7-24 End of Day: Positive Trade Developments Lift Corn, Soybeans, and Wheat

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 401.75 | 3.25 |

| DEC ’25 | 420.75 | 3.25 |

| DEC ’26 | 458.5 | 3 |

| Soybeans | ||

| AUG ’25 | 1004.25 | -1.5 |

| NOV ’25 | 1024.25 | 1.5 |

| NOV ’26 | 1066.75 | 3.25 |

| Chicago Wheat | ||

| SEP ’25 | 541.5 | 1 |

| DEC ’25 | 561.25 | 0 |

| JUL ’26 | 597.5 | 0.5 |

| K.C. Wheat | ||

| SEP ’25 | 528.5 | 5 |

| DEC ’25 | 549.75 | 3.75 |

| JUL ’26 | 592.75 | 2.75 |

| Mpls Wheat | ||

| SEP ’25 | 5.855 | -0.025 |

| DEC ’25 | 6.0675 | -0.0275 |

| SEP ’26 | 6.55 | 0.04 |

| S&P 500 | ||

| SEP ’25 | 6413.25 | 17 |

| Crude Oil | ||

| SEP ’25 | 66.09 | 0.84 |

| Gold | ||

| OCT ’25 | 3403.7 | -22.5 |

Grain Market Highlights

- 🌽 Corn: Recent trade developments gave a boost to the corn market today, with corn contracts closing higher across the board.

- 🌱 Soybeans: Soybeans ended the day higher despite a lackluster export report, as new trade developments provided enough support to keep prices in the green.

- 🌾 Wheat: Wheat markets closed mixed today on fairly favorable weather across key growing regions and a generally positive export report.

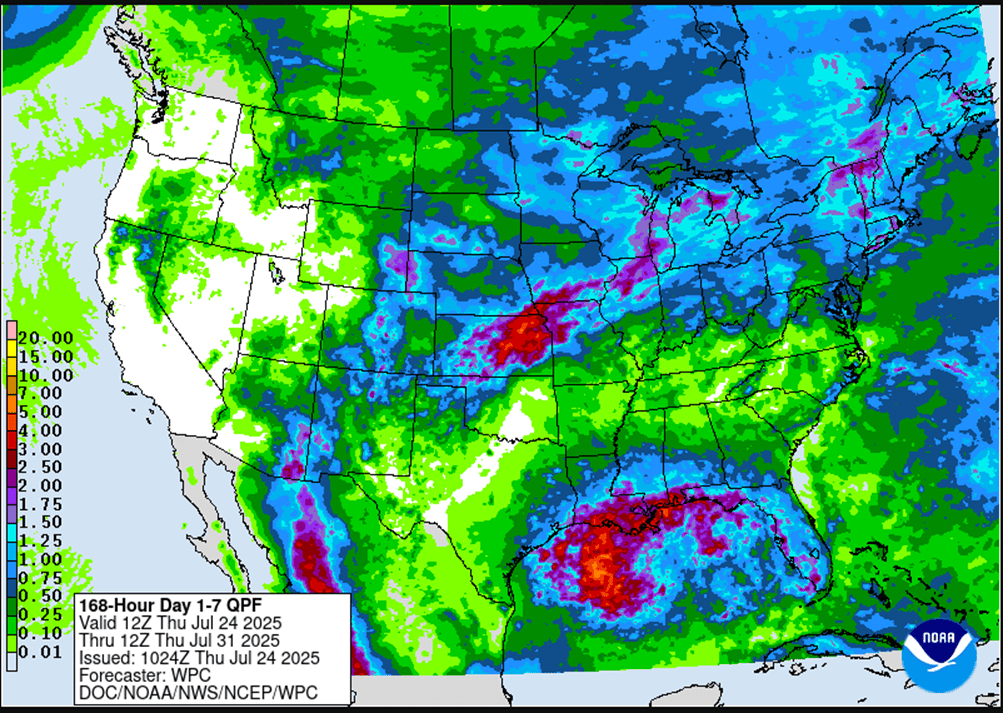

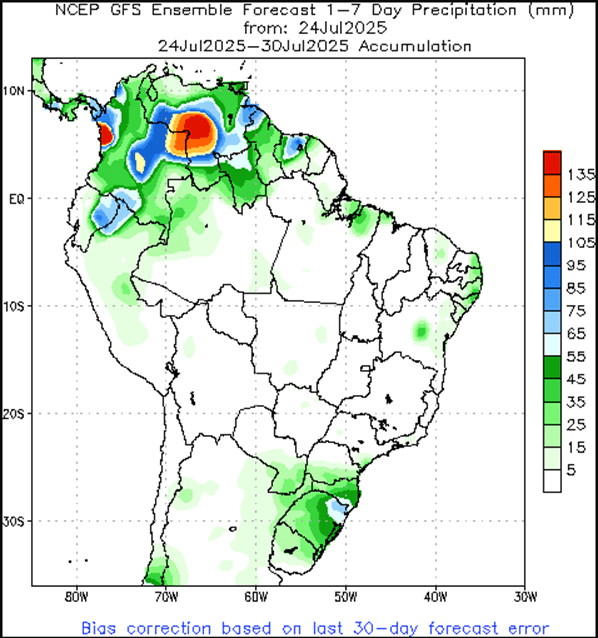

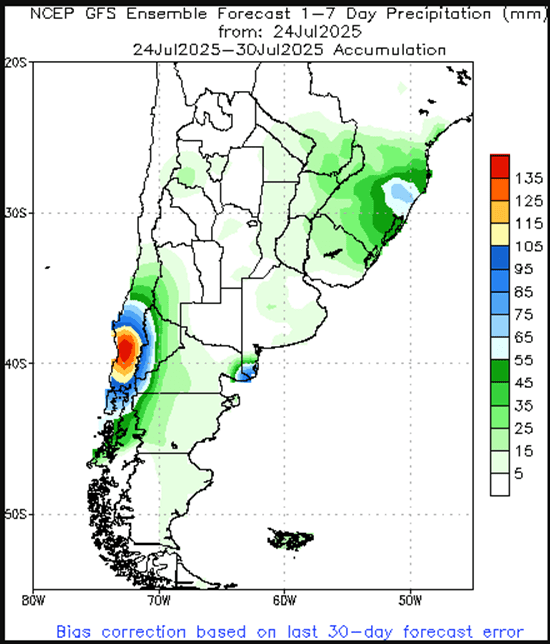

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

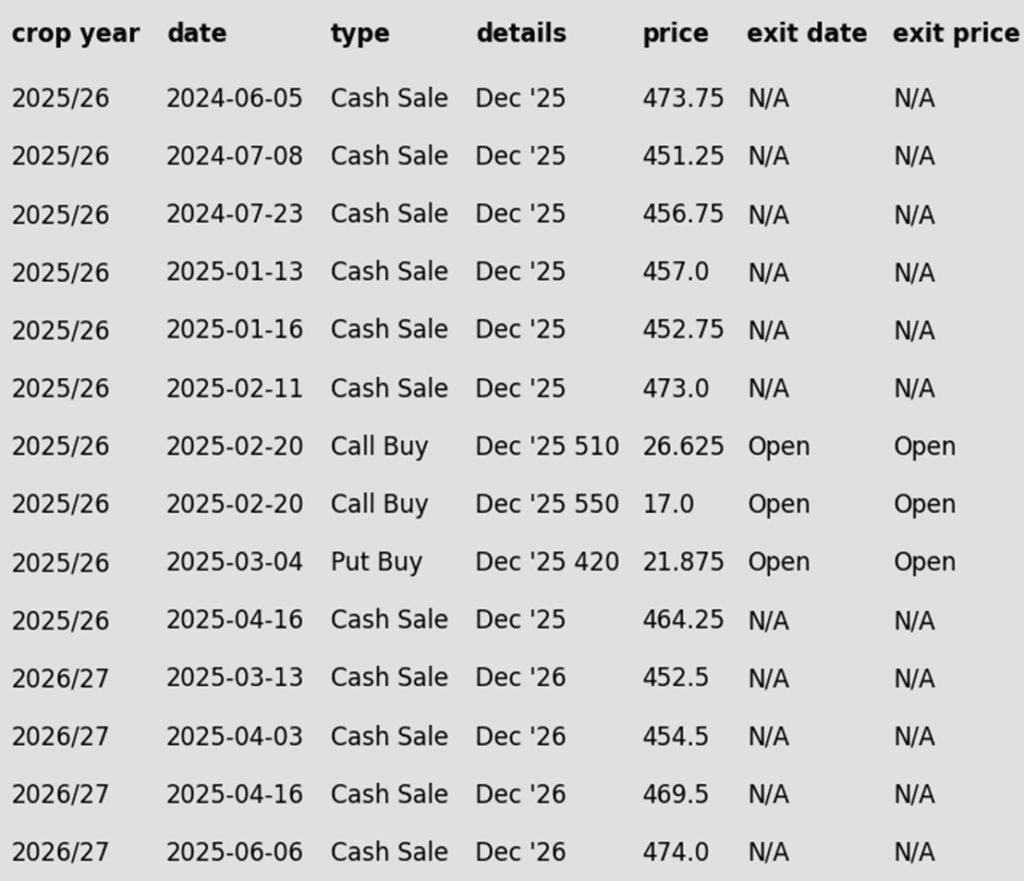

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- Target to exit a quarter of 420 puts at 411 has been cancelled.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None. The target remains 483 to make the next sale.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

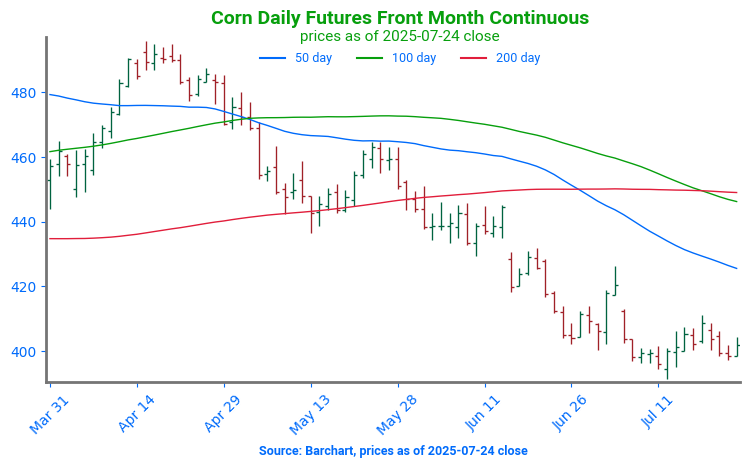

- Corn futures closed higher today, supported by recent trade deal announcements and technical support levels. September futures closed back above the $4.00 level while the December contract looks to have found support near $4.15.

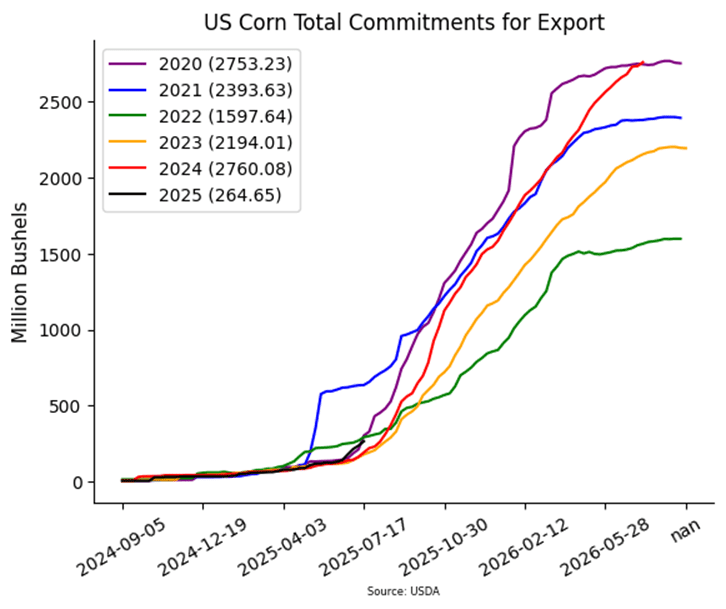

- Weekly export sales for corn came in at 54 mb. Year-to-date commitments now total 2.760 billion bushels, which is up 27% from a year ago.

- The USDA reported a correction of a previous export sale of 135k mt of U.S. corn to China. That sale was actually sold to South Korea, not China. Along with that sale the USDA also announced the sale of 285k mt of U.S. corn sold to unknown destinations.

- Weather will continue to be the main driver of price action for corn futures. Recent rainfall across the corn belt has pressured prices recently. The 8-14 day outlook shows additional precipitation could be on the way for much of the Western belt, which may add some more downside risk for corn prices.

Corn Futures Attempt Rebound with Bullish Reversal

Corn futures show signs of recovery mid-July, posting a bullish key reversal to start last week. An unfilled gap near 413 is the first upside target, followed by a gap at 430 if 420 is cleared. On the downside, support rests at last week’s low of 391.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

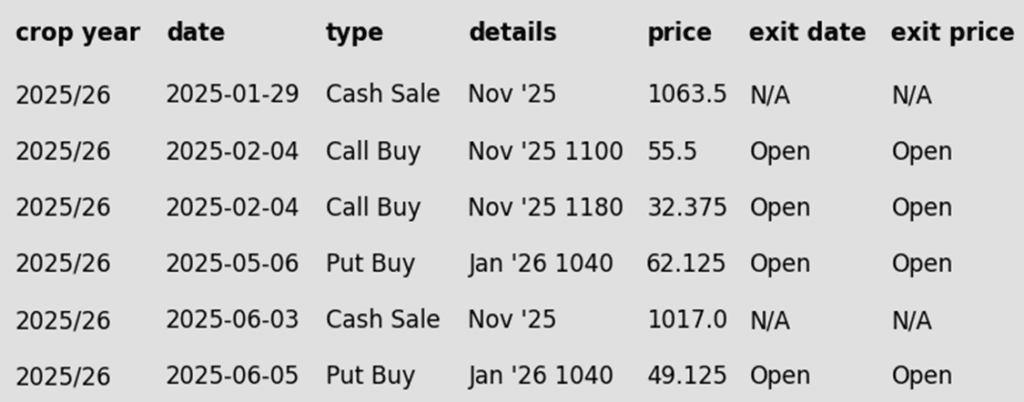

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None. No change to the 1114 upside target despite recent market weakness; a hot, dry August may be needed to reach it. While uncommon, sizeable August rallies have occurred before.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Still waiting on first targets for 2026 to post.

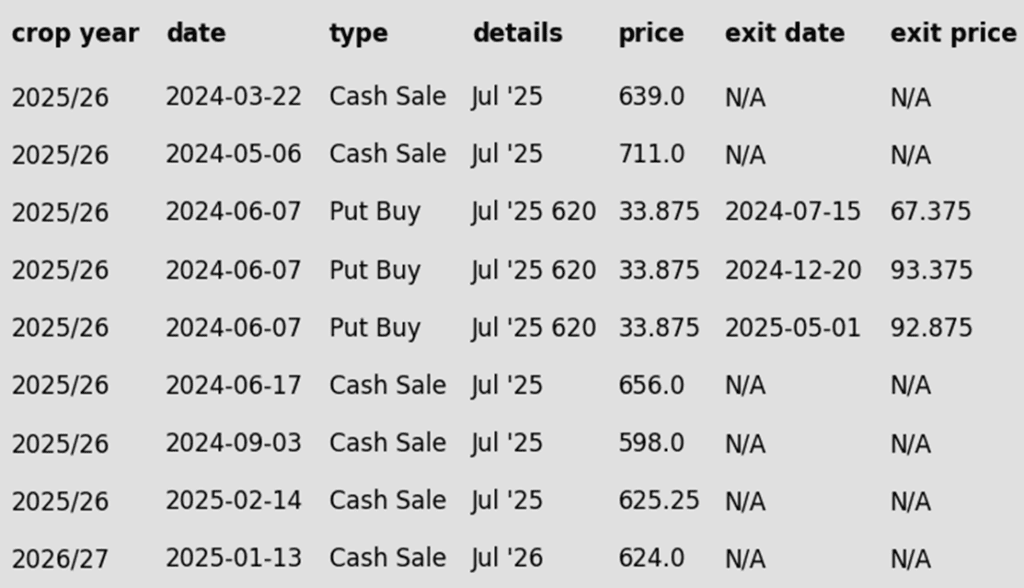

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans were higher to end the day after trading either side of unchanged throughout the session. Export sales were not particularly supportive, but ongoing trade deals both closed and still in negotiations were supportive. Expectations for large yields have kept prices from rallying on export news.

- While soybean meal was lower to end the day, soybean oil was higher following crude oil. The general trend over the last few months has been gains in soybean oil and decreased in soybean meal prices as the country shifts to stronger demand for biofuels. This leads to larger soybean crush numbers but also creates a glut of soybean meal.

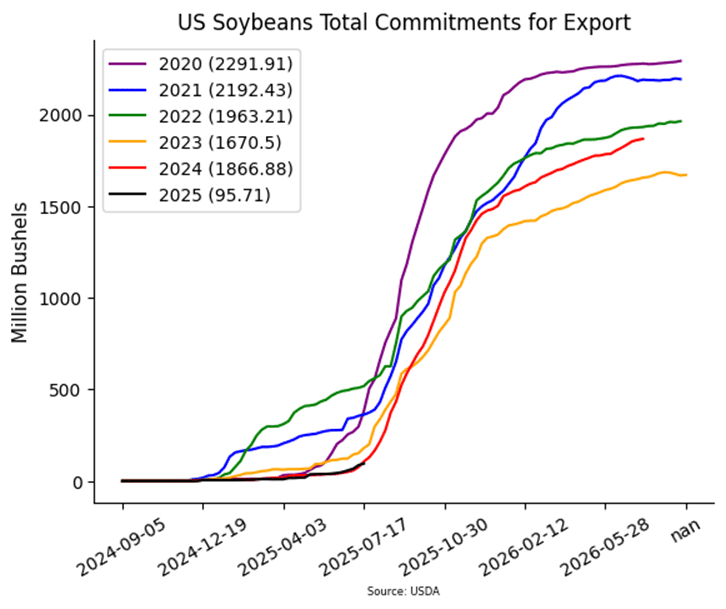

- Today’s export sales were at the low end of trade expectations with increases of 5.9 million bushels in 24/25, and an increase of 8.8 million bushels for 25/26. Primary destinations were to the Netherlands, Mexico, and Egypt. Last week’s export shipments of 13.3 mb were below the 17.1 mb needed each week to meet the USDA’s export estimates.

- Expectations for a large crop and softening demand continue to weigh on new-crop balance sheets. Some analysts project 2025/26 U.S. soybean ending stocks could rise to 510 million bushels — well above the USDA’s July estimate of 310 million — amid weaker domestic demand and export uncertainty.

Soybeans Find Support Near $10

Soybeans failed to break above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. If soybeans can breach the 100-day moving average the next upside target would be the gap left over the 4th of July weekend near 1050. Support found last week near 1000 will be the first line of defense on a pullback with the April lows near 980 as stronger support.

Wheat

Market Notes: Wheat

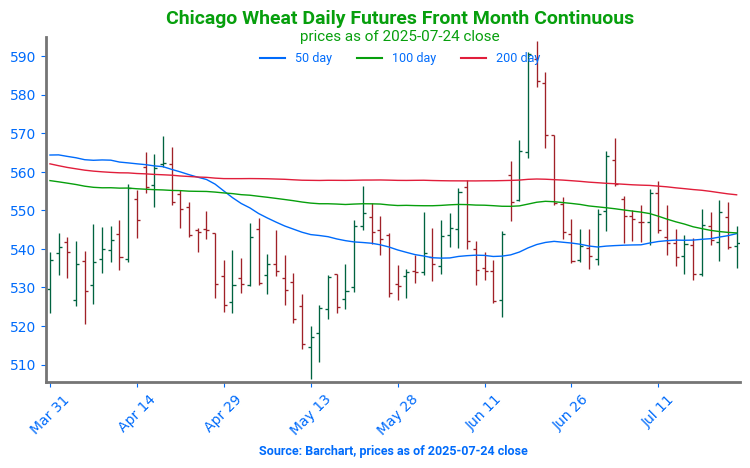

- Wheat saw a mixed close today, with Chicago and Kansas City contracts ending steady to higher, while Minneapolis posted modest losses. A lack of fresh, market-moving news and another negative session for Matif wheat likely limited upside potential for the U.S. market.

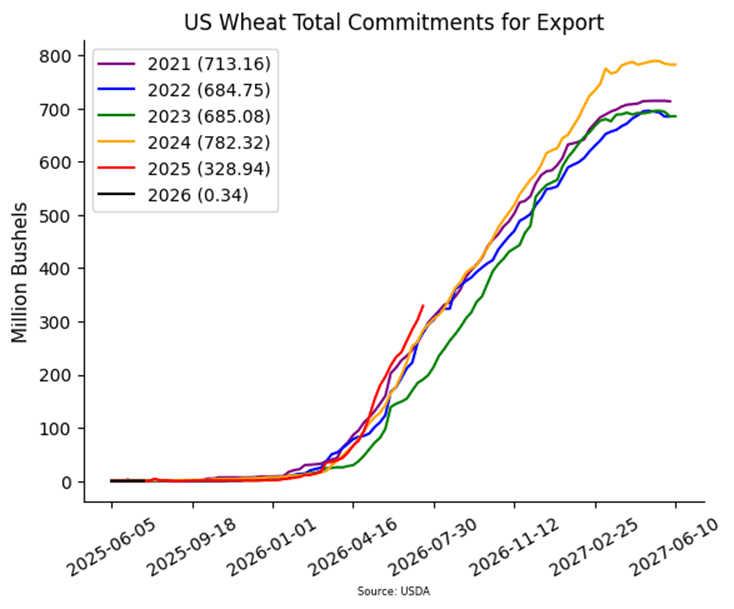

- The USDA reported an increase of 26.2 mb of wheat export sales for 25/26. Shipments last week totaled 28.0 mb, which exceeded the 16.7 mb pace needed per week to reach their goal of 850 mb. Total 25/26 wheat sales commitments have reached 329 mb, which is up 12% from last year.

- The second day of the Wheat Quality Council crop tour found an average North Dakota spring wheat yield of 47.1 bpa after sampling 139 fields. This is down 12% from the 53.7 bpa found on the second day a year ago. The USDA is estimating North Dakota’s spring wheat yield at 59 bpa.

- According to their food secretary, India’s domestic wheat price and supply are at “comfortable levels”, with no need for the government to sell from state reserves into the open market. It is worth noting that India has done this in the past to combat inflation and high food prices.

- Over the past couple of weeks, decent rainfall across the southern Canadian Prairies has helped ease early-season dryness and reduce crop stress. As a result, spring wheat production estimates have remained steady.

- The Argentine ministry of agriculture has reported national wheat planting at 92% complete versus 93% at this time last year. Additionally, recent rains and improved soil moisture have led to some increased production estimates, with one private firm projecting a 1% increase in the crop to 20.2 mmt. For reference, the USDA is estimating Argentina’s wheat harvest at 20 mmt.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. No active sales targets as still within the harvest window for SRW.

2026 Crop:

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

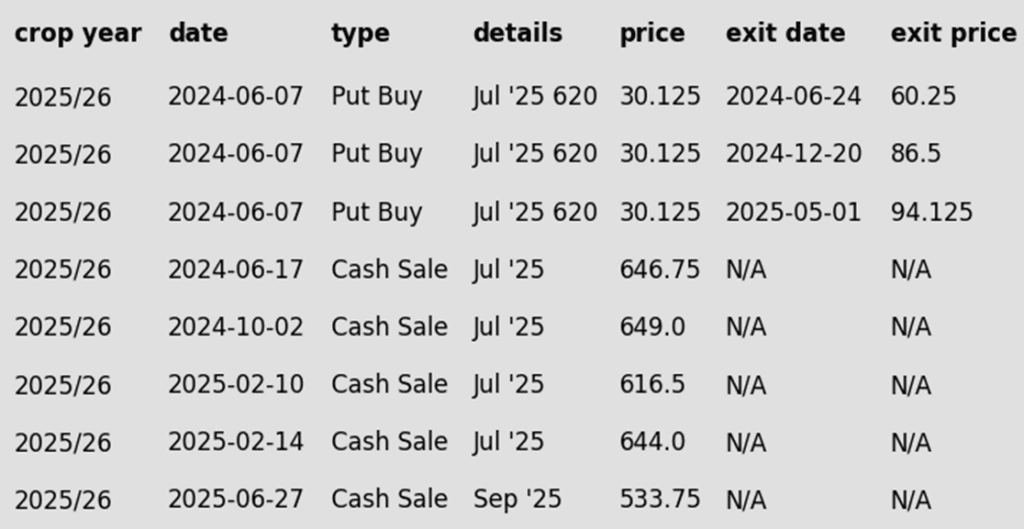

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Holds Range; Watching 558 Resistance and 522.25 Support

Chicago wheat’s sharp rally in mid-June was short-lived, with futures pulling back toward the upper end of their 2025 trading range. Initial support is found at the 50-day moving average; a break below that level could open the door to a retest of the June low at 522.25. On the upside, a weekly close above 558 would be constructive and could set up a move back toward the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None. With HRW harvest nearly complete, the window is opening for the next upside sales targets to post.

2026 Crop:

- Plan A:

- Target 683 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 to make the first cash sale.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Heads up that the July ‘26 contract is nearing the 584 Plan B stop, which if hit, would prompt buying July ‘26 put options.

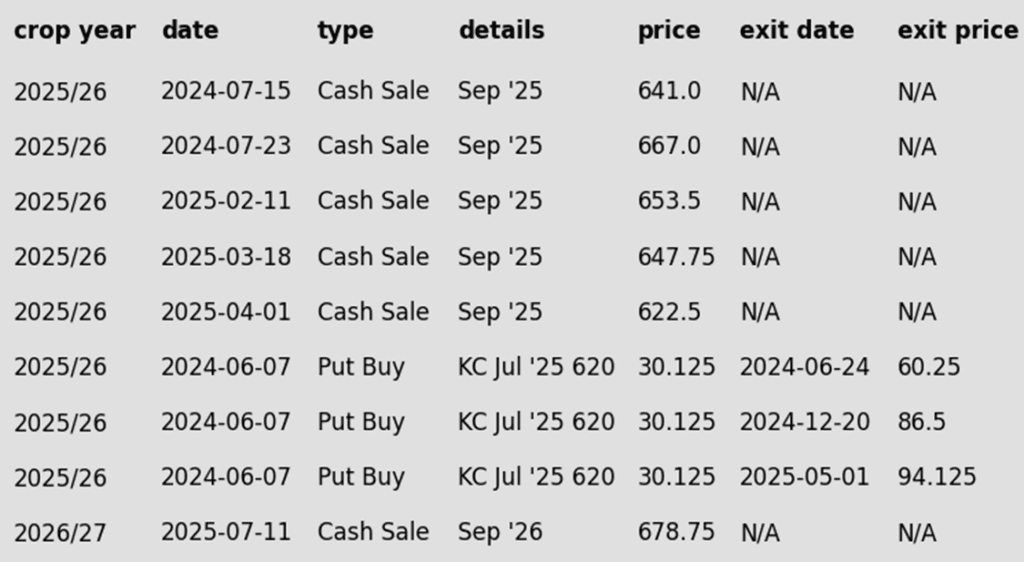

To date, Grain Market Insider has issued the following KC recommendations:

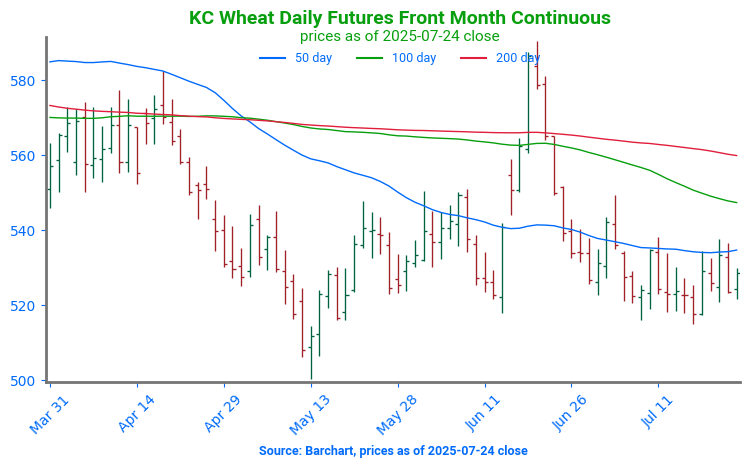

KC Wheat Pulls Back Below Key Averages, Support at June Lows

KC wheat futures saw a strong rally in June, briefly testing the April highs near 580. However, late-month weakness pulled prices back below both the 100 and 200-day moving averages, which now serve as key resistance levels. On the downside, initial support is seen at the June low of 517.75, with secondary support near the May low around 500.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

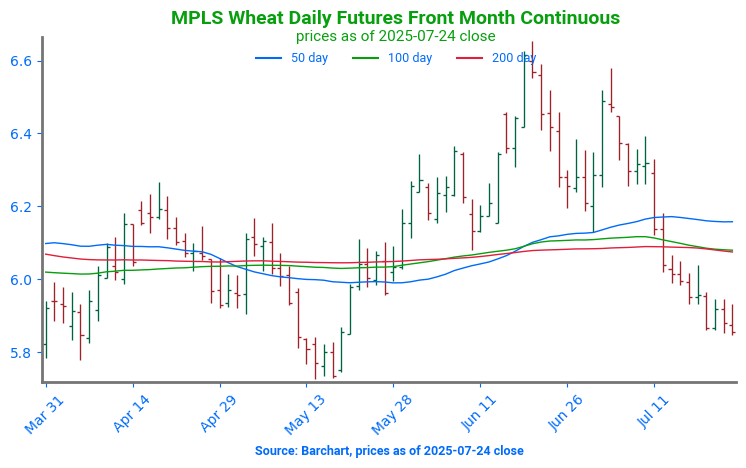

Spring Wheat Futures Test Key Support After July Slide

Spring wheat futures have come under pressure in July, weighed down by improving crop conditions and generally favorable weather across key growing areas. Technically, a cluster of major moving averages just above the 600 mark presents the first layer of upside resistance, with a chart gap near 650 serving as a secondary target if momentum builds. On the downside, the May lows near 580 should provide firm support in the event of further weakness.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.