7-31 End of Day: Corn Gains on Export Strength; Wheat and Soybeans Under Pressure

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 394 | 2.25 |

| DEC ’25 | 413.75 | 1.5 |

| DEC ’26 | 450.25 | -1.25 |

| Soybeans | ||

| AUG ’25 | 961.75 | -6 |

| NOV ’25 | 989.25 | -6.5 |

| NOV ’26 | 1043.75 | -4.25 |

| Chicago Wheat | ||

| SEP ’25 | 523.25 | -0.5 |

| DEC ’25 | 542.5 | -1.75 |

| JUL ’26 | 580 | -2.25 |

| K.C. Wheat | ||

| SEP ’25 | 526.25 | 4.25 |

| DEC ’25 | 544.75 | 2.5 |

| JUL ’26 | 584.75 | -0.25 |

| Mpls Wheat | ||

| SEP ’25 | 5.7775 | 0.005 |

| DEC ’25 | 6.0125 | 0.0125 |

| SEP ’26 | 6.5 | 0 |

| S&P 500 | ||

| SEP ’25 | 6394.75 | -1.5 |

| Crude Oil | ||

| SEP ’25 | 69.31 | -0.69 |

| Gold | ||

| OCT ’25 | 3319.9 | -5.4 |

Grain Market Highlights

- 🌽 Corn: Corn futures closed mostly higher today, supported by a positive export report and signs of improved demand.

- 🌱 Soybeans: Soybeans closed lower again, as ongoing weather pressure and improving crop conditions weighed on the market.

- 🌾 Wheat: Wheat ends mixed pressured from a stronger U.S. Dollar and the market adjusts from oversold levels.

To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

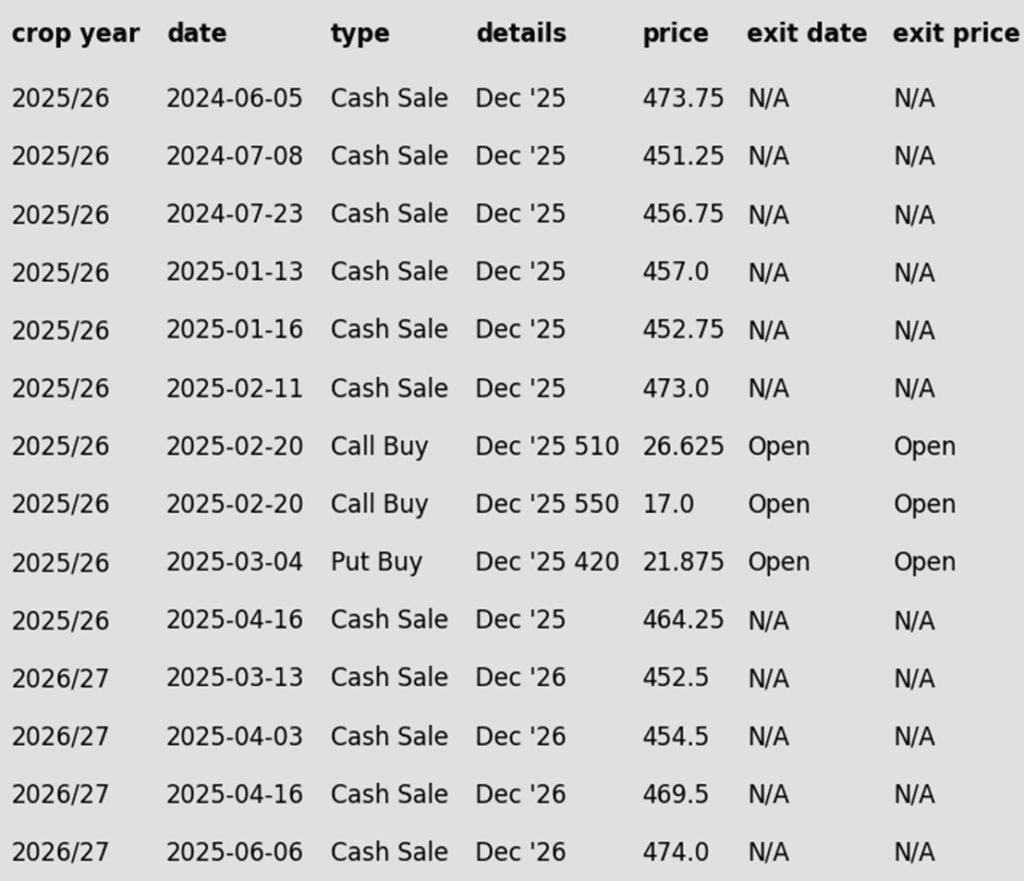

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

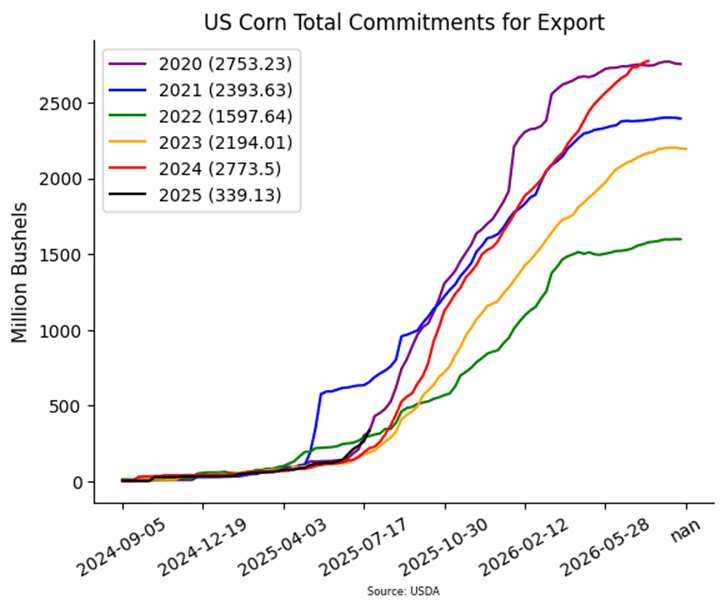

- Corn futures finished mixed, with front-month contracts showing buying strength supported by positive export news. Gains remained modest as the market balances an improved new-crop demand forecast against the potential for a record corn harvest this fall.

- Weekly corn export sales reflected a strong week of activity for new crop corn. For the week ending July 24, new crop corn sales were 1.892 MMT (74.5 mb), which was above market expectations as US corn is competitive versus global competition. Old crop sales slowed as the market year is winding down at 349,000 MT (13.4 mb) down 47% from last week.

- USDA reported three flash sales of corn on Thursday morning. Unknown destinations purchased 136,000MT (5.3 mb), Colombia purchased 100,000 MT (3.9 mb), and South Korea purchased 140,000 MT (5.5 mb). All purchases were for the 2025-26 marketing year.

- President Trump announced a 90-day negotiation period with Mexico regard trade and possible tariffs. The U.S. is currently holding the 25% trade tariff in place for the 90-day time window. Mexico is the largest importer on U.S. corn.

- The U.S. Dollar Index is trading at its highest level since May, recovering from recent lows. A stronger dollar against foreign currencies may reduce or eliminate the competitive edge U.S. corn currently holds in the export market.

Corn Futures Back Near Recent Lows

With few weather issues so far this season, the typically volatile months of May through July have been unusually quiet for corn price action. Futures slipped last week and are now testing support near 391. A break below this level could shift focus to the August 2024 low near 360. On the upside, an unfilled gap at 413 is the first target, with resistance near 420 and a second gap at 430 if momentum builds.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

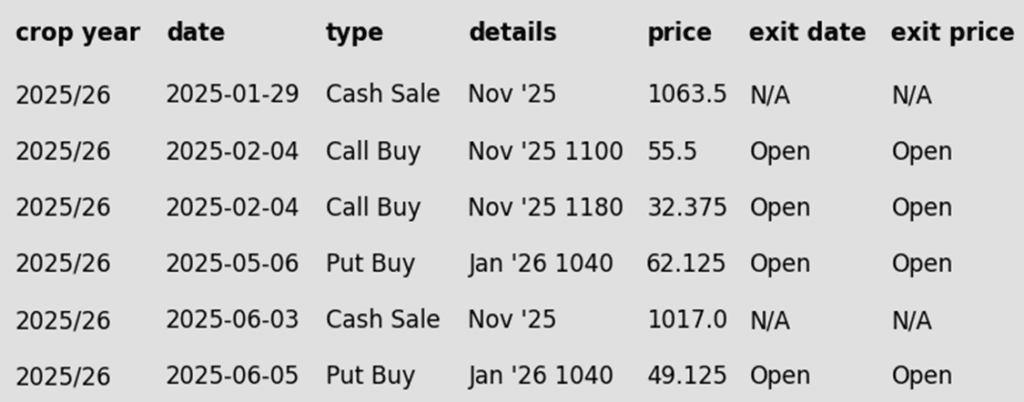

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None. No change to the 1114 upside target despite recent market weakness; a hot, dry August may be needed to reach it. While uncommon, sizeable August rallies have occurred before.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Still waiting on first targets for 2026 to post.

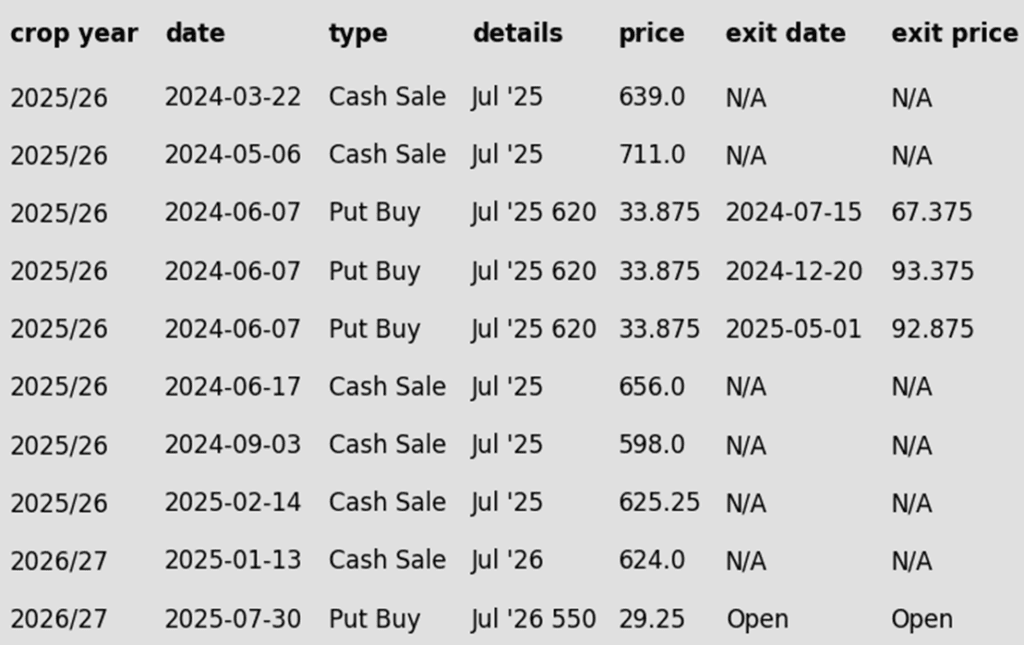

To date, Grain Market Insider has issued the following soybean recommendations:

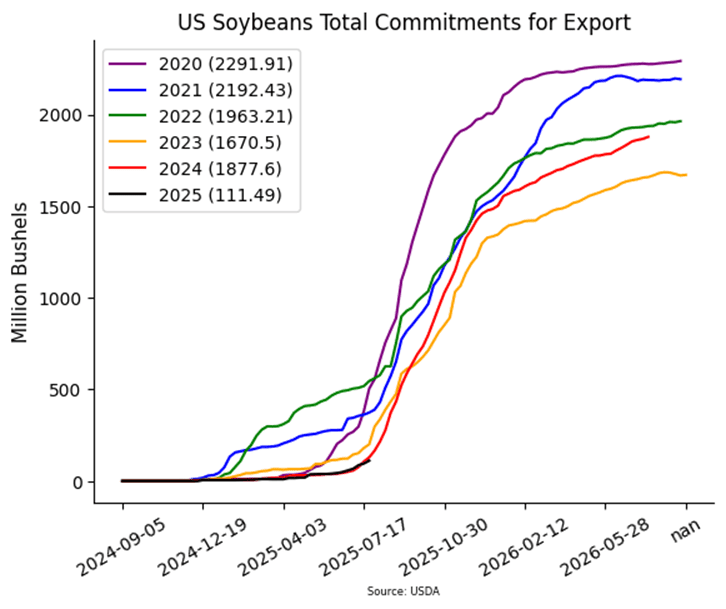

Market Notes: Soybeans

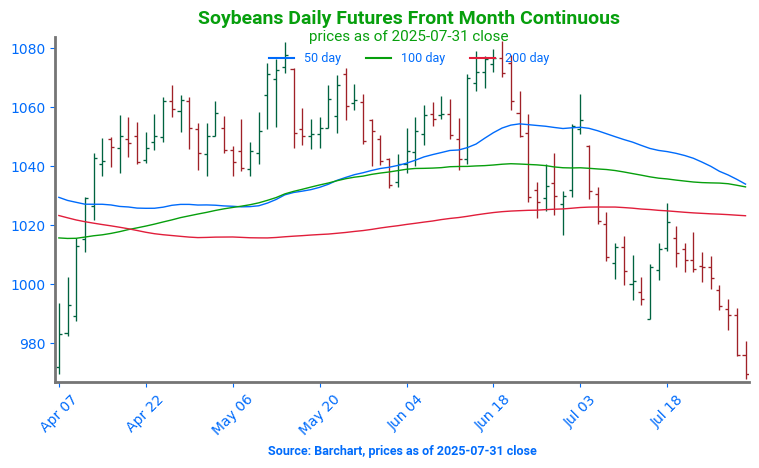

- Soybeans closed lower for the fifth straight day, pressured by improving August crop forecasts. November soybeans hit their lowest close since early April. While export sales remained solid, they weren’t enough to support prices. Today also marked first notice day for August futures. Soybean meal gained ground, but soybean oil declined alongside crude oil.

- Today the USDA reported an increase of 12.8 million bushels of soybean export sales for 24/25 and an increase of 15.8 mb for 25/26. This was within trade expectations, and top buyers were Egypt, Mexico, and the Netherlands. Last week’s export shipments of 18.4 mb were above the 17.7 mb needed each week to meet the USDA’s export estimates.

- Private analyst in Brazil are estimating continued growth in Brazil’s soybean production for 2025-26. The expectations are for the Brazil’s crop next year to reach nearly 120 million acres of production and production to grow to nearly 180 MMT.

- With the 90-day U.S.-China tariff pause set to expire on August 12, officials are reportedly working to extend the agreement. However, progress on a broader trade deal remains elusive, and China’s limited cooperation casts doubt on their need for U.S. soybeans in the near term.

Soybeans Stuck in Sideways Range

Soybeans failed to clear key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. A break above the 100-day moving average would open the door to filling the gap left over the 4th of July weekend near 1050. On the downside, initial support sits near 1000, with stronger support at the April lows near 980.

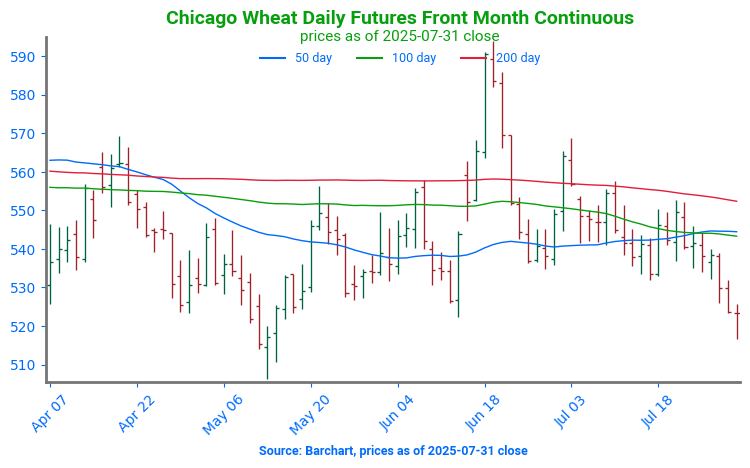

Wheat

Market Notes: Wheat

- Wheat closed lower in Chicago, while mixed in Kansas City and Minneapolis. Weighing on the market was a lower close for Matif wheat futures and the break in the US Dollar Index above its 100 day moving average. However, it appears wheat is trying to stabilize at these lower levels after having become technically oversold.

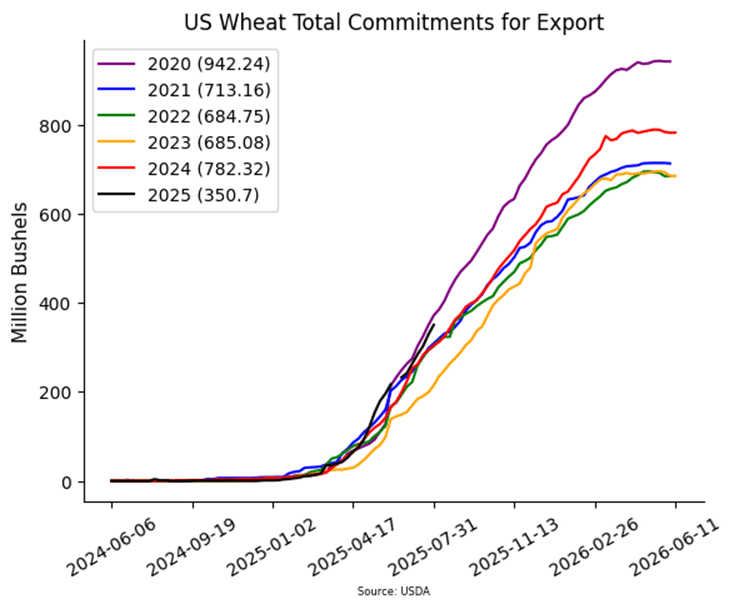

- The USDA reported an increase of 21.8 mb of wheat export sales for 25/26 and an increase of 1.4 mb for 26/27. Shipments last week totaled 10.9 mb, which falls under the 16.5 mb pace needed per week to reach their export goal of 850 mb. Total 25/26 export commitments have reached 351 mb, up 15% from last year.

- Recent rains have brought improvements to drought conditions for both winter and spring wheat. As of July 29, according to the USDA an estimated 30% of US winter wheat areas are experiencing drought, down 1% from last week. Spring wheat acres in drought declined 5% from last week to 38%.

- Ukraine’s economy ministry has reported that their nation has harvested 15.5 mmt of grain. Of that total, wheat accounts for 11.36 mmt; total grain harvest is expected to reach 53 mmt.

- The Polish central statistics office is estimating their 2025 wheat harvest will total 12.8 mmt. If realized this would be a 3% increase year over year. Total grain production is anticipated at 25.4 mmt, which would be in line with last year’s figure.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

Active

Enter(Buy) JUL ’26 Puts:

550 @ ~ 29c

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. No active sales targets as still within the harvest window for SRW.

2026 Crop:

- CONTINUED OPPORTUNITY – Buy July ‘26 550 Chicago wheat puts on a portion of your 2026 SRW crop for approximately 29 cents in premium, plus commission and fees.

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD). – Hit 7/29.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

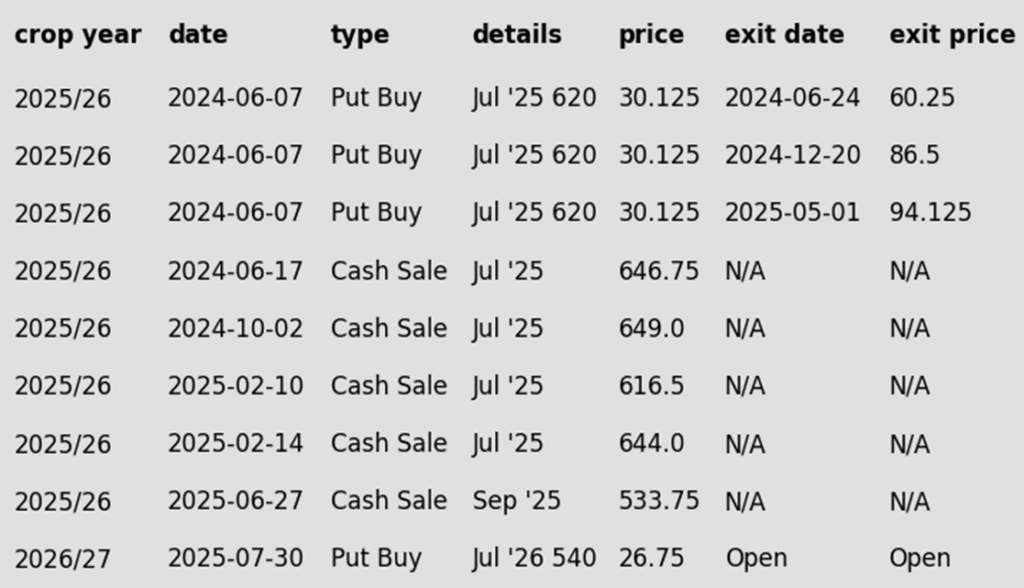

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Holds Range; Watching 558 Resistance and 522.25 Support

Chicago wheat’s sharp rally in mid-June was short-lived, with futures pulling back toward the upper end of their 2025 trading range. Initial support is found at the 50-day moving average; a break below that level could open the door to a retest of the June low at 522.25. On the upside, a weekly close above 558 would be constructive and could set up a move back toward the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

Active

Enter(Buy) JUL ’26 KC Puts:

540 @ ~ 26c

2027

No New Action

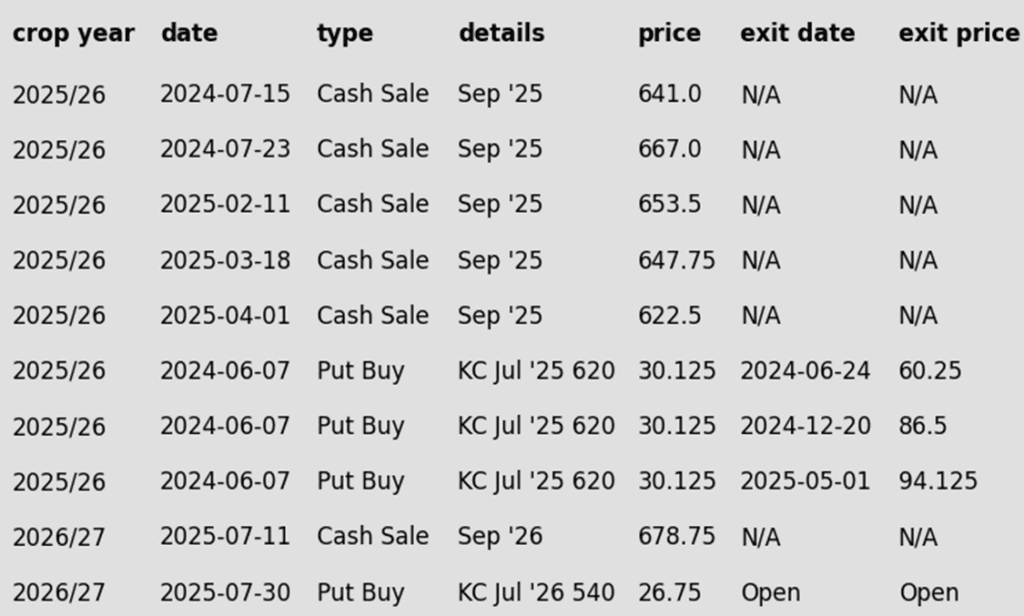

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None. With HRW harvest nearly complete, the window is opening for the next upside sales targets to post.

2026 Crop:

- CONTINUED OPPORTUNITY – Buy July ‘26 540 KC wheat puts on a portion of your 2026 HRW crop for approximately 26 cents in premium, plus commission and fees.

- Plan A:

- Target 683 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 to make the first cash sale.

- Close below 584 support and buy July ‘26 put options (strikes TBD). – Hit 7/29.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Heads up that the July ‘26 contract is nearing the 584 Plan B stop, which if hit, would prompt buying July ‘26 put options.

To date, Grain Market Insider has issued the following KC recommendations:

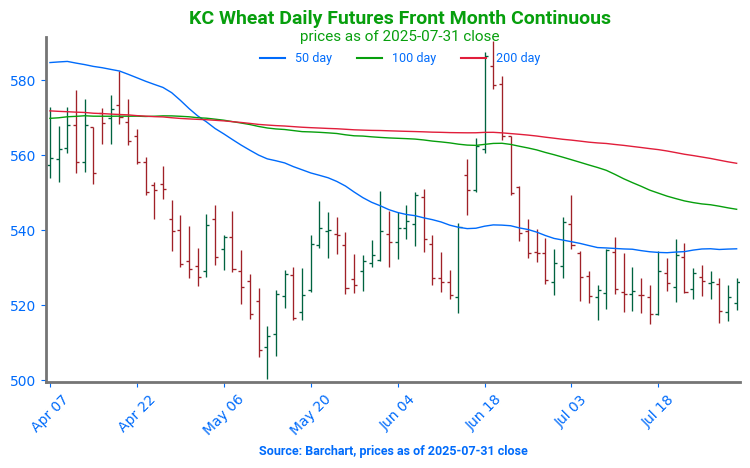

KC Wheat Pulls Back Below Key Averages, Support at June Lows

KC wheat futures saw a strong rally in June, briefly testing the April highs near 580. However, late-month weakness pulled prices back below both the 100 and 200-day moving averages, which now serve as key resistance levels. On the downside, initial support is seen at the June low of 517.75, with secondary support near the May low around 500.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

Active

Enter(Buy) JUL ’26 KC Puts:

540 @ ~ 26c

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- CONTINUED OPPORTUNITY – Buy July ‘26 540 KC wheat puts on a portion of your 2026 HRS crop for approximately 26 cents in premium, plus commission and fees.

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).– Hit 7/29.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

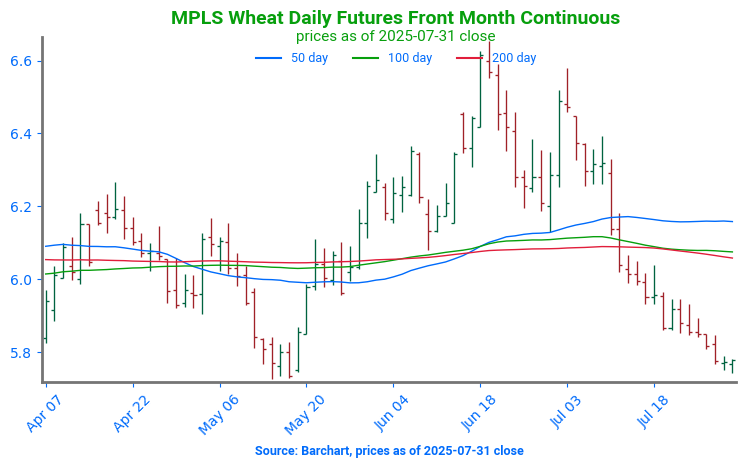

Spring Wheat Futures Test Key Support After July Slide

Spring wheat futures have come under pressure in July, weighed down by improving crop conditions and generally favorable weather across key growing areas. Technically, a cluster of major moving averages just above the 600 mark presents the first layer of upside resistance, with a chart gap near 650 serving as a secondary target if momentum builds. On the downside, the May lows near 580 should provide firm support in the event of further weakness.

Other Charts / Weather

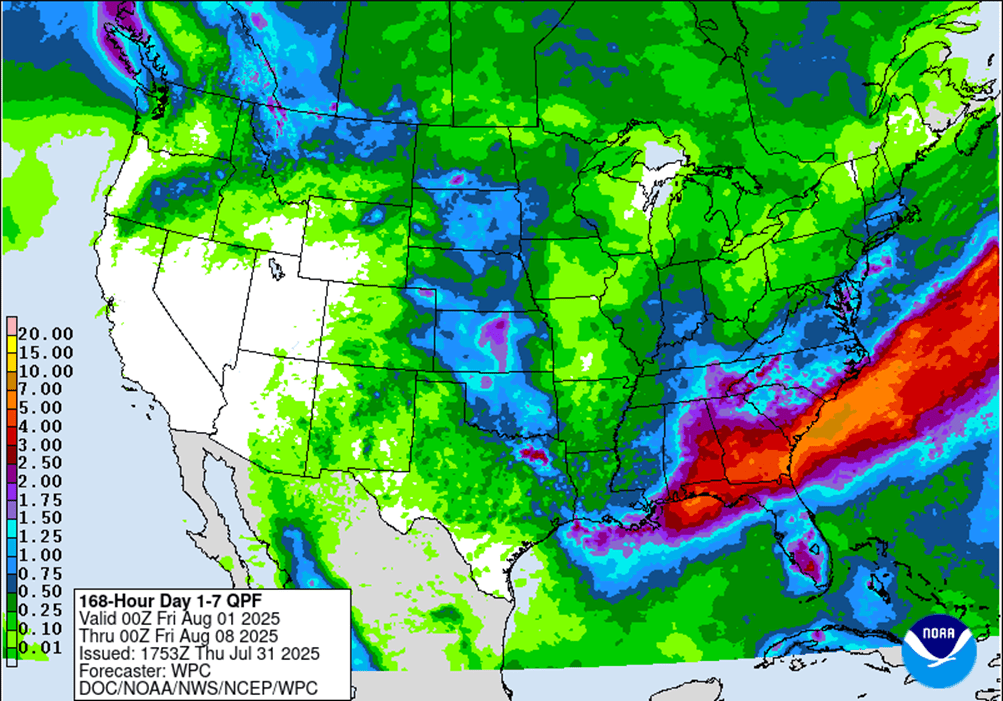

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

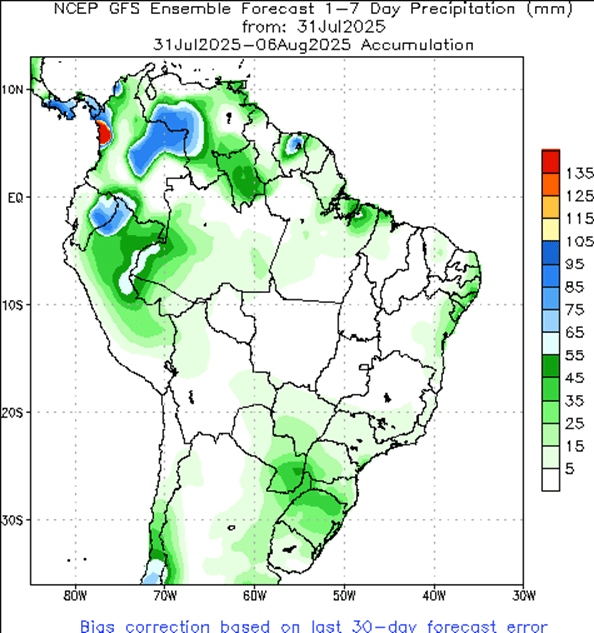

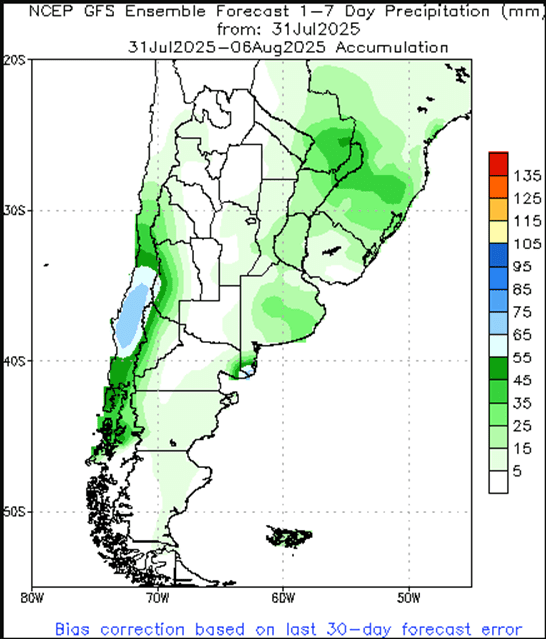

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.