7-31 End of Day: Soybeans Find Support from Higher Soybean Oil and Potential Profit Taking

All prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’24 | 382.75 | -6 |

| DEC ’24 | 399.75 | -5.25 |

| DEC ’25 | 445.25 | -2.75 |

| Soybeans | ||

| AUG ’24 | 1028.5 | 1.25 |

| NOV ’24 | 1022.5 | 1.25 |

| NOV ’25 | 1064.5 | 7 |

| Chicago Wheat | ||

| SEP ’24 | 527.25 | 3.25 |

| DEC ’24 | 552 | 3 |

| JUL ’25 | 588.5 | 2.75 |

| K.C. Wheat | ||

| SEP ’24 | 549 | -1.25 |

| DEC ’24 | 565.75 | -0.5 |

| JUL ’25 | 586.25 | 0.75 |

| Mpls Wheat | ||

| SEP ’24 | 581.5 | -3 |

| DEC ’24 | 601 | -2.25 |

| SEP ’25 | 639.25 | -1.25 |

| S&P 500 | ||

| SEP ’24 | 5574.75 | 102.25 |

| Crude Oil | ||

| SEP ’24 | 77.99 | 3.26 |

| Gold | ||

| OCT ’24 | 2451.5 | 23.1 |

Grain Market Highlights

- Despite a flash sale to unknown destinations, strong ethanol production numbers, and strength in crude oil, the corn market failed to gain upward traction and closed lower with September futures setting a new contract low close.

- Month end profit taking, and a surge in crude oil futures likely triggered by the killing of Hamas and Hezbollah leaders, helped give legs to the soybean oil market and in turn soybeans. Before rallying back to close higher on the day, September beans printed a fresh contract low. Soybean meal settled mostly lower, except for the August contract, which rallied on the lack of deliveries.

- A sharply lower US Dollar, a rise in Middle East tensions, and higher Matif wheat prices all likely lent underlying support to the wheat complex. Though the three wheat classes closed mixed, all three settled off their respective lows, with the Chicago and KC contracts showing the most resiliency.

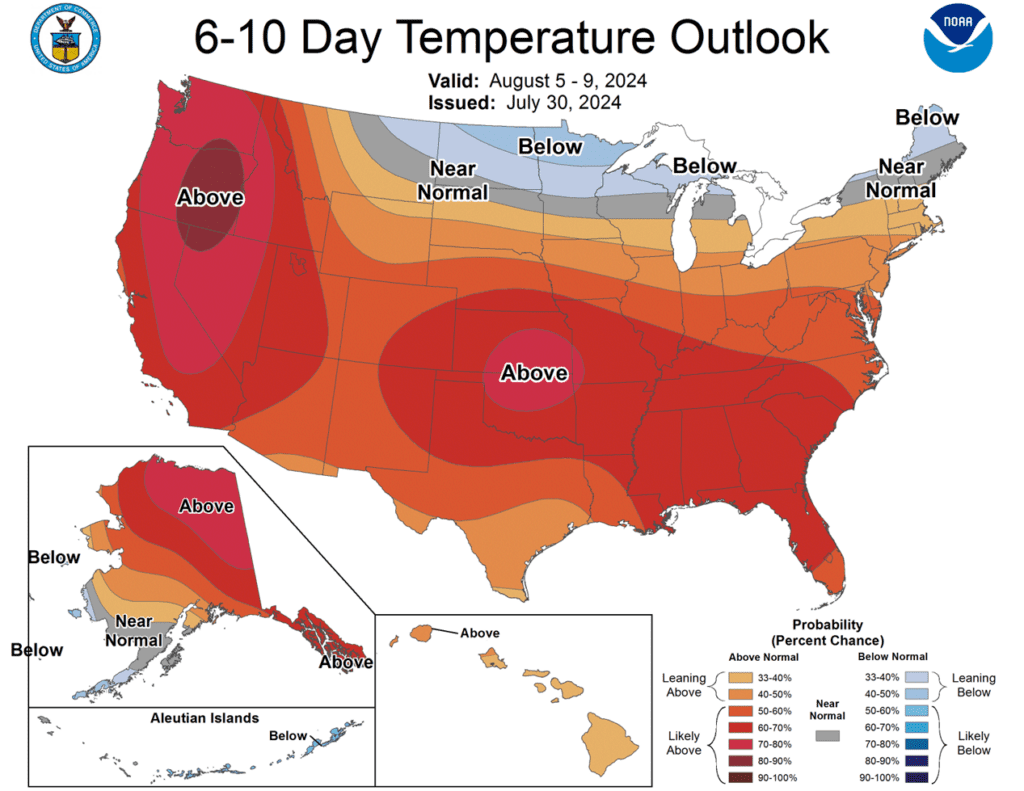

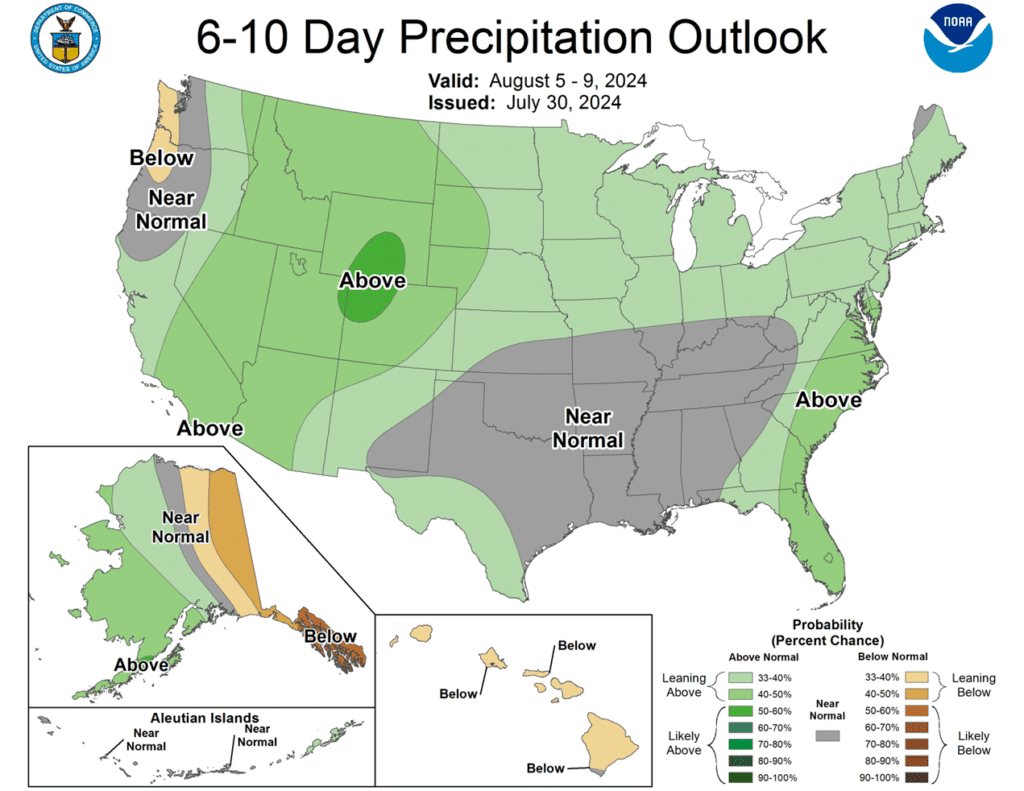

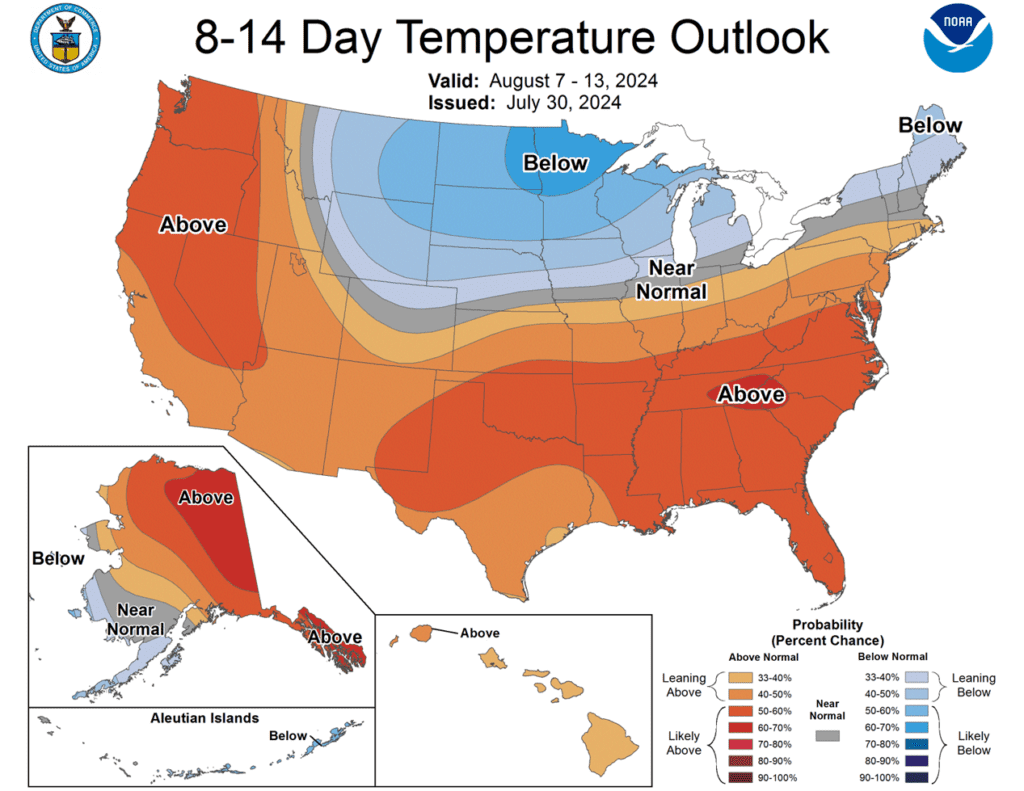

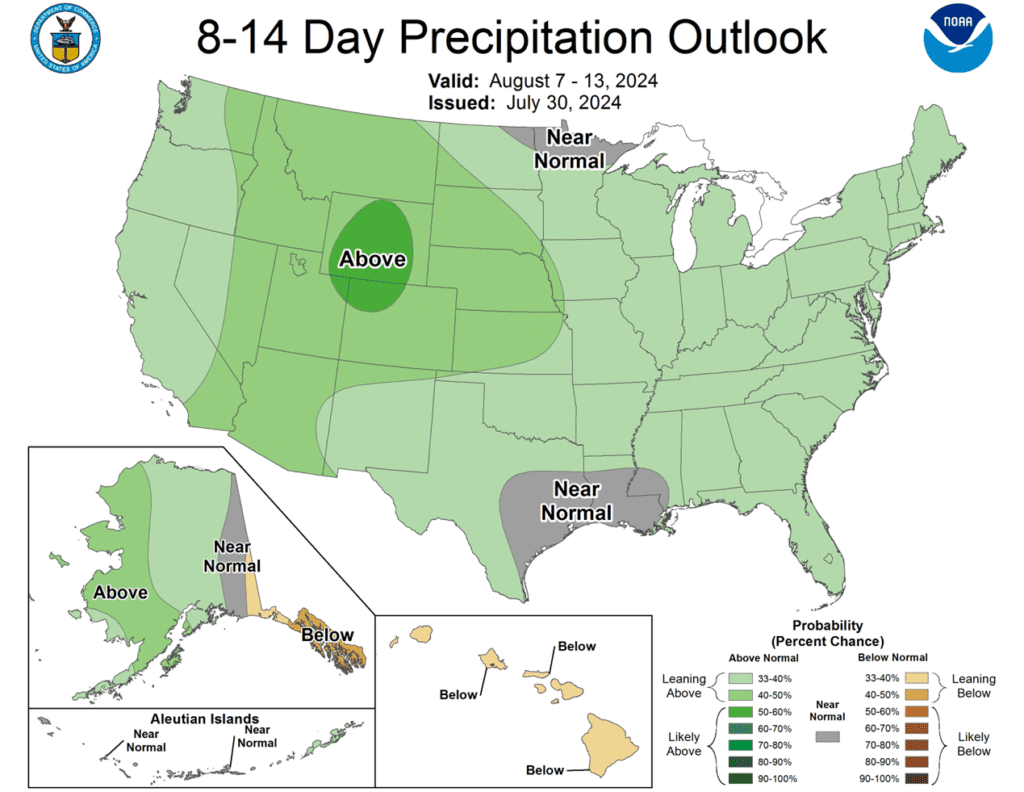

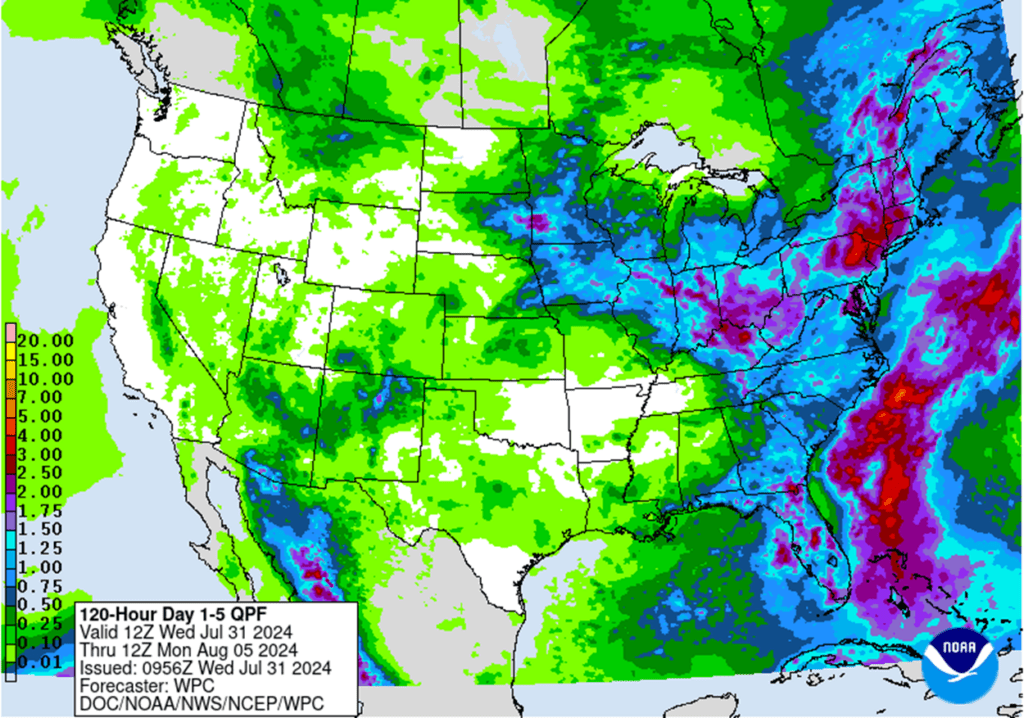

- To see the updated US 5-day precipitation forecast, and the 6-10 and 8-14 day Temperature and Precipitation Outlooks, courtesy of NOAA, and the Weather Prediction Center, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Corn Action Plan Summary

The USDA’s July WASDE report surprised the market by lowering 23/24 corn ending stocks below the low end of expectations resulting in a much lower than expected 24/25 ending stocks projection of 2.097 billion bushels. While this leaves new crop supplies at “adequate” levels, any increase in demand or drop in production could lead to short covering by the funds and higher prices.

- No new action is recommended for 2023 corn. Any remaining old crop 2023 corn should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 corn – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 corn. In June we recommended buying Dec ’24 470 and 510 calls after Dec ’24 closed below 451, for their relative value and because we are at that time of year of high volatility when markets can move swiftly. Moving forward, our current strategy is to target the value of 29 cents to exit the Dec ’24 470 calls. Exiting the 470 calls at 29 cents will allow you to lock in gains in case prices fall back and hold the remaining 510 calls at or near a net neutral cost, which should continue to protect existing sales and give you confidence to make further sales if the market rallies sharply. To take further action, we are targeting the 470 – 490 area to recommend making additional sales versus Dec ’24.

- No new action is currently recommended for 2025 corn. Since the growing season can often yield some of the best early sales opportunities, we recently made two separate sales recommendations to get some early sales on the books for next year’s crop. As we move forward and consider the sales that have been recommended, we will not be looking to post any targeted areas for new sales until late fall or early winter.

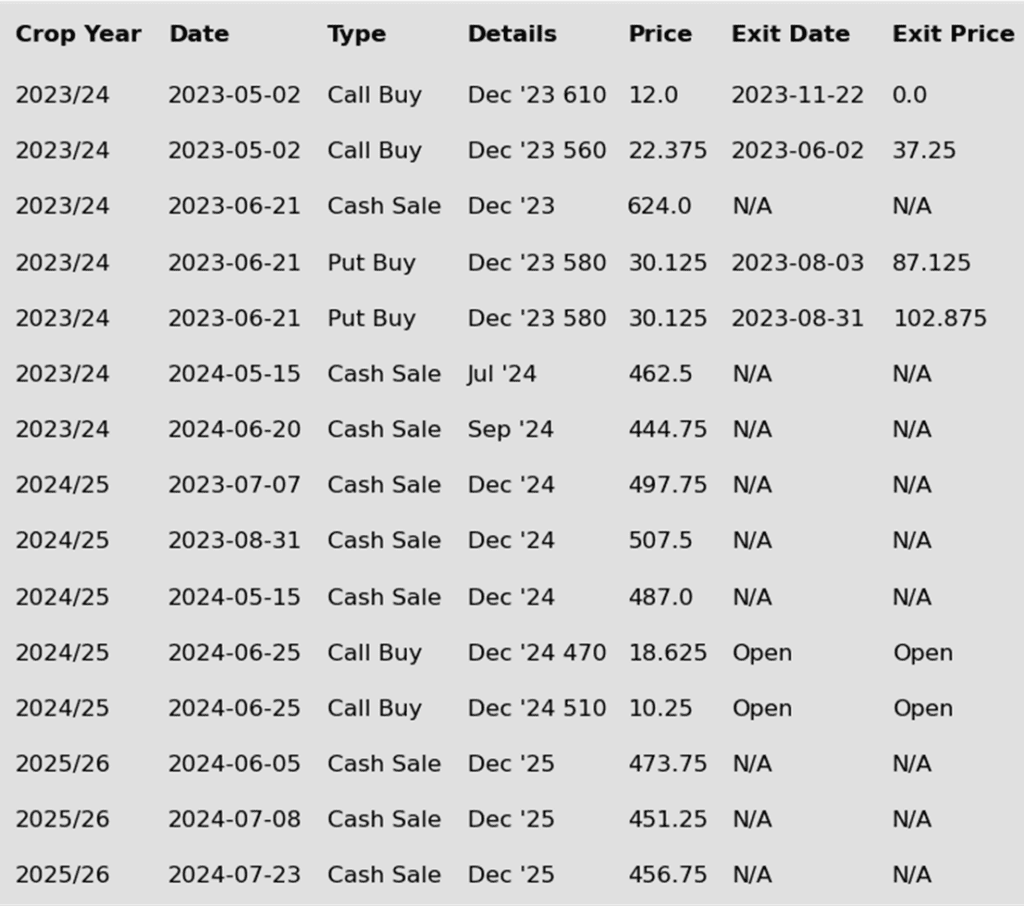

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- September corn futures closed at new contract lows on Wednesday as the selling pressure continues. The corn market failed to find any true footing as technical selling pressured the market even with some positive demand news and a strong move higher in crude oil prices due to geopolitical issues in the Middle East.

- The USDA announced a flash export sale this morning. Unknown destinations bought 4.1 mb (104,572 mt) for the 24/25 marketing year. While the export demand is needed, this was a small, routine sale that failed to move the market.

- On Thursday morning, the USDA will release the weekly export sales report. Expectations are for new sales to total 275,000 – 600,000 mt for old crop and 400,000 – 800,000 mt for new crop. Current new crop demand has been disappointing, with current sales on the books running at multi-year lows for this time frame.

- The USDA will release the August WASDE report on August 12, and they have announced that they will be looking at planted acre totals in this report. Talk in the market is a possible reduction of up to 1 million planted acres for corn. The possible decrease in acres could be outweighed by the market anticipating a potential better than trend yield for the current corn crop.

- Weather forecasts look very friendly for crop production into the middle of August, as temperatures are expected to trend below normal into the middle of the month. With that, overall precipitation across the majority of the corn belt is expected to run above normal for the same time period.

Above: The downside breakout through 489 could suggest that prices have further downside risk towards the 362 – 360 support area. However, if prices hold and turn around, they could encounter nearby resistance between 395 and 400, with heavier resistance between 404 and 415.

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Soybeans Action Plan Summary

Weighed down by sluggish export demand and favorable weather, the soybean market experienced a choppy downward trajectory leading up to the USDA’s July WASDE report. While the USDA lowered old crop ending stocks more than expected, resulting in a larger-than-anticipated drop in new crop carryout projections, the 435 mb projected carryout remains a bearish factor given the current demand picture. With much of the growing season still ahead, the lower anticipated supply leaves less margin for error if growing conditions turn hot and dry. For now, a weather-related issue or a surge in demand appears to be the most likely catalyst to push prices higher.

- No new action is recommended for 2023 soybeans. Any remaining old crop 2023 soybeans should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 soybeans – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for the 2024 crop. At the end of December, we recommended buying Nov ’24 1280 and 1360 calls due to the amount of uncertainty in the 2024 soybean crop and to give you confidence to make sales and protect those sales in an extended rally. Given that the market has retreated since that time, we are targeting the low to mid-1100s versus Nov ’24 futures to exit 1/3 of the 1280 calls to help preserve equity. Most recently we employed our Plan B strategy with the close below 1180 in Nov ’24 and recommended making additional sales due to the potential change in trend. With much of the growing season still ahead of us, should the market turn back higher, we are targeting the upper 1100s to low 1200s from our Plan A strategy to potentially make two additional sales recommendations.

- No Action is currently recommended for 2025 Soybeans. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

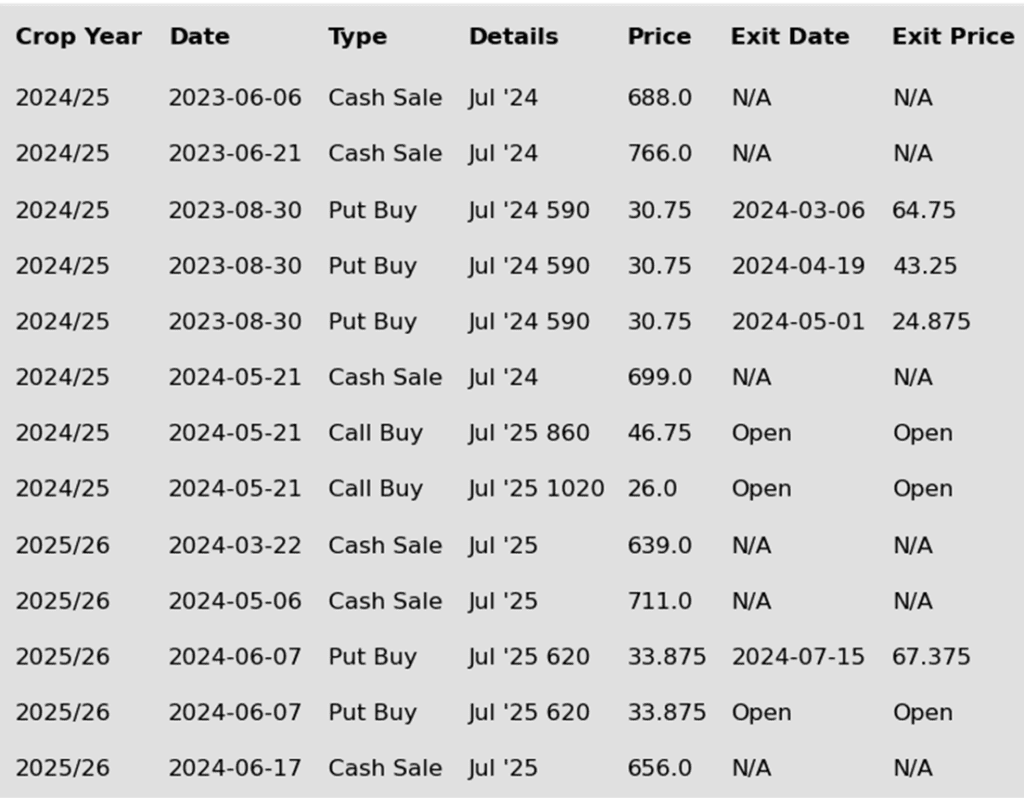

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day slightly higher after making new lows for the year earlier in the day. The trade was bear spread, with the front months only up slightly, while the November 2025 contract was up 7 cents. Today’s price action may have been due to funds taking profits on some of their short positions at the end of the month.

- Soybean products were mixed today with soybean meal closing lower while soybean oil was higher. The support for soybean oil likely came from higher crude oil prices that increased as a response to Israel’s assassination of a top political leader for Hamas in Iran. This move could further escalate the war in the Middle East.

- Brazilian consultancy Datagro, has estimated Brazil’s soybean acreage for 24/25 at 46.98 million hectares, or 116.09 million acres, which would be the 18th consecutive year that acreage was increased in the country if this is realized. Brazilian soybean production for 24/25 is estimated at 166.6 mmt which would be a 12% increase year over year.

- US weather is expected to be hotter than normal over the next 6 to 10 days across the southern and western areas of the country with rainfall amounts generally above normal. The 8 to 14-day forecast shows temperatures cooling off, while rainfall is expected to remain mostly above normal over the entire Midwest. As long as forecasts remain mostly favorable, funds will likely continue to be sellers.

Above: The break to, and subsequent rally from, the 1008 level in September soybeans suggests an area of support just below the market. Should prices rally further they may encounter resistance around 1082 ¼, a close above which could put them on track towards the 1130 – 1170 congestion area. If prices break lower and close below 1008, they could be at risk of trading down to 1000 and then 985.

Wheat

Market Notes: Wheat

- The wheat complex had a mixed close: Chicago ended the session with small gains, while Kansas City and Minneapolis were mixed to lower. Chicago’s strength followed a weak start, likely supported by a sharply lower US Dollar Index and a strong close for Matif wheat after early weakness.

- The killing of Hamas and Hezbollah leaders has increased tensions in the Middle East, contributing to crude oil’s sharp rally today. This, along with higher equity markets, may offer some spillover support to the grains.

- Favorable Australian weather may result in a boost to their wheat crop. Some estimates are now as high as 30 mmt, which compares to the USDA’s current estimate of 29 mmt. For reference, last year’s crop totaled 26 mmt.

- The French wheat crop is reportedly set for a “catastrophic” harvest, with estimates of production declines ranging from 15% to 28%. This could result in a crop as small as 26 mmt, prompting French farmers to seek financial aid from the government. The loss of income is estimated to exceed 1.6 billion euros, or about $1.7 billion USD.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

Chicago Wheat Action Plan Summary

Since late May, the wheat market has been trending downward as concerns about Russia’s shrinking wheat crop have eased, and the US winter wheat crop has surpassed expectations. At the same time, managed funds also reestablished a sizable net short position in Chicago wheat. While slow global import demand and low Russian export prices continue to exert downward pressure on prices, any increase in US demand due to smaller crops in Europe and the Black Sea region could trigger a short-covering rally by managed funds, especially given that global wheat ending stocks are projected to decline again this year.

- No new action is recommended for 2024 Chicago wheat. Considering the recent rally in wheat, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 740 – 760 versus Sept ’24 to recommend further sales and to target a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 Chicago Wheat. Our most recent recommendation was to exit half of the previously recommended July ’25 Chicago 620 puts once they reached 67 cents (approximately double their original cost), to lock in gains in case the market rallies back. Moving forward, our strategy is to hold the remaining July ’25 620 puts at, or near, a net neutral cost to maintain downside coverage for any unsold bushels, while also targeting the 610 – 630 range to recommend making additional sales.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

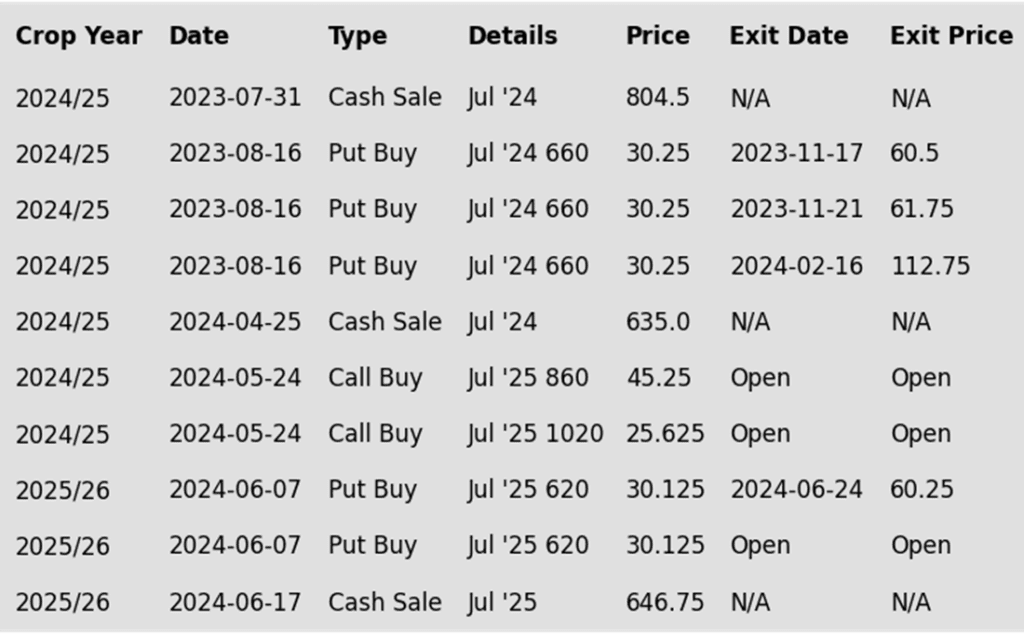

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The bullish reversal on July 29 suggests there is support below the market near 514. Should prices continue higher they may hit resistance between 555 and 580, with further resistance near 590 – 600. To the downside, a close below 514 could find support near 500 and then again in the 490 – 470 area.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

Since the end of May the wheat market has been trending lower as concerns regarding Russia’s shrinking wheat crop have waned, and US HRW harvest yields have been higher than expected. During this time managed funds started reestablishing their short positions while the market continues to show signs of being oversold. While low Black Sea export prices and slow world demand continue to weigh on US prices, the funds’ short position and oversold conditions could culminate in a short covering rally on any increase in US demand as world wheat ending stocks are expected to fall yet again this year.

- No new action is recommended for 2024 KC wheat. Considering the recent upside breakout in KC wheat, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 725 – 750 versus Sept ’24 to recommend further sales and to target a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. We recently recommended exiting half of the previously recommended July ’25 620 puts once they reached 60 cents (double the original approximate cost) to realize gains in case the market rallies back, while still holding the remaining 620 puts at, or near, a net neutral cost for continued downside coverage on any unsold bushels. Looking ahead, our strategy is to target the 660 – 690 range to recommend making additional sales.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

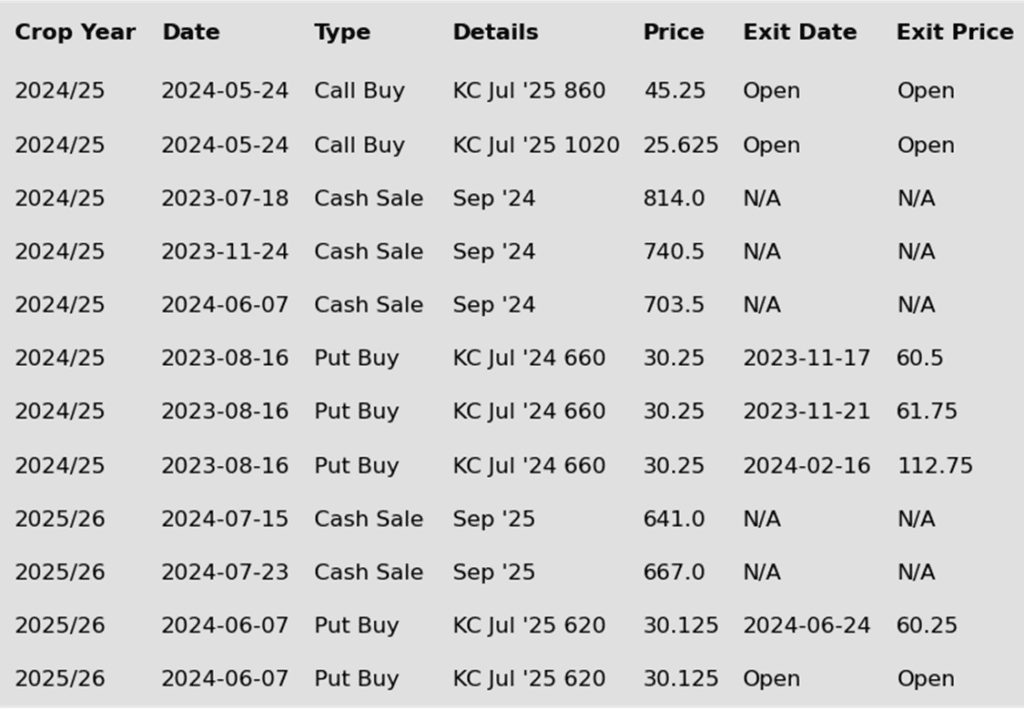

To date, Grain Market Insider has issued the following KC recommendations:

Above: The market action in the closing days of July indicates support below the market between 530 and 540. Should that area hold and close above 580, prices could then be on track toward the 600 resistance area. Otherwise, a close below 530 could find further support near 500.

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

Since the end of May, the wheat market has been in a down trend as concerns about Russia’s shrinking wheat crop have eased and the US winter wheat crop exceeded expectations. During this period, managed funds reestablished their short positions in Minneapolis wheat. Though declining Russian export prices continue to keep a lid on US prices, smaller crops in Europe and the Black Sea region could increase US demand, potentially triggering a short-covering rally with the fund’s newly reestablished short position, especially as global wheat ending stocks are projected to decline again this year.

- No new action is recommended for 2023 Minneapolis wheat. Any remaining 2023 spring wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Minneapolis wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Minneapolis wheat. With the recent close below the 712 support level, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices.

- No new action is currently recommended for the 2025 Minneapolis wheat crop. Since the growing season can often yield some of the best sales opportunities, we recently made two separate sales recommendations to get some early sales on the books for next year’s crop. While we will not be targeting any specific areas to make additional sales until later in the marketing year, we will continue to monitor the market for opportunities to exit the remaining July ’25 KC 620 puts that were recommended in June. To that end, should the market continue to be weak, we are currently targeting the upper 400 range to exit half of those remaining puts.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: After encountering resistance near 630, the market reversed lower and could be on track toward the July low near 575, where it could find support. A close below 575 puts the market at risk of drifting lower toward the 550 – 540 support area. To the upside, a close above 630 could put prices on track to test the 650 – 660 resistance area.

Other Charts / Weather

US 5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.