7-18 End of Day: Grains End Week Strong

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 408.5 | 6.5 |

| DEC ’25 | 427.75 | 6.75 |

| DEC ’26 | 460 | 3.75 |

| Soybeans | ||

| AUG ’25 | 1027.75 | 6.25 |

| NOV ’25 | 1035.75 | 9.25 |

| NOV ’26 | 1067.5 | 6.25 |

| Chicago Wheat | ||

| SEP ’25 | 546.25 | 12.75 |

| DEC ’25 | 567 | 12.75 |

| JUL ’26 | 602.75 | 12 |

| K.C. Wheat | ||

| SEP ’25 | 529 | 11.5 |

| DEC ’25 | 551.5 | 11.5 |

| JUL ’26 | 596.75 | 11.25 |

| Mpls Wheat | ||

| SEP ’25 | 5.955 | 0.005 |

| DEC ’25 | 6.165 | 0.0075 |

| SEP ’26 | 6.5575 | 0.0275 |

| S&P 500 | ||

| SEP ’25 | 6330 | -10.5 |

| Crude Oil | ||

| SEP ’25 | 66.12 | -0.11 |

| Gold | ||

| OCT ’25 | 3385.8 | 12.7 |

Grain Market Highlights

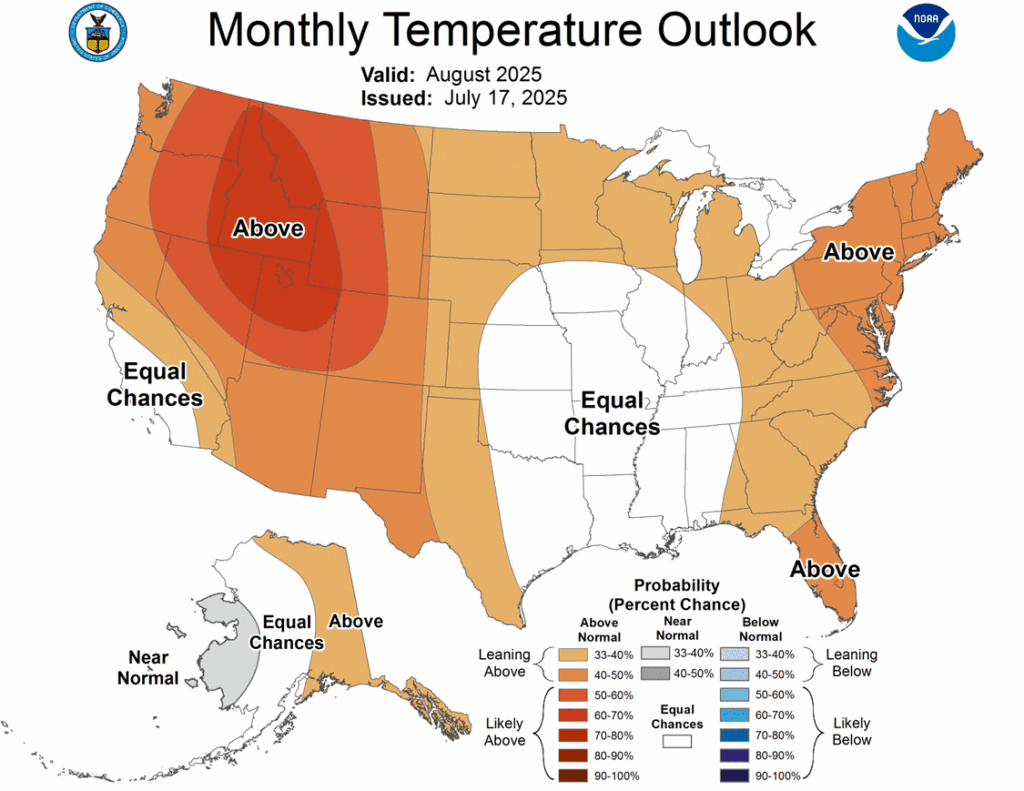

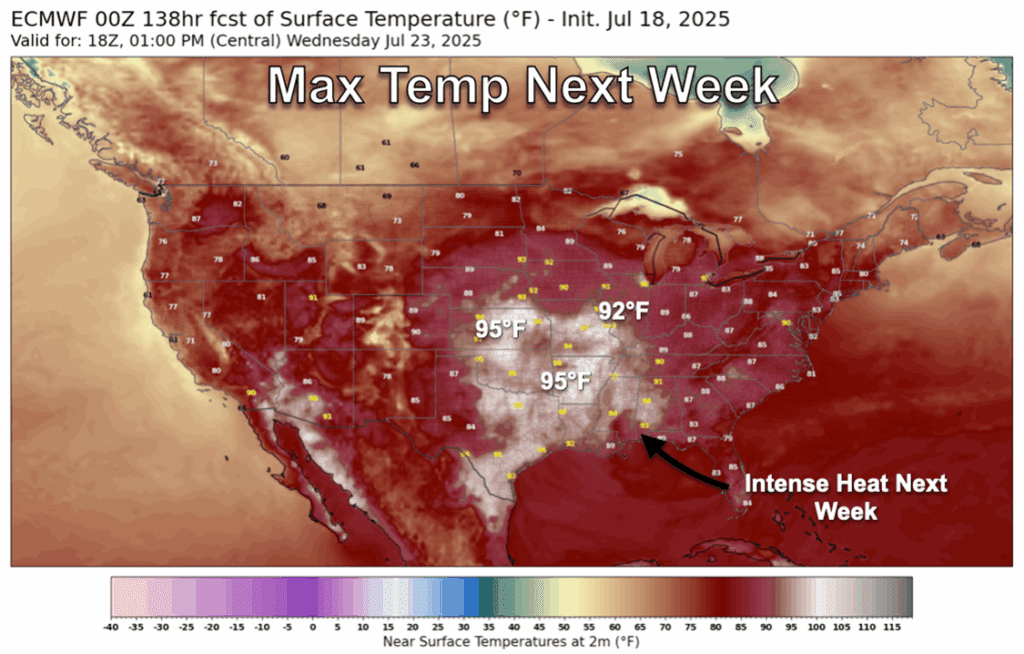

- 🌽 Corn: Corn futures ended the week on a strong note, with buyers returning amid short covering and technical buying. Support was triggered by forecasts calling for hotter weather ahead. For the week, December corn futures gained 15 ½ cents.

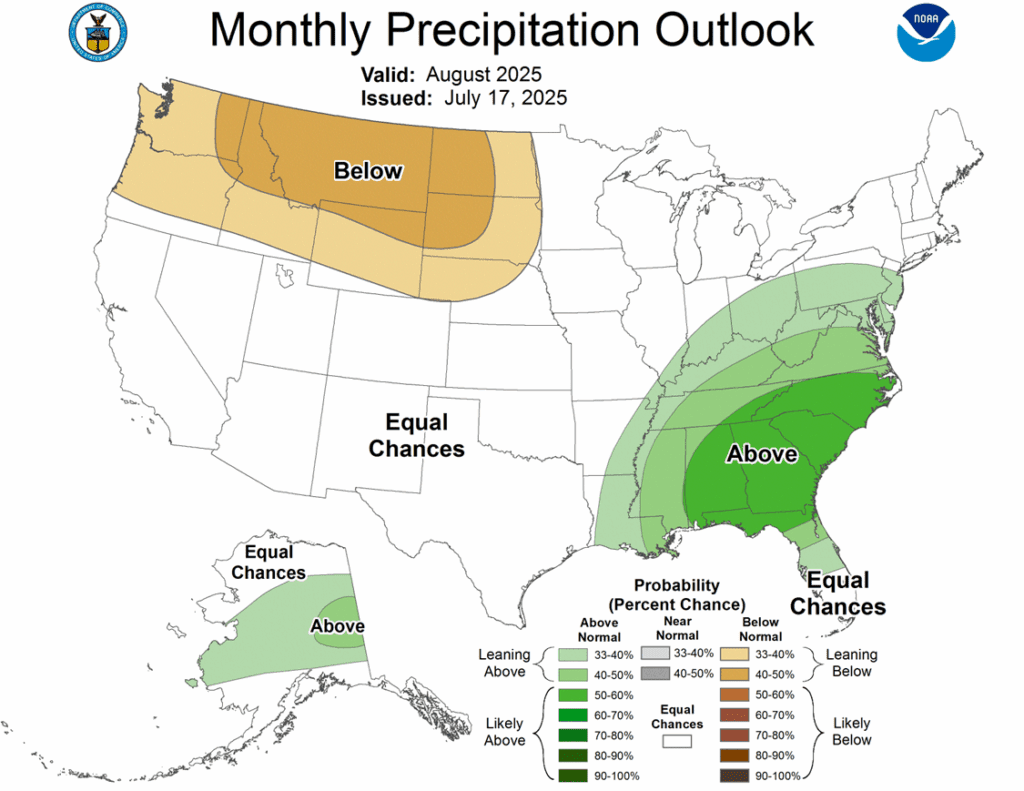

- 🌱 Soybeans: Soybeans ended higher as forecasts turned hotter and drier for the 6- to 10-day period. A weaker U.S. dollar added support across the grain complex, but weather will remain the key driver if the pattern persists into August.

- 🌾 Wheat: Wheat futures led the grain complex higher Friday, posting double-digit gains for both Chicago and Kansas City contracts. The rally was likely technical, following support established earlier this week.

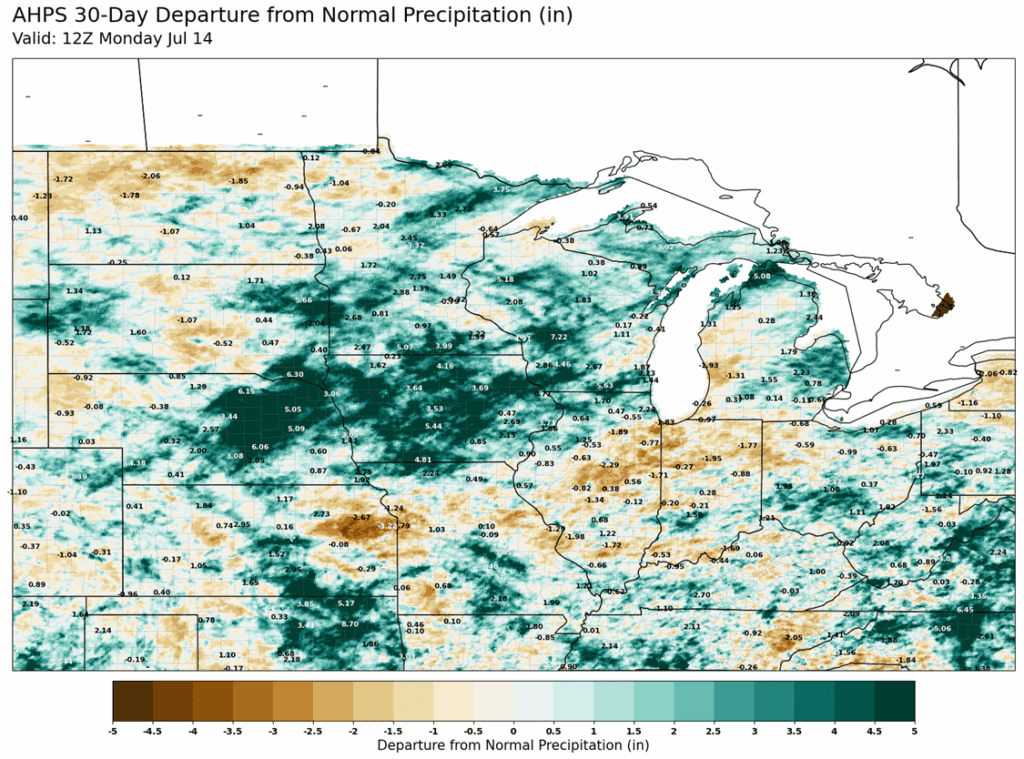

- To see updated U.S. weather forecast maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Buyers returned to the corn market to end the week. Additional short covering and technical buying was noticed in the grain markets as the prospect of a hotter weather forecast triggered some premium in the corn market. For the week, December corn futures gained 15 ½ cents.

- The 7-day outlook for the Corn Belt remains warm and wet. Forecast maps show much of the region could receive up to 140% of normal rainfall, which may prove critical if drier weather materializes as projected heading into August.

- Technical buying added support as corn futures pushed through key moving averages. However, the $4.30 level held as resistance, marking a critical threshold for the market heading into next week.

- Brazil’s corn harvest is accelerating amid drier weather, boosting availability. With Brazilian farmers managing record-large soybean and corn crops, the increase in global supplies may limit upside potential for U.S. corn prices.

- Argentina is in the final stages of this year’s corn harvest. As of Wednesday, corn harvest was 73% complete, down from last year’s 80% level due to wet weather. The Argentina corn crop is projected near 49 MMT.

Corn Futures Attempt Rebound with Bullish Reversal

Corn futures show signs of recovery mid-July, posting a bullish key reversal to start the week. An unfilled gap near 413 is the first upside target, followed by a gap at 430 if 420 is cleared. On the downside, support rests at this week’s low of 391.

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

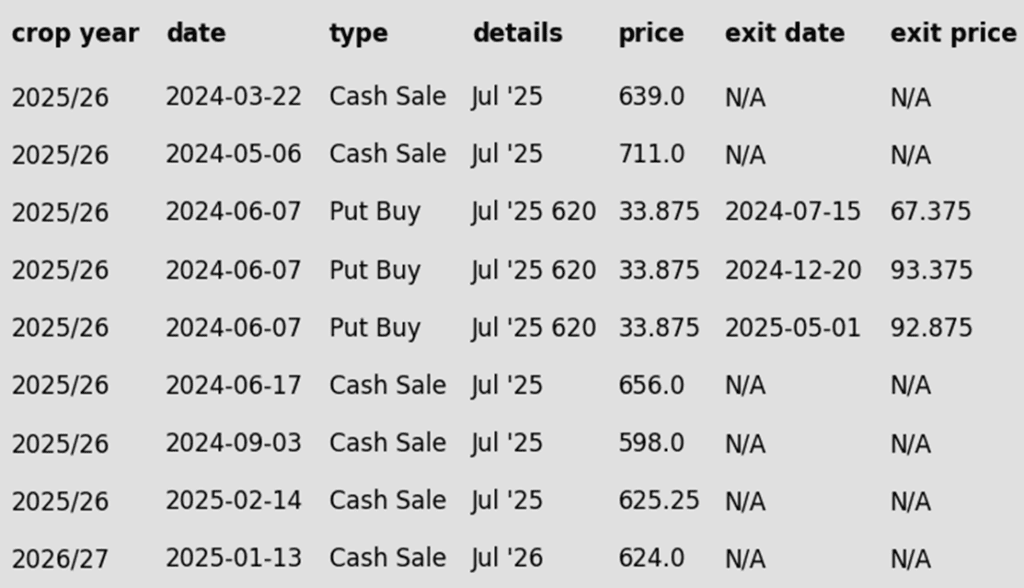

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended higher as forecasts turned hotter and drier for the 6- to 10-day period. A weaker U.S. dollar added support across the grain complex, but weather will remain the key driver if the pattern persists into August. Soybean meal finished higher, while bean oil slipped.

- November soybean futures broke through all three major moving averages on Friday. Despite late-session weakness, the contract closed above the 50-day moving average at $10.34 ½ — the first such close since July 3, signaling near-term technical strength.

- Soybeans drew support this week from surging soybean oil prices, which hit new highs Thursday. However, with no progress on a U.S.-China trade deal, futures remain rangebound. China typically ramps up U.S. purchases in August, but a potential Trump-Xi meeting still appears weeks away.

- For the week, August soybeans gained 23-1/2 cents at $10.27-3/4 while November gained 28-1/2 cents to $10.35-3/4. August soybean meal gained $3.70 to finish at $274 and August soybean oil gained 2.07 cents to close the week at 55.82 cents.

Soybeans Find Support Near $10

Soybeans failed to break above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. If soybeans can breach the 100-day moving average the next upside target would be the gap left over the 4th of July weekend near 1050. Support found this week near 1000 will be the first line of defense on a pullback with the April lows near 980 as stronger support.

Wheat

Market Notes: Wheat

- Wheat futures led the grain complex higher, posting double-digit gains for both Chicago and Kansas City contracts. Early strength was likely sparked by news of new EU sanctions against Russia. Although these measures target the energy sector, some support spilled over into the grain markets.

- September Paris milling wheat futures broke through and closed above the 50-day moving average resistance today, offering a boost to the U.S. market.

- According to Chinese customs data, their June wheat and wheat flour imports totaled just 350,000 mt, down 70.6% year over year for that month. The year-to-date figure at 1.96 mmt is down 78.9% year over year.

- In an update from the Buenos Aires Grain Exchange, Argentine wheat planting was reported at 92.8% complete, up from 91% last week. An estimated 6.7 million hectares will be planted in total, up from 6.3 million last year.

- France’s wheat harvest has advanced to 71% complete as of July 14, according to FranceAgriMer. This is up sharply from the 36% that was collected as the week before, and only 12% at this time a year ago.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

Chicago wheat’s sharp mid-June rally proved short-lived, with futures retreating to the upper end of the 2025 range. Initial support lies at the 50-day moving average, with a break targeting the June low of 522.25. On the upside, a weekly close above 558 could open the door for a retest of the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 688 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- The 688 target has been lowered to 683.

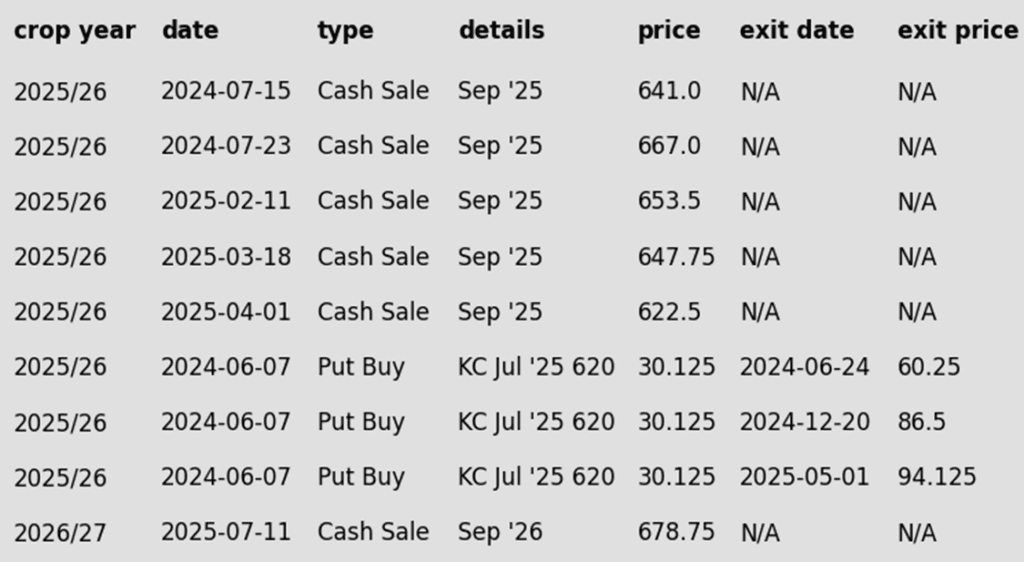

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Back Near Support

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- FYI – KC options are used for better liquidity.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Above Support

Spring wheat futures held above the upper end of their prior range for most of June, supported by a confluence of major moving averages. The June high near 665 is the next upside target. Key support lies at the 200-day moving average around 607, with a close below that level — and especially under the May low of 572.50 — likely opening the door to increased downside risk.

Other Charts / Weather

Above: From ag-wx.com