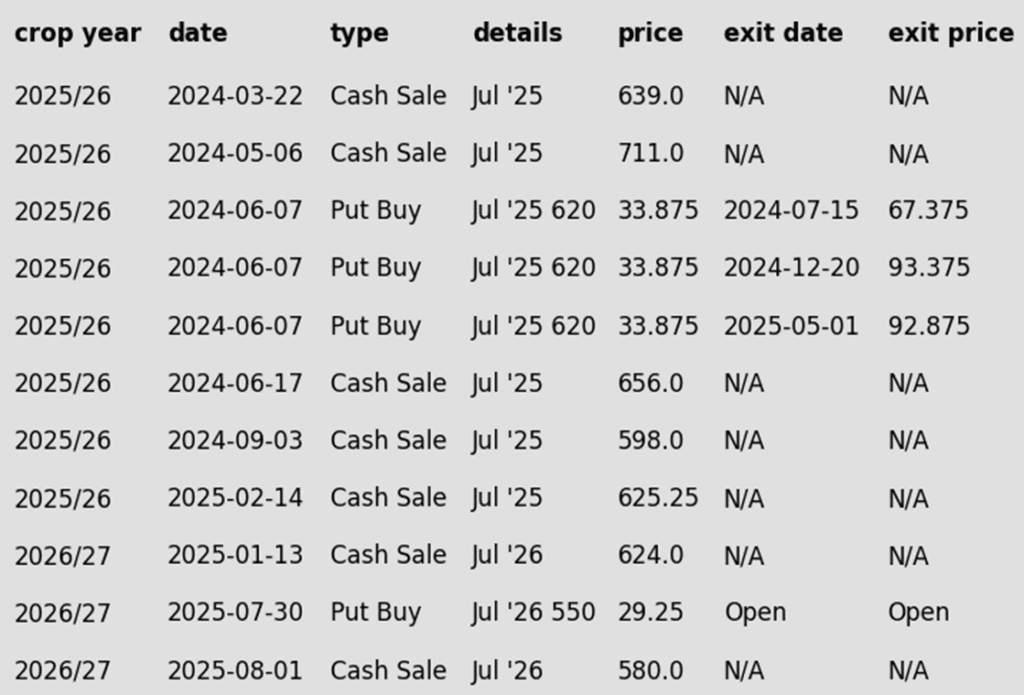

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- FYI – yesterday the 420 puts closed at 30-7/8 cents.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished mixed to lower in the session as prices consolidated at recent lows. Weaknesses in other grains, export sales cancellations, and the prospects of large supplies limit the upside in the corn market.

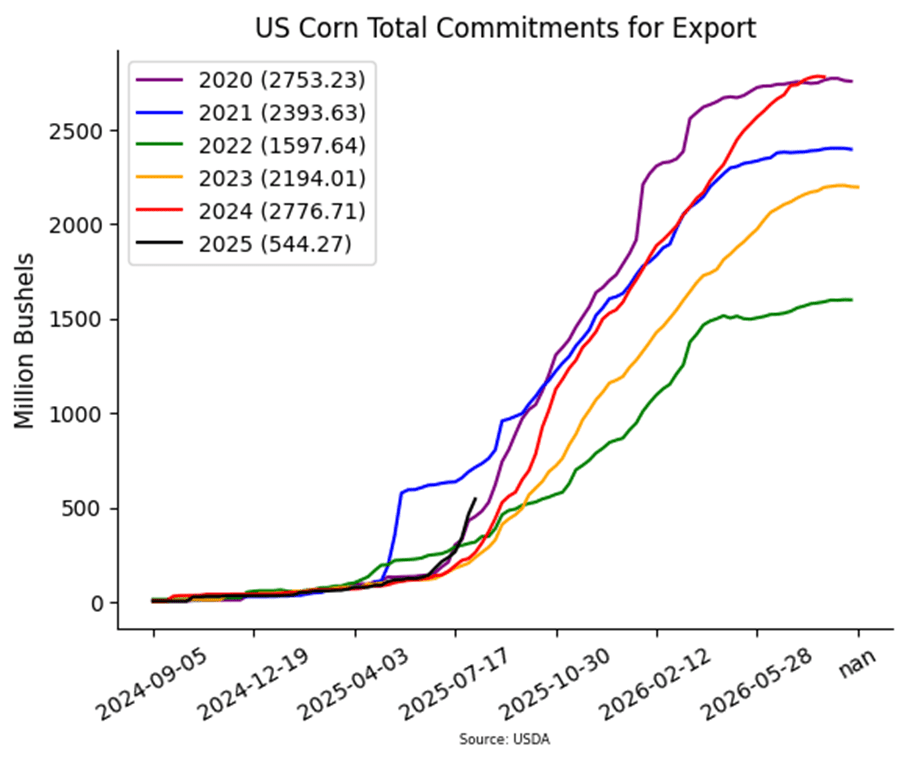

- The USDA released weekly corn export sales on Thursday morning, and it brought a mixed bag of information. Sales for the 2024-25 marketing year hit a market year low with net reductions of 88,700 MT (3.5 mb). While a few new sales occurred, they were offset by 601,200 MT (23.7 mb) of reductions. The marketing year ends at the end of the month, what can’t get shipped is either canceled or rolled to 2025-26. New crop sales remain strong with sales of 2.048 MMT (80.7 mb).

- USDA announced flash exports sales of corn on Thursday morning. South Korea to purchase 136,000MT and Spain added 132,000 MT for the 2025-26 marketing year. U.S. corn export prices will remain competitive moving into the fall months as the market works through a potential record supply of corn.

- The Brazil Ag agency, CONAB raise their expectations for the Brazil corn crop by 5 MMT on Thursday morning to 137 MMT crop (5.398 BB), which is a record production. USDA forecast the Brazil crop at 132 MMT on Tuesday WASDE report.

- Corn prices will likely stay pressured, or rallies limited as both the U.S. and Brazil are producing record corn crops. The large volume of supply in the global corn market will take time to digest as the corn market is currently in a supply driven bear market and demand will be the key.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- The upside target to exit two-thirds of the 1100 calls at 88 cents has been cancelled, given the substantial rally that would be required to reach that target.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- A new upside Plan B call buy stop has been activated. Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase. Remaining below this resistance keeps the broader trend sideways-lower, with no immediate need for call option coverage.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

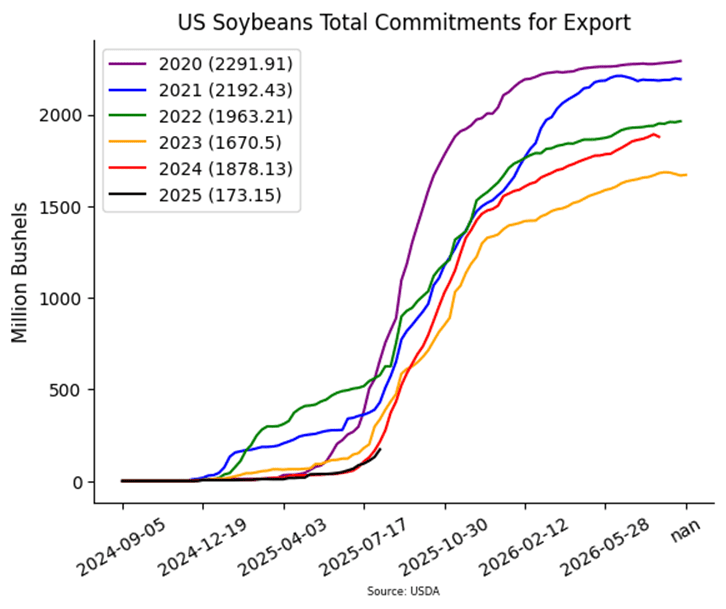

- Soybeans ended the day sharply lower following three days of large gains as weakness in soybean oil weighed on the complex along with concerns over export demand and China as a trade partner. Despite the losses, November futures closed above all major moving averages. Soybean meal ended the day lower as well.

- Export sales were mixed for soybeans with a net cancellation of 13.9 million bushels for 24/25 and an increase of 41.6 mb for 25/26. New crop sales were better than expected. Top buyers were the Netherlands, Bangladesh, and Japan. Last week’s export shipments of 19.6 mb were below the 26.9 mb needed each week to meet USDA expectations.

- Weather forecasts throughout the rest of the month call for warm summer temperatures and enough moisture to get through pod fill. It is possible that the USDA increases yield again in the September report, but it is also possible that export demand is lowered which could see the ending stocks number increase.

- In Brazil, soybean production is expected to rise by nearly 1 mmt to 170.5 mmt because of better than expected yields. The USDA has not yet increased production estimates for Brazil.

Wheat

Market Notes: Wheat

- Wheat closed lower across the board. Today’s PPI report showed higher than expected inflation, which led to a jump in the U.S. Dollar, which ultimately weighed on wheat values. Additionally, a recent lack of fresh friendly news has made it difficult for wheat to rally.

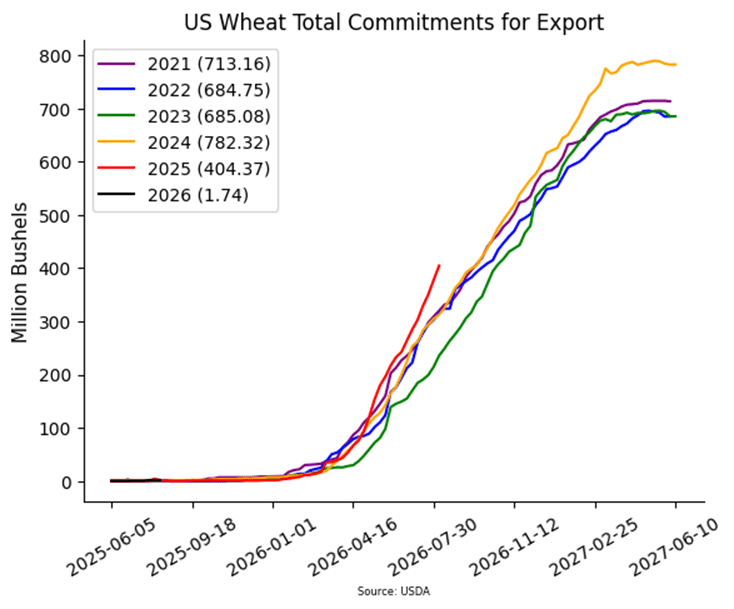

- The USDA reported an increase of 26.6 mb of wheat export sales for 25/26. Shipments last week totaled 12.5 mb, which falls under the 17.4 mb pace needed per week to reach their 25/26 export goal of 875 mb. However, total 25/26 sales commitments have reached 404 mb which is up 24% from last year.

- In an update from CONAB, they kept their Brazilian wheat production estimate unchanged at 7.81 mmt. This is slightly above the USDA’s guess of 7.5 mmt. Meanwhile, the Rosario Grain Exchange has said that good rains are benefiting Argentina’s wheat crop, and their production estimate has been kept steady at 20 mmt.

- After recent rains, spring wheat areas in drought as of August 12 have fallen to just 16% compared with 35% the week before. While the moisture may benefit later planted crops, it may also slow HRS harvest and potentially cause quality concerns. In addition, winter wheat areas in drought declined 1% to 29% over the same time period.

- According to DRV, a German ag co-op group, Germany’s 2025 grain harvest is now estimated at 43 mmt, up from 41.7 mmt previously. This would be a 10% jump above the 2024 crop, if accurate. Wheat production specifically is now seen at 22.4 mmt, compared with 21.6 mmt before.

- The finance and agriculture ministries in China have allocated 1.1 billion yuan (the equivalent of over $153 million USD) in disaster relief funds. The goal is to stabilize grain production in major growing regions.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 599.75 vs September for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

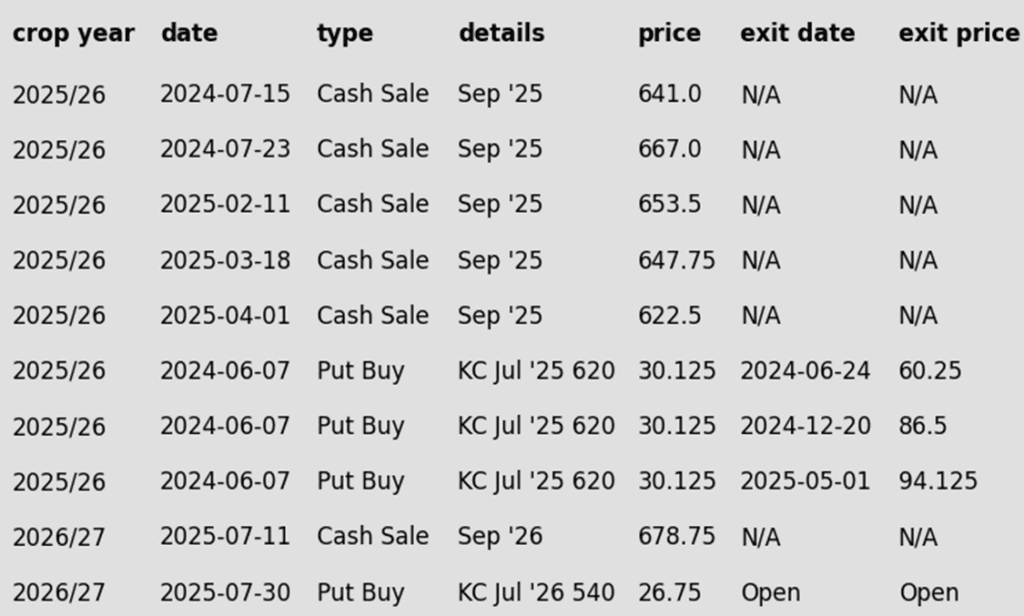

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The 599.75 target was lowered to 596.

2026 Crop:

- Plan A:

- Target 608.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The 608.50 upside target was raised to 612.25.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 622 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 to make the first cash sale.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 683 upside sale target was lowered to 661.

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. Still no new active sales targets to report yet.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.