7-23 End of Day: Weather Trumps Trade: Grains Drift Lower

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 398.5 | -0.75 |

| DEC ’25 | 417.5 | -0.5 |

| DEC ’26 | 455.5 | -1.25 |

| Soybeans | ||

| AUG ’25 | 1005.75 | -4.5 |

| NOV ’25 | 1022.75 | -2.75 |

| NOV ’26 | 1063.5 | 1.25 |

| Chicago Wheat | ||

| SEP ’25 | 540.5 | -9 |

| DEC ’25 | 561.25 | -8.25 |

| JUL ’26 | 597 | -7 |

| K.C. Wheat | ||

| SEP ’25 | 523.5 | -9.75 |

| DEC ’25 | 546 | -9 |

| JUL ’26 | 590 | -8 |

| Mpls Wheat | ||

| SEP ’25 | 5.88 | -0.0375 |

| DEC ’25 | 6.095 | -0.0225 |

| SEP ’26 | 6.51 | 0.005 |

| S&P 500 | ||

| SEP ’25 | 6388.75 | 42 |

| Crude Oil | ||

| SEP ’25 | 65.44 | 0.13 |

| Gold | ||

| OCT ’25 | 3432.7 | -39.4 |

Grain Market Highlights

- 🌽 Corn: Corn futures closed lower Wednesday, weighed down by favorable weather forecasts across key growing regions that continue to reinforce expectations for a record-large crop. Despite recent trade deal headlines and overnight developments, weather remains the dominant market driver.

- 🌱 Soybeans: Soybeans ended lower Tuesday, retreating from early session highs sparked by trade optimism. Gains were initially fueled by news of a trade agreement with Japan and a potential deal with the Philippines.

- 🌾 Wheat: Wheat futures finished lower across all classes Tuesday, pressured by a pullback in Matif wheat and technical selling after encountering resistance at key moving averages.

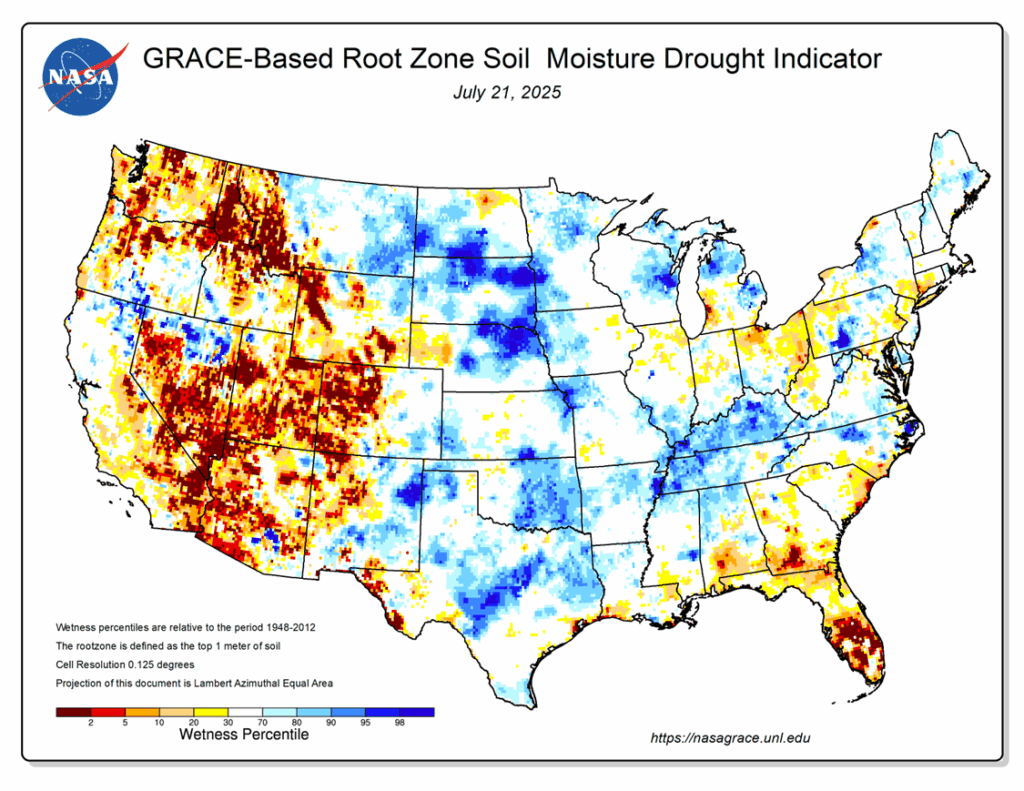

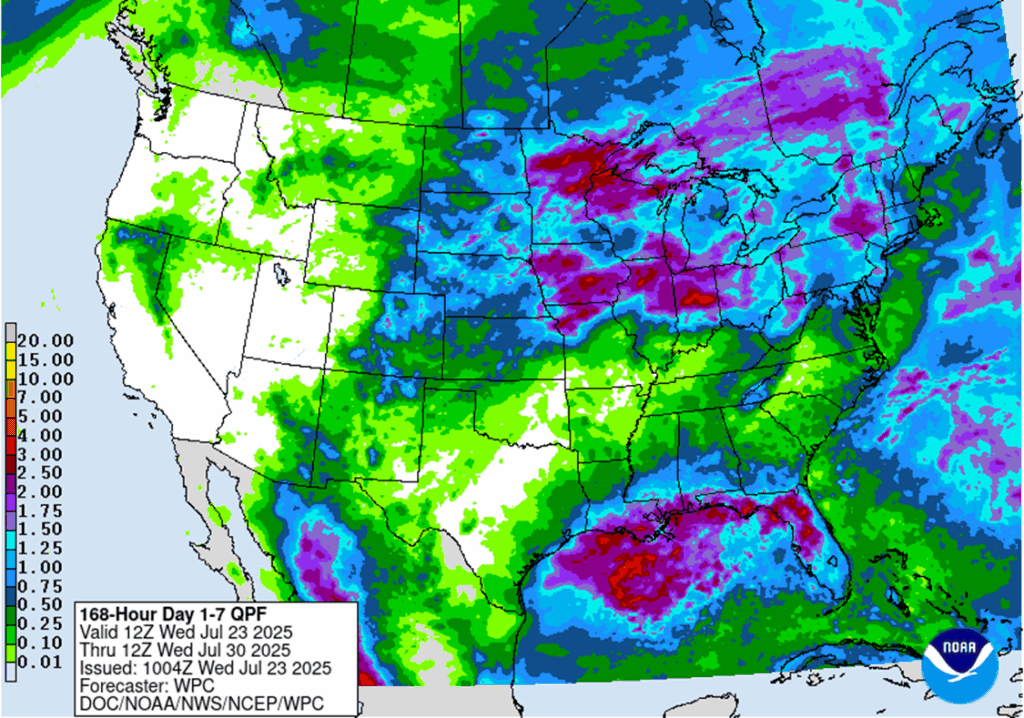

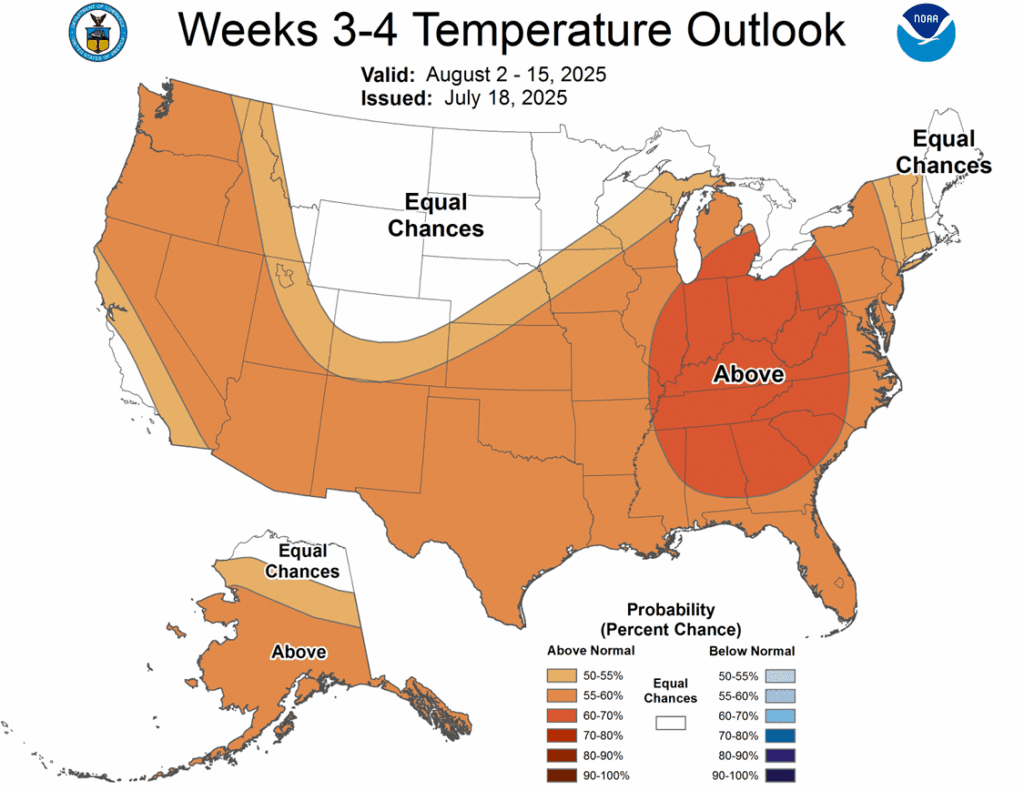

- To see the updated U.S weather forecast maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

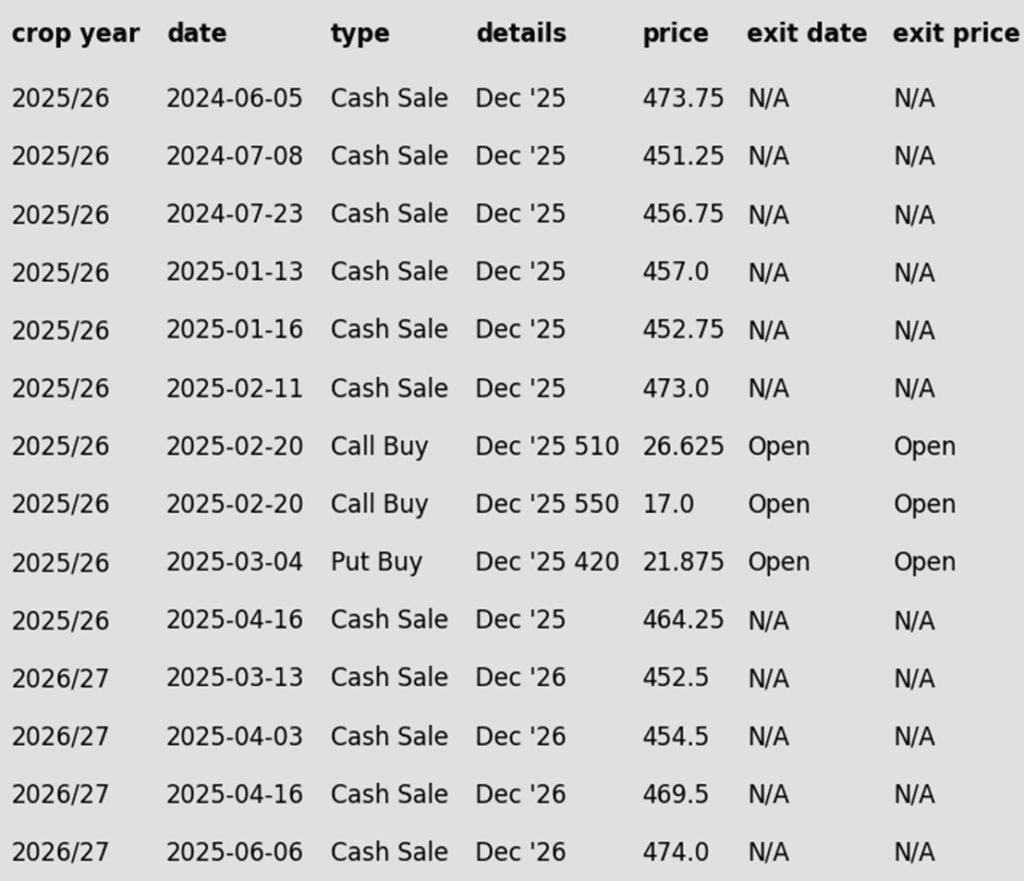

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures closed lower today, pressured by favorable weather forecasts across key growing regions, which continue to reinforce expectations for a record-breaking harvest. The market also struggled to build momentum following yesterday’s trade deal announcements and overnight developments, as favorable weather continues to take precedence over potential demand drivers. The lead month September contract remains below the psychological 400 price level.

- Traders remain cautious regarding the U.S.-Japan trade agreement, as Japan is already a major buyer of U.S. corn. In 2024, Japan ranked as the second-largest customer, importing $2.7 billion worth of corn. However, with few concrete details available, it remains unclear whether the deal will spur additional demand or simply formalize existing trade flows.

- Ethanol production for the week ending July 18 slightly declined to 1.078 million barrels per day, down from 1.087 million the previous week, marking a 1.6% year-over-year decrease. The production process consumed 15.37 million bushels of corn per day, exceeding the 15.3 million bushels per day pace needed to meet the USDA’s annual target. Year-to-date corn usage for ethanol production now totals 4.827 billion bushels.

- Ethanol stocks rose to 24.44 million barrels, marking a 3.4% increase compared to the same period last year. The build in stocks suggest that no changes are expected to the USDA’s corn usage forecast in the upcoming WASDE report.

Corn Futures Attempt Rebound with Bullish Reversal

Corn futures show signs of recovery mid-July, posting a bullish key reversal to start last week. An unfilled gap near 413 is the first upside target, followed by a gap at 430 if 420 is cleared. On the downside, support rests at last week’s low of 391.

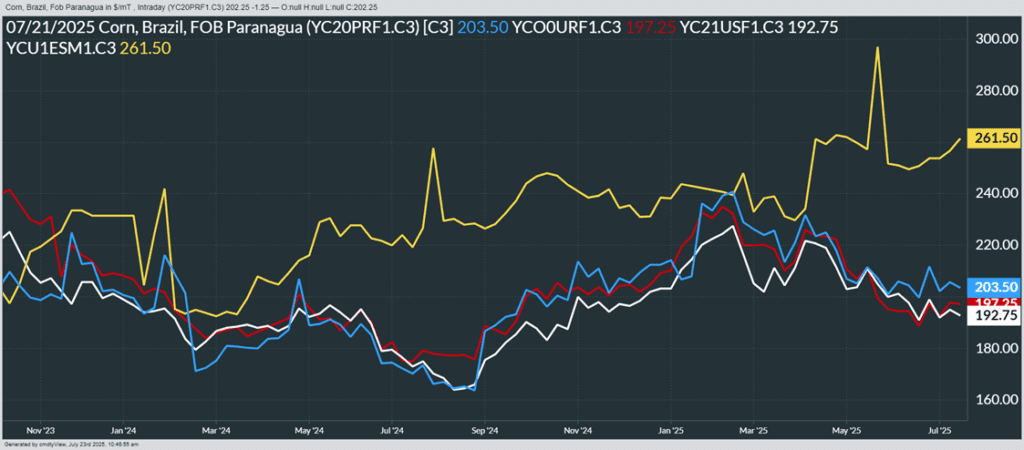

Above: From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

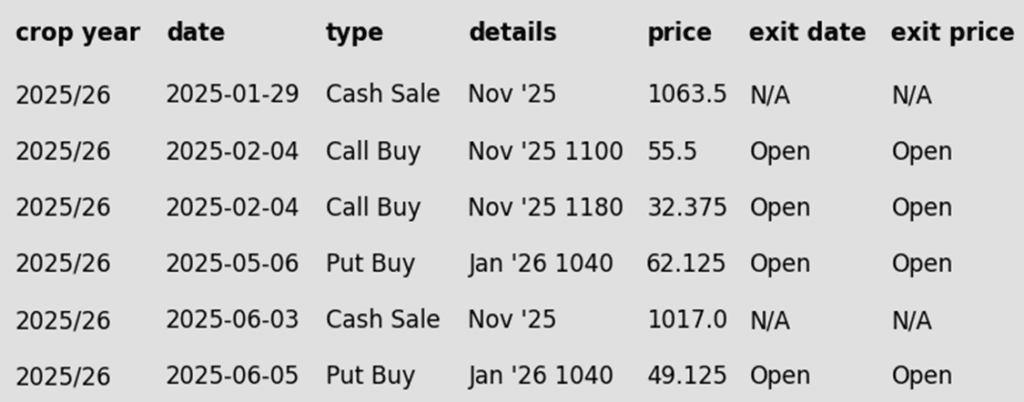

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower after falling from highs earlier in the day. The initial run higher was a result of a trade agreement with Japan and a deal in the works with the Philippines. Although August is expected to be hot and on the drier side, forecasts have slowly shifted to be slightly more favorable for growing conditions.

- Expectations for a large crop and softening demand continue to weigh on new-crop balance sheets. Some analysts project 2025/26 U.S. soybean ending stocks could rise to 510 million bushels — well above the USDA’s July estimate of 310 million — amid weaker domestic demand and export uncertainty.

- In China, soybean imports from Brazil have reportedly risen by 9.2% from the previous year. This was driven by a strong Brazilian harvest along with the ongoing U.S. trade war. Last month, China imported 86.6% of their total imports from Brazil alone.

- While Monday’s Crop Progress report saw soybean good to excellent ratings fall by 2 points to 68%, this is still a strong number historically. August weather will be a key factor and forecasts continue to fluctuate. States where crop conditions have fallen have primarily been Kansas and North Dakota.

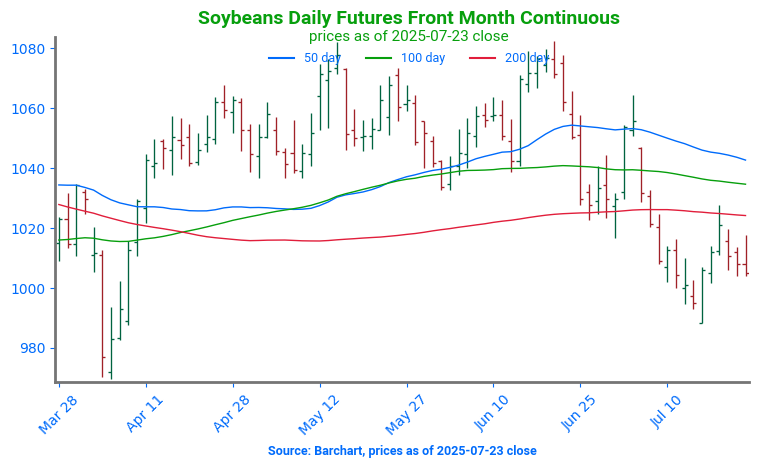

Soybeans Find Support Near $10

Soybeans failed to break above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. If soybeans can breach the 100-day moving average the next upside target would be the gap left over the 4th of July weekend near 1050. Support found last week near 1000 will be the first line of defense on a pullback with the April lows near 980 as stronger support.

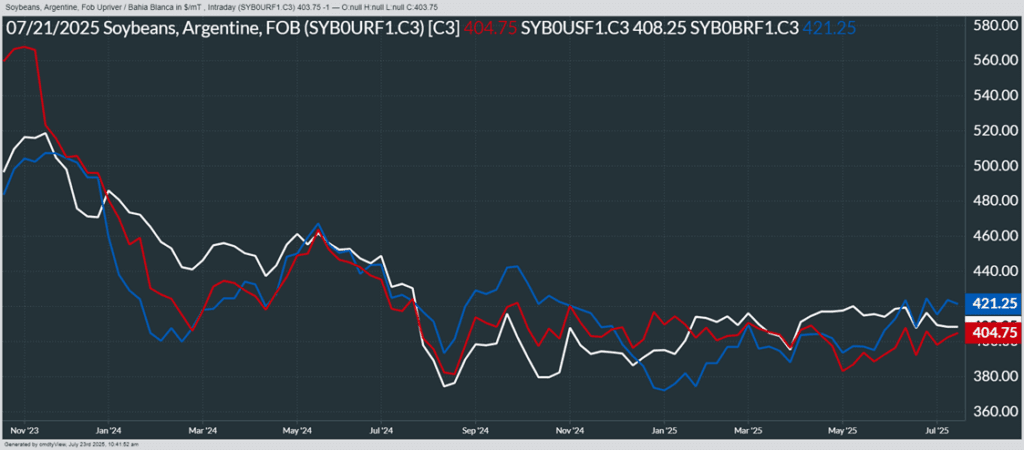

Above: From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

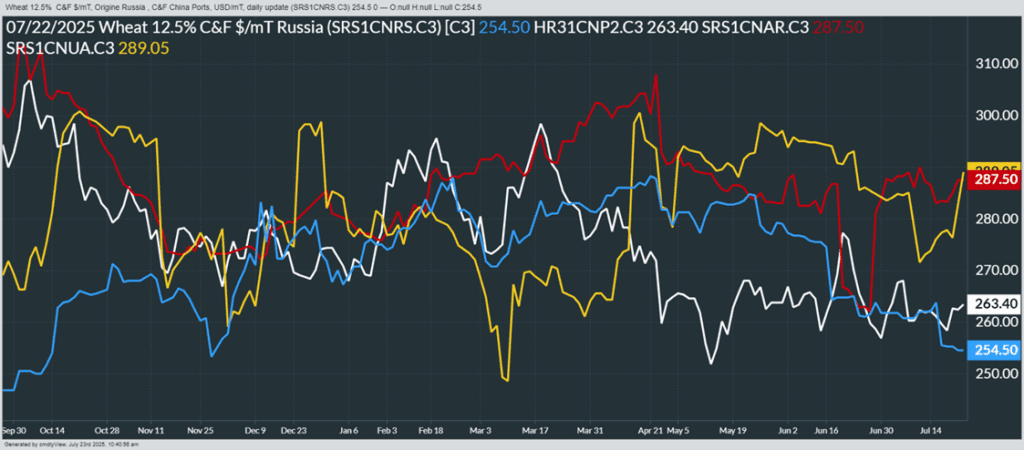

Market Notes: Wheat

- Wheat futures finished lower across all classes Tuesday, pressured by a pullback in Matif wheat and technical selling after encountering resistance at key moving averages. The weakness came despite a new U.S.-Japan trade agreement, which, while centered on the auto sector, includes agricultural products and raises hopes for future trade deals.

- Day one of the Wheat Quality Council’s spring wheat tour reported average yields of 50 bushels per acre in North Dakota after 167 fields were sampled. That’s down slightly from last year’s 52.5 bpa and well below the USDA’s forecast of 59 bpa, offering early insight into potential production shortfalls.

- According to LSEG commodities research, 25/26 European Union and United Kingdom combined wheat production is estimated at 147.9 mmt, which is a 1.2% boost from their last projection. Recently, central Europe has seen favorable rains, which is cited as the reason for the increase.

- FranceAgriMer has reported that 71% of the French soft wheat crop has been harvested as of July 14. Favorable weather has allowed the pace of fieldwork to pick up recently. In related news, The International Grain Council said that Russia’s wheat harvest is 28% complete – they also noted that so far, production is down 30% from 2024.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

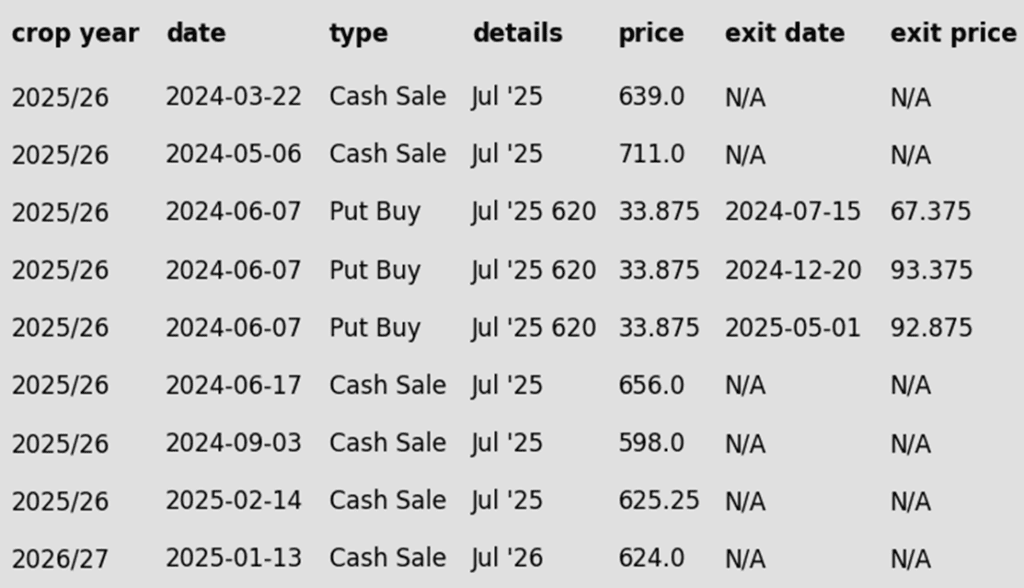

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

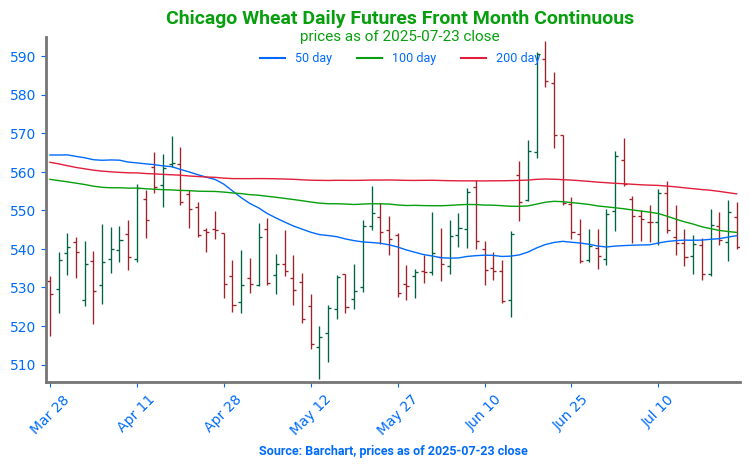

Chicago Wheat Returns to Recent Range

Chicago wheat’s sharp mid-June rally proved short-lived, with futures retreating to the upper end of the 2025 range. Initial support lies at the 50-day moving average, with a break targeting the June low of 522.25. On the upside, a weekly close above 558 could open the door for a retest of the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 688 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 688 target has been lowered to 683.

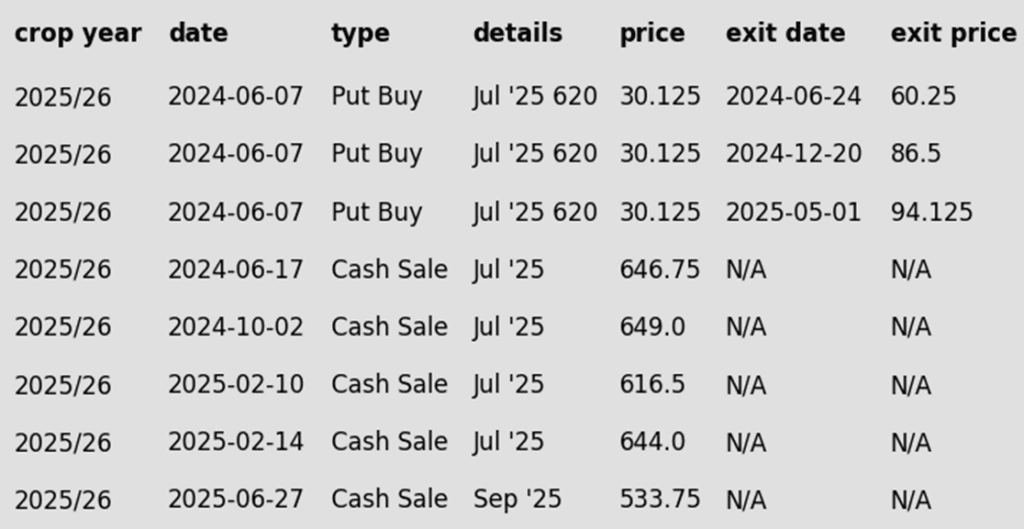

To date, Grain Market Insider has issued the following KC recommendations:

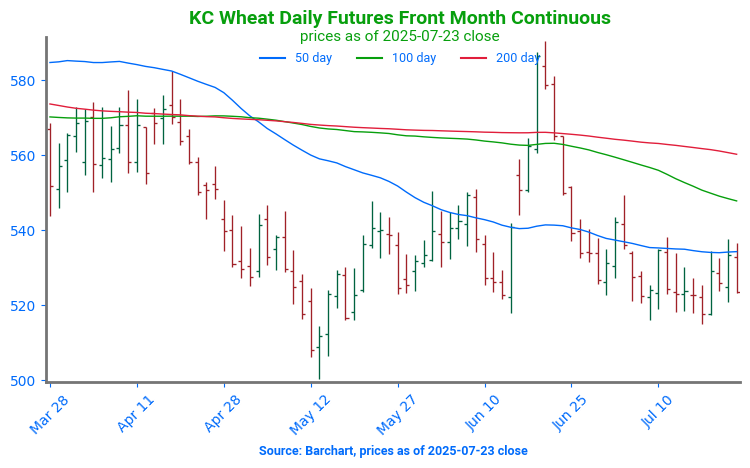

Kansas City Wheat Back Near Support

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

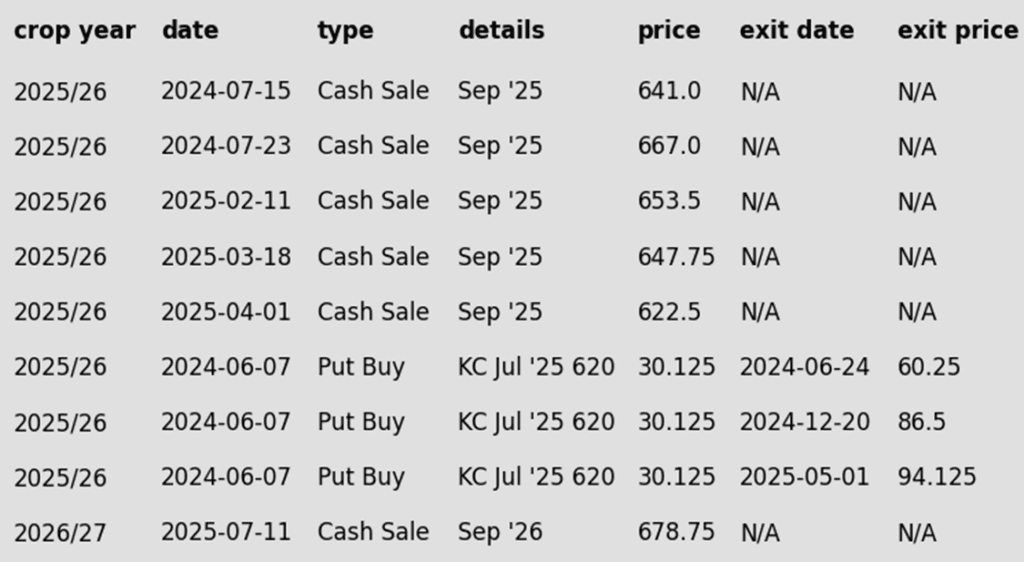

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

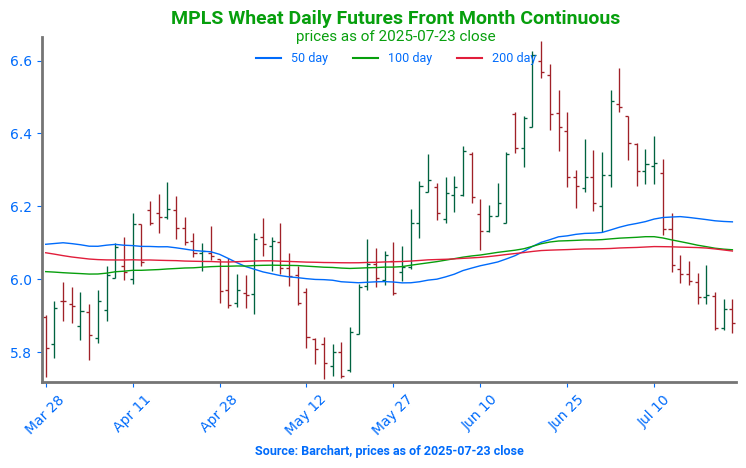

Spring Wheat Holds Above Support

Spring wheat futures held above the upper end of their prior range for most of June, supported by a confluence of major moving averages. The June high near 665 is the next upside target. Key support lies at the 200-day moving average around 607, with a close below that level — and especially under the May low of 572.50 — likely opening the door to increased downside risk.

Above: Spring wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Other Charts / Weather