7-22 End of Day: Grains End Mixed as Traders Digest Yesterday’s Crop Progress Report

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 399.25 | -4.5 |

| DEC ’25 | 418 | -4.25 |

| DEC ’26 | 456.75 | -0.5 |

| Soybeans | ||

| AUG ’25 | 1010.25 | -4.75 |

| NOV ’25 | 1025.5 | -0.5 |

| NOV ’26 | 1062.25 | 0.75 |

| Chicago Wheat | ||

| SEP ’25 | 549.5 | 7.25 |

| DEC ’25 | 569.5 | 6.25 |

| JUL ’26 | 604 | 4.75 |

| K.C. Wheat | ||

| SEP ’25 | 533.25 | 7.5 |

| DEC ’25 | 555 | 6.75 |

| JUL ’26 | 598 | 4.75 |

| Mpls Wheat | ||

| SEP ’25 | 5.9175 | 0.0525 |

| DEC ’25 | 6.1175 | 0.0325 |

| SEP ’26 | 6.505 | 0.025 |

| S&P 500 | ||

| SEP ’25 | 6346.25 | 1.5 |

| Crude Oil | ||

| SEP ’25 | 65.35 | -0.6 |

| Gold | ||

| OCT ’25 | 3471 | 37.3 |

Grain Market Highlights

- 🌽 Corn: Pressure remains on the corn market, which ended the day with losses for the second consecutive session. The decline was driven by favorable weather forecasts and strong crop conditions across the U.S.

- 🌱 Soybeans: Soybeans ended the day lower as traders digested yesterday’s USDA Crop Progress report and continued to monitor ongoing trade tensions between the U.S. and China.

- 🌾 Wheat: Wheat was the only major grain to post gains on Tuesday, supported by Monday’s Crop Progress report and a weaker U.S. dollar.

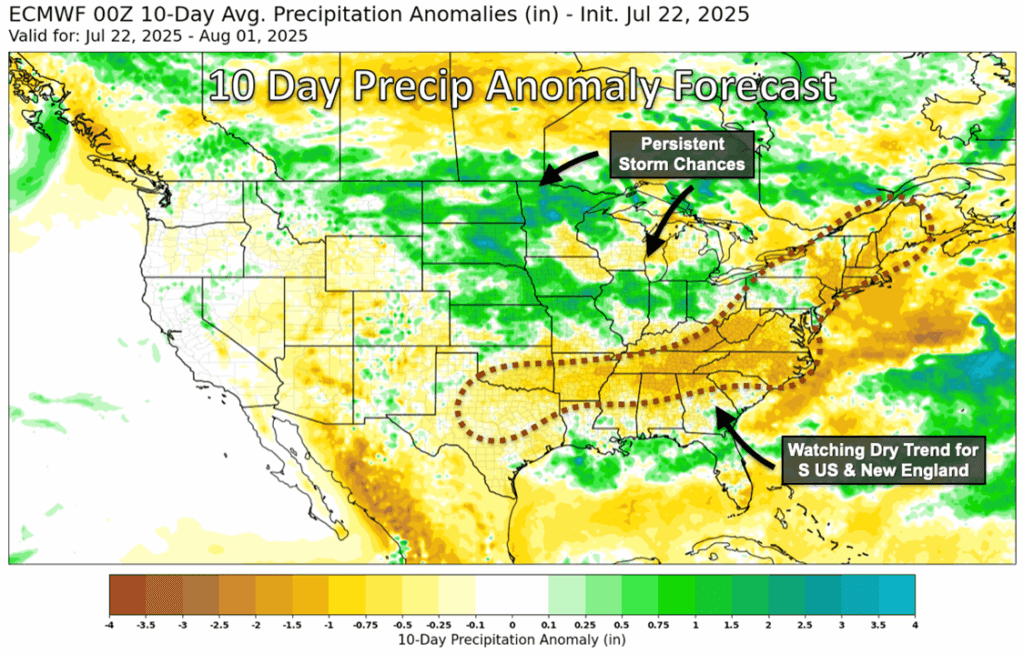

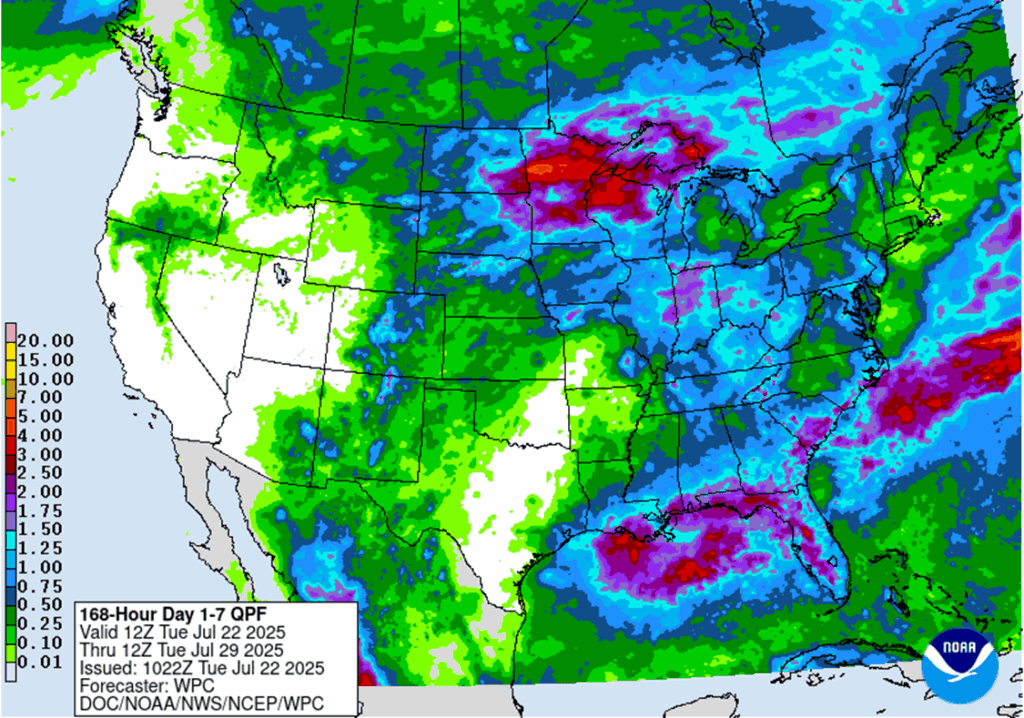

- To see the updated U.S weather forecast maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures fell for a second straight session, pressured by strong crop ratings and favorable weather forecasts, leading to moderate losses across the market. The lead month September contract closed back below the psychological 400 price level.

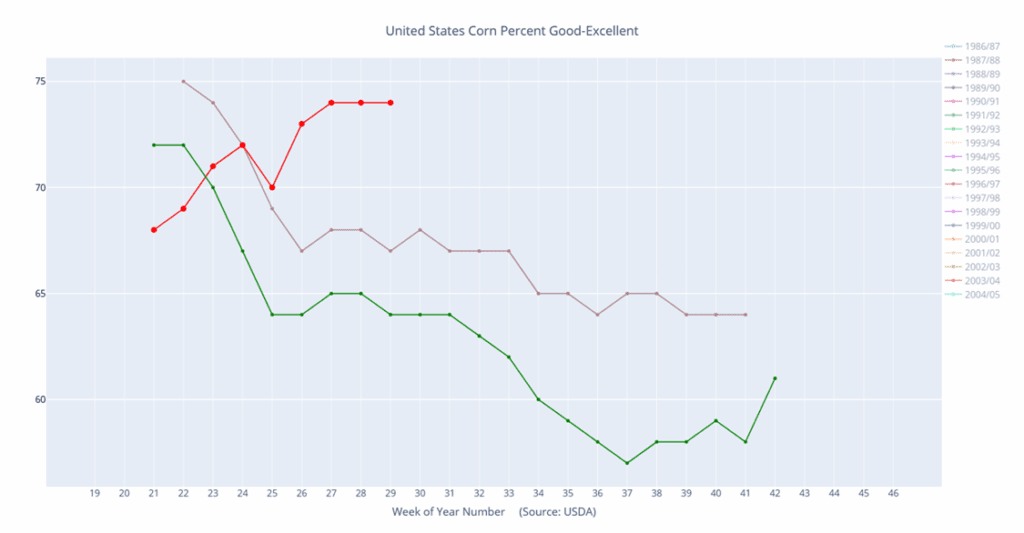

- Weekly crop ratings for corn remain unchanged at 74% G/E. Ratings would have likely improved, but rating drops in Colorado and Pennsylvania limited any movement. Regardless, this is the best rated corn since 2016. The final yield in 2016 finished 3.9% above the trend line yield to start the marketing year.

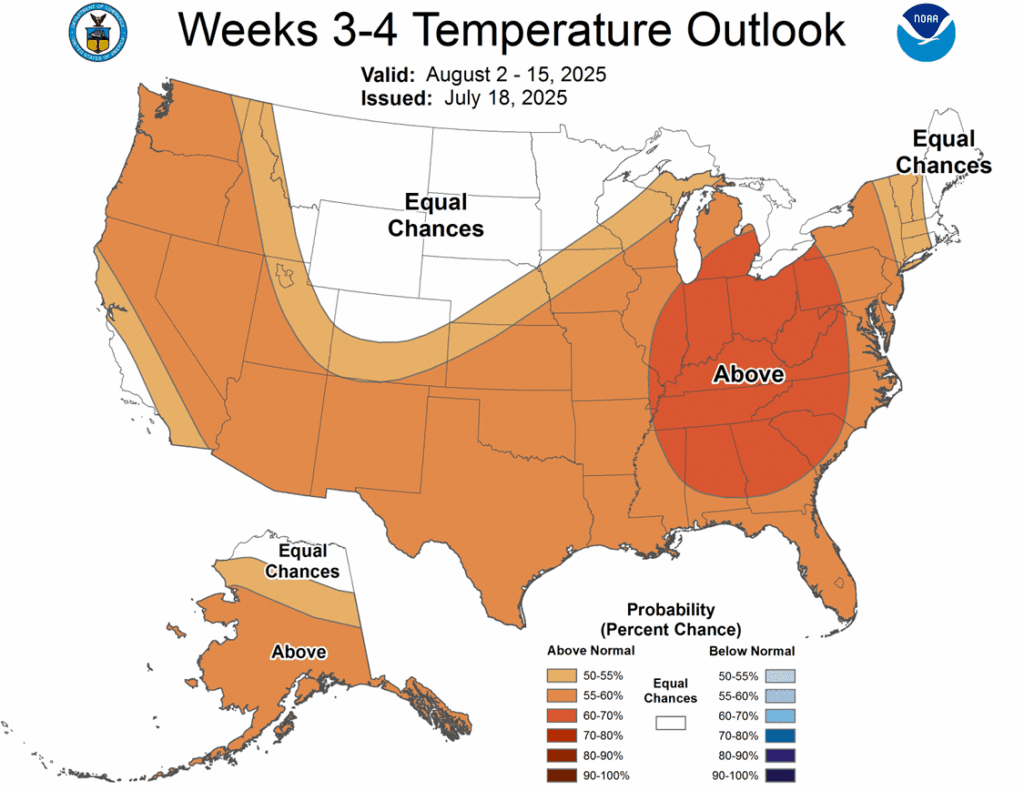

- Weather forecasts continue to moderate heading into August, adding pressure to the grain markets. Following a stretch of above-normal temperatures, early August outlooks are now calling for below-normal readings, which should reduce crop stress and support kernel fill.

- South Korea’s Mill Feed Group is looking to purchase corns and current bids for export corn for fall delivery have Brazil and Argentina prices at a discount to the U.S.

- Brazil corn harvest has been picking up speed, supported by improved weather. As of July 19, the second crop corn harvest was 55.5% complete, up nearly 14% over last week, but still well behind the 5-year average. Recently, wet weather and the logistics of handling a record corn crop have limited harvest progress..

Corn Futures Attempt Rebound with Bullish Reversal

Corn futures show signs of recovery mid-July, posting a bullish key reversal to start last week. An unfilled gap near 413 is the first upside target, followed by a gap at 430 if 420 is cleared. On the downside, support rests at last week’s low of 391.

Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

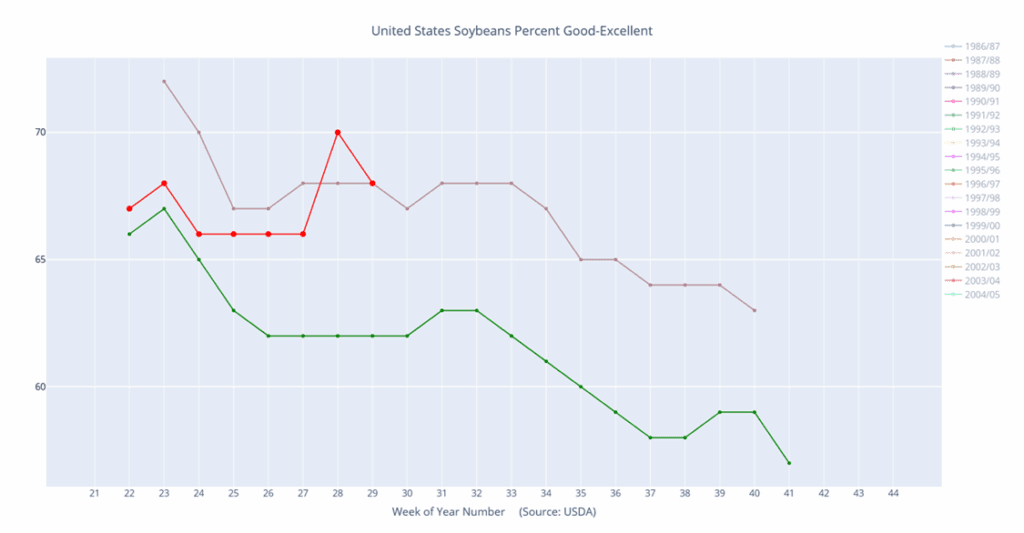

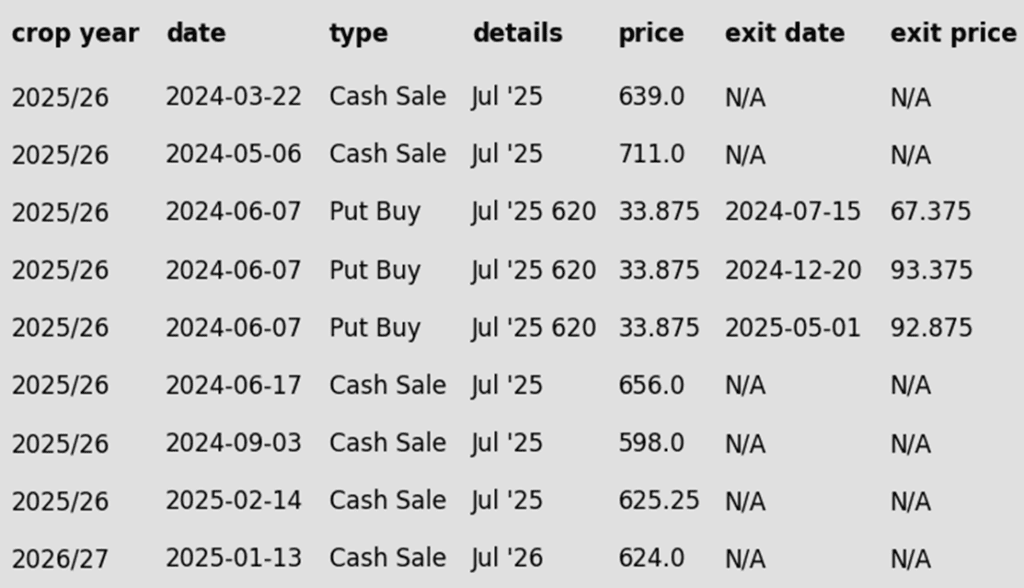

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower but came off their lows earlier in the day. The November contract took out yesterday’s low and is trading below the major moving averages. Yesterday’s Crop Progress report saw crop ratings fall slightly which should be supportive especially if weather gets hot and dry throughout August.

- Soybean oil followed crude oil lower today, while soybean meal found support on reports that President Trump is nearing a trade agreement with the Philippines. The potential deal could boost export demand for both soybeans and soybean meal.

- Yesterday’s Crop Progress report saw crop ratings for soybeans falling by 2 points from last week to 68% good to excellent. This is on par with this time last year. 62% of the crop is blooming compared to the average of 63% and 26% is setting pods which compares to the average of 26% at this time of year.

- In China, soybean imports from Brazil have reportedly risen by 9.2% from the previous year. This was driven by a strong Brazilian harvest along with the ongoing U.S. trade war. Last month, China imported 86.6% of their total imports from Brazil alone.

Soybeans Find Support Near $10

Soybeans failed to break above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. If soybeans can breach the 100-day moving average the next upside target would be the gap left over the 4th of July weekend near 1050. Support found last week near 1000 will be the first line of defense on a pullback with the April lows near 980 as stronger support.

Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

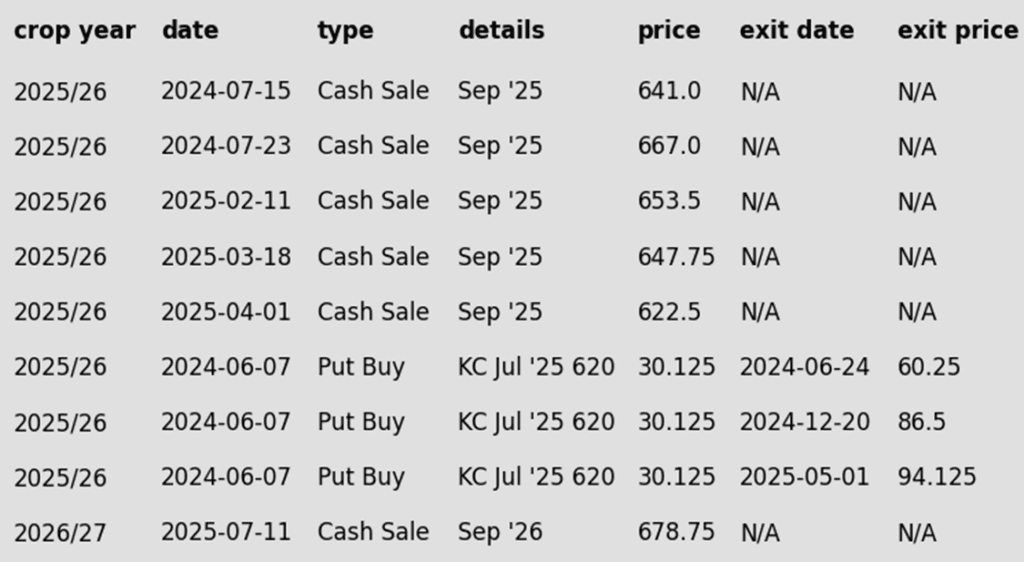

Wheat

Market Notes: Wheat

- Wheat finished the session with gains across all classes, despite lower closes in corn and soybean futures. Support came from a weaker U.S. dollar, reports of slowed farmer selling globally, and increased buying interest from end users for Russian wheat. Additionally, a decline in U.S. spring wheat crop ratings contributed to the bullish sentiment.

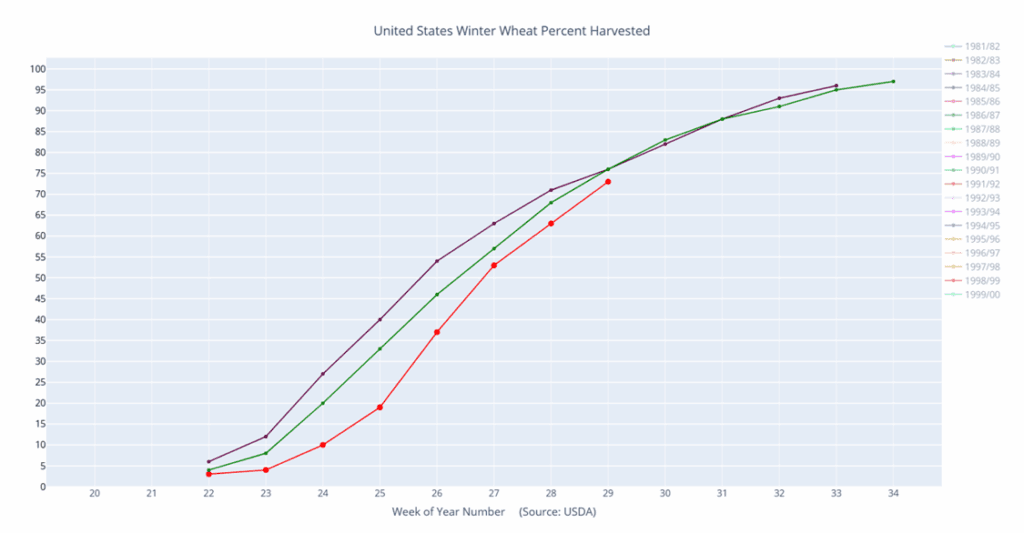

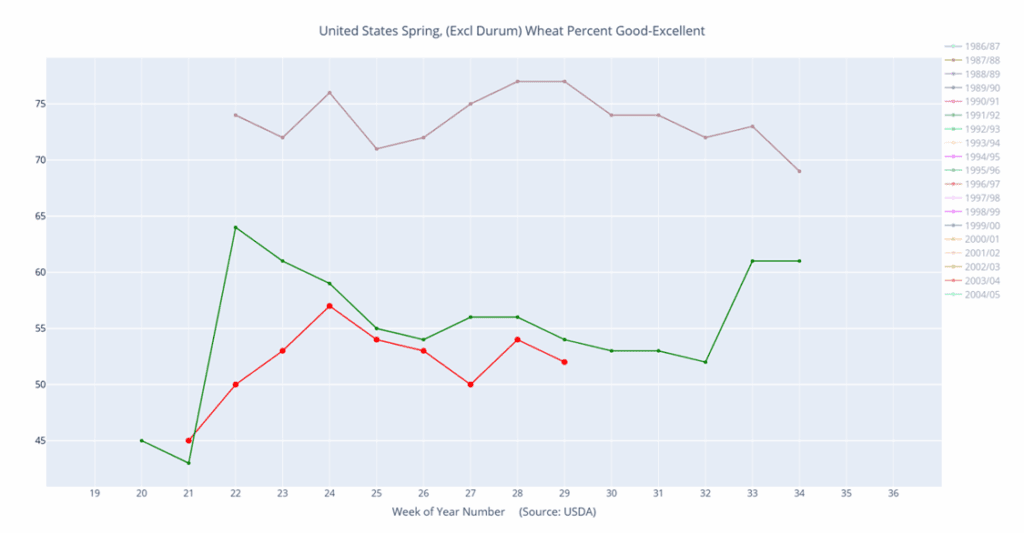

- Yesterday afternoon’s crop progress report indicated that the U.S. winter wheat harvest is 73% complete, compared to 75% last year and a five-year average of 72%. Furthermore, the spring wheat crop condition fell 2% from last week to 52% good to excellent; the wheat crop is 87% headed which is in line with last year an 1% behind average.

- Interfax has estimated Russian 25/26 grain exports will total between 53-55 mmt. Of that amount, wheat is expected to account for 43-44 mmt, which would be in line with last season. In addition, they left their grain harvest estimate unchanged at 135 mmt, with 88-90 mmt of that being wheat.

- Iraq is reported to have harvested 5.119 mmt of wheat this season. With reserves of about 1.5 mmt from last year, the total is closer to 6.5 mmt. Despite ongoing drought conditions, this marks the third consecutive year the government has not needed to import wheat for its subsidized food program. New irrigation projects have helped boost production, and authorities are reportedly working to build additional silos to increase reserves.

- According to CONAB, 91% of the projected wheat area has been planted in Brazil, which is in line with last year and the average. Region by region there is some variance, however, with 99% of Parana planted, but only 39% complete in Santa Catarina.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

Chicago wheat’s sharp mid-June rally proved short-lived, with futures retreating to the upper end of the 2025 range. Initial support lies at the 50-day moving average, with a break targeting the June low of 522.25. On the upside, a weekly close above 558 could open the door for a retest of the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 688 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 688 target has been lowered to 683.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Back Near Support

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

Winter wheat percent harvested (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Above Support

Spring wheat futures held above the upper end of their prior range for most of June, supported by a confluence of major moving averages. The June high near 665 is the next upside target. Key support lies at the 200-day moving average around 607, with a close below that level — and especially under the May low of 572.50 — likely opening the door to increased downside risk.

Spring wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Other Charts / Weather