7-30 End of Day: Favorable Weather Caps Rallies; Trade Tensions Return to Focus

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 391.75 | 2.5 |

| DEC ’25 | 412.25 | 1.25 |

| DEC ’26 | 451.5 | 0.25 |

| Soybeans | ||

| AUG ’25 | 967.75 | -14 |

| NOV ’25 | 995.75 | -13.75 |

| NOV ’26 | 1048 | -11.5 |

| Chicago Wheat | ||

| SEP ’25 | 523.75 | -6 |

| DEC ’25 | 544.25 | -5.75 |

| JUL ’26 | 582.25 | -4.5 |

| K.C. Wheat | ||

| SEP ’25 | 522 | 3.5 |

| DEC ’25 | 542.25 | 2.75 |

| JUL ’26 | 585 | 2.5 |

| Mpls Wheat | ||

| SEP ’25 | 5.7725 | -0.0025 |

| DEC ’25 | 6 | 0 |

| SEP ’26 | 6.5 | -0.0075 |

| S&P 500 | ||

| SEP ’25 | 6425 | 19 |

| Crude Oil | ||

| SEP ’25 | 69.94 | 0.73 |

| Gold | ||

| OCT ’25 | 3323.9 | -29.3 |

Grain Market Highlights

- 🌽 Corn: Corn futures ended slightly higher, breaking a three-day slide. The widening spread between September and December contracts led to profit-taking on that spread, offering support to the front end of the market.

- 🌱 Soybeans: Soybean futures closed sharply lower, marking the fourth straight losing session. November contracts fell below $10.00 for the first time since early April, turning that level into potential resistance.

- 🌾 Wheat: Wheat futures closed mixed, with losses in Chicago and Minneapolis contracts, while Kansas City posted slight gains. Continued strength in the U.S. Dollar is weighing on the wheat complex.

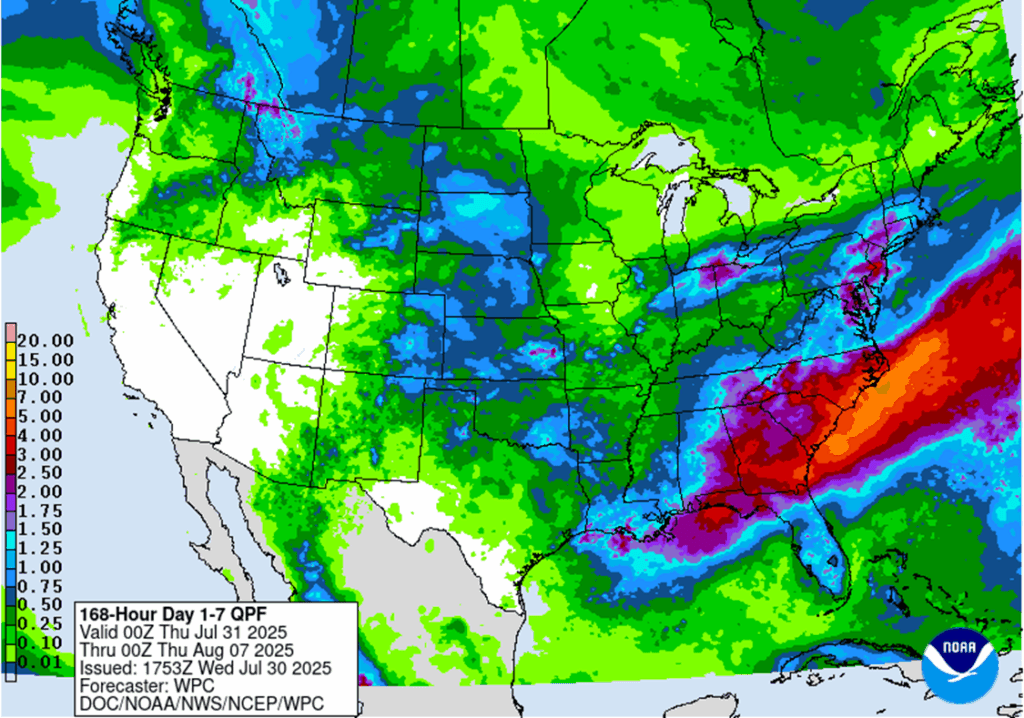

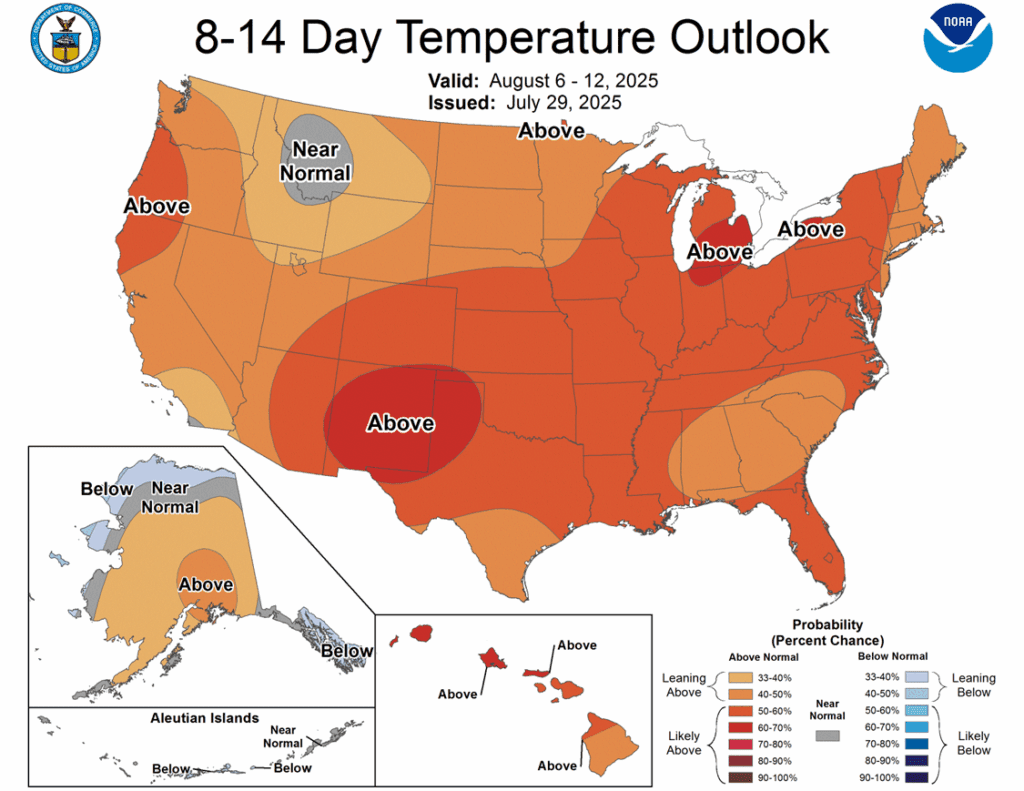

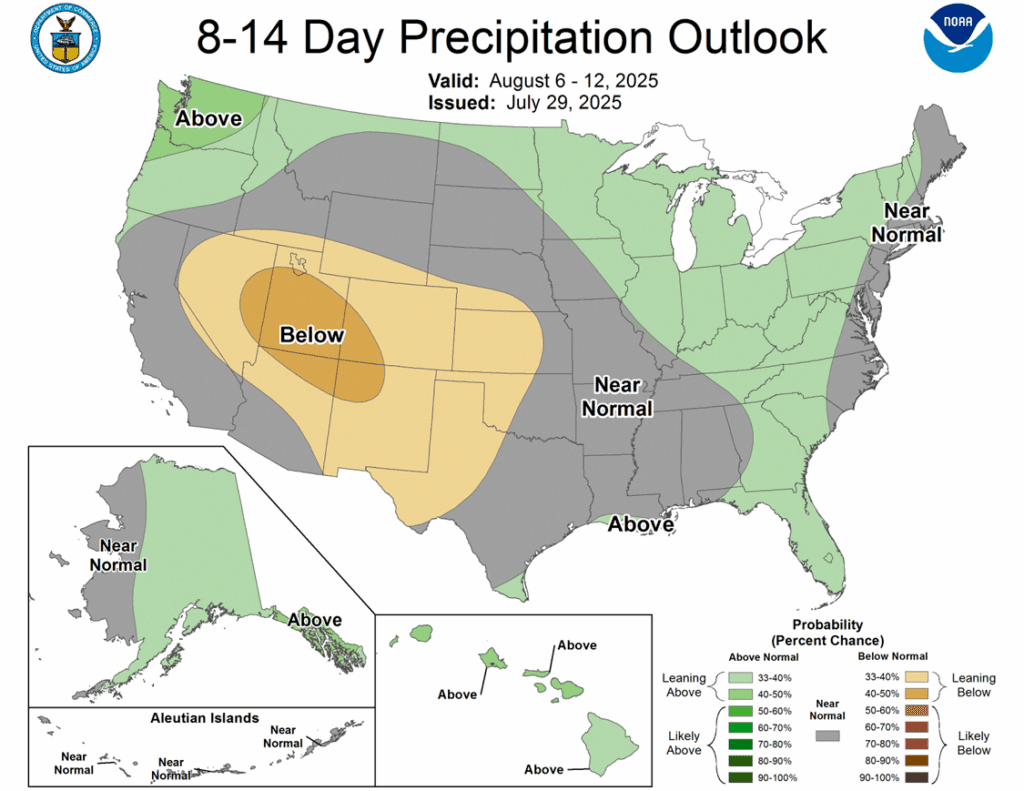

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None. The target remains 483 to make the next sale.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market broke a three-day lower price streak as the market pulled out minimal gains on the session. The spread between September and December had grown wide, and the market saw some profit taking on that spread, which supported the front end of the corn market.

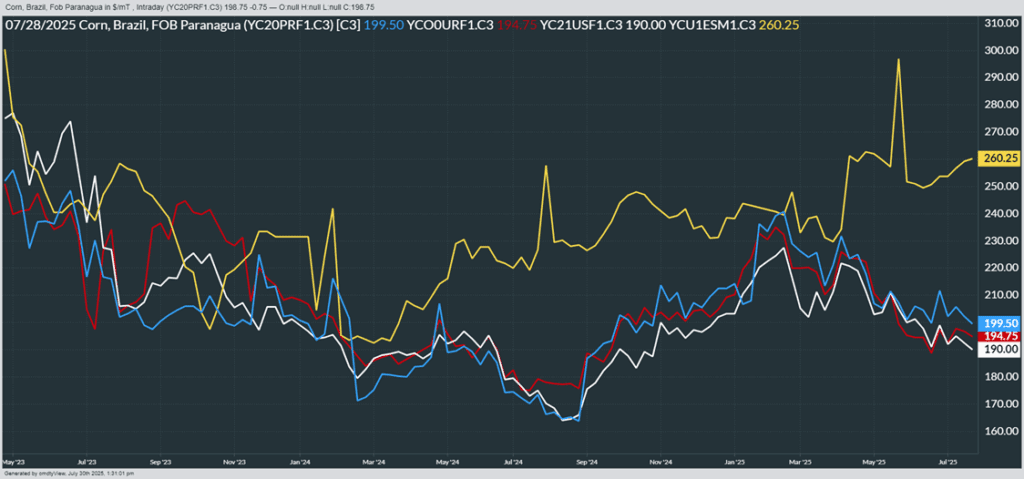

- Demand for new-crop U.S. corn has improved in recent weeks. Rising Brazilian corn prices — despite a record harvest — have made U.S. corn more competitive on the export market. Thursday’s export sales report is expected to reflect strong new-crop activity.

- Analysts are increasingly projecting a jump in U.S. corn yields in the August WASDE report, with early estimates averaging near 185 bu/acre. A yield at that level could add 350–400 million bushels to the balance sheet, pressuring prices further if demand doesn’t keep pace.

- Weather forecasts stay non-threatening into the first half of August. The combination of cooler than normal temperature and adequate moisture will help support the development of the crop into the finishing stages.

- Weekly ethanol production rose to 1.059 million barrels per day — higher than the prior week, but slightly below year-ago levels. About 105.9 million bushels of corn were used for ethanol, still running behind the pace needed to meet USDA projections for the marketing year.

Corn Futures Back Near Recent Lows

With few weather issues so far this season, the typically volatile months of May through July have been unusually quiet for corn price action. Futures slipped last week and are now testing support near 391. A break below this level could shift focus to the August 2024 low near 360. On the upside, an unfilled gap at 413 is the first target, with resistance near 420 and a second gap at 430 if momentum builds.

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None. No change to the 1114 upside target despite recent market weakness; a hot, dry August may be needed to reach it. While uncommon, sizeable August rallies have occurred before.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Still waiting on first targets for 2026 to post.

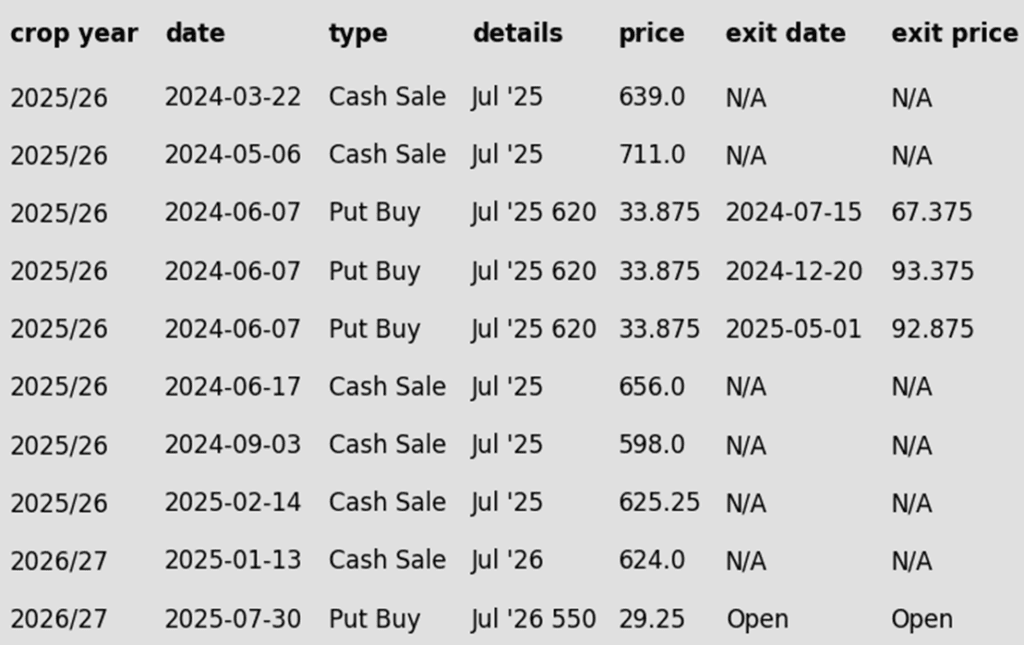

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybean futures closed sharply lower, marking the fourth straight losing session. November contracts fell below $10.00 for the first time since early April, turning that level into potential resistance. Improved weather forecasts and continued demand concerns remain key bearish drivers.

- Both soybean meal and bean oil ended lower, but soybean meal continues to lag due to a global surplus. China, in particular, has excess meal supplies for feed use, raising concerns about export demand for U.S. soybeans this fall.

- With the 90-day U.S.-China tariff pause set to expire on August 12, officials are reportedly working to extend the agreement. However, progress on a broader trade deal remains elusive, and China’s limited cooperation casts doubt on their need for U.S. soybeans in the near term.

- After factoring in import taxes, soybeans shipped from the U.S. Gulf are currently about $30/ton more expensive than Brazilian offerings. As a result, China has sourced nearly all of its soybean imports this year from Brazil and Argentina.

Soybeans Stuck in Sideways Range

Soybeans failed to clear key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. A break above the 100-day moving average would open the door to filling the gap left over the 4th of July weekend near 1050. On the downside, initial support sits near 1000, with stronger support at the April lows near 980.

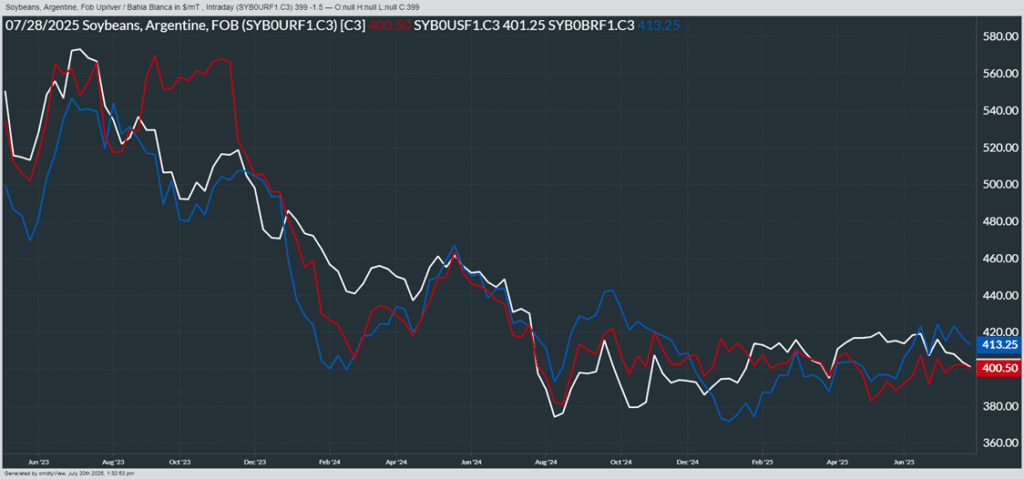

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- Wheat futures closed mixed, with losses in Chicago and Minneapolis contracts, while Kansas City posted slight gains. Continued strength in the U.S. Dollar is weighing on the wheat complex. However, with all three classes near oversold technical levels, the market may be attempting to establish a bottom.

- SovEcon increased its Russian wheat production forecast by 0.6 mmt to 83.6 mmt — just above USDA’s 83.5 mmt estimate. Russian wheat export projections were also lifted by 0.4 mmt to 43.3 mmt, though that remains below USDA’s 46 mmt outlook.

- According to the Ukrainian agriculture ministry, their nation has exported 1.3 mmt of grain since July 1, when the season began. This represents a 62% decrease from the 3.43 mmt shipped during the same timeframe last year. Of that total, wheat accounted for 487,000 mt which is down 66% year on year.

- LSEG has kept their 25/26 wheat production estimate for Ukraine unchanged at 20.7 mmt. Average temperatures and drier weather are expected to prevail for the next couple weeks, which should aid harvest. In related news a locust invasion is threatening crops in southern Ukraine. The extent of the damage is not known at this time but is believed to be mostly affecting their sunflower crop.

- The International Grains Council has reported the Russian wheat harvest is 37% done, but production is running about 22% below last year so far. However, harvest has been mostly in southern regions so far and yields are expected to be better in the northern areas.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

New Alert

Enter(Buy) JUL ’26 Puts:

550 @ ~ 29c

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. No active sales targets as still within the harvest window for SRW.

2026 Crop:

- NEW ALERT – Buy July ‘26 550 Chicago wheat puts on a portion of your 2026 SRW crop for approximately 29 cents in premium, plus commission and fees.

- Yesterday’s close below 588 support triggered this recommendation, as Grain Market Insider has been watching that level since early June as a Plan B signal to expand downside coverage on next year’s crop. This break of support puts 541 and 506 as the next potential downside risks. Using put options extends protection without committing additional physical bushels, while keeping the upside open should a bullish catalyst reverse wheat’s current trend.

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD). – Hit 7/29.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Holds Range; Watching 558 Resistance and 522.25 Support

Chicago wheat’s sharp rally in mid-June was short-lived, with futures pulling back toward the upper end of their 2025 trading range. Initial support is found at the 50-day moving average; a break below that level could open the door to a retest of the June low at 522.25. On the upside, a weekly close above 558 would be constructive and could set up a move back toward the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

New Alert

Enter(Buy) JUL ’26 KC Puts:

540 @ ~ 26c

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None. With HRW harvest nearly complete, the window is opening for the next upside sales targets to post.

2026 Crop:

- NEW ALERT – Buy July ‘26 540 KC wheat puts on a portion of your 2026 HRW crop for approximately 26 cents in premium, plus commission and fees.

- Yesterday’s close below 584 support triggered this recommendation, as Grain Market Insider has been watching that level since early June as a Plan B signal to expand downside coverage on next year’s crop. This break of support puts 545 and 501 as the next potential downside risks. Using put options extends protection without committing additional physical bushels, while keeping the upside open should a bullish catalyst reverse wheat’s current trend.

- Plan A:

- Target 683 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 to make the first cash sale.

- Close below 584 support and buy July ‘26 put options (strikes TBD). – Hit 7/29.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Heads up that the July ‘26 contract is nearing the 584 Plan B stop, which if hit, would prompt buying July ‘26 put options.

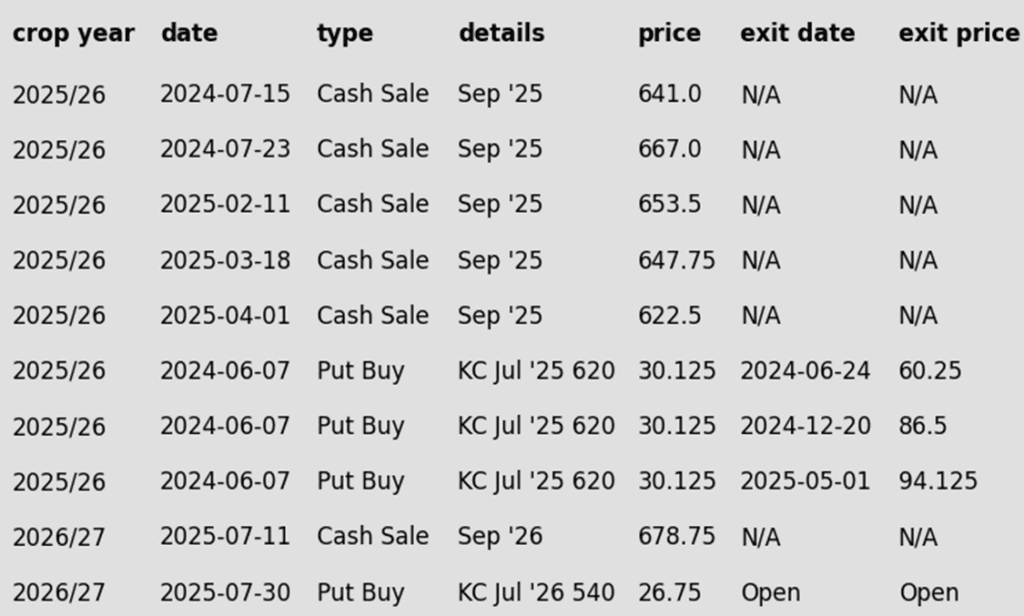

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Pulls Back Below Key Averages, Support at June Lows

KC wheat futures saw a strong rally in June, briefly testing the April highs near 580. However, late-month weakness pulled prices back below both the 100 and 200-day moving averages, which now serve as key resistance levels. On the downside, initial support is seen at the June low of 517.75, with secondary support near the May low around 500.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

New Alert

Enter(Buy) JUL ’26 KC Puts:

540 @ ~ 26c

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- NEW ALERT – Buy July ‘26 540 KC wheat puts on a portion of your 2026 HRS crop for approximately 26 cents in premium, plus commission and fees.

- Yesterday’s close below 584 support vs the July ‘26 KC contract triggered this recommendation, as Grain Market Insider has been watching that level since early June as a Plan B signal to expand downside coverage on next year’s crop. This break of support puts 545 and 501 as the next potential downside risks vs the July ‘26 KC futures contract. Using put options extends protection without committing additional physical bushels, while keeping the upside open should a bullish catalyst reverse wheat’s current trend. KC options are recommended as a cross-hedge given the high correlation between KC and Minneapolis wheat prices, and the higher liquidity in the KC options.

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).– Hit 7/29.

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Futures Test Key Support After July Slide

Spring wheat futures have come under pressure in July, weighed down by improving crop conditions and generally favorable weather across key growing areas. Technically, a cluster of major moving averages just above the 600 mark presents the first layer of upside resistance, with a chart gap near 650 serving as a secondary target if momentum builds. On the downside, the May lows near 580 should provide firm support in the event of further weakness.

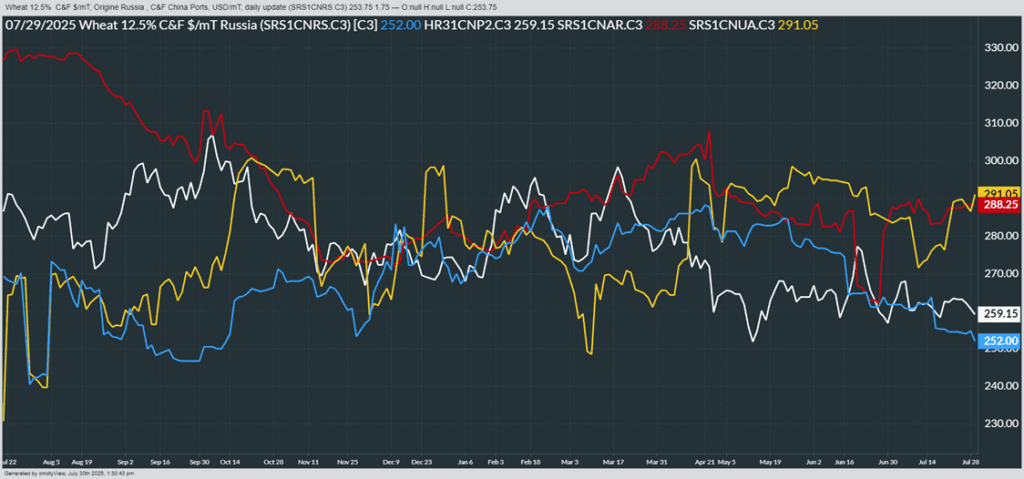

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather