7-9 End of Day: Grain Markets Struggle for Support Ahead of WASDE Report Friday

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 399.25 | 1.25 |

| DEC ’25 | 415.5 | 1.25 |

| DEC ’26 | 452.5 | 1.25 |

| Soybeans | ||

| AUG ’25 | 1009 | -12.25 |

| NOV ’25 | 1007.25 | -10.25 |

| NOV ’26 | 1042 | -5.75 |

| Chicago Wheat | ||

| SEP ’25 | 547 | -0.75 |

| DEC ’25 | 567.25 | -1.25 |

| JUL ’26 | 604 | -1.25 |

| K.C. Wheat | ||

| SEP ’25 | 524 | 1.5 |

| DEC ’25 | 547.75 | 0.5 |

| JUL ’26 | 594 | 0.25 |

| Mpls Wheat | ||

| SEP ’25 | 631.5 | 1.75 |

| DEC ’25 | 650 | 1 |

| SEP ’26 | 674.75 | -1.75 |

| S&P 500 | ||

| SEP ’25 | 6296.75 | 24.75 |

| Crude Oil | ||

| SEP ’25 | 66.99 | 0.01 |

| Gold | ||

| OCT ’25 | 3348.4 | 3.7 |

Grain Market Highlights

- 🌽 Corn: Corn futures ended slightly higher Wednesday, pausing after posting new contract lows overnight.

- 🌱 Soybeans: Soybeans closed lower for a third straight session Wednesday, with August futures down 46 ½ cents so far this week. Favorable weather and strong crop ratings continue to pressure the market, encouraging fund selling.

- 🌾 Wheat: Wheat futures closed mixed Wednesday—Chicago posted minor losses, while Kansas City and Minneapolis saw modest gains.

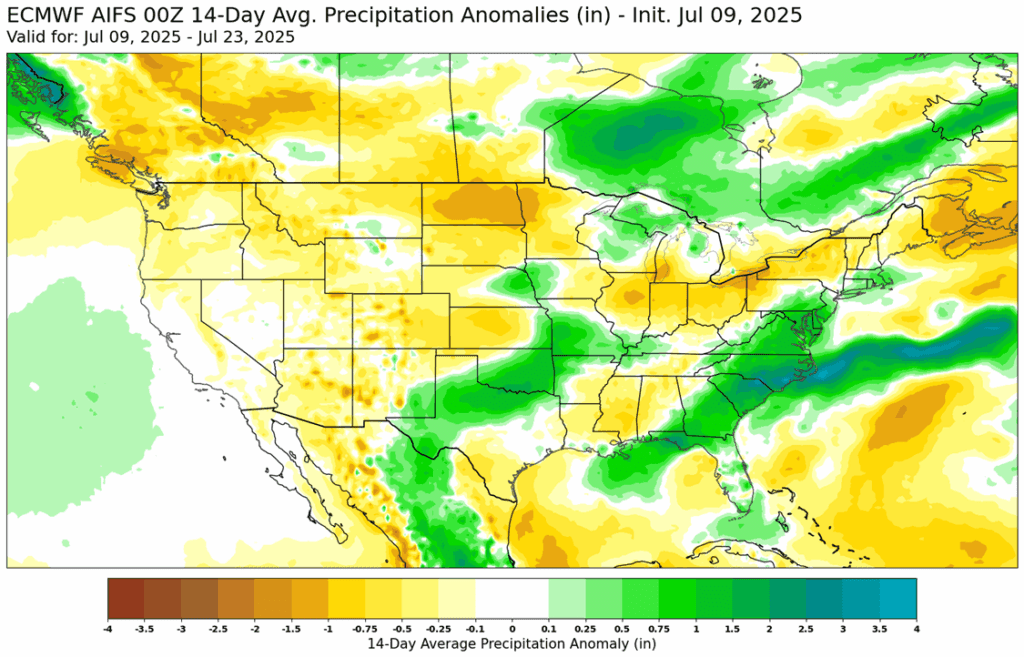

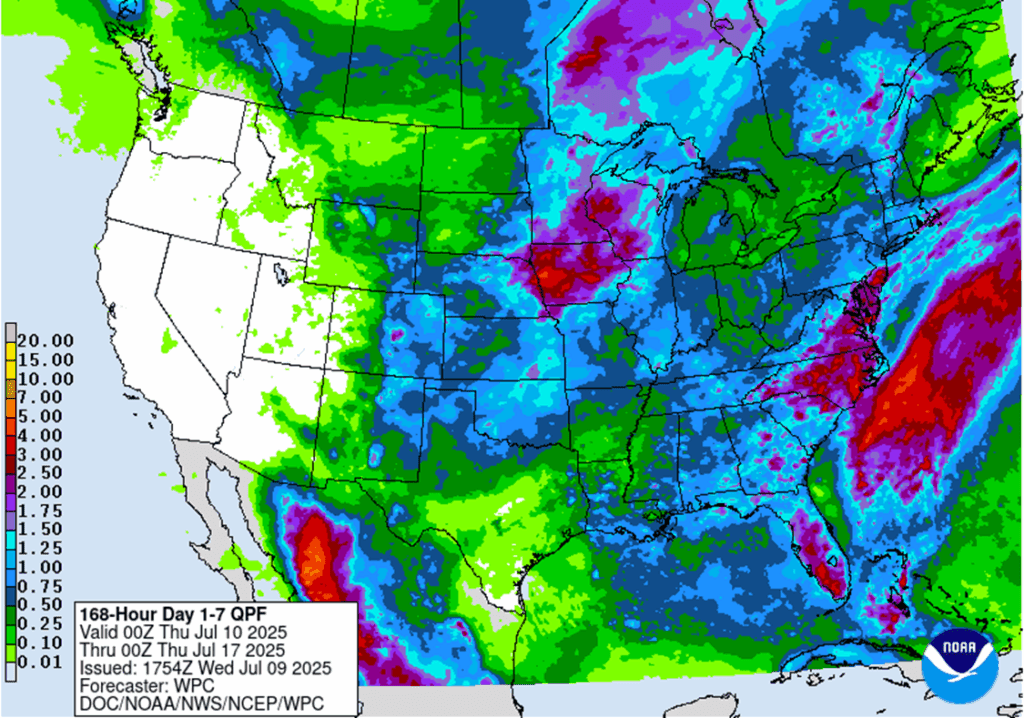

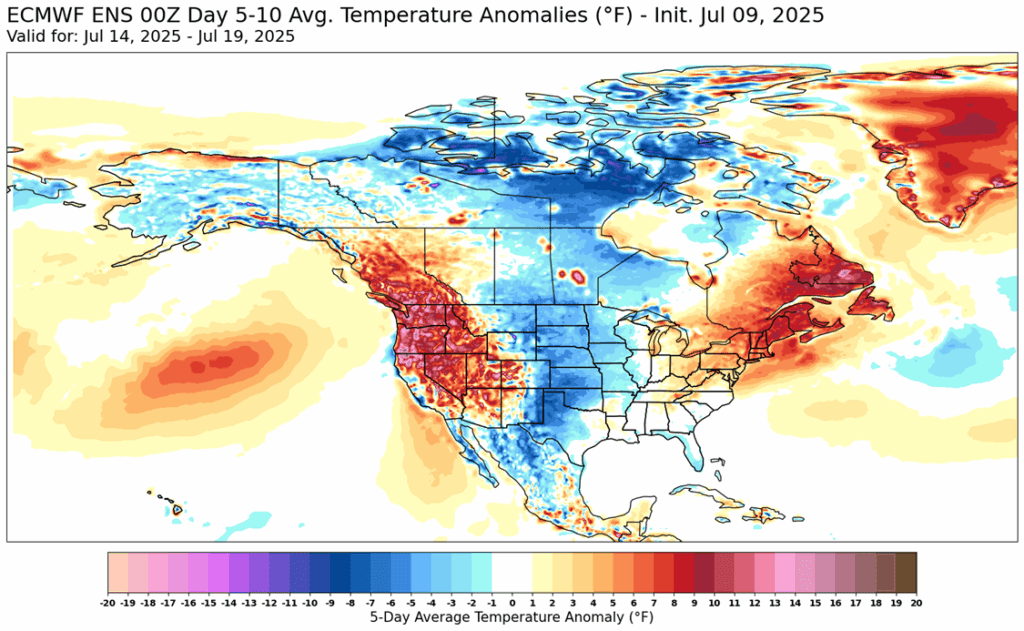

- To see updated U.S. weather forecasts scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

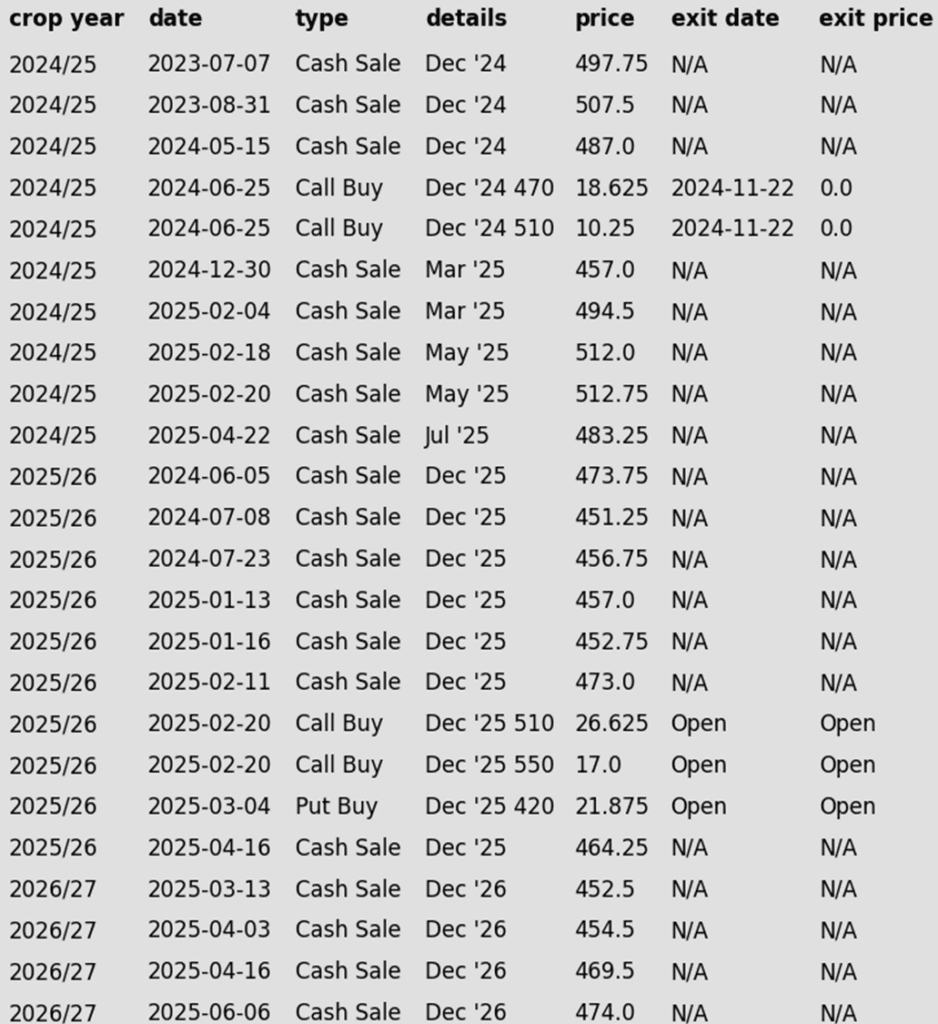

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

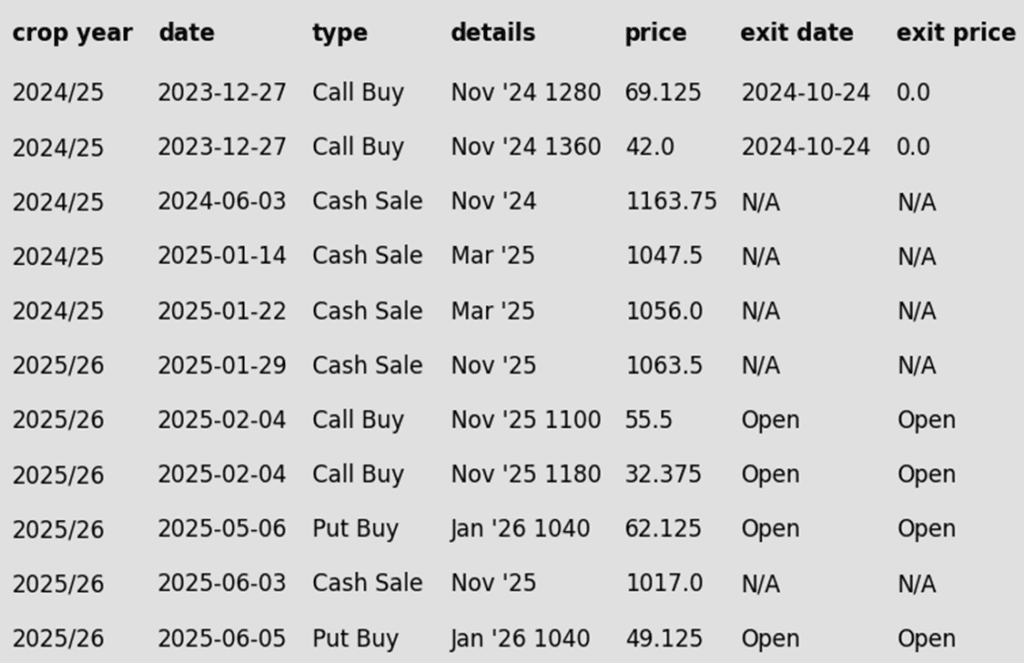

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures ended slightly higher Wednesday, pausing after posting new contract lows overnight. Prices attempted to rebound but failed to spark meaningful short covering, with consolidation at recent lows.

- Managed money continues to expand its net short position, with no immediate catalyst in sight to prompt a reversal.

- The USDA will release the next WASDE/Crop Production report on Friday. While corn yield is likely to remain unchanged until August, updates to acreage and old crop demand could shift new crop carryout estimates.

- Ethanol production rose to 1.085 million barrels/day last week, ahead of the pace needed to meet USDA’s annual corn use target. An estimated 104.9 mb of corn was used, up from the prior week and year.

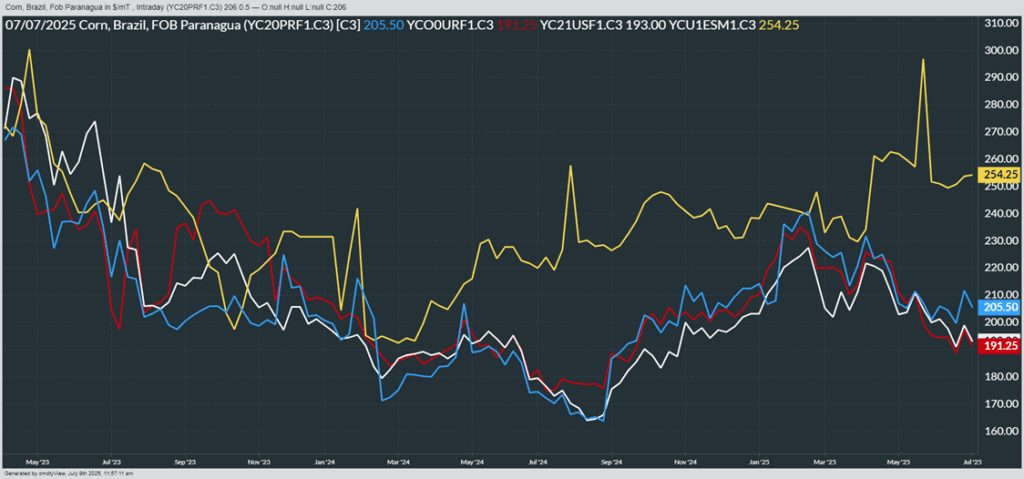

- Brazil is still harvesting a record supply of second crop corn. The Brazil corn market is concerned with logistic issues, and a softening demand base, which has weighed on global corn prices as a possible record U.S. corn crop develops.

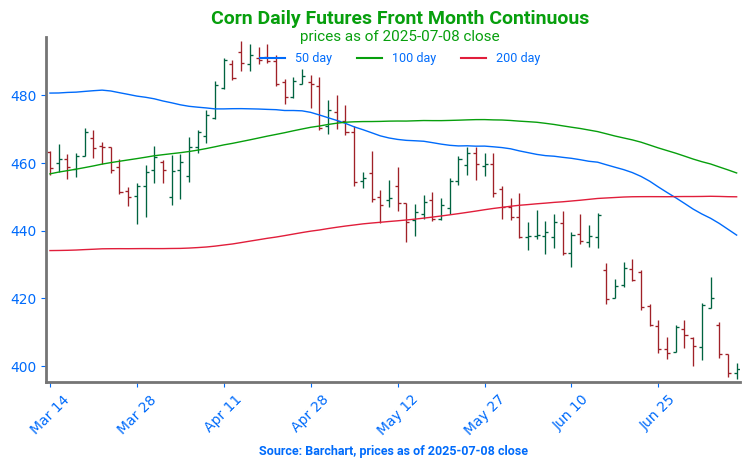

Corn Futures Back Near Lower end of Recent Range

Front-month corn futures struggled throughout June, breaking key support and leaving an unfilled chart gap following the roll to September. That gap near 430 now stands as the first upside target. On the downside, the late June low of 404 offers initial support, with stronger support seen at 394.

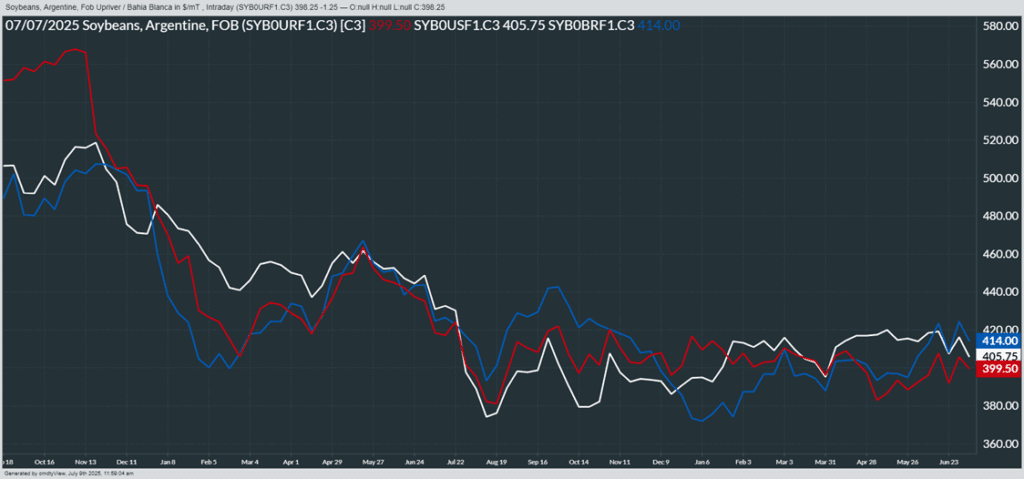

Above: From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs August.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

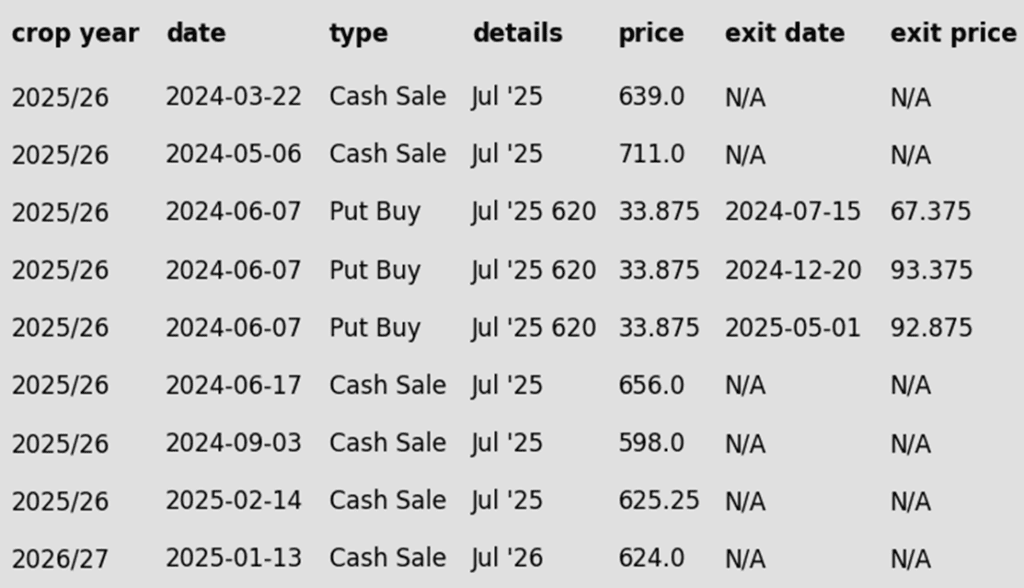

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower for the third consecutive day and have now lost 46-1/2 cents for the week in the August contract as good weather and crop ratings incentivize funds to continue selling. Both soybean meal and oil were lower, but bean oil led the complex lower.

- Sellers are in control of the soybean market as prices pushed through key levels of resistance during Wednesday’s session. The combination of softening demand tone, a 9-year low in soybean meal prices, and growing global supplies lead the market. Managed funds were still holding a small net long position in soybeans in the last Commitment of Traders report.

- Pre-report estimates for Friday’s USDA update peg old crop soybean ending stocks at 358 mb (up from June’s 350 mb), and new crop 2025/26 stocks at 302 mb (vs. 295 mb in June).

- Soybean meal prices push lower as the increase crush demand for oil has produced an excess supply of soybean meal on the global market. As of today’s close, front month soybean meal prices close at their lowest levels since February 2016.

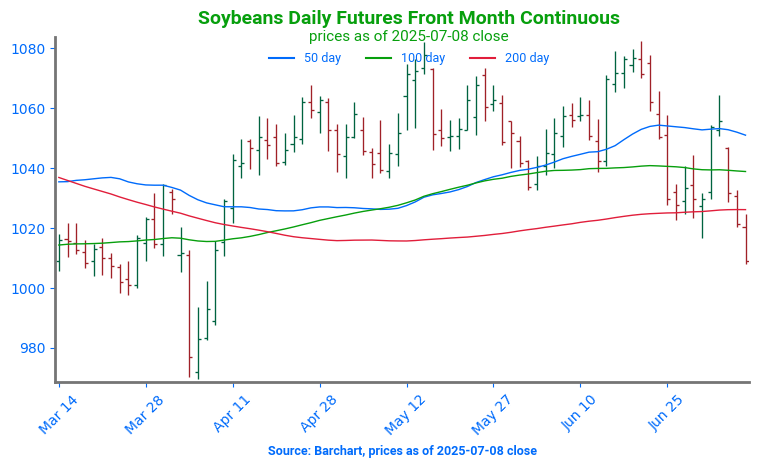

Soybeans Retreat from Recent Highs

Soybeans failed to close above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. A breakout above 1082 would open the door toward filling the June 2023 gap between 1161 and 1177. Soybean futures found support last week at the 200-day moving average and the bottom end of the recent range near 1030. A break below the 200-day would likely open the door to a test of the April lows near 980.

Above: From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- Wheat futures closed mixed Wednesday—Chicago posted minor losses, while Kansas City and Minneapolis saw modest gains. With winter wheat harvest now past halfway, pressure may be easing. A firmer close in Matif wheat also offered support.

- The Ukrainian Grain Union is estimating their nation’s 2025 wheat production at 22.4 mmt. This compares with the USDA at 23 mmt. In related news, grain infrastructure in Ukraine is reportedly not damaged after another round of Russian drone attacks. These strikes came shortly after the US resumed aid to Ukraine.

- South-central Canada remains dry, with scattered showers in the forecast, but overall moisture remains insufficient—posing risks to spring wheat now in its reproductive phase.

- According to LSEG, between October 2024 and May 2025, Australian wheat exports totaled about 15 mmt, up 2% year-over-year. They are estimating 24/25 total exports at 22.5 mmt, while pegging 25/26 shipments at 23 mmt. In general, Australian wheat exports are said to be encountering growing competition from the Northern Hemisphere, as well as weaker Chinese demand.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

2027 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

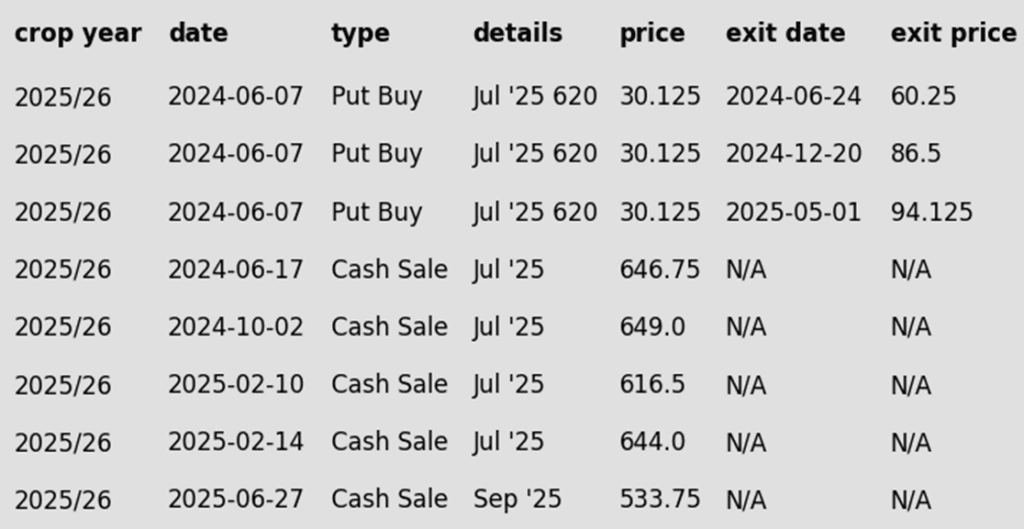

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

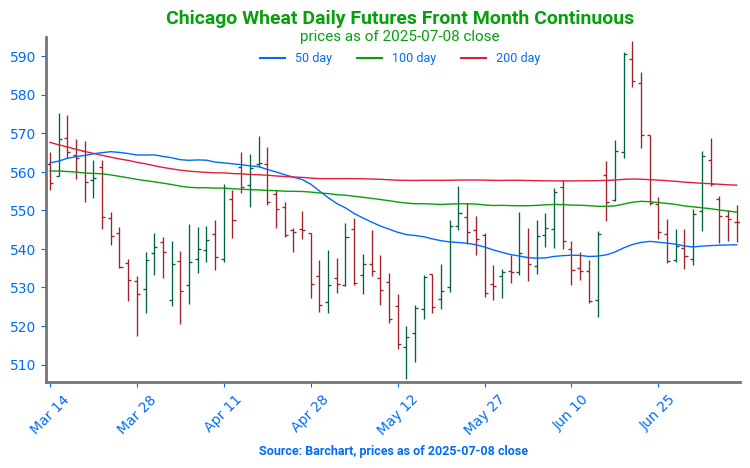

Chicago Wheat Returns to Recent Range

A sharp rally in mid-June was short lived for Chicago wheat futures. Prices have now returned back to the upper end of the range that has held prices for much of 2025. Initial support is at the June low of 522.25, with a break below that exposing further downside toward 506.25. On the upside, a weekly close above 558 could spark a test of the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A: Target 693 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

2027 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

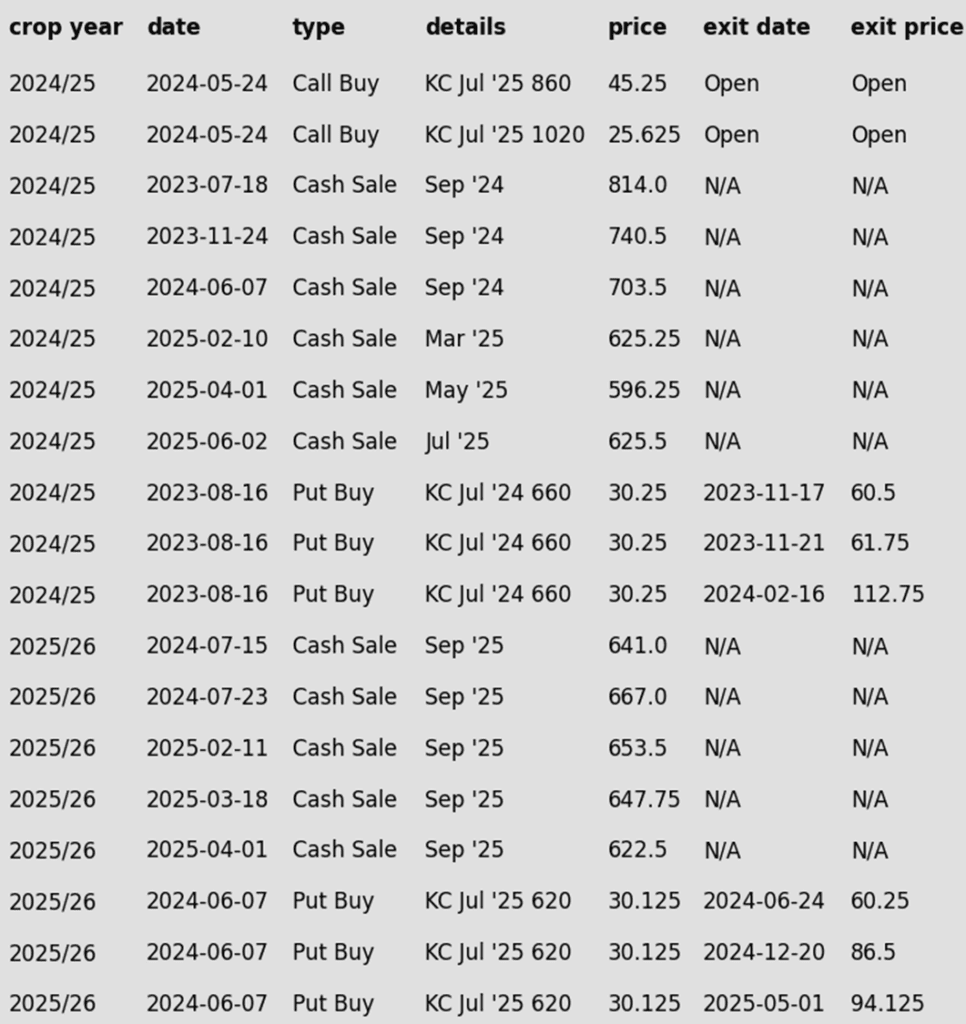

To date, Grain Market Insider has issued the following KC recommendations:

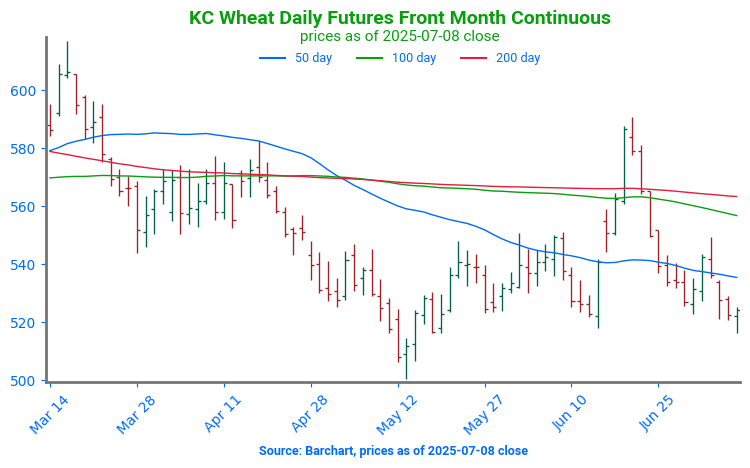

Kansas City Struggles Above Major Moving Averages

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Six sales recommendations made to date, with an average price of 684.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. The 2024 wheat crops will drop off the report next week.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

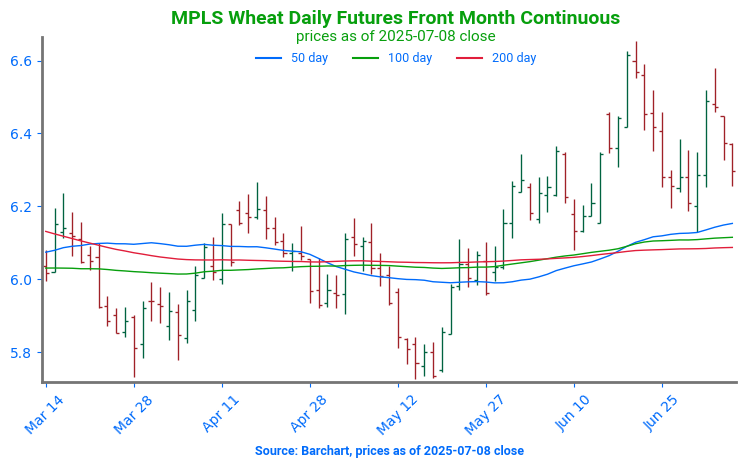

Spring Wheat on the Move Higher

Spring wheat futures spent nearly all of June above the upper end of the previous range and above a confluence of major moving averages. The first resistance and upside target would be the June high near 665. Key support now sits at the 200-day moving average near 607. A close below that level — and especially beneath the May low of 572.50 — would open the door to further downside risk.

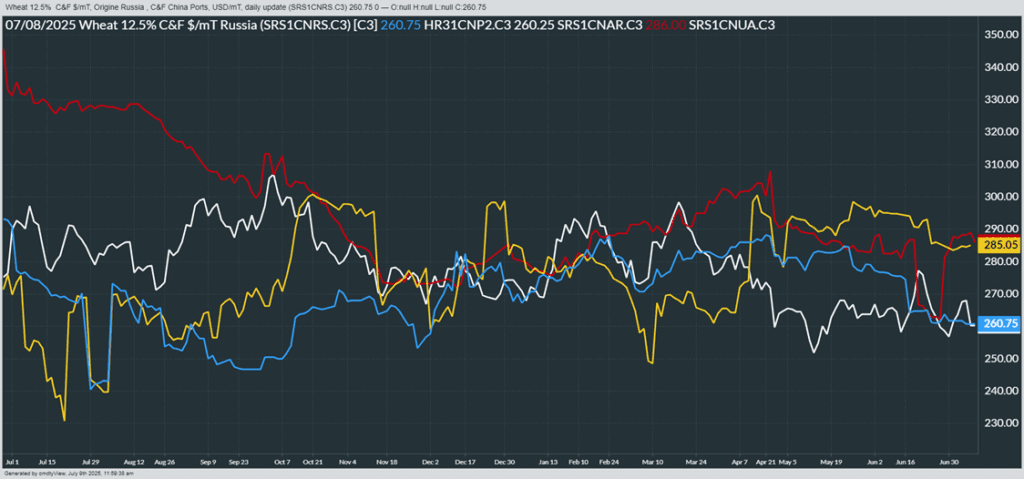

Above: From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather