7-21 End of Day: Grain Markets Retreat as Forecasts Turn Wetter

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 403.75 | -4.75 |

| DEC ’25 | 422.25 | -5.5 |

| DEC ’26 | 457.25 | -2.75 |

| Soybeans | ||

| AUG ’25 | 1015 | -12.75 |

| NOV ’25 | 1026 | -9.75 |

| NOV ’26 | 1061.5 | -6 |

| Chicago Wheat | ||

| SEP ’25 | 542.25 | -4 |

| DEC ’25 | 563.25 | -3.75 |

| JUL ’26 | 599.25 | -3.5 |

| K.C. Wheat | ||

| SEP ’25 | 525.75 | -3.25 |

| DEC ’25 | 548.25 | -3.25 |

| JUL ’26 | 593.25 | -3.5 |

| Mpls Wheat | ||

| SEP ’25 | 5.865 | -0.09 |

| DEC ’25 | 6.085 | -0.08 |

| SEP ’26 | 6.48 | -0.0775 |

| S&P 500 | ||

| SEP ’25 | 6368.25 | 33.5 |

| Crude Oil | ||

| SEP ’25 | 66 | -0.05 |

| Gold | ||

| OCT ’25 | 3434.5 | 48.8 |

Grain Market Highlights

- 🌽 Corn: Corn futures started the week lower as weekend rains and a moderating forecast prompted the removal of some weather premium priced in last week.

- 🌱 Soybeans: Soybeans ended the day lower on bear spreading, with front-month contracts leading losses. Weekend forecasts shifted wetter with slightly less heat, applying pressure across the grain complex.

- 🌾 Wheat: Wheat futures closed lower across all three U.S. classes, despite early strength. Losses followed weakness in corn, soybeans, and Paris (Matif) wheat. Weekend rains in the Northern Plains boosted spring wheat prospects, while uncertainty over potential August 1 tariffs contributed to long liquidation.

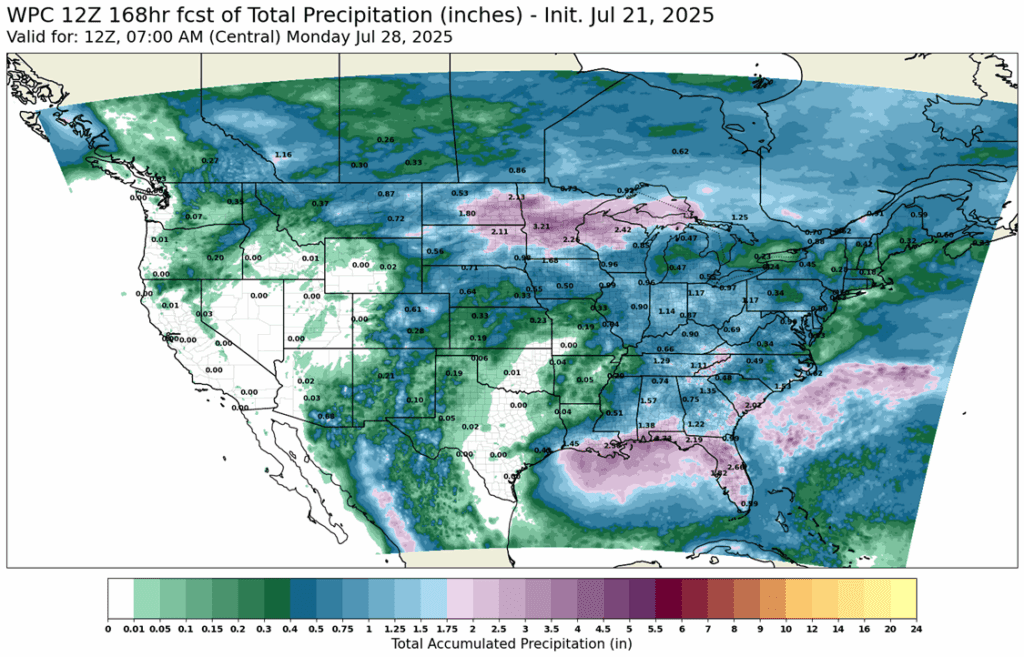

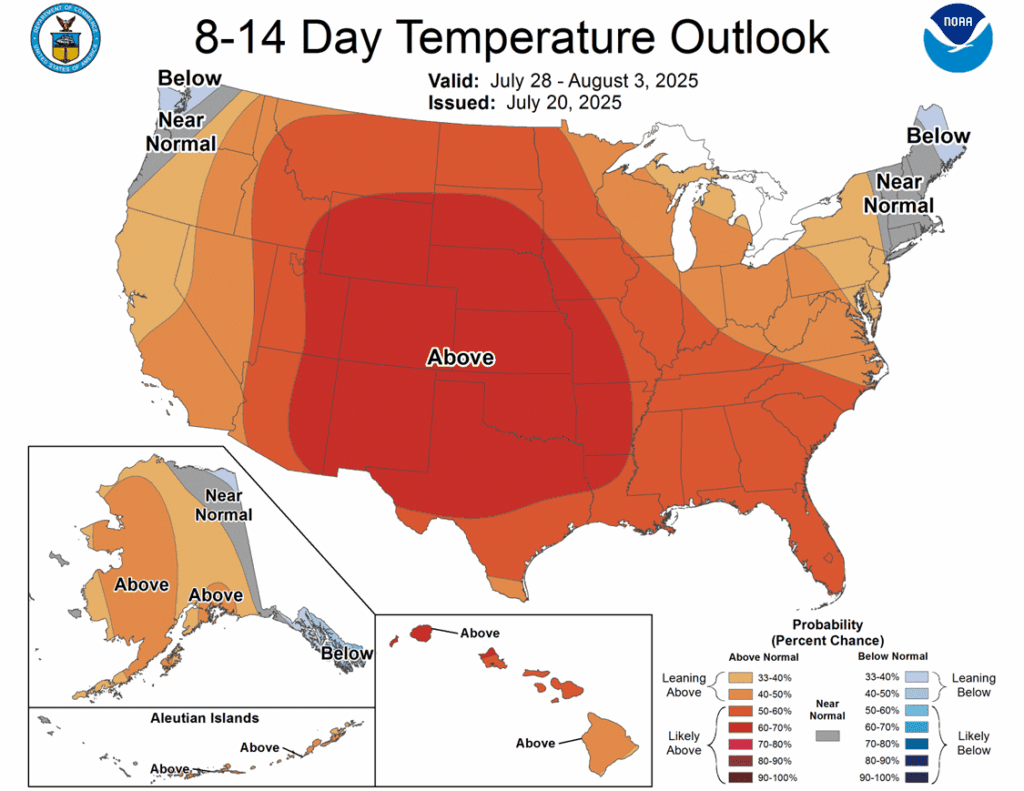

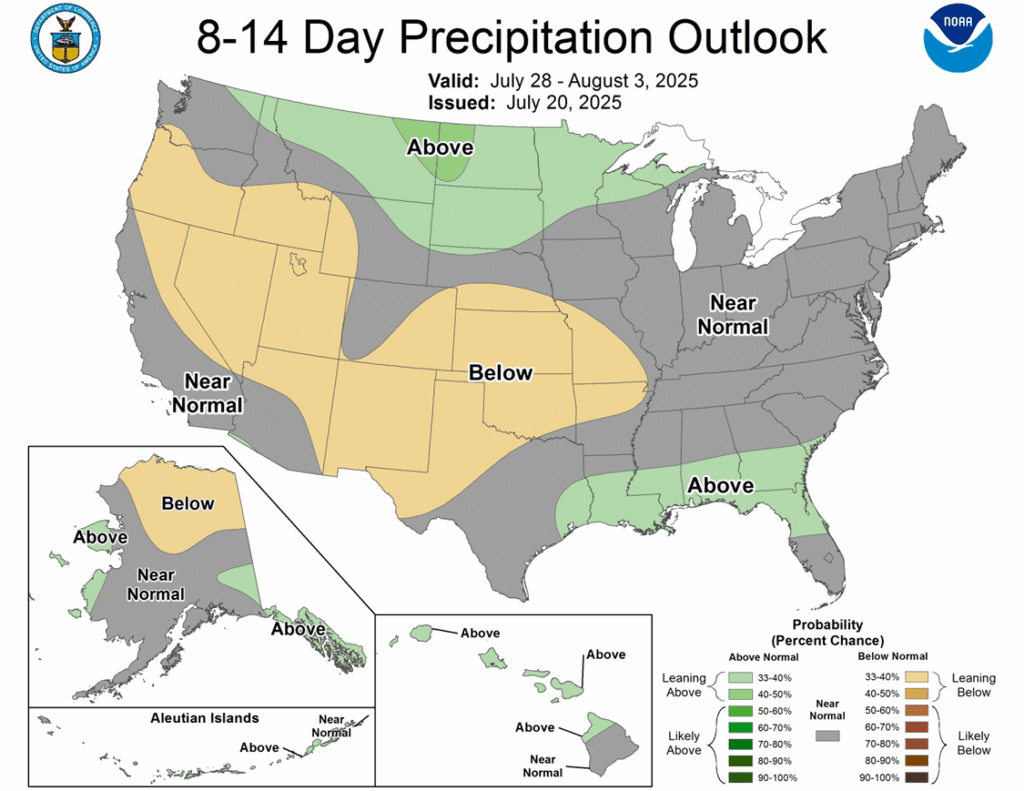

- To see updated U.S. weather forecast maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures started the week lower as weekend rains and a moderating forecast prompted the removal of some weather premium priced in last week. A poor export inspection report also added pressure, raising concerns about weakening demand.

- Weather forecasts eased to start the week, with expectations for less intense and shorter-duration heat. Improved rainfall projections for late July also weighed on futures, softening concerns about prolonged stress on the crop.

- Weekly corn export inspections came in below expectations, with U.S. exporters shipping just 984,000 metric tons (38.7 million bushels). While total exports remain 29% above last year, the weak showing followed an already disappointing sales report, fueling worries about demand erosion amid Brazil’s record harvest.

- Brazil analyst firm, Agrural raised their corn production output for the 2024-25 season to 136.3 MMT, up from 130.6 in their last projection. Favorable weather for the key second crop Brazil corn has supported this production raise.

- The U.S. dollar broke lower from recent consolidation, potentially signaling a return to a weaker trend. A softer dollar would generally provide support for U.S. corn and grain exports by improving global competitiveness.

Corn Futures Attempt Rebound with Bullish Reversal

Corn futures show signs of recovery mid-July, posting a bullish key reversal to start last week. An unfilled gap near 413 is the first upside target, followed by a gap at 430 if 420 is cleared. On the downside, support rests at last week’s low of 391.

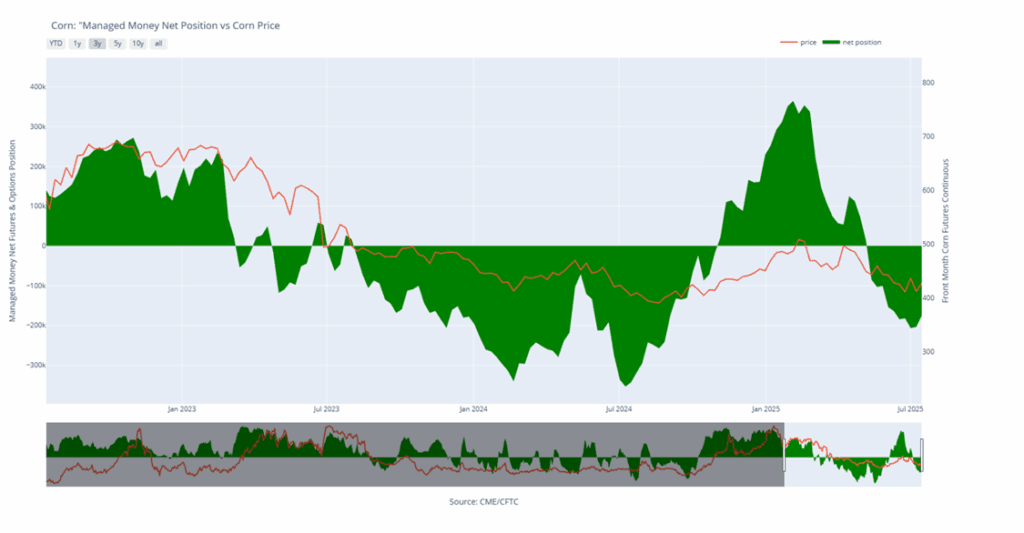

Above: Corn Managed Money Funds net position as of Tuesday, July 15. Net position in Green versus price in Red. Money Managers net bought 29,106 contracts between July 8 – July 15, bringing their total position to a net short 174,755 contracts.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

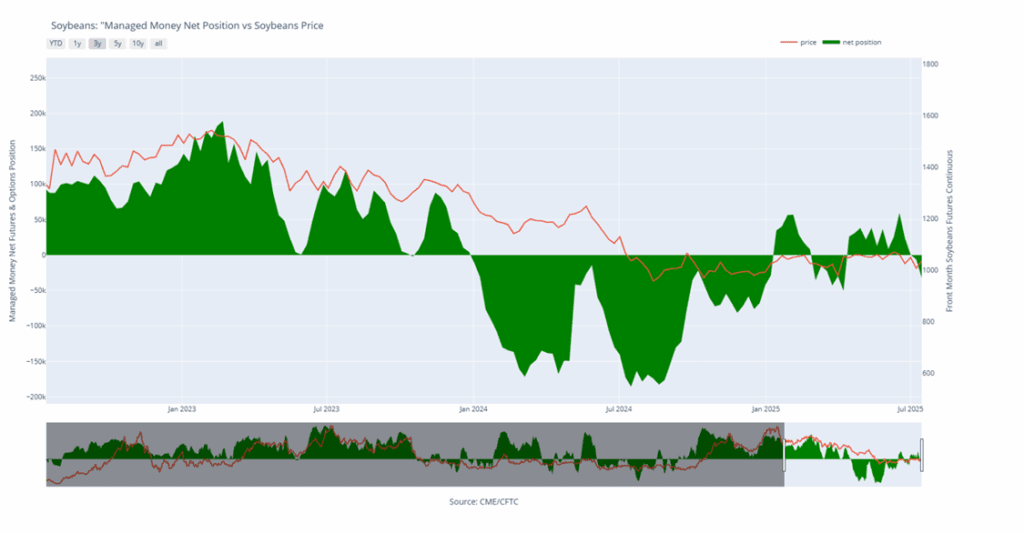

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower in bear spreading actions with the front months taking the brunt of losses. Forecasts over the weekend shifted to show more precipitation and a bit less heat from previous forecasts, which pressured the entire grain market today. Soybean meal was lower while soybean oil moved higher again.

- Today’s export inspections report was on the soft side for soybeans with inspections totaling 13.5 million bushels for the week ending July 17. This was within trade expectations and was above last weeks. Total inspections for 24/25 are up 10% from last year.

- In China, soybean imports from Brazil have reportedly risen by 9.2% from the previous year. This was driven by a strong Brazilian harvest along with the ongoing US trade war. Last month, China imported 86.6% of their total imports from Brazil alone.

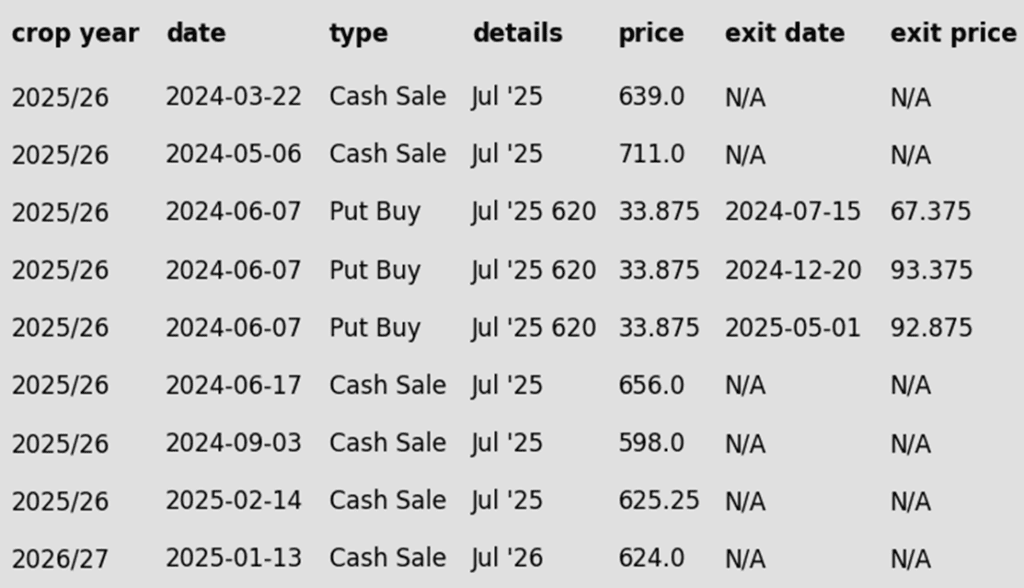

- Friday’s CFTC report saw funds as sellers of 26,062 contracts of soybeans which increased their net short position to 32,278 contracts. They bought 5,480 contracts of bean oil leaving them long 43,221 contracts and sold 1,537 contracts of meal leaving them short 133,016 contracts.

Soybeans Find Support Near $10

Soybeans failed to break above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. If soybeans can breach the 100-day moving average the next upside target would be the gap left over the 4th of July weekend near 1050. Support found last week near 1000 will be the first line of defense on a pullback with the April lows near 980 as stronger support.

Above: Soybean Managed Money Funds net position as of Tuesday, July 15. Net position in Green versus price in Red. Money Managers net sold 26,062 contracts between July 8 – July 15, bringing their total position to a net short 32,278 contracts.

Wheat

Market Notes: Wheat

- Wheat futures closed lower across all three U.S. classes, despite early strength. Losses followed weakness in corn, soybeans, and Paris (Matif) wheat. Weekend rains in the Northern Plains boosted spring wheat prospects, while uncertainty over potential August 1 tariffs likely contributed to long liquidation ahead of the U.S. Wheat Quality Council’s spring wheat tour.

- Weekly wheat export inspections totaled 26.9 million bushels, bringing the 2025/26 total to 111 million bushels—14% ahead of last year. Inspections are currently running above the USDA’s pace for projected exports of 850 million bushels, which would be a 3% increase year over year.

- Bangladesh signed a five-year trade agreement to purchase 700,000 metric tons of U.S. wheat annually—a bullish development, as the country traditionally relies on Black Sea suppliers and buys far less from the U.S.

- The weather outlook for the month of August in South America calls for widespread warmth, which should alleviate freeze concerns. Additionally, dryness in Argentina should allow for the end of wheat planting to go smoothly.

- Over the weekend the Canadian prairies saw scattered showers. Heavier totals were present in Saskatchewan and Alberta, with lighter amounts in Manitoba (where it has been drier). Additionally, more rain is expected through next week. In general, this moisture should benefit their spring wheat crop.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

Chicago wheat’s sharp mid-June rally proved short-lived, with futures retreating to the upper end of the 2025 range. Initial support lies at the 50-day moving average, with a break targeting the June low of 522.25. On the upside, a weekly close above 558 could open the door for a retest of the recent highs near 590.

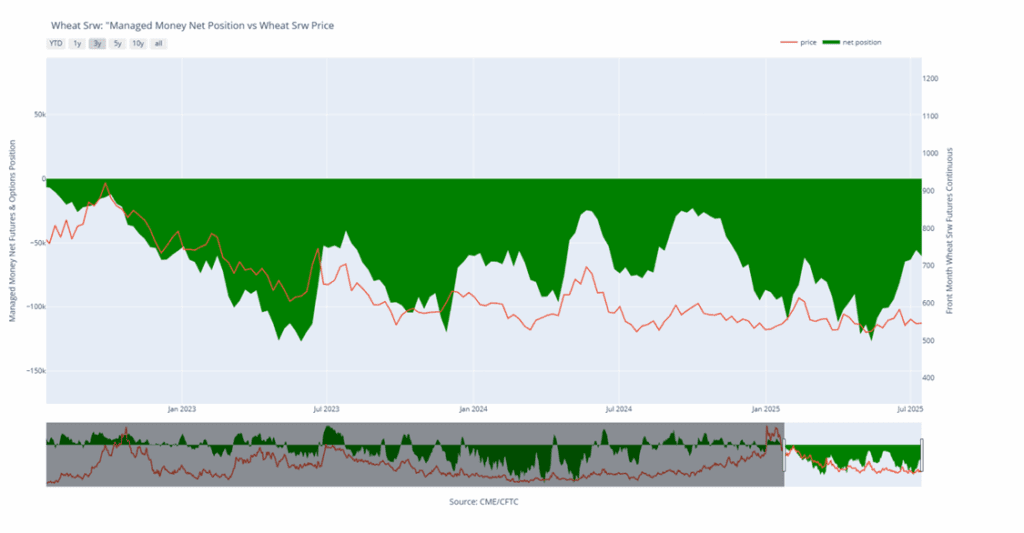

Above: Chicago Wheat Managed Money Funds’ net position as of Tuesday, July15. Net position in Green versus price in Red. Money Managers net sold 4,893 contracts between July 8 – July 15, bringing their total position to a net short 60,487 contracts.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 688 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 688 target has been lowered to 683.

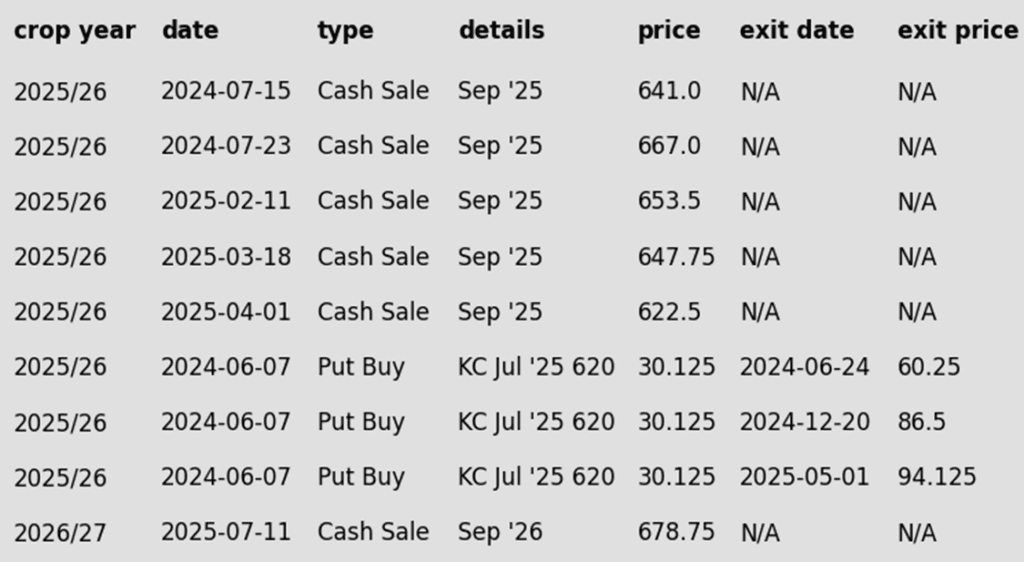

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Back Near Support

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

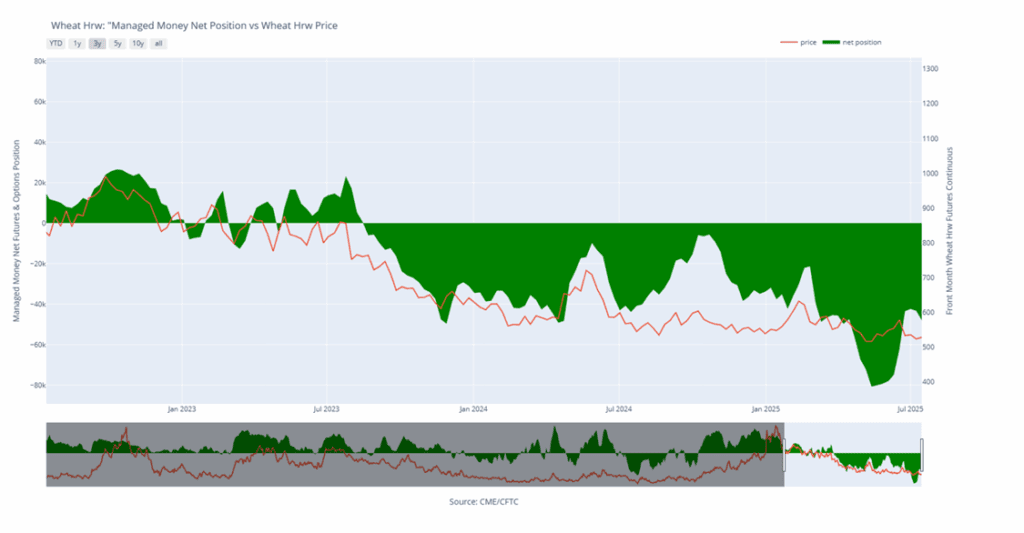

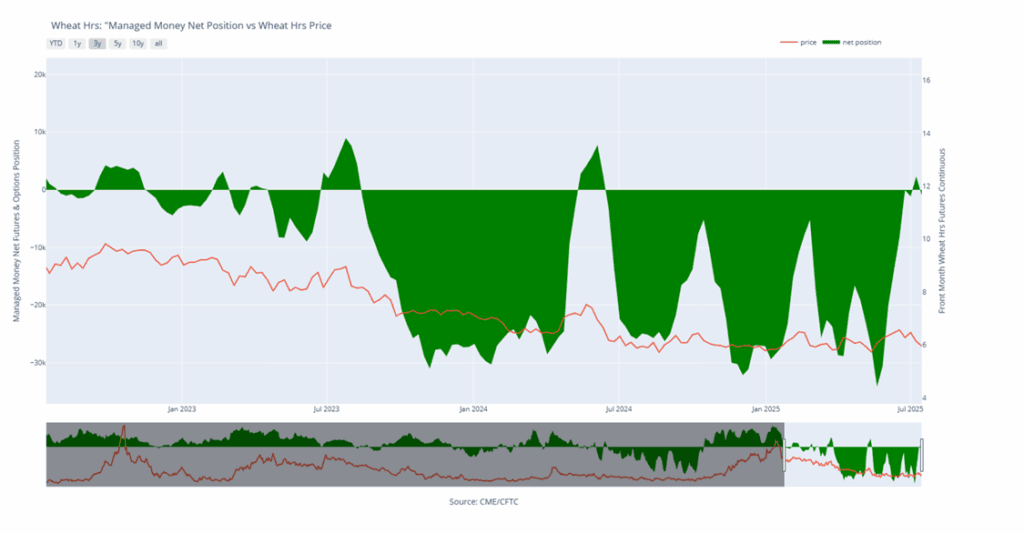

Above: KC Wheat Managed Money Funds’ net position as of Tuesday, July 15. Net position in Green versus price in Red. Money Managers net sold 4,683 contracts between July 8 – July 15, bringing their total position to a net short 48,002 contracts.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Above Support

Spring wheat futures held above the upper end of their prior range for most of June, supported by a confluence of major moving averages. The June high near 665 is the next upside target. Key support lies at the 200-day moving average around 607, with a close below that level — and especially under the May low of 572.50 — likely opening the door to increased downside risk.

Above: Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, July 15. Net position in Green versus price in Red. Money Managers net sold 3,284 contracts between July 8 – July 15, bringing their total position to a net short 997 contracts.

Other Charts / Weather