8-13 End of Day: Grain Markets Close Mixed as Traders Weigh USDA Data

We are excited to offer you a new way to follow the markets! While CME Group policy changes mean our daily updates will no longer show pricing data, you can now explore our interactive quote board, featuring up-to-date charts to help you track market trends.

Grain Market Insider Interactive Quote Board

Grain Market Highlights

- 🌽 Corn: The corn market finished higher today, as traders continued to digest yesterday’s report and found additional support from strength in the other grain markets.

- 🌱 Soybeans: Soybeans ended Wednesday’s trade higher, as traders continued to draw support from yesterday’s report and optimism over a potential trade deal with China.

- 🌾 Wheat: Wheat trade ended mixed, struggling to gain momentum following yesterday’s lackluster USDA report for the wheat markets.

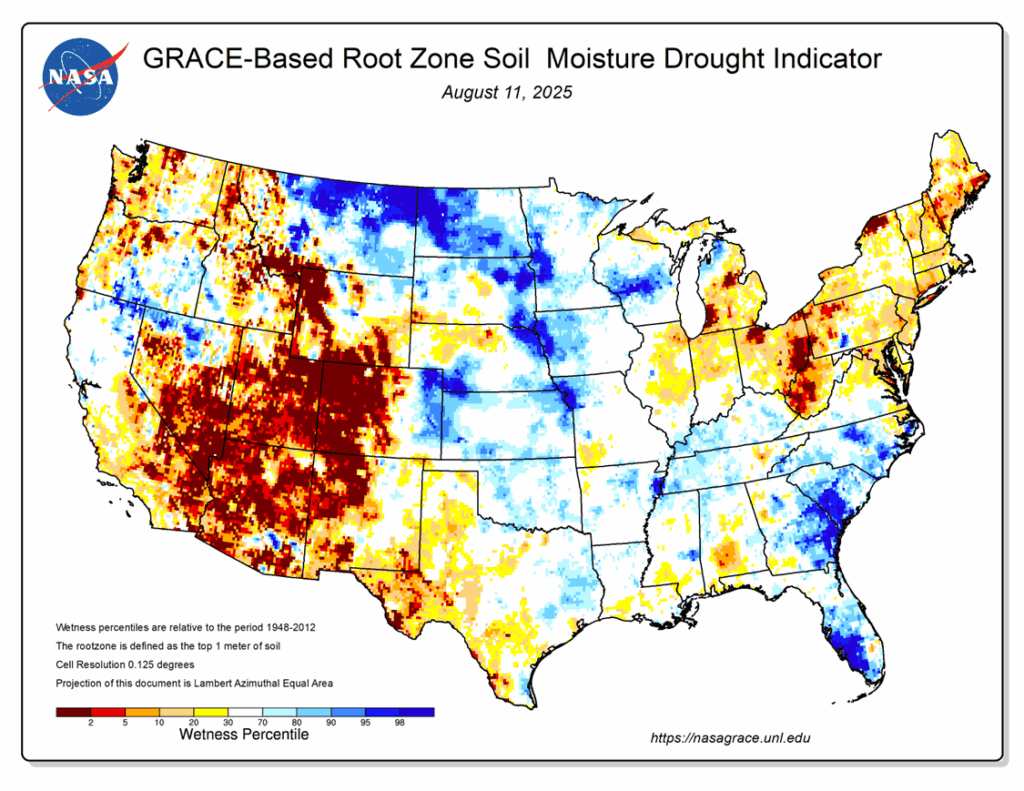

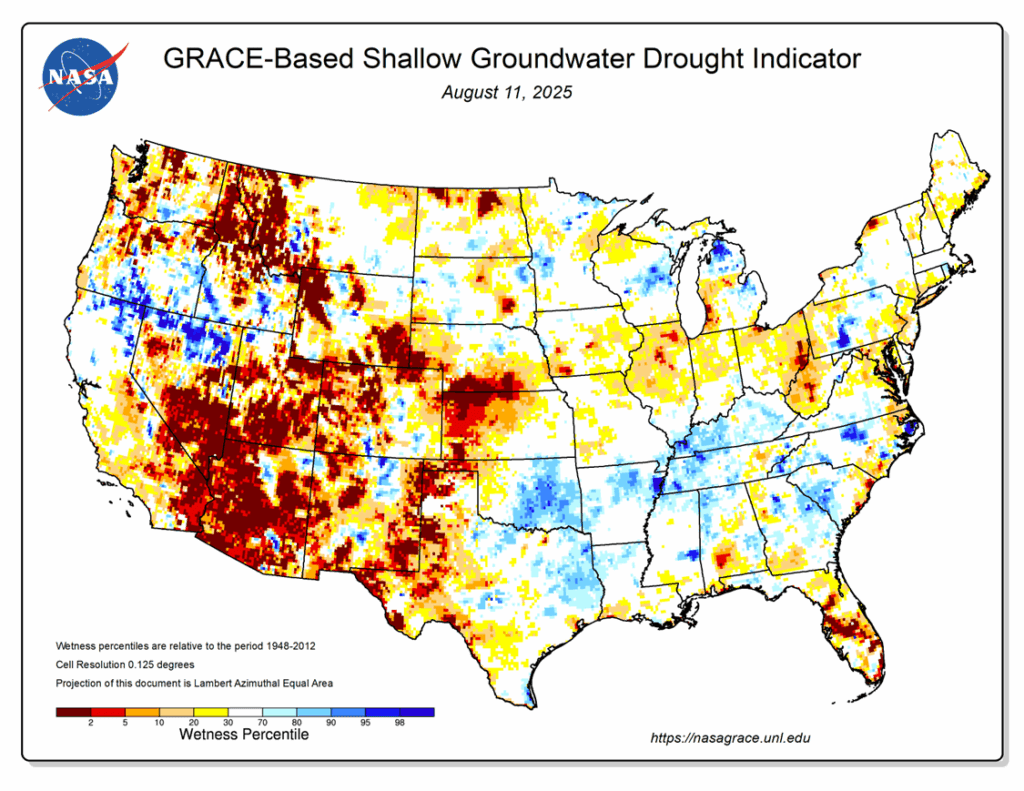

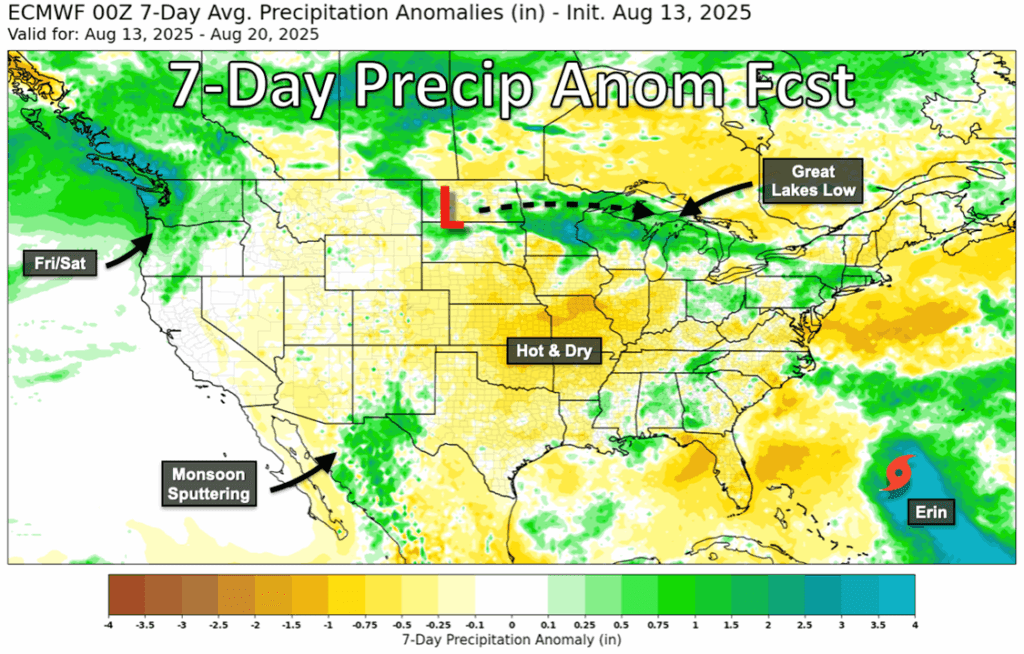

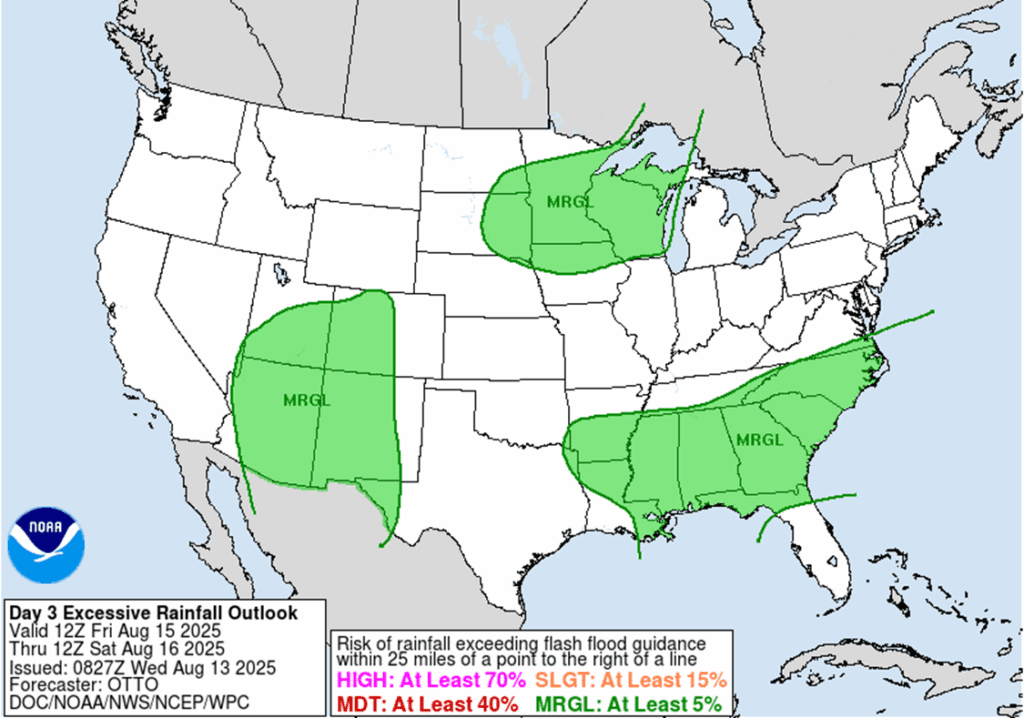

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- FYI – yesterday the 420 puts closed at 30-7/8 cents.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 482 resistance vs Dec ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

- Resistance for the macro trend sits at 482 vs December ’26. A close above 482 would signal a potential shift to a macro uptrend, triggering a call option purchase.

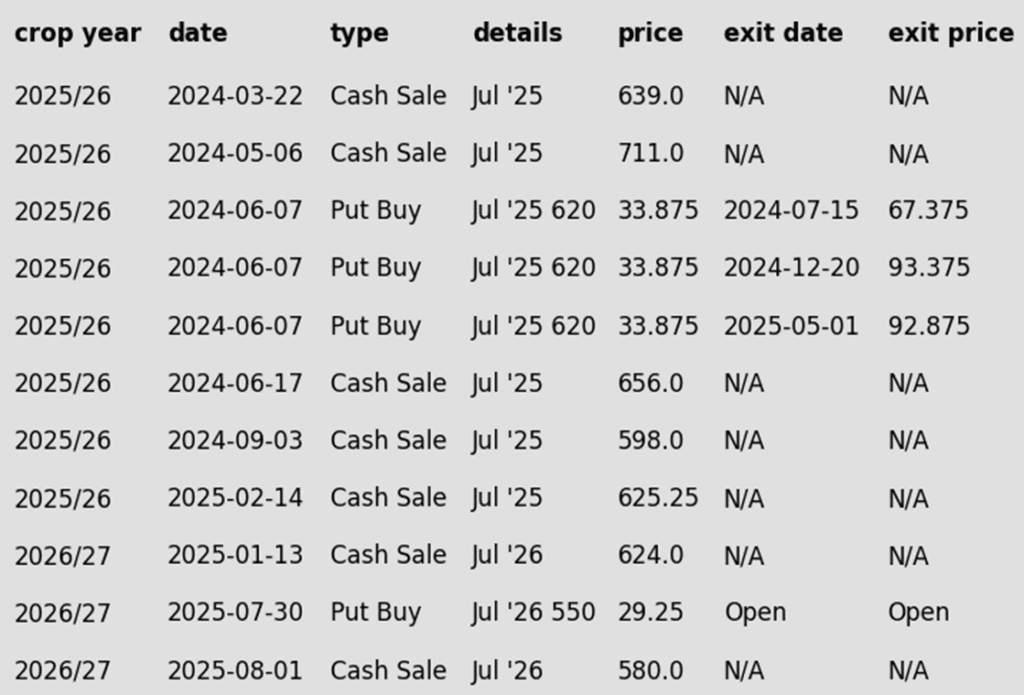

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market posted marginal gains on Wednesday as the market continues to process Tuesday’s negative USDA crop production report forecasting a record corn crop for this fall. Strength in other grains helped provide support to the market.

- Even with a yield forecast well above expectations, the addition of 2.1 million acres to the corn crop was the biggest weight on prices and potential supplies ballooned. The corn market is in a supply driven bear market, and demand will be the key to working through a burdensome supply outlook.

- New crop corn export sales are off to a strong start with one of the best years in accumulated sales over the past two decades. As of July 31, new crop export sales commitments have totaled 11.77 MMT (433.2 mb). This is over twice as much corn sold last year for the 2024-25 marketing year at this time window.

- USDA will release weekly export sales report tomorrow morning. Expectations are for new sales for the 2025-26 marketing year to range from 900,000 – 2.4 MMT for the week ending August 7.

- Participants in the corn market will be watching crop tours and “boots on the ground” tours to determine if the USDA yield is accurate. Finishing weather and disease pressure are going to be components in the final yield level puzzle.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit one-third of 1100 call options at 1085 vs November.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- The upside target to exit two-thirds of the 1100 calls at 88 cents has been cancelled, given the substantial rally that would be required to reach that target.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- A close over 1161 resistance vs Nov ‘26 and buy call options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- A new upside Plan B call buy stop has been activated. Resistance for the macro trend sits at 1161 vs November ‘26. A close above 1161 would signal a potential shift to a macro uptrend, triggering a call option purchase. Remaining below this resistance keeps the broader trend sideways-lower, with no immediate need for call option coverage.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day sharply higher for the third consecutive day with the November contract posting its highest close since July 3 and filled the gap on the chart for that day. For the week, November soybeans have gained a whopping 56-3/4 cents so far. Both soybean meal and oil ended the day higher as well.

- The U.S. is reportedly losing out on Chinese soybean sales as Brazil fills their needs during this key export period for the U.S. President Trump has tried to encourage China to buy, but they have been absent. In addition, U.S. soybeans are now much more expensive than Brazilian offers.

- Highlights from yesterday’s report included an increase in estimated yield to 53.6 bpa. This was above the average trade estimate of 53 bpa and was above last month’s estimate of 52.5 bpa. However, both production and ending stocks were lowered due to a surprise revision lower in planted acreage. Ending stocks for 25/26 are now at just 290 mb, below the estimate of 360 mb. World-ending stocks were lowered slightly for 25/26.

- Weather forecasts throughout the rest of the month call for warm summer temperatures and enough moisture to get through pod fill. It is possible that the USDA increases yield again in the September report, but it is also possible that export demand is lowered which could see the ending stocks number increase.

Wheat

Market Notes: Wheat

- Wheat had a mixed close today, not able to find strength in either direction. This is likely the result of a somewhat neutral report yesterday, along with a lack of fresh impactful news. While September Chicago did make a new low today, it has not breached support at the five-dollar level, yet. Wheat may continue to follow corn for the time being.

- Early next week, Argentinian wheat growing areas are expected to see beneficial rains. Meanwhile, rain in the US northern Plains is expected to have a negative impact on spring wheat quality and may also slow harvest.

- According to the Russian agriculture ministry, their 2025 grain harvest is 47% complete – an estimated 75 mmt of grain has been collected so far. Recently, they estimated that total grain output would reach 135 mmt.

- SovEcon has increased their Russian wheat production estimate from 83.6 mmt to 85.2 mmt. Better than expected yields, along with higher acreage, are cited as the reasons for the uptick. Wheat planted area is now estimated at 26.9 million hectares versus 26.6 million hectares previously.

- European Union soft wheat exports reached 1.43 mmt as of August 10; the export season began on July 1. This total is down about 56% from the 3.28 mmt shipped during the same timeframe last year. The top importer was Saudi Arabia, followed by Nigeria and Algeria.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Target 599.75 vs September for the next sale.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The 599.75 target was lowered to 596.

2026 Crop:

- Plan A:

- Target 608.50 vs July ‘26 for the next sale.

- Plan B:

- No active targets.

- Details:

- Sales Recs: One sales recommendation made to date at 624.

- Changes:

- The 681 upside target was lowered to 608.5.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 622 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 to make the first cash sale.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 683 upside sale target was lowered to 662.

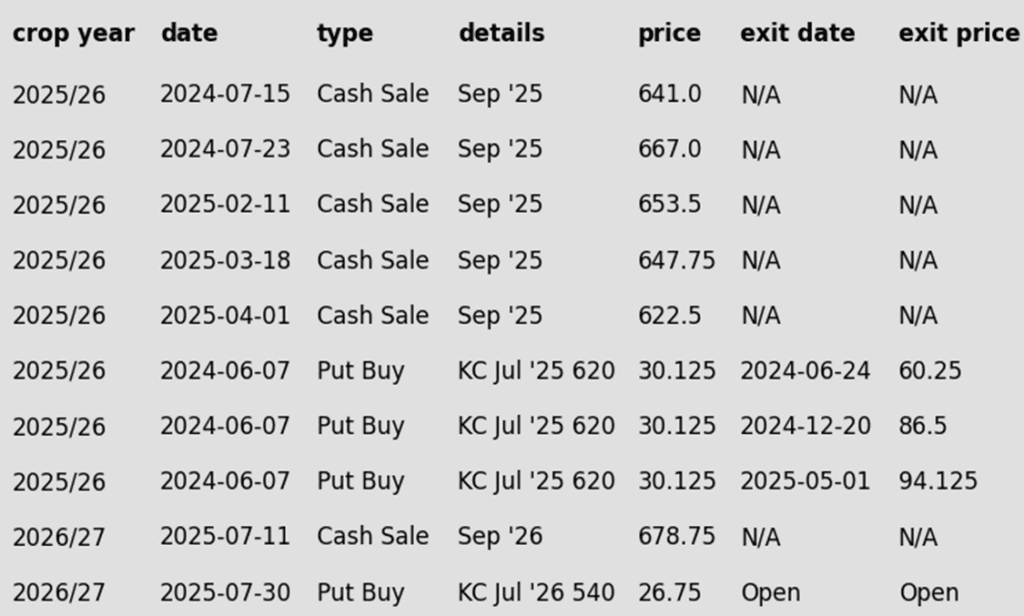

To date, Grain Market Insider has issued the following KC recommendations:

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. Still no new active sales targets to report yet.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Other Charts / Weather