7-16 End of Day: Corn and Soybeans Rebound on Fund Short-Covering and Dollar Weakness; Wheat Mixed

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 405.25 | 4 |

| DEC ’25 | 424 | 4.25 |

| DEC ’26 | 456.25 | 1.5 |

| Soybeans | ||

| AUG ’25 | 1013.5 | 18.5 |

| NOV ’25 | 1020.5 | 18.75 |

| NOV ’26 | 1055.75 | 15.5 |

| Chicago Wheat | ||

| SEP ’25 | 541.25 | 3.25 |

| DEC ’25 | 561.75 | 3 |

| JUL ’26 | 598.75 | 2.5 |

| K.C. Wheat | ||

| SEP ’25 | 522.75 | -1 |

| DEC ’25 | 545.25 | -0.75 |

| JUL ’26 | 589.75 | -0.75 |

| Mpls Wheat | ||

| SEP ’25 | 5.995 | -0.0175 |

| DEC ’25 | 6.2 | -0.0125 |

| SEP ’26 | 6.55 | 0.03 |

| S&P 500 | ||

| SEP ’25 | 6297.5 | 13.5 |

| Crude Oil | ||

| SEP ’25 | 65.34 | -0.03 |

| Gold | ||

| OCT ’25 | 3388 | 23.4 |

Grain Market Highlights

- 🌽 Corn: Corn futures closed higher for the third straight session, supported by fund short covering, above-normal temperature forecasts, and outside market volatility.

- 🌱 Soybeans: Soybean futures surged Wednesday after three days of losses, as traders responded to oversold technicals and a weaker U.S. dollar. Soybean meal and oil also posted gains.

- 🌾 Wheat: Wheat futures ended mixed Wednesday: Chicago posted small gains, while Kansas City and Minneapolis saw slight losses. A sharp drop in the U.S. dollar offered some support.

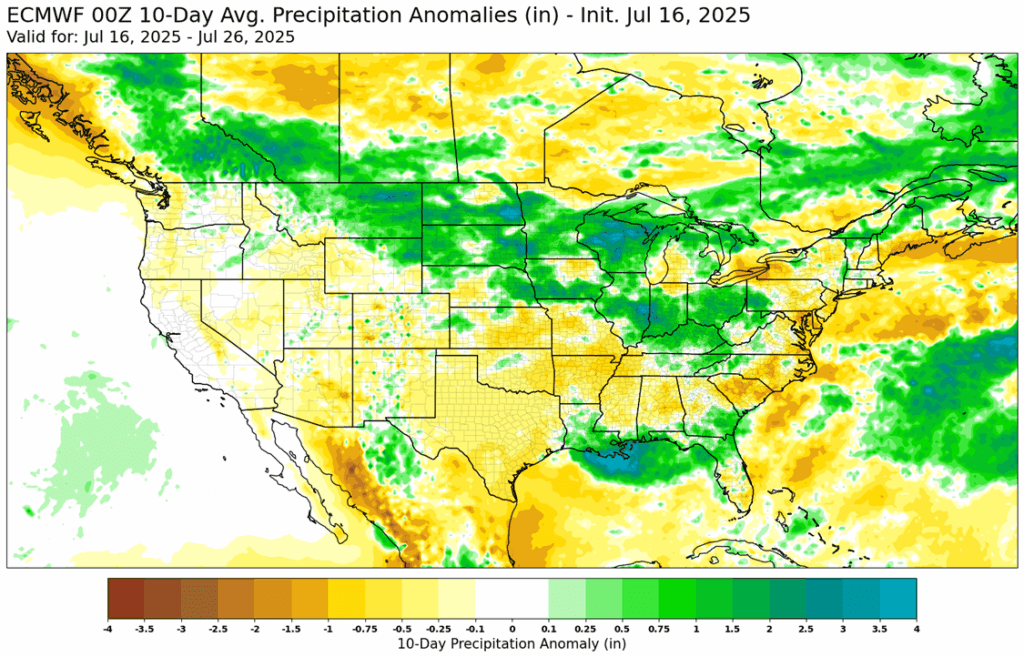

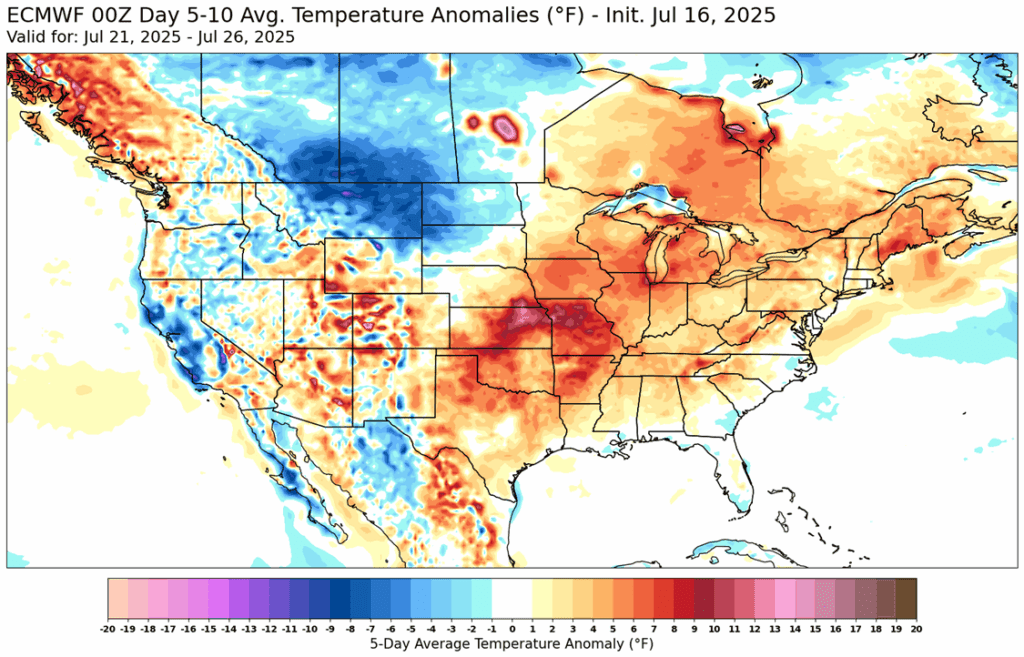

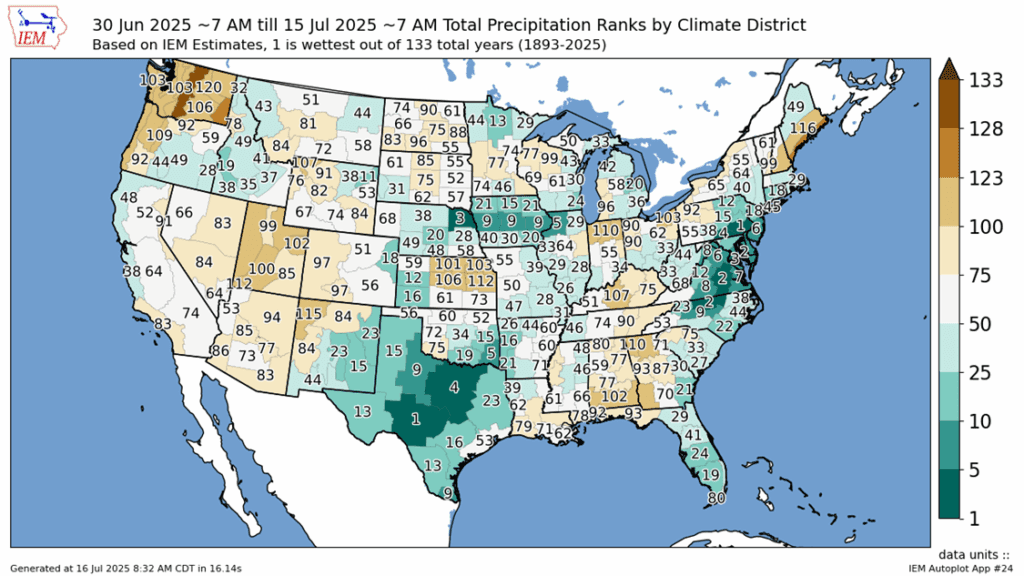

- To see update U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

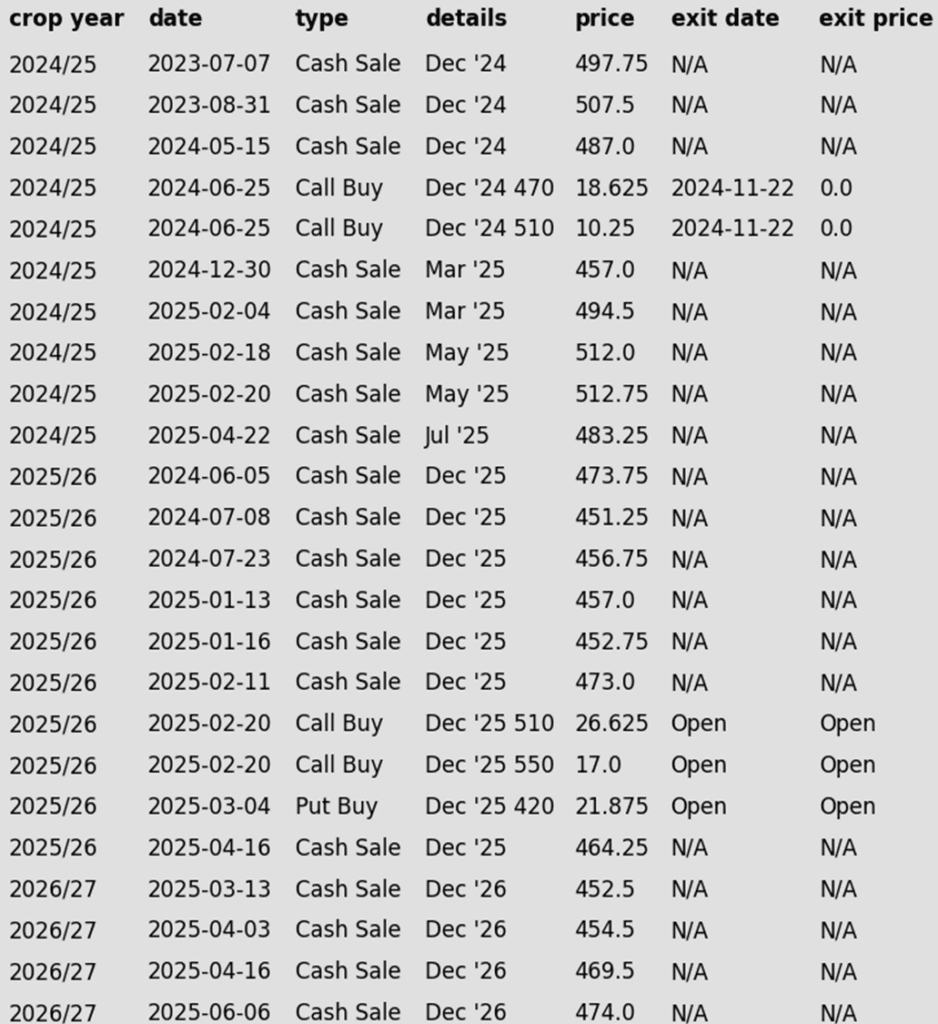

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

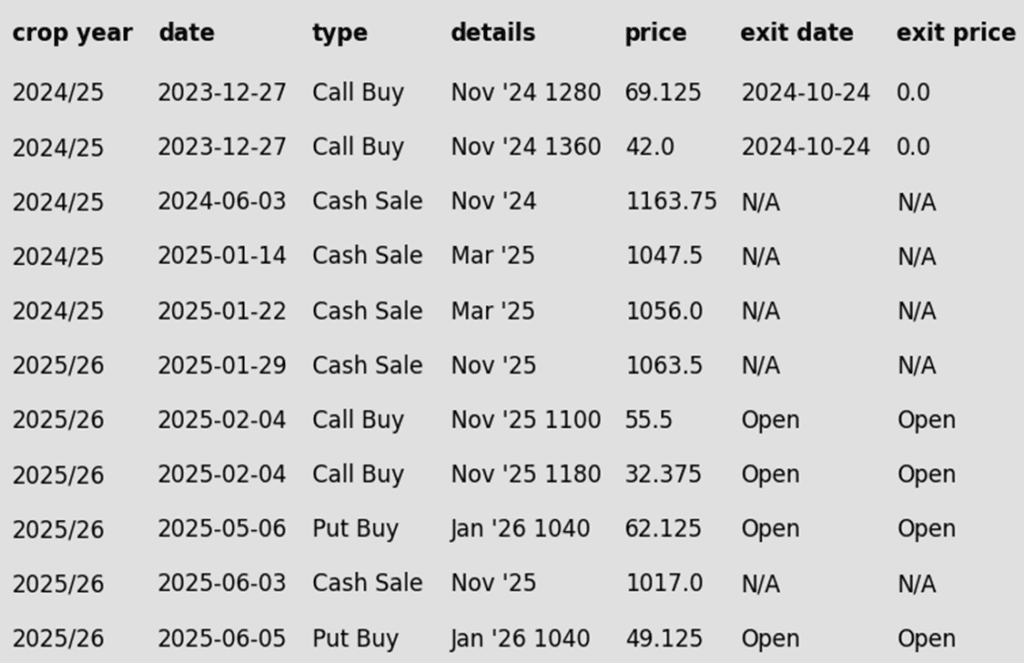

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures closed higher for the third straight session, supported by fund short covering, above-normal temperature forecasts, and outside market volatility.

- Managed funds continued to unwind large short positions, contributing to gains despite declining open interest.

- Talk of President Trump removing Fed Chair Powell from his position had markets on edge during the session. The potential pressured the U.S. dollar lower for the first time in nine sessions, supporting grain markets. Comments by President Trump later in the day denying Chair Powell’s possible removal brought volatility to the markets.

- Weekly ethanol production rose slightly to 1.087 million barrels/day, using 105.1 million bushels of corn — just below the pace needed to hit USDA’s annual target.

- Hot weather is forecast into late July across parts of the Corn Belt, with much of the crop entering pollination and early grain fill, adding modest weather premium to prices.

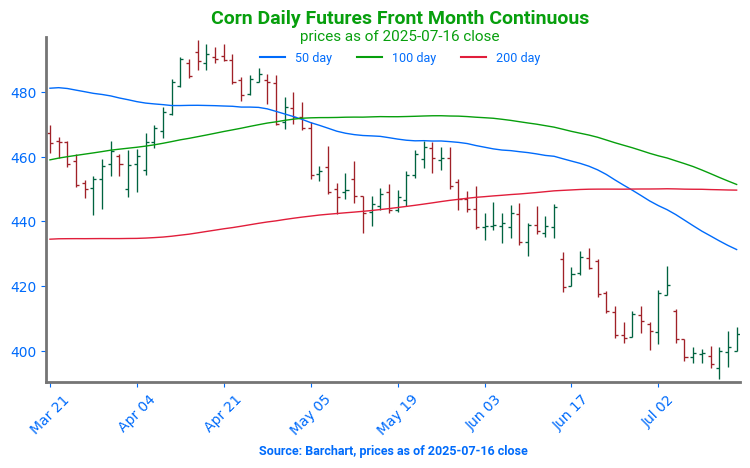

Corn Futures Attempt Rebound with Bullish Reversal

Corn futures show signs of recovery mid-July, posting a bullish key reversal to start the week. An unfilled gap near 413 is the first upside target, followed by a gap at 430 if 420 is cleared. On the downside, support rests at this week’s low of 391.

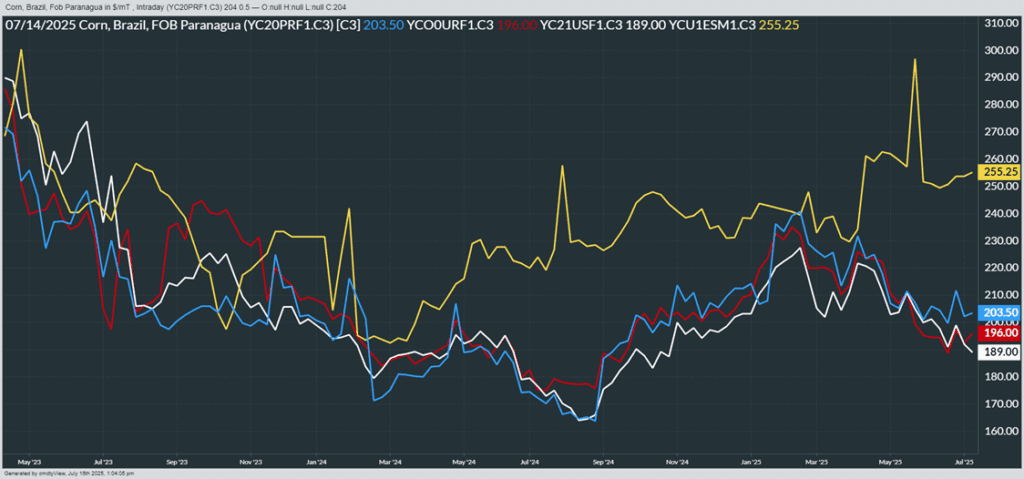

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybean futures surged Wednesday after three days of losses, as traders responded to oversold technicals and a weaker U.S. dollar. Soybean meal and oil also posted gains.

- This morning, private exporters reported sales of 120,000 metric tons of soybeans for delivery to unknown destinations during the 25/26 marketing year. Export sales have been on the slow side, but the reduction in planted acreage this year should provide support with reduced supply.

- June NOPA crush totaled 185.71 mb, a record for the month and above expectations—down 3.7% from May, but up 5.8% year-over-year. The market remains cautious about excess soybean meal from increased crush demand for oil.

- On Tuesday, President Trump announced a trade deal with Indonesia with early details indicating framework that includes $4.5 billion in annual U.S. agricultural product purchases.

Soybeans Break Below 200-day

Soybeans failed to break above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. A close above that level would target the June 2023 gap between 1161 and 1177. On the downside, futures recently slipped below the 200-day moving average, with next support at the April low near 980.

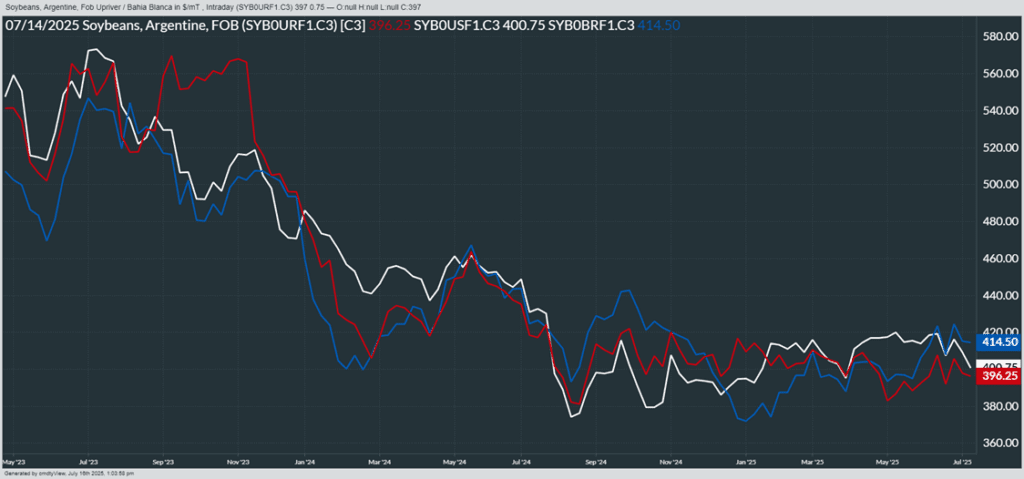

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- Wheat futures ended mixed Wednesday: Chicago posted small gains, while Kansas City and Minneapolis saw slight losses. A sharp drop in the U.S. dollar — following speculation about Fed Chair Powell’s future — offered some support before President Trump denied any firing plans.

- Midwest rains are expected over the next week, but drier conditions in the Southern Plains should allow the hard red winter (HRW) wheat harvest to pick up pace.

- Algeria reportedly purchased 1 MMT of wheat at $256/MT CNF, $12 above their previous buy. Most of the wheat is expected to come from the Black Sea, with some potentially from the Baltic region.

- SovEcon has increased their estimate of Russian wheat production by 0.6 mmt to 83.6 mmt. This comes just a day after IKAR decreased their estimate by 0.5 mmt to 84 mmt. This has both groups inching closer to the USDA’s forecast of 83.5 mmt. Additionally, SovEcon has said that Russia’s wheat harvest is going slowly, with them having collected 11 mmt through July 11; this is down 56% from the 24.8 mmt harvested at this time last year.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

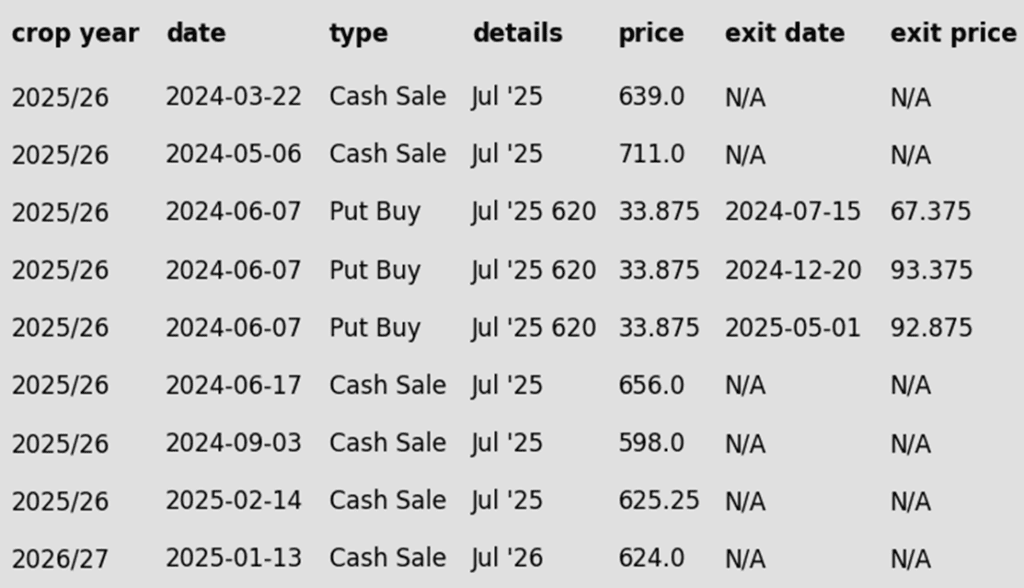

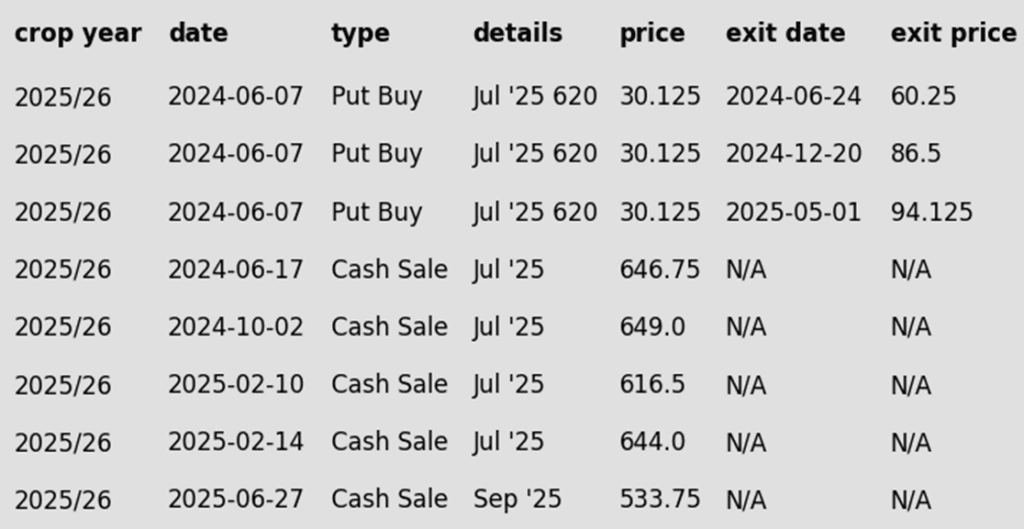

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

Chicago wheat’s sharp mid-June rally proved short-lived, with futures retreating to the upper end of the 2025 range. Initial support lies at the 50-day moving average, with a break targeting the June low of 522.25. On the upside, a weekly close above 558 could open the door for a retest of the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 688 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Back Near Support

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

- Changes:

- None.

- Changes:

- Sales Recs: One sales recommendation made to date, at a price of 678.75.

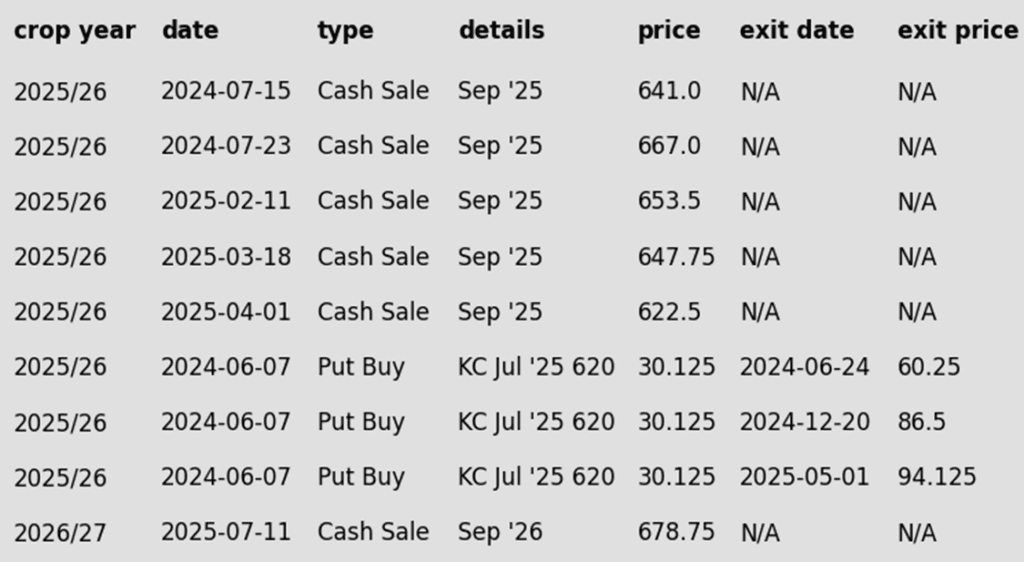

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

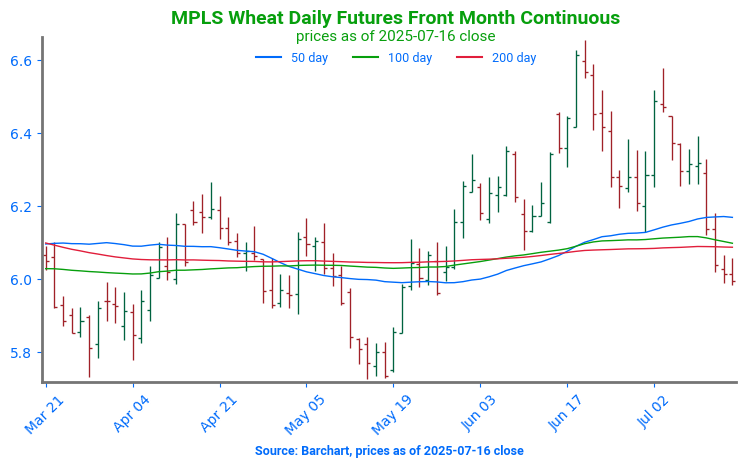

Spring Wheat Holds Above Support

Spring wheat futures held above the upper end of their prior range for most of June, supported by a confluence of major moving averages. The June high near 665 is the next upside target. Key support lies at the 200-day moving average around 607, with a close below that level — and especially under the May low of 572.50 — likely opening the door to increased downside risk.

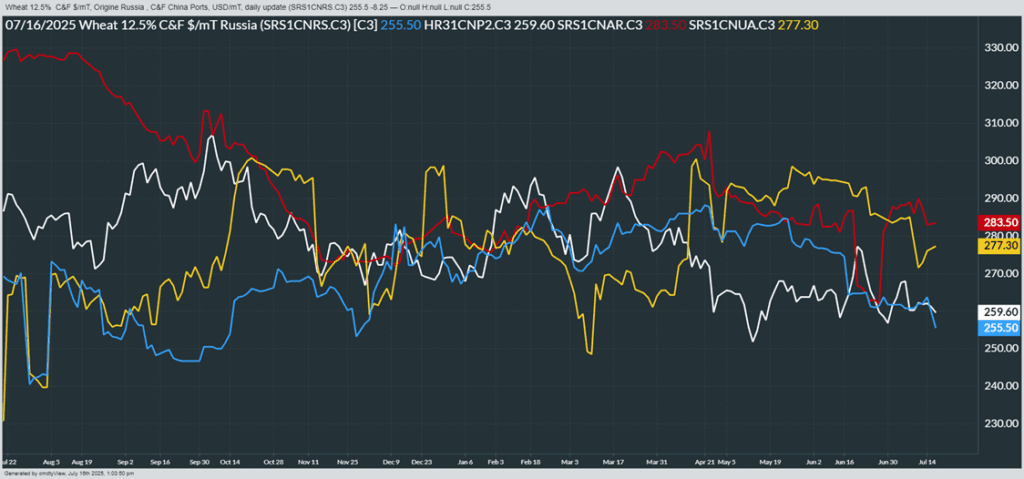

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather