7-17 End of Day: Wheat Leads Corn Higher; Soybeans Close Mixed

All prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’24 | 398 | 2.25 |

| DEC ’24 | 411.75 | 3 |

| DEC ’25 | 453.75 | 2.75 |

| Soybeans | ||

| AUG ’24 | 1097.25 | 6.75 |

| NOV ’24 | 1041 | -2.25 |

| NOV ’25 | 1065 | -4.5 |

| Chicago Wheat | ||

| SEP ’24 | 539.25 | 8.5 |

| DEC ’24 | 563.5 | 8 |

| JUL ’25 | 601 | 5.5 |

| K.C. Wheat | ||

| SEP ’24 | 561 | 10.75 |

| DEC ’24 | 577.5 | 10.5 |

| JUL ’25 | 597.75 | 7.5 |

| Mpls Wheat | ||

| SEP ’24 | 591.75 | 16 |

| DEC ’24 | 611.5 | 14.25 |

| SEP ’25 | 645.75 | 10 |

| S&P 500 | ||

| SEP ’24 | 5649.5 | -67.75 |

| Crude Oil | ||

| SEP ’24 | 81.46 | 1.75 |

| Gold | ||

| OCT ’24 | 2485 | -7 |

Grain Market Highlights

- Carryover strength from the wheat market, and solid ethanol production numbers, lent support to the corn market as prices continue to consolidate around the 410 area in the December contract.

- Soybean futures closed mixed, with spot month August maintaining strength from canceled deliverable receipts and a strong cash market. Deferred contracts fell on prospects of healthy supplies ahead, while sharply lower soybean oil limited the rally potential. Meanwhile, meal rallied off its lows to close moderately higher.

- A sharp drop in the US dollar triggered buying in all three wheat classes, as they closed higher across the board in an attempt to correct from oversold conditions. Minneapolis contracts showed the most strength, followed by KC.

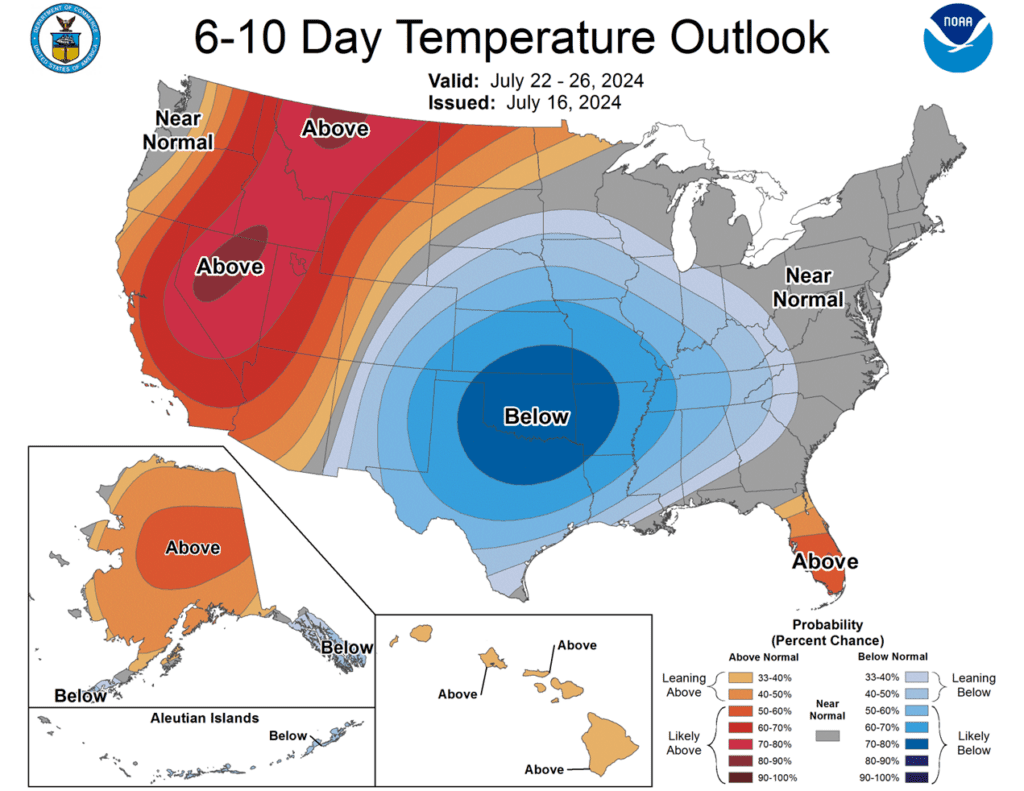

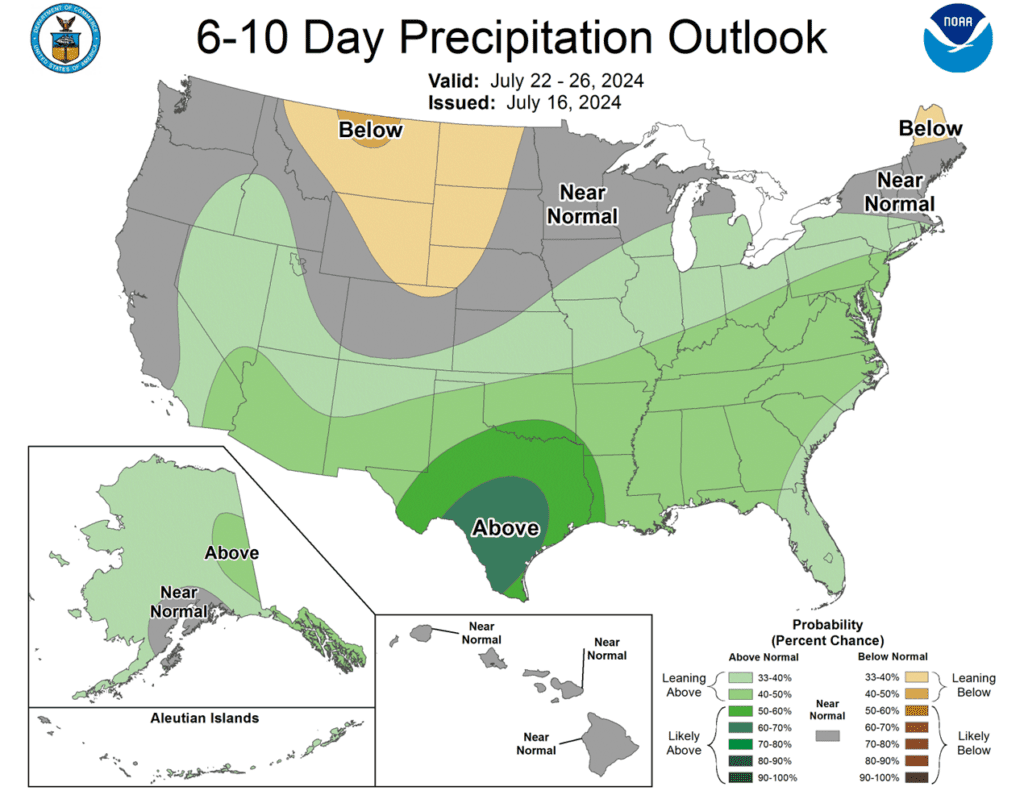

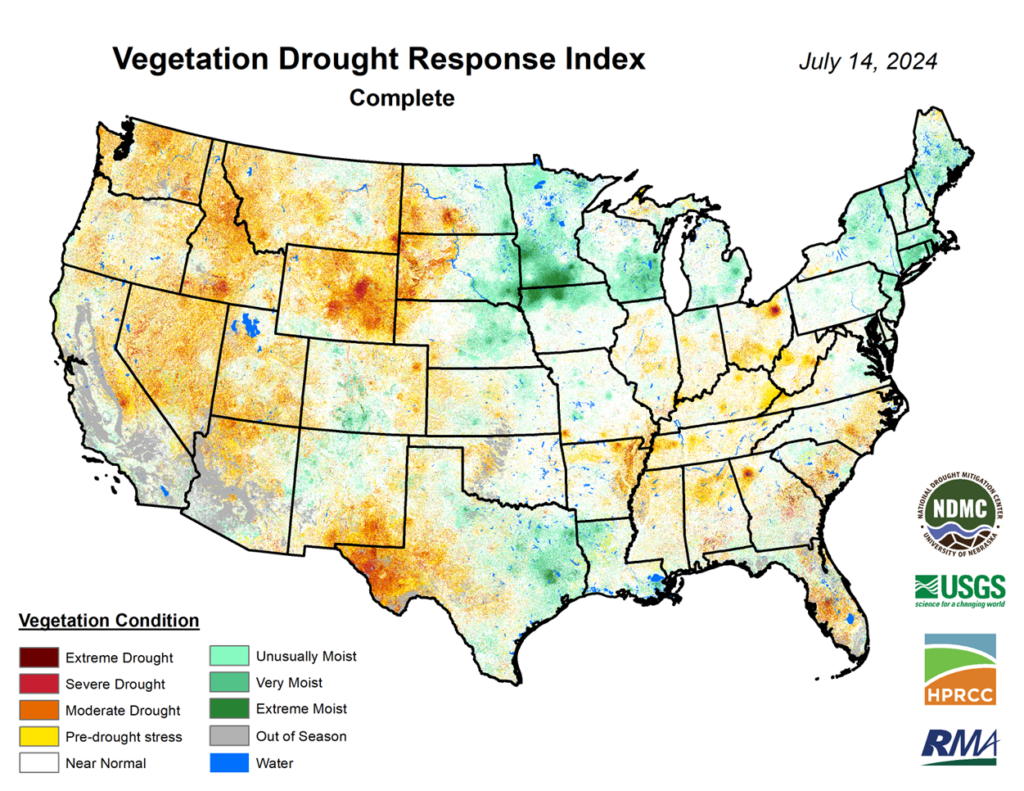

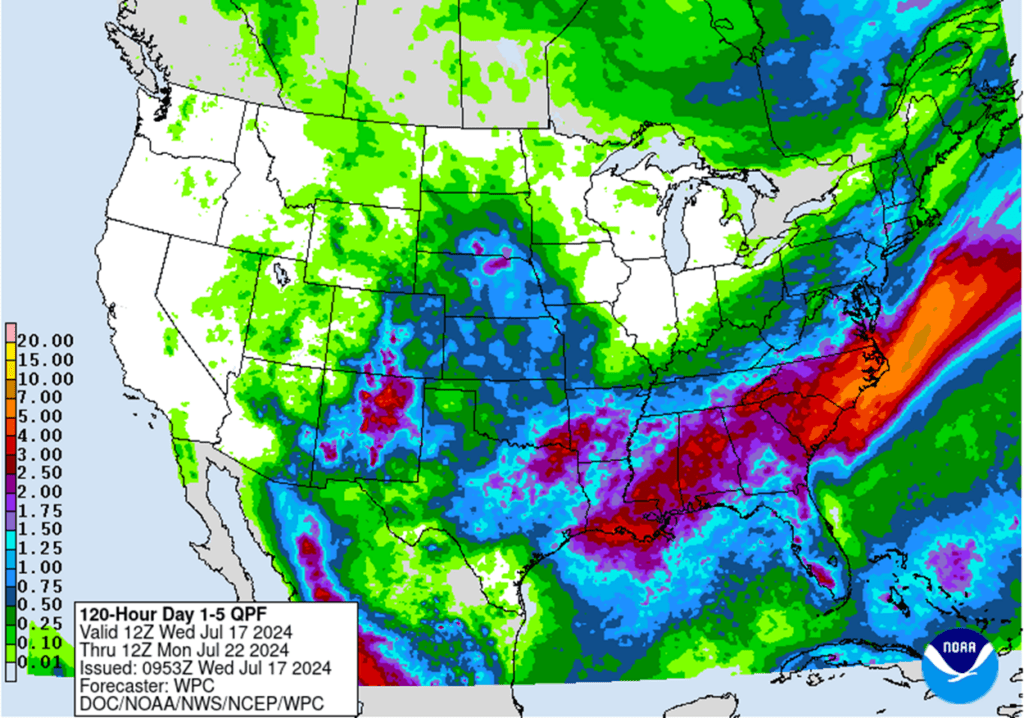

- To see the updated US 5-day precipitation forecast, 6-10 day Temperature and Precipitation Outlooks, and the Vegetation Drought Response Index, courtesy of NOAA, the Weather Prediction Center, and NDMC, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Corn Action Plan Summary

The USDA’s July WASDE report surprised the market by lowering 23/24 corn ending stocks below the low end of expectations resulting in a much lower than expected 24/25 ending stocks projection of 2.097 billion bushels. While this leaves new crop supplies at “adequate” levels, any increase in demand or drop in production could lead to short covering by the funds and higher prices.

- No new action is recommended for 2023 corn. Any remaining old crop 2023 corn should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 corn – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

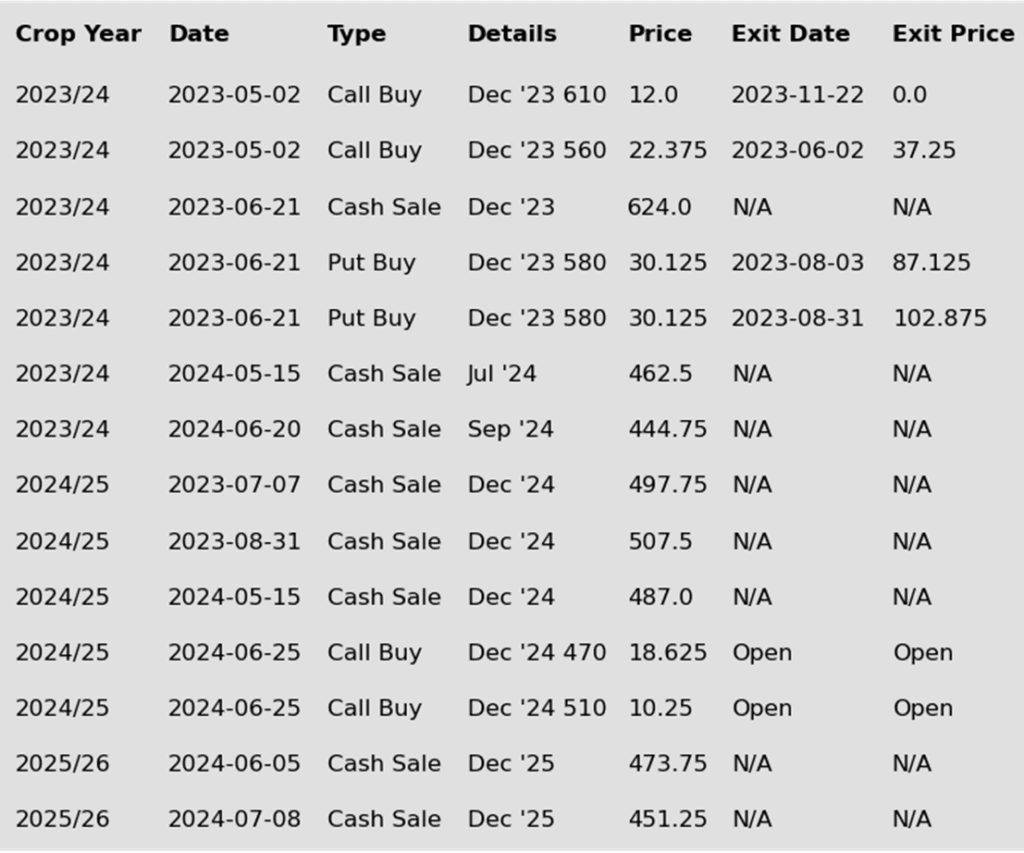

- No new action is recommended for 2024 corn. We recently recommended buying Dec ’24 470 and 510 calls after Dec ’24 closed below 451, for their relative value and because we are at that time of year of high volatility when markets can move swiftly. Moving forward, our current strategy is to target the value of 29 cents to exit the Dec ’24 470 calls. Exiting the 470 calls at 29 cents will allow you to lock in gains in case prices fall back and hold the remaining 510 calls at or near a net neutral cost, which should continue to protect existing sales and give you confidence to make further sales if the market rallies sharply. To take further action, we are targeting the 490 – 510 area to recommend making additional sales versus Dec ’24.

- No new action is currently recommended for 2025 corn. Considering we are at the time of year to get early sales made for next year’s crop, we recently issued our first sales recommendation for the 2025 corn crop. Given that the growing season has potential for high volatility and can provide some of the best pricing opportunities for the next crop year, we will also be watching the calendar along with price action. If our current Plan A upside objective in the 490 – 510 range isn’t met by our Plan B sales deadline of July 23, we will likely make another sales recommendation at that time.

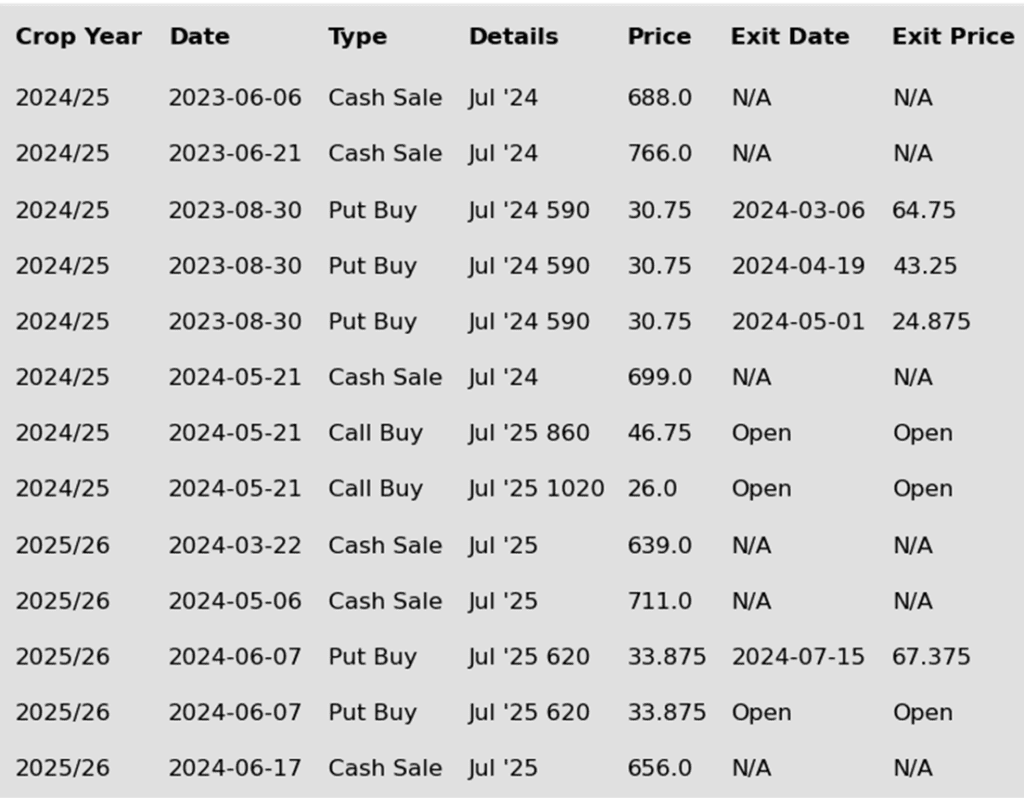

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Spillover strength in the wheat market helped support December corn futures prices around the 410 area. The market has been consolidating in this area for the past 7 sessions as the market has moved into a sideways pattern, with corn prices looking for a signal for the next price move.

- With improved margins, weekly ethanol production trended higher last week. Average production last week was 1.106 million barrels/day. This was up 4.9% from last week and up 3.4% from last year and set a new daily high for ethanol production for this week of the calendar year. The amount of corn used for the week is estimated at 109.78 million bushels, which is slightly below the pace to reach the new USDA ethanol usage targets for the marketing year.

- The USDA will release the weekly export sales report on Thursday morning. Expectations are for new sales to range from 500,000 – 800,000 mt for the old crop and up to 400,000 mt for the new crop. With just over a month left in the marketing year, the market will be starting to focus more on new crop sales, which have been lackluster.

- Weather concerns other than extremes are likely past the point of impacting the corn crop nationally. Going into the end of the month, the forecast remains very favorable for corn production.

Above: The negative market action on July 15 puts the bullish reversal from report day July 12 in question. If support in the area of 391 holds and prices reverse back higher, they could run toward 425 – 430, though they may encounter initial resistance around 410 – 415. On the downside, a break below 391 could suggest a further decline towards the 362 – 360 area.

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

Active

Sell AUG ’24 Cash

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Soybeans Action Plan Summary

Weighed down by sluggish export demand and favorable weather, the soybean market experienced a choppy downward trajectory leading up to the USDA’s July WASDE report. While the USDA lowered old crop ending stocks more than expected, resulting in a larger-than-anticipated drop in new crop carryout projections, the 435 mb projected carryout remains a bearish factor given the current demand picture. With much of the growing season still ahead, the lower anticipated supply leaves less margin for error if growing conditions turn hot and dry. For now, a weather-related issue or a surge in demand appears to be the most likely catalyst to push prices higher.

- Grain Market Insider sees a continued opportunity to sell a portion of your 2023 soybean crop. With no bullish surprises in last week’s WASDE report, and since the market has not provided an opportunity to make a sale at our Plan A target, we are employing our Plan B time stop strategy, considering that we try not to carry old crop bushels past mid-July due to seasonal weakness. Therefore, we are making what will be our last sales recommendation for the 2023 soybean crop at this time.

- No new action is recommended for the 2024 crop. At the end of December, we recommended buying Nov ’24 1280 and 1360 calls due to the amount of uncertainty in the 2024 soybean crop and to give you confidence to make sales and protect those sales in an extended rally. Given that the market has retreated since that time, we are targeting the upper 1100s versus Nov ’24 futures to exit 1/3 of the 1280 calls to help preserve equity. Most recently we employed our Plan B strategy with the close below 1180 in Nov ’24 and recommended making additional sales due to the potential change in trend. With much of the growing season still ahead of us, should the market turn back higher, we are targeting the low 1200s from our Plan A strategy to potentially make two additional sales recommendations.

- No Action is currently recommended for 2025 Soybeans. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- The soybean market closed the session in mixed fashion with the August and September contracts settling higher on the day, with the deferred contracts lower. August beans gained support as CBOT deliverable receipts showed net cancellations for all three legs of the complex, indicating firm demand in the cash market.

- Just before the morning break, August beans rallied to close the gap left behind from Sunday evening’s lower opening from Friday’s close. Once filled, August soybeans retreated in choppy trade as new crop contracts led the way lower, with weakness coming from sharply lower soybean oil. Soybean meal, on the other hand, rebounded and settled in the green near the day’s highs.

- It’s been reported that China bought upwards of 4.5 million metric tons of Brazilian soybeans, primarily for August delivery, since the beginning of July, taking advantage of the recent drop in prices and the recent drop in the Brazilian real, which makes Brazil’s soybeans more competitive on the export market compared to US offers.

- The recent buying activity by China from Brazil highlights the thin book of sales that the US currently has for the new crop. More recently, there have been rumors that China may have bought 6 or 7 cargoes of US beans off the PNW for late summer delivery since the Brazilian real has rebounded and stabilized, allowing US offers to be more competitive.

Above: The large gap on the continuous chart represents the roll from the August soybean contract to the September, where the 50 cent premium in the August contract relative to the September contract is no longer represented. That said, support for the September contract may come in near the 1000 psychological level with further support around 985. Overhead, a turnaround toward higher prices may encounter resistance between 1065 – 1075.

Wheat

Market Notes: Wheat

- Though closing below session highs, wheat was the upside leader today in the grain complex. The US Dollar Index offered support as it dropped sharply today, hitting the lowest level since late March. This may be tied to the belief that the Federal Reserve will issue a rate cut in September. Additionally, US wheat futures are very oversold and could be due for more of an upside correction.

- The chart gap above the market has yet to be filled for Paris milling wheat futures, despite a higher close for those contracts today. Along with being technically oversold, this may lend credence to the idea that wheat has some potential to rally, as gaps tend to be filled over time.

- Russia supplied the majority of the wheat in Egypt’s largest tender in two years. Of the 770,000 mt total, Russia fulfilled 720,000, while Bulgaria got the rest of the business for 50,000 mt. Russia continues to dominate the export market despite some of the issues their crop faced. Currently, their spring wheat crop may be impacted by heat and dryness.

- According to their agriculture ministry, the export duty on Russian wheat increased 4.7% from 1,701.3 to 1,780.5 Rubles per mt as of July 17. These duties are said to be valid until July 23, and only apply to wheat; duties on barley and corn will remain at zero.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Exit Half JUL ’25 620 Puts ~ 67c

2026

No New Action

Chicago Wheat Action Plan Summary

Since rallying nearly 200 cents from the March low to the May high, largely on fund short covering from Russian crop concerns and dryness in the southwestern Plains, prices have fallen from their peak with seasonal weakness and a quick harvest pace. Although prices remain weak, the market shows signs of being oversold, which can be supportive in the event prices turn back higher, while the breakout above the December highs suggests there is potential for a test of the 2023 summer highs post-harvest.

- No new action is recommended for 2024 Chicago wheat. Considering the recent rally in wheat, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 740 – 760 versus Sept ’24 to recommend further sales and to target a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- Grain Market Insider sees a continued opportunity to sell half of your July ‘25 620 Chicago Wheat puts at approximately 67 cents in premium minus fees and commission. Last month Grain Market Insider recommended buying July ’25 620 Chicago wheat puts for approximately 34 cents in premium plus commission and fees to protect the downside from further potential price erosion. At the time, July Chicago wheat had just broken through support near 706. The breaking of 706 support increased the risk of the market retreating further. Since that time July ’25 Chicago wheat has dropped over 100 cents, with the July ’25 620 Chicago wheat puts having roughly doubled in value. Though prices are depressed following this market drop, plenty of time remains to market the ’25 crop, and plenty of unknowns remain that could rally prices. Grain Market Insider recommends selling half of the previously recommended July ’25 620 Chicago wheat puts to lock in gains in case prices rally back and holding the remaining puts at a net neutral cost, which will continue to protect any unsold bushels if prices erode further.

- No action is currently recommended for 2026 Chicago Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The recent break through 556 support suggests that the market could trend lower. Below the market, prices may find initial support around 520, with further support down between 490 and 470, with psychological support coming in near 500. If initial support around holds, upside resistance could be found between 555 and 580, with additional resistance between 590 and 600.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

KC Wheat Action Plan Summary

Since the end of May the wheat market has been trending lower as concerns regarding Russia’s shrinking wheat crop have waned, and US HRW harvest yields have been higher than expected. During this time managed funds started reestablishing their short positions while the market continues to show signs of being oversold. While harvest pressure and falling Black Sea export prices continue to weigh on US prices, the funds’ short position and oversold conditions could culminate in a short covering rally on any increase in demand as world wheat ending stocks are expected to fall yet again this year.

- No new action is recommended for 2024 KC wheat. Considering the recent upside breakout in KC wheat, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 725 – 750 versus Sept ’24 to recommend further sales and to target a selling price of about 71 cents on the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 KC Wheat. We recently recommended exiting half of the previously recommended July ’25 620 puts once they reached 60 cents (double the original approximate cost) to realize gains in case the market rallies back, while still holding the remaining 620 puts at, or near, a net neutral cost for continued downside coverage on any unsold bushels. Looking ahead, our strategy is to target the 680 – 710 range to recommend making additional sales.

- No action is currently recommended for 2026 KC Wheat. We currently aren’t considering any recommendations at this time for the 2026 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

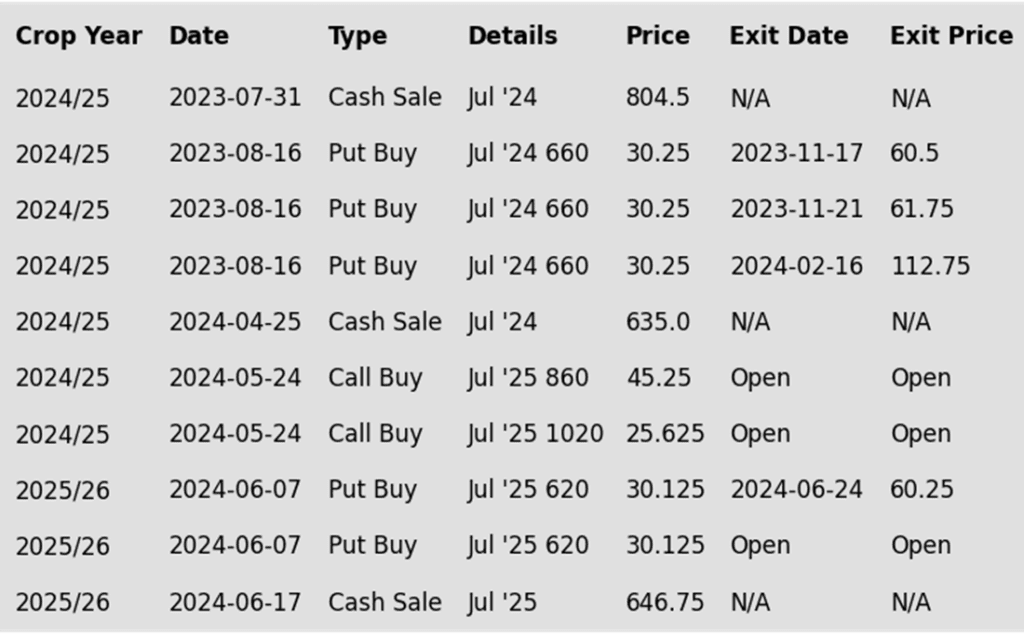

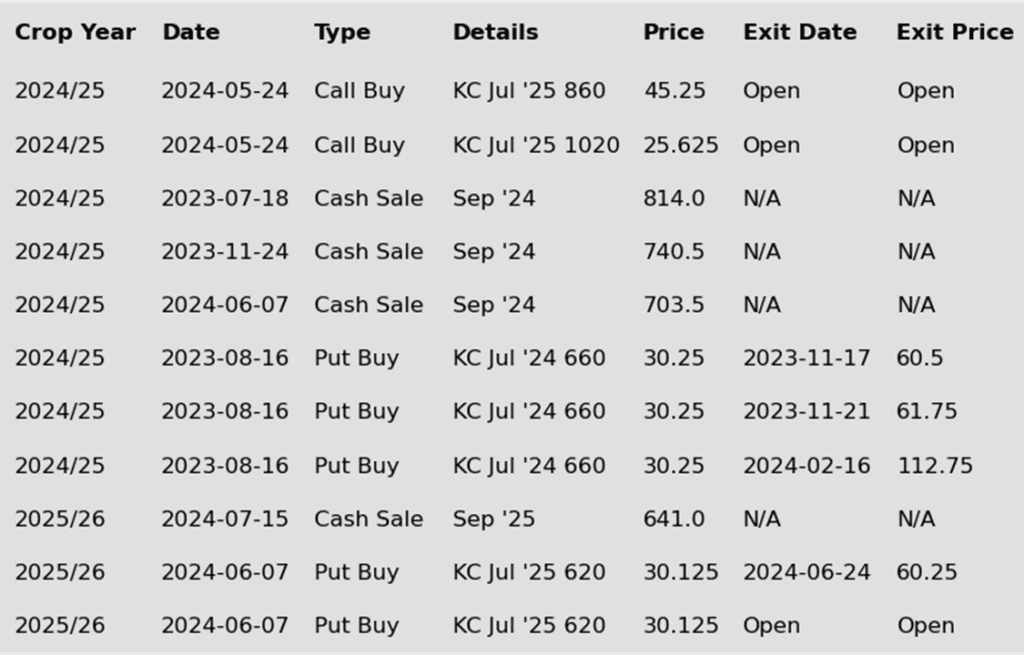

To date, Grain Market Insider has issued the following KC recommendations:

Above: After breaking through the bottom end of its consolidation range, KC wheat may find support in the 560 – 550 area of last spring’s lows. If this area holds, prices could turn higher and encounter resistance near 600, as they move towards the 634 – 654 resistance area. Otherwise, a break below 550 could find further support in the 530 area.

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

Active

Sell SEP ’25 Cash

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

Since the end of May, the wheat market has been trending lower as concerns about Russia’s shrinking wheat crop have eased and US HRW harvest yields have exceeded expectations. During this period, the market has become extremely oversold, leading managed funds to reestablish their short positions in Minneapolis wheat. Although declining Black Sea export prices and slow world demand continue to depress US prices, the funds’ short positions and oversold conditions could trigger a short-covering rally with any increase in demand, especially as global wheat ending stocks are projected to decline again this year.

- No new action is recommended for 2023 Minneapolis wheat. Any remaining 2023 spring wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Minneapolis wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Minneapolis wheat. With the recent close below the 712 support level, Grain Market Insider implemented its Plan B stop strategy, recommending additional sales for the 2024 crop due to waning upside momentum and an increased likelihood of a downward trend. Given the heightened volatility and the amount of time that remains to market this crop, we will maintain the current July ’25 KC wheat 860 and 1020 call options. Our target is a selling price of about 71 cents for the 860 calls to achieve a net neutral cost on the remaining 1020 calls. These 1020 calls will continue to protect existing sales and provide confidence to make additional sales at higher prices.

- Grain Market Insider sees a continued opportunity to sell a portion of your anticipated 2025 spring wheat production. Since rallying in late June, the market has retraced back toward its lows, and has broken the 644 support level. The breaking of 644 support suggests that our Plan A upside targets are now less likely to be achieved, and prices could trend lower. Considering this and that it is the time of year to begin getting early sales on the books for next year, Grain Market Insider is implementing its Plan B Stop strategy and recommends selling a portion of your 2025 spring wheat crop using either Sept ’25 futures or a Sept ’25 HTA contract, so that basis can be set at a more advantageous time later on.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The break below 596 support suggests that prices could retreat further towards the 550 – 540 support area. While a rally back above 600 could encounter resistance near 610 with heavier resistance near 636.

Other Charts / Weather

Above: US 5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.