7-28 End of Day: Grains start the week mostly lower

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 393.75 | -5.75 |

| DEC ’25 | 414 | -5 |

| DEC ’26 | 453.5 | -3.25 |

| Soybeans | ||

| AUG ’25 | 988.75 | -10 |

| NOV ’25 | 1011.5 | -9.5 |

| NOV ’26 | 1059.25 | -7.25 |

| Chicago Wheat | ||

| SEP ’25 | 538.5 | 0.25 |

| DEC ’25 | 558.75 | 0.5 |

| JUL ’26 | 595.5 | 0.5 |

| K.C. Wheat | ||

| SEP ’25 | 526 | -0.5 |

| DEC ’25 | 546.75 | -1 |

| JUL ’26 | 590.25 | -1.25 |

| Mpls Wheat | ||

| SEP ’25 | 5.815 | -0.0325 |

| DEC ’25 | 6.03 | -0.03 |

| SEP ’26 | 6.51 | -0.0175 |

| S&P 500 | ||

| SEP ’25 | 6413 | -12 |

| Crude Oil | ||

| SEP ’25 | 66.87 | 1.71 |

| Gold | ||

| OCT ’25 | 3341.8 | -22.6 |

Grain Market Highlights

- 🌽 Corn: Corn futures started the week with modest losses as a less threatening weather outlook and expectations for a large fall harvest weighed on prices. The front-month September contract tested recent lows but held support.

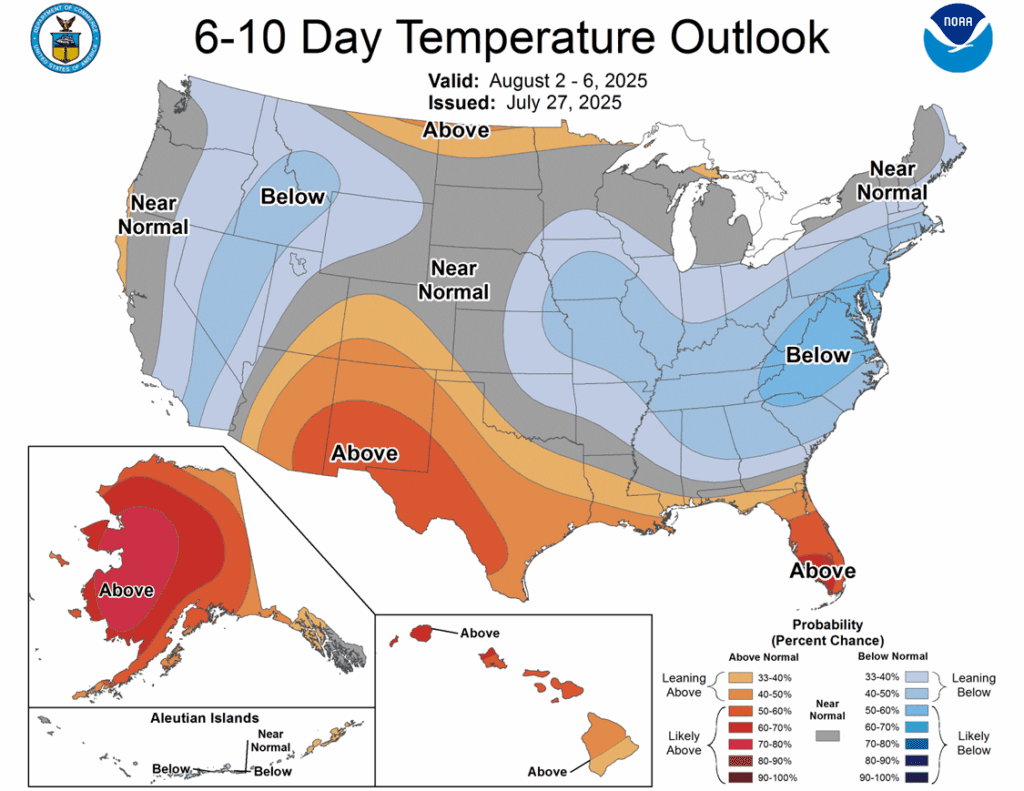

- 🌱 Soybeans: Soybeans finished lower for the second straight session, closing below all major moving averages. Weekend weather forecasts turned slightly less threatening, with more moderate temperatures and improved rain chances into August.

- 🌾 Wheat: Wheat futures showed relative strength to start the week. Despite weakness in corn and soybeans and a sharply higher U.S. Dollar Index, Chicago wheat managed a small gain, while Kansas City and Minneapolis posted only minor losses.

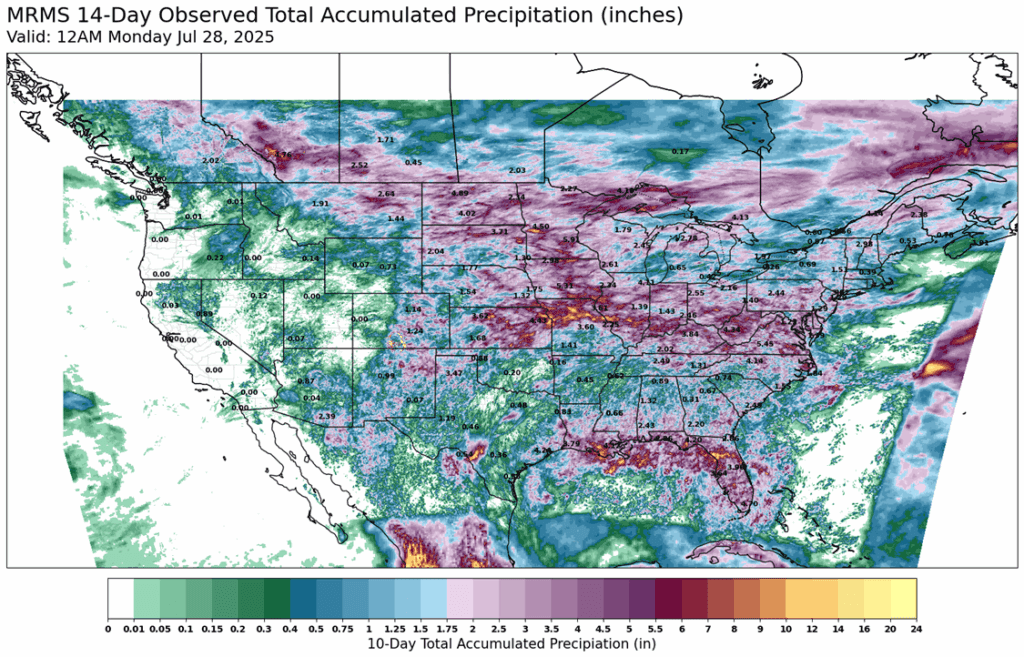

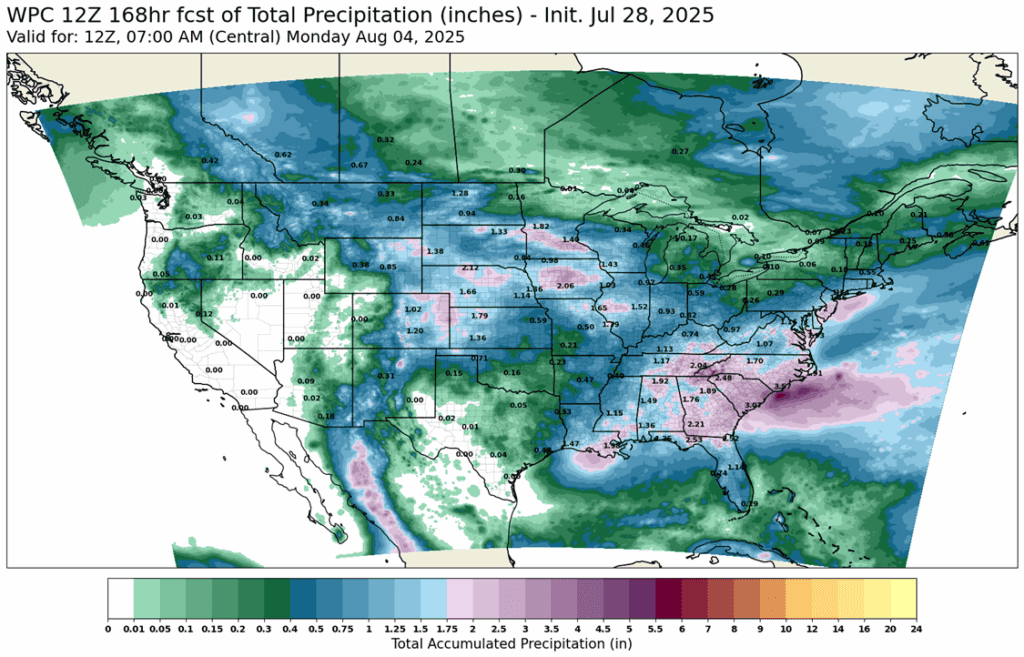

- To see updated U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Target to exit a quarter of 420 puts at 411 has been cancelled.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None. The target remains 483 to make the next sale.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures started the week with modest losses as a less threatening weather outlook and expectations for a large fall harvest weighed on prices. The front-month September contract tested recent lows but held support. Still, the weak close leaves the market vulnerable to further selling.

- USDA announced flash export sales of corn on Monday morning. Mexico purchased 225,000 MT (8.9 mb) of corn for the 2025-26 marketing year. In addition, Unknown destinations purchased 229,000 MT (9.0 mb) of corn, split with 35,000 MT (1.4 mb) for 2024-25 and 194,000 MT (7.6 mb) for 2025-26.

- Weekly corn export inspections totaled 1.522 MMT for the week ending July 24, near the high end of expectations. Total inspections are running 29% ahead of last year. With the marketing year ending August 30, exporters still need to ship 9.9 MMT in existing sales commitments.

- Forecasts into early August are calling for below-normal temperatures and normal to above-normal precipitation across most of the Corn Belt. These conditions are expected to support crop development as pollination wraps up.

- In a move to support domestic farmers, Argentine President Milei announced a reduction in corn export taxes from 12% to 9.5%. The cut could make Argentine corn more competitive on the global market.

Corn Futures Back Near Recent Lows

With few weather issues so far this season, the typically volatile months of May through July have been unusually quiet for corn price action. Futures slipped last week and are now testing support near 391. A break below this level could shift focus to the August 2024 low near 360. On the upside, an unfilled gap at 413 is the first target, with resistance near 420 and a second gap at 430 if momentum builds.

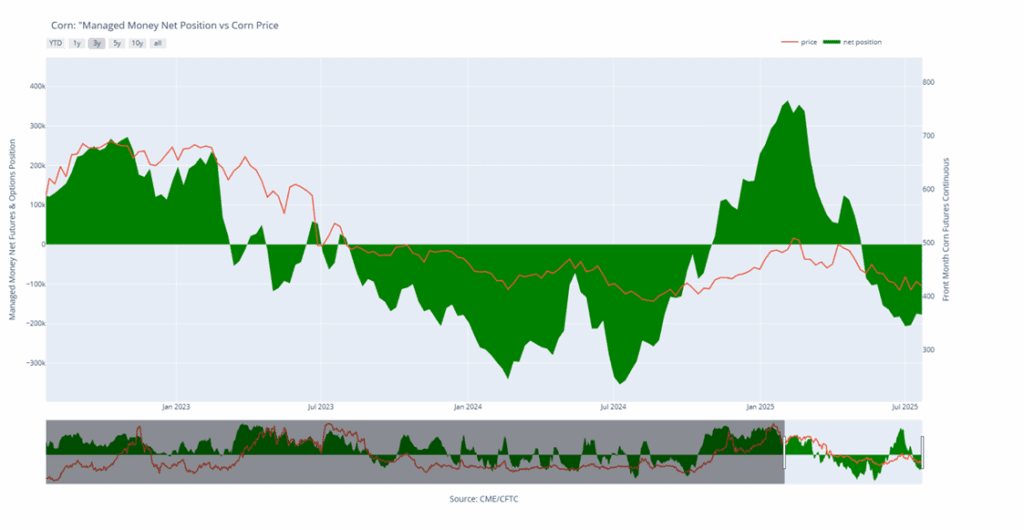

Corn Managed Money Funds net position as of Tuesday, July 22. Net position in Green versus price in Red. Money Managers net sold 2,610 contracts between July 15- July 22, bringing their total position to a net short 177,365 contracts.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None. No change to the 1114 upside target despite recent market weakness; a hot, dry August may be needed to reach it. While uncommon, sizeable August rallies have occurred before.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Still waiting on first targets for 2026 to post.

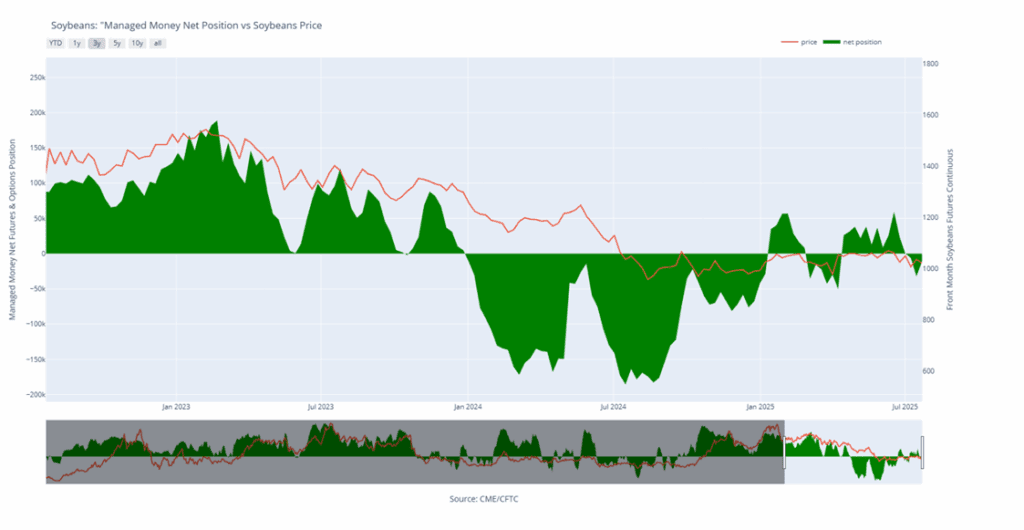

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower for the second consecutive day and closed below all major moving averages. Weather forecasts over the weekend shifted to be slightly less severe, going into August with more moderate temperatures and better chances for rain. Export inspections were not supportive, and there are concerns that demand will not keep up with the larger crop that is expected. Soybean meal led the complex lower while bean oil was higher.

- USDA reported soybean inspections at 410,000 metric tons — above last week’s 377,000 tons and near the high end of trade expectations. Cumulative inspections are now running 10% ahead of last year.

- China booked 22 to 25 soybean cargoes last week, all from Brazil. Year-to-date, Brazil has shipped 284 cargoes to China, Argentina 84, and none from the U.S. — raising further concern about export demand.

- Friday’s CFTC report saw funds as buyers of soybeans by 21,412 contracts which reduced their net short position to 10,866 contracts. They bought back 12,105 contracts of bean oil leaving them long 55,326 contracts and bought 3,273 contracts of meal reducing their net short position to 129,743 contracts.

Soybeans Stuck in Sideways Range

Soybeans failed to clear key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. A break above the 100-day moving average would open the door to filling the gap left over the 4th of July weekend near 1050. On the downside, initial support sits near 1000, with stronger support at the April lows near 980.

Soybean Managed Money Funds net position as of Tuesday, July 22. Net position in Green versus price in Red. Money Managers net bought 21,412 contracts between July 15 – July 22, bringing their total position to a net short 10,866 contracts.

Wheat

Market Notes: Wheat

- Wheat futures showed relative strength to start the week. Despite weakness in corn and soybeans and a sharply higher U.S. Dollar Index, Chicago wheat managed a small gain, while Kansas City and Minneapolis posted only minor losses. Bullish key reversals in September and December Paris milling wheat offered support, and fund buying may have played a role — Friday’s CFTC report showed net short positions were reduced by 14% in Chicago and 8.4% in Kansas City.

- Weekly wheat inspections totaled just 10.6 mb, falling short of the 16 mb weekly pace needed to meet USDA’s export forecast. Still, total inspections at 122 mb are running 6% ahead of last year.

- The Ukrainian economy ministry has reported that their nation has harvested 10.3 mmt of grain this season. This is 45% under the 19.0 mmt collected at the same time last year. Wheat harvest in particular has reached 7.1 mmt versus 14.7 mmt a year ago.

- The USDA ag attaché to Australia reported that widespread early July rains have improved wheat crop prospects in southern regions. With the extended forecast calling for continued favorable moisture, above-average wheat production is now expected.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. No active sales targets as still within the harvest window for SRW.

2026 Crop:

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Holds Range; Watching 558 Resistance and 522.25 Support

Chicago wheat’s sharp rally in mid-June was short-lived, with futures pulling back toward the upper end of their 2025 trading range. Initial support is found at the 50-day moving average; a break below that level could open the door to a retest of the June low at 522.25. On the upside, a weekly close above 558 would be constructive and could set up a move back toward the recent highs near 590.

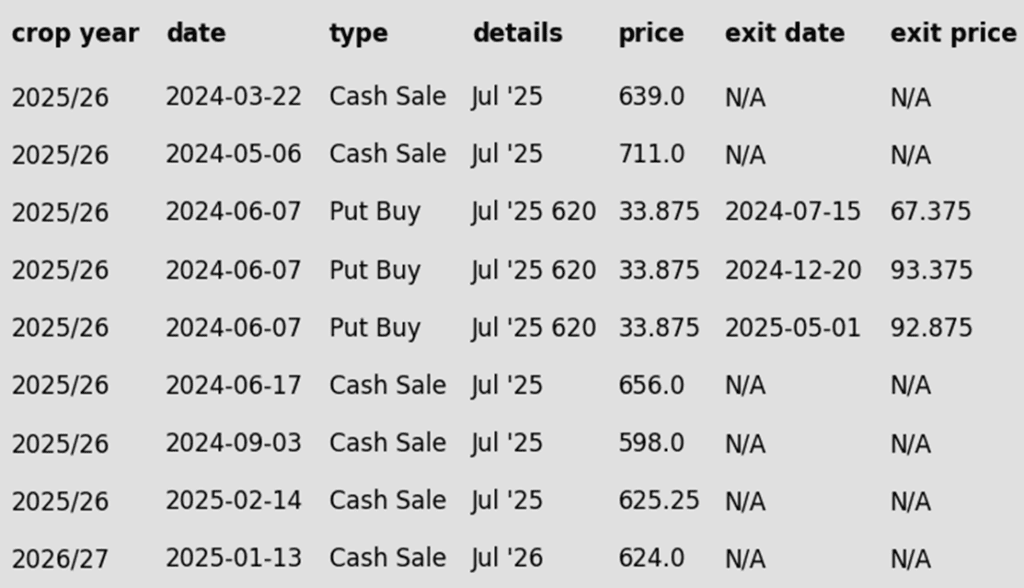

Chicago Wheat Managed Money Funds’ net position as of Tuesday, July 22. Net position in Green versus price in Red. Money Managers net bought 8,446 contracts between July 15 – July 22, bringing their total position to a net short 52,041 contracts.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None. With HRW harvest nearly complete, the window is opening for the next upside sales targets to post.

2026 Crop:

- Plan A:

- Target 683 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 to make the first cash sale.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Heads up that the July ‘26 contract is nearing the 584 Plan B stop, which if hit, would prompt buying July ‘26 put options.

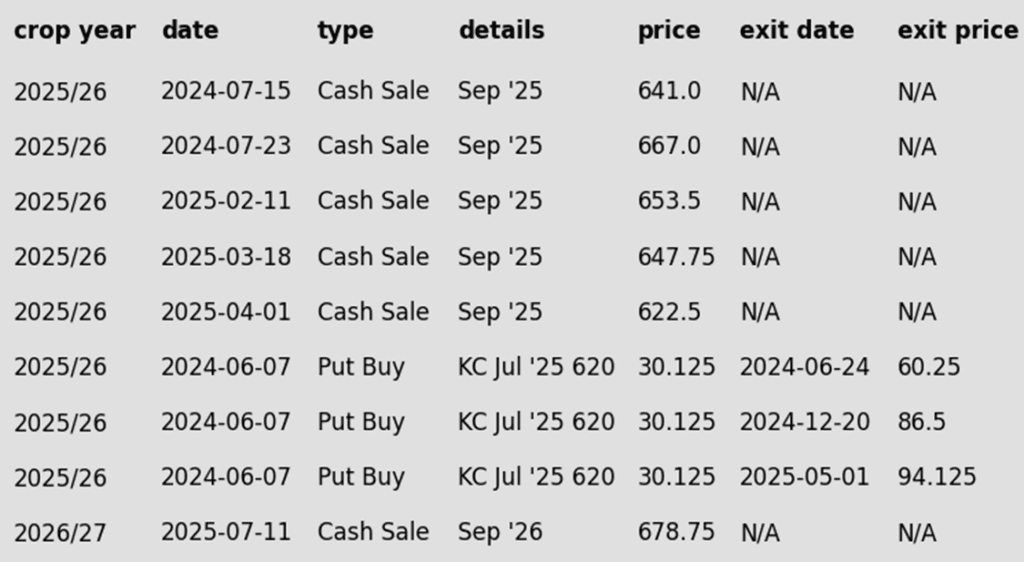

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Pulls Back Below Key Averages, Support at June Lows

KC wheat futures saw a strong rally in June, briefly testing the April highs near 580. However, late-month weakness pulled prices back below both the 100 and 200-day moving averages, which now serve as key resistance levels. On the downside, initial support is seen at the June low of 517.75, with secondary support near the May low around 500.

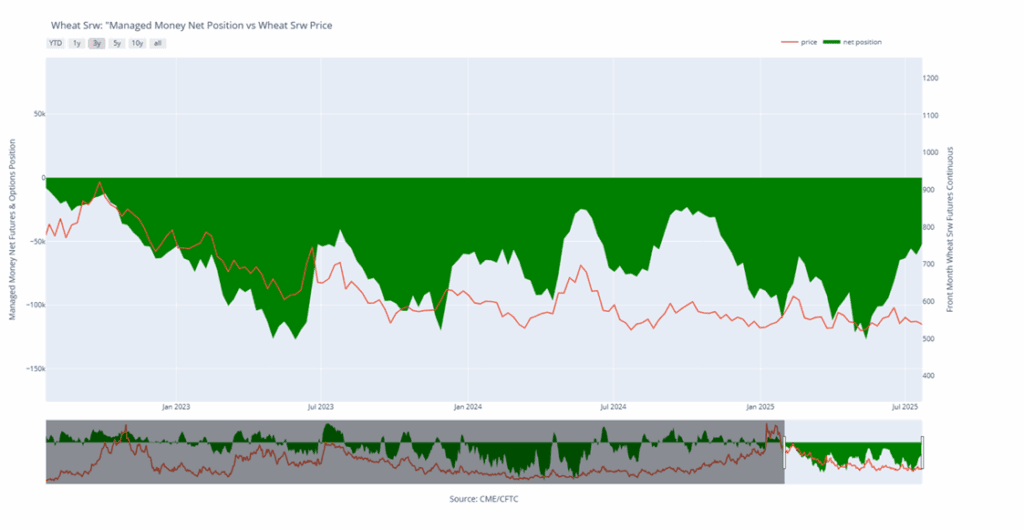

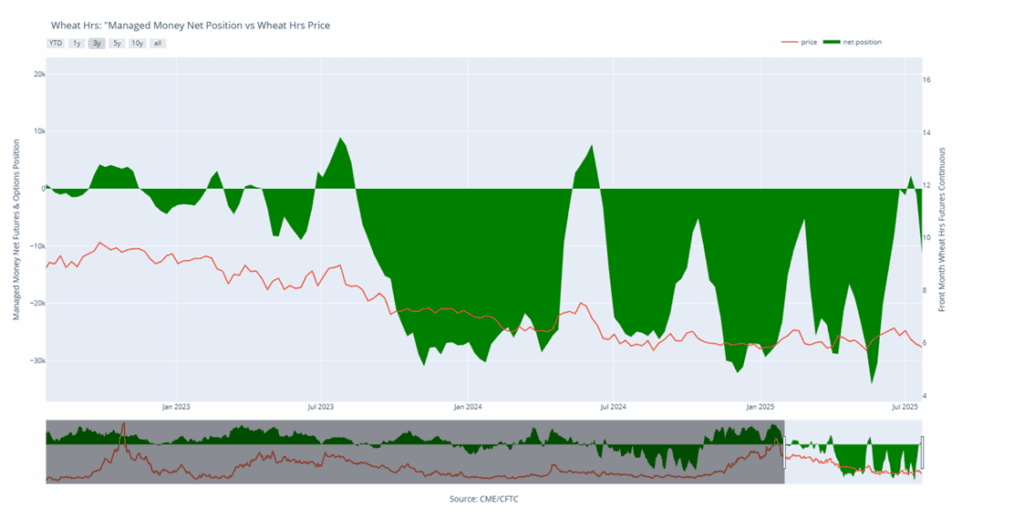

KC Wheat Managed Money Funds’ net position as of Tuesday, July 22. Net position in Green versus price in Red. Money Managers net bought 4,043 contracts between July 15– July 22, bringing their total position to a net short 43,959 contracts.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Futures Test Key Support After July Slide

Spring wheat futures have come under pressure in July, weighed down by improving crop conditions and generally favorable weather across key growing areas. Technically, a cluster of major moving averages just above the 600 mark presents the first layer of upside resistance, with a chart gap near 650 serving as a secondary target if momentum builds. On the downside, the May lows near 580 should provide firm support in the event of further weakness.

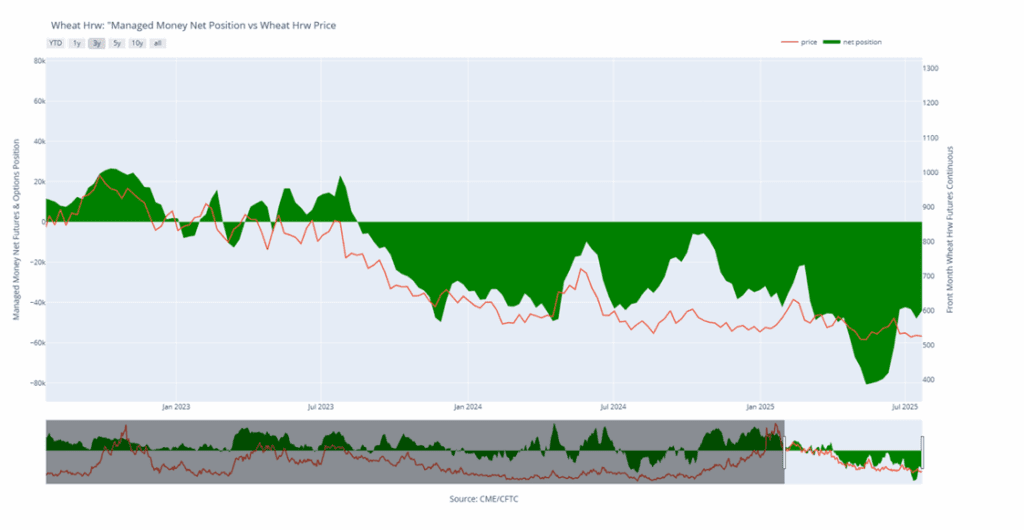

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, July 22. Net position in Green versus price in Red. Money Managers net sold 10,291 contracts between July 15 – July 22, bringing their total position to a net short 11,288 contracts.

Other Charts / Weather